Solid bounce today in equities. SPX bounced off its uptrend line and confirmed the macro downtrend line & 200 MA as support.

Given fund manager positioning & sentiment, the rally could have some fuel.

#stocks #investing #trading #stockmarket #equities #macro #macroeconomics

https://pbs.twimg.com/media/FqVLcNHWAAQEAl1?format=png&name=large

📈📉 If you haven't yet, be sure to check out yesterday's Chart of the Day to see why Capital Notes is short/intermediate term bullish on the stock market and risk assets.💰

Capital Notes first pointed out the bullish case on January 12th in a post titled, "Quick Note: The Bull Case"

Be sure to like and subscribe to the newsletter if you want this type of content delivered straight to your inbox!

#stocks #investing #trading #stockmarket #SPY #QQQ #macroeconomics #macro #valuation #sentiment #markets #economics #economy

https://capitalnotes.substack.com/p/charts-of-the-day-march-2-2023

U.S. stocks remain significantly overvalued.

The price you pay for an asset drives the long-term returns the asset will deliver.

Source: The Daily Shot

#finance #stocks #investing #trading #valuation #stockmarket #SPY #QQQ

https://www.instagram.com/p/CpTcFyHu7-r/?igshid=NTU1Mzc3ZGM=

Are U.S. stocks heading higher or lower?

We attempt to answer this with a series of charts covering fund flows, sentiment, positioning, and valuation.

Check it out!👇

https://capitalnotes.substack.com/p/charts-of-the-day-march-2-2023

#stocks #investing #trading #stockmarket #SPY #QQQ #macroeconomics #macro

Ever wonder why stocks react in weird ways to what is usually perceived as "good" news? 💰📊

Correlations are constantly shifting. You must understand this to identify the current market regime.

Right now, "good news" is actually "bad news". In other words, positive economic news is likely to drive a negative stock market reaction. 📈📉

Source: @JoeConsorti

#stocks #stockmarket #macroeconomics #SPY #SPX #markets #news #investing #trading #technicalanalysis #charts #QQQ #macro

https://pbs.twimg.com/media/FqOgRNvXgAAtHPd?format=png&name=small

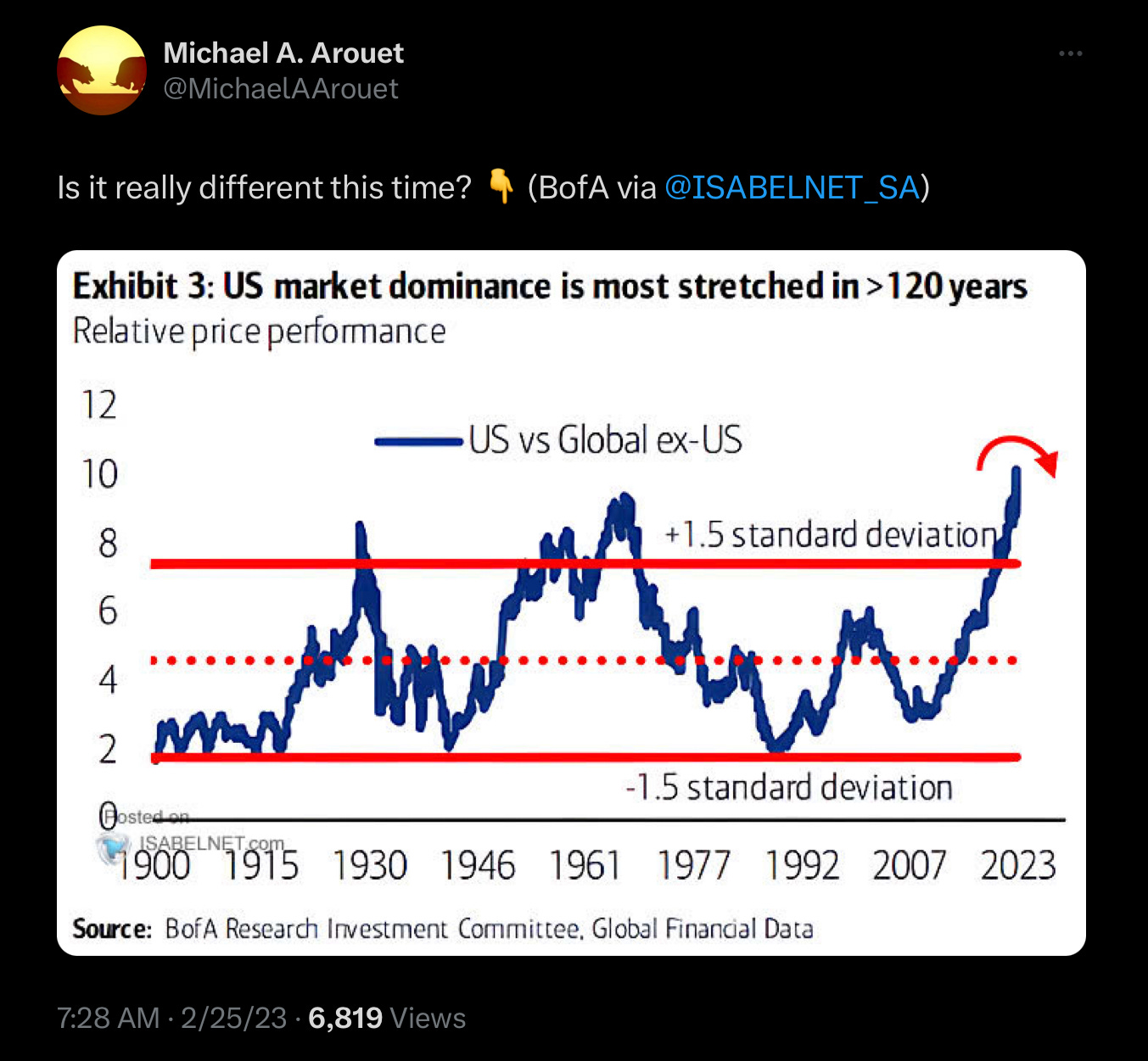

US biased investors may have a rough go of it the next decade.

#investing #trading #stocks

Just wait until the hoards of banksters or ever the WSB apes realize 0DTE can be used to spike VIX to 100 --- which would very likely take out a few financial institutions.

They had a great discussion about this on the most recent Market Huddle podcast episode. Harris Kupperman was the guest -- he's always a great on to hear different views from.

He's been pretty clear about it for quite awhile. Even in the Blockchain class he taught at MIT, that can be watched on YouTube, he was saying this. I'm not sure why so many are surprised he's going after shit coins.

Investors may be at risk of significant underperformance the next decade if they're underweight international and emerging markets. Check out today's Chart of the Day to find out why!👇

#emergingmarkets #stocks #stockmarket #investing #trading #SPY #EEM #EFA #QQQ

Is the US destined to see much higher interest rates? The Taylor Rule is suggesting this is a real possibility.

#FedPolicy #macro #macroeconomics #interestrates #federalreserve #Fed #economy

In today's Chart of the Day, Capital Notes reviews the implications of the recent weakness in housing demand. Be sure to check this one out! 👇

#investing #trading #housing #stocks #houseprices #housingmarket #realestate #mortgage #stockmarket #Fed

https://capitalnotes.substack.com/p/chart-of-the-day-february-22-2023?sd=pf

Is global #liquidity, driven by central banks, actually supporting asset prices?

#Fed #BoJ #ECB #PBOC #inflation #stocks

https://capitalnotes.substack.com/p/charts-of-the-day-february-20-2023