Interesting how even Bitcoin dumps when geopolitical risks come into the fold. That tells me that there is more education necessary here.

When geopolitical risks present themselves, and Bitcoin dumps, that is a time to buy!

War is funded with printed fiat. Why would anyone dump their hard money positions for fiat when the most likely time for more fiat to be printed is at a time of geopolitical risk?

Not investment advice, but I’ll take a dip like that any day 😎

Steady upward price discovery from here on out…am I wrong?

Doesn’t matter, I guess. Let’s punch 70K

Just learned last week about UTXO management…are most aware of this concept to prevent their BTC from turning to dust?

Good listen regarding the big players coming in for some of the corn

If BTC could be mined like dollars can be printed (and therefore, lead to a manipulation of the money supply) would the White House stand by its proposed 30% tax on the energy costs of mining?

White House Council of Economic Advisors (CEA) claims, “Currently, crypto mining firms do not have to pay for the full cost they impose on others, in the form of local environmental pollution, higher energy prices, and the impacts of increased greenhouse gas emissions on the climate.”

If the currency was centralized, what would the CEA have to say about its impacts on climate change?

Will platform fees fall quickly after this ordinal congestion rests?

Here's an analogous example: When fiat inflation skyrocketed this past year, rent prices everywhere decided to hold its hand on the way UP. However, it seemed to let go when inflation went back down and remained at that elevated level (and continues to rise, in many cases).

Would love to see a trendline of margins for these cryptocurrency platform companies before, during, and after the dust settles. How do we QC the legitimacy of this ordinal congestion over time to know these high fees are legitimate?

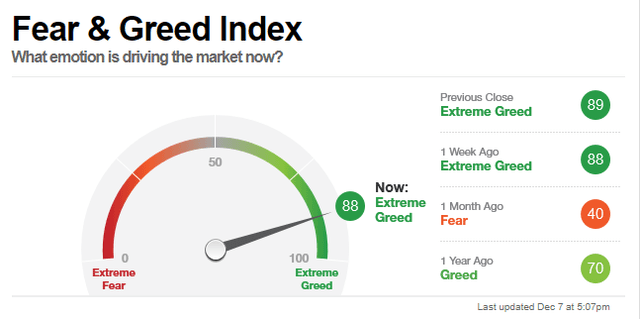

Where do these platforms sit on the index below?