ECB Reports Record Loss for 2023, Publishes Another Hit Piece on Bitcoin

- "The ECB is likely to incur further losses over the next few years as a result of the materialisation of interest rate risk, before returning to making sustained profits. The ECB can operate effectively and fulfil its primary mandate of maintaining price stability regardless of any losses."

- "Bitcoin has failed on the promise to be a global decentralised digital currency and is still hardly used for legitimate transfers. The latest approval of an ETF doesn’t change the fact that Bitcoin is not suitable as means of payment or as an investment."

https://www.nobsbitcoin.com/ecb-reports-record-loss-for-2023-says-bitcoin-has-failed/

I just shared this with a German friend and he's curious about Bitcoin but turned off by the energy consumption.

does anyone know a good online resource on the energy consumption of Bitcoin?

I am also risk averse, and I used to only invest in S&P500. Then to my gut senses bitcoin started looking less risky than S&P so I also dumped index fund into Bitcoin

In Austin, Texas, it seems much cheaper to rent. There are houses for rent for 2000-3000/month that cost 600000.

The interest at 6% on a 500,000 mortgage is 30,000/ year which is as much as the rent. the property tax is then another 6000-10000.

My strategy is:

--Save 100,000 downpayment in Bitcoin in 2024

--by 2025 House prices will be correcting to mean

--2 Bitcoin stash may possibly pay for the house if I'm lucky.

so enlightening, thank you. that makes a lot of sense now... can't believe i went for 18 months down the rabbit hole without knowing this.

I wonder what's next

It's not going to get broken into. This is most likely what they're using. https://docs.cloud.coinbase.com/waas/docs/mpc

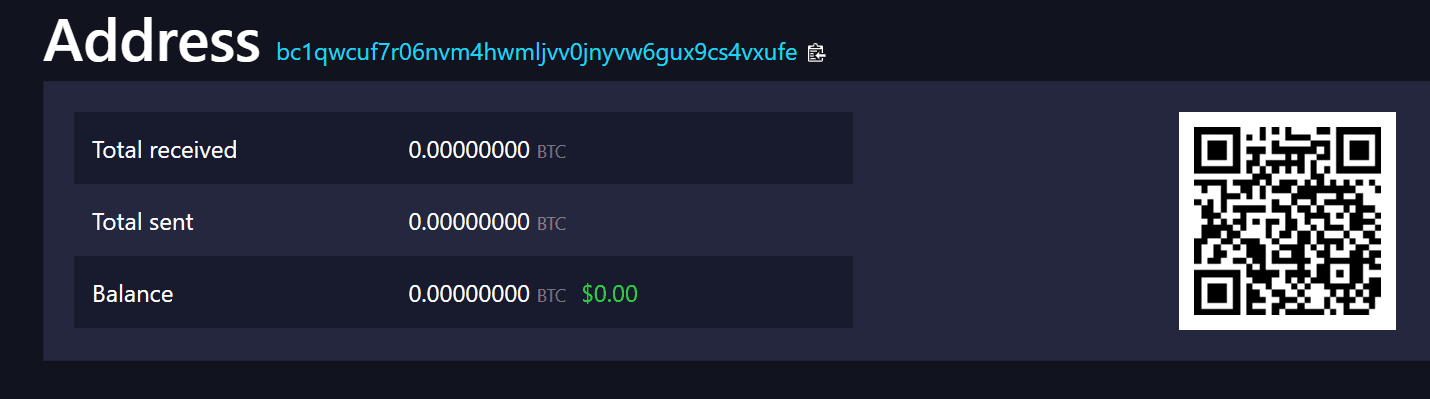

Is it possible for bitcoin wallets to be too big to steal?

If the worst-case scenario came true in which Carmen San Diego figured out the key and moved all of the wallet, where would she go to spend the Sats? It would be hard to buy things expensive enough with the money. And the larger items that would be bought (houses, planes) are more easily traced.

Maybe it's an irrational actor YOLOing. Or maybe someone proving a point, and just never spending it.

It reminds me of the Rai stones from Saifedean's book. Everyone knows who this belongs to. It's possible to steal the stone and cart it home, but now that we have all seen the address, we all know who really owns it.

In my mind, the best option for Carmen San Diego would be to return the Sats in return for indemnity and earn a prize for helping identify security flaws.

For a newbie here, why would it be easy to break into if it's not a HW wallet or even if it is?

why would it be easy to break into this address if it is a hardware wallet.

For people with very small amounts to invest, what's the minimum size of a self custody wallet that makes sense to maintain? What minimum amount makes sense due to the very high fees on base chain?

If fees continue to rise, 100k sat utxos will basically be worthless in the future. Current fees are around 70 sats/vb, or about a 10k sat fee. This is a 10% transaction fee. This may be helpful: https://bitcoinops.org/en/tools/calc-size/

what do you think the smallest sized UTXO will have any value in the future?

i wonder if there are any equations about this or thinking about how much value in the world changes hands on a daily basis.

And what kind of minimum batching (e.g. 0.1 BTC, 1 BTC, 10 BTC) will be needed to get that value through the resistance of the block sizes as it moves back and forth?

New to the UTXO topic and shocked to find fees are so high.

Can anyone explain why there are so many of these transactions in the Mempool that send 0.00000546 BTC to hundreds of addresses and pay enormous $2000 fees?

who would throw away so much money to unconsolidate so many small amounts of Satoshis? doesn't that mean they are forever after lost/unspendable in high fee environment?

slice an onion in half and wear it in a thin scarf like earphones. results guaranteed in 10 minutes