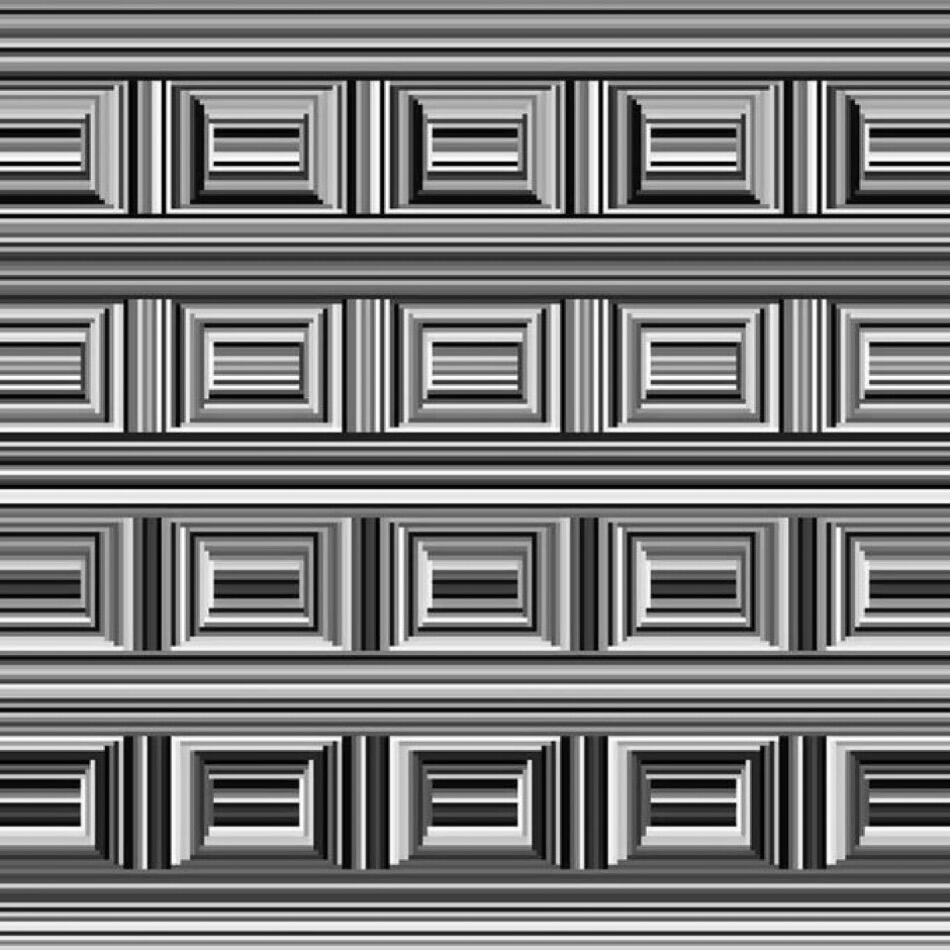

This is called the Coffer illusion.

In this image there are 16 circles. Can you find them?

Bitcoin is worthless

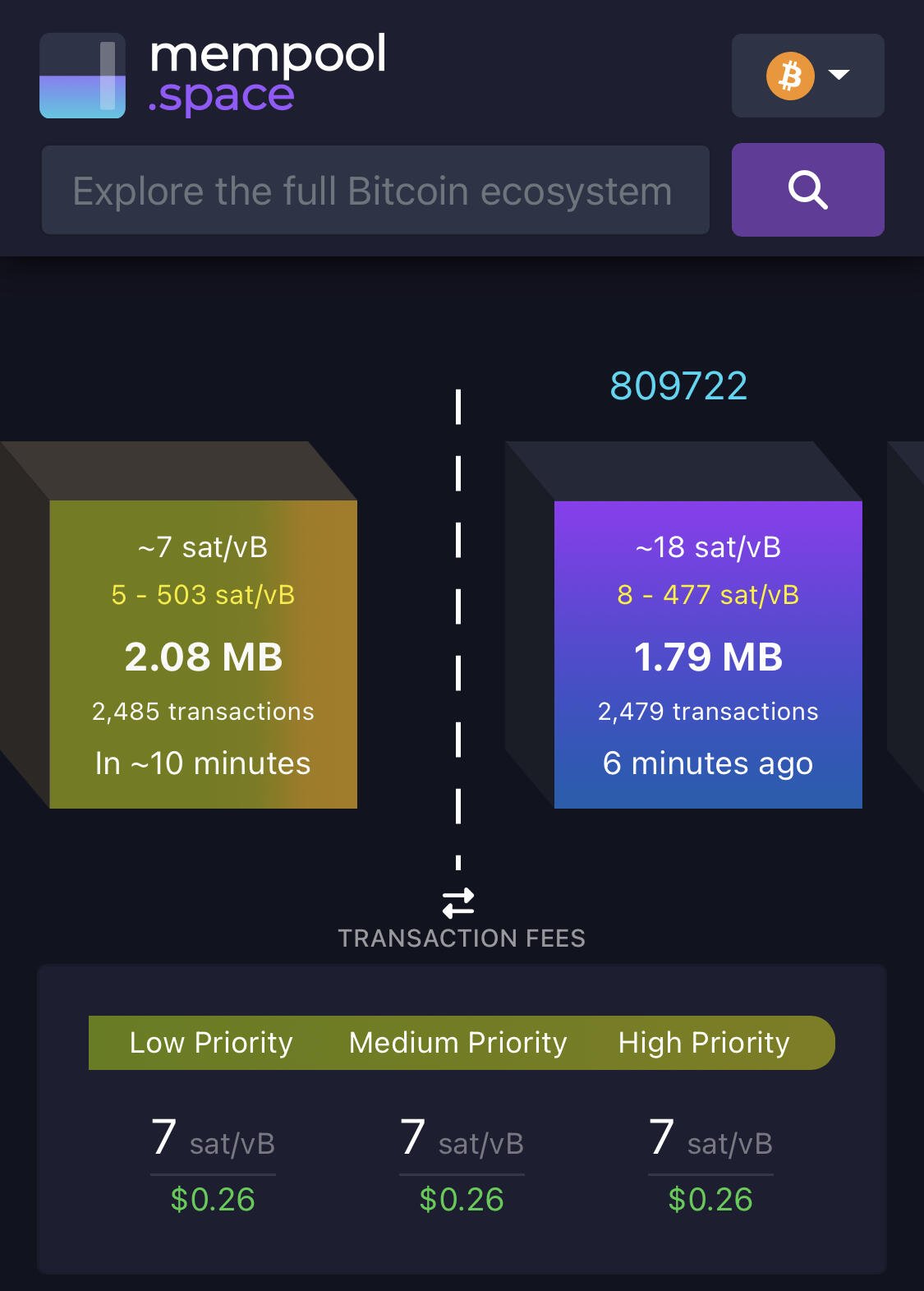

I thought that most of the mempool is clogged up with low-fee ordinals/inscriptions/BRC-20 token degen gambling speculators. That’s crowding people who actually want to use the network out of a low fee environment into a high fee environment. If OCEAN enforces a filter against that, the number of their low fee transactions sitting in the mempool will increase. Some might get frustrated and just stop, but those that remain will have to pay a higher fee for the non-Ocean pool to take their transaction. The higher fee environment may further erode speculation. StratumV2 isn’t going to help them unless they up their fees. Unless I’m wrong.

I just want to know, does Ocean have a chance at fixing this?

Shill me your Bitcoin memes

I believe that holding your own keys is not that expensive. Forgetting an offline hardware signing device, you could just use an app on your phone, if you don’t have a phone roll some dice to generate your seed words that you store on paper. BUT, if you’re talking about affording the fees to transact on layer-1, then there may be people that can’t afford the fees (especially with Ordinal inscription speculation filling up the mempool). These people may be more in favor of asking their “bank” to hold their bitcoin, which provides them a layer 2 channel for cheaper transactions. The upside is that Banks won’t be able to fractional reserve re-hypothecate as they do now.

Well, let’s just say my list of reasons why I don’t trust the government is getting pretty long.

Today on THE #Bitcoin Podcast I’m speaking with nostr:npub1u8um5vstlax9p60644zygvhc7w5mkzfyhwyvj453l3j7l9mrf5rspnc3c3 about TrueVote.

TrueVote is an open-source solution for tamper-proof ballot data, built on Bitcoin, opentimestamps, and #Nostr

Here’s the white paper: https://truevote.org/TrueVote.pdf

What questions do you have for Brett?

I had an idea like this years ago, and people boo’ed me for ‘trusting blockchain tech (or any tech) with voting.’ I suppose the question I would have is if Bitcoin is pseudonymous, how would you prevent voter fraud (like dead people being given a vote) or what blind-spots or dangers do you see to this system?

Tony Klaus just made a huge post on X about leveraging lightning to create a stable coin channel on Bitcoin. Seems interesting.

https://x.com/tonklaus/status/1729567459579945017

A few day ago I broadcast the first Stable Channel onto the bitcoin mainnet.

Stable Channels lets users get stable USD or leveraged BTC price exposure using Lightning. Peer-to-peer, 100% bitcoin.

This is finance, streaming. Let's look inside.

We have two types of users in a Stable Channel:

1 - Stable Receivers want stable USD. To peg their BTC at, say, $100.

2 - Stable Providers want to leverage their BTC.

Short vs. long. We connect them over Lightning and settle frequently, so they both get what they want.

Both sides put in $100 (of bitcoin) into a dual-funded channel.

Last week this was 0.002648 BTC, or 0.005296 BTC total.

The transaction took less than one hour to settle on the bitcoin blockchain.

Each side contributed $2.15 for transaction fees.

Every 5 minutes there's a Lightning settlement. Both nodes query 5 BTC/USD price feeds and take the median.

BTC price ⬇️? More BTC required for $100 stability. Stable Provider pays Stable Receiver.

BTC price ⬆️? Less BTC for $100. Stable Receiver pays Stable Provider.

Since confirmation, there have been 763 settlement events, 288 per day.

If the Stable Receiver's BTC is not within 0.01% of the agreed-upon USD value ($100), a payment is made.

611 payments were made for a total of $43.90 and an average of payment of $0.07.

Zero fees.

Each counterparty keeps track of their numbers and whether they are paid on time. No oracle signatures are required.

If they are not paid on time, their counterparty's risk score goes up.

Each side remains self-custodial, and can leave at any time. This has trade-offs.

The BTC price has been stable recently.

The stable USD side now has 0.00002545 more BTC. The long side lost BTC.

Despite little volatility, ~$44 dollars went back and forth.

Lots of payments? No problem with Lightning. Lessen counterparty risk with rapid settlement.

What are the benefits of Stable Channels?

Self-custodial, simple, no fiat, no banks, no tokens, no shitcoins, no Treasury bonds, less oracle risk. Better for financial privacy, decentralized, tax advantages.

And of course: only bitcoin and bitcoin infrastructure.

Okay, and the challenges?

Same problems as Lightning: need to run a node, hot private keys, maybe high fees, always online. + your counterparty can leave anytime.

If we can prevent catastrophic failure, can we manage marginal counterparty risk with great software? TBD.

What can you do with Stable Channels?

Stable USD, long BTC. Better trading experience, quick-to-market structured products.

Be kept stable at the 7-day, 52-week, 200-week BTC moving average, lessening user volatility.

Plug in funding rates and yield. Plug in payments!

Acknowledgments. Thanks to many folks for their open-source code, inspiration, and conversations: @jamaljsr @niftynei @Snyke @cguida6 @KenSedgwick @Blockstream @olegmikh1 @r0ckstardev @_AlexLewin @BtcFrancis @endothermicdev @adam3us @arielaguilar @markgoodw_in @peterktodd

Next steps.

Want to get stable in USD terms, or leverage your BTC? DM.

Want to run the code? It's open-source, a CLN plugin. Happy to walk you through it. github.com/toneloc/stable…

Want to suck hundreds of billions of USD liquidity into bitcoin and Lightning? Join us. 🧙♂️

I can’t tell if it’s warm or cold there. Stacy & Max in costs, Jimmy in short sleeves.

Ocean already has 82 people mining through the newly launched Decentralized mining pool! Now that’s a successful launch on the first day.

People need to check this thing out.

Congrats nostr:npub1lh273a4wpkup00stw8dzqjvvrqrfdrv2v3v4t8pynuezlfe5vjnsnaa9nk nostr:npub1sg6plzptd64u62a878hep2kev88swjh3tw00gjsfl8f237lmu63q0uf63m

Woah, it was at 75 people 10 minutes ago! Pres, if this is fully decentralized, does it have the potential to gobble up all the centralized pools?

Congrats to the nostr:npub1qtvl2em0llpnnllffhat8zltugwwz97x79gfmxfz4qk52n6zpk3qq87dze team! https://ocean.xyz/

And now for some news

I hear decentralized coinjoins using #nostr are coming to Electrum

https://mempool.space/signet/tx/0cf53abb348a1835b7f586c0c669598bacf746053bc810b73d6ebc37c4d6624c

Hello my people, I’ve been spending too much time on Twitter and have been reminded of how toxic it can be. It’s been a while since I was over here, but the interface looks much improved; I think I’m going to be over here more.

Achievement unlocked : hammered a nail into a wood board using only feet.