"Good morning! The BTC is at €92,896 at 8:25.

Bukele is abolishing BTC as legal tender in El Salvador - for a few million dollars.

Trump and his wife are launching a shitcoin and scamming people for several million dollars.

The Argentine president Milei is actively promoting a shitcoin on X that scams its buyers for several million.

So: Trust no politician, not even the 'good' ones!

Fortunately, there is the independent Bitcoin network!"

Into the Wild! Something Like Idea of North by Glenn Gould, what do you think?

GM!

Ein sehr interessantes Video mit Niko Jilche und Chris Burger, wie Bitcoin dem oder Law folgt: https://www.youtube.com/watch?v=CwQ8Zgdvk_c

Dazu diese Grafik:

:saylor: Michael Saylor suggests that the U.S. should purchase 20% of all #Bitcoin.

https://junkflex.com/bitcoin/saylor20.mp4

:reward: Share > Like > Comment = ⚡️21

:topreward: Top Comment = ⚡️500

(For 24 hrs Only)

Isn‘t that again a step towards centrilisation Nobody wants?

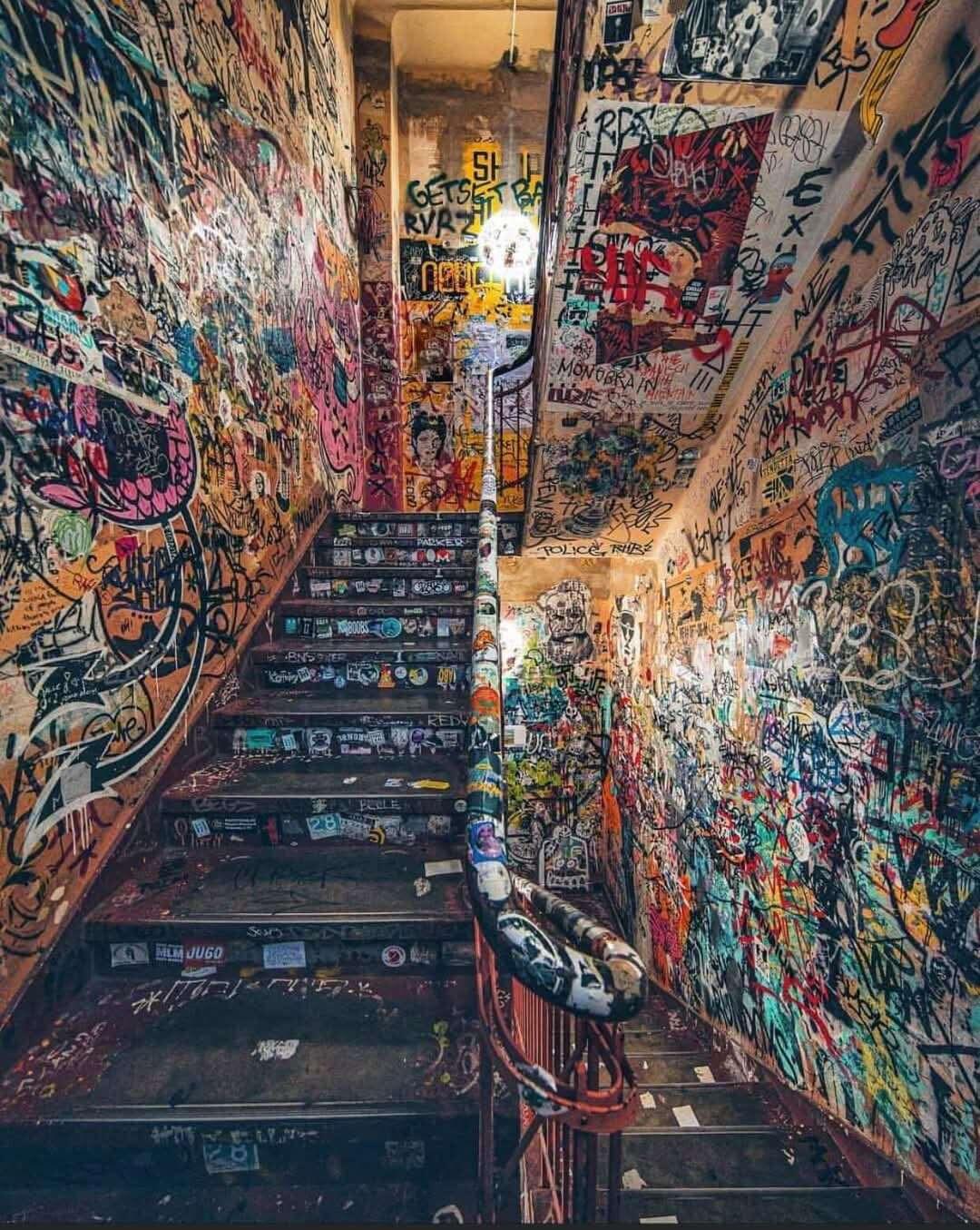

Bitcoin is very, very important. But we can't just limit ourselves to promoting Bitcoin all the time! Life is more diverse and colorful!

Why do you think its abandonned?

Mein ausführliches Video über Bitcoin als Dekonstruktion des Zentralbank- und Fiat-Geldsystems! #bitcoin #dekonstruktion #dekonstruktion #derrida #derrida #fiatmoney #fiatmoney #centralbank

https://myairymedia.vids.io/videos/d391d1bf121ee5c35a/bitcoin-als-dekonstruktion

Eine sehr schöne informative Podcastserie aus libertärer Sicht über alle Fragen zum Geld - natürlich auch bitcoin - von Paul Brandenburg: https://www.spreaker.com/podcast/nacktes-geld--6415139

Bitcoin Meetup Goerlitz 11.2.25 ab 19:00 Uhr Johnnys Pizza Bahnhofstraße. 78 Goerlitz

I asked DeepSeek this question:

what do Rothbard's criticism of fiat money and the theoretical implications of bitcoin have in common?

first I received this description of its thinking process:

Okay, so I need to figure out what Rothbard's criticism of fiat money and the theoretical implications of Bitcoin have in common. Let's start by recalling who Rothbard is. Murray Rothbard was an Austrian economist, right? He was a big proponent of libertarianism and free markets. I remember he was critical of central banking and fiat currency. Fiat money is government-issued currency that isn't backed by a physical commodity like gold. So, Rothbard probably criticized fiat money because it's controlled by the state, leading to inflation and economic instability.

Now, Bitcoin. Bitcoin is a decentralized digital currency, not controlled by any government or central bank. Its implications would relate to things like decentralization, limited supply (since there's a cap of 21 million coins), and being outside state control. So, maybe the common ground is their opposition to state-controlled money systems. Rothbard would dislike fiat money because it's prone to manipulation by governments, leading to inflation. Bitcoin, being decentralized and with a fixed supply, could be seen as a solution to those problems.

But wait, Rothbard was a proponent of the gold standard, right? He believed money should be a commodity like gold to prevent inflation. Bitcoin is sometimes called "digital gold" because of its limited supply. So, both Rothbard's ideal money and Bitcoin have a fixed supply, preventing inflationary practices. That's another common point.

Also, Rothbard emphasized voluntary exchange and free markets. Bitcoin operates on a peer-to-peer network without intermediaries, which aligns with free market principles. So both critiques might center around the need for money that isn't subject to central authority, thus preserving individual freedom and economic stability.

Another angle: Rothbard criticized fiat money because it allows governments to fund deficits through inflation, which he saw as a form of taxation without consent. Bitcoin's design prevents this because the supply is algorithmically controlled, so governments can't just print more. Thus, both critiques involve resisting government overreach and protecting individuals from inflationary taxation.

But are there differences? Rothbard advocated for a gold standard, which is a physical commodity, while Bitcoin is digital and relies on cryptography and network consensus. However, the theoretical implications of Bitcoin might align with Rothbard's principles even if the mechanisms differ. So the commonalities are in their opposition to state-controlled money, support for sound money with limited supply, and promotion of economic freedom.

I should also check if there are other points. Maybe the ethical standpoint: Rothbard viewed fiat money as unethical because it's coercive, while Bitcoin offers an ethical alternative by being voluntary. Both emphasize the importance of consent in economic transactions.

So, in summary, the commonalities between Rothbard's criticism of fiat money and Bitcoin's implications are: rejection of state-controlled currency, advocacy for sound money with limited supply to prevent inflation, promotion of free markets and voluntary exchange, and a focus on individual sovereignty against government monetary manipulation.

This is the answer I received, and I think it’s correct:

Rothbard's criticism of fiat money and Bitcoin's theoretical implications share several key commonalities, rooted in their opposition to centralized monetary control and advocacy for sound money principles:

Opposition to State-Controlled Money:

Rothbard condemned fiat money as a tool of government coercion, enabling unchecked monetary expansion and inflation. He viewed central banking as a mechanism for wealth redistribution and economic distortion.

Bitcoin, as a decentralized, peer-to-peer currency, inherently resists state or institutional control, aligning with Rothbard’s distrust of centralized monetary authority.

Advocacy for Sound Money:

Rothbard championed the gold standard, arguing money should be a scarce commodity to limit inflationary practices and ensure stability.

Bitcoin’s capped supply (21 million) mirrors this principle, creating a deflationary model resistant to arbitrary inflation, akin to Rothbard’s ideal of "hard money."

Resistance to Inflationary Taxation:

Rothbard criticized fiat systems for enabling governments to debase currency, effectively imposing an invisible tax via inflation.

Bitcoin’s fixed supply prevents such manipulation, theoretically shielding users from state-induced devaluation.

Promotion of Free Markets and Voluntary Exchange:

Rothbard emphasized voluntary interactions in free markets, rejecting coercive monetary systems.

Bitcoin facilitates peer-to-peer transactions without intermediaries, embodying libertarian ideals of consent and decentralization.

Focus on Individual Sovereignty:

Both frameworks prioritize individual autonomy over financial decisions, opposing state encroachment through monetary policy. Bitcoin’s cryptographic security and self-custody options empower users, reflecting Rothbardian principles of self-ownership.

Key Distinction: While Rothbard advocated for commodity-backed money (e.g., gold), Bitcoin’s digital, algorithmically enforced scarcity represents a modern reinterpretation of sound money principles. Despite differing mechanisms, both critiques converge on limiting state power and fostering monetary integrity.

What do you think? Seems useful!

Are the US even interested in controlling bitcoin? They seem to go crypto much more, US-made crypto!

Meine 50 Cent zum großen Bitcoin-Buch von Marc Friedrich und Florian Kössler unter besonderer Berücksichtigung der Kritik von Rieck daran. #bitcoin #marcfriedrich #grössterevolutionallerzeiten

https://horstwerner.com/die-groesste-revolution-aller-zeiten/

Ok.

So here is the NOSTR version of my Tweet this morning about $TRUMP

So, why did $TRUMP choose to start a shitcoin and why on Solana?

Shall we follow the 'MoNeY' to find out if there are any conflicts of interest and misaligned incentives?

1. Who is David Sacks and why was he chosen to be the CrYptO Czar for Trump's administration?

He is a general partner of Craft Ventures, a venture capital fund he co-founded in late 2017.

Craft ventures focus on 'Leaders in B2B software'.

And also seem to have a keen interest on anything Musk is building.

Including:

Space X

X

XAi (grok)

and even The Boring Company, weird.

Ok, so is there any connection to Musk?

https://craftventures.com/portfolio

2.

Well, yes and more than both being South African-Americans.

Musk and Sacks are connected through Paypal.

Sacks was COO whilst Musk was CEO.

Nicely sitting atop the tree of the Paypal Mafia.

3. But what does this have to do with Solana, the appointment of Crypto Czar or the TRUMP shitcoin?

Well, we now have to assess whether or not there is a conflict of interest, signs of insider trading or nepotism.

So let's dig in.

Sacks also invested, via Craft Ventures into another fund called MultiCoin.

Here is his own article about why:

https://multicoin.capital/2018/03/12/why-we-invested-in-multicoin/

4. Who are Multicoin?

"As a crypto-native fund, we actively engage and participate in the networks we invest in. Moreover, we are intimately familiar with the crypto technology landscape and market structure. We are hands-on investors, and will do everything in our power to maximize the success of our portfolio companies."

https://multicoin.capital/about/

5.

So to recap, Sacks, through Craft Ventures now has a direct interest in the success of any companies that MultiCoin have invested in.

Who, to use their own words from their own website "will do everything in our power to maximize the success of our portfolio companies".

Ok, so who do MultiCoin invest in?

Well, literally 100's of Shitcoin projects, you have to scroll it to believe it.

https://multicoin.capital/portfolio/

6.

So how would Sacks be able to help steer these companies in the right direction and make sure there is enough hype around them to make sure his investments clear any 'lock-up' period so the funds can make an exit and make huge profits?

Well, from Sacks Wiki page:

he is a co-host of the All In podcast, alongside Chamath Palihapitiya, Jason Calacanis and David Friedberg.

Yes, he has a CrYpTo Podcast.

But Suuuuurely he would never brag about investments or exits he has made on that podcast with his other slimeball co-hosts, would he?

@SilvermanJacob

has this clip of them doing exactly that below in 2021:

https://x.com/silvermanjacob/status/1595059806200643589?s=46&t=OhFuTtv-xPcwkmJSTd2Ovg

7.

So, yes, the clip shows them bragging about their Solana 'bags' and how they have pumped and beginning to dump them on retail.

"You better clear that Solana position, what's your lock up, 24 months?"

"Your holding right"

"Ish"

"ish, yeah me too".

Disgusting.

Watch again, then please share and bookmark Jacob's post.

8.

So back to MultiCoin, could they have invested in any 'projects' that were dependant on the Solana BlOcKcHaIn?

Loads:

01

Coral

Fractal

Hubble

Jito

MarginFi

Metaplex

Saber

Sec3

Serum

SOLANA

Solscan

Strata Protocol

Wormhole.

9. Wait, did they invest directly into SOLANA

Yes, yes they did.

"Today I’m excited to share Multicoin’s investment thesis in Solana, alongside the fact that we led an $20M investment in Solana. Here's Solana's press release."

Here is the press release.

https://multicoin.capital/2019/07/30/the-world-computer-should-be-logically-centralized/

10.

Wait, wait, wait, wait a minute.

So Sacks is now directly tied to dozens of companies running on the Solana BlOcKcHaIn AND the network itself!?

And is advising the President on CrYptO as his Czar?

This can't get anymore conflicted.

Can it?

11.

We haven't fully considered nepotism yet.

So, Sacks is up to his knees in the Solana network, tokens AND dozens of 'UnIcOrnS' running shitcoin projects on it's BlOckChAin.

What was the weird part about Musk earlier and their connection via PayPal, it seems kind of weird to point that out.

12.

After leaving PayPal both went separate ways to start new ventures, famously Musk founded (joined) Tesla Motors and became (pushed aside existing) CEO.

There have been many ups and downs through the Tesla journey of Musk, but no story is weirder than the one involving the 2.6 BILLION acquisition of Solar City in 2016.

This acquisition left Tesla shareholders enraged as they saw it to be a "Bailout".

"Tesla shareholders alleged the company’s acquisition of the solar installer amounted to a bailout, pushed through by Musk who sat on both company boards at the time."

13.

So who were Solar City and why would shareholders believe this to be a 'Bailout' rather than a straight forward business acquisition?

Who were the founders and CEO of Solar City?

Lyndon and Peter Rive.

Big whoop, why does that matter?

"Lyndon Robert Rive (born 22 January 1977) is a South African-American businessman known as the co-founder of SolarCity, and its CEO until 2016."

"SolarCity is a provider of photovoltaic systems and related services. Rive co-founded SolarCity with his brother Peter in 2006."

https://en.wikipedia.org/wiki/Lyndon_Rive

14.

Big whoop.

Who cares that two South African-American brothers founded a Solar company that was acquired by Musk?

- For 2.6 Billion dollars.

- Against the wishes of his shareholders.

Well, you see, Lyndon and Peter are Elon's cousins, sons of his mother's twin sister.

So, yes, maybe the shareholders were onto something when they alleged that it could be a bailout rather than a prudent business acquisition.

https://ghanafuo.com/elon-musk-cousins/

15.

Fear not, the shareholders were judged to be conthpirathy theorists and Musk won his case.

"Vice Chancellor Joseph R. Slights, who decided the case shortly before retiring, sided with Musk, writing: “Elon was more involved in the process than a conflicted fiduciary should be. And conflicts among other Tesla Board members were not completely neutralized. With that said, the Tesla Board meaningfully vetted the Acquisition, and Elon did not stand in its way.”

16.

So what the AF does this have to do with Sacks, Solana, Musk and Trump?

Well....

Step up

@realJakeSimmons with this report:

https://www.newsbtc.com/news/solana/elon-musk-cousin-first-investors-solana/#author-box

17.

WAIT WHAT?

Rive was bailed out (allegedly) then disappears to become an Angel Investor and is one of the first investors in Solana?

No way.

No fkn way.

18.

Damn, this is getting weird.

So let's recap.

- Sacks is Trump's Crypto Czar and is knee-deep across the whole Solana spectrum.

- Trump's DOGE - Department Of Governmental Efficiency - (An anagram clearly chosen to pump another Shitcoin) is chaired by Musk.

- Musk's cousin is one of the first seed Angel Investors in Solana.

19.

So, could it be at all claimed that maybe, just maybe there is a conflict of Interest, Insider Trading and Nepotism involved in launching $TRUMP ?

A Presidential Shitcoin on the SOLANA network!?

Would those involved be able to:

1. Protect pre-existing investments?

2. Pump pre-existing investments?

3. Dump pre-existing investments?

I am sure the Donald is very much the innocent party in this debacle and has been the victim of poor advice.

Perhaps he should consider clearing house of his CrYpTo AdViSorS on day -1 of his presidency?

Perhaps he shoud de-list $TRUMP effect immediately and make any tricked investors whole.

Perhaps we should be more vigilant (toxic) in the #bitcoin space and be ready to call out scams, even if they are at the highest level.

Or maaaaaybe this is all just me being a silly conthpirathy theorist.

Have a great Sunday, don't let all of this information worry you......

Great content!

Why are Europeans so stupid?

“We have never lived in a global free market. You have no reference frame for what I’m talking about.”

Don’t miss this interview with nostr:npub1s05p3ha7en49dv8429tkk07nnfa9pcwczkf5x5qrdraqshxdje9sq6eyhe it’s 🤯🤯

Great interview!

Irritating Winter Image #snow #winter #chess

And I am very angry about that!

Meine Rezension des „Bitcoin Standard“!

https://horstwerner.com/der-bitcoin-standard/ #bitcoin #österreichischeSchule #solidesGeld