Fractional reserve banking. Quantitative easing/tightening. Bailouts. Raising the debt ceiling. The debt spiral.

Lobbying. Insider trading. Corporate financing. Corporate board seats after office. Bribery. Favoritism.

Effects of the control and manipulation of money.

Opt out: #bitcoin

The banks don't have your money,

The FDIC has no reserves,

The house of cards assumes we're dummies,

But we're on to how it's freaking absurd.

#bitcoin

There were 561 bank failures from 2001-2022 (FDIC)

Since banks don’t even have your money, it may be wise to rely on them as little as possible

Be your own bank instead: #bitcoin

#HFSS

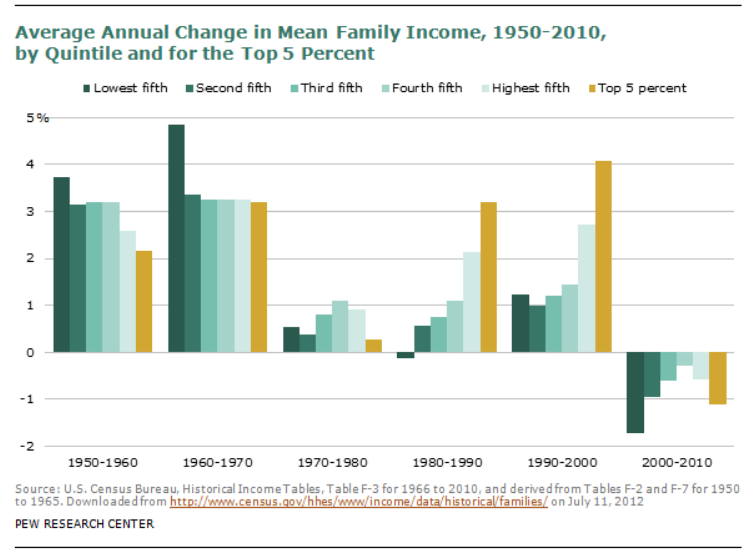

The last decades of the Gold Standard led to healthy YoY income gains for all groups. This is why a single earner could often afford to buy a house.

Since then, the reverse has happened: gains have favored the top and left the middle and bottom behind.

A #Bitcoin Standard can fix this. But until then, workers can still start saving long-term in bitcoin, combatting the rising prices of everything around them and the fact that wages are not keeping up

When I posted this block, I was under the impression it would be moved to main chain Twitter SC like the majority of sidechains

Now that it seems it won’t and will exist on its own, and since it’s not possible to delete a post on Nostr, I hereby state publicly that I want this hash to reside only on Twitter SC, not here

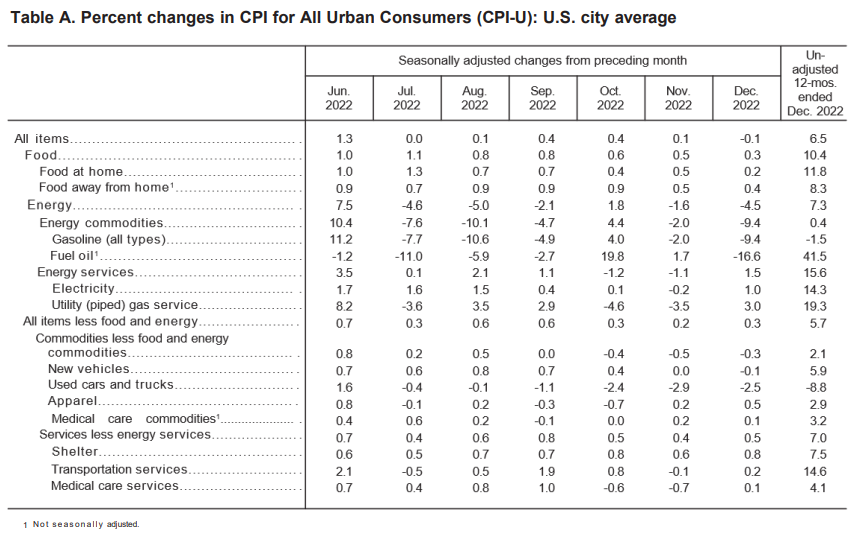

Between 1971-2022, median wages have inflated 526% yet the dollar in this same time period has inflated 623% (BLS)

Everyone in the bottom half of the income distribution who is saving in dollars is losing money faster than they can make it

Saving in #bitcoin directly fixes this

This is how the #Bitcoin network is(nt) destroying the climate. https://twitter.com/DocumentingBTC/status/1633086613415772160

Great example of the trend toward energy efficiency.

It’s working: https://twitter.com/dsbatten/status/1633033854280925184?s=46&t=z11diCwys_-q8S5wsE-97g

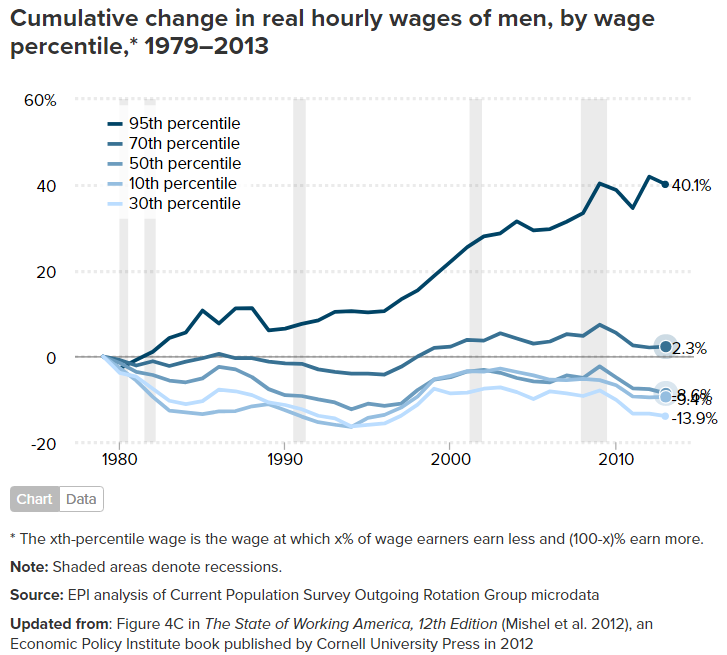

From 1979-2013, male workers below the 70th percentile experienced negative real (inflation adjusted) hourly wage growth.

When nominal wages improve but life is getting harder, many don't know it's due to broken money.

Saving in #bitcoin over time protects workers from this.

True, glad it worked out for you! And thanks!! 🙏

If you didn't receive a 10%+ raise in 2022, you likely took on more debt to pay for life's necessities: food and energy.

You can try to battle inflation with wages and debt, or you can start saving long-term in the hardest money in human history: #bitcoin

😂 I was just wishing B the cure a good night for all his hard work, on his European timezone