In 1970, the median income of upper-income households was 6.3x that of lower-income households and 2.2x that of middle-income households. By 2020, it was 7.3x greater than the median lower class income and 2.4x greater than the median middle class income (Pew).

Got #bitcoin ?

Since 1967, the middle 60% of earners have been slowly getting poorer as compared to previous generations and to the top 20%.

To combat this, the Middle Class can take matters into their own hands and start saving in the hardest money on the planet: #bitcoin

Nice stack Louis!! And find 7.

We can definitely help with that ser, just require ur consent 🤝

This is accurate. Also here’s the meme I made for the fork war conclusion that u may have missed since leaving Twatter 🧡

When middle-income earners ($30k-$100k) were asked how they will change their financial behavior to combat inflation, the majority of their answers would put them even worse off in the future

The survey designers also missed the most important strategy of all: saving in #bitcoin

The dollar is already weaponized. But they, like anyone, can buy bitcoin anytime.

It was also the time the US broke away from the Gold Standard, i.e., starting printing money from thin air

From the late 1940s to the early 1970s, gains in wages and productivity were nearly identical

After 1971, the minimum wage fell well behind productivity as did inflation-adjusted average wages

There's no incentive for those in power to fix this but you can take the power into your own hands now: #bitcoin

"Credit card balances saw a $61 billion increase in the fourth quarter, surpassing the pre-pandemic high of $927 billion. Credit card balances now stand at $986 billion" (NY FED)

As prices rise faster than wages, people turn to credit

Saving long-term in #bitcoin can fix this

We can't vote our way out of the US debt growing. We can't hope for policies that will protect us from the pain and suffering this causes. We can't expect those who control and manipulate the money will ever have our best interests at heart.

But we can opt out: #bitcoin

Inflation looks mostly level over time, right? That's a good thing, right?

This would be true except inflation compounds. And wages don't rise nearly as fast, so we're all falling behind.

More work and more debt will never fix this long-term, but savings will: #bitcoin

Bitcoiners enjoying life with sats in cold storage while the world plays losing fiat games

Hell yeah! Awesome addid photo feature wooooo!!

I choose transparent and fair rules over control and manipulation by rulers #bitcoin

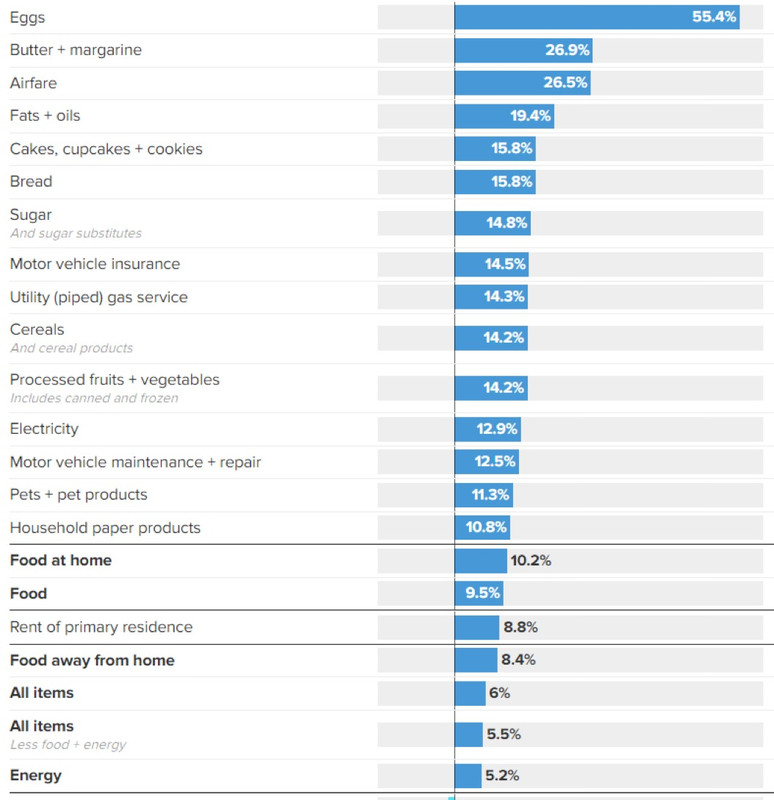

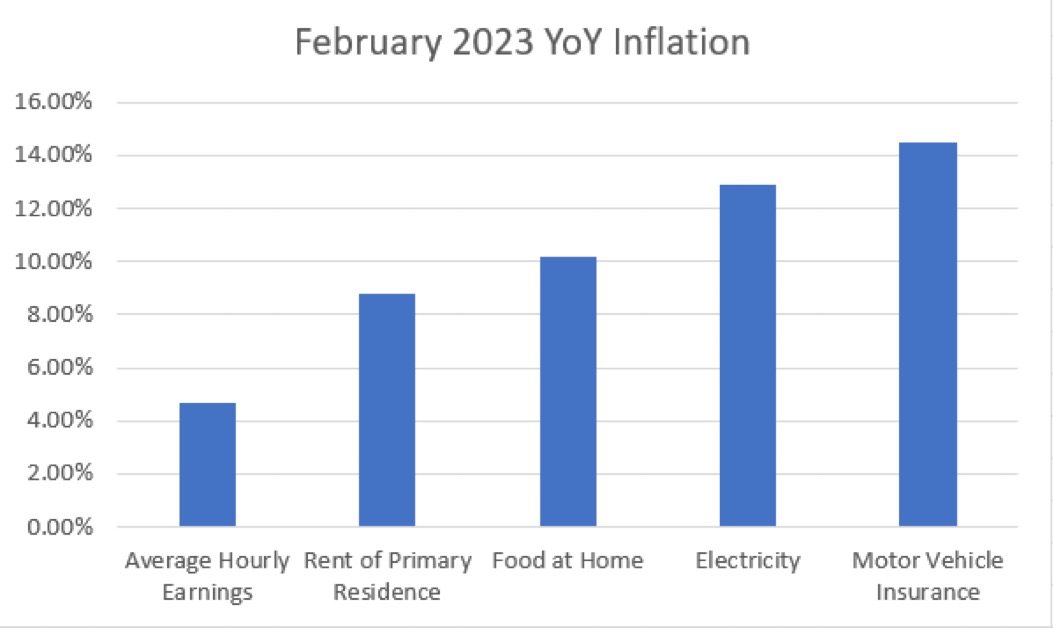

Whether it's 1971-2022 versus Feb. 2022-Feb. 2023, median wages versus average hourly earnings, the story is always the same: people are falling behind

The "invest or suffer" logic implies everyone needs to master the market

But workers can just save long-term instead: #bitcoin

#[1]

Real average hourly earnings decreased 1.3%, seasonally adjusted, from 2/22 to 2/23 (BLS).

But this is based off February CPI at 6%.

Looking at 'food at home', workers are down -5.5% (-1.3+-4.2) using income to eat.

Workers need a savings tool to combat this: #bitcoin