Good call. Great flick

Truth… just done a 6 hours stop over saving £45… 😑

Stay humble & stack sats, may end up being the greatest advice I ever received.

https://fountain.fm/episode/XCJzob9JrOr5AHfima0d

nostr:nevent1qvzqqqpxquqzpx40fev5w4skqwyqw9p22zvxdzmdj02z6t9rw7hel7m08gsnmc4vsv5747

On a level Pee I hear you but I’m starting to see the more profound aspect of the network effect. Spending sats and earning sats is the ultimate expression of bitcoin’s use case. Stacking is a starting point once we’ve taken the orange pill

Truth Gee!

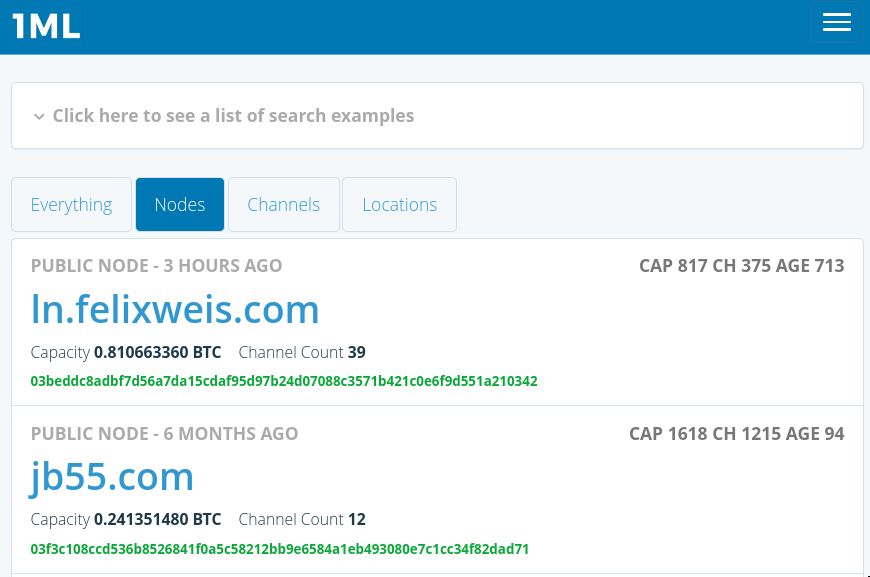

Me and felix weis still holding down the top 2 oldest nodes still running on the lightning network 😎

Staunch Willy

You can make an account and pay in on-chain bitcoin, or you can pay via lightning at https://vpn.sovereign.engineering/

Boom!

✅ Nostr Panel - done! nostr:npub1ze93u0u37u3x0gnfffgxl33k60v7t3afs64jgzf4xznapr4ra5us0u3pxq

Topics: Nostr - A New Social Layer and Space for Web Creators | The Sovereign Identity and Interoperable Data Layer of the Web

—

With nostr:npub1lelkh3hhxw9hdwlcpk6q9t0xt9f7yze0y0nxazvzqjmre3p98x3sthkvyz nostr:npub1dtgg8yk3h23ldlm6jsy79tz723p4sun9mz62tqwxqe7c363szkzqm8up6m & nostr:npub1l2vyh47mk2p0qlsku7hg0vn29faehy9hy34ygaclpn66ukqp3afqutajft - thx guys!

📸 photo by nostr:npub1hz5alqscpp8yjrvgsdp2n4ygkl8slvstrgvmjca7e45w6644ew7sewtysa | cc nostr:npub1pumdyz7qfu0suamv4nrl0vcg574dtl5mwazva6nyjxhpwc4ccxxqca3ane

Gonna give this a listen on Fountain

Along with Steve Lee of Spiral and Ren of Electrical Capital, I co-authored a paper on Bitcoin consensus and the analysis of risks around protocol upgrades from a technical & economic perspective:

https://github.com/bitcoin-cap/bcap

Here's the v1.0 PDF version:

https://github.com/bitcoin-cap/bcap/blob/main/bcap_v1.0.pdf

It explores what consensus is, how Bitcoin has historically upgraded its consensus over time including through contentious periods, and what some of the future paths and associated risks there are for potential changes in the future.

The paper doesn't take a stance for or against any given consensus change, but rather analyzes the field for how changes are made (which partially evolves over time as the network grows, i.e. 2024 is different than 2017 is different than 2009), and what some of the specific risks are for contentious changes from a blended economic and technical perspective.

For example, we analyze scenarios around bounty claims, which is a risk that can manifest when the majority of miners adopt a change but only a minority of economic nodes have:

https://github.com/bitcoin-cap/bcap?tab=readme-ov-file#how-might-this-occur-with-a-soft-fork

And in a world of sovereign holders, corporate treasurer holders, ETF holders, and so forth, some of that could play out differently today or in the future compared to how it might have played out in the past. And so we provide a framework to help analyze those scenarios and risks.

For the v1.0 version, we had the paper reviewed by major exchanges, ETFs, corporate treasurers, developers, miners, legal experts, philosophy professors, etc to make it as accurate and helpful as an educational resource across domains.

However, we consider our initial version to only be the start. We're releasing the paper to the public domain, and inviting people to contribute to it or even help maintain it on Github.

It's a living document, in other words. We're not the authorities on this; we just did a lot of research and review on the topic as a starting point. If there's something you think could be clarified, or something you disagree with, then we invite your contribution! And a big thank you to the initial people that reviewed it and provided feedback for the initial v1.0 version!

Important contribution. Thank you

My most downloaded guest is back: Col. Douglas Macgregor on what’s next with the economy, Trump Admin 2.0 and global conflicts:

https://youtu.be/omnMNMyDGPo?si=ZZEKddO1UHOTE22F

Audio only: https://podcasts.apple.com/us/podcast/coin-stories/id1569130932?i=1000676049249

This will definitely be worth a watch!

LoLz! Let them know I said ‘whateva’

Real… however I’d say Trump is the first ‘bitcoin conscious’ US president, so at the very least we won’t be under open attack.

He’s got a hell of a lot on his plate, a team to build with Musk, RFK, Gabbard, Ramaswami & Vance.

There’s that national debt, federal overreach, big pharma, the industrial military complex, Ukraine & Middle Eastern conflict, the UN’s 2030 agenda and Europe’s continuing march into a socialist totalitarian superstate to name a few!

If Trump and the team can get you all back to the Constitution I’d say that would be a major move.

Truth is Bitcoin doesn’t need government backing and truth government can’t stop it. We just got to keep on keeping on. Buy it with fiat, get it off centralised exchanges, buy shit with it, sell shit for it, run nodes as sovereign individuals maintaining the protocol, setup channels on lightning to support borderless commerce, pleb mine like true cypherpunks, build on the tech stack, build communities on it and distribute them orange pills.

It’s on us to make the thing real across the globe, for all peoples in all places using all that this freedom tach has to offer.

I hear you G. I use the built-in Brave VPN but am feeling it’s time to grow up. Will take a look at Mullvad

nostr:npub1rtlqca8r6auyaw5n5h3l5422dm4sry5dzfee4696fqe8s6qgudks7djtfs x nostr:npub1hk0tv47ztd8kekngsuwwycje68umccjzqjr7xgjfqkm8ffcs53dqvv20pf x nostr:npub10qrssqjsydd38j8mv7h27dq0ynpns3djgu88mhr7cr2qcqrgyezspkxqj8 is #16 on Fountains “Hot” list. We gotta pump those numbers up. Those are rookie numbers.

Gotta catch this episode!