What is this thing called "society" that they write of... But seriously, congrats!!

Eternal September in October?!

Cantona quotes are a cut above though!

Digital id with bitcoin, using block space for such, was a howler

Je me souvien

Only 2 years ago, Canadian gov seizing and freezing accounts plus the super shady doxxing of donors on top... waiting for the 'muricans to do waaaaaay more than this when the rubber meets the road... Hope all you devs are readying preemptive soft forks candidates for when the time comes... Thanks in advance!!

You're not saying that they've had incentive to fix/manipulate the price of gold?! Say it ain't so!

by nostr:npub13l3lyslfzyscrqg8saw4r09y70702s6r025hz52sajqrvdvf88zskh8xc2

This new paper is a true declaration of war: the ECB claims that early #bitcoin adopters steal economic value from latecomers. I strongly believe authorities will use this luddite argument to enact harsh taxes or bans. Check 🧵 for why:

Rather than praising bitcoin as a tech paradigm shift à la petroleum and the internet, the authors introduce the blatantly luddite argument that "early adopters" ... "increase their real wealth and consumption" ... "at the expense of [latecomers]".

Then they go on to brazenly advocate for legislation ... "to prevent bitcoin prices from rising or to see bitcoin disappear altogether" in order to prevent "the division of society".

The authors also model some projections, to illustrate the paltry amount of BTC that will remain available for latecomers. (Woe is me! Conspicuously left out is the reason that has driven 15 years of bitcoin adoption & development: it's simply better tech.)

In all the years I've been monitoring the bitcoin space, this is by far the most aggressive paper to come from authorities. The gloves are off. It's clear that these central bank economists now see bitcoin as an existential threat, to be attacked with any means possible.

Many of us have warned that this was coming: bitcoin as a major political fault line both in national and international elections. Well here it is. It means that us HODLers must take action to insure that governments respect our basic right to hold property.

And no, this won't be a war between haves and have-nots. Rather this will be a historic clash between those who stand for the natural rights of the individual, and those who clutch at the failed ideologies of collectivism and central planning.

Here's the download link to the paper: "The distributional consequences of Bitcoin". (We need detailed rebuttals. Who's writing one?)

Tl;Dr:

A la "animal farm":

Bankers are generous and good

Bitcoiners are greedy and bad

Everybody sing it with me!

-ECB et al

(PS even with many delusions about, methinks, this banker Revolution will find a hard time gaining traction?!)

ECB Economists: Nocoiners May Be Impoverished by Rising Bitcoin Prices

A new paper by ECB economists describes a 'Bitcoin-positive' scenario as one in which the price of Bitcoin continues to rise significantly and sustainably over time.

"If the price of Bitcoin rises for good, the existence of Bitcoin impoverishes both non-holders and latecomers."

https://www.nobsbitcoin.com/ecb-economists-nocoiners-may-be-impoverished-by-rising-bitcoin-prices/

Does the ECB have intrinsic value?!

Wasn't their pitch :

You will own nothing and be happy

What happened?!

Thank you sir!!

I admit to adhering too much to s2f...however, when the various housing cults (I.e. highest s2f with all sorts of national protections) start to implode, watch out!

I'm talking about using like a personal, no trusted third-party savings account ... Not that western govs are friendly towards bitcoin either....

I propose $ as a hateful symbol

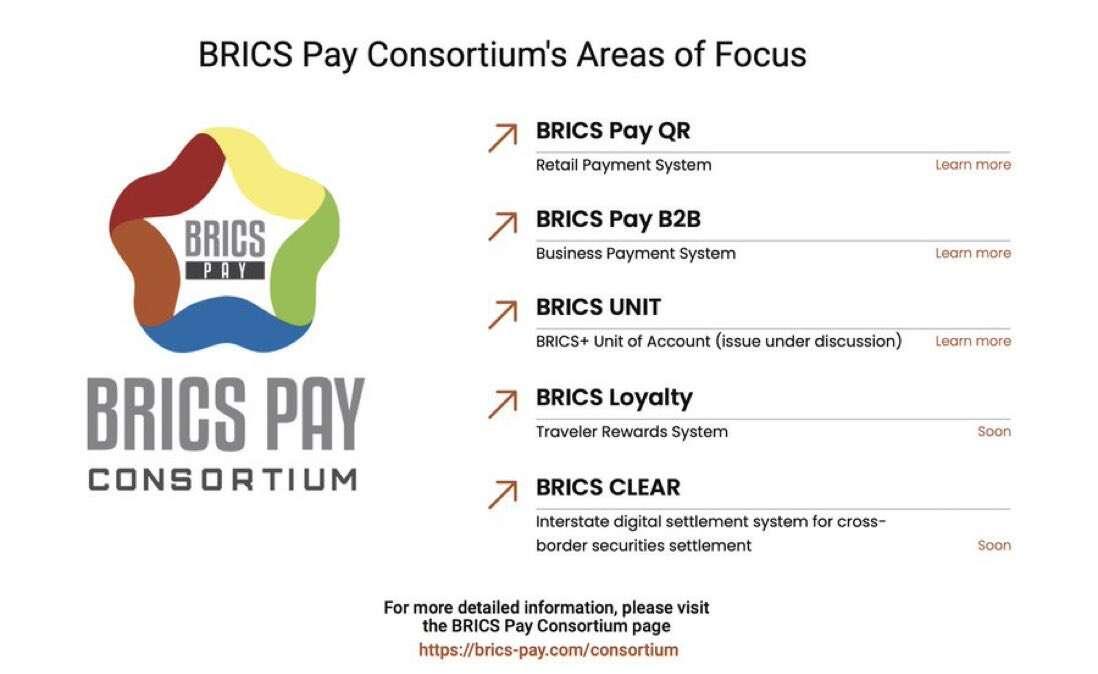

Even if it proved to be an honest measure, there is no way most westerners will have the option to use this...

Thanks for this "testimony" wrapped up in an enjoyable read!! Kudos to British Columbian truck drivers as well... arising from one of the most sinister covidian jurisdictions (even to today, john rustad receives "vaccine skeptic" smears as if it is some kind of gotcha during this provincial election)

...and the euro is far from lindy... Surprised that EU hasn't induced (adoption AND price) hyperbitcoinization yet

No Business Like War Business: US Spending on Mideast Conflict Tops $22 Billion in One Year

From Sputnik

The Biden administration began the emergency supply of weapons and ammunition to Tel Aviv immediately after the start of the Israel-Hamas War a year ago, further ramping up its involvement in the conflict by deploying carrier battlegroups, aircraft squadrons, air defenses and boots on the ground at bases across the Middle East.

Oct 8th 2024 1:27pm EDT

Share, promote & comment with Nostr: https://dissentwatch.com/boost/?boost_post_id=854516

That is eminently meme-able sir!

There's no business like war business, like war business