🇺🇸 SECURITIES REGULATORS NOW ALLOW WALL STREET BANKS TO HOLD #BITCOIN AND CRYPTO - FT 🤯

THIS IS A HUGE DEAL 🚀

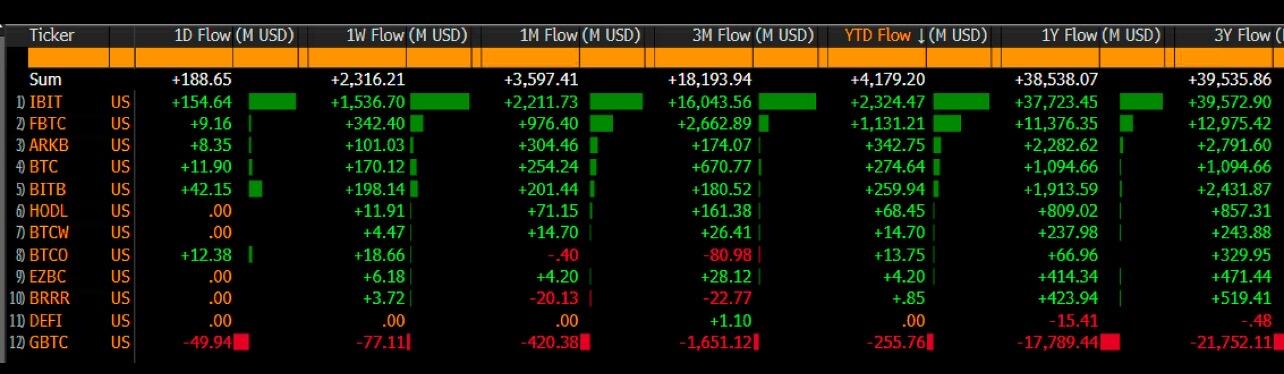

The spot bitcoin ETFs quietly on fire to start year, with $4.2b in flows which is 6% of all ETF flows. Now at +$40b net since launch with aum at $121b and return of 127%. For context they just passed ESG ETFs in assets ($117b) and have about same as gold spot.

If you’re new to Bitcoin, a Sat (Satoshi) is a smaller unit of Bitcoin

So the way there’s 100 Pennies in a dollar there are 100M sats in 1 Bitcoin

One day 1 Sat will be equal to $1

Right now you can get 975 sats for $1

975 sats for just $1..

If you own 1 BTC, you own 0.00000476% of the total supply that will ever be created.

This may seem small...

But compared to today's valuation of all assets around the world being 900 trillion, owning 1 bitcoin is the equivalent of owning $43M of assets

🇪🇸 Spain proposes a 100% tax on property purchases for non-EU citizens.

I've been warning you: EU countries are bankrupt and will try to seize your assets. Gradually, then suddenly.

Bitcoin rules can't change

Saw this post on X: Prostitution used to be nearly exclusively the domain of poor desperate young women. Now thanks to Only Fans prostitution has become a possible career choice for financially stable upper middle class women.

Made me think: maybe our middle class is no longer a middle class due to the welth gap inflation and money printing

Thoughts?

I was a real estate investor but the rules keep changing between capital gains tax and property tax, Montréal history

2023 property tax hike: 7%

2024 property tax hike: 9.5%

2025 proposed property tax hike: 6.9%

That means the equivalent of a 26% increase since 2023.

At least with BTC you know what you're buying and what the rules are.

🇮🇹 Italy's largest bank, Intesa Sanpaolo just bought €1 million worth of #Bitcoin 🤯

You need $1 million down to even be considered by corporate on becoming a McDonald's franchise owner

If you're accepted, you can expect to make an average profit of $290,000 per year from your store.

You can ROI in your 4th year, and make $2,190,000 after recouping your investment by year 11.

Sounds pretty good right?

Let's look at it from on the of employees perspectives.

If you make an average of $25,000 per year and save 15% of your salary in bitcoin?

You've made $2,596,765 by year 11.

Who's better off?

The franchise owner? He has to deal with the stress of running a business, the responsibilities that go with it, and the risk of holding the business together.

The employee just has to show up to work and deals with ZERO stress after hours.

This will be the trend for every employee in every business for the foreseeable future.

It's not about how much you can make per year, it's about how much you can save in bitcoin per year.

Those that stack sats will WIN over the next decade

Bitcoin rocketed from $26K to $73K in 5 months.

If you weren't in the market, you were completely left behind and missed out on 180% gains.

We then spent 8 months grinding sideways with lower highs and lower lows.

Many feared that we had already peaked at $73K.

But that was merely the shakeout before another quick 100% took us over $100K in the blink of an eye.

Today we are once again consolidating sideways.

And people fear we have peaked.

No one knows for sure where we're going short term.

But here's what we do know:

Bitcoin adoption is only going one direction.

And so is the amount of fiat that needs to be created to keep the sovereign debt house of cards from collapsing.

Finite Bitcoin vs. Infinite Fiat.

It isn't rocket science. It's common sense.

Remember what you own and enjoy your weekend

I bought my house in March 2023. The price was $495,000, which was 22.5 BTC at the time.

Today it is worth $540,000, which is 5.7 BTC.

In a little less than 2 years my home value increased 9% in dollars.

But it lost 75% of its value in #Bitcoin.

Real estate is COLLAPSING.

Imagine working 9-5 for 50 years then The Fed prints 40% of the total money supply and inflates away 20 years of your work

I'll stop buying #Bitcoin as soon as someone can provide a GOOD explanation for why 2% inflation?

If oil goes sub 50$/ barrel Russia will then use its oil to mine bitcoin to be profitable and export bitcoin instead of oil. The more bitcoin Russia buys the more their oil will be worth when mining. This is why the U.S. has to buy a lot of Bitcoin first.

It would take almost 50 years for the average earning American to buy ONE Bitcoin at the average savings rate. Assuming the Bitcoin price is frozen at $100,000

The great fortunes of this world were made making massive and innovative financial bets.

Rockefeller consolidated the oil industry in the 1872 "Cleveland Massacre" buying his competitors with stock in Standard oil and deferred payment plans. Within 13 years he had 90% of the entire industry.

Carnegie consolidated his steel empire vertically in the 1880s, aggressively buying coal fields, iron ore mines and railroads until he had 70% of the steel market.

Bezos raised 1.25 Billion in February 1999 in a massive convertible note. Altogether the company has raised 30 Billion, mainly in bonds to fund his complete domination of e-commerce.

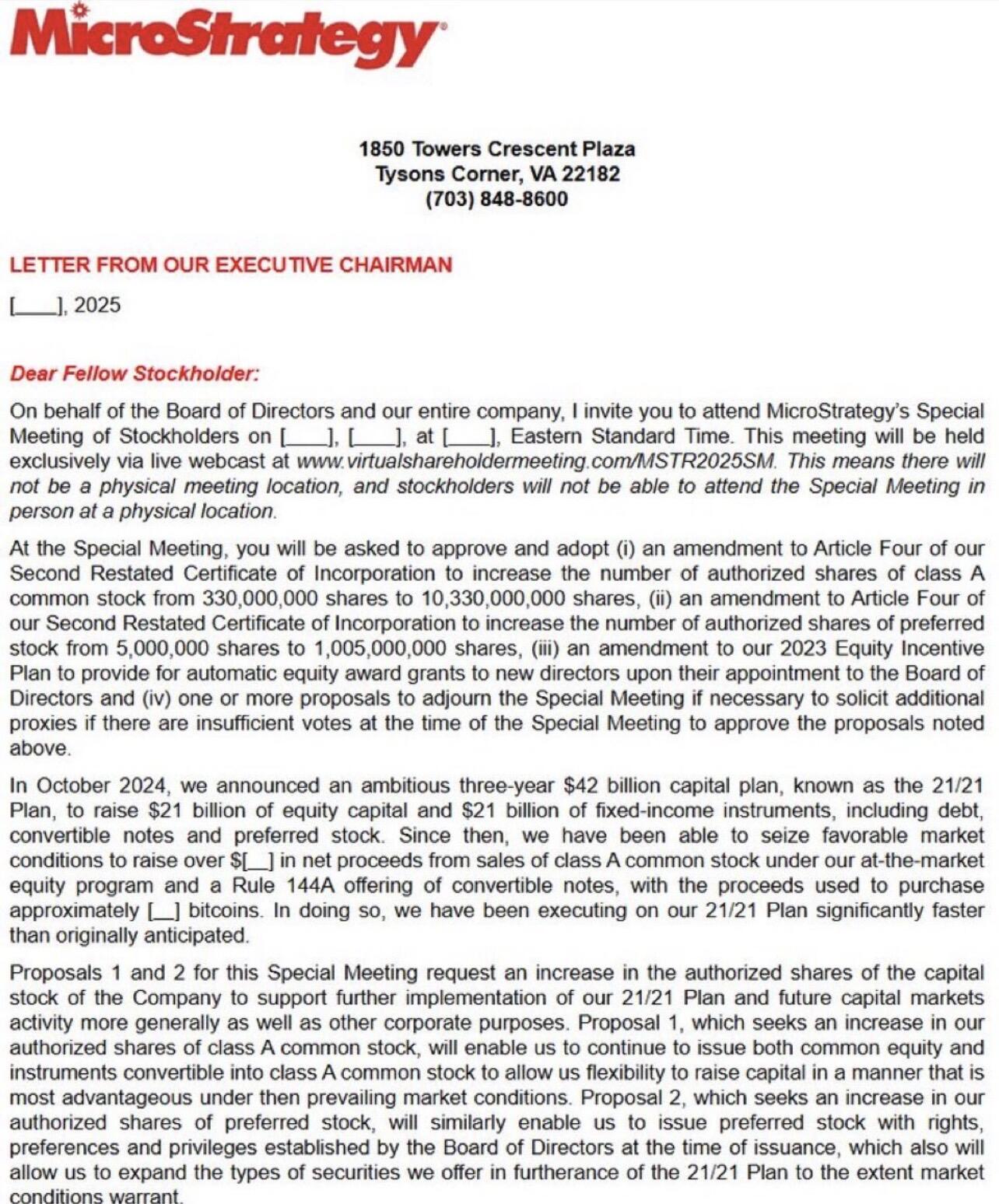

Saylor is making a similar massive bet. It may sound crazy and dilutive, but there is no execution risk. If he gets the funding, the price of Bitcoin will go up, and TradFi will jump on board. The meme will create itself.

Do you think this is possible ⬇️

Michael Saylor's end game is to buy $3 trillion worth of #Bitcoin! 👀

Microstrategy could, CONSERVATIVELY, own approximately 16% of the total Bitcoin Supply or 3,439,002 Bitcoin!!

For those that think this is a MOONBOI projection, listen to the video clip below, VERY CLOSELY, and you will hear him say that he plans on buying $3 trillion worth of Bitcoin 🤯

Even if Saylor buys $3 trillion worth of Bitcoin, at an average price of $1 million per coin, he would be able to buy 3,000,000 Bitcoin! Check my math!

This would CONSERVATIVELY bring his total Bitcoin holdings to 3,444,262, or 16% of the total Bitcoin Supply!!

Saylor could single handedly jack the price of Bitcoin to $1 million per coin and @Excellion's Omega candle could be coming in 2025.

What going to happen when Nation States, Google, Amazon, Facebook and billions of people complement Saylor's $3 trillion purchase? What is bigger than an omega candle? I asked GROK and it doesn't even know! 😂

I think we should name it the ♾️ candle. This would be representative of @w_s_bitcoin's

Stock to Fomo model (see graphic below) and his post: x.com/w_s_bitcoin/st…

Saylor has said he is going to double his $42 Billion Bitcoin investment at least 4 times and here is how this could lead to him acquiring more than 4 million Bitcoin in 2025:

Q1 2025 - Raise $84 Billion to buy 700,000 Bitcoin at average price of $120k/Bitcoin.

Q2 2025 - Raise $168 Billion to buy 988,235 Bitcoin at average price of $170k/Bitcoin

Q3 2025 - Raise $336 Billion to buy 1,050,000 Bitcoin at average price of $320k/Bitcoin

Q4 2025 - Raise $672 Billion to buy 1,680,000 Bitcoin at average price of $400k/Bitcoin

In one year there is the possibility that he could REALISTICALLY buy 4,418,235 Bitcoin!! I say "realistically" because the demand for Saylor's $42 Billion equity raise was so great that he is going to be able to use it all up in 3-4 months instead of the projected 3 years!!🤯

This would bring their current Bitcoin holdings of 444,262 Bitcoin to 4,857,237!!!! Or 23% of all Bitcoin!!

Calculations are based on our post below:

x.com/SatoshisJourna…

We are closer to $1 million Bitcoin than you think. I believe we will get to this price sooner than Wicked 's projected date of 4/4/2030. I agree with Samson that we get to $1 million per coin by the end of 2025! Hold on to your hat, because we are about to experience exponential, LIFTOFF.

To understand exponential growth, envision yourself holding two very powerful magnets. As you start to bring the two magnets together, it gets harder to hold them apart and all of a sudden, BAM, they clap together! This is what we are about to experience, a SUDDEN BAM, in the price of Bitcoin as adoption goes from <1% to 10% in a very short time frame.

Now you may better understand why Saylor is frantically, but intelligently, trying to buy $42 Billion of Bitcoin. As an engineer he understands what exponential demand will cause to the price of a finite commodity.

Saylor has been on record as saying that "he will be buying the top forever."

Don't ever underestimate an astro/aeronautical MIT engineer.

MSTR wants to issue 10 billion more shares to buy Bitcoin.

Historical #Bitcoin prices on Christmas Eve🎄

2013 - $666

2014 - $323

2015 - $455

2016 - $899

2017 - $13,926

2018 - $4,079

2019 - $7,323

2020 - $23,736

2021 - $50,822

2022 - $16,822

2023 - $43,665

2024 - $94,120

They print the money we work for

We give away our time, effort, and energy in exchange for something that can be created at will

We give up time with family and friends, and we don't pursue hobbies because we have to work more to make ends meet

To earn more of these things that can be printed

This should deeply upset you!