MSTR will not only temper the next #Bitcoin bear market, but with $40-$50m DAILY purchasing, we've just set a floor price for 450 #Bitcoin mined daily. From ONE buyer.

I don't understand why people are risking betting on Trump win when they have tried to assassinate him 3 times, and there is the potential for wide spread cheating and voter fraud when you can just bet #Bitcoin..

Scenario 1: betting on the election relying on a "fair" system with voter fraud cheating and attempted murder. = loose loose risking 63 cents to win 34 cents where you loose 100% of your inistial bet.

Scenario 2: betting BTC is win win

1. Both candidates are inflationary,

2. If Trump wins he campaigned on bitcoin

3. If Kamala wins people won't believe election results and want to opt out of the system. Plus as much as the democrats fought bitcoin it thrives under more government censorship, centralization, and government spending.

Even if you loose you don't loose 100% of your bet

Imo scenario 1 is a bad risk management and a bad bet.

Visa launches real-time #Bitcoin and crypto purchases with debit cards in partnership with Coinbase - Bloomberg

*** I think what this article from seeking Alpha misses is that some bond traders can't get exposure to spot BTC as it's not allowed in their mandate but the can buy Microstrategy bonds knowing they will continue to dilute shares to add more bitcoin per share**

Summary

MicroStrategy's stock has surged 483% due to its massive underlying Bitcoin holdings and aggressive BTC 'Pyramiding' tactic.

The company's strategy involves issuing shares and debt to buy BTC, but its financials are weak, and we think the company is nearing its borrowing capacity.

MSTR's valuation is extremely inflated, making it better to buy BTC directly. We recommend a pair trade: Buy BTC, Sell MSTR.

There are some risks around a potential short squeeze and further multiple expansion, but overall this hedged trade offers a favorable risk/reward.

Abstract bitcoin concept

koto_feja

In case you've been hiding under a rock, MicroStrategy (NASDAQ:MSTR) has had one hell of a year.

Over the last 365 days, shares in the firm are up more than 483%, crushing the market and lapping Bitcoin (BTC-USD), the company's main treasury asset:

MSTR

TradingView

Some of MSTR's incredible performance can be attributed to the firm's considerable BTC holdings, which total more than $17.3 billion at last count.

That said, an even larger portion of the firm's increase in value has come from MSTR's BTC 'Pyramiding' strategy. For those who aren't aware, essentially, as BTC has increased in price, MSTR has continued issuing shares and debt to fund purchases of the leading digital asset. As book value has increased, MSTR shares have headed higher, which has led to further issuances and more BTC on the books.

For the time being, this hasn't raised any issues, as MSTR's underlying SaaS business has been able to foot the bill (interest).

However, as the company's organic financials continue to shrink and the company's diluted share count continues to soar, we think paying a premium valuation for MSTR's stock doesn't make a lot of sense.

Today, we'll explore MSTR's financials, explain why we think the company doesn't have a lot of remaining firepower for BTC buys, and describe a pair trade that looks to take advantage of the company's absurd valuation premium.

Sound good? Let's dive in.

MSTR's Financials

MicroStrategy is a relatively simple firm to understand from a top-down point of view.

On the surface, MSTR calls itself a 'Bitcoin development' company, and is focused on three main things:

Acquiring Bitcoin

Creating technology related to Bitcoin

Advocating for Bitcoin from a legislative/policy perspective

The firm also has a legacy 'business intelligence' SaaS offering, which has stuck around since the firm pivoted back in 2020.

From a functional standpoint, there are really two things to focus on - the company's treasury management strategy, and the legacy BI SaaS offering.

Let's start with the SaaS business.

On the surface, MSTR talks a good game about this segment, but in reality, the business is small on a relative basis:

MicroStrategy is a pioneer in AI-powered business intelligence (BI), and a global leader in enterprise analytics solutions. We provide software and services designed to turn complex, chaotic data environments into rich, reliable, and convenient information feeds for our customers. Our vision is to make every worker a domain expert by delivering Intelligence Everywhere™... Integral to the MicroStrategy ONE platform are Generative AI capabilities that are designed to automate and accelerate the deployment of AI-enabled applications across our customers’ enterprises.

In short, MSTR offers a business intelligence platform to organizations around the world, and annualized sales currently run at around the ~$480 million mark:

MSTR

10Q

$480 million in revenue is nothing to sneeze at, but the key issue with MSTR's organic business is that top-line sales aren't growing. In fact, over the last few years, sales have shrunk slightly, indicating decreasing client satisfaction and utility from the MicroStrategy ONE platform:

MSTR

Seeking Alpha

This underperformance is put into even more stark contrast when you consider that other B2B SaaS companies like Palantir (PLTR), ServiceNow (NOW), and Datadog (DDOG) have been growing revenues in the 20 - 30% YoY range for a number of years now.

Clearly, the opportunity for top-tier business tools and SaaS products is there, but MSTR simply isn't executing on this front.

On the bottom line, MSTR's core offering doesn't appear to be profitable, either.

Even when you take out the $180 million in digital asset losses MSTR took in Q2 2024, the business lost roughly $20 million in 'real' operating results.

Some of this is undoubtedly from increased R&D expenses as the company looks to transition into blockchain SaaS products, but if you zoom out to MSTR's 'Cash from Operations' situation, you'll find that the company is operating, roughly, at breakeven:

MSTR

Seeking Alpha

We don't expect this to change much in the coming years.

In our view, the legacy business's relative underperformance seems to be the result of a lack of focus on B2B given the company's pivot to Bitcoin under CEO Michael Saylor.

MSTR's Treasury Pyramid

Let's move on now to MSTR's treasury management strategy, which you're probably familiar with.

In short, the company's goal is to slowly, steadily acquire bitcoin in a way that is accretive to shareholders.

How does it fund these acquisitions?

One of three ways - debt, share sales, and cash from operations.

As we've seen, excess cash from operations has been relatively sparse, which has led to management mainly raising capital for BTC acquisitions from the open markets:

MSTR

Seeking Alpha

Over the last few years, MSTR management has sold a massive number of shares (some via convertible debt) to investors, which it has plowed straight into BTC. As BTC prices have risen, so too has MSTR's book value (increasing asset value vs. stable debt value), which has led to higher share prices. This, in turn, has created a virtuous cycle of higher prices, more share sales, more debt, and more BTC on the balance sheet.

If you take a step back, what you have now with MSTR is essentially a massive Bitcoin position and a relatively small operating segment, partially offset by a large amount of debt, mostly in the form of convertible notes.

Selling convertible notes was a smart move from a cash flow perspective as it allowed MSTR to keep interest costs low, but this strategy has also led to a massive increase in diluted share count which is most certainly not accretive to shareholders:

MSTR

8K

In all, MSTR owns about $17.3 billion worth of Bitcoin, and has roughly $4.2 billion in long-term debt. As long as BTC's price continues to move higher, MSTR's share sales via convertible debt aren't a limiting factor.

So - when will MSTR no longer be able to continue buying BTC?

In short, MSTR's convertible notes are low interest, but they're not no interest.

Over the last twelve months, MSTR paid roughly $50 million in interest to bondholders, which is significantly more than the underlying company made in profit:

MSTR

Interest Charges (Seeking Alpha)

In fact, if you recall from the financials section, MSTR, on a cash from operations basis, is basically breakeven.

Looking ahead, MSTR is planning for roughly $35 million in interest charges over the next year.

In our view, as this continues, we think there will be less and less room for MSTR to add on convertible note offerings - even if BTC prices move higher - due to the limiting factor of interest vs. MSTR's organic payback abilities.

Thus, MSTR seems about as 'levered' as it's going to get with roughly 250k Bitcoin. Even if MSTR can get to 300k, we'd argue that's probably the 'cap' of where MSTR can go in terms of non-dilutive BTC acquisition. There simply is a limiting factor as a result of the underlying business financing capacity.

MSTR's Valuation

So - right now, the company's market cap is $47 billion.

The underlying company assets include roughly $17.3 billion in Bitcoin and a breakeven operating segment.

How does this make sense?

Sure, the convertible notes, to some degree, amount to outside investors taking a bet on BTC 'through' MSTR, which has diluted shareholder value, but a majority of the premium is from the success of the company's pyramiding strategy and inherent leverage. Given that we think this dynamic will slow in coming quarters, paying nearly $190,000 per Bitcoin for MSTR's underlying exposure (calculated from MSTR's 176% premium vs. market value of holdings) doesn't make a lot of sense.

If you want exposure to BTC, buying it at the open market appears to be a much better strategy.

Thus - our trade idea: Buy BTC, Sell MSTR.

This trade hasn't performed well up through today, given MSTR's outperformance:

MSTR

TradingView

That said, from here, we see two potential routes for Bitcoin.

In the event that BTC heads lower, we expect that MSTR will head much lower given the balance sheet's inherent leverage, combined with some multiple compression as excitement comes out of the market.

In the event BTC heads higher, you've essentially purchased BTC at a much better price than you're buying BTC through MSTR shares for, which, we think, will ultimately result in value.

Either way, we think it's a win-win proposition.

Two notes. First, a trade like this needs to have an equal amount of nominal value on either side to properly hedge out BTC price risk, so keep that in mind. Second, shorting MSTR has a borrow rate roughly around the 0.3% per year mark (at present), so that's an additional cost to factor in.

Risks

Given that we've suggested a hedged strategy for trading MSTR and BTC, we see two potential risk vectors to consider.

First, MSTR's short float % is relatively high, which could lead to a 'short squeeze' higher. This is a risk for shorts, especially given that it would be a secular event that wouldn't be hedged by a long position in BTC. Thus, monitoring this situation is important if you go down this road.

Additionally, MSTR could see continued multiple expansion on the back of increased BTC acquisition or investor sentiment. We think both of these factors look very, very stretched, but the possibility remains that MSTR's premium could expand further than it already has.

We wouldn't be surprised to see this in the short term (realistically, it's hard to hit a trade right at the top or bottom), but we think it's less of a risk over the mid-term as more BTC buyers move to buy the asset through on-par wrappers like IBIT.

Summary

All in all, we think buying BTC and shorting MSTR is the best way to play the current situation.

Yes, MSTR's premium could expand further on extending investor sentiment, or a short squeeze could damage a short position, but as new traders come into this situation, entering a hedged, well priced pair trade appears to be the best way to maximize risk / reward going forward.

Thus, our 'Strong Buy' rating on BTC-USD, and 'Strong Sell' rating on MSTR.

Good luck out there!

Saylor wants to buy $42 billion in BTC over the next 3 years.

At current prices, that works out to ~577,160 BTC. Only ~492,750 BTC will be issued over the next 3 years.

BREAKING: MicroStrategy unveils its “21/21 Plan,” aiming to raise $42 billion over the next three years—$21 billion in equity and $21 billion in fixed income—to acquire more Bitcoin 👀

Florida Treasurer Jimmy Patronis makes history with letter endorsing a ‘Strategic Bitcoin Reserve’ - Pushes state pensions to add Bitcoin.

What if the last bull market cycle was muted bc of FTX, Celsius, Gemini, 3AC, cash-settled futures, and other shenanigans?

How to protect your #Bitcoin profits WITHOUT ever selling your #Bitcoin

1. Buy #Bitcoin @ say $73,000.

2. Let it appreciate to say $300,000.

3. Buy Puts on IBIT (when launched) at $300,000 with following math:

Profit: $227,000.

10% of profits allocated to Puts: $22,700.

4. Scenario 1 - Bitcoin collapses down to 200W moving average - say $80,000. Watch the $22,700 in Puts ride up to $150,000 - $200,000 in profit. SELL the Puts and collect the cash.

Scenario 2 - #Bitcoin hits S Curve and America announces Strategic National Reserve buying 1 Million Bitcoin and Bitcoin goes vertical to say $1m and stabilizes.

You lose $22,700 in the Puts you bought.

But your #Bitcoin is now worth $930,000.

You're hedged both ways.

AND YOU NEVER EVER NEED TO SELL YOUR BITCOIN.

And it works in both ways if you hold ETFs or Cold Storage.

You can always just buy Puts in a brokerage account while having the Bitcoin in your cold storage

If Tether was under investigation would people not try to swap USDT for BTC as fast as they could...?

Bitcoiners

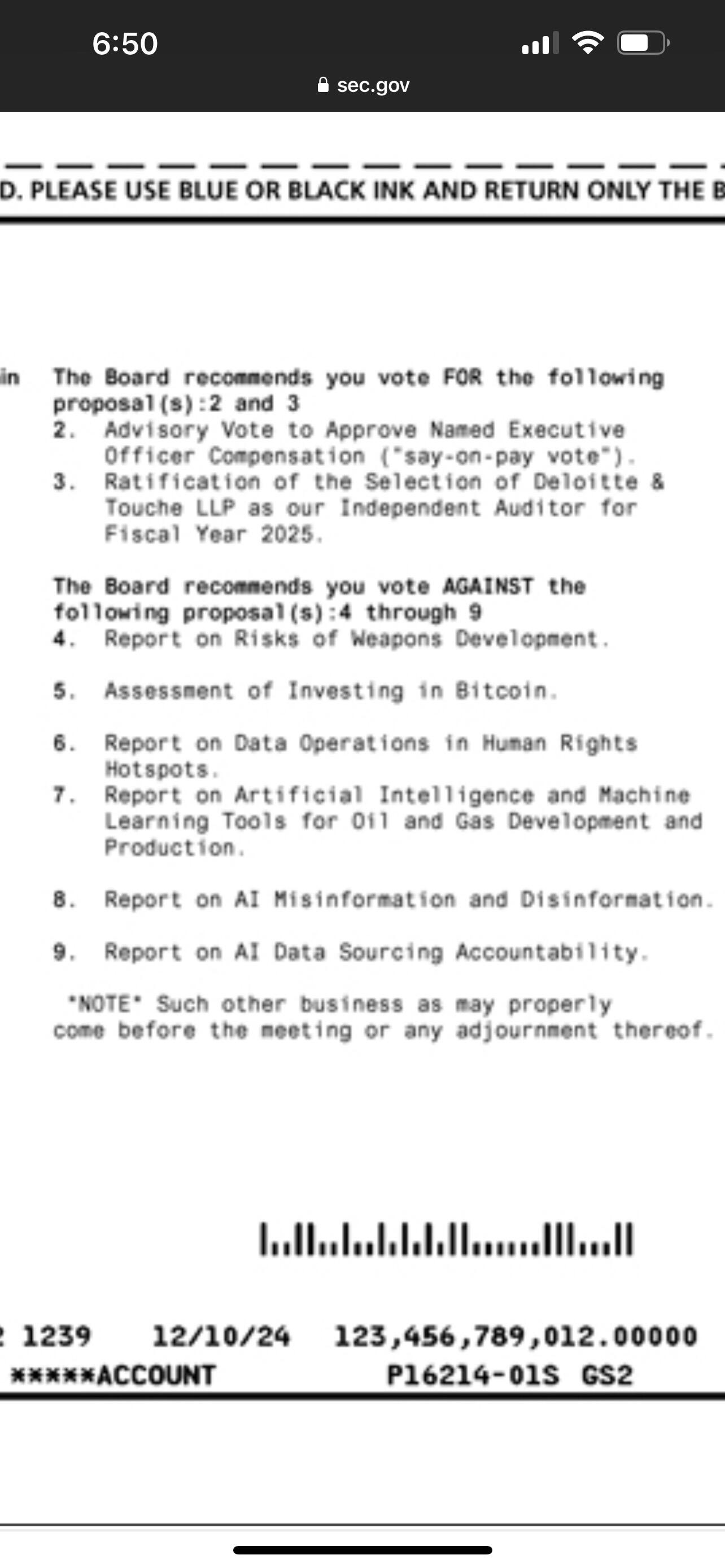

In an SEC filing late this afternoon, Microsoft disclosed that "Assessment of Investing in Bitcoin" is currently proposed and will be a voting item for the shareholder meeting on December 10 (the filing notes that "the Board recommends a vote against this proposal").

The filing is here (see voting item #5):

sec.gov/Archives/edgar…

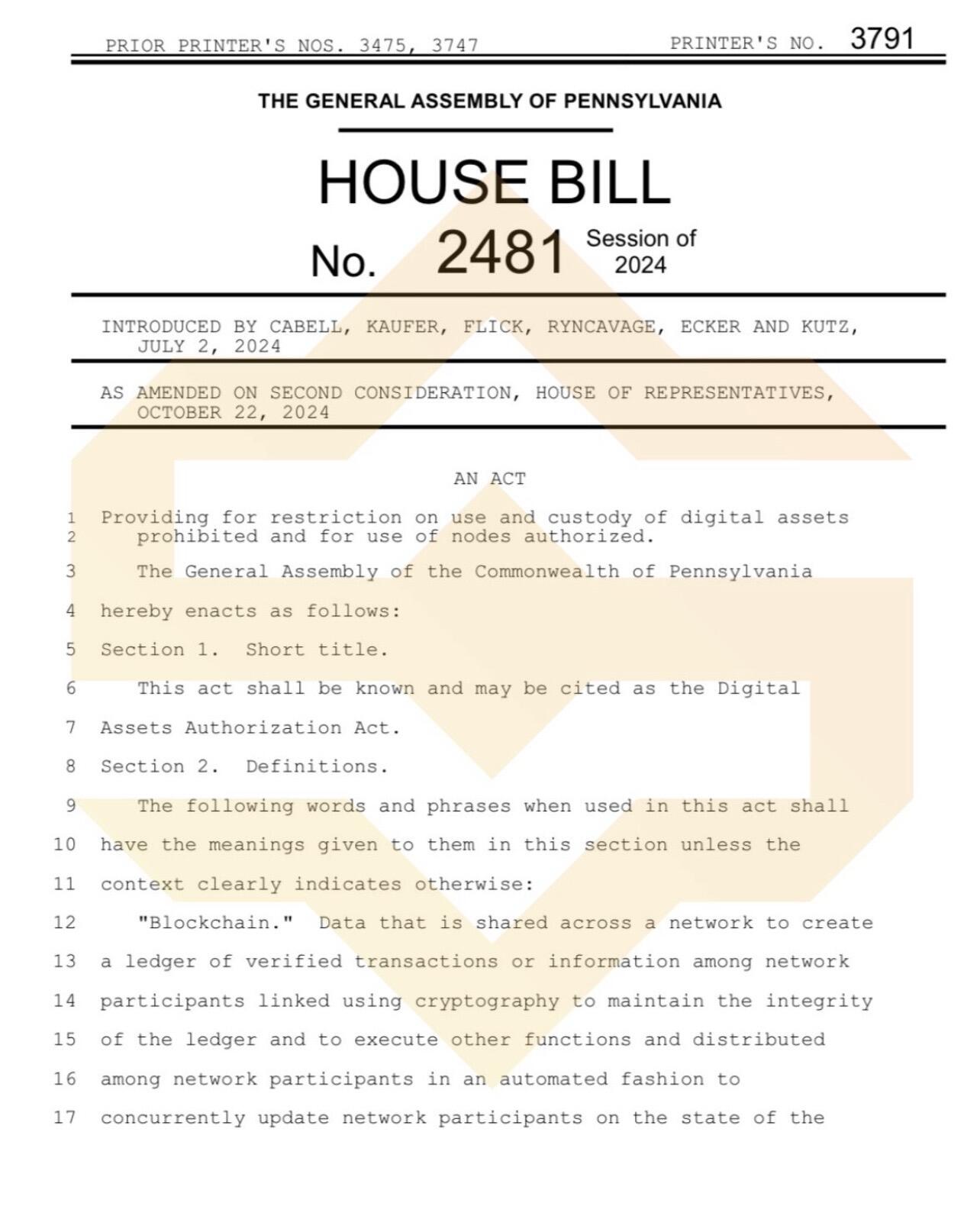

Source Dennis Porter, BREAKING: The state of Pennsylvania has passed ‘Bitcoin Rights’ in the House by a sweeping majority. Both Republicans and Democrats united together to pass the bill.

Pennsylvania is poised to be the most important state in the ‘24 election & this bill is poised to play a role👇

Making the market cap 3.486 quadrillion.

If each #Bitcoin was worth 166,666,666$USD the U.S. government would have no debt base on their bitcoin reserves.

Something to think about...

🚨 13 YEARS AGO TODAY: The Economist called #Bitcoin a bubble at $2.50.

Today, it's $67K. 🚀

**The Lesson here is do your own homework and formulate your own opinion.**

Doom loop! Not only are people not buying but shorting. Treasury will have to print to buy their own bonds monetizing their debt

Max Keiser

I believe:

- Money existed before the state

- Bitcoin separates money from state

- Bitcoin kills the state

It was a little presumptuous, I should have put could sell 4 billion of bitcoin... but you would also speculate based on the governments past track records attacking bitcoin and selling it that they will continue.