The people refusing to buy Bitcoin today will be so angry at the people who are going all in

Today they say "It's a Ponzi scheme," "It's going to zero," or "It's too risky"

In 2034 they will say "It's so unfair," "They were lucky," and "Bitcoin is too powerful, it should be banned"

Today 1 BTC = $62,000.

You can buy 1,612 Satoshis, or 0.00001612 BTC, for $1.

If someone earns $15/hour, they can buy 24,193 satoshis or 0.00024193 BTC per hour.

When Bitcoin is $1M, this amount of BTC will be worth $241.93, meaning you ~16x your money.

Your actual hourly wage will be worth a lot less in terms of Bitcoin (eg. if it's $20/hour, you'll be able to buy 2,000 Satoshis or 0.00002 BTC with the hourly wage), but the purchasing power of your savings will increase.

There is no top for #Bitcoin's price because there's no bottom for fiat currencies

We will see a new high every 4 years or so (some cycles may be a bit different, I can't predict the future, but halvings happen ever 4 years so I think this will be the case)

Each cycle fewer people want to sell and more people want to buy

Everyone I know who understands Bitcoin wants to add more to their stack!

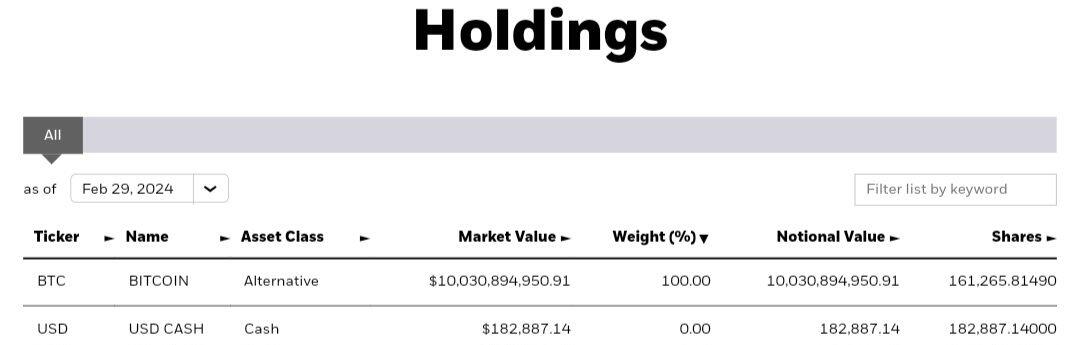

Blackrock's Bitcoin ETF SURPASSED $10 BILLION of assets under management!

$IBIT now holds 161,265 BTC, up 9630 from yesterday.

Blackrock now holds 0.77% of the total supply of BTC.

900 BTC are issued per day. In April this will drop to 450.

Blackrock clients bought almost 11x the newly issued supply!

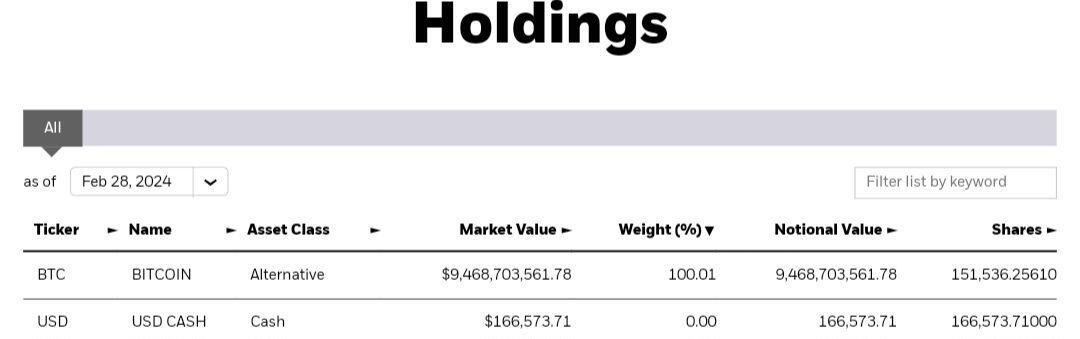

Blackrock's Bitcoin ETF now holds 151,536 BTC, up 10,140 from yesterday. This is a NEW record for the biggest day of inflows 🤯🤯

IBIT's total holdings are now worth $9.5 BILLION.

Blackrock now holds 0.72% of the total supply of BTC.

900 BTC are issued per day. In April this will drop to 450.

Blackrock clients bought over 11x the newly issued supply!

IBIT (Blackrock's Bitcoin ETF) had ~$3 billion in volume today!

That's insane

Yesterday it was $1.3 Billion

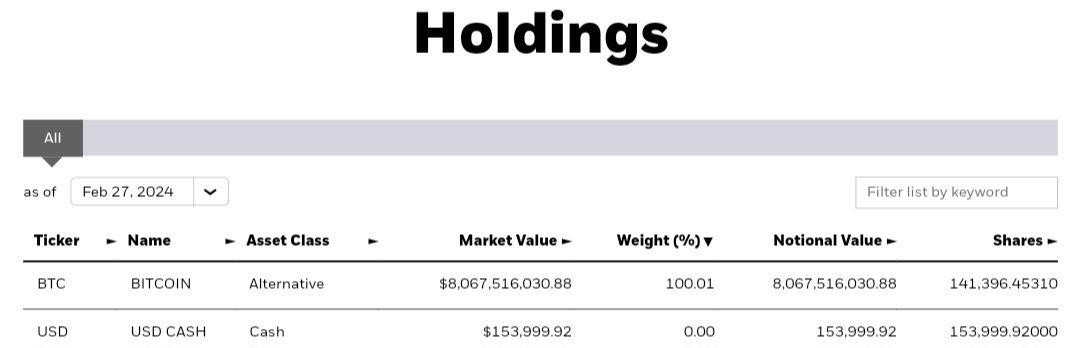

Blackrock's Bitcoin ETF now holds 141,396 BTC, up 9,114 from yesterday. This was the BIGGEST DAY so far for inflows 🤯🤯

IBIT's total holdings are now worth $8.07 BILLION.

Blackrock now holds 0.67% of the total supply of BTC.

900 BTC are issued per day. In April this will drop to 450.

Blackrock clients bought 10x the newly issued supply!

Most people don't realize that they're using real estate as a store of value...

Because dollars don't work

Bitcoin is a BETTER store of value than real estate

Cash flow is irrelevant if you have a 5+ year time horizon

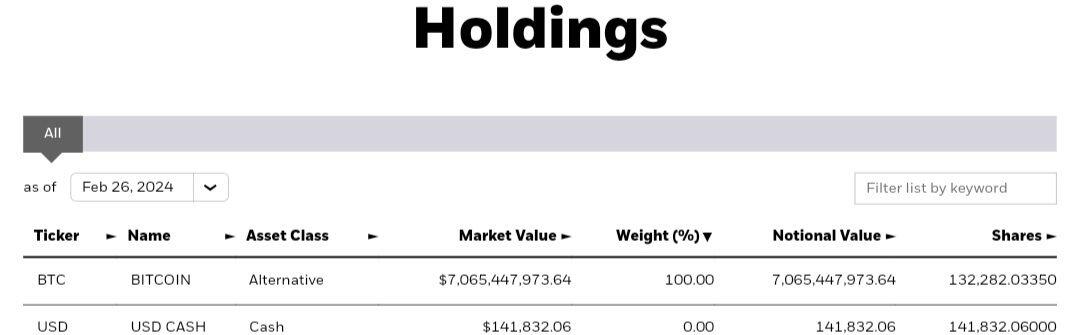

Blackrock's Bitcoin ETF now holds 132,282 BTC, up 2,051 from yesterday.

Their total holdings are now worth $7.07 BILLION.

Blackrock now holds 0.63% of the total supply of BTC.

900 BTC are issued per day. In April this will drop to 450.

Blackrock clients bought 2.28x the newly issued supply.

Bitcoin is a Veblen good

When the price rises, so does demand

There's more demand at $55k than there was at $16k

There will be more demand at $110K than there is at $55k

There will be even more demand at $1M than there will be at $110K

It's just a matter of time

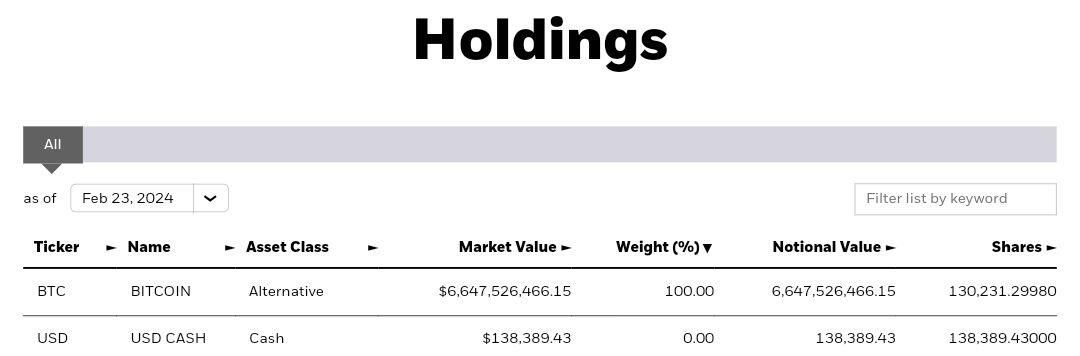

Blackrock's Bitcoin ETF now holds 130,231 BTC, up 3,281 from Thursday.

Their total holdings are now worth $6.65 BILLION.

Blackrock now holds 0.62% of the total supply of BTC.

900 BTC are issued per day. In April this will drop to 450.

On Friday, Blackrock clients bought 3.5x the newly issued supply.

$625k home

20% down-payment

$500k mortgage

With a 6% interest rate and a 30-year term, you are paying $579,190.95 in interest.

The $625,000 house cost you $1,204,190.95.

This is equal to a $3,345 monthly rental payment, plus you pay for maintenance and repairs.

Houses cost so much because people can borrow money that's created with the press of a button to buy them.

If everyone had to pay in cash for their home, prices would drop significantly.

Most people think mortgages are designed to help them.

But NO.

Mortgages are designed to earn profits for banks.

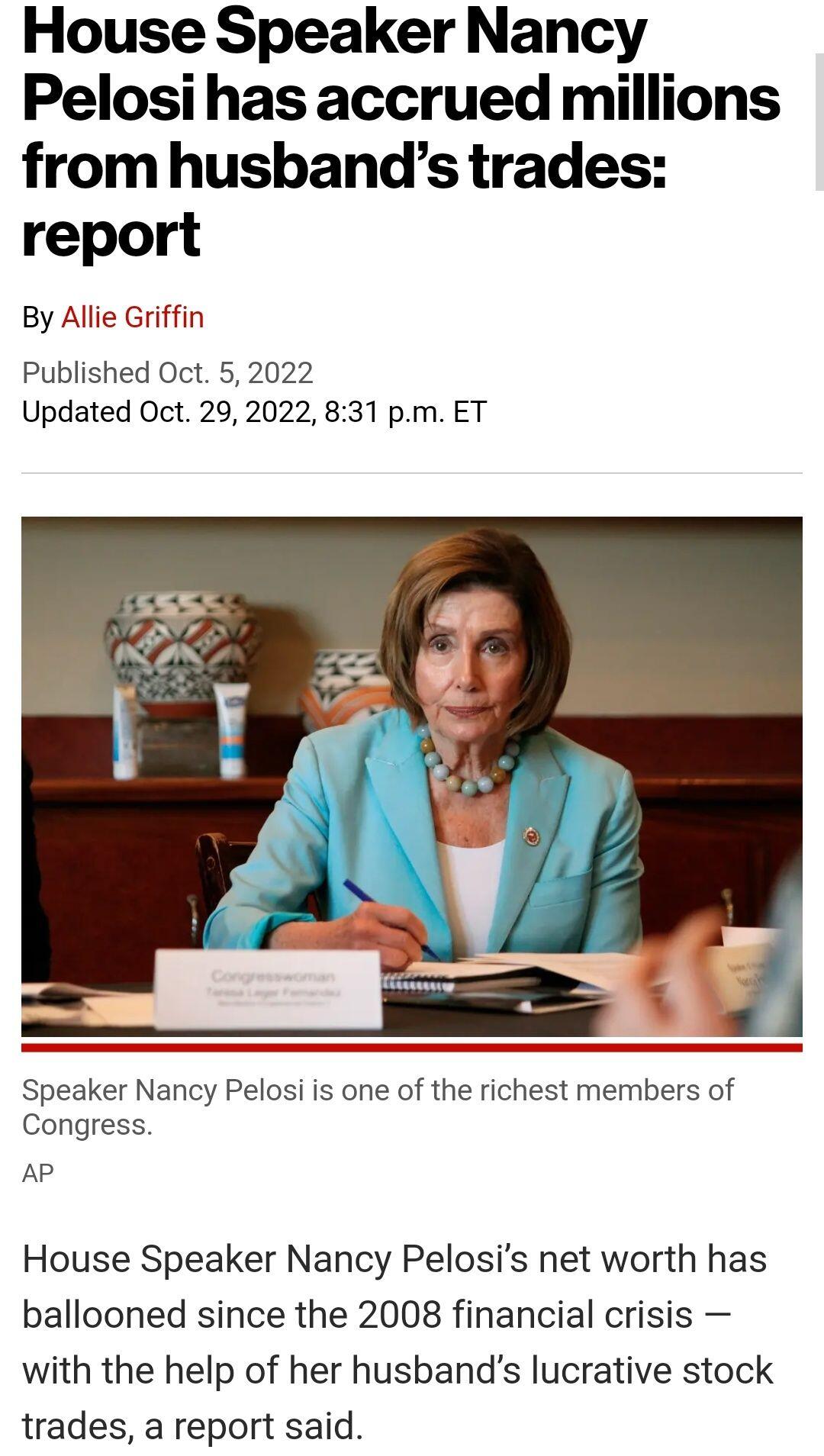

A BP employee's husband made over $1M through insider trading.

He listened to his wife's call without her knowledge and overheard a conversation about BPs takeover of Travel Centers of America.

He faces up to 5 years in federal prison and a possible $250,000 maximum fine.

Isn't it crazy how this guy might be going to jail...

But Nancy Pelosi's husband is just seen as a "Lucrative Stock Trader"?

Bitcoin is the only way to opt out.

We're still very early to Bitcoin

Every post I see about Bitcoin has comments like:

- It's a Ponzi scheme (it's not)

- It uses too much energy (it doesn't)

- It's too expensive to use (layer 2 solutions will solve this)

- It has no intrinsic value (it doesn't need to)

- It will be taken down by governments around the world (this is the most ridiculous argument of all because the protocol is run on computers all around the world, and a lot are hidden with a VPN)

Some of these comments come from people pumping random garbage altcoins, 99.9% of which will never make new highs against the price of BTC

The vast majority come from people backing up gold, real estate, and stocks who are worried that their investment is slowly being demonetized

The people commenting are usually arrogant and can't back up what they claim with facts

The vast majority of the public has no clue what this is, but they reject the idea without understanding it in depth

Most people prefer to stick to the old system because that's what they're familiar with and Bitcoin is confusing

They don't realize that the old system is designed to extract their wealth and make them poorer

Stop letting the distractions keep you from doing your own research

Verify EVERYTHING you learn from multiple sources and look at the arguments for and against the topic

The only way to opt out of the rising cost of goods and live a life of abundance is to understand how money works

Bitcoin will lead you down so many rabbit holes and it will expose so much of the world to you

If you're going to take this route, get mentally ready to take off the rose-tinted glasses and be disappointed with how things are run today

#Bitcoin doesn't need to produce cash flows

#BTC IS the money

Other things will produce Bitcoin.

Over the next 20-30 years, we will assess businesses based on their ability to earn Bitcoin cash flows.

We are so early that you can buy money today using pieces of paper!

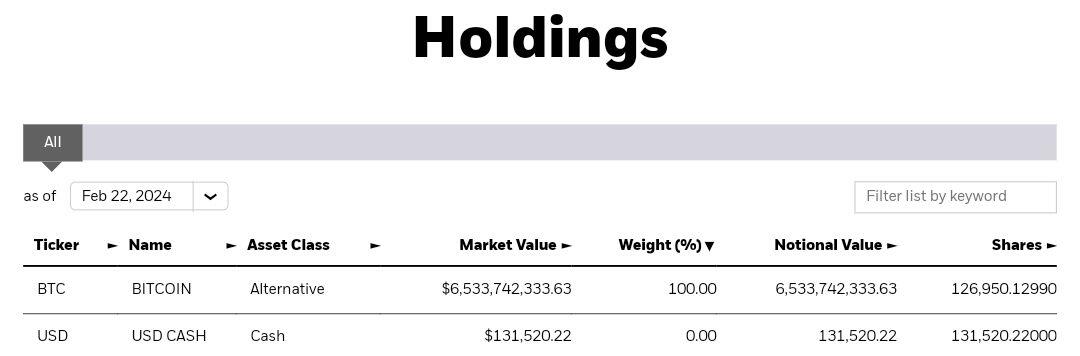

Blackrock's Btcoin ETF now holds 126,950 BTC, up 2,416 from yesterday.

Their total holdings are now worth $6.5 billion.

Blackrock now holds 0.604% of the total supply of BTC.

900 BTC are issued per day. In April this will drop to 450.

Blackrock clients bought 2.7x the newly issued supply.

Blackrock's Bitcoin ETF now holds 124,534 BTC, up 1,891 from yesterday.

Their total holdings are now worth $6.4 billion.

Blackrock now holds 0.593% of the total supply of BTC.

900 BTC are issued per day. In April this will drop to 450.

Blackrock clients bought 2x the newly issued supply.

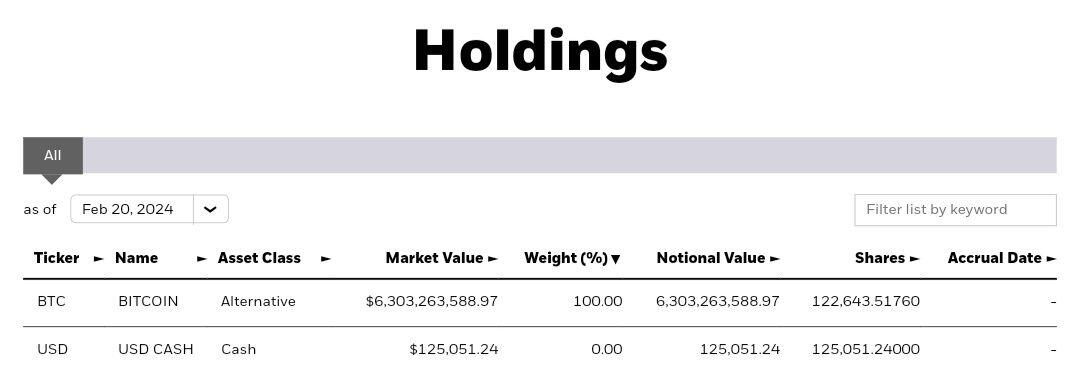

Blackrock's Bitcoin ETF now holds 122,643 BTC, up 2,962 from Friday.

Their total holdings are now worth $6.3 BILLION.

Blackrock now holds 0.584% of the total supply of BTC.

900 BTC are issued per day. In April this will drop to 450.

Yesterday, Blackrock clients bought 3.3x the newly issued supply.