#bitcoin is not here to tell you how it ends. It is here to tell you how it begins.

How it ends is up to you.

We are all Satoshi.

You were born into a monetary prison, designed to sap your time and energy, to serve the ruling class. Those that play the game well are rewarded with relatively more. Those that don't, receive less and suffer greater enslavement.

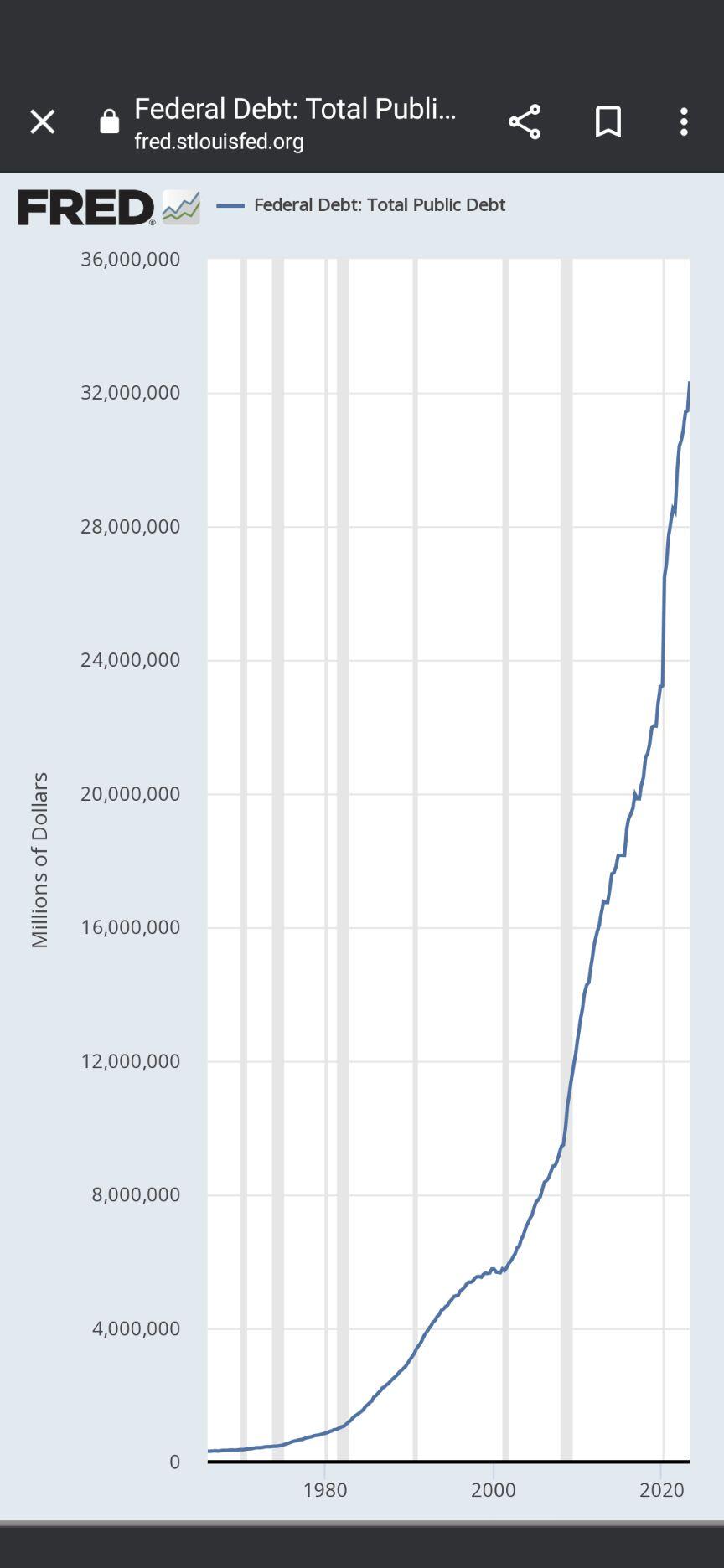

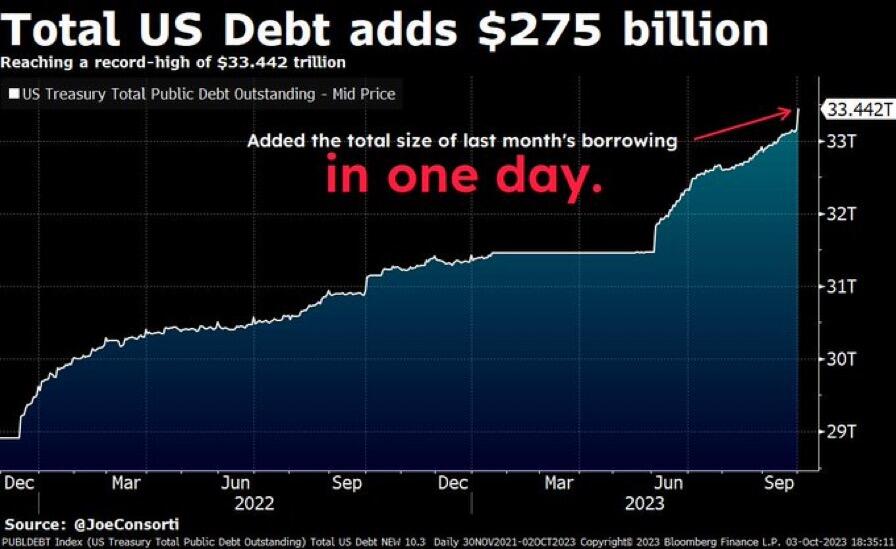

"A bubble pops when people wake up and realize that the debt can never be paid off."

nostr:npub1s05p3ha7en49dv8429tkk07nnfa9pcwczkf5x5qrdraqshxdje9sq6eyhe, "The Price of Tomorrow"

Ray Dalio has lost trust that the US can pay its debts.

https://www.cnbc.com/2023/09/28/ray-dalio-says-the-us-is-going-to-have-a-debt-crisis.html

nostr:npub1a2cww4kn9wqte4ry70vyfwqyqvpswksna27rtxd8vty6c74era8sdcw83a's latest newsletter made note on the ongoing carnage in sovereign bonds. I won't summarize the analysis or position, given it is a subscriber newsletter. But it is an interesting and meaningful debate as to the direction of interest rates. Related, there was a Barrons story this week about the labor market, noting its resilience as evidence to a likely soft landing (typical MSM garbage).

My contrarian view to that the labor market remains weak because excess liquidity still defines the economy. In other words, if central banks and government really want to bring price inflation under control, they need to destroy more demand and create more unemployment, such that monetary units come more in line with the scarcity of people's time and energy.

Applying this thought to the future of interest rates, they need to go up more. And sovereign debt needs to go down more. The question is "when" and "how violently." I think central banks will pause and expand their balance sheets sooner than people think, likely in response to crisis. But I also don't think they can go on doing this too much longer, before trust is completely lost and collapse occurs.

So, is sovereign debt a good buy? I suspect it is a matter of timing, but "no" longer term.

Elon is bought and paid for...follow the incentives, and run the other way.

Bloomberg: Elon Musk’s SpaceX has received its first contract from the US Space Force to provide customized satellite communications for the military

Why 2% inflation?

Powell: Let me dodge this question by telling you this is the agreed target by all central banks.

How does that help people?

Powell: Let me dodge this question by telling you, that inflation is going to be what you all believe it is going to be.

😂🤡🌎😂 https://video.nostr.build/1d1281c58c8d9b7b81bcf58f9a9e3279cf6baec02278ab94249c005412b6640c.mov

According to Powell's testimony, the reason we have a given level of price inflation is because (drum roll) it is the level of inflation people expect. It has nothing to do with monetary policy.

The Fed, with the projected power of its hundreds and hundreds of PhDs, is nothing more the a psychological operation on the people. It is just selling expectation. If we can just convince people inflation won't be, it won't be. Hmm.

In other words none of it is real, which makes sense given the same is true about our money.

#Bitcoin (ie proof of work, scarcity) fixes this.

The ambition of youth finds us learning to trust ourselves.

The cynicism and caution of age finds us questioning the truth of those around us.

Truth unleashes possibility, because it is real. Pro tip: spend your time and energy on what is true and real. Fuck the rest.

“Modern schools of economics do not teach the reality of economics as the study of human action, which results in their adherents being incapable of understanding the hard work, sacrifice, and risk needed for anyone to become a capital owner. This inability to understand cause and effect leads to imagining capital as some sort of heavenly privilege bestowed upon a particular race of people. You either belong to that race or you do not. There is little appreciation or understanding of the actions necessary to accumulate capital and hold on to it successfully, and as a result, many people waste their time, and the fruit of their labor, complaining bitterly about capital, rather than working to acquire it and raise their productivity and living standards. This economic ignorance is the wind in the sails of demagogue politicians who exploit it to achieve power and use it to expropriate capital owners.”

Principles Of Economics by nostr:npub1gdu7w6l6w65qhrdeaf6eyywepwe7v7ezqtugsrxy7hl7ypjsvxksd76nak

100%. This misunderstanding also leads to a mind-numbing misallocation of people's time. The irony is Keynsian economics relies on the concept of efficiency. But when you think about all the time spent learning this flawed theory by professors and students, and then all the wasted time spent by economists and central bankers trying to study and apply it, followed by the time individuals and corporations spend trying to do the same, and all the journalistic time and energy spent reporting on it daily, globally, it is a true shame that our lives on this planet are so distorted, with time spent chasing false dreams. And when you see the light, and know others in power must know it too, you realized the theory has become a system of control. The ruling class benefits from this societal inefficiency and wants you to waste your time.

This sad reality is the hope of technology like #Bitcoin and #Nostr -- they are platforms of truth, allowing people the opportunity to release the shackles and enjoy the real world. Pura Vida describes it well. Very grateful. 🙏

China is the new Germany, benefitting from relatively cheap Russian resources, and selling finished industrial goods to the emerging markets. All the while, expanding its influence, and de-dollarizing the globe at an exponentialrate..In the meantime, the US and its allies cheapen their currencies, increase debt, retarding growth, driving inflation and its social and economic destructions.

Dr. Jordan Peterson having a slight orange pill moment with Saifedean Ammous 🦾💜 (nicer version) 🤩

Full video in link below

#Bitcoin nostr:npub1gdu7w6l6w65qhrdeaf6eyywepwe7v7ezqtugsrxy7hl7ypjsvxksd76nak #Nostr #Plebchain https://video.nostr.build/c3c45adfb088e4df4b0cc97d7b0d71aa965dba412ebb2d5630a9d18d25a74f9c.mov