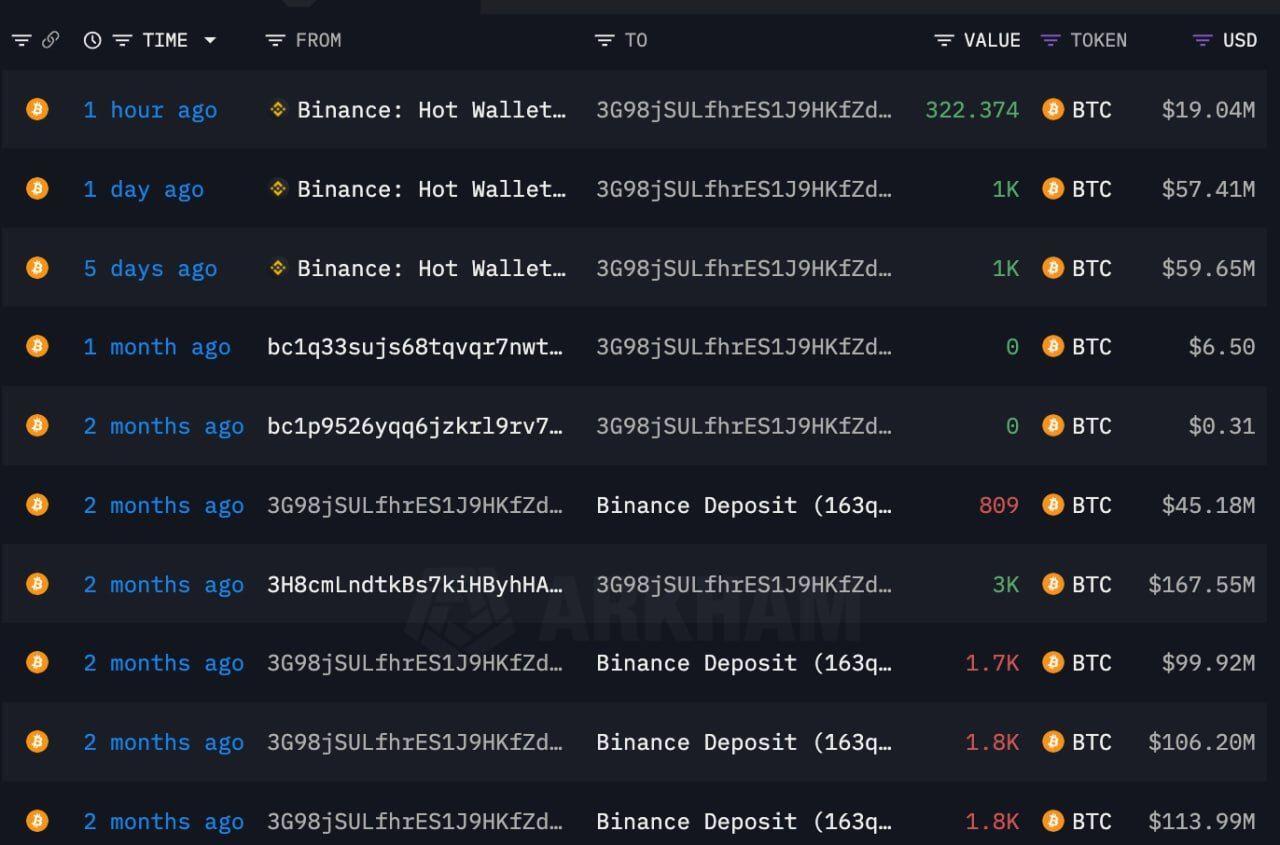

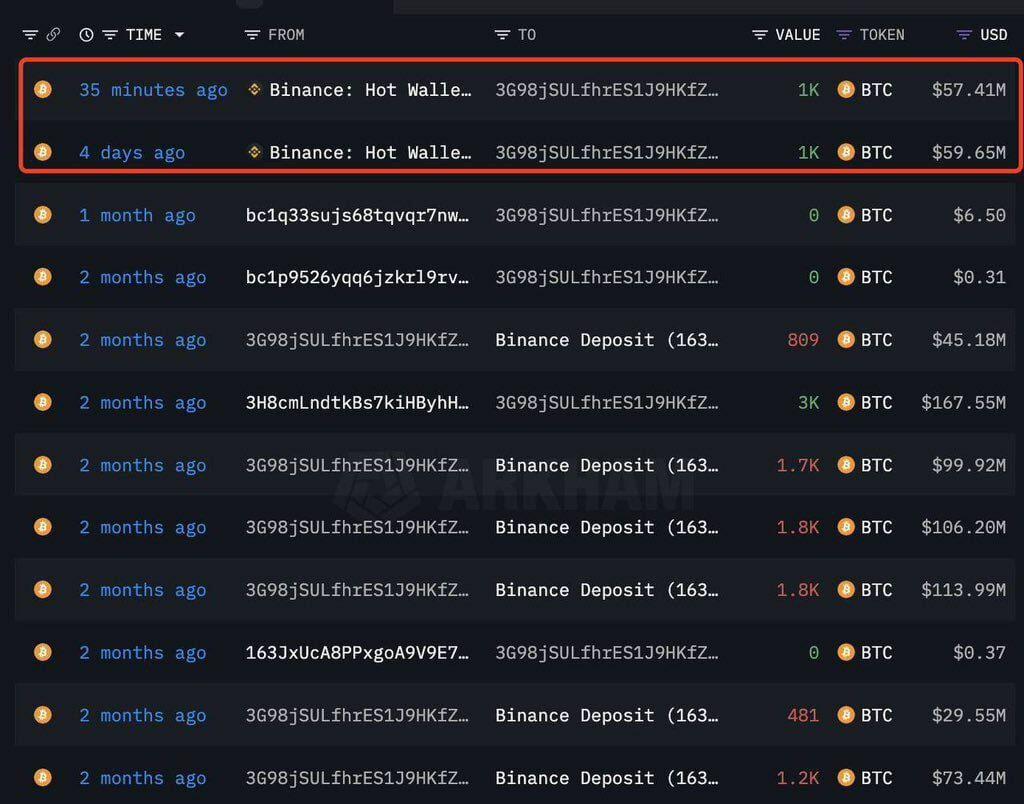

This whale bought $322.37 BTC ($19M) again 1 hour ago.

Bought $2,322.37 BTC ($136M) in 5 days and currently holds $8,881 BTC ($523M).

ADDRESS:

3G98jSULfhrES1J9HKfZdDjXx1sTNvHkhN

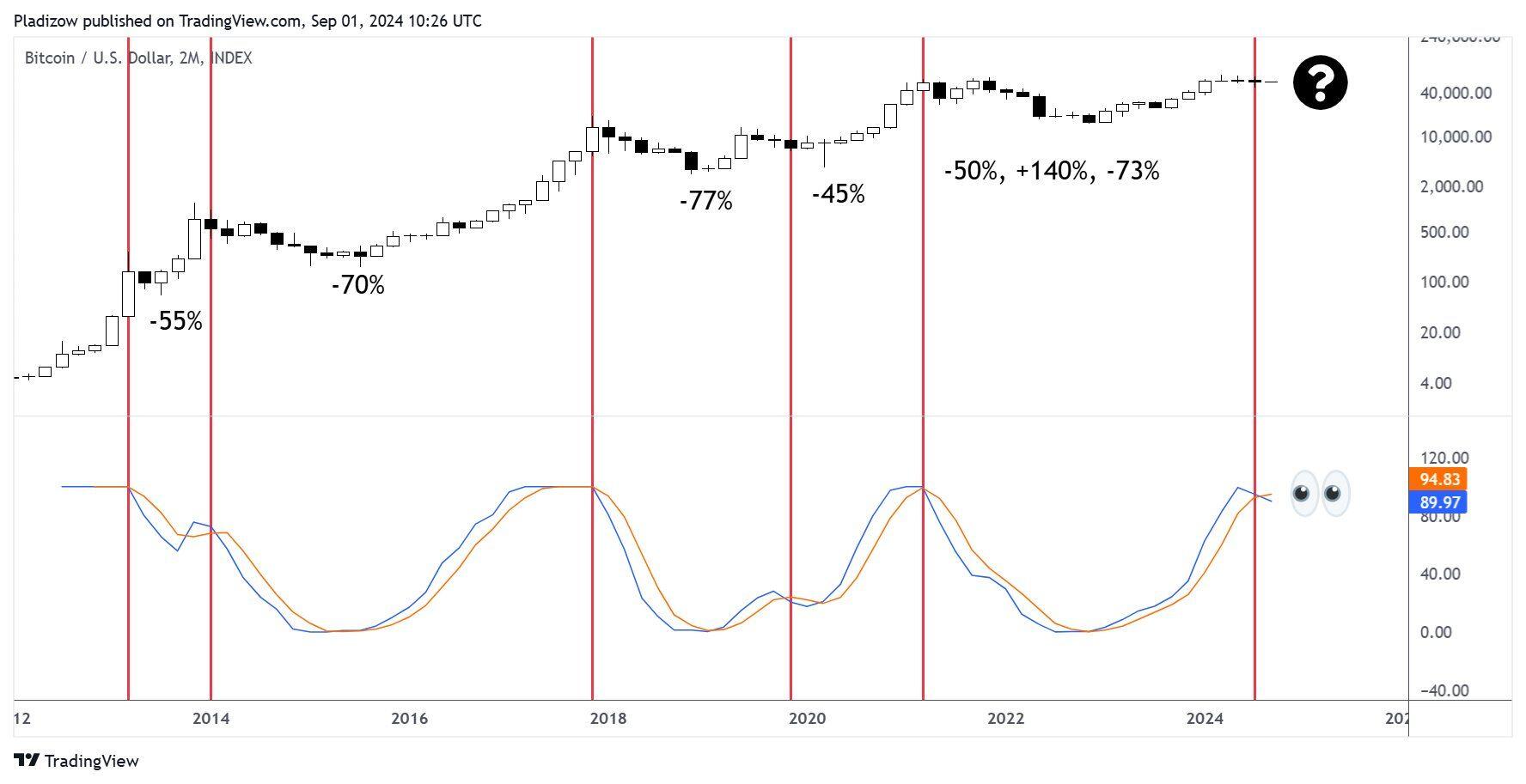

September is traditionally the most bearish month of the year for Bitcoin. Over the past 13 years, only 4 months were positive, while the rest were negative.

🚨 Blackrock Holds.

Zero outflows.

Bitcoin fell below $56k amid US and Japanese stock market crashes

Bitcoin fell to its lowest level since early August on Wednesday morning on the Asian exchange after sharp losses in the US and Asian stock markets, sending some major stocks down nearly 10%.

BTC briefly fell to $55,500, its lowest level since Aug. 8, and wiped out nearly all of its gains over the past month. The broader market tracked by CoinDesk 20 (CD20), a liquid index that tracks the largest tokens by market capitalization, fell nearly 6%. The major tokens Solana (SOL) and ether (ETH) fell more than 7% in losses.

U.S. stocks tracked by the Nasdaq 100 and S&P 500 fell 3.5% on Tuesday to start the historically bearish month of September as weak manufacturing data revived fears of an economic slowdown. The movement spread to Asian markets as Japan's Nikkei fell more than 4 percent in the hours after the open, adding to the jolts from last month's yen trade wind-down.

The August reading of the Institute for Supply Management's manufacturing index fell for the fifth straight month, recovering from July but remaining below the 50 threshold. The index is a monthly gauge of the level of economic activity in the U.S. manufacturing sector and is considered a sign of the broader economy.

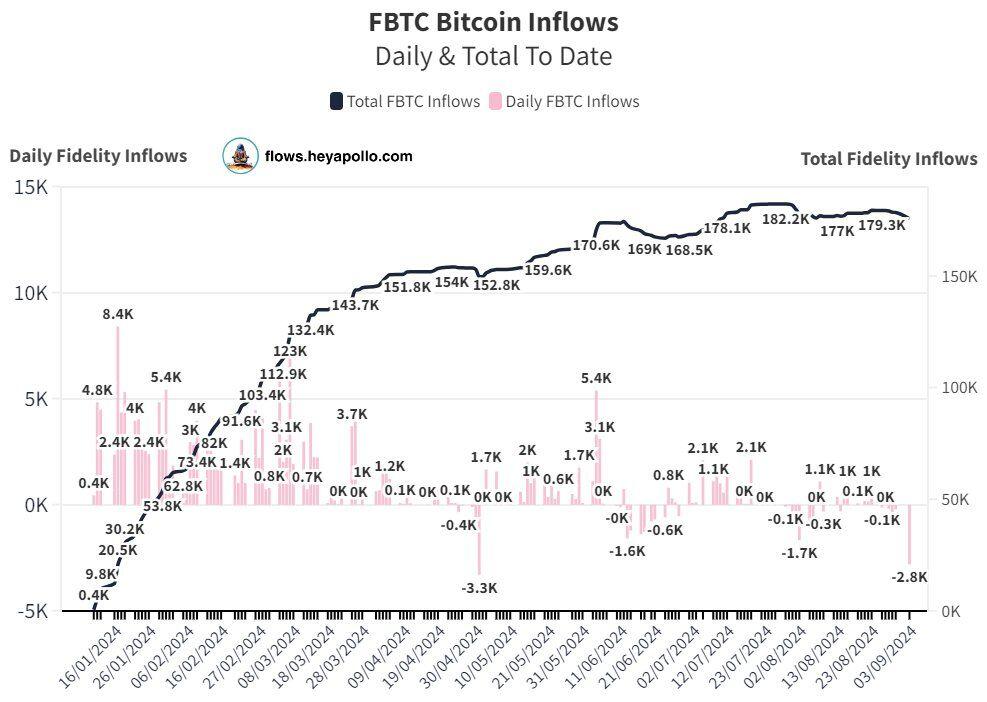

🚨 Fidelity Sells 2812 #Bitcoin

Wow. Second largest outflow ever.

What happened?

Happy Tuesday everyone. Here's what you need to know this morning:

🔵 Today, the impact of ETFs on the price of bitcoin returns. Yesterday, Monday, September 2, the US stock market was not operational due to a holiday. ETFs have been the main factor driving the price of BTC this cycle.

🔵 Japan will continue to raise interest rates, which would make the carry trade even less profitable. There is a risk that even more money will flow out of global markets to the yen, which would be bearish for markets in general.

🔵 Ethereum had its worst month since 2022. The price of ETH closed August with a drop of more than 21%, accompanied by disappointing performance from its ETFs.

🔵 Bitcoin hashrate reaches an all-time high amid the worst profitability in years. Mining activity continues to increase, despite adverse conditions for miners.

Bitcoin on its way to $110,000: optimistic forecasts and bottom localization

Popular on the social network X crypto analyst Titan of Crypto said that the price of bitcoin is moving towards the $110,000 mark by 2025. The basis for such an optimistic forecast was based on technical analysis of the BTC chart, in particular the cup-and-handle formation.

“Bitcoin at $110,000 is on its way. The 'cup and handle' formation is still in play. Need a little more patience - the last quarter of the year is going to be epic!” - wrote an analyst on social media X.

The cup-and-handle formation is a popular bullish pattern that signals the continuation of an uptrend and is used to look for opportunities to open long positions on an asset.

Another technical indicator also points to a possible rise to $100,000 in the first quarter of 2025. Elja Boom, an analyst popular on social network X, said:

“Giant inverse 'head and shoulders' formation for BTC. When the breakout occurs, bitcoin will soar above $100,000. I predict the all-time high will be updated in the fourth quarter and $100,000 in the first quarter of 2025.”

One last correction before the rise?

Despite optimistic six-figure forecasts, bitcoin may face a continued correction before reaching new heights. However, some analysts believe that the decline will not be serious. For example, popular in Moustache expects the price will not fall significantly below $57,000:

“Many are waiting for a drop to $53,500, but I believe that BTC has already found the bottom or is close to it (around $57,000). This is assuming the chart continues to repeat the COVID-19 period fractal of 2020. It's a curious situation, isn't it?”

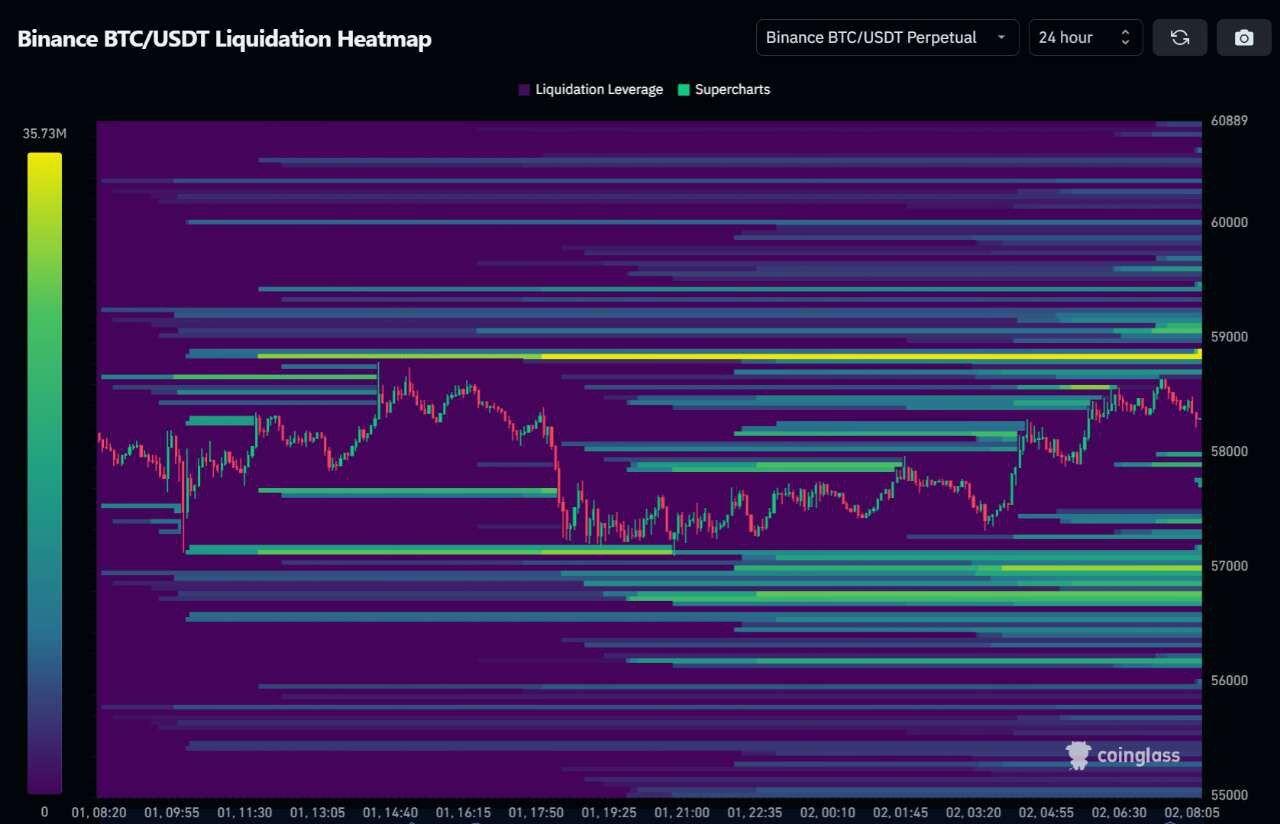

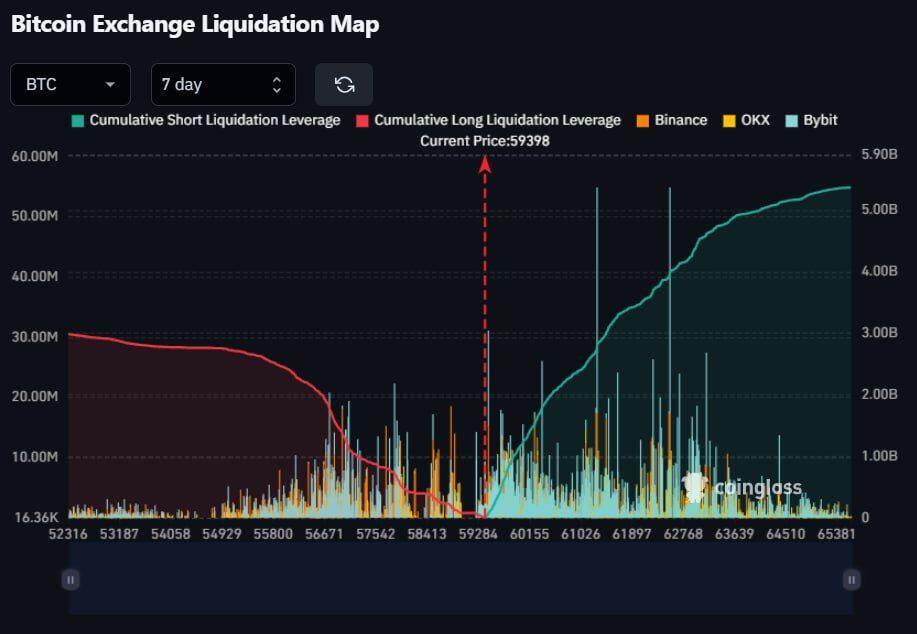

Bitcoin currently has strong support at the $57,000 level. A possible move below this mark would result in the liquidation of accumulated short positions worth more than $860 million, according to Coinglass data.

🚨🚨🚨 BREAKING : The South Korean 🇰🇷 government has launched an investigation into the messaging app #Telegram💰, accusing it of facilitating sexual crimes.

🚨🚨 $5.5 billion in short positions will be liquidated when #Bitcoin hits $65,000

Today

$BTC 4H

bulls making some progress on the falling wedge

Yesterday

Bitcoin has shown signs of life as the S&P 500 is paused for Labor Day. Signs of crypto growth without reliance on equities is a promising hint of the sector's strength. Combined with growing trader bearishness and FUD, there are promising signs an upcoming rebound is near.

Fear & Greed Index - Sep 03, 2024:

Today: 26 (Fear)

Yesterday: 26 (Fear)

Avg. 1W: 29 😱

Avg. 2W: 37 😣

Avg. 1M: 33 😣

Avg. 2M: 43 😕

Avg. 3M: 48 😕

Avg. 6M: 60 😁

Avg. 1Y: 62 🤑

🔸 #Bitcoin

Price: $59,133

24h Low: $57,276

24h High: $59,337

MC Change: $35.5B (3.1%)

Dominance: 53.9%

24h: 3.2%

7d: -6.3%

14d: -0.0%

30d: -2.5%

60d: 2.0%

200d: 14.3%

1y: 128.7%

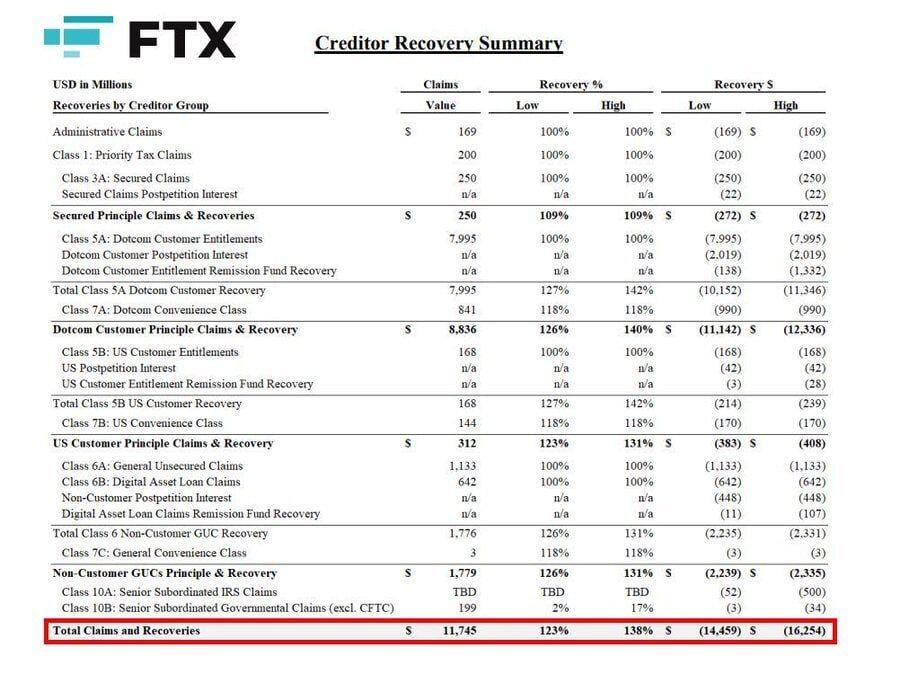

JUST IN: 🚨 FTX will start repaying $16B to creditors in Q4 2024 👀

Will this be bullish for #Bitcoin?

🚨 🚨 🚨 🚨 🚨 🚨 🚨 2,659 #BTC (157,347,236 USD) transferred from unknown wallet to unknown new wallet

A WHALE BOUGHT 1000 BITCOIN

WORTH $57.3 MILLION ON BINANCE TODAY.

IN THE LAST 4 DAYS THIS WHALE HAS ACCUMULATED 2000 BTC AND NOW HAS A TOTAL OF 8559 BTC WORTH $490 MILLION.

RETAIL IS PANIC AND WHALES

ARE BUYING THEIR BITCOIN CHEAP.🐳🚀

Kamala Harris wants to have full control to censor all social media platforms 👀 Bitcoin and Nostr are censorship resistant ✊

https://video.nostr.build/5223e0e11c03d4c5ec11a290ce654b88fa2b930cf7c911de461181a921745bad.mp4

BTC 2month:

Stoch RSI

Different this time?

USDT flows into exchanges reflect challenges for bitcoin price to rise.

📊 There are low USDT inflows into exchanges, indicating little appetite from investors to buy BTC.

👀 "This data suggests that investors do not believe the decline is over," says analyst.

Read the full note ⬅️

Do you think the decrease in USDT inflows into exchanges will affect the price of Bitcoin?

#Bitcoin Liquidity Heat Map Update