You have to show us what you make!

GN 😘😴

This is insane. I can’t stop watching but need to sleep!

How about your thoughts?

Hmmmm it’s crazy isn’t it.

I think with the exchange rate above 140 investors are still borrowing yen to invest. Maybe they are confident the BOJ will intervene.

Is it also significant that the spread between US and Japan interest rate is still large so the trade still makes sense?

I haven’t forgotten the trauma from 10 years ago.

Long and angry in the end. Best to sleep it off

Yeah that’s really good advice. I’m definitely learning to balance myself more and could probably do better at it. If I just did what you do I would beat myself up with guilt…yet probably have the same heart / muscle benefits.

Oh yeah I’m well aware.

Not training for anything, just needed to increase my capacity…so I signed up to Michael Blevins new platform. I’m familiar with their training style so all ok. Definitely won’t do that volume/intensity on a regular basis. Old enough to know how quickly I break.

How about you?

Excellent movie

Just realised how unfit I am. Try this ⬇️

PSA:

If you are heavily invested in US assets... including stocks, bonds and/or real estate... then you should probably take a listen to this recent interview with nostr:nprofile1qyx8wumn8ghj7cnjvghxjmcpz4mhxue69uhk2er9dchxummnw3ezumrpdejqqgq73kpcjhhrptf9gnd9qksu3k2nxr09tusez8ltmk8z9x4h6wdavuwmfgqg

The major secular trend has already started... and few are ready for the necessary shift away from over-financialized US assets and to hard assets (like bitcoin and gold) and international equites.

Give it a watch/listen and let me know your thoughts below!

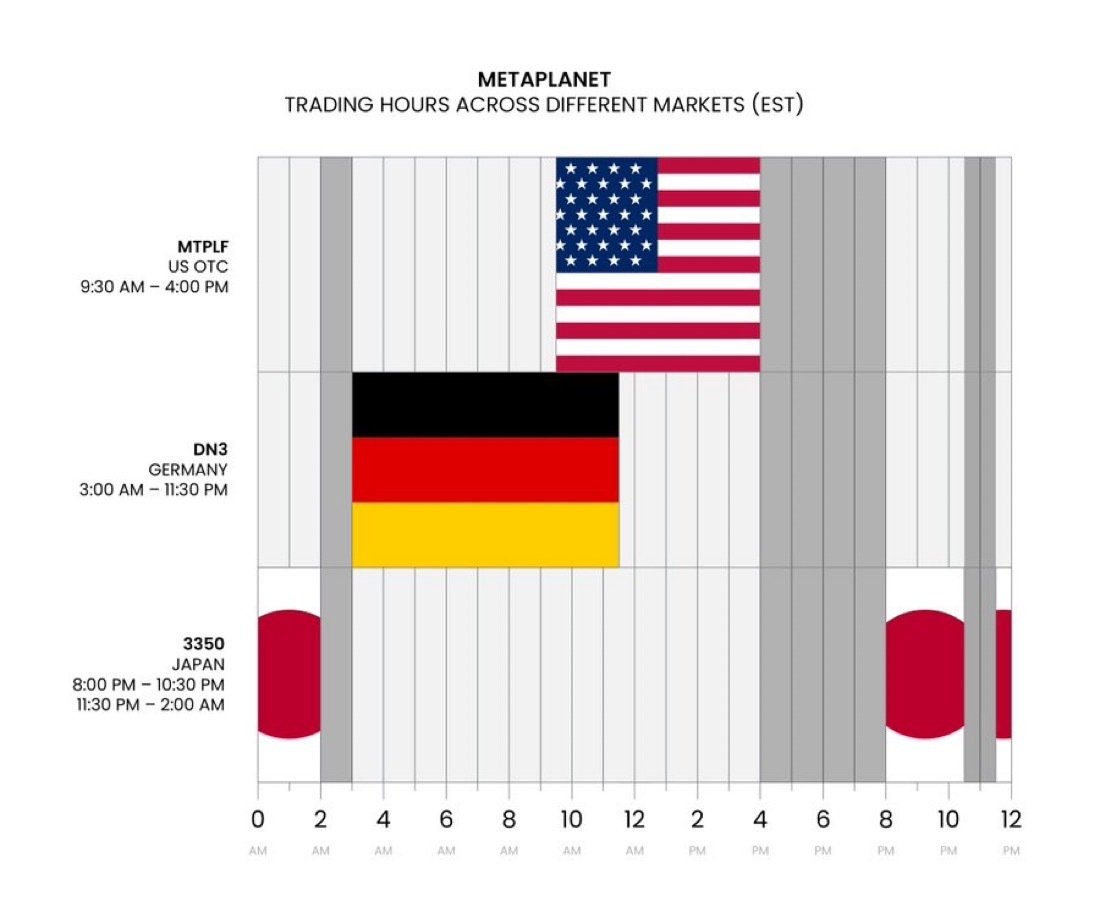

Japan

I love them but I do get a little nervous a chunk of my house will fall off.