This is why we nostr ⚡

I'm so jacked up for this week's nostr:npub10uthwp4ddc9w5adfuv69m8la4enkwma07fymuetmt93htcww6wgs55xdlq already!

Supercycle nostr:npub1guh5grefa7vkay4ps6udxg8lrqxg2kgr3qh9n4gduxut64nfxq0q9y6hjy and not-humble nostr:npub1qny3tkh0acurzla8x3zy4nhrjz5zd8l9sy9jys09umwng00manysew95gx LFG 🚀

La necesidad o no de KYC depende de tu posición en ese flujo, por ejemplo, si estás recibiendo el pago de Pix o si nos estás enviando el pago inicial en bitcoins. También depende del volumen por transacción o mensual que se remita, aunque estos umbrales se fijan actualmente bastante alto en los miles antes de que necesitemos recopilar mucho 🙏.

We're excited to launch our new Remittances API powering instant, cross-border payments for any platform 🚀

One easy integration to send Mexican Pesos 🇲🇽 or Brazilian Real 🇧🇷 to local bank accounts in under 1 second⚡

More currencies & countries coming soon!

If you want to turn on cross-border payments in your application please reach out!

https://thebitcoincompany.com/remittances

Our team is proud to finally unveil this to you all!

We're extremely bullish on LatAm 🐂 Underserved by the broken legacy system, they're primed to now leapfrog into the magical world of the Bitcoin stack ⚡

Cheap and fast money transfers for everyone! LFG 🚀

nostr:note16perfu2a3n7c8u6r94vtw4z73ah3szf4h4am4su4cujc420u4cqsans4yy

All fucking legends! Miss all u guys already

Day 4 of Only Surviving on #bitcoin

Is everything fake?

Can you really go shopping with bitcoin?

Full Video: https://youtu.be/TMZDGqqQy08

Feat: nostr:npub1aftmyhm62lrp6lwsha3yzyjy5kqdvuy7g23qg28a8q0cnmudv0ds0sdcke nostr:npub1h882a66p0zj5n69s2u8nfzev4f97lzfnlcej84z78p6uqxge5tpqlupz20 https://v.nostr.build/76l3.mp4

That's awesome dude!! We're at @@npub18tcc00lqpysdsurg567dllzg7jeyr5wcyk2v6w23rx3s3ygyze2qv32nxx are proud to support you and everybody else 🫶

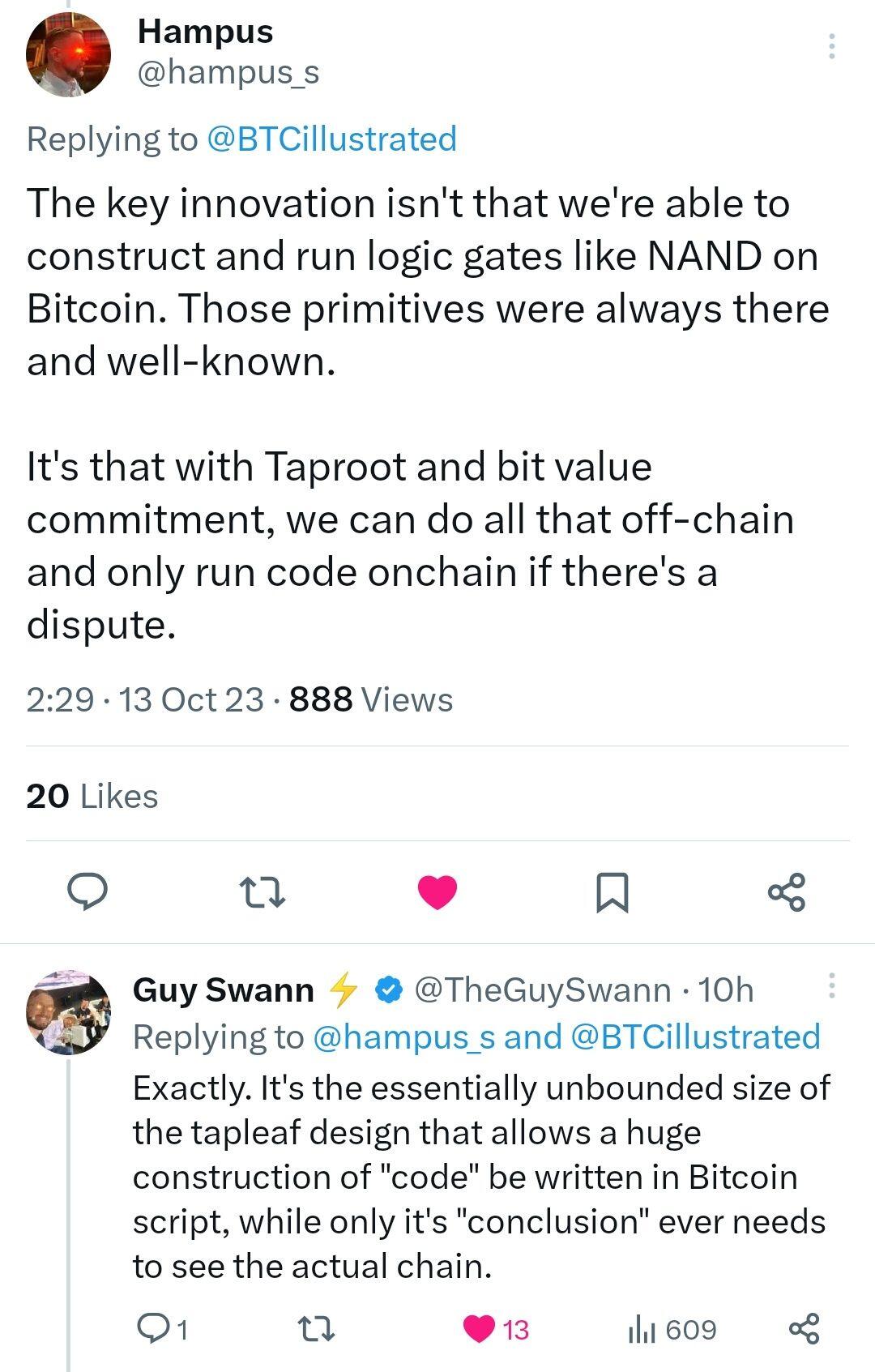

This is a very important nuance that I haven't seen emphasized all that much in the current discussions on BitVM!

There's an order of operations to building such a protocol & network (h/t nostr:npub1guh5grefa7vkay4ps6udxg8lrqxg2kgr3qh9n4gduxut64nfxq0q9y6hjy). A simple, yet extremely resilient core is the leverage for everything else 🚀

Shitcoiners don't understand and are once again in disbelief 🤡

nostr:npub1v4v57fu60zvc9d2uq23cey4fnwvxlzga9q2vta2n6xalu03rs57s0mxwu8 nostr:npub1kzu0hk2h3tpru7pdj73jk7e6wtx6qas8vy6eh4jkv82zw545py9qu9rf4g

signal

How to arrive at that probability 👇

P = 1 - e^[(-S*t)/( 1-R)]

(Risk-neutral default probability following Hull & White (2000))

R is the recovery rate and equal to 0.4 in our case

S is the spread and equal to 0.0766

t=5 and represents time to maturity

-> P ≈ 47%

Tik, tok next ... bank failure?

Credit Suisse CDS blowing up with an implied default probability of almost 50% 👀

"The root problem with conventional currency is all the trust that's required to make it work."

Many people learned about this and counterparty risk this weekend. Gradually, then suddenly.

Running Nostr