What happens when insurers cant guarantee the viability of the infrastructure projects and the long term assets they invest in. I haven't seen any projects like that being done in an efficient, timely and fiscally prudent manner over the last two decades. There is a reason they are high risk. I'd expect and explosion in costs and time caused by regulations, planning and court cases.

So either:

Layoffs and bust companies,

Money printing bailouts paid for by Joe Blogs

or

Massive insurance premium increases for Joe Blogs to cover the losses.

All bad for the country in the current climate.

Summary -

The Bank of England is set to relax its regulations, allowing insurance companies to engage in riskier investments. This move is part of a broader effort to encourage insurers to invest more in infrastructure projects and other long-term assets, potentially freeing up significant capital. The easing of rules is aimed at boosting the UK economy by allowing insurers to take on more risk while still maintaining policyholder protection. This decision follows a period of debate over the balance between financial stability and economic growth, with the Bank signaling a shift towards promoting investment opportunities for insurers. Critics have previously expressed concerns about the potential risks to policyholders given the reduction in capital requirements, but the Bank aims to ensure that the new regulations do not compromise the financial safety of policyholders.

It does sound more and more like the start of "The Big Short 2".

I'm torn between:

"F*ck the Banks"

&

"F*uck Regulations"

In a truly free market: Let them do what they want and let them fail.

In a state insured market: Regulate them harder.

Get on it devs! 😀

A sentiment and subject filter ....go!

Yesterday I was treated to my first Chaumian ecash test transaction by a super excited bitcoiner friend using cashu.me wallet.

Great stuff. Instant, super private and intuitive for bitcoiners. Love it. I can see why he was excited.

Down the rabbit hole I go. 🐇 🕳️👋

Agreed, should have had mine 10 years before I did. Might have been in a better place to get through the sleep deprivation. 🤣

Including that load of washing that was hanging around 🤣

"As volatility tests a Bitcoiner's conviction, time reveals their true character"

- Chéng Míng

I loved it, a great introduction for the normies who are the most likely to follow mainstream narratives.

Share this with all your normie friends to help them understand #bitcoin

@satsvsfiat & @satmojoe (on x) just made a great video.

Share until your thumbs bleed.

YouTube link

Share this with all your normie friends to help them understand #bitcoin

@satsvsfiat & @satmojoe (on x) just made a great video.

Share until your thumbs bleed.

YouTube link

Anyone this old?

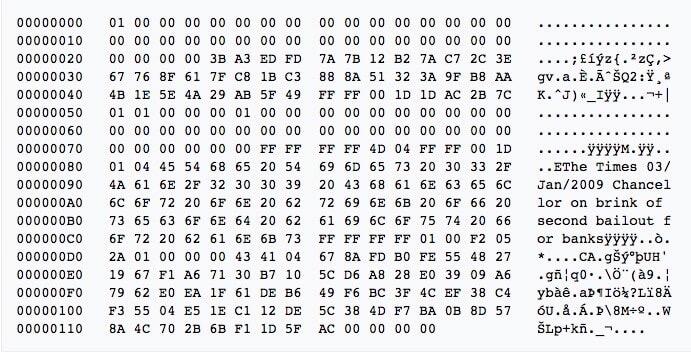

"The Times 03/Jan/2009 Chancellor on brink of second bailout for banks,"

Happy 16th Birthday #Bitcoin

PLACE YOUR BETS

Now that Christmas is over…

Which UK high street chain is going to go into administration first?

Neither do I. Purely experience 🫡

Time preference

Be more Right hand column!

I had a day today of feeling like I was stuck in the first half of The Big Short.

Is this a #Bitcoin Maxi thing or does it happen to normies too?