When you buy puts, the counterparty you buy the puts from will likely sell #bitcoin short to hedge the puts they sold you

So even though you aren’t selling your #bitcoin you are contributing to the margin and short sellers out there who are selling short

How about a hand-wall-clock that reflects sats/$1, so it counts down once #bitcoin gets to 1,200 #bitcoin/USD (approx. $83,333/BTC)

The outer ring would by the usual 1-12 ring and the seconds hand would be on an inner 0-99 ring, reflecting the first two and last two digits, respectively

Like the Moscow time digital clock but this would be a simple, cheap hand clock operating counterclockwise

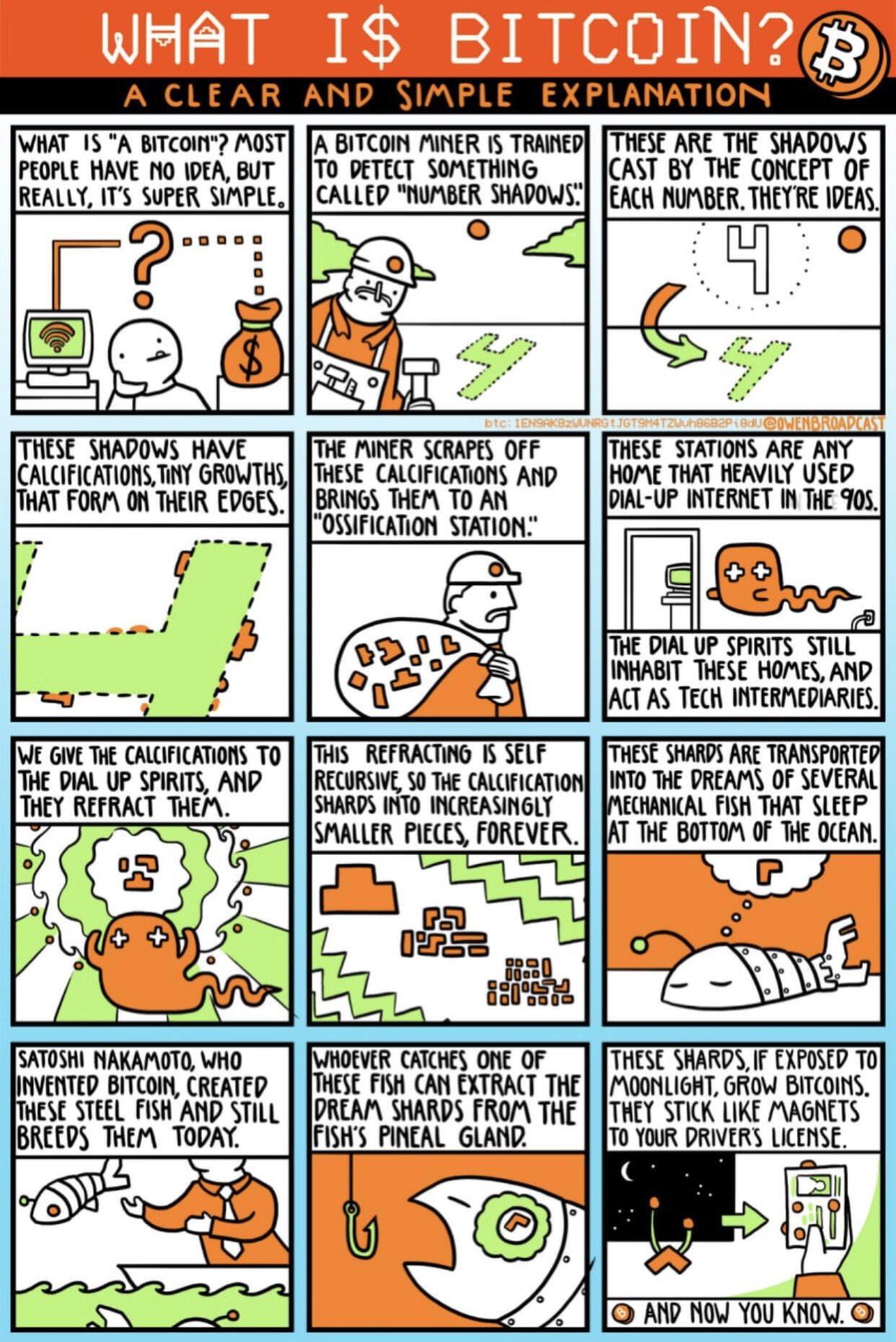

A timely re-post of a primer for your new friends asking about #bitcoin

Share it and encourage them to ask questions

1380 #bitcoin for 1 #USD?!?

#satoshisarebitcoin

People under the age of 16 today will not know a world without #bitcoin

#hope #future

Left off, “endure the backache”

If #bitcoin ‘s price is suppressed, by definition it is a buying opportunity

Every time you think #bitcoin price is suppressed, buy/earn/get more #bitcoin

It’s a great way to go from pessimistic to optimistic

Lightning and vending machines are matches in heaven nostr:nevent1qqs88ea9jwheme4te2k4rqev4dxfqpww42spfcf5pacfx5fw7rzzhmspp4mhxue69uhkummn9ekx7mqpzpmhxue69uhkummnw3ezumrpdejqz9thwden5te0v4jx2m3wdehhxarj9ekxzmnyqyv8wumn8ghj7un9d3shjtnndehhyapwwdhkx6tpds789r7x

How many more #signs do you need?

#FED #reservecurrency #fiat #bitcoin https://video.nostr.build/a793267a8bcbbe2cdd04e92870507e4a1494c6520e8b5a1b4247c5f7d3e39837.mp4

The US National debt is permanent. You know it, the #minniapolisFED knows it with their recent #bitcoin paper, and even AI knows it 👇🏻

Time to wash your hands of the whole #fiat mess and #optout and opt-in to #bitcoin

%%👇🏻AI Response to a query about paying off the US National debt👇🏻%%

I'll modify the analysis to work within current tax rates and revenue structures, which means a longer paydown period and different allocation scenarios.

Key Findings:

1. With Current Deficit Growth (4%):

- The debt CANNOT be paid off under current tax rates and revenue structures

- This is because the 4% deficit growth rate exceeds the combination of:

* Current tax revenue capacity

* Productivity growth (1.1%)

* Population growth (0.5%)

- The debt continues to grow faster than our capacity to pay it down

2. If Deficit Spending Stopped Completely:

- Minimum paydown period: ~215 years

- Current workforce contribution: ~116 hours per worker per year

- Breakdown of annual payment (~$920 billion):

* Initially: ~80% goes to interest (~$736 billion)

* Initially: ~20% goes to principal (~$184 billion)

- This ratio improves over time as principal is paid down

3. Critical Constraints:

- Current federal tax revenue ≈ $4.6 trillion

- Available for debt service (20%) ≈ $920 billion

- Current interest payments ≈ $736 billion

- Leaving only ≈ $184 billion for principal reduction

Key Implications:

1. Under current tax rates, the debt can only be paid off if:

- Deficit spending stops completely

- Current debt service allocation is maintained for over 200 years

- No major economic disruptions occur

2. With continued deficit spending, the debt becomes mathematically impossible to pay off under current tax rates

3. The high inflation rate (7.3%) helps reduce the real burden, but not enough to overcome the deficit growth rate

Disenfranchise #fiat and #google with

#bitcoin

nostr:npub14uhkst639zvc2trx2nlsvk4yqkjp690zk89keytnzgmq2az0qmnq58ez89 ill beg an updated to current video—love the music, too. Could listen for hours

#bitcoin

Challenge it every day

#bitcoin

lol! But I didn’t see the lanyard?

Executive order 6102

Saylor or nostr:npub1excellx58e497gan6fcsdnseujkjm7ym5yp3m4rp0ud4j8ss39js2pn72a

Who do you agree with?

Is this one of those “they’re the same picture” memes?

From my treasured archives:

#Shinjuku

#新宿 #日本 #東京 #bitcoin

#energy is abundant and free, accessing and utilising energy is not

Build an #energyabundant future at lowest cost and we will gain the stars together

#bitcoin makes the path a reality with its correct scarcity, privacy and low time preference incentives