Money doesn’t grow on trees.

Bitcoin is the only method of monetizing excess energy capacity without the need for distribution. Large companies are starting to have conversations about hosting bitcoin miners at their sites where building pipelines and/or grid capacity isn’t economically feasible.

Anyone who says “Bitcoin isn’t backed by anything” clearly doesn’t understand energy nor energy markets.

What will be the big global / macro distraction that will rollout next Wednesday - Friday? Feels like something big, too; news coverage needs to stay pretty much constant through the weekend and into the week of 4/22. People need to be captivated.

Centralization isn’t a problem until it is … and I’m pretty confident that miners at scale aren’t going to put their profitability / future profitability at risk if the overall hashrate starts to consolidate too much with any one pool / template. They’ll move / diversify hashrate

Who cares? There are too many of us for them to realistically do anything about if we all stand tall and stand together. Recruit more outspoken bitcoiners. Make it impossible for them to act with aggression or malice against us.

At worst it’s locked up forever. At best, they can’t keep it without continued work. Any action they take towards it legitimizes it over the long run.

Also, Bitcoin is for enemies.

I disagree. Difficulty impacts profitability. Profitability is dependent on price paid for electricity. Cheap electricity isn’t centralized.

Going public started when Twitter started taking VC money. With VC fund backing, every company starts making decisions based on their investors’ exits …

Just buy and hodl bitcoin…the difficulty adjustment will take care of the rest.

That won’t last. Beauty of the difficulty adjustment is that mining finds its way to small, cheap, waste energy.

500-1000MW bitcoin mining facilities will not be profitable in 6 years. Waste energy doesn’t come in those sizes…

Even if he inexplicably rugs … his strategic playbook is sound and could be (arguably should be) copied by everyone.

I disagree, bitcoin’s value won’t be as great as if it is adopted with MoE and UoA but bitcoin will still become more and more valuable as miners buy ASICs and electricity for fewer and fewer bitcoins.

Have some gnocchi in Boston’s North End and you’ll realized you’re wrong.

//zen.

nostr:note1p7p0gq8kgs9szcjjclkxj3kkj84uq5l2s7j0l99udmgglwpq49pq9r0syu

nostr:note1p7p0gq8kgs9szcjjclkxj3kkj84uq5l2s7j0l99udmgglwpq49pq9r0syu

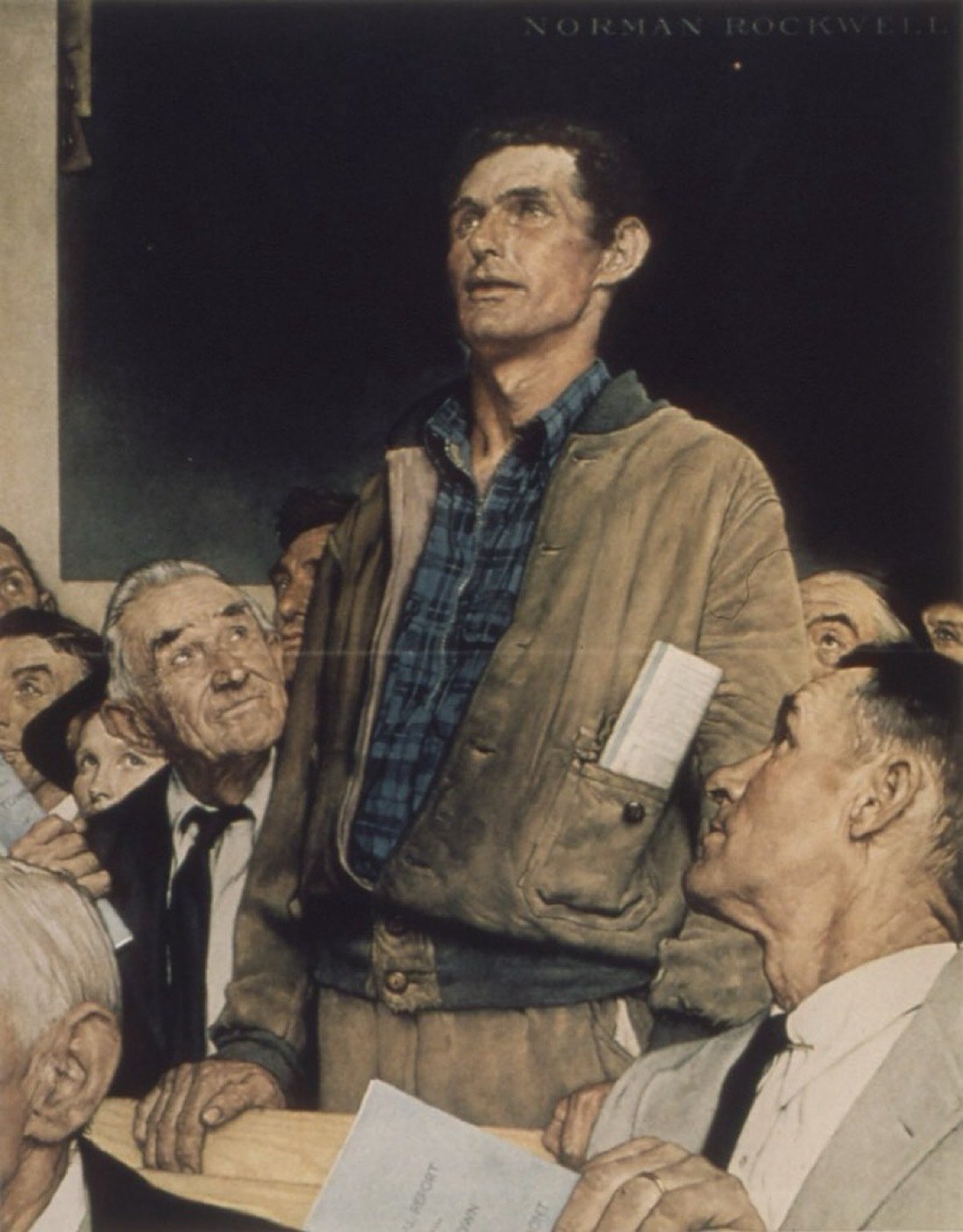

Mood.

🌎👩🏼🚀🔫👩🏼🚀 nostr:note14h2z63zw8cnvxkvsl3k77gc2svat0906v657xqmcvh79l2eaj3dqcuacu9

👩🏼🚀🔫👩🏼🚀 nostr:note14h2z63zw8cnvxkvsl3k77gc2svat0906v657xqmcvh79l2eaj3dqcuacu9

Meh.

Fidelity has been in the bitcoin game for a long time. They are the custody provider for their ETF clients. They seem to be active in the industry and putting out good people into the ecosystem.

For those where the real thing is a bridge too far, I’m recommending they start their journey with FBTC. Obviously there are risks but for so many people out there getting started is the hardest part.

Bankrupt the Boomers.