A significant breakout happened today in tech land. #ORCL pushed above a textbook consolidation zone to new ATHs.

This is similar to what I highlighted yesterday about #AAPL. Check it out:

🔗: https://capitalnotes.substack.com/p/why-do-i-use-technical-analysis

Subscribe for #macro commentary and investment ideas.

The U.S. dollar could see a big countermove if the Fed leans dovish today:

https://capitalnotes.substack.com/p/watch-the-us-dollar

Check it out here 👆📈

#macro #dollar #bitcoin #gold #Fed

Is the Santa rally on its last legs?

Understanding investor sentiment is important for short-, intermediate-, and long-term investors.

Check out our most recent note on the current state of sentiment and investor psychology here:

🔗 https://capitalnotes.substack.com/p/is-santa-exhausted-the-probability

#investing #stocks #stockmarket #trading #bitcoin #sentiment

📊 New post today on Capital Notes.

Check out the chart pack for an update on various macro, market, and other important indicators.

This one is packed with information.

Link 🔗: https://open.substack.com/pub/capitalnotes/p/is-santa-on-his-way

#stocks #investing #trading #spy #qqq #macro #economy #Fed #COIN #BTC #bitcoin

“All of humanity's problems, stem from man's inability to sit quietly in a room alone.”

- Blaise Pascal

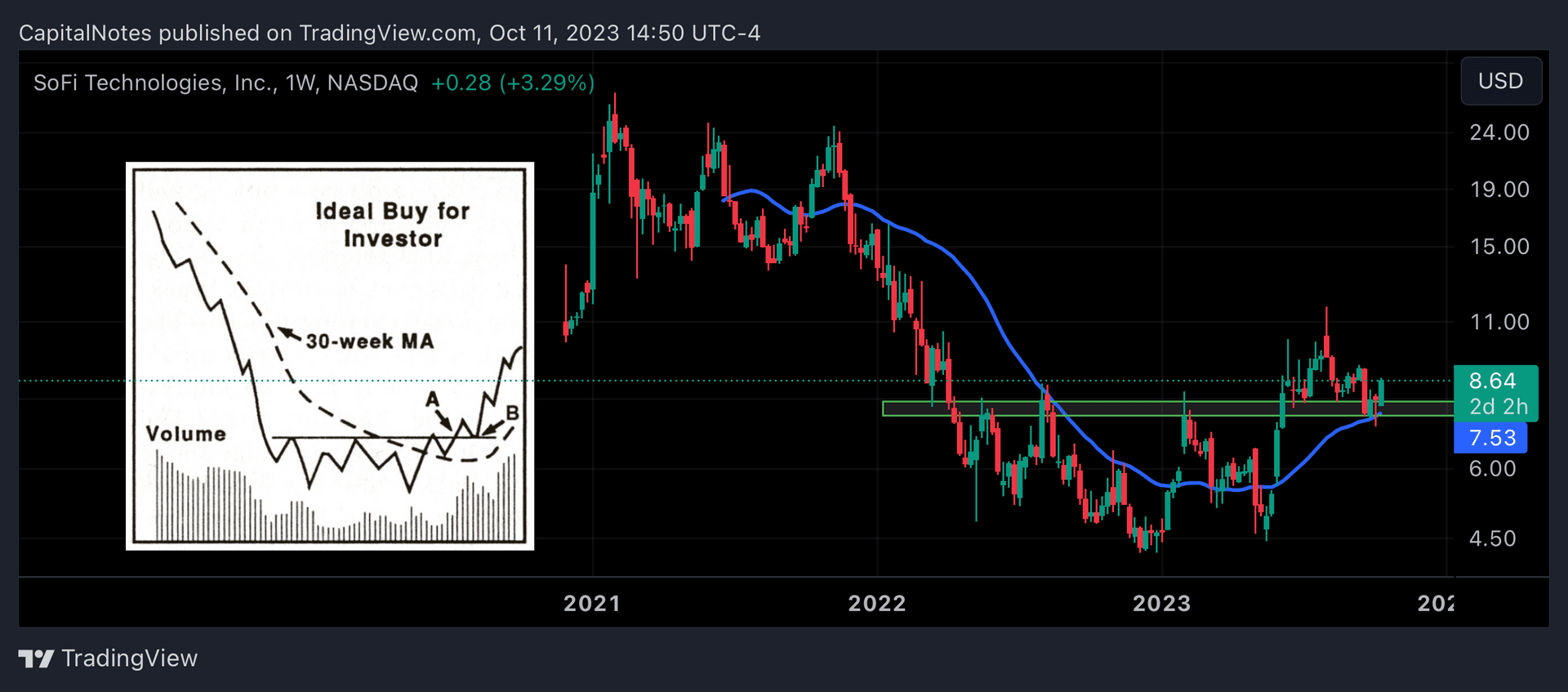

SOFI looks quite interesting from a technical perspective.

WARNING: I have performed ZERO fundamental analysis. Do your own due diligence. This is NOT a recommendation to buy or sale any security.

#SOFI #stocks #investing #trading

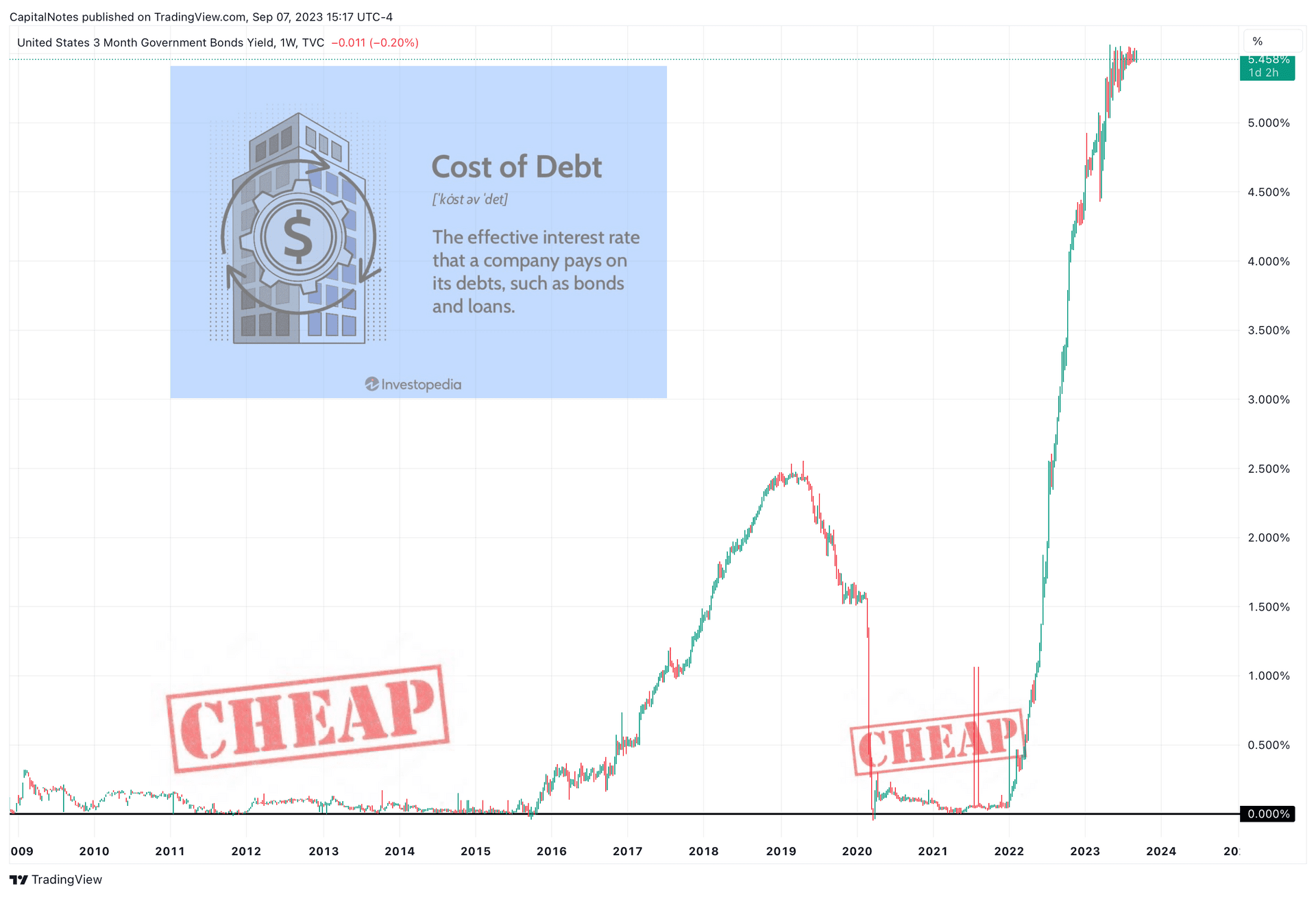

US Treasury Yields trading like a meme stock.

Uranium is finally making a move.

#stocks #uranium #nuclear #energy

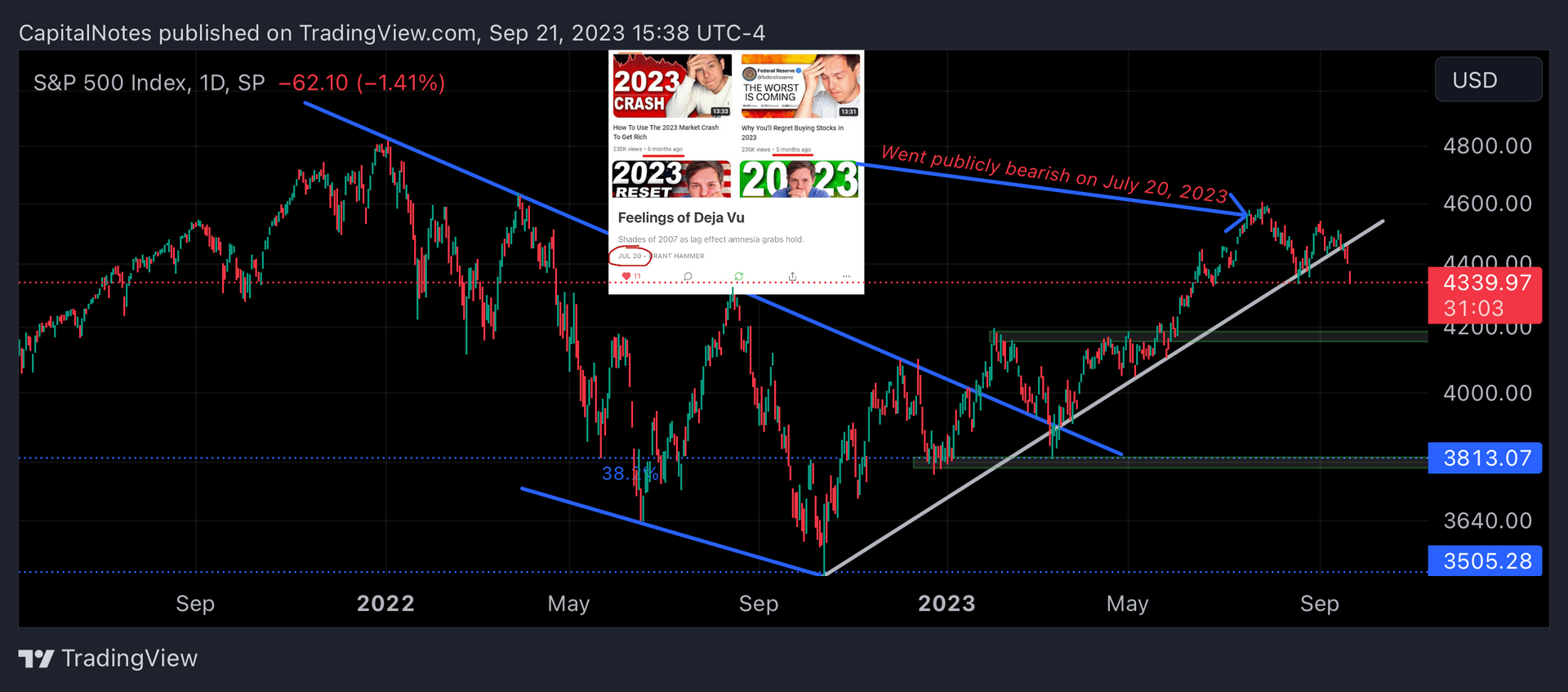

Capital Notes turned bearish on risk assets with a piece published on July 20, 2023. This was after a period of bullishness starting in January 2023.

So far, so good.

A test of the 200 day moving average around 4200 on the S&P 500 is our current downside price target.

Been saying for quite awhile inflation isn’t dead and expectations for a end to tight policy are getting ahead of themselves.

Oil prices look quite bullish. $100 is a psychological area that will push inflation expectations ip and force the Fed and politicians to react.

Higher for longer is still in play.

The trend in equities remains higher but a inflation scare has the potential to de-stabilize risk assets.

https://open.substack.com/pub/capitalnotes/p/the-trend-remains-up

“Cheap capital and capital misallocation go hand in hand like lock and key...We are living in the times of Icarus…Wings are melting all over the place...”

- Broderick Adams

“We've just loaded $30 trillion in debt over the past generation - where's the Hoover Dam that we've built? What did we get for this $30 trillion of debt?...When you pile on debt, it has to be for productive stuff."

- Louis Gave

Now it's easy to decide what to read the next few nights.

If you're not following nostr:npub1a2cww4kn9wqte4ry70vyfwqyqvpswksna27rtxd8vty6c74era8sdcw83a, you probably should be.

#BrokenMoney

Nvidia might have a difficult time generating the same level of annualized returns over the next 10 years as it has the last 10. Just saying.

#stocks #investing #trading #AI #NVDA

Very interesting chart. Thanks for bringing it to my attention @dailychartbook.

Clearly long duration assets care very much about inflation and the major trend seems to have shifted.

Take notice.

#macro #interestrates #inflation #economics #economy #stocks #investing #trading #deflation #Fed

The US leading economic indicators from The Conference Board are still quite weak, indicating a rocky road ahead for economic activity. Can these be wrong? Sure. But they should not under any circumstance be completely dismissed.

#macro #economics #economy #stocks #investing #trading

Seasonality favors the bears. Pairing this with sentiment, positioning, valuation, and stretched technicals provides a lot of fuel for a potential correction. Not is guaranteed. Trading and investing is only about putting the odds in your favor.

Source: @dailychartbook

#sentiment #seasonality #finance #trading #investing #economy

My recent post was lucky to be featured today in the Top Pieces section of The Morning Hark, Harkster's widely read daily market update.

I'd encourage you to check out my newsletter post as well as the Harkster platform. Harkster pulls together all of the best finance, economic, and investing newsletters and and articles into one place so your favorite publications are easy to locate and track.

Here is my recent post: https://lnkd.in/ed8r5pMK

#finance #investing #trading #economy #sentiment #stocks #stockmarket #bonds #newsletter

📈 Volatility returns to Wall Street in Q3 2023! Dive into a deep analysis of the S&P 500's performance, Fitch downgrade implications, and exciting changes to Capital Notes. Don't miss out:

https://capitalnotes.substack.com/p/the-final-bear-capitulates

#stocks #investing #sentiment #stockmarket #psychology #recession #Fed #trading