“Success consists of being able to secure ever-growing quantities of debt as you pass through the stages of life: a big college loan that allows you to get into the best paying job, whose salary will allow you a larger loan for a large house and another loan for a car.” -nostr:npub1gdu7w6l6w65qhrdeaf6eyywepwe7v7ezqtugsrxy7hl7ypjsvxksd76nak

Exit the fiat debt world with #bitcoin

Gary Cardone is a perfect example of this. “Yeah man, I was here in 2016.”

“We” being born-again, then yes.

If not, no.

Christ Jesus saying, “Do not marvel that I said to you, ‘You must be born again.”

Bro..but blockchain 🤣

“Whenever I get to a low point, where I think, “why do I even bother?” I just remind myself this is where most people stop, and this is why most people don’t win.”

-Chris Williamson

Stay humble stack sats #bitcoin

We must win.

“You shouldn’t worry about criticism from someone you would never ask advice from.”

1. Global wealth is not $2Q

2. Derivatives don’t create wealth

3. The fed likes to print but not that much (quadrillions, would mean collapse)

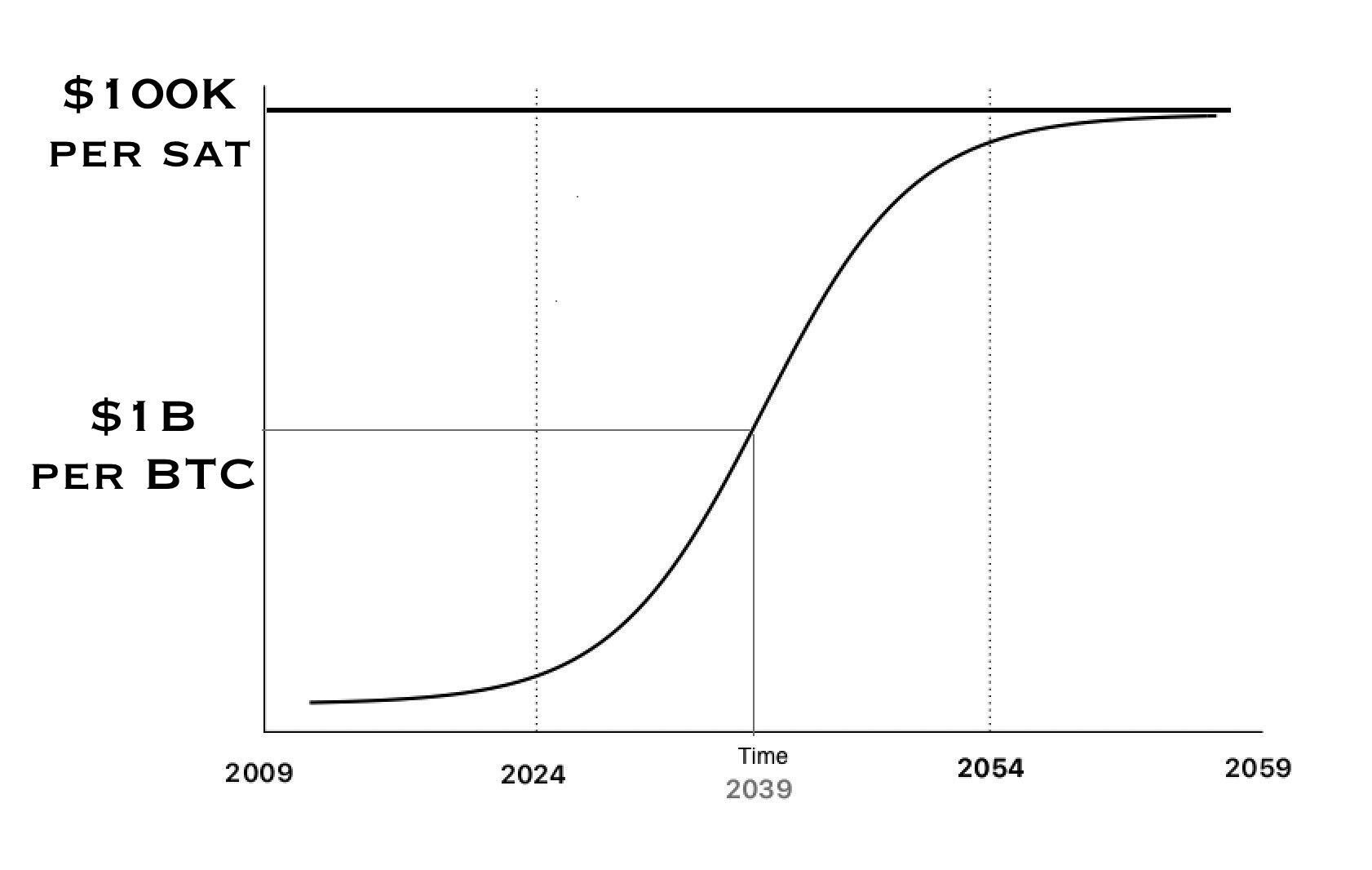

But let’s just assume your assumptions are correct. That illustrates the destruction of the fiat world in an unnecessary way. You don’t need one system to completely blowup for the other to thrive in such a short amount of time. I hate the fiat world just as the next bitcoiner, but your proposed market cap assumes an unneeded destruction too quickly.

You’re saying $100 million per #bitcoin ($1=1sat) in 4 years? If that were true that would put Bitcoin’s market cap at 2 quadrillion in 4 years? (Current total wealth $600-900 trillion). You see now how unlikely this scenario is. Mathematically impossible.

The stock market is turned on and off everyday.

“We’re in bubble, this thing is going to burst any day now.”

Then leave it off! 🤣

Exit the fiat clown world #bitcoin

I tell my wife, “I’d rather be miserable with you, than happy with someone else.”

#Bitcoin couples.

We are in #Bitcoin to help build and secure the individual’s value creation worldwide.

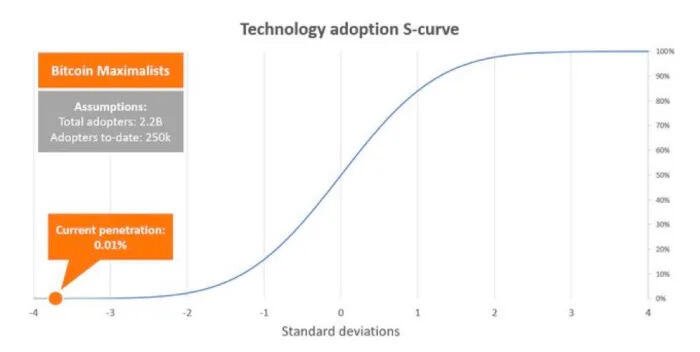

I’m not referring to a currency collapse. If Bitcoin were to achieve $1 = 1 sat parity in 5 years because the rich wanted to get richer, that would be extremely damaging for billions of peoples potential future purchasing power. The people that are actually on a Bitcoin standard in 2024 is less than 1 million. I would encourage you to start listening to Jeff Booth or better yet read his book “The Price of Tomorrow.”

America “adopting Bitcoin” is highly unlikely. In the same way that Blockbuster couldn’t compete with Netflix. They couldn’t even see what was happening. True story, they added candy isles to “boost profits” to try and compete with Netflix.

Now $10-$15 million per Bitcoin by 2045 IMHO is a more reasonable adoption rate, helping give billions a people around the world to secure their purchasing price.

Sorry, extremely unlikely…and let’s hope that doesn’t happen

🤣🤣🤣

Still one of the best #bitcoin articles.

https://www.onceinaspecies.com/p/why-the-yuppie-elite-dismiss-bitcoin

They will play funny games until fiat no longer has serious purchasing power. Unfortunately this may continue for many more cycles.

Imagine balling out for dinner with $10 bucks

Hodl gents one day the menus will list sats like this #bitcoin

Dear ETH head, this is your future.

Bitcoiners have tried to warn you for years. But maybe this song will cheer you up. 🤣

Get em nostr:npub1rtlqca8r6auyaw5n5h3l5422dm4sry5dzfee4696fqe8s6qgudks7djtfs