Agreed. I like the ability to dig deeper on subjects because content creators not have the capacity do. These types of posts generally do well too. Stack Hodler illustrates this, as does Macroscope and a few others.

nostr:note1shfnjh8xcfpayczpytvanv6pwn3pq6yemnuzlfmvfekxwt8dyqzqxe2el8

Personally a fan of some long form, but yes, generally short is good.

????

Yeah I don’t necessarily believe all of that stuff. And hyperbitcoinization might not characteristically look like any of those things that bitcoiners might think. Again, I think it’s as simple as freedom tech, and adopting sound principles relative to sound money. I don’t think we need to add all of these additional things to it. I also think it’s been 13 years, and we can’t actually compare bitcoin directly to anything because nothing there’s simply nothing like it. We are just trying to build models around technology from the past, but this is radically different. So while I indirectly compare it to the internet, combustion engine, printing press, etc, I don’t think characteristically we can say they’re all the same. They will all follow their own adoption paths, and something that has the ability to disrupt the financial system will take longer considering more friction. I do think less banking will occur and more will use open applications for money and commerce, where they can send money just like they would a text message free of required of a centralized institution, but that may be more for the tech savvy. There will probably be LSP onboarding services which will reduce the friction of adoption for things like Lightning. Disrupting finance isn’t easy, but I’m still expecting that to occur, just maybe not in the exact what everyone is thinking.

Bitcoin is the only asset where I’m genuinely afraid it’ll increase in value quickly.

I can’t get this damn thing out of my head.

I advise all stacking plebs to accumulate what they can, but to try and attain 1 bitcoin (no leverage) as soon as they can before it’s too late.

Nostr might actually be better than Twitter.

Maybe it won’t lead to mass hyperbitcoinization across the globe. But I do feel there will be a bigger cohort of individuals/families who operate within the bitcoin standard than we have today, and that may actually be a very prosperous way of life for them. This in turn has the ability to influence others to adopt a similar framework. We must educate (sound financial and ethical principles) while hyperbitcoinizing ourselves and becoming strong role models and leaders in our households and communities. Then only do we have a chance of hyperbitcoinizing the world.

SCARCE DESIRABLE ASSETS

ONLY 1-2M ON EXCHANGES

TRADI FI WILL BE FIGHTING FOR LESS THAN 10% OF SUPPLY

#BITCOIN 🔥

All is well

How many people are on this app?

#bitcoin ❤️

Bitcoin or we’re doomed to trusting third parties with no choice

Secure

Nunchuk for collaborative custody across directors who operate a bitcoin company is pretty cool

Approaching

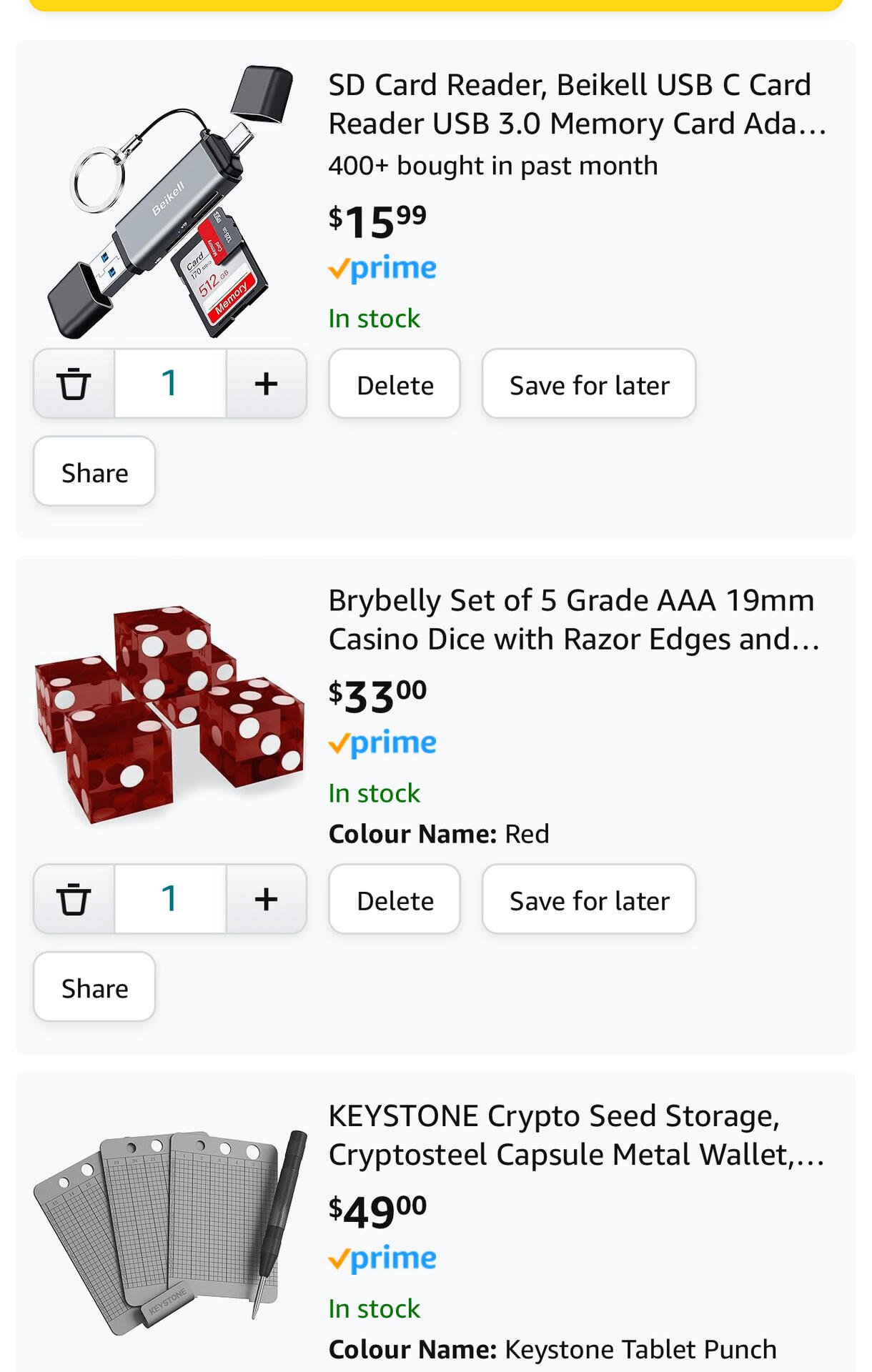

Time to up security

Damus and Nostr are finally useable without consistent lag.