🚀 WVU SMIF Weekly Portfolio Update #4🚀

After a historic market rally fueled by President Trump’s surprise reversal of tariffs (on everyone but China), stocks soared—and volatility followed.

In this week’s update, the WVU Student Managed Investment Fund (SMIF) team breaks down:

• Top portfolio performers and sector insights

• How we navigated the rapid swings in Financials, Tech, Energy, and more

• Key risks and opportunities shaping the weeks ahead

Perfect for alumni, students, and anyone interested in real-world investing, finance, and market strategy.

Catch the full update here: https://wvusmif.substack.com/p/wvu-smif-portfolio-update-april-13

If you enjoy the content, please like, comment, repost, and subscribe to receive these updates directly in your inbox! 📥

#Finance #Investing #WVU #Markets #Trading #Stocks #Tariffs #TradeWar

🚨💡This is the first installment of what will be a weekly portfolio update report published by the WVU Student Managed Investment Fund.

We hope that this report will help alumni, students, investors, and anyone else interested in investing understand what we do in the SMIF program at WVU.

Please check it out, like 👍, share, repost, and subscribe to the Substack to receive future posts like these delivered straight to your inbox. Your support is much appreciated!

Stay tuned for more weekly updates like this one and additional content in future weeks. Future content will include weekly stock idea deep dives and weekly chart packs.

All post will resume the week of 3/24-3/28, after WVU's Spring Break.

https://wvusmif.substack.com/p/wvu-smif-portfolio-update-march-16

🚨📈 Here is a solid, potential development for the stock market bulls! 🐂

This is a gauge of sentiment that nostr:npub1k6m950rpy2xw04nsgmmdpzjjn76x56wz4nwe3nqgctpwj9y5rzds48rve6 prefers to use to time short to intermediate term bottoms in the stock market.

This chart measures the VIX Term Structure, or VIX calendar spread. In other words, it measures the difference between the spot VIX and the CBOE 3-Month VIX futures.

When this chart closes above 1 we have a VIX Term Structure inversion. The inversion indicates that traders expect the volatility today to be greater than volatility 3 months from now. This generally happens during a panic, as the VIX 3 months in the future should naturally always be greater, given we have no idea what could transpire in the future but we are well aware what is happening in the world today.

A buy signal is generated when the chart closes back below 1, indicating that the term structure inversion is over and traders have digested whatever panic or worry led to the inversion.

As of right now, today could generate a buy signal as the chart is currently falling back below 1. However, we must wait for a confirmation on the close before the buy signal is actually issued.

#VIX #VolatilityIndex #stocks #investing #trading #SPY #QQQ

There are not many U.S. dollar bulls around at the moment, but the chart certainly points to some dollar strength on the way.

Dollar strength is a negative for global liquidity and international stock markets are the pain trade for a 💪 dollar.

#stocks $SPY $DXY $QQQ $EFA $EEM

📉 On a relative basis, commodities are cheap and equities are expensive.

This chart compares the S&P Commodity Index vs. the S&P 500, showing that we're near historic lows in terms of commodities' value relative to equities. Historically, these extreme lows have preceded major shifts.

Could this signal an upcoming reversal? It might be time to look into real assets and the companies that produce them. 🌾⛏️📈

#commodities #stocks #investing #macro #trading

Earnings drive long-term stock prices, not tax rates. Check out my latest Substack post where I break down the relationship between corporate tax rates and the S&P 500—backed by historical data and charts. 📊💡

Read more here: https://capitalnotes.substack.com/p/election-year-the-circus-is-here

#Investing #Finance #trading #stocks #stockmarket #SPY #QQQ

The median home has never been more expensive for the median household.

#realestate #RE #house #housing #realestateinvesting

Check out the new post today from Capital Notes! This is the first ever Capital Notes Media Digest, a series of hand selected charts, tweets, and other media that Capital Notes believes is relevant. All of this information is presented in a quick and easy to understand format.

TL;DR:

- Sentiment is nearing bullish extremes

- Positive economic growth continues

- Inflation continues to be a problem

- Unemployment might be starting to crack

- U.S. stock market valuations remain rich

- Housing is extremely unaffordable

Take a look and remember to like and subscribe if you enjoy the content!

🔗 https://capitalnotes.substack.com/p/capital-notes-media-digest-1

#stocks #inflation #investing #trading #stockmarket #finance #economy

#Bitcoin is trying to bounce off the confluence of the bottom of its short term trend channel yellow) and the 200 day moving average (blue).

Successfully finding support here would suggest a retest of the ATHs near $70,000 is likely.

#BTC #trading #investing #crypto #BTCUSD

🍻 Here is an example of a company that I would find interesting enough to perform further due diligence.

Boston Beer Company, Inc. (SAM), the makers of the Sam Adams brand of beer.

The consensus of analyst are showing expectations for a re-acceleration in earnings per share at the same time as the stock price has declined significantly. However, the decline's momentum has slowed down and the price has returned to long-term VWAPs that are likley to provide a solid level of support.

As usual, this is just a idea that could justify further due diligence. It is not investment advice.

#SAM #investing #stocks #trading #stockmarket

#Bitcoin is approaching a major level of support. A breakdown here would target $46,500-$48,500.

A drop here will require a substantial sentiment reset before a durable rally to new highs can potentially begin.

#BTC #BTCUSD #investing #trading #crypto

#Bitcoin still channeling sideways.

#btc #investing #trading

nostr:note19rcwl42v6xdrjxl40cps686me5njjpp6z0ljxzt5lfd93uyaxkjsehdfff

📈💡A massive basing pattern has formed on the #TTD monthly chart over the last 3+ years.

A solid monthly close above the yellow resistance zone suggests an increased probability of a substantial upside repricing of the stock.

🚨Capital Notes has not performed a fundamental analysis or valuation of Trade Desk. This is purely a technical idea.

#stocks #investing #trading #investment #money

#Bitcoin just keeps channeling sideways.

Nothing to see here. Yet.

#btc #investing #trading

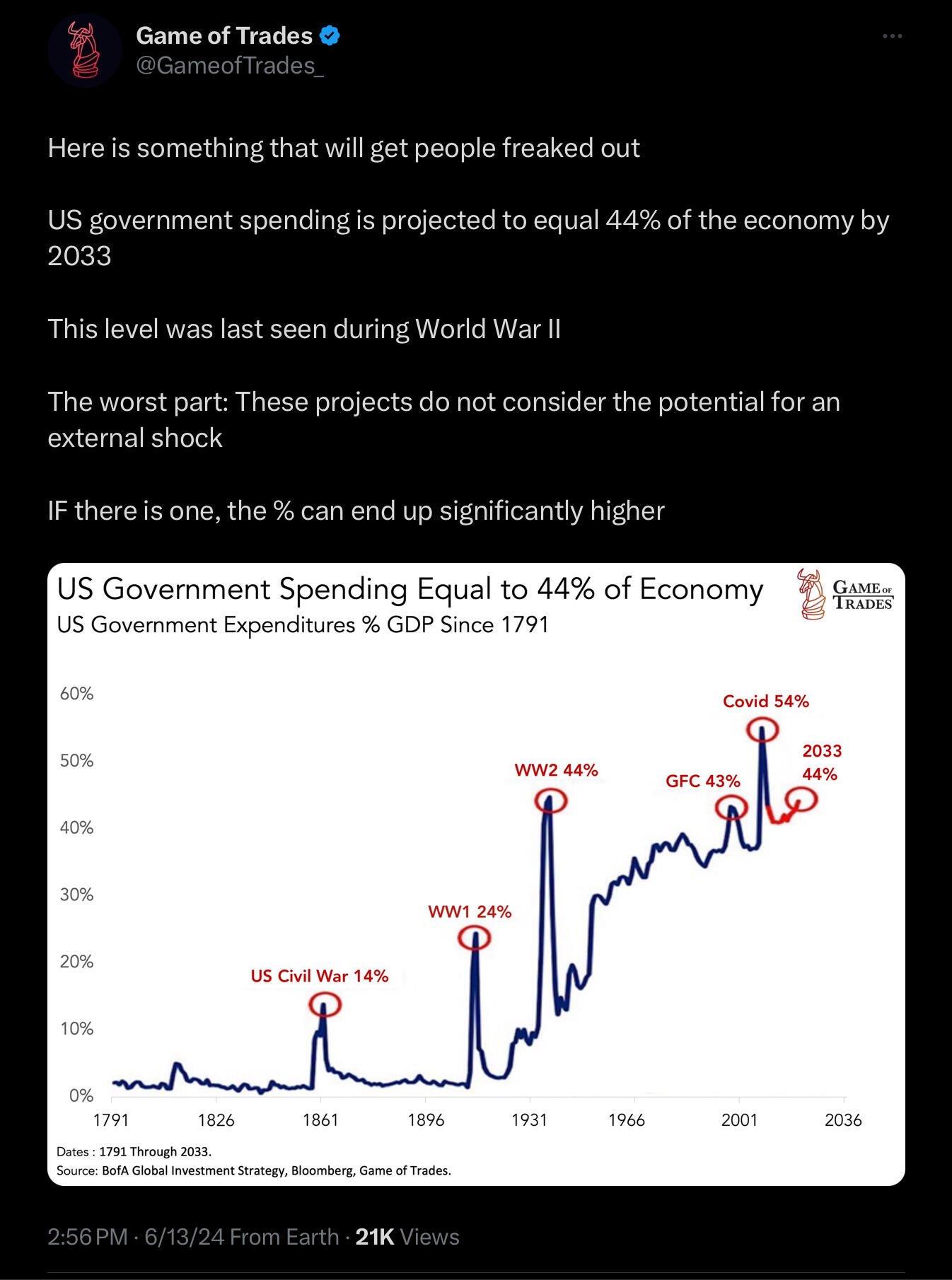

🔍 Understanding the Impact of Rising Government Spending on Economic Efficiency

Dive into our latest analysis on how increasing government spending, projected to reach 44% of GDP by 2033, could lead to significant economic inefficiencies. Leveraging insights from Ray Dalio's economic machine model and critiques by Murray Rothbard and Ludwig von Mises, we explore the potential long-term consequences for resource allocation, inflation, and overall economic growth.

📊 Key Takeaways:

- The role of government spending in distorting natural economic cycles

- The impact of bureaucratic inefficiency and misallocation of resources

- How increased government intervention can crowd out private investment

Stay informed and critically assess the balance between government spending and economic stability.

🔗 https://capitalnotes.substack.com/p/the-cbo-projects-government-spending

#government #debt #economy #inflation #CPI #Fed #economics

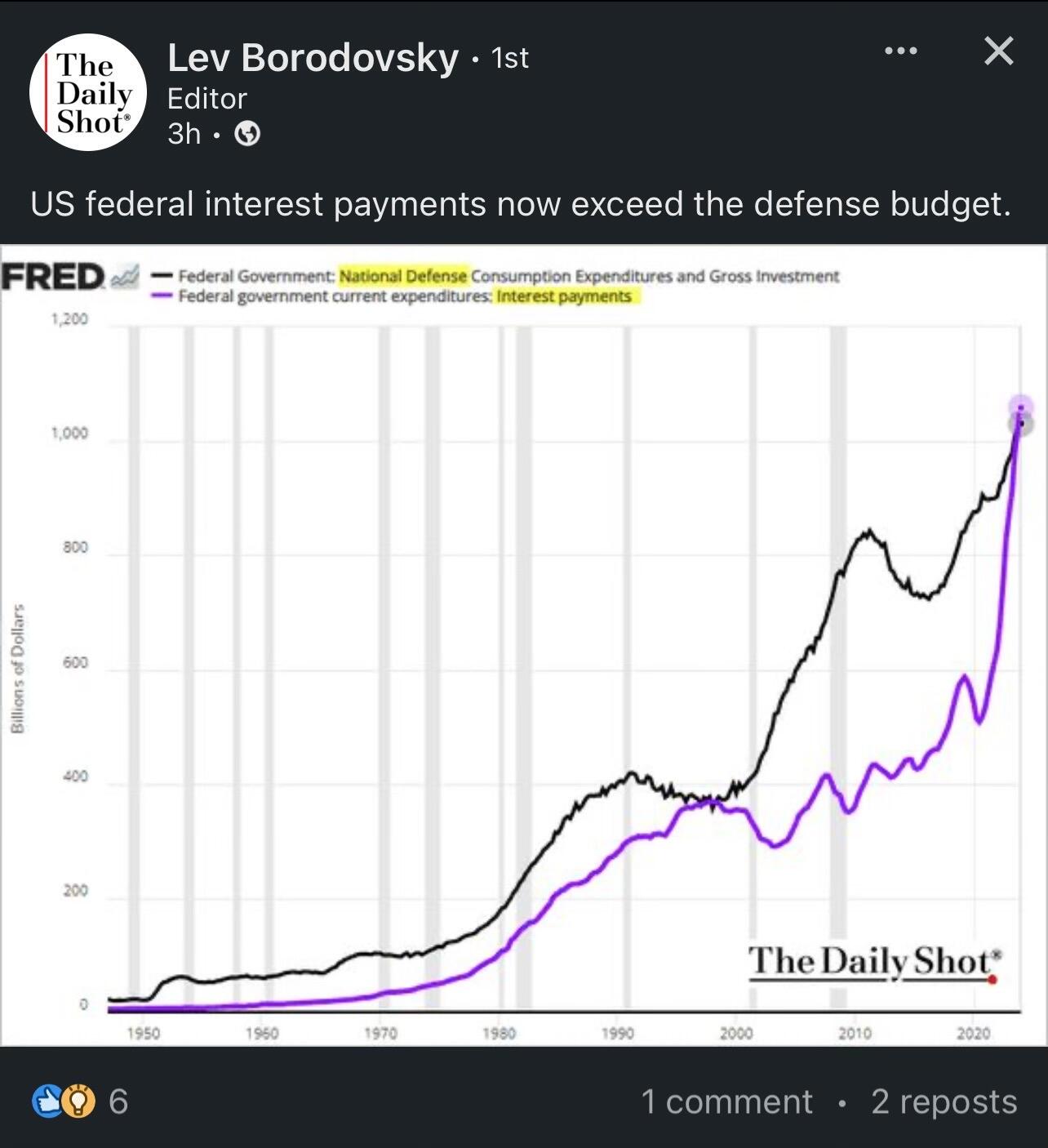

It’s been said quite often by economists, financial pundits, political analysts, and politicians that the United States “spends far too much on its military and defense”.

After all, they say, those resources could be put to better use elsewhere.

I wonder what the message will be now that annual interest expenses on our debt exceed the amount spent on the national security and defense apparatus.

H/T: The Daily Shot

#debt #treasury #economy #bonds #interest

Tell me again how the U.S. economy is a "free market"?

H/T Game of Trades

#macro #economy #economics #debt #treasury #deficit

Is #MSTR going to breakout to new ATHs?

#MicroStrategy #btc #bitcoin #stocks #investing #trading

📈💡One tool often overlooked by investors is the relative direction of offensive vs defensive fund flows.

An easy way to measure this is by monitoring the relative performance of traditionally "offensive" sectors vs the performance of "defensive" sectors. Below I have attached one of my custom charts that display this relationship.

This week, offensive sectors are breaking out to new highs vs defensive sectors. This is a bullish development.

Typically, this relationship will diverge from the broad market indexes at major price turning points. So far, no negative divergence has yet to develop. This is a ✅ in the bull column and supports a continuation of the up trend in stocks.

#stocks #investing #trading #SPY #QQQ #stockmarket

Oracle breakout.

#ORCL #stocks #investing #trading  nostr:note1jzx92csrymvl274lhnddzt33cfxfjgu8jwzz4zw5ny35yymq5rtqqjyhja

nostr:note1jzx92csrymvl274lhnddzt33cfxfjgu8jwzz4zw5ny35yymq5rtqqjyhja