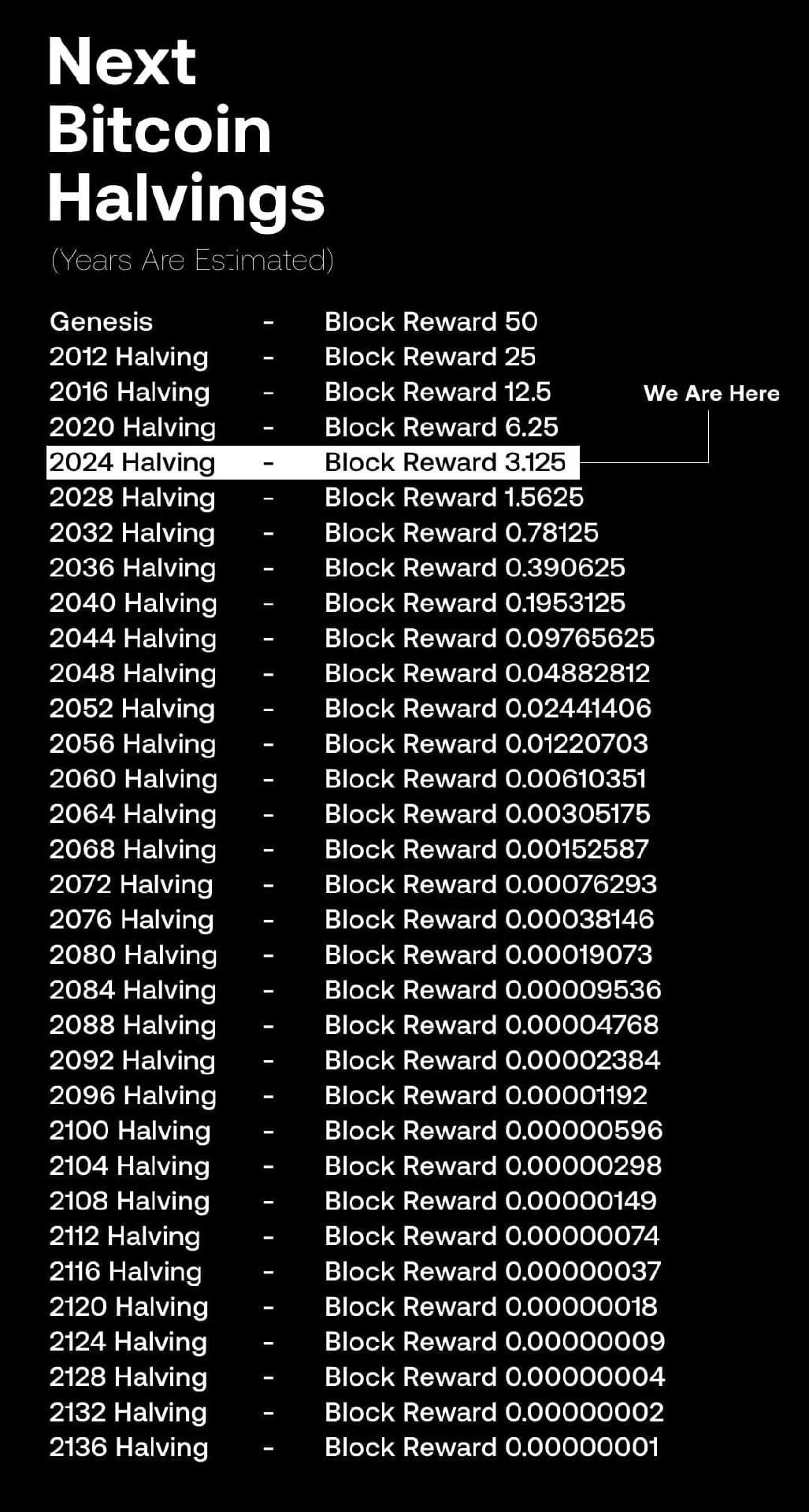

Michael Saylor believes owning 0.1 BTC by 2025 could be significant because of Bitcoin’s limited supply (21 million coins), growing global adoption, and its role as a hedge against inflation.

As Bitcoin’s value rises due to increased demand and its potential to act as digital gold, owning 0.1 BTC could place you in an elite financial tier. This amount may represent substantial wealth in the future as Bitcoin becomes a dominant global asset.

#btc #bitcoin #nostr #siamstr

If MicroStrategy is added to the S&P 500, its influence in the financial markets could grow significantly. Here’s how and why:

1. Automatic Investment:

Being in the S&P 500 means that index funds, ETFs, and institutional investors must buy MicroStrategy’s stock to match the index. This would create consistent demand for the stock, increasing its price and market presence.

2. Bitcoin Proxy Role:

MicroStrategy has tied its fortunes to Bitcoin by using its cash and borrowing money to buy large amounts of it. If included in the S&P 500, anyone investing in the index would indirectly gain exposure to Bitcoin through MicroStrategy, whether they intend to or not. This could further link traditional markets to Bitcoin’s price movements.

3. Convertible Bond Strategy:

MicroStrategy has raised funds for Bitcoin purchases by issuing convertible bonds—debt that can be turned into shares if the stock price rises. If the stock price increases after joining the S&P 500:

• Bondholders might convert their debt into stock, reducing the company’s debt but diluting existing shareholders.

• If Bitcoin’s price drops and the stock falls, the company could face challenges repaying these bonds.

4. Draining Market Liquidity:

With so much focus on MicroStrategy, other stocks in the index might see reduced investment as funds shift money toward it. This “suction effect” could make MicroStrategy a dominant force in the market, concentrating risk in one company.

5. Regulatory Concerns:

Regulators may question whether MicroStrategy is still a software company or effectively a Bitcoin holding vehicle. Increased scrutiny could limit its ability to operate as it has so far.

Outcome:

MicroStrategy could reshape market dynamics by blending traditional business with speculative Bitcoin holdings, drawing capital and attention. However, its heavy reliance on Bitcoin and leveraged debt creates significant risks. If Bitcoin performs well, the strategy could pay off massively; if not, the consequences could ripple through both the company and the broader market.

#siamstr #bitcoin #btc #nostr

Every child is born with innate joy, a natural state that society suppresses early on. Blissful individuals are uncontrollable and free, while unhappy people can be manipulated. Society, built on control, cannot allow too many joyful people, as they threaten its structure.

A joyful person is a rebel, not a revolutionary. Revolutionaries seek to replace one system with another, but rebels reject all rigid structures, trusting in nature’s order over man-made control. They believe life flourishes without rulers, as seen in the universe, animals, and plants.

Governance exists because humanity is neurotic, unable to trust in freedom. From a young age, children are denied the taste of liberty to ensure they conform. Without this suppression, they would resist control and refuse to be enslaved. A society dominated by blissful individuals would feel its power dissolve, as joy is incompatible with oppression.

———OSHO

#siamstr #btc #bitcoin #nostr

Ethereum faces criticism for its premine, where 72M ETH (65% of the initial supply) was pre-allocated to founders, developers, and early investors before public access, raising concerns over centralization and fairness.

Its 2015 ICO model, while innovative, inspired speculative investments and fraudulent projects. High gas fees, scalability issues, and reliance on complex smart contracts have also drawn scrutiny.

Additionally, cloud mining scams and Ponzi schemes linked to Ethereum damage its reputation. Despite these concerns, supporters highlight its innovation in smart contracts and decentralized applications.

The debate largely depends on views about fairness, decentralization, and trust.

#siamstr #btc #bitcoin #nostr

Bitcoin’s value is grounded in its proof-of-work model, where each coin is earned through the mining process, requiring significant energy and human effort. This resource-intensive process creates scarcity, with a limited supply of only 21 million coins, giving Bitcoin inherent value and making it a trusted, decentralized asset. The effort and energy involved in mining ensure that Bitcoin remains secure, fair, and transparent, setting it apart from other cryptocurrencies.

In contrast, Ethereum’s launch included a premine, with 72 million ETH allocated to developers and early investors, raising concerns over centralization and fairness. While Ethereum has introduced innovative technologies like smart contracts and decentralized applications, the premine has led to criticism about its deviation from true decentralization. Bitcoin’s focus on scarcity, decentralization, and security continues to make it the most trusted and valuable cryptocurrency, while Ethereum’s approach has sparked debates about its long-term sustainability.

#siamstr #btc #bitcoin #nostr

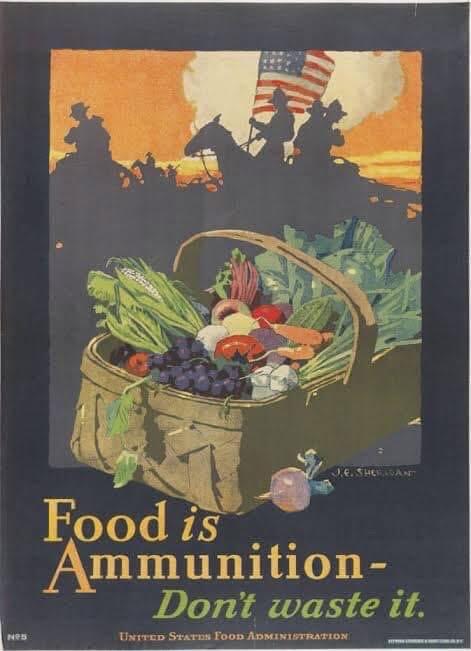

Meat is highly nutritious, offering complete proteins, essential vitamins like B12, and bioavailable minerals like heme iron and zinc, which are easily absorbed by the body. It also provides healthy fats and unique compounds like creatine and omega-3s, crucial for energy, brain health, and muscle function. In contrast, legumes and grains, while valuable, lack some essential nutrients and often contain anti-nutrients that block mineral absorption.

Interestingly, some governments promote grains and legumes heavily through subsidies and fund studies—such as those by institutions like Harvard—to highlight their benefits. Critics argue this serves to mask inflation by pushing cheaper, plant-based staples over nutrient-rich meat, keeping food costs low while reducing focus on more expensive but essential foods. This strategy, while economical, may come at the cost of public health, as it prioritizes affordability over nutritional quality. Meat remains a critical part of a balanced diet, offering nutrients that plant-based foods can’t fully replace.

#siamstr #btc #bitcoin #nostr

#siamstr #btc #bitcoin #nostr

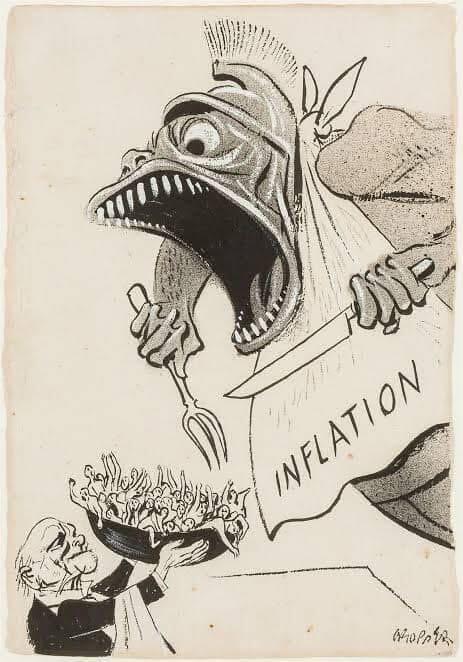

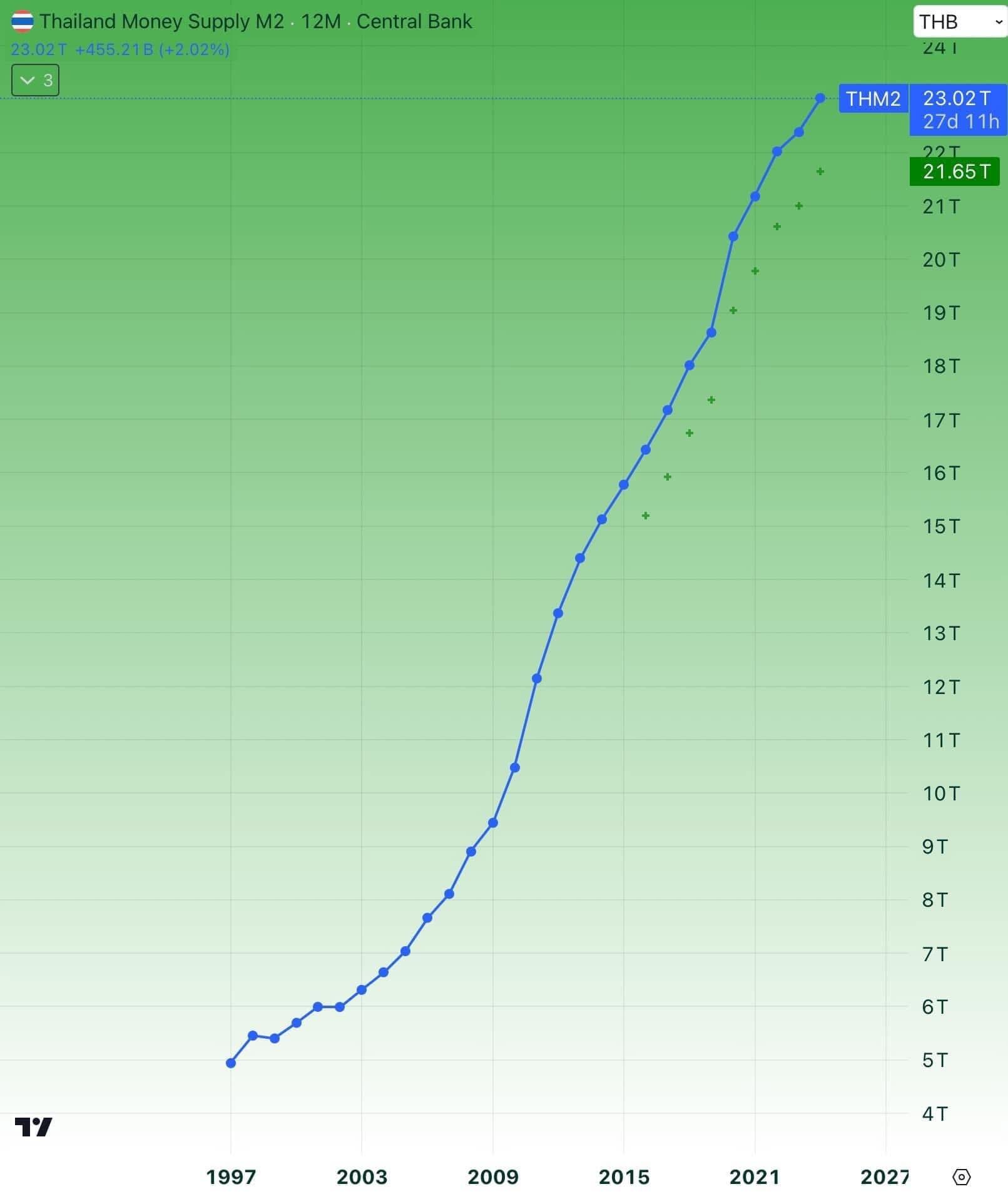

M2 money supply is considered a better indicator of inflation than CPI because it reflects the total money circulating in the economy, which can lead to future price increases.

While CPI tracks the price changes of a fixed basket of goods, it can “hide” real inflation by excluding asset prices, not fully accounting for substitution bias, and lagging behind money supply changes.

M2 is seen as a leading indicator, signaling inflation before it shows up in CPI, especially in cases where rising asset prices or increased money supply drive inflation. Therefore, many argue that real inflation is more accurately captured by M2 than CPI.

#btc #bitcoin #siamstr #nostr

The Consumer Price Index (CPI) is a widely used measure of inflation, but it has limitations that can cause it to “hide” the real inflation that people experience. Here’s how:

1. Substitution Bias: CPI assumes consumers continue buying the same items, even when prices rise. However, people often switch to cheaper alternatives, which CPI doesn’t fully account for.

2. Exclusion of Asset Prices: CPI doesn’t include rising prices of assets like real estate or stocks, which can significantly affect people’s wealth and purchasing power.

3. Quality Adjustments: The CPI adjusts for improvements in product quality, but this can understate real price increases, as consumers may still feel the financial burden despite higher-quality goods.

4. Overweighting Certain Items: CPI uses a fixed basket of goods, and if certain items (like housing) are underweighted, it can lead to a less accurate reflection of inflation for individuals who spend more on those items.

5. Lagging Indicator: CPI is released monthly or quarterly, so it may not capture rapid price changes in real-time, especially during sudden price spikes in sectors like food and energy.

6. Regional Variations: As CPI is a national

average, it may not reflect regional differences in cost of living, making inflation appear lower than it feels for people in high-cost areas.

Conclusion: While CPI is a useful tool, it doesn’t always capture the full scope of inflation, particularly for those facing high costs in areas like housing and healthcare. This can result in an underestimation of the real inflation people experience daily.

#btc #bitcoin #siamstr #nostr

Libertarians argue that government execution is worse than the private sector due to inefficiencies stemming from monopolistic structures, lack of competition, and misaligned incentives. Governments operate through coercive means like taxation and are often driven by political motives, leading to waste, resource misallocation, and bureaucratic delays. In contrast, the private sector relies on voluntary exchanges, competition, and market-based signals, which drive innovation, efficiency, and accountability.

Lower government intervention is seen as essential for fostering economic freedom, encouraging personal responsibility, and allowing markets to allocate resources efficiently. By minimizing regulations and avoiding distortions like cronyism or moral hazards, a smaller government preserves individual liberty and promotes a system where voluntary cooperation and competition lead to societal progress.

#btc #bitcoin #siamstr #nostr

Capitalism operates through mechanisms like mass production, consumer sovereignty, capital accumulation, and free markets to drive economic efficiency and growth. Mass production lowers costs and increases accessibility to goods, while consumer sovereignty ensures producers respond to demand, leading to better quality, innovation, and efficient resource allocation.

Capital accumulation, through reinvestment of profits, fosters long-term development and wealth creation. Free markets, guided by supply and demand, enable competition that drives innovation, improves quality, and lowers prices. In contrast, socialism’s central planning and lack of competition often result in inefficiency, resource misallocation, and slower innovation.

Proponents argue capitalism is superior to socialism because it fosters efficiency, innovation, and higher living standards through competition and individual economic freedom. While socialism emphasizes equality, it often lacks the incentives and adaptability needed for sustained growth and wealth generation. By aligning incentives with individual and collective prosperity, capitalism creates a dynamic system that is better suited to meet societal needs and promote progress.

#siamstr #nostr #btc #bitcoin

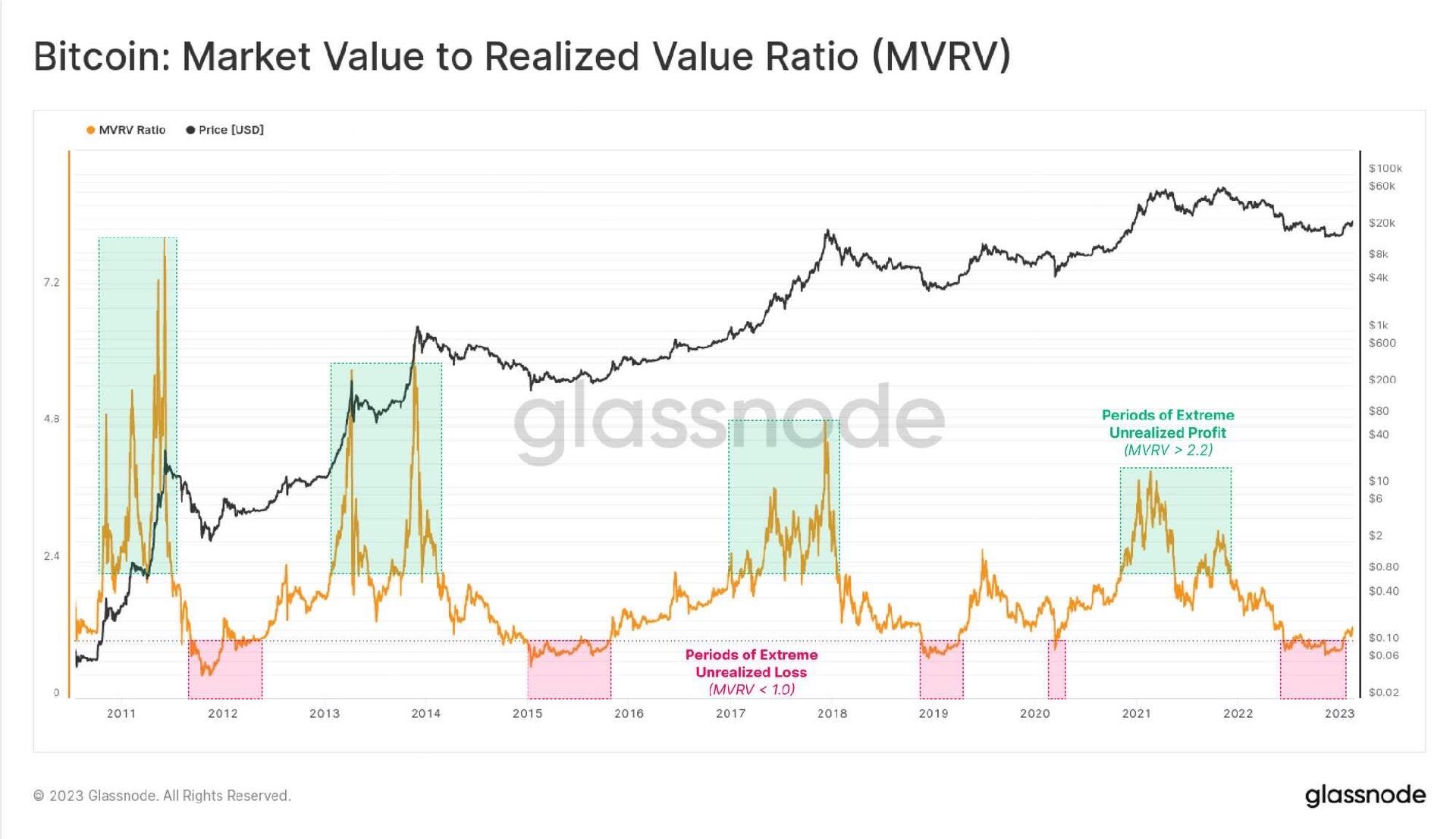

The MVRV (Market Value to Realized Value) ratio for Bitcoin compares its market price to the price at which each Bitcoin last moved (the realized price). Typically, an MVRV ratio between 1 and 3 suggests fair valuation. During times of market exuberance, the ratio can exceed 4 or 5, signaling potential overvaluation and speculative conditions. For instance, during Bitcoin’s 2017 bull market, the MVRV reached a peak of 7.6, suggesting significant overvaluation at a price of around $19,000. Higher MVRV values, such as those above 10, are rare but theoretically possible during extreme market bubbles, signaling potential for sharp corrections or crashes .

If Bitcoin’s price were to rise to $232,400 with an MVRV ratio of 7, it would reflect a dramatic overvaluation, as this would be about seven times the realized value, which is approximately $33,200. Such a high MVRV ratio is extremely rare and would typically indicate speculative mania in the market, where the price far exceeds the underlying value, potentially marking the end of the bull run and the onset of a significant correction .

#btc #bitcoin #nostr #siamstr

To take profits from Bitcoin effectively, it’s important to monitor the MVRV (Market Value to Realized Value) ratio, which indicates whether Bitcoin is overvalued. Historically, an MVRV ratio above 4 to 5 suggests that the market is entering overvalued territory, and ratios above 6 to 7 often signal a market top. If the MVRV ratio reaches these higher levels, it may be a good time to consider selling some of your Bitcoin holdings, as these values often precede corrections. By keeping an eye on MVRV and overall market sentiment, you can make more informed decisions on when to exit your positions.

In addition to using the MVRV ratio as a guide, Dollar-Cost Averaging (DCA) can be an effective strategy for taking profits. This involves gradually selling small portions of your Bitcoin holdings at different price levels instead of selling all at once. This approach helps mitigate the risk of timing the market poorly, as it allows you to capture profits at various stages of price increases. By combining the MVRV ratio with a DCA strategy, you can secure profits while still maintaining exposure to potential future growth, reducing the impact of sudden market swings.

#btc #bitcoin #siamstr #nostr

The increase in Thailand’s M2 money supply from 5 trillion baht in 1997 to 23.02 trillion baht in 2024 indicates a significant expansion of the monetary base, reflecting economic growth, credit creation, and monetary easing over the years. However, this growth also suggests a long-term decline in the baht’s purchasing power. While M2 growth is often linked to inflation, its direct impact depends on how money circulates and whether it fuels productive activity or asset bubbles. Much of this money may have gone into financial markets or real estate rather than consumer goods, leading to asset price inflation rather than a noticeable rise in the Consumer Price Index (CPI).

The government’s reported 2% inflation rate, based on the CPI, may not fully capture the true cost-of-living increases faced by households. CPI measures a limited basket of goods and can exclude significant price changes in assets or services. Additionally, subsidies, price controls, and global economic factors may suppress reported inflation. This mismatch suggests the real inflation rate could be higher than the official figure, raising concerns about the long-term erosion of savings value and the sustainability of economic growth fueled by monetary expansion.

#btc #bitcoin #siamstr #nostr

In the stock market and investment funds, returns are often influenced by monetary supply increases (like a rise in M2), which can drive up asset prices without reflecting the actual performance of businesses. When the money supply grows, more liquidity is available, and investors may bid up the prices of assets like stocks, real estate, and bonds. As a result, asset values can rise even if companies aren’t seeing significant growth in revenue or profits.

This means that nominal returns on investments may be more a reflection of inflation and monetary expansion than the true economic value created by businesses. In such cases, while investors might see their investments grow, those gains may simply mirror the inflationary effects of an increased money supply, rather than representing a real increase in wealth or business performance. Therefore, monetary policies and inflation can play a crucial role in shaping investment returns.

#siamstr #btc #bitcoin #nostr

#siamstr #nostr #bitcoin #btc

#siamstr #btc #bitcoin #nostr