For me, the charts are no longer “how rich am I” but rather “how long until the world finally gets off the fiat wild ride.” The higher BTC goes, the lower USD is going, hopefully leading to its near demise.

This is the world Bitcoiners want #bitcoin #memes #memestr

#bitcoin

#memes #memestr

Don't fall for the spin!

He wanted it shut down, not save it. Just more #trump lies!

#tiktok

#tiktokban

I don’t follow this story at all. Would you mind an ELI5 of what’s happening?

Thank you for the detailed response. Trying to translate it to my own world view: the velocity of money in Keynesian terms is a specific statistic that can be measured and influenced by policy makers. Austrians would avoid that for many of the reasons you mentioned. That makes sense to me. Instead, they would subsume those kinds of effects under other behavior.

I think my misunderstanding was thinking of velocity not as an aggregate statistic, but as a general trend, similar to say “the money supply went up.” But maybe even there I’m still thinking too Keynesian-ly and thinking we can make broad predictions based on these trends.

Anyway, thank you for the thoughtful response.

I don’t know the details of the Trump coin, but almost certainly market makers. You’d be shocked (or not) to find out how much the centralized exchanges demand from companies looking to list tokens, including presence of market makers. The grift for everyone involved is amazing.

I happen to think there _is_ a use case for some projects in the crypto space and that governance tokens with assigned portions of revenue is a fair method for compensation, so I’m not against all coins but BTC. But clearly this stance doesn’t apply to pure meme coins.

The example I gave would be one. We like to understand what changes will lead to which outcomes. There’s value in understanding that a change in payment technology or consumer behavior may result in an increase in average prices, for example. It helps us make intelligent business planning decisions, as well as providing useful models for understanding history. That can be vital in shooting down BS monetary theory from the Keynesian side.

To make sure I’m being clear, I’m not disagreeing with your statements overall. I’m simply trying to understand if I’m correct that Austrian economics generally doesn’t use this paradigm and, if that’s the case, how they would explain changes in the economy that a Keynesian would attribute to velocity of money.

I agree with not dictating monetary policy. But velocity of money would still be useful in analysis of the economy, e.g. “despite the fact that the money supply itself did not increase, we experienced an increase in velocity of money due to introduction of faster payment settlement technologies which resulted in an increase in the average price level.”

Not at all saying that statement is accurate, just saying velocity could be used as a tool of analysis.

Low velocity can result from lots of factors, including what you describe. What I’m asking about though is: am I correct that Austrians don’t use this concept in discussions of monetary policy, and if not, how do they address it?

#memes #memestr

One of the few non Austrian economics ideas that makes sense to me is velocity is money. The more often the same unit of money is used in transactions, the larger it’s impact on things like inflation. However, per my understanding, Austrian economics does not use this concept. Can anyone explain how Austrian economics addresses this? #economics #asknostr

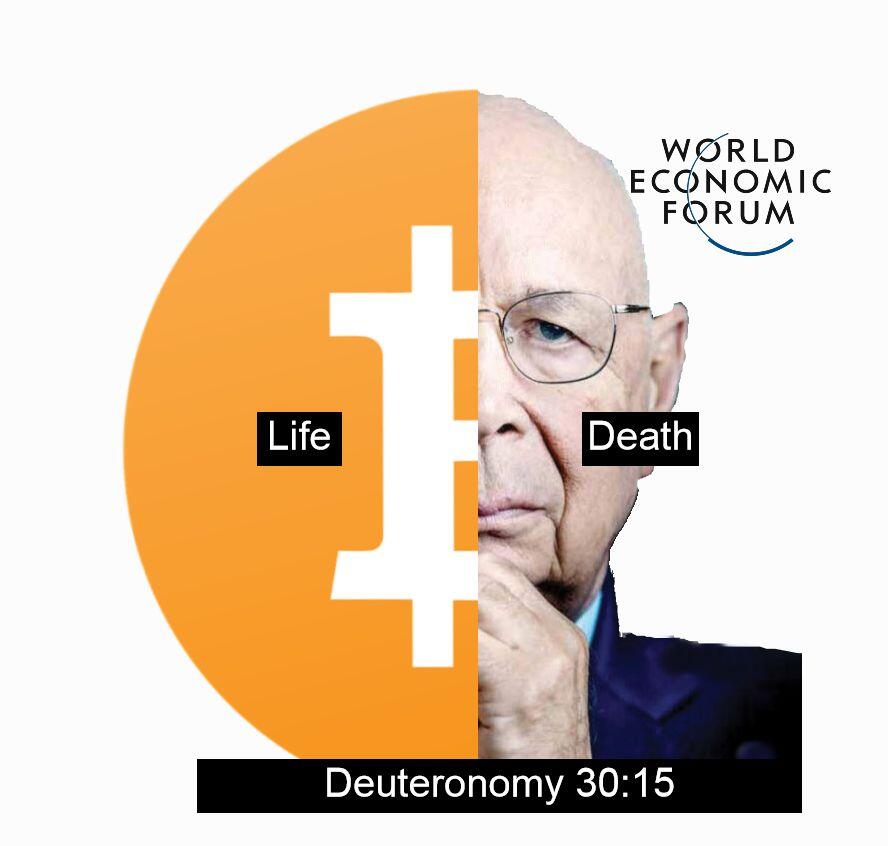

And don’t forget verse 19: choose life!

35 hours. 46 minutes.

The true definition of conspiracy theorist is “someone who sees the incentive structures present and see where corruption likely resides.”