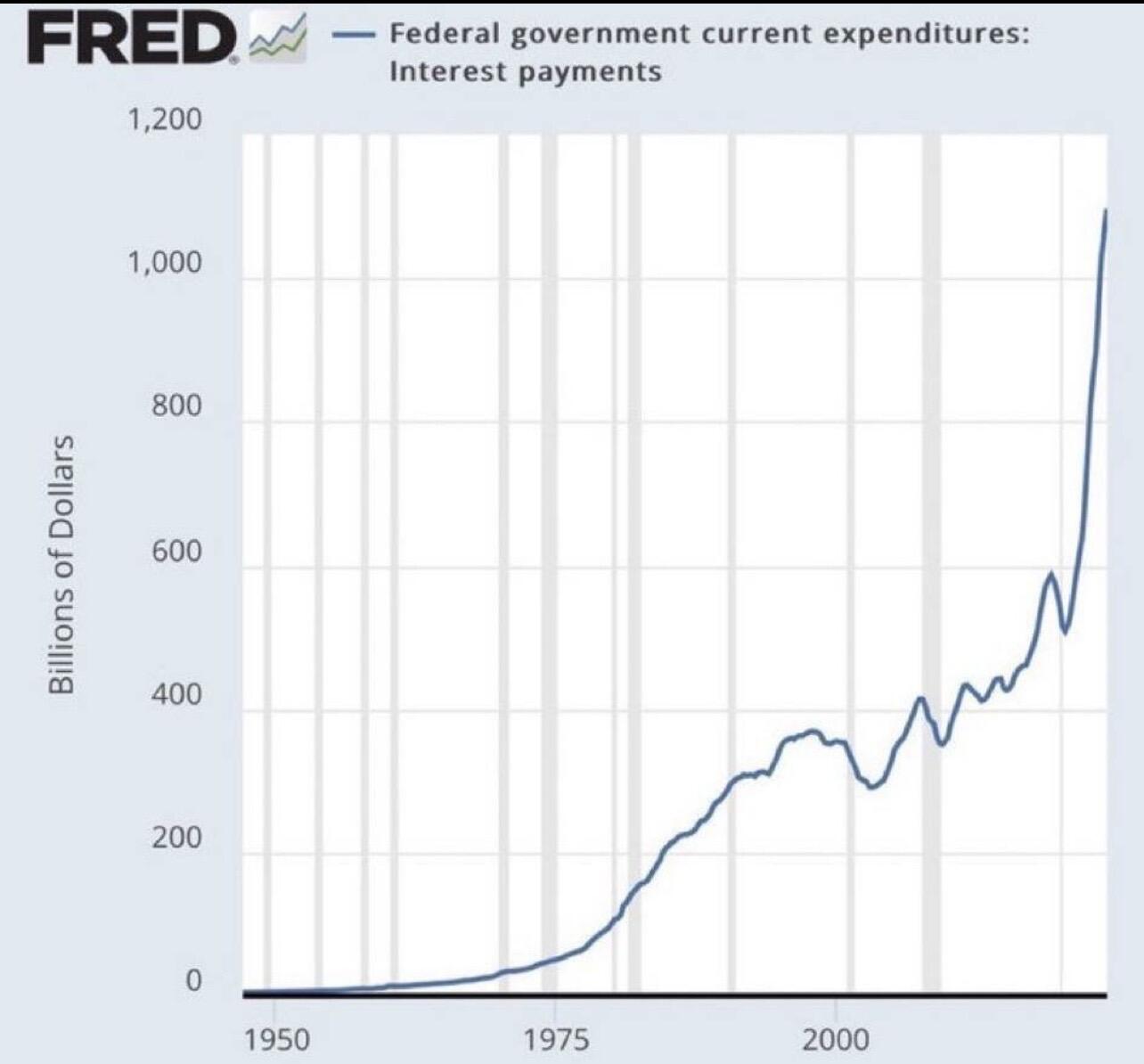

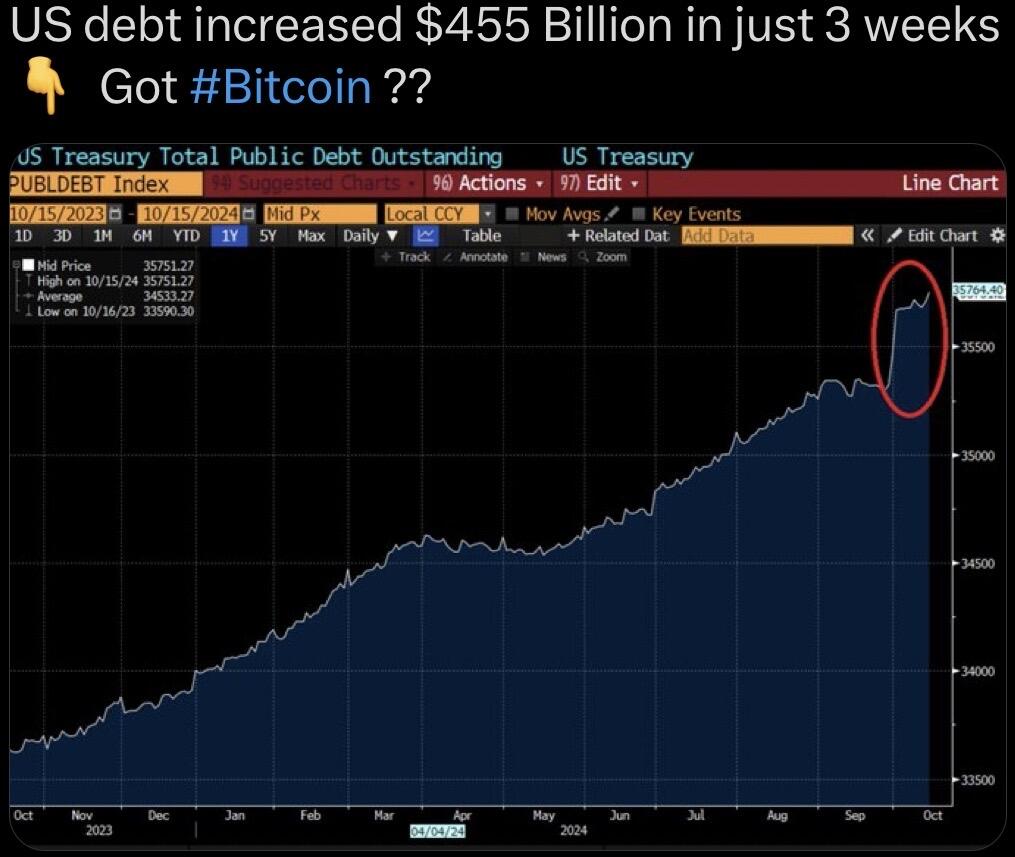

Most proposals are to just stop the dept to GDP from rising past 120% but the artery is already bleeding interest payments!

The way past civilizations have dealt with this is to inflate the debt away.

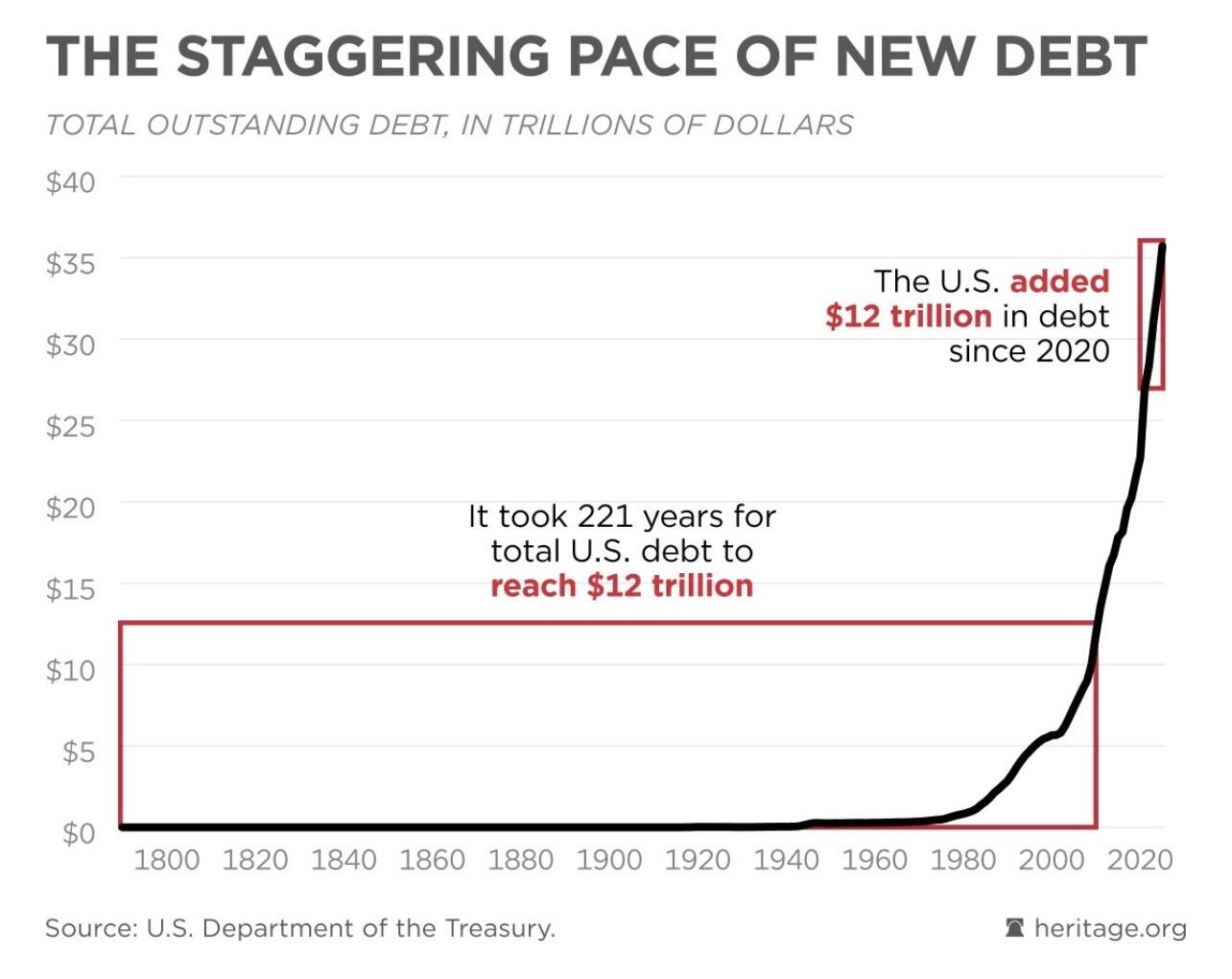

It took 221 years for the US to create the first $12 trillion of national debt.

another $12 trillion of debt was added in the last 5 years.

Fix the money

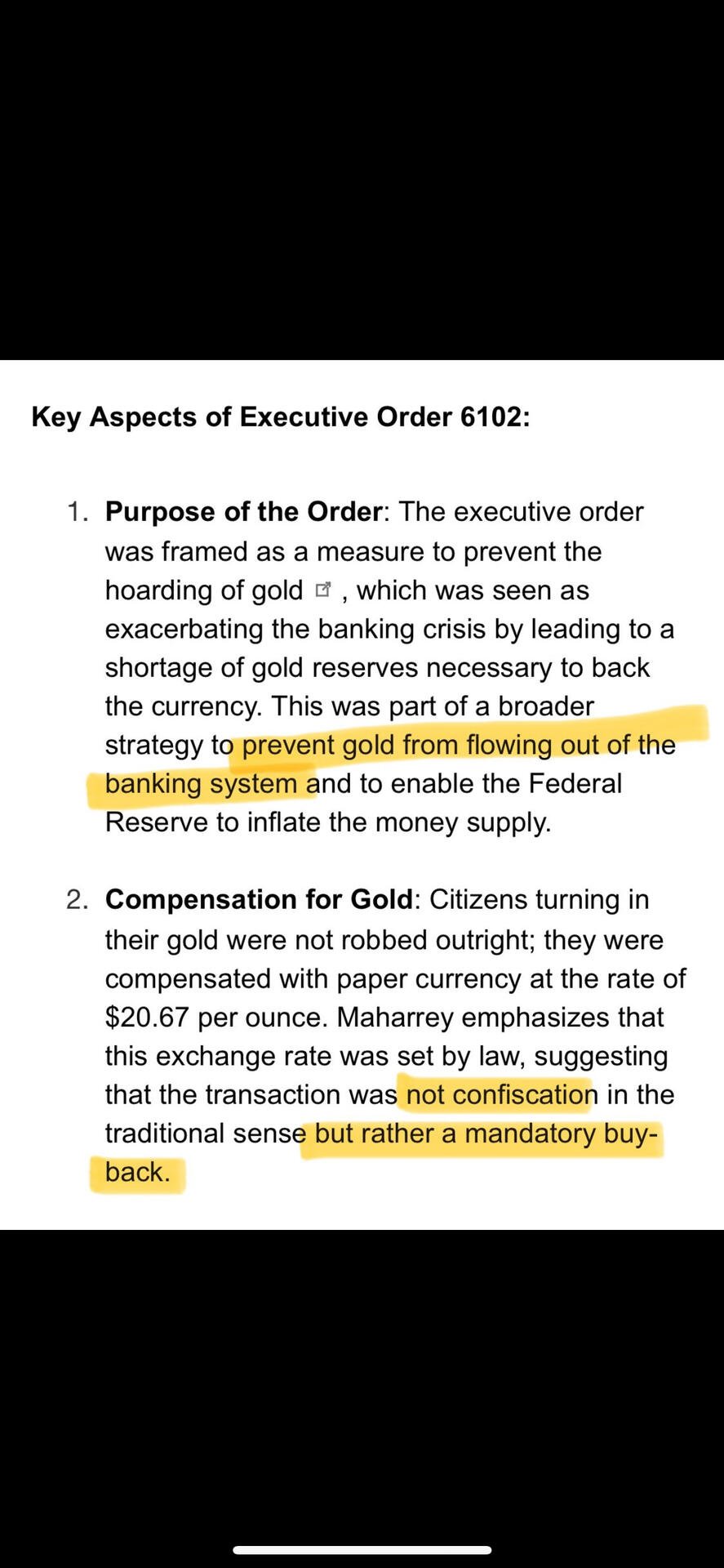

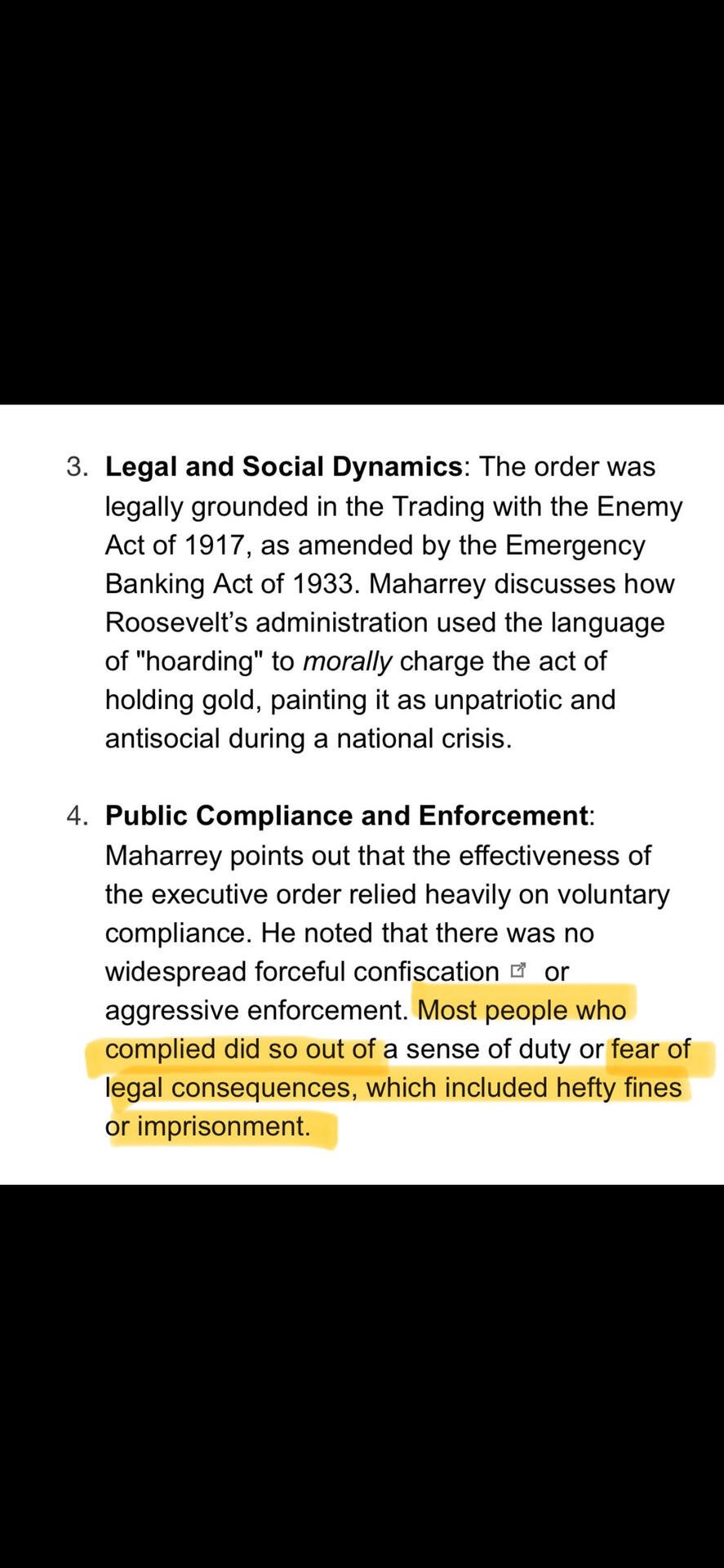

Saylor: "People Voluntarily Turned in their Gold" in 1933.

Reality: The penalties for non-compliance were severe:

Fines: Individuals who failed to comply with the order faced a fine of up to $10,000 (equivalent to about $220,000 today, accounting for inflation).

Imprisonment: Violators could also be subject to up to 10 years of imprisonment.

Asset Seizure: In addition to fines and imprisonment, any gold that was hoarded or not surrendered could be seized by the government

Bitcoin went from 0 to 1% adoption in 15 years and the price went from less than $0.001 to over $70,000.

0 to 1% adoption and Bitcoin's value increased by over 70,000,000%.

A $100 purchase would have turned into over $70 million.

What do you think happens when we go from 1% to 5%? 10%? 25%?

50%?

100%?

You're so early.

Buy Bitcoin.

FUN FACT: Henry Ford actually predicted Bitcoin in 1921. He called it ‘Energy Currency.’

“Under the energy currency system the standard would be a certain amount of energy exerted for one hour that would be equal to USD 1. It’s simply a case of thinking and calculating in terms different from those laid down to us by the international banking group to which we have grown so accustomed that we think there is no other desirable standard.”

“The essential evil of gold in its relation to war is the fact that it can be controlled. Break the control and you stop war.”

Wild!!

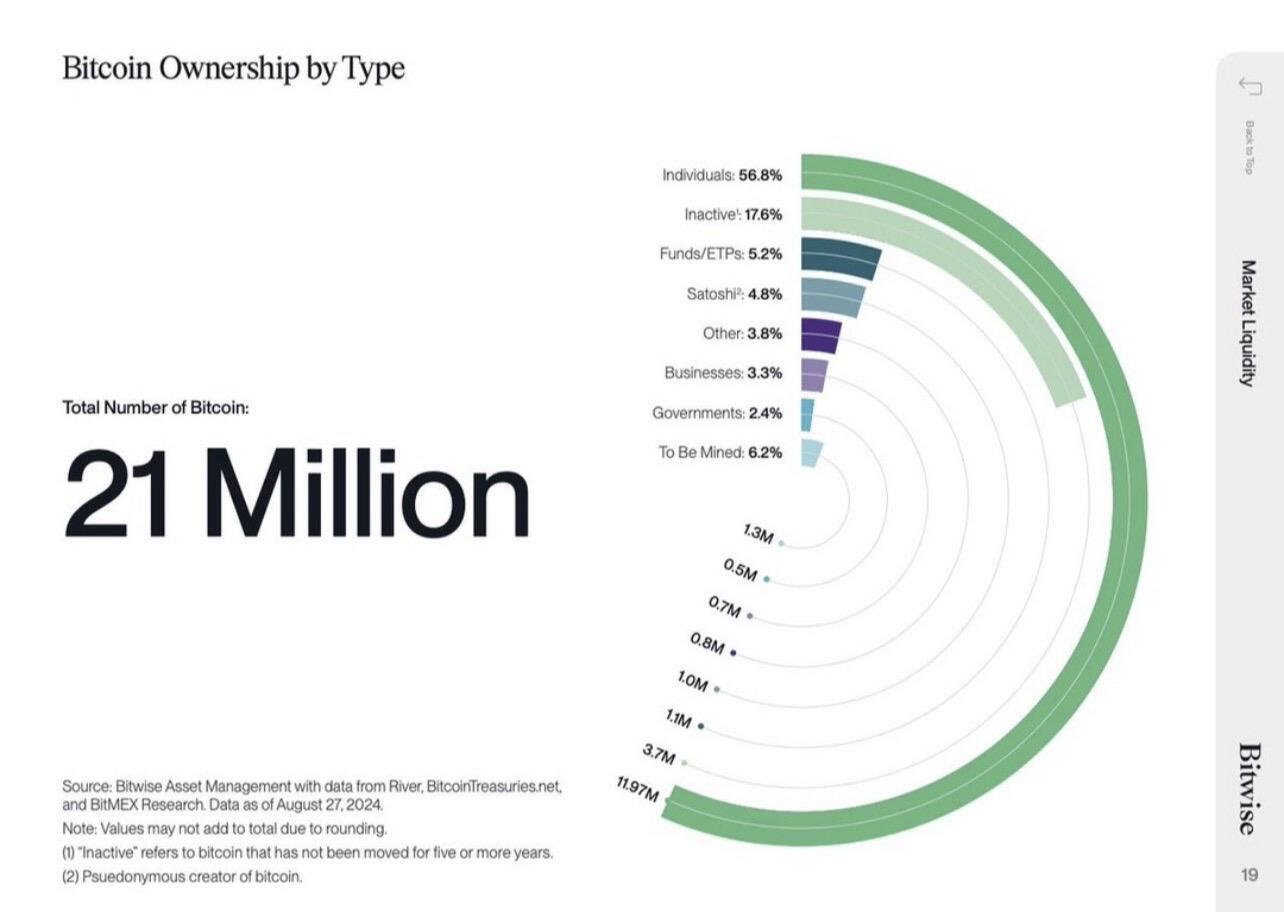

#bitcoin ownership breakdown

Some key passages from @LynAldenContact's latest paywalled newsletter on $MSTR:

"Investors are paying in the ballpark of about 3x net asset value for the company. When they had their massive price surge in March 2024, I warned about the high NAV premium, and trimmed some of the position out. However, I haven’t trimmed all of it, and keep letting the rest of the position run. It touched new highs on Friday."

"From a risk/reward perspective, I prefer buying direct bitcoin versus MicroStrategy when the premium is this high like it has been since March. It feels safer owning the asset 1:1 when that disconnect grows to this degree. But it doesn’t mean the disconnect has to narrow anytime soon. It might or it might not."

"MicroStrategy directly benefits from this high premium to NAV. They can keep issuing more convertible notes or other types of capital, and use it to buy bitcoin, which increases their amount of bitcoin per share. (In contrast, if MicroStrategy were trading below NAV, then issuing equity or convertible notes would reduce the amount of bitcoin per share)."

"What MicroStrategy is doing here makes absolute sense. The market is giving them a big premium, and so by all accounts they’re just going to keep arbitraging it for their shareholders while meeting market demand for its securities. They’ll likely keep issuing more and more capital and suck in more and more bitcoin until the trade is exhausted and premiums over NAV diminish."

"It’s important to consider investor mandates. There are portfolio managers that have a mandate to only own stocks, for example, and if a portfolio manager happens to be bullish on bitcoin, then a few entities like MicroStrategy and some miners are the only avenues for them to express that view. They can’t buy a spot bitcoin ETF or other similar instrument. Similarly, there are bond managers that happen be bullish on bitcoin, but have a mandate to only own bonds. So they can buy MicroStrategy convertible bonds to capture potential upside when the bitcoin price surges, within the context of a bond fund. There is no financial entity that has been identifying and meeting this need for certain types of security mandates better than MicroStrategy."

"This is a recursive flywheel that I will continue to monitor. A lot of people monitor ETF flows, which I think are important, but this specific combination of high premium to NAV and thus the incentive to keep issuing capital to buy more bitcoin, creates a big vacuum that will keep sucking up bitcoin until it doesn’t anymore."

$MSTR converts Bitcoin volatility into cash flow by ‘selling volatility’ in the options market. Then they buy more Bitcoin with the proceeds.

The ‘Saylor Put’ on Bitcoin price is real.

All five revenue streams go into buying more Bitcoin.

Bitcoin has a monopoly on long-term, sovereign, digital wealth storage.

Patience, confidence, and commitment to hodling in the face of volatility is the short-term price you pay for long-term freedom.

But still no proof of original Satoshi coins moved. Thanks HBO play again next time 5-10 year before the next documentary.

HBO says @peterktodd is satoshi and his response was perfect

"This is going to be very funny when you put this into the documentary and a bunch of bitcoiners watch it."

$mstr This is how to try to explain what all ya'll already know when talking to tradfi normies.

EVERYTIME Saylor goes to market to sell convertible bonds he is OVERSUBSCRIBED even though he is only promising like .6% interest on the bonds.

WHY?

Because there is an embedded call option on bitcoin in the convertible bonds and these bonds make every bond portfolio look like the ALPHA ALL STAR bond portfolio.

The bond market is 100's of trillions of dollars and the best performing bond fund managers in the world the last 5 years have owned $MSTR convertible bonds.

This is a competitive market where people look at top performers and hope to copy them.

Saylor is tapping into tiny little drops of the 200 TRILLION dollar debt market and slowly using that money to buy bitcoin.

All bitcoin in existence only adds up to about 1.2 trillion dollars.

The pressure building up in the debt market to get same exposure as the TOP performing bond fund managers is only building.

Do you see how that can play out over the next few years as outperformance of bitcoin friendly bond fund managers continues?

Strange that the US government gets the ok to sell 4 billion in bitcoin the same day a documentary about Satoshi is released 11 years after the seizure.

I think until someone can actually move the Bitcoin in Satoshis wallet to prove their identity it doesn't matter and we shouldn't speculate on it.

Because If we keep guessing at it there are alternative motives that we will never know what they really are.... people want to know who he she they (group of people ) are to tear their credibility and thus the credibility of bitcoin.

US government about to sell #bitcoin, let the weak hands sell we are better off. Let this happen now Vs in the future.

🇺🇸 US government to sell $4 billion in #Bitcoin soon..

Non of the US bitcoin was purchased it is not theirs to sell. Real power at work.

🇺🇸 Supreme Court Allows the US to Sell 69,370 Seized Silk Road #bitcoin

This should be a clear sign of where the Democratic Harris Walz party actually stands towards Bitcoin

This should also be a sign that the government is scared of what #bitcoin can accomplish for everyday people

Based on this you might get a cheaper fiat entry point to remove yourself from government overreach, censorship, and the loss of purchasing power through constant fiat debasement.