Terrific conversation. While listening you can almost feel the overton window stretching, and the world starting to come around, with more and more folks (like the Colonel) talking publicly about bitcoin's strategic importance.

Here, here.

Also remember Silicon Valley is captured, and under the thumb. The platforms and networks you choose are very important, as is how you interpret messaging from those that are controlled.

The moment you realize those positioning themselves as the problems solution are its root cause. #truth

nostr:note10nr65a6amcfyjcx7cef35846r47xgv73esl0cr7hj5lv2ac5txjsc3jsh2

Twitter users are like addicts who need an intervention. Tough love: show some self respect and stop supporting platforms captured by the State. Be your own person. Control your own destiny. Stop thinking you need Twitter to be cool or important or make money. You do not. The same way you don't need fiat or central banking to be rich.

Next year maybe it will protect against audience capture from the politicized Princeton simps?

Don't underestimate RFKjr's presidential candidacy.

Be your own Blackrock

Don't be Larry Fink's bitch.

we hear the same from bitcoin

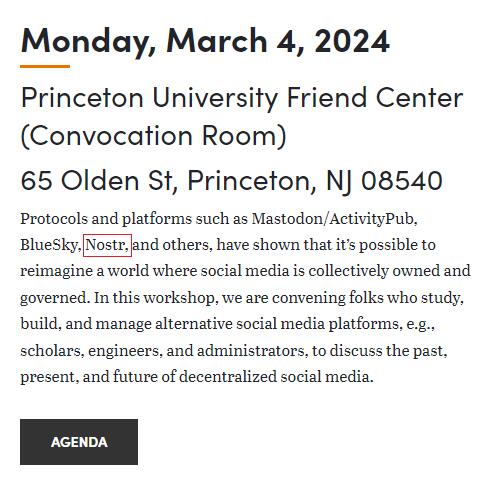

influencers who, in whole or Parr, reject nostr for Twitter. I wonder if their primary motivation is building their own brand, or helping the mission. Associating with the Princeton name helps the former, and I didn't see that many plebs in the audience. 🤔

GM. I'm using the time to re-listen to CD92. Shriver is such a boss. A pure expression of the mission.

Maybe I am not understanding, but if you have $100k set aside for consumption over the next year (ie, liquidity needs), are you saying it is prudent to take out a $100k mortgage to hedge against monetary inflation?

Current mortgage rates are 6-7%. 6 month CDs (ie, where you might park your savings) is paying about half that in the US.

Do you really think the risk of short term monetary inflation is worth the delta (ie, around 3%), and then that real estate is a good hedge (after fees associated with the mortgage, etc)?

What am I missing?

When you look at margin debt in relation to currency in circulation, current leverage is at cyclical lows.

Bitcoin and Nostr doesn't need Princeton.

So awesome. Thanks for all you do.

Every day the freaks push humanity forward in giant leaps.

Stack sats. Stay humble. USE NOSTR.

Easy is the byproduct of hard.

Keep moving forward. We are with you.

#bitcoin is truth at the speed of light, a network for sovereign individuals to repulse the lies, reject the manipulation, and build for the future.

Most VC are nothing more than market timers, who use specks of truth to inflate bubbles and talk up their book, before dumping it on retail. They delude themselves and others into thinking they are smarter and doing God's work. In reality, they are weak, soft-handed, whiny babies and overpaid pond scum. So, will they follow Chamath in thinking Bitcoin is the story for 2023, shit all over the space, splash the table, and leave a mess...you can bet on it. But, bitcoin doesnt care. Nor do I.

Prices cycled higher through the late 1960s and 1970s, which makes sense:

Money gets debased by government. Prices go up. People save more in response to higher prices, reducing demand for money, and prices go down. Government then stimulates, with further monetary debasement, to discourage savings, and prices go up faster, causing more savings. Rinse, repeat.

We shouldnt be surprised in this cycle repeats, as well, in the 2020s. The problem is government manipulation of money supply. #bitcoin