NEW: 🟠 $9 billion in #Bitcoin shorts to be liquidated at $68,000 🚀

💰#Bitcoin 1S

A weekly close above $58,300 would be very good🤞

JUST IN: 🟠 The IMF proposed an 85% energy tax hike for #Bitcoin miners, citing a potential 75% rise in energy consumption❗️

From the $51K level, there is a +9% increase, totaling 4.2M BTC - that is exactly how many coins are in the wallets of investors holding between 100-1K BTC on their balance. At the current rate, this amounts to $250B.

Essentially, they control 20% of the total supply.

The Accumulation Trend Score (ATS) indicates a market shift back to accumulation, with the ATS reaching its maximum value of 1.0, signaling significant accumulation over the past month.

📊 On #Polymarket, #Harris's chance in the US 🇺🇸 Presidential Election surged to 54%, while #Trump's chance dropped from 72% to 44%.

#BTC: The market is trying to throw you off the scent

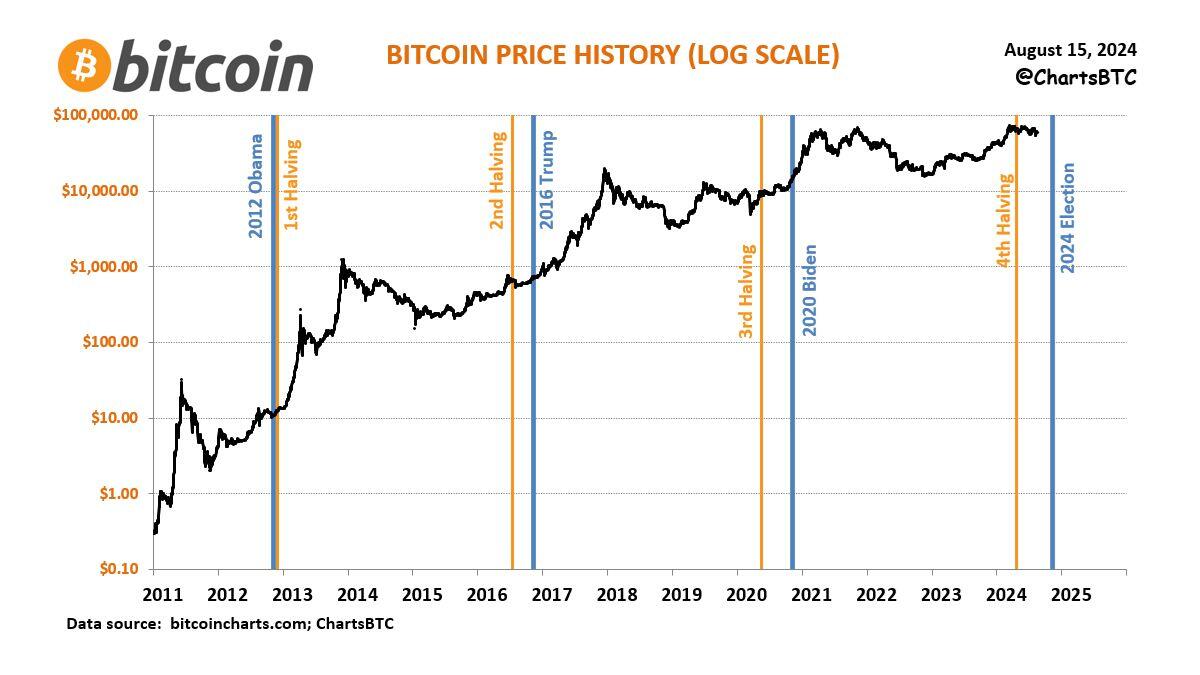

Same cycle, same year, different skin.

#Bitcoin Blue Year has had the same structure each and every time.

Two significant highs, two sideways periods.

This cycle, we traded a shorter more powerful move from the January - March high for a longer correction afterward.

No cycle has ever been able to achieve ATHs in Blue Year like our current one has, which is why the correction is taking so long.

All highs you see here have taken about a month to find their bottom, while we are going on 5 months.

Now the good news.

Every second early top (light blue circle) has bottomed around August, for which our latest August drop looks like a likely culprit.

The month that that price makes new highs after that has been pushed forward each year.

New highs in September inbound?

It's great to see that despite regular differences, the Halving Cycles Theory and a top in late 2025 look like it may have never derailed.

$100k by election day?

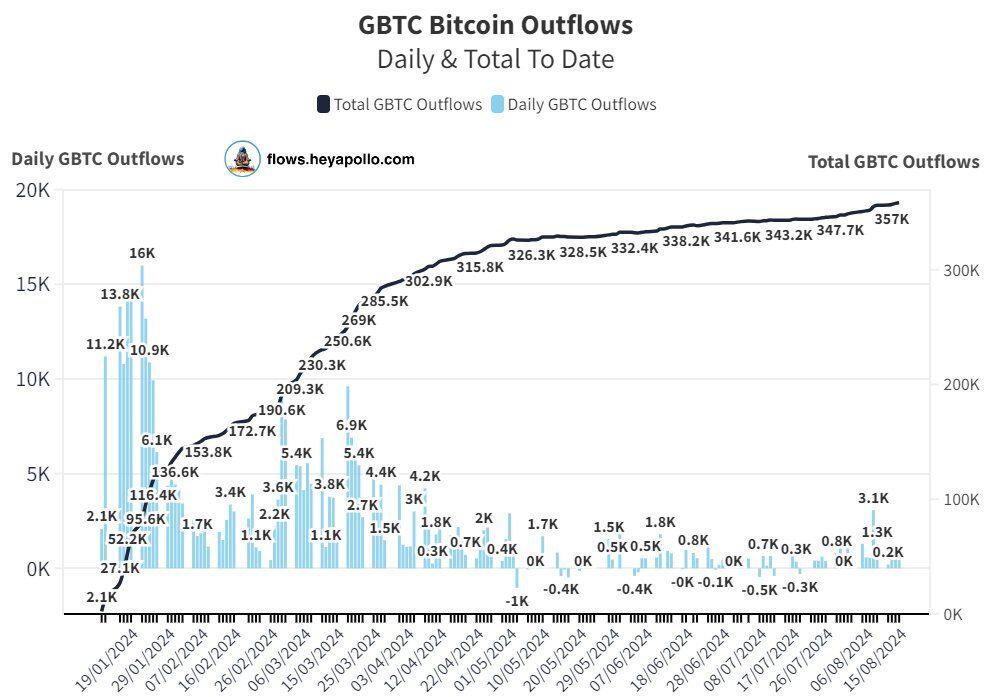

🚨 GBTC Sells 435 Bitcoin

Their steady drain continues

Fear & Greed Index - Aug 16, 2024:

Today: 27 (Fear)

Yesterday: 29 (Fear)

Avg. 1W: 32 😣

Avg. 2W: 31 😣

Avg. 1M: 50 😕

Avg. 2M: 47 😕

Avg. 3M: 56 😁

Avg. 6M: 64 🤑

Avg. 1Y: 62 🤑

🔸 #Bitcoin

Price: $57,537

24h Low: $56,647

24h High: $59,834

MC Change: -$21.9B (-1.9%)

Dominance: 53.3%

24h: -2.0%

7d: -7.8%

14d: -11.6%

30d: -11.1%

60d: -13.8%

200d: 37.6%

1y: 97.3%

SAYLOR: 🟠 “I know we’re winning and #Bitcoin is winning, it’s pretty obvious.” 🙌

https://video.nostr.build/c5f4048a3f362e00676b49acc8bf7def792e1f6498de6b1129bbfd1f3951a7f7.mp4

JUST IN: 🟠 While the #Bitcoin price is going down, the spot Bitcoin ETF inflows continue to go up 👀

The institutions are buying the dip.

#Bitcoin is taking over Wall Street 🚀

https://video.nostr.build/814bea5c13e74a564449cccef446a882ddf97078b41bf1cbc30b5ccdf587dddf.mp4

🟠 94% of the 21 million #bitcoin has now been mined ⛏

Only 6% left to be mined over the next 116 years!

Bitcoin mining complexity down 4.19%

-- On August 15, the complexity of bitcoin mining decreased by 4.19%.

-- The index fell to a mark of 86.87 T.

-- The average hash rate is holding steady at 740.30 EH/s.

On August 15, 2024, the bitcoin mining difficulty decreased to a mark of 86.87 T. Since the last change date, the figure has decreased by 4.19%, according to BTC.com.

The current average hash rate on the bitcoin network is 740.30 EH/s.

Note, the difficulty of mining determines the required total power of equipment for mining cryptocurrency. If the indicator has increased, it may indicate that the activity among miners is growing, and vice versa.

The increase in this indicator brings closer the date of halving the first cryptocurrency, which last took place on April 20, 2024.

The next recalculation will take place tentatively on August 29. The forecast is an increase in the indicator by 0.23%, according to BTC.com.

Recall, on July 31, 2024, the complexity of bitcoin mining updated the historical maximum and reached a mark of 90.67 T.

Bitcoin collapsed below $58,000 amid capital movements in US authorities' accounts

-- Arkham experts said on August 14 that US authorities transferred nearly $600 million worth of bitcoins.

-- The assets went to the depository address of the Coinbase Prime platform.

-- Bitcoin reacted to the news with a drawdown.

In the evening of August 14, 2024 Arkham experts said that the US authorities transferred 10,000 BTC to the Coinbase Prime platform. Against this background, the rate of the asset collapsed.

According to analysts, these are crypto assets in the case of a darknet marketplace called Silk Road. The court approved the order of their confiscation in December 2023.

As early as January 2024, US authorities said they plan to sell these crypto-assets. In April, 2,000 BTC from the frozen funds were transferred to Coinbase Prime.

Experts pointed out that the authorities sent the bitcoins to the wallet from which the assets were eventually withdrawn two weeks ago. The transfer was made from an address directly linked to the U.S. Department of Justice, according to Arkham Intelligence.

Transferring assets to an exchange's deposit address often indicates an intent to sell them. However, it should also be considered that the U.S. Marshals Service entered into an agreement with Coinbase Prime in July 2024 to, among other things, securely store the assets. Whether these bitcoins have been sold is unknown at the time of writing.

The asset reacted to the news with a drawdown. The price fell to $58,000. On the morning of August 15, 2024, the negative trend continued. At the moment, the price reached $57,957:

It is likely that the drawdown is directly related to the news about the possible sale of confiscated assets. Earlier on August 14, the bitcoin rate jumped on the background of inflation data in the United States.

It is noteworthy, US presidential candidate Donald Trump earlier publicly announced his intention to pardon the founder of Silk Road Ross Ulbricht.

The politician also spoke against the sale of bitcoins by the US authorities. In his opinion, they can serve as the main for the creation of the state reserve.

Good morning. This is what you should know this Thursday, August 15:

🔵 #Bitcoin price teeters below $59,000. Capital outflows from ETFs and BTC movements from the US government could be causing this behavior.

🔵 Investment in bitcoin in Wisconsin, in the United States, grows slightly. The entity's Investment Board increased its holdings in BlackRock's #ETF, although it reduced its exposure to Grayscale's.

🔵 #XRP does not take off and is one of the most bearish of the week in the top 100. The price of the Ripple cryptocurrency is approaching levels prior to "Black Monday", despite having rebounded strongly last week.

🔵 "Kamala Harris is willing to approve regulation for bitcoin," say Democrats. Senate Majority Leader Chuck Schumer assures that they will approve a law before the end of the year even though the candidate has not directly expressed her opinion.

⚡️JUST IN: River releases new video explaining why the US should hold #Bitcoin💰 as a strategic reserve asset 👀

"If the US could obtain 5% of all the bitcoin supply, this could help pay off a significant portion of the national debt" 🇺🇸

https://video.nostr.build/eefdd7a5b53a2d36028b0e4ee0e2d3811570b032430a86db6351a9db77fafa92.mp4