It is in Europe & eastward … more than half the world … good enough for me.

It’s just a small stack as I too am essentially empty. But a stack nonetheless.

In general, boomers didn’t have to do anything special to get ahead. They showed up and rode the wave of fiat expansion.

Of course there is variation within the sample (not all boomers are lazy) but if we want to understand why millennials, Gen Z, etc. are so frustrated and lost and acting out, it is because the boomers soaked up all the value of the fiat system during their working years and are hoarding it for themselves as they age.

Literally had this conversation with a boomer yesterday. Incredible amount of ignorance out there … they truly are the “laziest” generation. nostr:note12pkxykazxqrggekf0jj80hhzm3cw0drqucldy90hdzxju4zuae3qftmkux

Not on capital gains. I believe you’re thinking income.

nostr:nevent1qqsthxf7zayxxw43dlpq7uq8g97nyrm9hyf3s58yj0tsnwjpg5myztgpr9mhxue69uhkummnw3ezuurvv43xx6rpd9hzummjvuq3kamnwvaz7tmjv4kxz7fwvf5hgcm0d9h8qctjdvhxxmmdqyvhwumn8ghj7ur4wfshv6tyvyhxummnw3ezumrpdejqzythwden5te0dehhxarjxgcjucm0d58pzfgj nostr:note13hl65tfcwzwqkcppcu3agad0pqx4395amesylad9ngdsddqxsmssjrng05

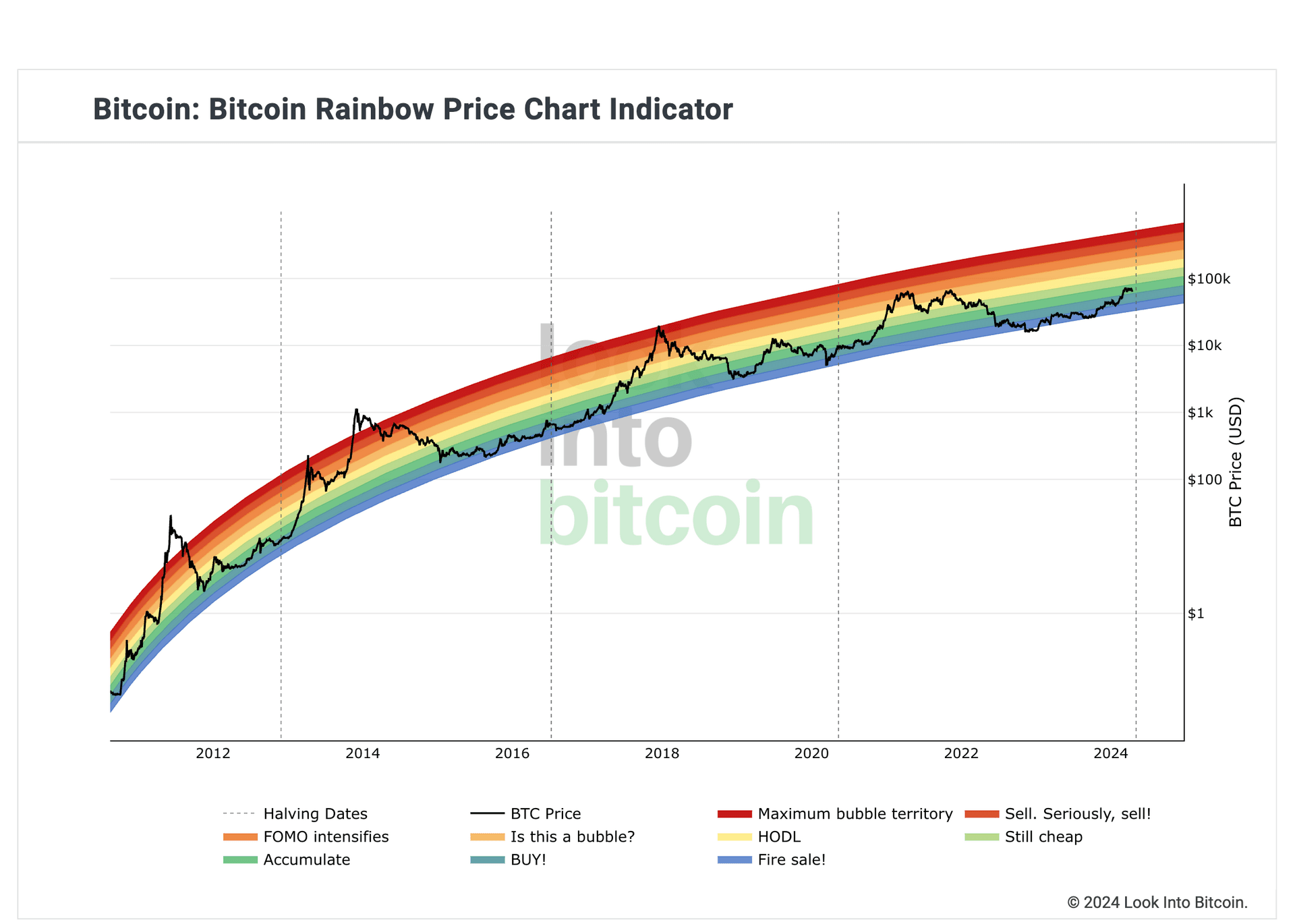

The volatility of #Bitcoin smooths as adoption increases.

And a longer time horizon reveals an ever-upward trend.

Chart source Look Into Bitcoin: https://www.lookintobitcoin.com/charts/bitcoin-rainbow-chart/

I think market manipulations impacted the volatility this last cycle. “Bitcoin is less volatile” isn’t how bitcoiners should position bitcoin…we should look at bitcoin’s Sharpe Ratio (volatility-adjusted returns) over a 4-year (more accurately a 210k block) epoch.

Willy Woo had a good chart on this but it hasn’t been auto updating for awhile now.

Miners and over-leveraged traders? Who else has the incentive to sell?

I can forgive the miners, they’re about to go through a rough time and are trying everything they can to stay turned on.

nostr:npub1yul83qxn35u607er3m7039t6rddj06qezfagfqlfw4qk5z5slrfqu8ncdu this interview with nostr:npub1s5yq6wadwrxde4lhfs56gn64hwzuhnfa6r9mj476r5s4hkunzgzqrs6q7z is helping a lot to understand better..

I’m definitely going to listen to this one…better lending options is a HUGE need for this upcoming epoch. Bitcoiners have to be able to treat our assets like today’s collateralizeable property and/or other property needs to be repriced with less fiat credit available. Has to happen this cycle.

Just sitting and hodling is cool but it is handcuffing smart people from deploying g their capital towards cool projects. It’s slowing adoption and giving the fiat economy an undeserved leg up in the near to medium term.

The Innovator's DNA: Mastering the Five Skills of Disruptive Innovators https://a.co/d/5faR0zV

The Innovator's Solution: Creating and Sustaining Successful Growth https://a.co/d/940kmr7

The Innovator's Dilemma: When New Technologies Cause Great Firms to Fail (Management of Innovation and Change) https://a.co/d/2PdqSBT

The Innovator's Solution: Creating and Sustaining Successful Growth https://a.co/d/940kmr7

The Innovator's Dilemma: When New Technologies Cause Great Firms to Fail (Management of Innovation and Change) https://a.co/d/2PdqSBT

In Clayton Christensen’s ‘Disruption’ framework, Bitcoin’s “job to be done” is to set the risk-free rate for money using a free and open market. The implications of bitcoin disrupting the currently corrupted solution addressing this need in the market (i.e. Federal Reserve-enabled and controlled US Treasuries) are massive; the implications cannot be overstated.

Raising interest rates will make rental homes less attractive to own financially - win for those without access to housing.

Bitcoin is changing those behaviors for those of us using it as a savings technology. So our consumption is going down.

My point is that there are some people out there who are worried about the environment but aren’t radicalized climate alarmists. An effective argument for that population is that raising interest rates will lower consumption. That’s all we “have to do to fix the man-made impact on climate.” Then it becomes a conversation of why won’t politicians and central bankers use that very simple tool to fix the climate (if we’re all so worried about it). That’s when it shifts from a conversation about conservation (and efficient use of our resources) into a conversation about power, control, and coercion.

I’d like to point out Joe is making $200/ month on Twitter. WGAF.

If a friend or family member is legitimately concerned with “man-made global warming” the appropriate response is to (1) be understanding and empathetic to their opinion and (2) suggest the best solution to the problem is simple: raise interest rates (which in turn will reduce consumption). Finally, (3) share with them that bitcoin sets the risk-free rate at 50%+ and so it is beneficial to the environment.

…If authorities really were concerned about the planet, they merely would need to raise interest rates to 20%+ and people would consume a lot less and be intentional about what they were consuming. Emissions would go way down relative to the 1970s-2020s fiat era…

Private property rights. It’s all about private property rights. #bitcoin nostr:note1lwj4d9gvhppmc79nzn20ayl8rfd92sj8907r3q9czs5k3dhhcu0q6vm3kl

Cries of “WW3!” literally the week of the halving?

Tick tock, next block.