Last days by the Mediterranean, soaking in the sun with family. Recharging for la rentrée, ready to face what's next

Lol, fun stuff

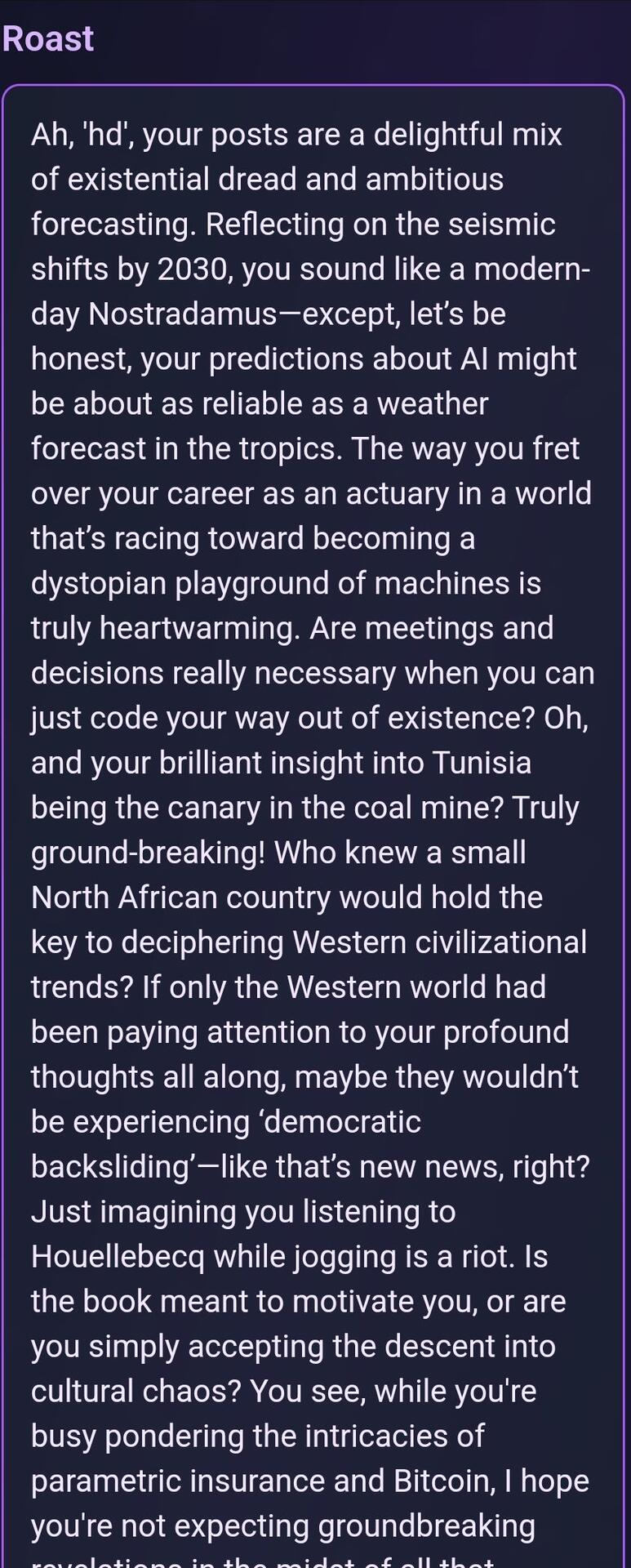

https://nostr-personality.vercel.app/npub1h7hawnagnvfwre6xysmzdxtr90mddsgxmruss9fy0gxkad06gegsvzxxjk

"All in all, your current thought processes resemble a complex board game—lots of moves, not necessarily leading anywhere coherent." Can't agree more

I've been reflecting on Raoul Pal's theory (which I largely agree with) about the world undergoing a massive shift by 2030 due to the exponential rise of AI. Pal is an excellent speaker and a great simplifier of complex ideas. However, his businessman side occasionally makes him seem opportunistic, especially with the promotion of questionable cryptocurrencies. Still, the alpha he delivers elsewhere more than makes up for it.

In this context, I often find myself feeling lost regarding my career direction. Is it even sensible for someone in a traditional industry to carry on as usual—holding meetings and making decisions about topics that might soon become irrelevant?

As an actuary with an executive role in an insurance company, I now find myself doing things solo in a matter of days with these very recent tools like Cursor or Replit Agent—things that used to take entire teams months to accomplish.

So, what to do to hedge against this uncertain future? One approach is to carry on as usual and save as much as possible in the "future currency" of AI interactions (#btc if your still wondering ;) ), or to start adapting now to the coming changes.

But what does "adapting" even mean when AI, far smarter and more efficient than any of us, is set to flood both cyberspace and the physical world? That’s the big question, and it’s one that occupies most of my thinking these days. Yet, I haven't been able to draw any clear conclusions.

Interestingly, I’ve just learned that nostr:nprofile1qqsw4v882mfjhq9u63j08kzyhqzqxqc8tgf740p4nxnk9jdv02u37ncpz4mhxue69uhhyetvv9uju6mpd4czuumfw3jsz9nhwden5te0wfjkccte9ec8y6tdv9kzumn9wsq3yamnwvaz7tmsw4e8qmr9wpskwtn9wvql3tqm is venturing into science fiction, and my first reaction is that this might help me explore these questions. Her economic and financial newsletter is outstanding—pragmatic, rooted in a bottom-up engineering approach. This, I believe, holds her back somewhat from diving deep into speculative thought. Yet, her insights on what the world of tomorrow could look like would be fascinating, and what better way to let her intuition about the future flow freely than through science fiction? It might provide valuable clues on how to prepare for what’s coming.

That said, I might just be imagining things, and Lyn’s story will end up focusing on some completely unrelated topic, set in a cigar galaxy in the year 6373.

Ah, September—where the market spirits drop BTC just enough to let everyone stack sats and quietly lower the Gini coefficient. Perfect timing for the next wave of FUD about wealth inequality! 📉🍂 #Bitcoin #SeptemberDip #btc

As a keen observer of the Mediterranean world, I've developed this fascinating theory over the past few months: modern Tunisia serves as the canary in the coal mine for major global transformations. I'm convinced that this small North African country is an early indicator of dramatic changes that will later manifest more intensely in the Western world.

My theory is based on concrete observations. Tunisia generally feels the symptoms of major upheavals first, albeit less intensely, before they occur in the West. This phenomenon is explained, in my view, by the country's remarkable resilience despite its limited resources. Shocks occur quickly but at low intensity, making it an ideal barometer of emerging global trends.

Here are historical examples that support my theory:

- Decolonization (1956): Tunisian independence preceded the African decolonization wave.

- Women's emancipation (1956-present): Tunisia pioneered women's rights reforms in the Arab world.

- Rise of Islamist terrorism (1980s-2000s): Tunisia experienced Islamist violence well before it became a global concern post-9/11.

- Arab Spring (2010-2011): The Tunisian revolution triggered a broader movement in the region.

- Migration crisis (2011-present): Tunisia faced migration pressures before the 2015 European crisis.

- Rise of populism (2019-present): The election of populist president Kais Saied preceded a global wave of populist movements.

Factors that I believe contribute to Tunisia's unique role:

1. Its geopolitical position at the crossroads of Africa, the Middle East, and Europe.

2. Its resilience despite limited resources.

3. Its cultural diversity and receptiveness to global trends.

4. Its relatively well-educated and connected population.

5. Its history of political experimentation.

Observing recent developments in Tunisia, I predict the following trends for the Western world:

1. Erosion of institutional power: The weakening of Tunisian institutions foreshadows similar trends in Western democracies, manifesting as:

- Increased executive overreach

- Weakening of checks and balances

- Erosion of judicial independence

2. Democratic backsliding: President Saied's power consolidation since 2021 heralds challenges for established democracies.

3. Economic stratification: Growing disparities, especially for less mobile populations, indicate intensifying class divisions coming to the West.

4. Youth disillusionment: High youth unemployment and political disengagement signal imminent frustration with traditional systems.

5. Digital authoritarianism: Tunisia's struggles balancing digital freedoms and state control preview similar Western challenges.

6. Migration: Tunisia's challenges offer insights into future population movements that will affect Western nations.

Connecting to the Fourth Turning theory:

The erosion of institutional power and societal tensions we're observing in Tunisia signal, I'm convinced, the imminent approach of a Fourth Turning-like period in Western societies. The Fourth Turning, a concept from generational theory, suggests that every 80-100 years, societies undergo a crisis period that reshapes institutions and values. nostr:nprofile1qqs2auxkkgfgylem580xrztp8ek5sf83s86k0vfq2feuz6y4lkhskgcpr9mhxue69uhhyetvv9ujuumwdae8gtnnda3kjctv9usfh5g5 has nice podcast episodes about the topic with nostr:nprofile1qqsfxhwffq7ndujy26532rwnlzt43ekyrl3qfkzms3m2gxmrdt6r5fqpr9mhxue69uhhyetvv9ujuumwdae8gtnnda3kjctv9uaq82ed

Tunisia's current struggles with institutional decay, economic hardship, and societal polarization are, in my view, early indicators of a broader cycle of change. If my theory is correct, and I strongly believe it is, we are on the cusp of a significant transformative period in the Western world.

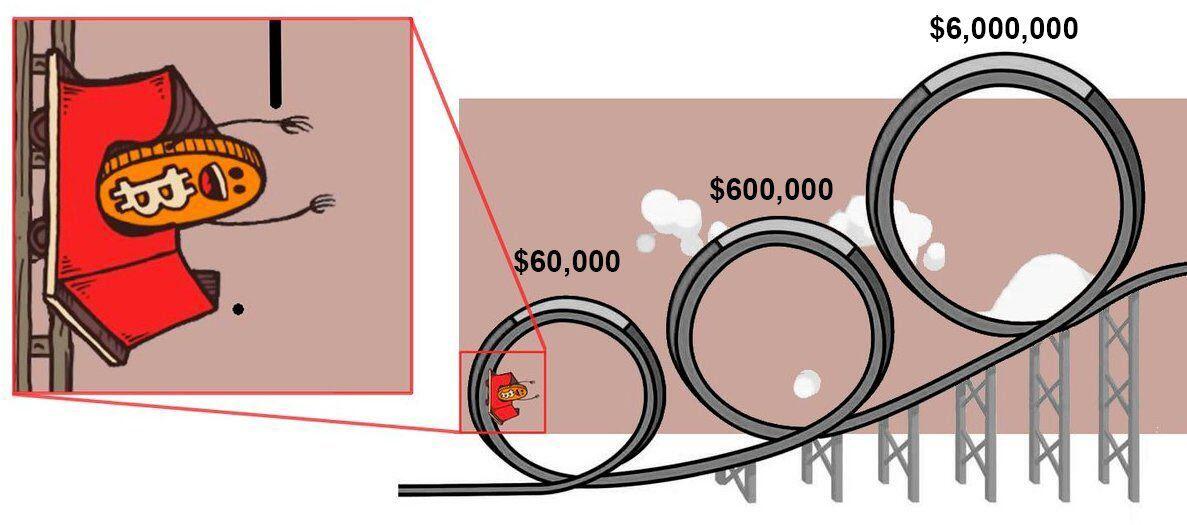

I agree that HODLing is a real test of conviction, especially during 50% or larger drawdowns. That said, I think that in the long run, greed can't be the only driver. It can be a powerful motivator in the first cycles, but at some point, there needs to be a higher, more moral goal that goes beyond just accumulating wealth.

As for diversification, I'm aligned with your view (or is it Pierre Rochard’s or Saif’s?) that Bitcoin in self-custody is probably the best ETF for the global economy. Still, diversification can make sense—not so much to improve the risk/reward ratio in the traditional portfolio sense, but more to build resilience against different kinds of "attacks" whether they're tax-related, legal, or more personal (like the $5 wrench attack or an unexpected family need combined with some offramps being locked).

On hyperbitcoinization (I bring it up because I believe that this rational conviction is probably the only one that justifies HODLing at all costs) unfortunately, while it might be the ultimate goal, I’m afraid it might be still far away and current price action might show that the suddenly phase is not happening tomorrow. That doesn't mean we shouldn't work towards it, even if the path might be longer than we’d like

On the third dip, Saylor said, 'Let there be buys,' and there were buys. And the market saw it was good.

true, but patience can sometimes lead to inaction. Knowing when to act is just as important as being kind and patient

Gm 🌞

Spent the afternoon brainstorming about combining parametric insurance with Nostr and Zaps. 🤔

Key concept: Using DeFi-style liquidity pools on Nostr for parametric insurance products.

Potential benefits:

- Instant, automated payouts for policyholders

- New investment opportunities for liquidity providers

- Leveraging Nostr for transparency and Zaps for efficient payments

Still pondering:

1. Technical challenges of integrating Nostr, smart contracts, and Zaps

2. Regulatory implications in different jurisdictions

3. Scalability to various types of insurable events

I'll try to ship an mvp

#NostrInsurance #Parametric

Back

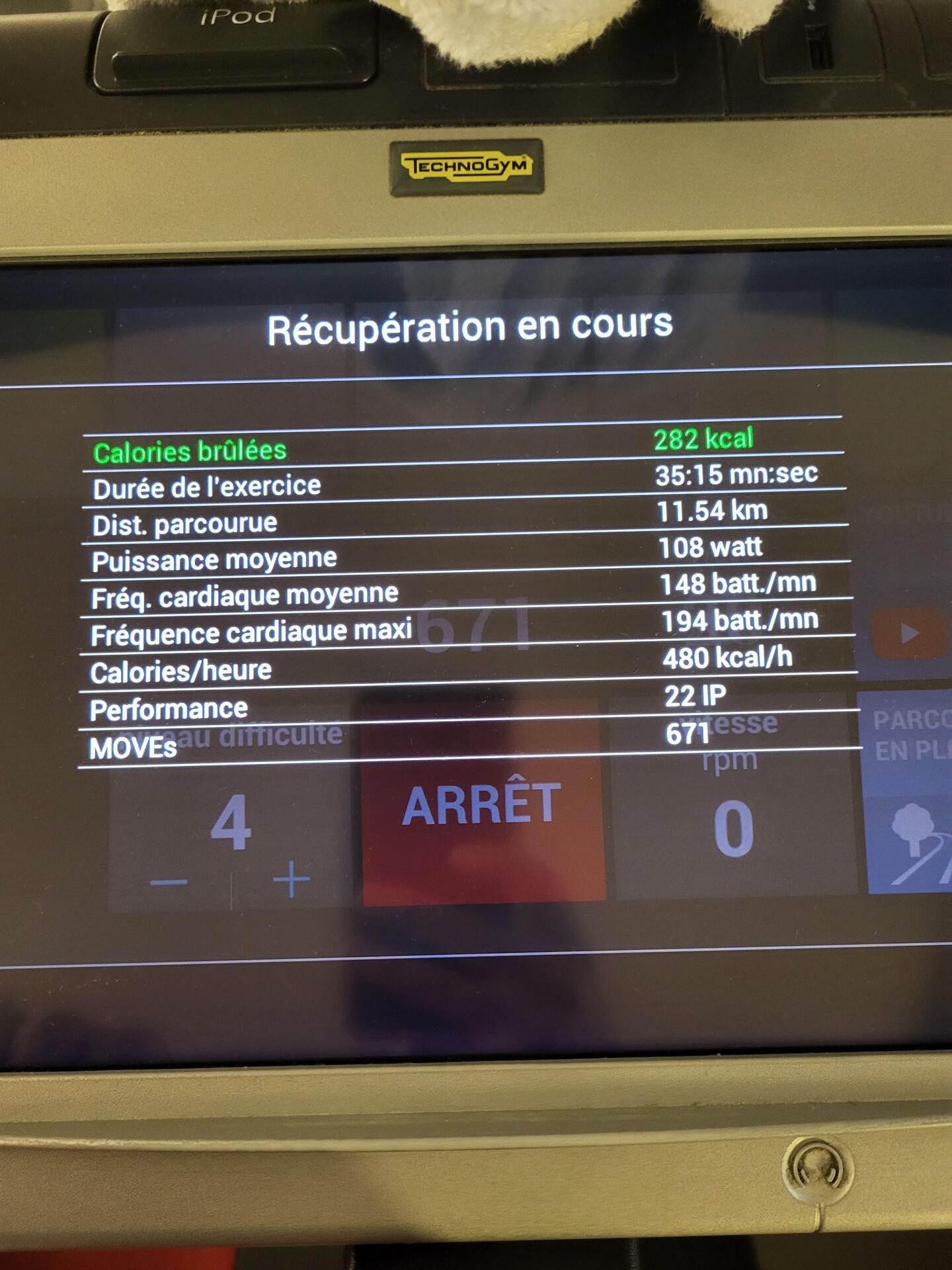

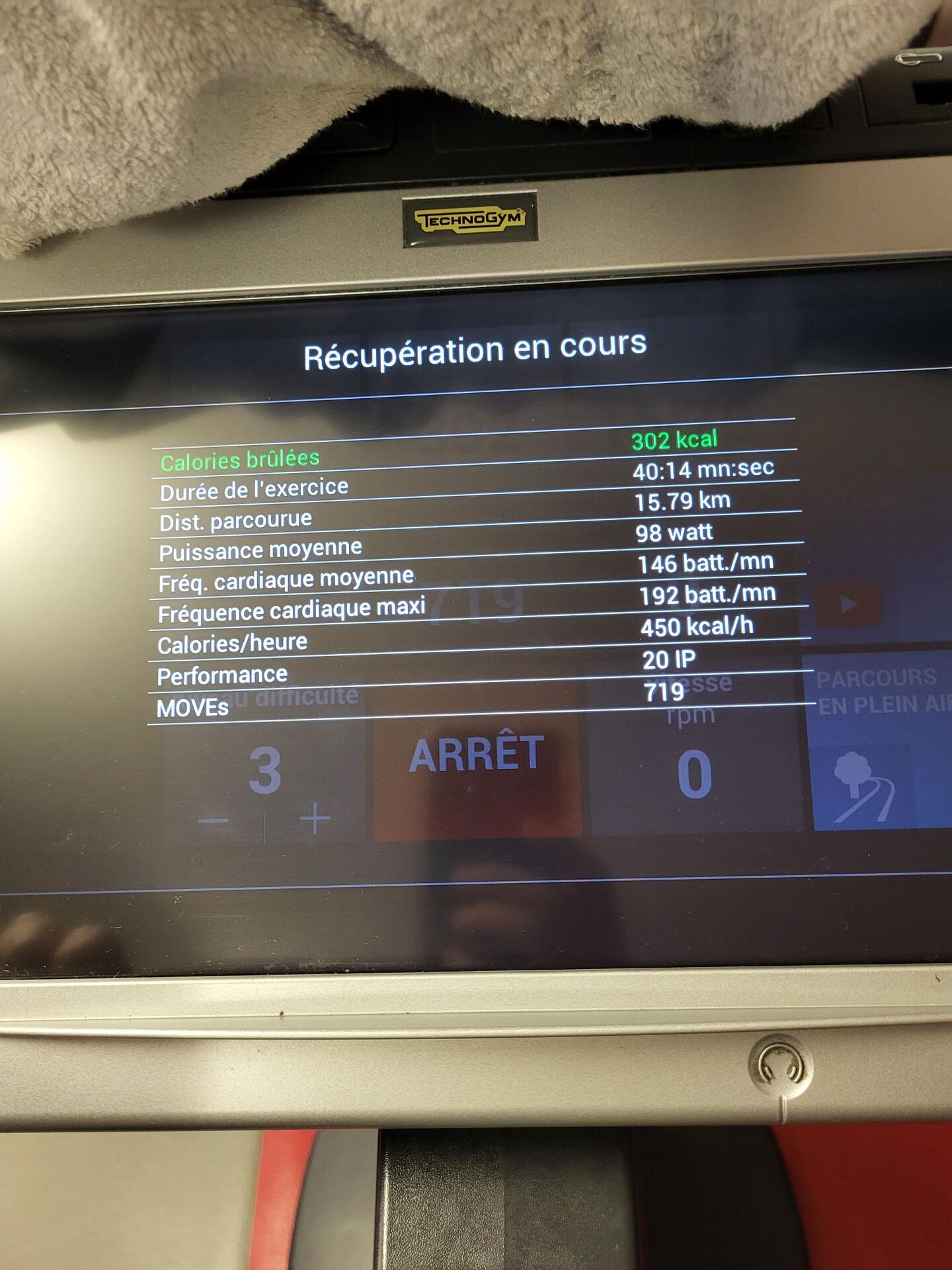

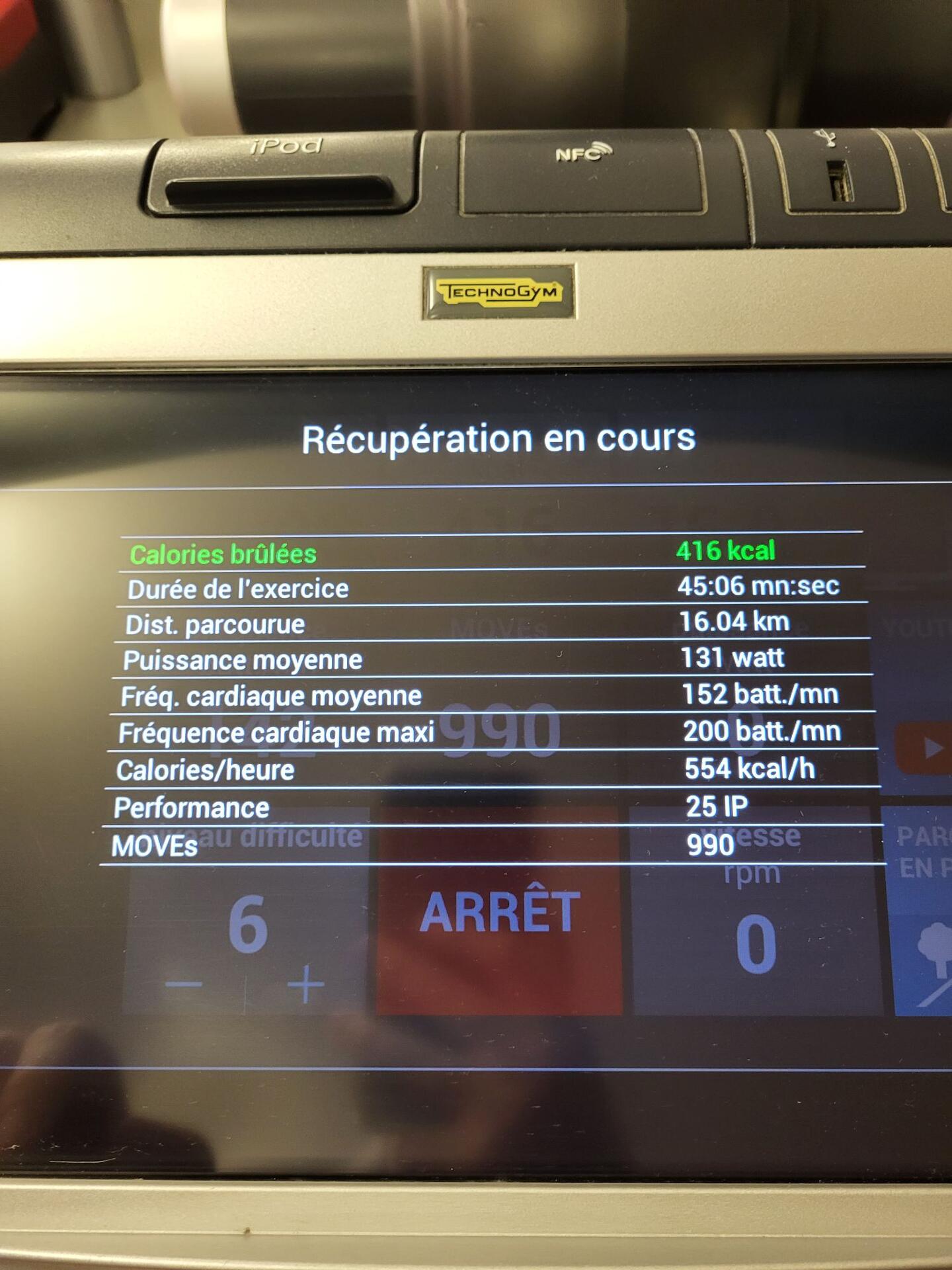

Type2 #pow

T2 #pow