This was a CRAZY day for Bitcoin in Washington, DC. Ignore the FUD, ignore the ups and downs of daily price action. We are winning friends. We haven’t won, there’s work to be done. But anyone who spent this morning with Congressional leadership, administration, and industry leaders couldn’t help but feel the palpable change of Bitcoin’s influence in Washington, DC.

When life allows, I often spend Sunday afternoons catching up on reading (I never keep up with all my subscriptions) and, as I did today, flipping through the “archives.” I’ve failed in my aspiration to scribble routinely, but over the years I was a diligent chronicler of periods in my life I knew would be both meaningful and transitory. I was away in service for much of my daughter’s first year, and although I regret that to this day, the journal I kept at the time (written to her, should fate have prevented me from seeing her grow up) is quite dear to me. Another well-chronicled chapter of my life was the period of my adolescence when I lived Germany – West Germany, to be specific. As I flipped through the pages, the entry on October 19, 1988 specifically caught my attention – the day I first visited East Berlin.

My thoughts this afternoon are less about the details of the experience and more about how it and others served to construct my worldview. Since those Cold War days, I have been an Atlanticist as a matter of temperament. I have spent a not insignificant portion of my life in Europe, both as an adolescent and later in life professionally. I’ve at least stepped foot in a large plurality of the countries generally understood as constituting Europe, and to this day feel myself indebted to the Western cannon. Although later in life some of the fecklessness I saw emerge in European political culture frankly annoyed me, I never fundamentally questioned the foundational nature of the importance of our relationship with Europe or its place in the global order.

It's difficult to pinpoint the time when that fecklessness drifted into seemingly deliberate failure. Whatever autopilot this class was able to rely on seems to have been fatally disrupted by the mass immigration caused by the Arab Spring and associated collapses of Libya and Syria. The European political class can hem and haw about the dangers of emergent populist movements in their politics, but the reality is these movements were predictable creations of these elites’ own policies. Their reaction of choice – attempting to hold the proverbial beach ball under water will no doubt end with the predictable eruption of force that occurs once that beach ball slips your grasp.

Back in 2011, many Arab governments were facing what felt to be an inevitable tidal wave of support for Islamist parties, threatening to overturn the established regional order. Most chose the same method European leaders seem to have chosen today – hold the beach ball under as long as you can. But King Mohamed 6 of Morocco chose a different path – he brought the Islamist PJD into government and with that, immediately removed the air from that proverbial beach ball. Now part of the “problem,” the PJD later suffered the same electoral defeats establishment parties had suffered under the barrage of the PJD’s criticism.

I can’t help but feel that the European establishment (perhaps more accurately, the western European establishment) is on a collision course with reality. They’re drifting toward overt repression to keep populist parties out of government, cobbling together coalitions that will only hasten or even amplify their collapse. They’re pathologically attached to energy policies that make their vision of rearmament and industrial renaissance a near fantastical delusion. They’re doing nothing to repair the frayed social consensus that pushed them to this precipice in the first place.

Back to East Berlin in 1988, reading my journal today I can vividly relive that euphoric buzz I felt about a year later when the Wall fell and communism collapsed in the East. And with that buzz, the optimism most of us felt about the European project in general. Of course I was young at the time, and as optimism so often is, a lot of this was always aspirational. But to think that well within one lifetime, we’ve experienced both revival and decline is dizzying.

Wonder what happened here last night….?

Had the previous regime understood or even knew about eCash, I’ve no doubt there would have been investigations and prosecutions. The incentives were obvious - shutting down financial innovators sharing their vision through open source software was encouraged and rewarded.

Today, for the time being, the government doesn’t seem inclined to prosecute developers. The new regime seems to cast a benign eye toward financial innovators and people deploying open source software for the world to use.

This is a welcome change, and as #Bitcoin becomes stickier in the global financial system, there is an opportunity to move the Overton Window on payment tech, and perhaps even let loose a renaissance in the only recently lost appreciation of the value peer to peer cash transactions.

Today Bitcoin is pushing a wide path through the resistance of the legacy financial and regulatory system. Behind it, a golden opportunity for developers and innovators to draft off this disruption. I think eCash is a prime candidate - maybe even the candidate we all need - to slip into that position.

I don’t think even most Bitcoiners get the revolutionary nature of #ecash. nostr:nprofile1qqs9pk20ctv9srrg9vr354p03v0rrgsqkpggh2u45va77zz4mu5p6ccpz4mhxue69uhhyetvv9ujuerpd46hxtnfduhszxrhwden5te0wfjkccte9eekjctdwd68ytnrdakj7ege9wx is a national treasure….of every nation. Use it, learn about it. It’s that good.

It was a great day for #Bitcoin today. The USG’s policy is to hold on its balance sheet an asset that didn’t exist 20 years ago. Tell me how that’s not winning.

The only digital asset the US should stockpile is #Bitcoin. If for some reason the USG ever needed a surplus of XRP, for example, all they need to do is give Ripple a call and Ripple can print as much as the government might need.

Easy peasy.

SORRY ODELL, WHAT DID YOU SAY? COULDN’T HEAR YOU….

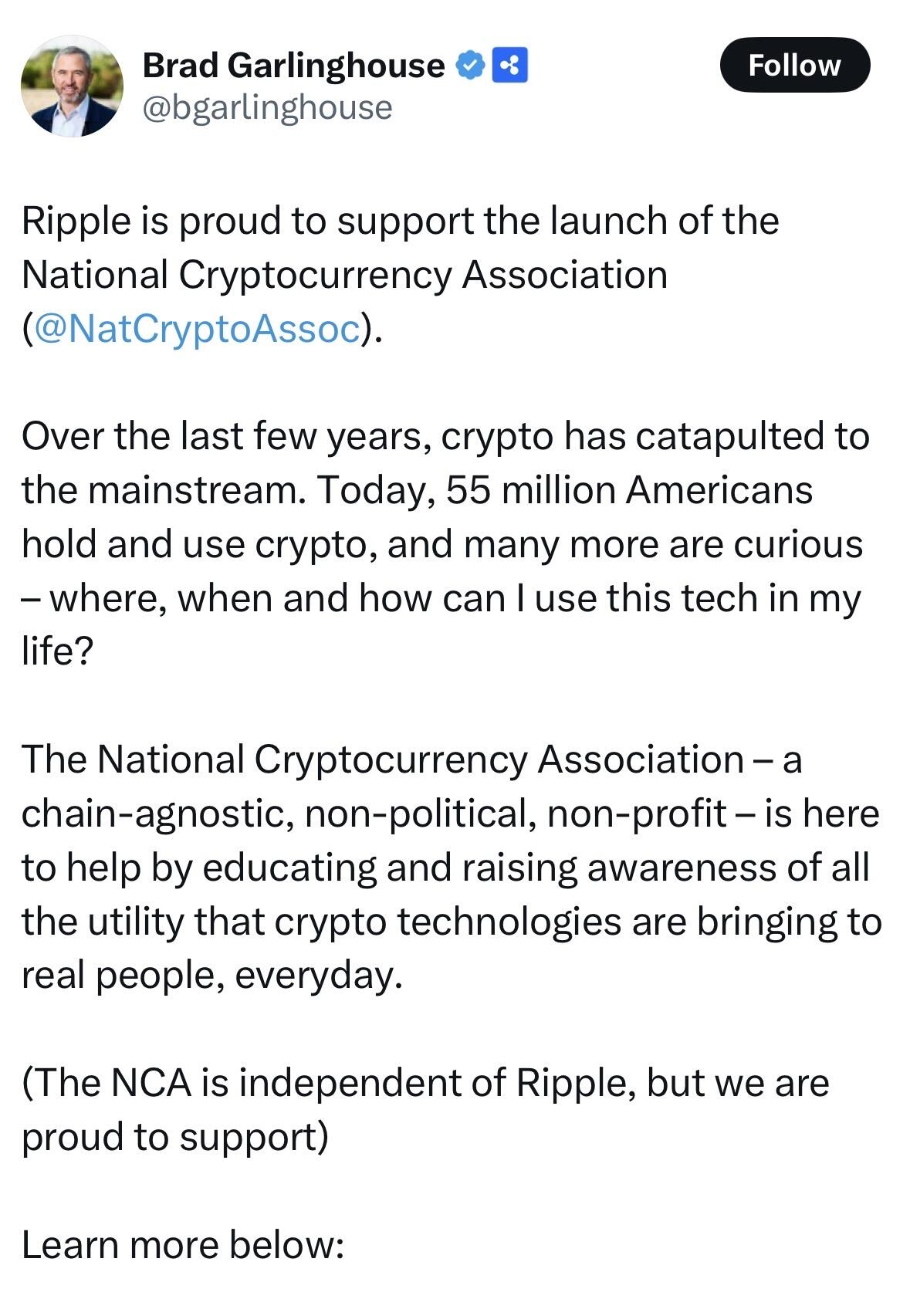

Today the CEO of Ripple announced the creation of a new independent crypto education group - the National Cryptocurrency Association.

Omitted from the post was who is actually running this new independent association.

Real strategic assets - a short list:

Fossil fuels - pumped from the ground;

Precious metals - mined from the ground;

Industrial metals - mined from the ground;

Rare earth minerals - mined from the ground;

Lumber - harvested from forests;

Fisheries - harvested from the sea;

Agricultural products - grown and harvested;

Industry - constructed using natural and human resources;

Military capabilities - designed and constructed using natural and industrial resources;

Bitcoin - mined through compute power using available energy.

What do they have in common - proof of work.

An asset can’t be described as strategic if there’s no demand for it internationally. Please across

the globe certainly use XRP, SOL, and ADA for their primary purpose - speculation. But no other country is accumulating these or running validators on these networks.

But what are many countries doing - accumulating #Bitcoin, supporting investment in mining infrastructure, diversifying their sovereign wealth funds.

#Bitcoin is the strategic asset.

US "CRYPTO CZAR" DAVID SACKS LAUGHING ABOUT HIS SOLANA PREMINE BAG.

https://cdn.satellite.earth/693b0371172e30089a60af93e5f9558ccd1fd72f0a204df7913b963098580739.mp4

🧐

A lot of chatter today following the President’s post about the possible composition of a “Crypto Strategic Reserve,” especially before he qualified it with a follow up post about #Bitcoin and Ethereum. It’s no accident that the three chains mentioned in that first post – XRP, SOL, and ADA – are centralized projects whose leadership teams lobby to elevate their status in Washington, DC. But that centralization is ultimately why those projects won’t win.

Conversely, over the past few weeks, we have seen the emergence of an intellectually vibrant and committed Bitcoin community across Washington, DC. From lawmakers and legislative staff to national security professionals and policymakers, there has been a profound change in the presence and influence of Bitcoiners across the city. It’s easy to get distracted when Bitcoin isn’t the focus of “crypto” discussions among policymakers. And I’m not saying to ignore the noise – call your representatives and let them know you’re a Bitcoiner. But I’m as confident as ever – Bitcoin is going to win.