For sale. DM for more info.

nostr:npub1qny3tkh0acurzla8x3zy4nhrjz5zd8l9sy9jys09umwng00manysew95gx says we need spicier content. please reply with your spiciest meme.

You’re still supporting those industries by giving reservation demand to scam leveraged equities and (war) bonds. Unless it’s self directed and all in MSTR or a BTC ETF, but still. If it can be seized, it will be seized and used to support more war. Best case scenario, Bitcoin eats all of the monetary premium of those equities and bonds anyway, you book a -99.9% loss relative to self custodied Bitcoin.

nostr:note1tuyhyagvw2hy4sj8sr6gz0jfz8auqktgzumpj5l2cg9hx7kxhgsq56zhvn

nostr:note1tuyhyagvw2hy4sj8sr6gz0jfz8auqktgzumpj5l2cg9hx7kxhgsq56zhvn

They hate us cuz they ain’t us.

Luke Gromen: A gold standard could work again because we can move the gold with airplanes.

Me, looking down at my phone while I hear Luke say this ⬇️

As for “blockchain”, yes they do. That’s the main goal of MIT’s DCI digital currency initiative. The director, Neha Narula, testified to Congress on camera that they can make a CBDC blockchain better than Bitcoin. (Which they obviously can’t.)

As for making it more centralized, commercial banks won’t allow it. They’re the main Fed shareholders anyway. They profit too much from the status quo. Centralize by absorbing commercial competitors, sure. But disintermediate themselves? Never.

Yea how does that work exactly in such a way that’s meaningfully different than what exists now. It’s all vaporware hand waiving to sound relevant. I see it as exactly like someone saying they can make a better Bitcoin. Not possible.

Build what exactly. MIT DCI is too. But it’s all vaporware. There’s nothing that can be built.

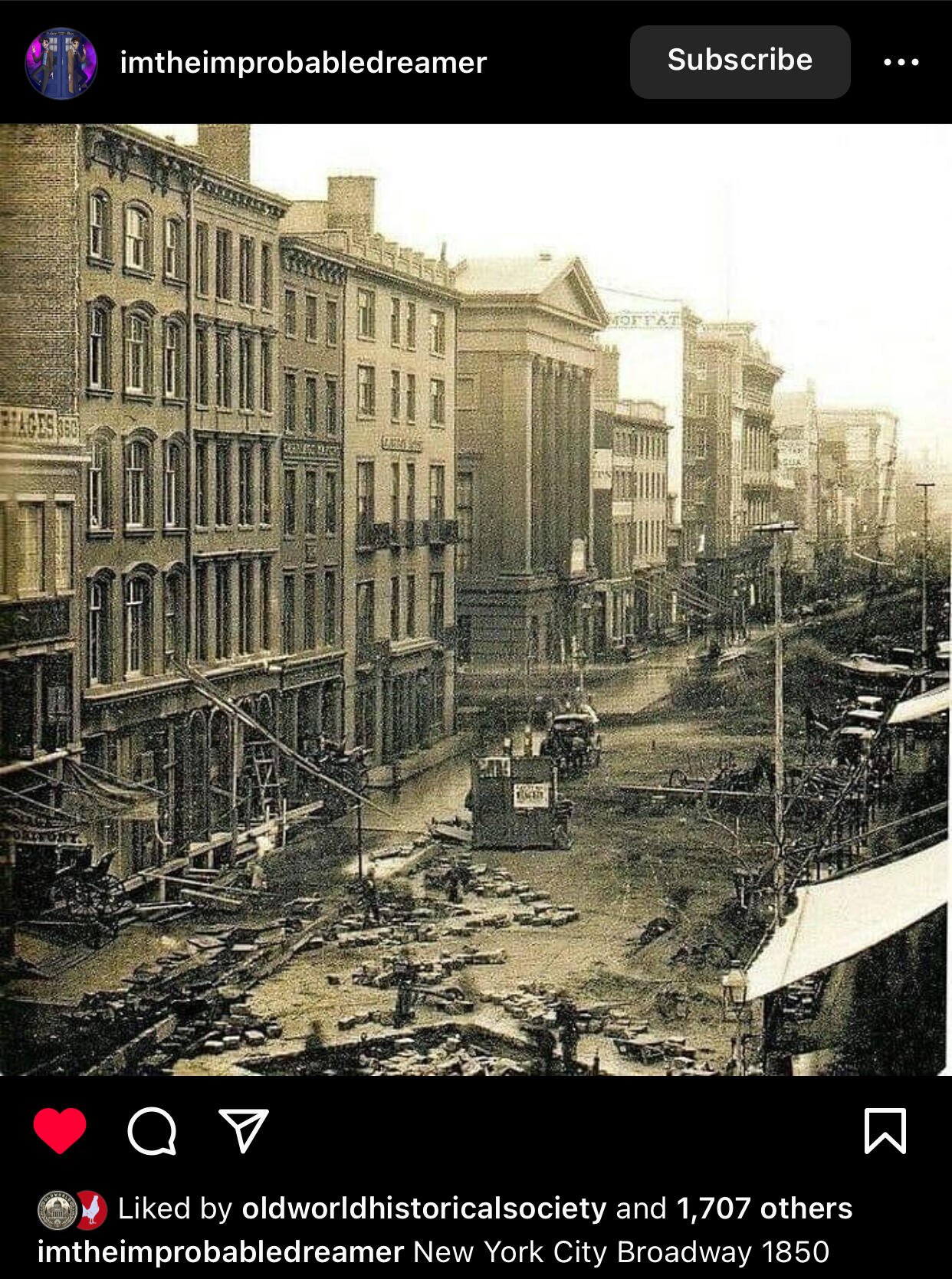

HOW DID THEY BUILD THOSE ROADS WITHOUT THE INCOME TAX

They’re backed by a pile of US treasuries because they’re the US’s bitch. When they start to wind those down in order to buy an even higher % of their own bonds, they’re cooked.

Hand waving. They suck at IT. This is no different than the McKinsey class who talks about “blockchain not Bitcoin” or “distributed ledger technology”, just at the central banker level. They won’t launch shit. At best, they tweak a few things and rebrand it as something bigger than it is just to try to feel relevant.

USA's New Home Market Plunges: Prices Drop 20% Since Peak

The United States is still witnessing a rapid decline in new home prices, plummeting by a staggering 20% from their peak in 202 https://nostrcheck.me/media/863f2c555276e9ed738933b0efee6b021042f16e1529dd755704885b87fee183/ab18306877837dc6dfa816aad950285555be5867ed8843176088d808c1bc6011.webp Recent data reveals a significant shift in the housing market dynamics, with the median sale price of a new house nosediving from a robust $497,000 in mid-2022 to just over $400,000 today.

This downturn far surpasses the rate of decline experienced during the 2008 financial crisis, raising concerns across the industry and among homeowners alike. Notably, banks are grappling with the repercussions as collateral repricing wreaks havoc on their balance sheets.

#USRealEstate #HousingMarket #EconomicTrends #FinancialNews #HomePrices #MarketAnalysis

Chart it against M2 and that green line should turn into a red line.

A central bank that starts to become the sole buyer of its government’s debt quickly reaches the same fate as FTX/FTT and Terra/UST. Stack accordingly.

nostr:note1dku2pk549ksz2nxdqh3h3msnvfuwh7nyd5tqq99hktufhsxzcupsy84jdl

nostr:note1dku2pk549ksz2nxdqh3h3msnvfuwh7nyd5tqq99hktufhsxzcupsy84jdl