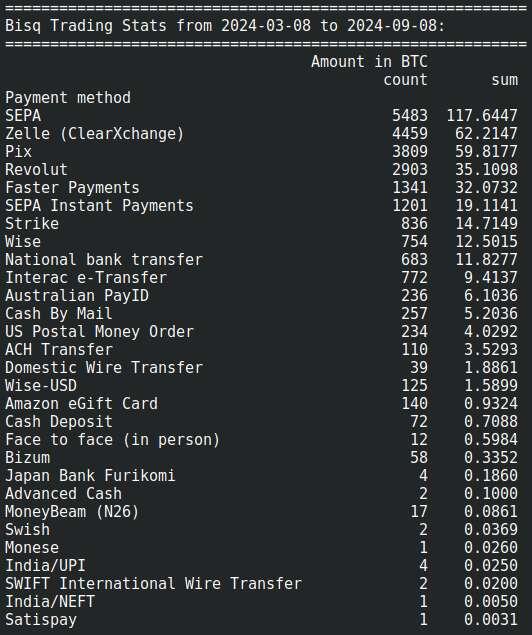

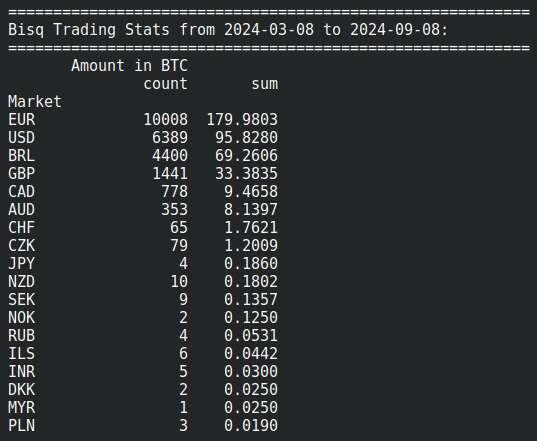

Bisq Market Update

The Watchman Privacy Podcast: Torchlight Chats 1 - The Assassination of Mohsen Fakhrizadeh

Episode webpage: https://watchmanprivacy.com/

Media file: https://traffic.libsyn.com/secure/watchmanprivacy/Torchlight_Chat_1.mp3?dest-id=2727836

The Watchman Privacy Podcast: 119 - South Dakota Residency Part 2

Episode webpage: https://watchmanprivacy.com/

Is the https://relay.exchange/ down?

Could I run my own backend, such as an Electrum server, similar to BlueWallet and SparrowWallet?

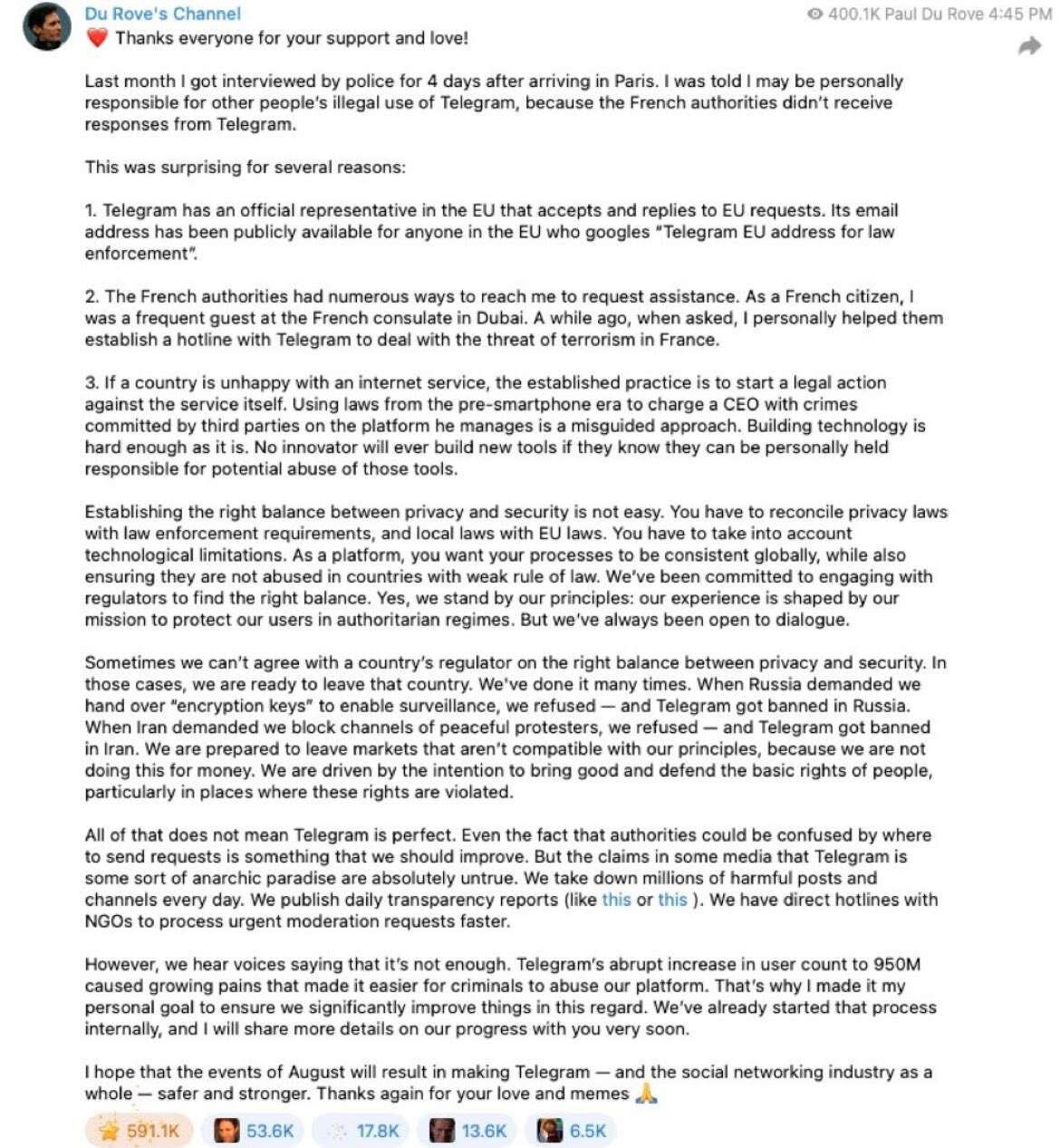

#Durov

The price of Bitcoin can be a different quantity for different people. You might recall the 2017 arb between the Korean price and the USD price.

If I choose to only ever trade on Bisq, then my bitcoin price will be whatever is available on Bisq.

I guess when you refer to price you refer to the lowest friction most liquid representation of the price. Then you are trying to talk about the factors that influence the price of the lowest friction most liquid representation of the price.

I think you simplified the representation by talking about CEX price as a single quantity. Technically every currency pair is slightly different. Every CEX will also differ in price, with the price potentially varying alongside the credit worthiness, or simply from the long/short bias differences in the userbase.

You also have the price of futures vs the spot market, which is very actively traded too, in addition to the OTC trading desks.

In a Liquid well capitalized market these differences will be small, and track the cost of capital for putting on the spread to arbitrage the price descrepancies.

Back to the case of Bisq, if we say it is not common for people to arbitrage the price difference. Consider the Bisq users might have two separate KYC and non-KYC stacks which never mix, but if they want to exchange BTC for fiat or vice versa they might prefer Bisq vs CEX on the margin at some price difference. Thus in that way they can still affect an influence on the price in the other venues.

Above all the influence on price will be proportional to the volume traded. Though CEX can play games with inflating volume, they still have >99.99% market share for price discovery.

It would have impact price if it's market share was higher. Since Bisq volume is <1/10,000 of CEX volume, it's affect on price is negligible in aggregate.

Though I'd also argue that a dollar of sats bought from Bisq has more influence on price than a dollar of sats bought on CEX, since the Bisq sats are self-custodial and only re-hypotheticated.

You guys are killing it. Stay true to your principles and you will crush the competition in the long run.

If you try 2 on me in Bisq, I will chain analysis your deposit TX and cancel the trade, potentially taking your deposit if the moderaters agree with me that we don't want dirty tainted KYC sats on Bisq.

In practice, I do not see much of people selling KYC sats on P2P platforms. Owners of KYC sats should understand that selling on KYC-free creates a tax liability, unless they want to undermine the KYC-free platform by declaring all the details to the IRS.

Thanks. Do you have a link to the LNUrl server you used and any guides that might have helped you?

Is it possible to use PhoenixD as a self-hosted LNUrl for your Nostr account for receiving Zaps 24/7? How did you get an LNUrl address for your PhoenixD instance as distinct from the bolt12 address?

I setup https://apemithrandir.com/.well-known/nostr.json and put apemithrandir@apemithrandir.com in my NIP-05 profile field. Is that all that is required for NIP-05 to work?

Ignored Odell shilling Nostr for the longest time. Now with latest Fountain update get onto Nostr for minimal effort.

https://fountain.fm/episode/1i0ax59wJxo40GbhL0Ks

nostr:nevent1qvzqqqpxquqzqunl3ehkpt43pr62567aaxdqyjjfy0t08xewyax443884ysyhjqxyye4hw

Double boost. I got the latest Fountain. Does that mean this goes to Nostr now?

https://fountain.fm/episode/meY9nyt70HnirLta6MZC

nostr:nevent1qvzqqqpxquqzqwrf9k967fgjjafr2e3yq6el879mln9l9qxlepmppkefx6euwxt26f4y0u