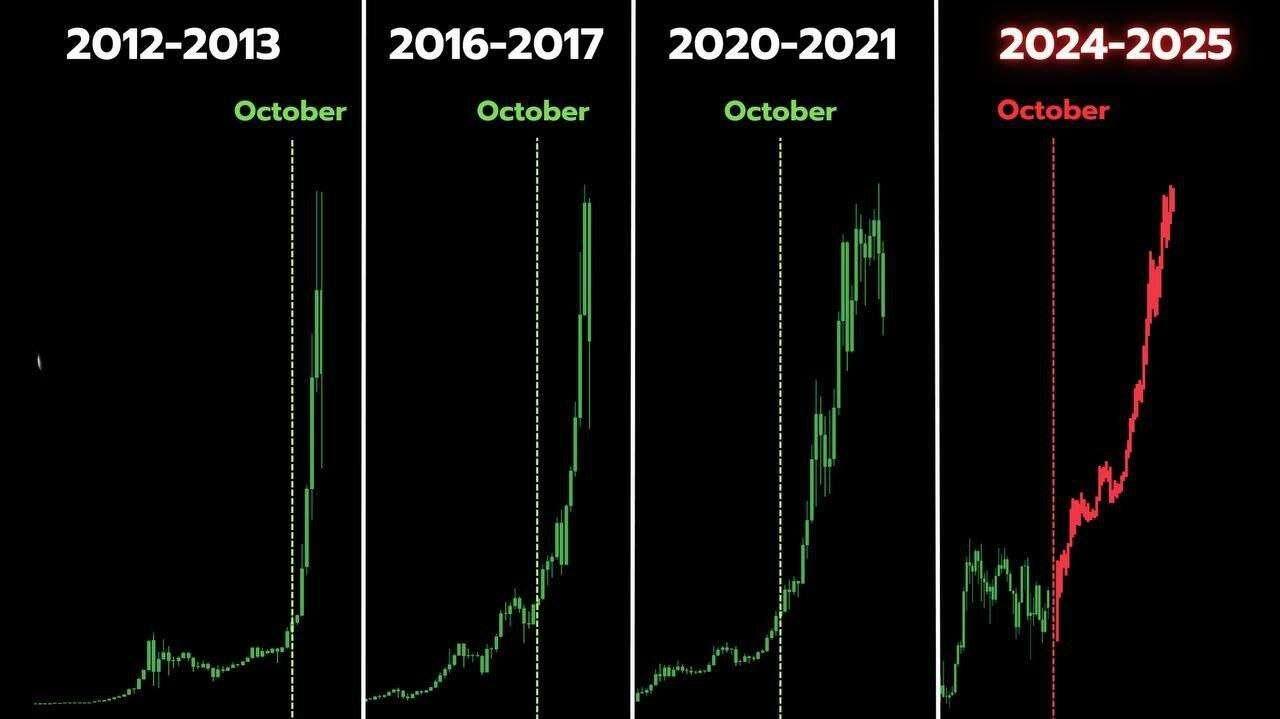

Bull markets historically begin in October 🔥

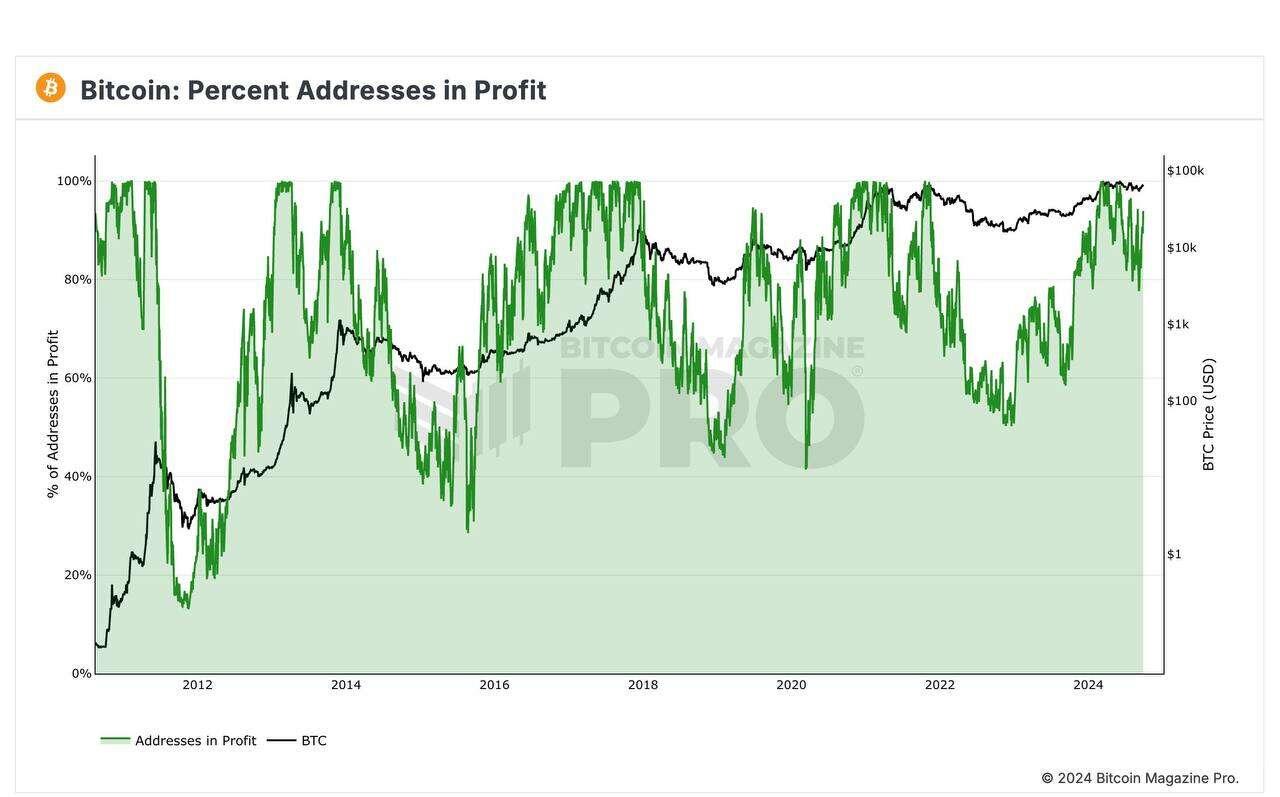

BREAKING: Almost 94% of #Bitcoin addresses are in profit 🚀

Bullish 🐂

Historically the #Bitcoin Bull Run starts now 👀⏳

Do you think this cycle will repeat? 🧐

#NostrMemes Sponsored Contests Are Back!

This Weekend’s Contest is sponsored by our fren nostr:npub18kpw3akvdsyk239lx0jgwksr74sq4nlha3r8u9g2rnrhztfpfhysy469c4

If you want to earn more sats on #Nostr, put a Bitcoin sticker or Bitcoin sign in public from nostr:npub18kpw3akvdsyk239lx0jgwksr74sq4nlha3r8u9g2rnrhztfpfhysy469c4

They're free - check the link in their bio.

🚨 Rules are very simple frens: 1 submission per contestant, this weekends meme theme is “Bitcoin Awareness” memes! (include nostr:npub18kpw3akvdsyk239lx0jgwksr74sq4nlha3r8u9g2rnrhztfpfhysy469c4 Lawn Sign in the meme,PNG is on the site https://bitcoin.rocks/signs as well as on this note) as a reply to this note, not a quote reply or noteID reply. 🚨 ORIGINAL MEMES ONLY!

Give a like 🤙 and zap ⚡️ to the meme you want to vote for 🗳️

🥇 Place Winner 105k sats

🥈 Place Winner 70k sats

🥉 Place Winner 35k sats

CONTEST STARTS TODAY SATURDAY AT 1:00 PM EST ⏰🔓

& ENDS SUNDAY AT 1:00 PM EST ⏰🔒

#nostrmemes

The #Bitcoin ETF yesterday recorded its largest inflow this month with $365.7 million. Bullish 🚀

Happy Friday, we leave you what you should know early to start this day:

🔵 The price of #bitcoin is today awaiting inflation data. High volatility is expected, although the previous days have been mostly positive for BTC.

🔵 #Bitcoin ETFs recorded the highest inflow in 2 months. BTC price is approaching $66,000 this morning.

🔵 A serious crisis is hitting #China and could spread globally. The specter of deflation and economic recession haunts the Asian country.

🔵 Gary Gensler confirms that BNY Mellon can custody bitcoin and #Ethereum, beyond ETFs. The SEC chairman said there are more entities presenting plans to custody digital assets.

🔵 Changpeng Zhao (CZ), former CEO of #Binance, is expected to be released today. Although it corresponds to Sunday, September 29, a federal rule provides that if the release day is a holiday, it can be executed on the last previous business day.

#BTC

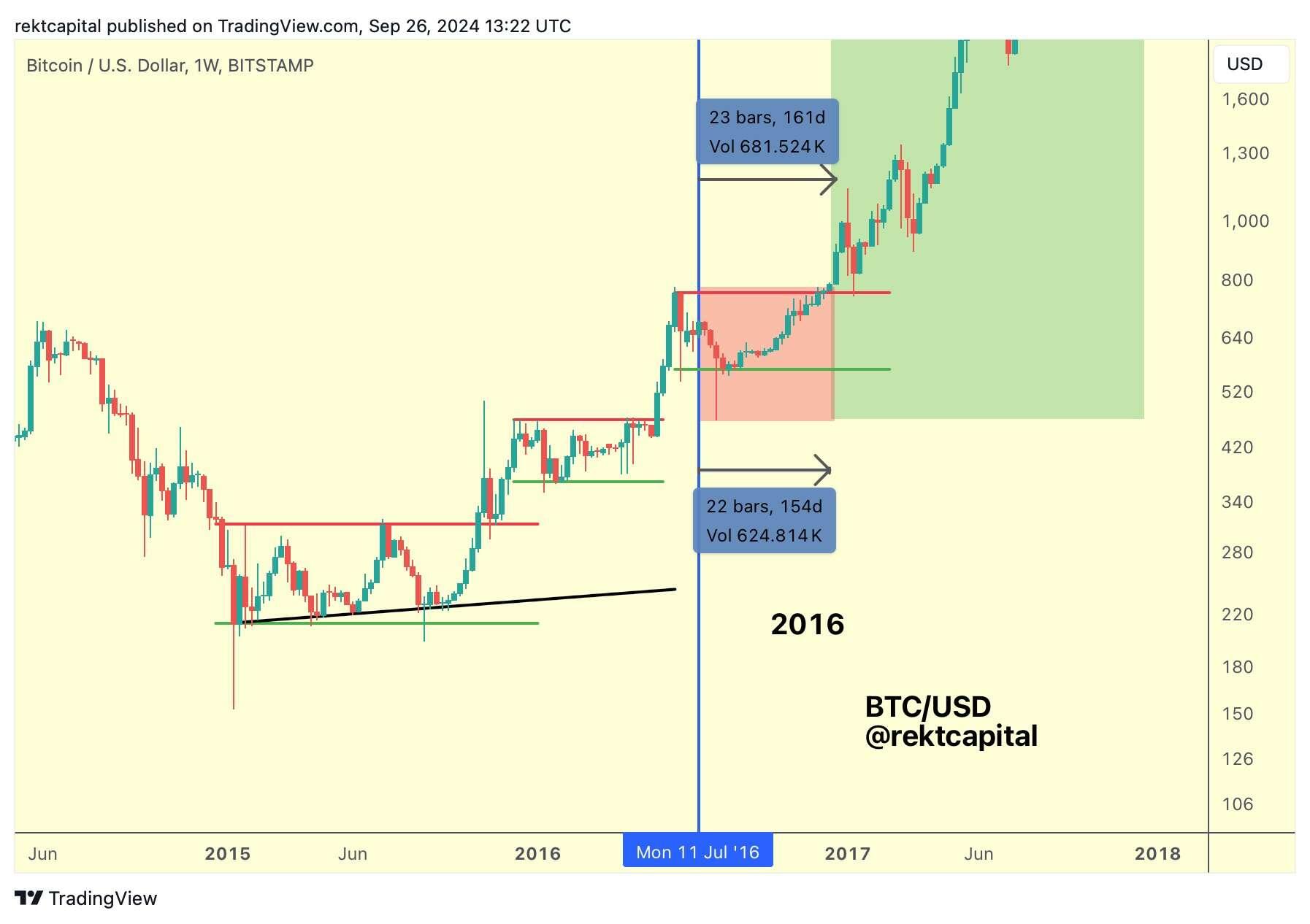

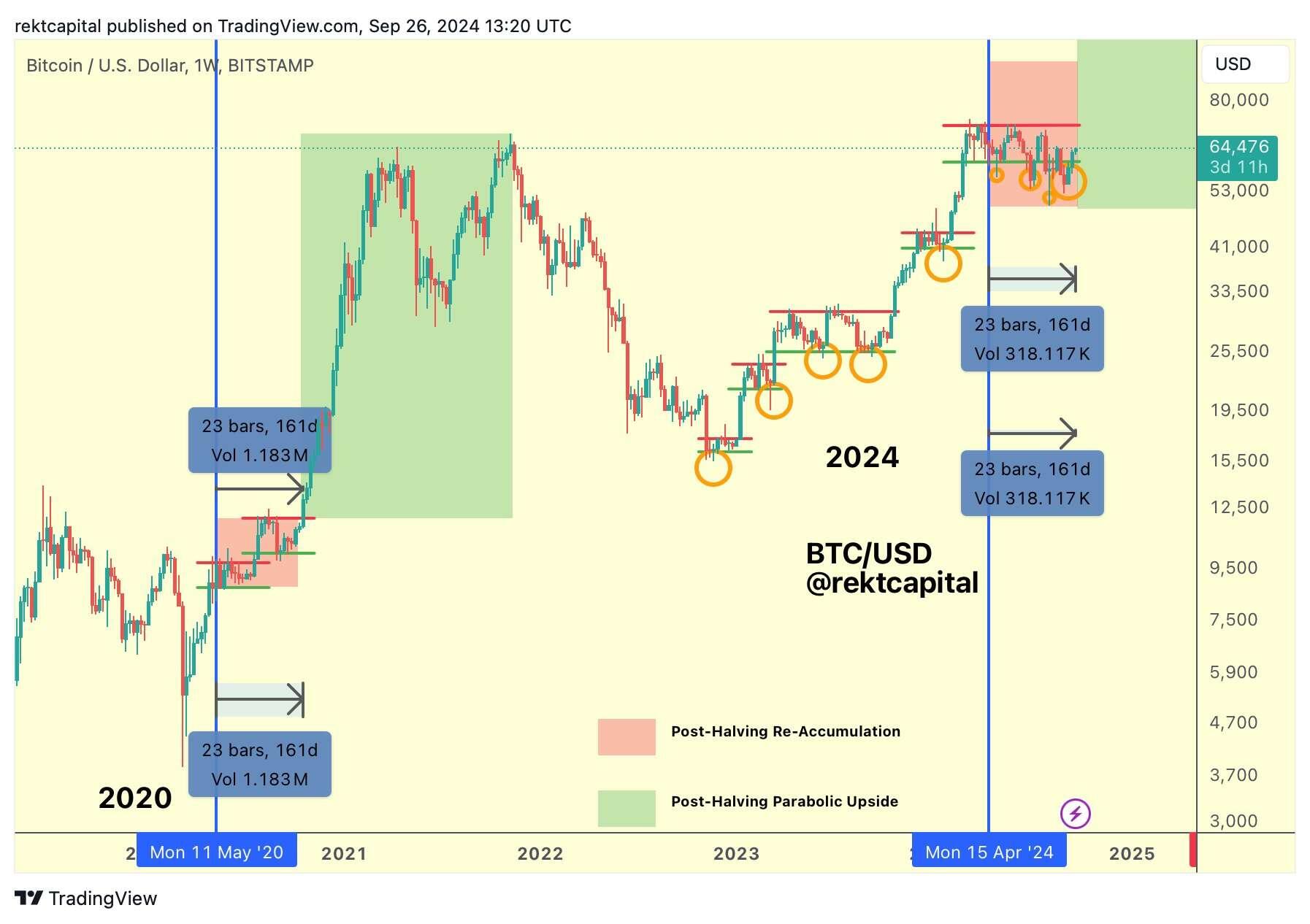

It is currently 159 days after the Halving

By standards of 2016, Bitcoin should've broken out 5 days ago

By standards of 2020, Bitcoin should be breaking out in the 4 days or so

Bitcoin is in a pretty good position right now

#Bitcoin $65K waiting room ⏳

Even if BTC ends up sweeping 65K and rejecting, which wouldn't be great, it would still make sense to at least sweep the level for liquidity purposes.

The longer we trade below it though, the more likely I think it is we hold it if it breaks.

BTC bulls are charting a path to $66K, but will they make it?

Bitcoin bulls are making progress in their attempt to reclaim the 200-day moving average, but a close above $66,000 could kick off a rally towards BTC's all-time high

🇦🇷Argentina distances itself from the UN Future Pact: According to the Minister of Foreign Affairs, Diana Mondino, the regulations proposed in the pact, approved by more than 190 countries in the plenary session of the United Nations, clash with the growth plan economic without external regulations proposed by Javier Milei.

🇺🇸Congressmen ask the SEC to allow bitcoin custody in banks: In a letter signed by 43 Republican legislators, led by Patrick McHenry and Senator Cynthia Lummis, they asked Gary Gensler, president of the SEC, to eliminate the SAB 121 rule that limits banks from being able to custody certain types of digital assets, including cryptocurrencies.

🏦The oldest bank in the US will custody the bitcoin and Ethererum ETFs: Despite the SAB 121 regulation, BNY Mellon assured that it would custody the underlying assets of the BTC and ETH ETFs, communicating that, given the recent review by the SEC, it did not impose any type of limitation on this measure.

💸 One of Hal Finney's wallets sent 5 BTC, approximately USD 315 thousand, to the Kraken exchange.

Since his death, management has been under family control.

The wallet in question holds more than 1,215 BTC, more than USD 76 million.

💰Let's also remember that Finney was the first bitcoiner, this wallet even received mined BTC in the first 2 months of the network's life.

This is just one of the wallets that could have belonged to Finney. So your family may still have a sizable stash of BTC.

Historically, the #Bitcoin bull market always started in October.

FYI: 🟠 Bitcoin is growing faster than the Internet 🌐

💰 Only 0.27% of the world's population can own 1 #Bitcoin each.

💡 What if we've finally cracked the "Crypto Cycles Matrix Code" and can finally provide a clear answer to the question: when altcoin season?

I've noticed a curious pattern in the #BTC cycle. 🎢

🔍 In the cycle that ended in late 2017, key dates on the chart seem to be linked to... December 17!

📅 December 17, 2017 - ATH

📅 December 17, 2018 - Bottom

📅 December 17, 2020 - Breakout into discovery zone (220 days after #Bitcoin halving)

Now, here's the interesting part: in the cycle that ended in late 2021, everything seems tied to... November 10! 😯

📅 November 10, 2021 - ATH

📅 November 10, 2022 - Bottom

Am I allowed to believe that the breakout into the discovery zone will happen on 📅 November ~10, 2024? 🤔

Manipulation, coincidence or destiny? IDK, but this could have huge implications for the entire crypto market—after all, we've seen before that altcoin season tends to follow after #Bitcoin's breakout into price discovery.

At least now we have a strong reference point: November 10 , 205 days after #Bitcoin halving.

NOTE: We are currently sitting at 156 days after the #Bitcoin halving. Altcoin season hasn't started yet.

This does not constitute financial advice for investments. It represents my observations and correlations between various elements that form the crypto cycles, which appear to convey an interpretable meaning.

#Bitcoin gained +61% in Q4 of 2016 and +171% in 2020. Interestingly, 2024's price action so far mirrors both years—could history be repeating itself?