I'm on Stacker news too ⚡

ONLY IN: 🇺🇸 SEC officially ends investigation into stablecoin issuer Paxos and declares $BUSD not a security.

Bitcoin between terms and phrases!

Throughout the years of Bitcoin, terms or phrases have been predefined referring to the current market, types of users, etc.; We have already defined HODL and To The Moon 🌙, but there are also the following:

⚡Bullish: is a term that refers to a bullish market sentiment regarding Bitcoin. Bullish comes from the English word “Bull” and in Spanish means bull.

⚡Bull run: Similar to the previous term, the use of bull run points to the belief that the price of Bitcoin will rise constantly over a certain period of time.

⚡Bearish: Bearish is the opposite of Bullish. Bearish comes from the English word “bear”, which in Spanish means bear. The bear analogy is used to refer to bearish market sentiment.

⚡Whale: When talking about whales, we refer to those people or institutions that own a large amount of Bitcoin and that in certain cases their transactions can influence the price.

🔼Bitcoin is capable of reaching a new all-time high in August and hitting $100,000 by the U.S. presidential election in November, according to Standard Chartered

✔️ Bank analysts suggest that the prices will respond to the prospects of Joe Biden's participation in the presidential race. August 4th is the registration deadline for candidates.

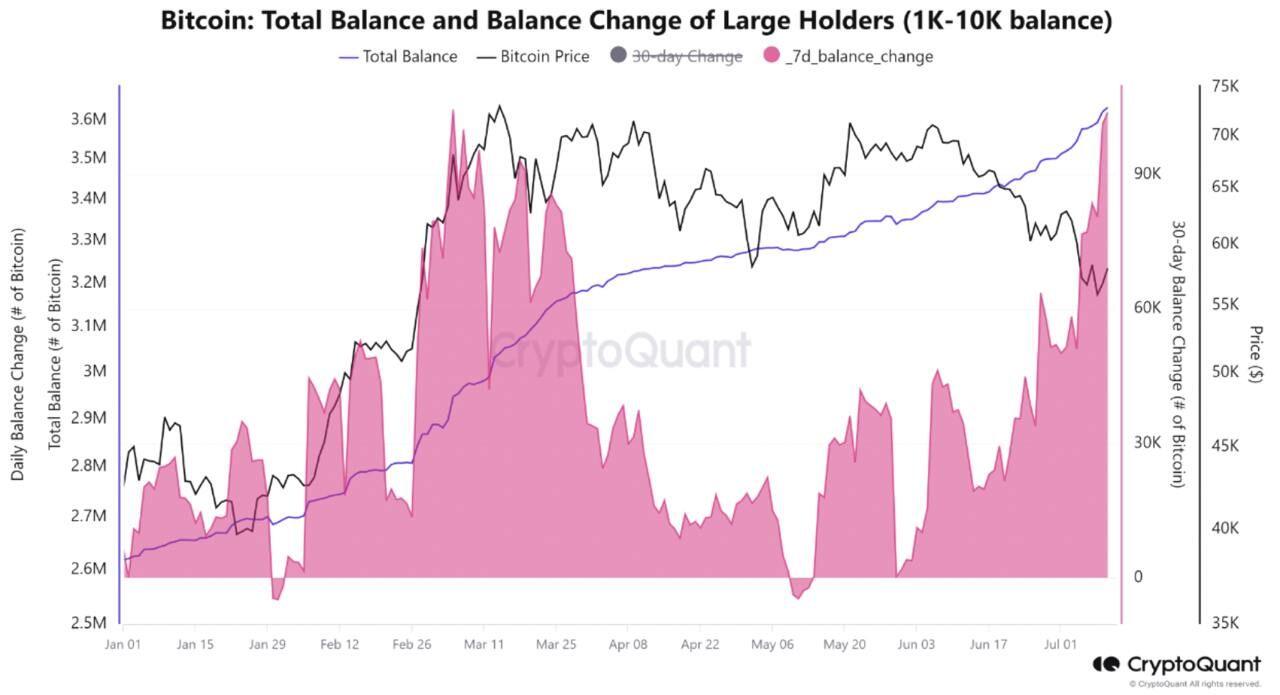

The second largest institutional accumulation process of 2024

“The current institutional accumulation may indicate a true process of "buying the dip" in large players.” – Link:

🚨🚨🚨 JUST IN: The German Government just sent another 3250 #BTC🥇 ($191.02M) to Cumberland, Coinbase, Bitstamp, and Kraken.

#Bitcoin 1D Update

$BTC is on the rise, once again surpassing the June downtrend (white line)

But it is really important that the price can close on the daily chart above and retest the downtrend line as support to confirm the breakout.

#Bitcoin is back above the 200 DMA, all eyes are on it again

🚨 BREAKING : US annual CPI inflation in June rises 3.0%, below expectations of 3.1%.

Core CPI inflation rose 3.3% year-over-year, compared with forecasts for a 3.4% gain.

It looks like a rate cut is coming in September.

Since the correction began, Binance has increased its reserves by 41K BTC.

This is one answer to who was buying when others were selling.

Realized losses over the last 30 days total $403M, similar to early COVID market crash losses.

However, they are far less than the losses post-China’s mining ban (3.3x higher) and the Luna ecosystem crash (4.6x higher).

📊 BItcoin chart on 12h and weekly scale

We are facing a potential deviation from the bitcoin range created in recent weeks.

If we recover it, the target will be $63k, which is a fibonacci level 0.5-0.618

At a macro level on a weekly scale we are consolidating below ATH, technically to break it.

An owl #inkblotart

📈7/10 Total Net Flow:$ 127 million

BlackRock $IBIT: $ 22.3 m

Grayscale $GBTC: $ -8.2 m

Fidelity $FBTC: $ 57.8 m

Bitwise $BITB: $ 4.7 m

Ark $ARKB: $ 5.7 m

Invesco $BTCO: $ 9.5 m

Franklin $EZBC: $ 31.7 m

Valkyrie $BRRR: $ (n/a)

VanEck $HODL: $ 3.3 m

WisdomTree $BTCW: $ 0

$BTCUSD Previous support at 60K becomes the new resistance. Uptrend is still intact wit price being above year-long average and inside channel.

🚨 Fidelity Buys 1005 #Bitcoin

That's 5,800 #Bitcoin ($370m) in four trading days!

🚨 GBTC Sells 140 #Bitcoin

Grayscale can't find buyers even when German coins are on sale

🚨 BlackRock holds 312k BTC

They didn't sell a single coin during the recent #BTC drawdown

How does that make you feel?