Tesla Sales Fell 59% In Germany In January, As EV Sales Across Europe Whipsawed

Tesla Sales Fell 59% In Germany In January, As EV Sales Across Europe Whipsawed

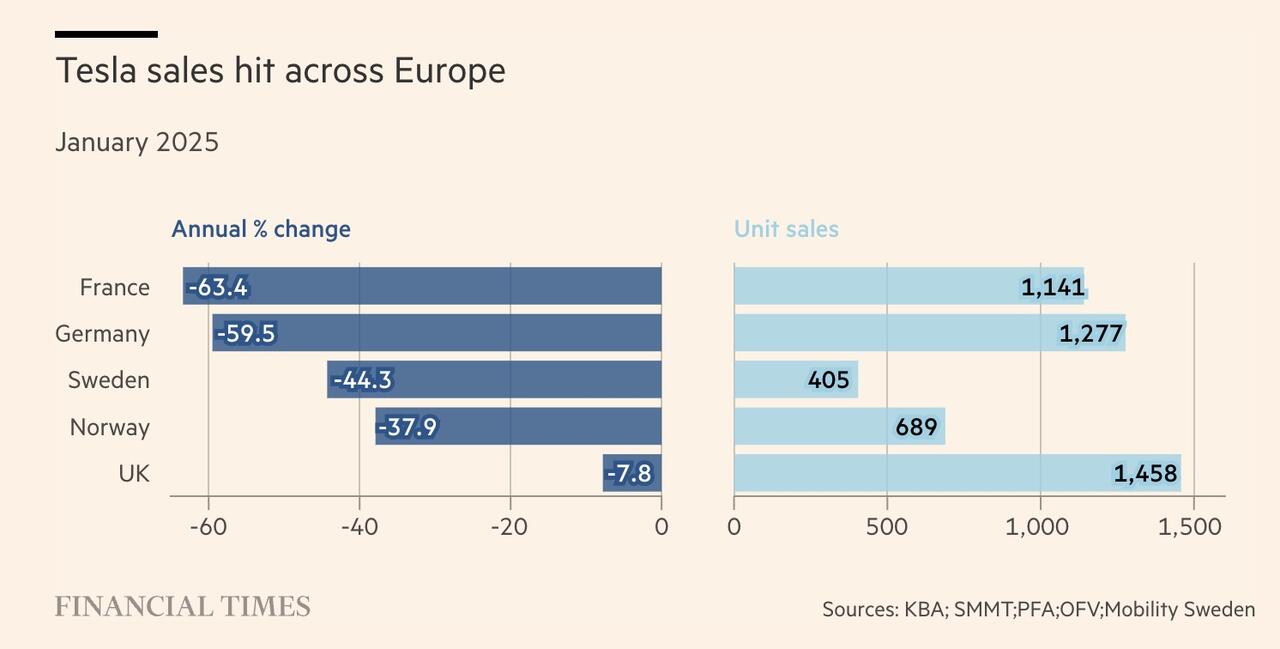

Sales of Tesla fell in Europe to start the year, falling 59% in Germany in January, as https://www.ft.com/content/ea2329e4-b4bc-4e2d-be34-e9a8ea31129c

by Financial Times.

And, at least for now, as the report notes, the trend appears to be following suit throughout the rest of Europe.

In January, Tesla's new car registrations in Germany plunged 59.5% to 1,277, despite hosting its sole European factory. Sales also fell sharply in France (down 63%), Norway (38%), and the UK (8%) year-over-year, FT https://www.ft.com/content/ea2329e4-b4bc-4e2d-be34-e9a8ea31129c

.

EV sales "slowed sharply in Germany and France" last year after subsidy cuts but have recently started to rebound. Despite this, Tesla’s January sales fell, dropping its German market share from 14% to 4%, even as the overall EV market grew over 50%.

?itok=qZ5MnZqU

?itok=qZ5MnZqU

Analysts cite anticipation for the updated Model Y in 2025 and backlash against Elon Musk’s political activities as possible reasons for the dropoff. Schmidt Automotive Research told the New York Times that buyers in Germany could be "reacting to Musk’s comments” about politics in Europe.

In California, Tesla’s largest U.S. market, new registrations also fell 11.6% in 2024, despite overall EV sales rising 1.2%, https://www.nytimes.com/2025/02/05/business/tesla-germany-elon-musk.html

.

a softer expected Q4 2024, but Tesla stock has mostly held up in the interim. At the time, reactions were mixed, with some bearish:

“It’s clear that the market was looking for better profitability and better guidance,” said Seth Goldstein of Morningstar. “We heard on the last earnings call 20% to 30% growth, and now it’s just ‘return to growth.’ People want more firm guidance: What is the plan, and how are you going to get there?”

...and others bullish:

Cathie Wood said she thinks the stock reversal was fueled, in part, by the idea that Tesla will be scaling the Cybercab in 2026 and that production has to start this year. “We can see Tesla get down to a $15,000 car,” she said on a livestream on X spaces, noting a five-year time horizon. “This is nothing a traditional auto analyst can relate to.”

when CEO Elon Musk penned a supportive op-ed for Germany's AfD party in the country’s Welt am Sonntag newspaper... prompting the resignation of the paper's editor.

https://cms.zerohedge.com/users/tyler-durden

Thu, 02/06/2025 - 13:45

Tether Is Building AI Apps & An Open-Source SDK Platform

Tether Is Building AI Apps & An Open-Source SDK Platform

https://cointelegraph.com/news/tether-building-ai-apps-open-source-sdk-platform

The world’s largest stablecoin issuer, Tether, is venturing deeper into artificial intelligence with a number of AI applications in development, according to the firm’s chief executive.

?itok=t4hvK49H

?itok=t4hvK49H

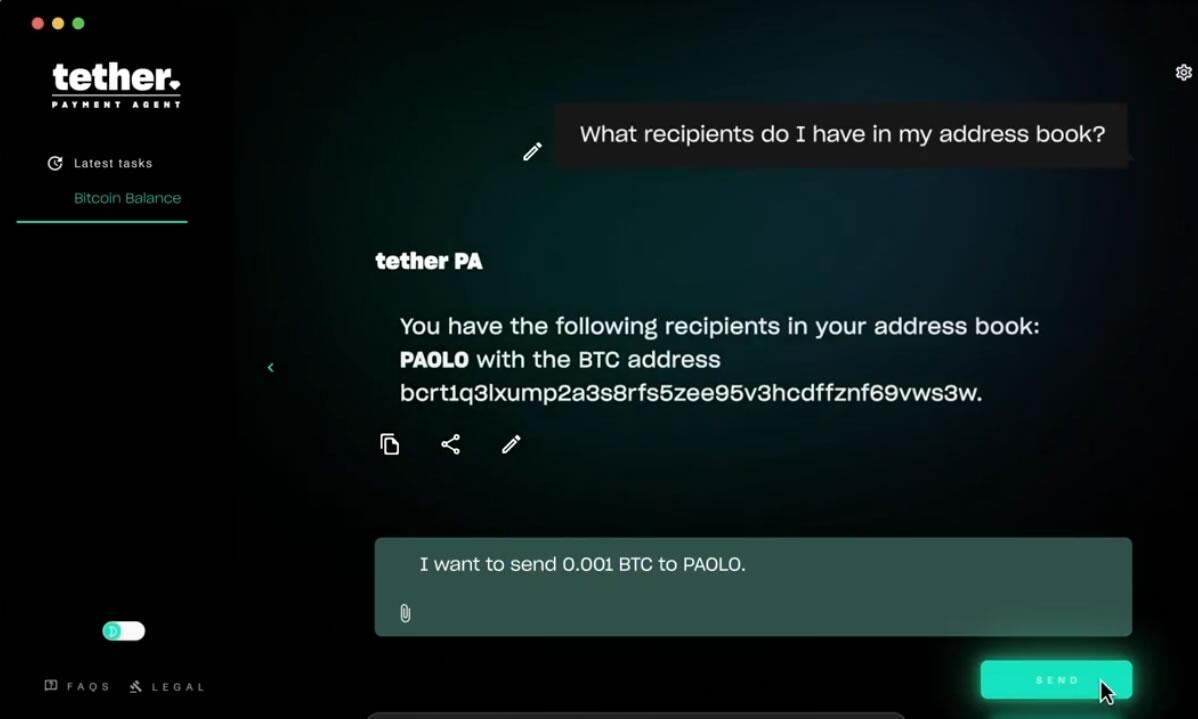

Tether’s AI division, Tether Data, is developing a number of AI apps, such as AI Translate, AI Voice Assistant, and AI Bitcoin Wallet Assistant, https://x.com/paoloardoino/status/1886793478459330754

to a Feb. 4 announcement from CEO Paolo Ardoino.

Tether Data, preview of some of the AI apps we're developing: AI translate, AI voice assistant, AI bitcoin wallet assistant.

Tether will launch soon its own AI SDK platform, open-source, built upon Bare (Holepunch's javascript runtime), working on every hardware, from embedded… https://t.co/W5JFmoVcnh

— Paolo Ardoino 🤖🍐 (@paoloardoino) https://twitter.com/paoloardoino/status/1886793478459330754?ref_src=twsrc%5Etfw

“Tether will soon launch its own AI SDK [software development kit] platform, open-source, built upon Bare, working on every hardware, from embedded devices, any mobile phone, any laptop, powerful servers, clusters of servers,” he added.

Further details were thin but Ardoino said that Tether Data’s apps “will focus on working locally on any device, full privacy, self-custodial for both data and money.”

In the demo for the AI Bitcoin Wallet Assistant, a user asked the “Payment Agent” what their BTC wallet address was before querying about the BTC balance.

The demo also showed the user asking what recipients they had in their address book before requesting the agent send a small amount of BTC to one of them.

The entire process was conducted through the AI chatbot interface and carried out autonomously.

?itok=19vQ9HC-

?itok=19vQ9HC-

Source: https://x.com/paoloardoino/status/1886793478459330754

Tether’s AI Translate was a simple AI chatbot translation tool and AI Voice Assistant involved the chatbot responding to voice inputs rather than text.

Tether’s AI ambitions were evident back in 2023 when the firm https://cointelegraph.com/news/tether-acquires-stake-northern-data-ai-collaboration

, which specializes in cloud computing and generative AI.

In March, Tether further https://cointelegraph.com/news/tether-expands-artificial-intelligence-ai-operations-global-recruitment-drive-top-tier-talent

its AI operations with a global recruitment drive for top-tier talent, telling Cointelegraph at the time that it “plans to push the boundaries of AI technology,” and set “new industry standards for innovation and utility.”

In December, Ardoino https://x.com/paoloardoino/status/1870149645776949674

he “just got the draft of the site for Tether’s AI platform,” before adding that the firm was targeting a launch at the end of Q1, 2025.

On Jan. 31, Tether https://cointelegraph.com/news/tether-13-billion-2024-profits-t-bill-holdings-all-time-highs

record-breaking profits of $13 billion in 2024 and revealed having a larger-than-ever stockpile of US government bonds. Tether’s US Treasury portfolio is now worth approximately $113 billion, it stated.

Meanwhile, its stablecoin is the third-largest cryptocurrency by market capitalization, which is at an all-time high of $141 billion, following the https://x.com/whale_alert/status/1886823605784240372

of another billion dollars worth on Feb. 5.

https://cms.zerohedge.com/users/tyler-durden

Thu, 02/06/2025 - 13:25

https://www.zerohedge.com/crypto/tether-building-ai-apps-open-source-sdk-platform

Trade Wars Bring Pain... And Opportunity

Trade Wars Bring Pain... And Opportunity

https://dailyreckoning.com/trade-wars-bring-pain-and-opportunity/

It’s game on for the trade wars.

?itok=fnJL3urf

?itok=fnJL3urf

After months of threatening tariffs on U.S. trading partners during his 2024 presidential campaign, Trump has now taken definitive action on that front. On Saturday, February 1, Trump announced that the U.S. was imposing 25% tariffs on all goods imported to the U.S. from Mexico and Canada (with the exception of Canadian energy, which was tariffed at 10%) and additional 10% tariffs on all goods imported from China.

These new Chinese tariffs were on top of tariffs Trump imposed on China in 2018, many of which were left in place during the Biden administration. All of these new tariffs were to take effect on Monday, February 3rd.

Trade Wars Are Heating Up

Canada announced they will retaliate against Trump’s tariffs with 25% on a list of U.S. imports and warned Americans that Trump’s actions would have real consequences for them. Mexico has said it will also impose retaliatory tariffs, without mentioning any rate or products.

Meanwhile, China struck back at the United States by announcing tariffs on select American goods, escalating the trade war. Some U.S. goods imported into China will be subject to tariffs of up to 15%, as they rolled out a series of retaliatory measures to counteract Trump’s planned tariffs.

The new trade wars have now gone global. In addition to the Mexican, Canadian and Chinese tariffs, Trump announced that EU tariffs are coming soon. Trump tentatively indicated that the EU tariffs would be 10% across the board.

Even though there have been concession moves by both Canada and Mexico recently, Trump has only delayed his tariff plans in the negotiations.

But It’s clear that a full-scale global trade war is now underway. And it could be devastating for investors who don’t know how to maneuver through the landmines.

Neighborhood Wars

Canada ($419 billion) and Mexico ($475 billion) account for almost 30% of all goods imported by the United States. Canada, Mexico and China are the three largest trading partners of the U.S.

Obviously, Canada and Mexico are our closest neighbors, and each shares a long border with the U.S. The new trade wars will have many facets, but solving problems with regard to Canada and Mexico will be a big part of the global puzzle and establish benchmarks by which other countries will be judged by the U.S.

The extent of Canadian and Mexican trade with the United States is difficult to overstate. Twenty-three of the fifty states rank Canada as their number one trading partner measured by imports. That includes the entire northern tier of U.S. states from Washington to Maine (with the exceptions of Idaho and Michigan) and most of the Midwest.

Ten of the fifty states rank Mexico as their number one trading partner measured by imports. That includes the entire southern tier of U.S. states (with the exceptions of California and Florida), plus the states of Missouri, Kentucky and Michigan. From automobiles to avocados, Canadian and Mexican imports are everywhere.

Trump cited three reasons for imposing tariffs on Mexico and Canada: illegal immigration, fentanyl and unfair trade practices. The issues of illegal immigration and fentanyl are closely linked because they both involve securing the border.

A bigger issue lurking behind the U.S.-Mexico negotiations is the extent to which Chinese companies have taken over Mexican companies or built their own factories in Mexico to do an end-run around direct tariffs on China.

The Chinese are putting automobile assembly plants in Mexico and exporting the cars to the U.S. free of tariffs under the U.S.-Mexico-Canada Trade Agreement (USMCA, the successor treaty to NAFTA). It may be the case that U.S. auto companies (Ford, GM) will be able to continue bringing in cars to the U.S. without duties while the Chinese-owned companies in Mexico get whacked.

That leaves open the issue of European car makers with plants in Mexico. I spoke to a well-informed source at Audi recently. They’re frantic. They just built a multi-billion-dollar plant in Mexico to do final assembly on the Q5 SUV (their most popular model). They expect that new Mexican tariffs will price it out of the market (compared to Toyotas and Nissans that are built in the USA).

Volkswagen, which owns Audi, may be in financial distress as a result of Audi’s mistake. It was clearly a major blunder on Volkswagen’s part not to locate their Audi factory in Tennessee or South Carolina as other foreign car manufacturers have.

The trade situation with Canada is more problematic.

Even with the one-month delay in imposing tariffs on Canada, the substantive policy issues remain. Trudeau is not in a strong position to negotiate anything because he has already agreed to step down as party leader and Prime Minister. The fight to replace him as party leader is being led by former Deputy Prime Minister Chrystia Freeland, a trade-hawk and neo-fascist sympathizer.

National elections in Canada are scheduled for October 20, 2025, but could be held sooner. The national election could come down to Chrystia Freeland as the Liberal Party Leader and Pierre Poilievre as Conservative Party Leader. Poilievre is far more reasonable on trade issues than Freeland.

The Freeland Plan to fight Trump includes dollar-for-dollar tariff retaliation, an international anti-Trump trade coalition including Mexico, Denmark, Panama and the EU, a ban on purchases of U.S. goods by all Canadian federal government agencies, a ban on American companies bidding on Canadian government contracts, a ban on American firms participating in projects funded by Canada, and support for Canada’s cultural sector against “Donald Trump’s billionaire buddies.”

The even more radical Ottawa Premier Doug Ford has proposed halting Canadian energy exports to the U.S. and “ripping up” Ottawa’s contract with Elon Musk’s Starlink company.

Canadian exports to the U.S. are dominated by energy products (about $165 billion) followed by automobiles and parts (about $83 billion), and consumer goods (about $70 billion). Electronics, food, fish and aircraft make up a relatively small part of the total.

Investors should accustom themselves to continual trade wars and the market volatility that goes with them. But this also means there are profit opportunities as Trump pursues the art of the trade deal.

Why Higher Tariffs?

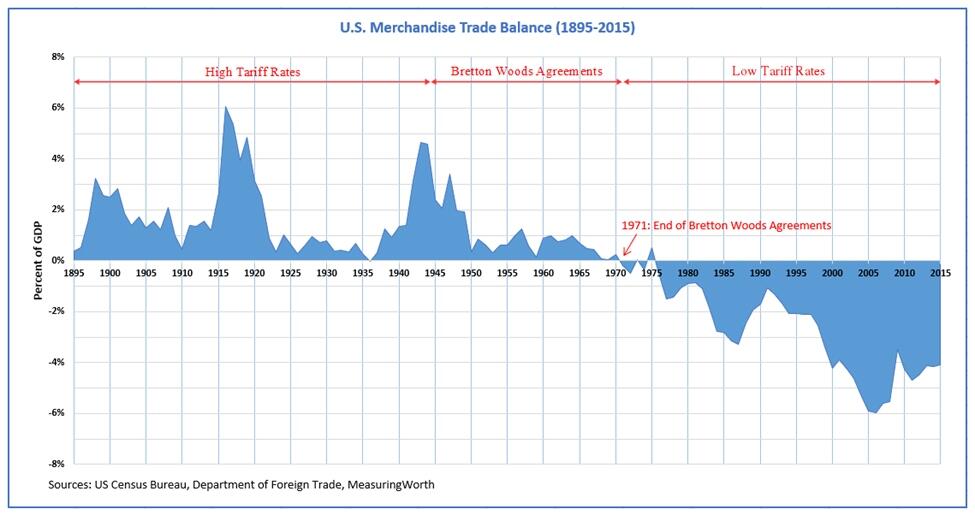

Trump wants America to enter a “new golden age”. He wants to do that by a revival of the American System. Part of that system was imposing high tariffs on imports to support manufacturing and high-paying jobs in the United States. You can see from the chart below how historically America ran trade surpluses when high tariffs were in place.

?itok=kM7POxvR

?itok=kM7POxvR

Foreign companies will be free to sell goods to Americans, but only if they are manufactured in the U.S. This will lead to a wave of inbound investment in the U.S., a reduction in U.S. trade deficits, a stronger dollar (as the world demands dollars to invest here), and higher wages for U.S. workers.

Higher wages will raise real incomes, stimulate consumption, decrease income inequality and expand the tax base to help reduce deficits without raising tax rates. Trump’s plan is designed to rebuild American factories, the American economy, and support American workers.

The increase in investment in the U.S. also accelerates the U.S. lead in high technology including semiconductors, artificial intelligence, nanotechnology and quantum computing. China has kept pace in these fields by stealing intellectual property and providing massive government support. Now, the U.S. can pull away from China by importing some of that technology and relying on private investment along with government support.

Contemporary critics of tariffs (basically all mainstream economists) claim that these tariffs will invite retaliation by trading partners and may cause a replay of the collapse of world trade that did occur in the 1930s.

This flawed analysis ignores the initial conditions qualifications described above. China is in the opposite position of the U.S. It produces too much and does not consume enough. China’s best approach would be to lower its tariffs, encourage consumption by its citizens and attempt to strengthen its currency so that its consumers can afford more imported goods.

In fact, we expect China to do the opposite and hunker down in its neo-mercantilist approach by cheapening its currency and attempting to flood the world with more exports.

If China takes the latter approach, it will fail. That won’t be the fault of the United States, it will be China’s own failure. U.S. policy should not be designed to Make China Great Again. That’s China’s job.

U.S. policy is to Make American Great Again. That means high tariffs, lower taxes, more productive investment (including public investment) and high-paying jobs that will support consumption side-by-side with increased investment.

The global tariff and financial wars will feature countries stealing growth from their trading partners. There will be pain but also opportunity. Some sectors will do better than others as this chess match plays out.

https://cms.zerohedge.com/users/tyler-durden

Thu, 02/06/2025 - 12:45

https://www.zerohedge.com/geopolitical/trade-wars-bring-pain-and-opportunity

Treasury Targets Iran's Oil Network In New Sanctions As Trump Stuns By Talking Deal

Treasury Targets Iran's Oil Network In New Sanctions As Trump Stuns By Talking Deal

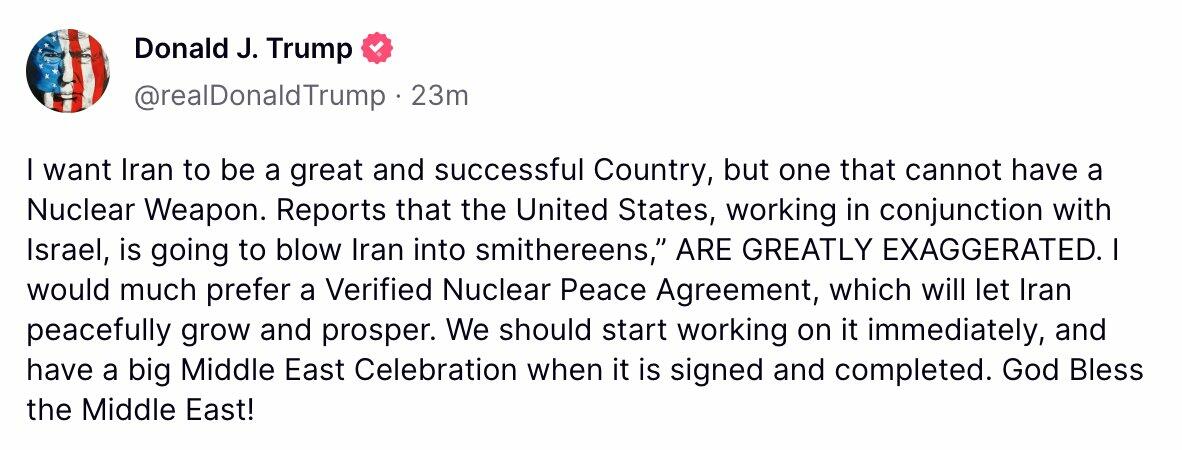

President Donald Trump has been notoriously hawkish on Iran, as have some of his top national security officials, which is why it was surprising and refreshing for his rhetoric to take a different track in Wednesday statements. Responding to reports that the US and Israel are preparing scenarios to attack Iran and its nuclear sites, Trump stated Wednesday that these reports are "greatly exaggerated" and said that making a deal would be preferable instead.

"I want Iran to be a great and successful Country, but one that cannot have a Nuclear Weapon," the president wrote on Truth Social. "I would much prefer a Verified Nuclear Peace Agreement, which will let Iran peacefully grow and prosper. We should start working on it immediately, and have a big Middle East Celebration when it is signed and completed. God Bless the Middle East!" Trump added.

?itok=HfJus66m

?itok=HfJus66m

During his first administration, Trump unilaterally pulled the United States out of the JCPOA nuclear deal with Iran in 2018, which had been implemented during the Obama administration, and involved the other P5+1 countries of China, France, Germany, Russia, the United Kingdom, as well as the European Union.

He also dropped a surprise bombshell upon signing the new executive order to reimpose "maximum pressure" on the Islamic Republic, though it's been woefully underreported in the media:

"There are many people at the top ranks of Iran that do not want to have a nuclear weapon," Trump said in the Oval Office.

Still, Trump claimed when he signed it that he was "unhappy" to do it - perhaps revealing it as leverage and part of his big stick approach which can induce a better deal down the road.

?itok=tACcCxG2

?itok=tACcCxG2

Iran and Mideast regional analyst Trita Parsi commented on how unexpected and significant these words are for a sitting https://responsiblestatecraft.org/trump-iran-executive-order/

:

I cannot recall any U.S. president ever deviating from the quasi-official American line that Tehran is dead set on getting nukes. U.S. officials rarely allow any nuance, or any shades of gray: Iranians always want a nuclear weapon and the only way to stop them from getting one is by preventing them from having access to the necessary material, know-how, or technology. If they have access, they will invariably build a bomb. It’s an unchallengeable certainty.

The 2007 National Intelligence Estimate on Iran caused a major controversy for simply https://www.nytimes.com/2007/12/04/washington/04itext.html

that Iran did not have an active nuclear weapons program, even though it also concluded “with moderate-to-high confidence that Tehran at a minimum is keeping open the option to develop nuclear weapons.”

That is: Iran still wanted a bomb but appeared to have temporarily paused its pursuit of one.

In the meantime, as of Thursday, maximum pressure has formally gone into effect as the US Treasury implements sanctions on the international Iranian oil transport network.

"This action is consistent with the President’s February 4 National Security Presidential Memorandum directing the Treasury Department and other U.S. government agencies to enact maximum economic pressure on Iran in order to deny all paths to a nuclear weapon and counter Iran’s malign influence," the fresh Treasuring notification said. It announced that this will deprive the country of hundreds of millions of dollars for its military machine.

Trump stuns...

In a rare break from Washington dogma, Trump said what no U.S. president has dared: Some top Iranian leaders do not want a nuclear weapon. A major shift in the narrative that has fueled decades of hawkish policy. https://twitter.com/hashtag/Iran?src=hash&ref_src=twsrc%5Etfw

— Responsible Statecraft (@RStatecraft) https://twitter.com/RStatecraft/status/1887297658655760693?ref_src=twsrc%5Etfw

Tehran is seeking to rally OPEC to its side after Trump threatened to take Iran's crudel exports https://www.reuters.com/business/energy/iran-says-us-sanctions-will-destabilise-oil-energy-markets-2025-02-05/

:

Iran's President Masoud Pezeshkian urged OPEC members to unite against possible U.S. sanctions on the major oil producer, after U.S. President Donald Trump said he would seek to drive Tehran's oil exports to zero.

Iranian crude oil exports currently stand at around 1.5 million barrels per day, with the majority going to China. The loss of such a volume, equal to about 1.4% of total world supply, would be significant for markets.

US Treasury Secretary Bessent further announced the US is aggressively targeting Iranian efforts to use oil revenues to bolster its nuclear program, develop ballistic missiles, and support its terror proxies. Will this serve to bring Tehran and the Trump administration to the negotiating table? It looks calculated to do so, at least.

https://cms.zerohedge.com/users/tyler-durden

Thu, 02/06/2025 - 11:45

Too Many Politico Subscriptions? There's An App For That

Too Many Politico Subscriptions? There's An App For That

The federal government has spent $44.2 million on subscriptions to political news site POLITICO since 2017. That includes dozens of Executive Branch agencies as well as offices in the House of Representatives.

There’s an app for people who’ve lost track of how many subscriptions. For government, though, that app is DOGE!

?itok=fa6Z6JGW

?itok=fa6Z6JGW

BY THE NUMBERS

The dollar figure includes $32.3 million in spending from inside the White House and $11.9 million from staffers in the House of Representatives.

Despite the online buzz, our auditors did not find any evidence of federal grants given to the news outlet. The only direct assistance the government has sent to Politico was a https://www.usaspending.gov/award/ASST_NON_EIDLGT%3A3300989183_7300

Covid-19 relief grant from 2020.

Virtually all of the payments are, in fact, subscription fees!

Donald Trump’s White House spent just over $1 million on Politico in 2017, his first year as president. By 2020 subscription payments had increased to $2.8 million.

Then, payments increased dramatically once Joe Biden took office. The White House spent $4.4 million on Politico subscriptions in 2021. Payments reached a high of $7.8 million in 2023 and totaled $7.4 million in 2024.

It seems no one in the federal bureaucracy thought to share their password with their colleagues in other agencies. Thirty-eight different federal agencies and subagencies have sent payments to Politico since 2017.

The Department of Health and Human Services spent more than twice as much as any other federal agency with $6.9 million since 2017. The Department of Energy and Department of the Interior also spent more than $3 million in the same time frame. The Agency for International Development spent $44,000.

One might expect that federal bureaucrats are leading experts on government policy and public affairs, more so than journalists at Politico. That may not be the case.

INSIDER INFO

The White House is paying to get behind an even fancier paywall – access to Politico Pro. It’s a service meant to teach the public about what is happening inside the White House, but staffers there have spent $16 million on it since 2017. Thirty-one different agencies and subagencies have also subscribed.

The subscription rate for the Pro version has reached nearly $3,000 per person: a $140,203 payment from HHS in 2024 yielded only 49 subscriptions.

“Whether you’re a lobbyist, executive, consultant, researcher, strategist, or analyst, POLITICO Pro has what you need to power successful policy—anywhere,” the service’s https://www.politicopro.com/

explains. “POLITICO Pro gives you the inside scoop on the public policy and players that matter most to you. Stay informed and ahead with to-the-point news and automatic tracking of government affairs and policy. Keep pace with the help of experts who act as an extension of your team. With this kind of elite access, you can be a leader in your policy arena.”

BOTTOM LINEThe public is broadly skeptical of national media outlets, distrustful of their reporting and presumes an ideological bent to their coverage. Like most major outlets, POLITICO has its fans and partisans.

But why should the public be on the hook to pay the subscription fee for operatives, staffers and bureacrats somewhere in Washington? We deal with enough paywalls in our own lives. Why are we propping up mainstream media outlets – private, for-profit businesses -- with our own tax dollars?

It looks like DOGE is already on the case, but it comes after the better part of a decade of subscription spending.

https://cms.zerohedge.com/users/tyler-durden

Thu, 02/06/2025 - 11:20

https://www.zerohedge.com/economics/too-many-politico-subscriptions-theres-app

Bessent-ing The Facts Of Life

Bessent-ing The Facts Of Life

By Michael Every of Rabobank

As the whirlwind of the US political, geopolitical, and geoeconomic (counter?) revolution plays out, it’s getting harder for even the most committed bean counter and econometricians to ignore.

Secretary of State Rubio will not be attending the upcoming G20 in South Africa to protest its policies. It remains to be seen if the G20 now joins the growing list of acronymic institutions that the US no longer has time for. If the latter, how long until we get to the holy of holies, the IMF? After all, is there any US strategic logic in supporting a multilateral institution whose neoliberal economic policies have been largely opposed to its own for the last eight years, and which will be even more counter to its stance for the next four?

The prospect of the US ‘owning’ Gaza has been floated, then sunk by all other parties, yet the US says this a starting point for new thinking, challenging others to come up with ideas that must, by design, shake things up. There’s not any oil involved here, but the key Suez Canal is very close, and the ‘if lines on maps can move --and peoples-- so can lines on screens’ and “This is America too” elements are worth noting for those who think about volatility and term premia.

President Trump is also again talking about a deal with Iran if it will drop its potentially accelerated efforts to build a nuclear bomb and work with the US. So far, the track record in flipping members of the Axis of Resistance to Team Trump is poor, and the threat of being “smashed to smithereens” is still out there, even if markets once again jumped on the ‘Trump is all about the deal, not dealing with things’ bandwagon.

Panama now allows the US Navy to use its Canal for free, may cancel the contracts of the Hong Kong firm operating the ports of Balboa and Cristobal at either end, and has agreed to “safeguard the canal” and “increase military collaboration” with the US. Guess which of the two will be sending more collaborating forces to the other? Defence Secretary Hegseth also stressed the US commitment to its mutual defence pact with the Philippines and offered increased defence aid to it - which will not please China.

Major US tech firms with one foot in the US and the other in China seem on the shakiest of ground; that’s as the US postal service has reinstated parcel service from China and Hong Kong after briefly suspending it, a warning to those assuming goods must flow.

Of course, there are also tariffs, which bean counters and econometricians understand ‘best’. As one headline has it, ‘https://public-eur.mkt.dynamics.com/api/orgs/285245b1-7c6f-ef11-a66d-000d3a4b6c6a/r/K1geTFnCtUiHk2nIvtmF7AAAAAA?target=%7B%22TargetUrl%22%3A%22https%253A%252F%252Fwww.msn.com%252Fen-us%252Fmoney%252Fmarkets%252Fchicago-fed-s-goolsbee-shifts-from-dove-to-hawk-says-tariffs-impact-on-inflation-might-be-much-larger-this-time%252Far-AA1yufqE%253Focid%253DBingNewsSerp%22%2C%22RedirectOptions%22%3A%7B%225%22%3Anull%2C%221%22%3Anull%2C%222%22%3A%7B%22utm_medium%22%3A%22email%22%2C%22utm_term%22%3A%22N%2FA%22%2C%22utm_source%22%3A%22dynamics-rr%22%2C%22utm_campaign%22%3A%221%22%7D%7D%7D&digest=faIt2UZu7hN9rX%2FdwFpkOFc26ucrfZ6ZnN5xAF%2BuKRo%3D&secretVersion=7c13c22c20aa46a1b2fc8b71fde4d19a

’

Meanwhile, Treasury Secretary Bessent says US tariffs will be back (not just vs Canada, Mexico, and China): the long game globally is “to squeeze trading partners now to create a self-sufficient industrial base later.” ‘Goolsbees’ will have to get buzzy with that in their modelling from now on, as will market observers bravely saying, “Trump is a trade paper tiger.” Indeed, India is already sending out signals that https://public-eur.mkt.dynamics.com/api/orgs/285245b1-7c6f-ef11-a66d-000d3a4b6c6a/r/K1geTFnCtUiHk2nIvtmF7AEAAAA?target=%7B%22TargetUrl%22%3A%22https%253A%252F%252Fwww.bloomberg.com%252Fopinion%252Farticles%252F2025-02-05%252Ftrade-war-india-cheered-trump-s-return-now-it-s-scared%22%2C%22RedirectOptions%22%3A%7B%225%22%3Anull%2C%221%22%3Anull%2C%222%22%3A%7B%22utm_medium%22%3A%22email%22%2C%22utm_term%22%3A%22N%2FA%22%2C%22utm_source%22%3A%22dynamics-rr%22%2C%22utm_campaign%22%3A%221%22%7D%7D%7D&digest=IzZijt4zKuiaEC1pWFvf9vTg%2BpXCCZKCS91qNEGRTHE%3D&secretVersion=7c13c22c20aa46a1b2fc8b71fde4d19a

, happy to yield that metaphorical crown in the hope of some upcoming noblesse oblige on trade from the White House – an outcome which may depend on geopolitics as much as comparative advantage.

Bessent then ‘clarified’ that President Trump is not leaning on the Fed to lower rates – he would just like to see them lowered. See the difference? More importantly, the key focus is not Fed Funds but the US 10-year yield. So, Treasury ‘focus’, not an official target. See the difference?

Notably, Bessent thinks 10-year yields can decline as a result of his “3, 3, 3” economic policy targets – 3% real GDP growth, a 3% fiscal deficit, and a 3m barrels per day (bpd) increase in oil production. Yet they are not going to be possible without economic statecraft. To join the dots for you here:

A 3% fiscal deficit might see some inroads made by DOGE’s ferreting efforts and the 1% voluntary shrinkage in the federal civil service already achieved, but with permanent tax cuts also lobbied for by Bessent --and a 15% corporate tax rate by the president-- it would need a lot of new revenue from tariffs, which he also floated;

A 3% rate of real GDP growth needs help from the Fed and the long end of the curve, which won’t do so voluntarily while they worry about tariff inflation;

The 3m bpd US oil equivalent increase won’t happen via market forces, even if https://public-eur.mkt.dynamics.com/api/orgs/285245b1-7c6f-ef11-a66d-000d3a4b6c6a/r/K1geTFnCtUiHk2nIvtmF7AIAAAA?target=%7B%22TargetUrl%22%3A%22https%253A%252F%252Fwww.reuters.com%252Fbusiness%252Fenergy%252Fus-energy-secretary-derides-net-zero-policies-new-order-2025-02-06%252F%22%2C%22RedirectOptions%22%3A%7B%225%22%3Anull%2C%221%22%3Anull%2C%222%22%3A%7B%22utm_medium%22%3A%22email%22%2C%22utm_term%22%3A%22N%2FA%22%2C%22utm_source%22%3A%22dynamics-rr%22%2C%22utm_campaign%22%3A%221%22%7D%7D%7D&digest=RtFMXCMFEjMa55npbHQ4bg3rg84CXiY%2FPF%2BtYgWpYNw%3D&secretVersion=7c13c22c20aa46a1b2fc8b71fde4d19a

just announced "Net-zero policies raise energy costs for American families and businesses, threaten the reliability of our energy system, and undermine our energy and national security… the Department's goal will be to unleash the great abundance of American energy required to power modern life and to achieve a durable state of American energy dominance." While our energy analyst Joe DeLaura expects oil prices to drift lower, to get cheap oil the US may have to use the Defence Production Act to force firms to “Drill, baby, drill”; or subsidies – paid for by tariffs(?); or get help from Venezuela --not in the US camp-- or Iran --under “maximum pressure”-- or Saudi Arabia, who at current oil prices already can’t afford their megaprojects like the first (and last?) linear city, Neom.

One perhaps starts to see how the Middle East, and the Americas and the US Monroe Doctrine, and White House economic, political, and even military statecraft are all in the complex mix here. Or perhaps once doesn’t and just counts beans. But it’s all going to play out anyway.

On which note, gold continues to flood out of the Bank of England’s vaults, as the French government survived a no-confidence vote, avoiding chaos. https://public-eur.mkt.dynamics.com/api/orgs/285245b1-7c6f-ef11-a66d-000d3a4b6c6a/r/K1geTFnCtUiHk2nIvtmF7AMAAAA?target=%7B%22TargetUrl%22%3A%22https%253A%252F%252Fwww.politico.eu%252Farticle%252Fchinas-online-shopping-boom-gets-eu-crackdown%252F%22%2C%22RedirectOptions%22%3A%7B%225%22%3Anull%2C%221%22%3Anull%2C%222%22%3A%7B%22utm_medium%22%3A%22email%22%2C%22utm_term%22%3A%22N%2FA%22%2C%22utm_source%22%3A%22dynamics-rr%22%2C%22utm_campaign%22%3A%221%22%7D%7D%7D&digest=kPk1rmm8mFlYWc1pJBpSOBprcALbN3wwzhjKILzaYMU%3D&secretVersion=7c13c22c20aa46a1b2fc8b71fde4d19a

’ underlines that in key respects Europe is centuries behind the US, which doesn’t help with its statecraft, and hence its economic policy targets or competitiveness compasses, in any shape or form.

Elsewhere, the BOJ’s Tamura today, the bank’s most hawkish member, suggested there could be two or more 25bps rate hikes in the fiscal year starting in April, and that the BOJ’s key rate should be back at 1% by H2 2025. Obviously, this pushed JPY higher.

It will be interesting to see if/how Washington, D.C. and Tokyo, and the BOJ and the Fed, can coordinate not just their monetary policies but their statecraft together going forwards. Markets will need to know the same if even they don’t focus on that bigger picture.

The same is of course also true for D.C. and London and Mexico City, and the Fed and the BOE and the Bank of Mexico, both of which meet on rates today.

There are lots of uncomfortable thoughts in all this for some: but I am just Bessent-ing the facts of life.

https://cms.zerohedge.com/users/tyler-durden

Thu, 02/06/2025 - 10:40

Judge Blocks Trump's Order To Transfer Men Who Identify As Women To Male Prisons

Judge Blocks Trump's Order To Transfer Men Who Identify As Women To Male Prisons

A judge this week temporarily blocked President Donald Trump’s executive order, which mandated that transgender inmates who identify as women be housed in male prisons and that the government cease funding their access to hormone therapy.

?itok=SI2dBYQc

?itok=SI2dBYQc

U.S. District Judge Royce Lamberth in Washington granted the temporary restraining order at the request of three anonymous transgender inmates who filed a https://storage.courtlistener.com/recap/gov.uscourts.dcd.276959/gov.uscourts.dcd.276959.1.0_1.pdf

.

Lamberth found the three would likely succeed in arguing the order violates the Eighth Amendment’s protections against cruel and unusual punishment.

titled “Defending Women from Gender Ideology Extremism and Restoring Biological Truth to the Federal Government,” requires the attorney general and the Homeland Security secretary to ensure that “males are not detained in women’s prisons or housed in women’s detention centers.”

The order states that the attorney general must ensure the Bureau of Prisons (BOP) revises its medical care policies so that federal funds aren’t spent on “any medical procedure, treatment, or drug for the purpose of conforming an inmate’s appearance to that of the opposite sex.” It also states that it is the policy of the United States to recognize two sexes only: male and female.

“These sexes are not changeable and are grounded in fundamental and incontrovertible reality,” the order states.

Lamberth said that the plaintiffs in the Washington case presented evidence, including various government reports and regulations, recognizing that transgender inmates are at “a significantly elevated risk of physical and sexual violence relative to other inmates” when housed in a facility corresponding to their biological sex, the judge wrote in his https://storage.courtlistener.com/recap/gov.uscourts.dcd.276959/gov.uscourts.dcd.276959.23.0.pdf

.

The plaintiffs also claim that being in a male prison alone will exacerbate the symptoms of their gender dysphoria.

The inmates also presented evidence from a physician explaining that having no access to medications to treat gender dysphoria could cause “numerous and severe symptoms,” Lamberth wrote.

“It is, of course, possible that further briefing of the constitutional issues at the center of this dispute, or factual discovery, will eventually yield a different outcome,” Lamberth concluded.

“But the plaintiffs, through their largely undisputed factual allegations and proffered affidavits, have met their burden to show a likelihood of success on the merits.”

Lamberth declined to reach a verdict regarding the inmates’ other arguments that the order violates the Administrative Procedure Act and the Constitution’s equal protection guarantee.

The Department of Justice (DOJ) has defended the order by arguing that it has broad authority to make decisions regarding the placement of inmates and an interest in protecting inmates’ privacy and security.

Lamberth dismissed that claim, however, writing in his order that public interest in seeing the plaintiffs relocated immediately to male facilities is “slight at best.”

?itok=3knMOQdE

?itok=3knMOQdE

President Donald Trump signs executive orders in the Oval Office of the White House on Jan. 20, 2025. Anna Moneymaker/Getty Images

Lamberth’s order comes after a federal judge in Boston last week https://www.theepochtimes.com/us/judge-blocks-transfer-of-man-who-identifies-as-woman-to-mens-prison-5802030

from transferring a biologically male inmate who identifies as a woman to a men’s facility. In that case, the ruling only applied to the specific inmate who had challenged Trump’s executive order.

In contrast, Tuesday’s ruling in Washington applies to all 16 transgender inmates identifying as women currently housed in federal women’s prisons.

About 2,230 transgender inmates are housed in federal custodial facilities and halfway houses across the United States, according to the DOJ. About two-thirds of them, 1,506, are biological males who identify as females; the majority of whom are housed in men’s prisons.

The Epoch Times has contacted the DOJ and the Bureau of Prisons for comment.

https://cms.zerohedge.com/users/tyler-durden

Thu, 02/06/2025 - 10:05

Roblox Shares Plunge On Active Users Miss As Growth Scare Emerges

Roblox Shares Plunge On Active Users Miss As Growth Scare Emerges

Roblox Corporation reported daily active user data that fell short of analyst estimates tracked by Bloomberg, raising concerns over the platform's growth trajectory and sending shares crashing in premarket trading.

The number of daily active users on Roblox increased to 85.3 million in the fourth quarter, missing the Bloomberg Consensus estimate of 88.39 million. Bookings during the quarter slightly missed $1.36 billion versus the $1.37 billion estimate.

?itok=RoabFJuI

?itok=RoabFJuI

Here's a snapshot of the fourth quarter earnings (courtesy of Bloomberg):

Daily active users 85.3 million, estimate 88.39 million (Bloomberg Consensus)

Hours engaged 73.5 billion, estimate 19.42 billion

Bookings $1.36 billion, estimate $1.37 billion

Revenue $988.2 million, estimate $967.2 million

Loss per share 33c

Free cash flow $120.6 million, estimate $120.8 million

Cash and cash equivalents $711.7 million, estimate $672.3 million

Roblox provided a lackluster outlook for the first quarter and full year, as growth in the online video game platform appears to be slowing. Meanwhile, the video game industry has been in a downturn.

First quarter forecast:

Sees bookings $1.13 billion to $1.15 billion, estimate $1.1 billion

Sees revenue $990 million to $1.02 billion, estimate $981.3 million

Sees consolidated net loss $267 million to $287 million, estimate loss $271.2 million

Full-year forecast:

Sees bookings $5.20 billion to $5.30 billion, estimate $5.1 billion

Sees revenue $4.25 billion to $4.35 billion, estimate $4.36 billion

Sees consolidated net loss $995 million to $1.07 billion, estimate loss $972.3 million

Sees adjusted Ebitda $190 million to $265 million, estimate $1.03 billion

Roblox shares in New York crashed 18% in premarket trading.

?itok=meBbIZNl

?itok=meBbIZNl

Outgoing CFO Michael Guthrie told Reuters that Roblox's outlook suggests a third consecutive year of 20% booking growth, even as competitor platforms experience slowdowns.

"We're growing at a substantial premium to the overall gaming market. Right now, gaming is barely growing as a category," Guthrie said.

Guthrie attributed the weaker growth to very tough year-over-year comparisons, noting that Roblox's launch on Sony's PlayStation consoles in 2023 sent new sign-ups higher. He added that the platform's suspension in Turkey over safety and child protection concerns hampered growth.

Short sellers have made claims the platform aimed at kids hasn't done enough to https://www.zerohedge.com/markets/pedophile-hellscape-roblox-shares-tank-after-hindenburg-alleges-inflated-metrics-rampant

.

Meanwhile, a note from research firm Newzoo showed that the US video game industry is in slug mode, having only grown by 2.1% in 2024.

Last month, video gaming analyst Matthew Ball of Epyllion pointed out how the gaming industry has been in a https://www.zerohedge.com/technology/grand-theft-auto-6-priced-100-gaming-analyst-believes-so

developers and publishers, but new "hopes" center around Rockstar Games' guaranteed mega-hit Grand Theft Auto 6 release this fall that "could re-establish packed video game prices after decades of deflation despite rampant cost growth."

https://cms.zerohedge.com/users/tyler-durden

Thu, 02/06/2025 - 09:45

https://www.zerohedge.com/technology/roblox-shares-plunge-active-users-miss-growth-scare-emerges

Pound Tumbles After Bank of England Cuts Rates While Warning Of Mounting Stagflation; Two Officials Vote For Bigger Cut

Pound Tumbles After Bank of England Cuts Rates While Warning Of Mounting Stagflation; Two Officials Vote For Bigger Cut

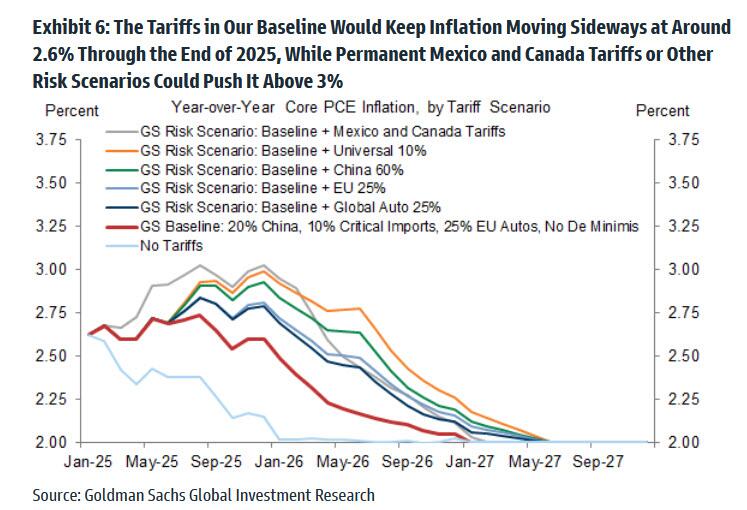

While the Fed engages in navel-gazing how much Trump's tariffs will raise inflation by, and according to Goldman the answer is by a https://www.zerohedge.com/markets/what-happens-next-trade-war-goldmans-deep-dive-trumps-tariffs

(from 2.1% in the absence of tariffs)...

?itok=wNux7EaE

?itok=wNux7EaE

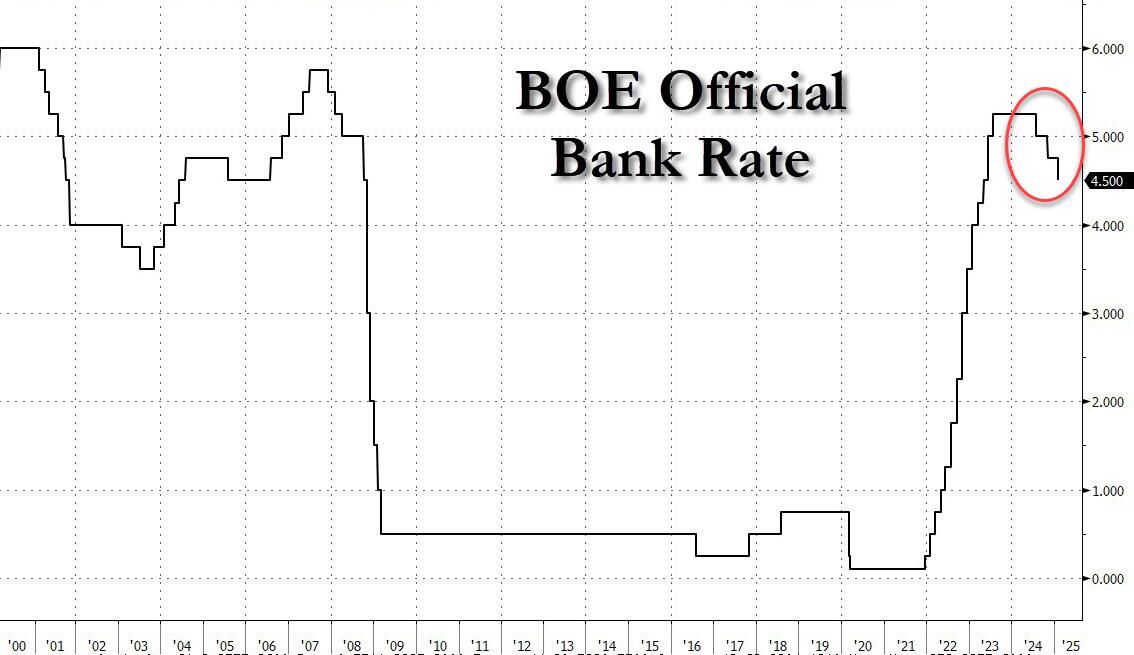

... the rest of the world continues to quietly stimulate its economies by injecting more reflationary liquidity into the system, and this morning the Bank of England was the latest to do so when it not only cut rates for the third consecutive time by 0.25% to a 19-month low of 4.5%, as expected...

?itok=wUlRIaYc

?itok=wUlRIaYc

... but in a surprise to the market, two of the nine MPC members voted for a bigger, 50bps rate cut, which in turn prompted markets to boost bets on more easing ignoring the BOE's own phrasing.

The Monetary Policy Committee voted by a majority of 7-2 to reduce https://twitter.com/hashtag/BankRate?src=hash&ref_src=twsrc%5Etfw

to 4.5%.

Find out more in our https://twitter.com/hashtag/MonetaryPolicyReport?src=hash&ref_src=twsrc%5Etfw

— Bank of England (@bankofengland) https://twitter.com/bankofengland/status/1887471598224974292?ref_src=twsrc%5Etfw

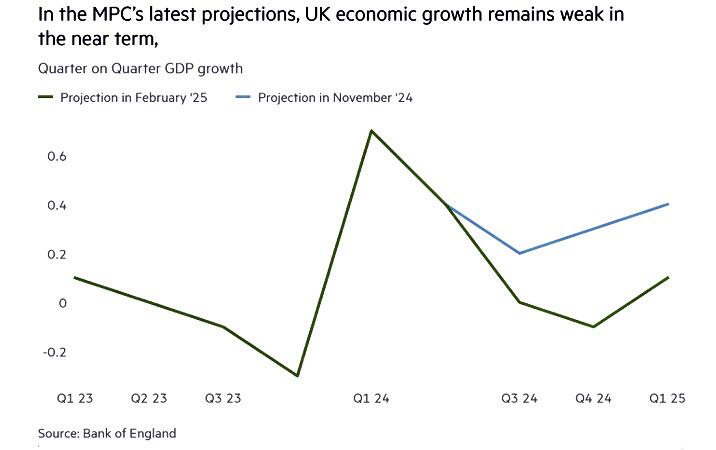

There was another twist: in a blow to UK chancellor Rachel Reeves, the BoE slashed its growth forecast saying it now expected the economy to grow by only 0.75% this year, half its November forecast of 1.5% which, would at least justify the rate cut...

?itok=LfBAnOrB

?itok=LfBAnOrB

... but the BOE also upgraded its inflation forecast, which now peaks at 3.7% because of higher energy prices, and up from the prior projection of 2.8%. In other words, the UK is now in a stagflationary trap, yet in a world where no more pain can be tolerated the central bank's obvious reaction was to cut rates more.

The bank’s outlook is a bleak backdrop for Reeves, who has presided over a collapse in growth since Labour won the general election last July. The BOE believes the economy contracted 0.1% in the three months to December, the quarter that included Reeves’ tax-raising budget on Oct. 30, and will grow just 0.1% in the first quarter of 2025.

The growth forecast for this year has been halved to 0.75% but picks up to 1.5% in 2026 and 2027, from the prior projection of 1.25% in both years. The bank said its forecast is “not conditional on any change in global tariffs” but that a trade war could depress UK growth by “delaying investment spending and hiring decisions.”

Amid this cacaphony of swirling outlooks, it is no surprise that the MPC signaled a “gradual and careful approach” to future rate cuts, warning of uncertainty due to, what else, Trump tariffs and suggesting in their forecasts that only two more reductions were needed to bring inflation back to the 2% target.

The addition of the word “careful” to the bank’s core guidance for future easing reflected questions about the global economy, according to Bailey. “We live in an uncertain world, and the road ahead will have bumps,” he said.

“Some domestic inflationary pressures remain and may have eased a little more slowly than we expected last year,” Bailey told reporters after the decision. “And that reaffirms the importance of taking a gradual approach to the withdrawal of monetary policy restrictiveness.”

Despite Bailey's cautious languages, traders focused on the calls from two policymakers for a sharper reduction, adding to bets on future interest-rate cuts. Money markets are now favoring three more 25-basis-point reductions this year.

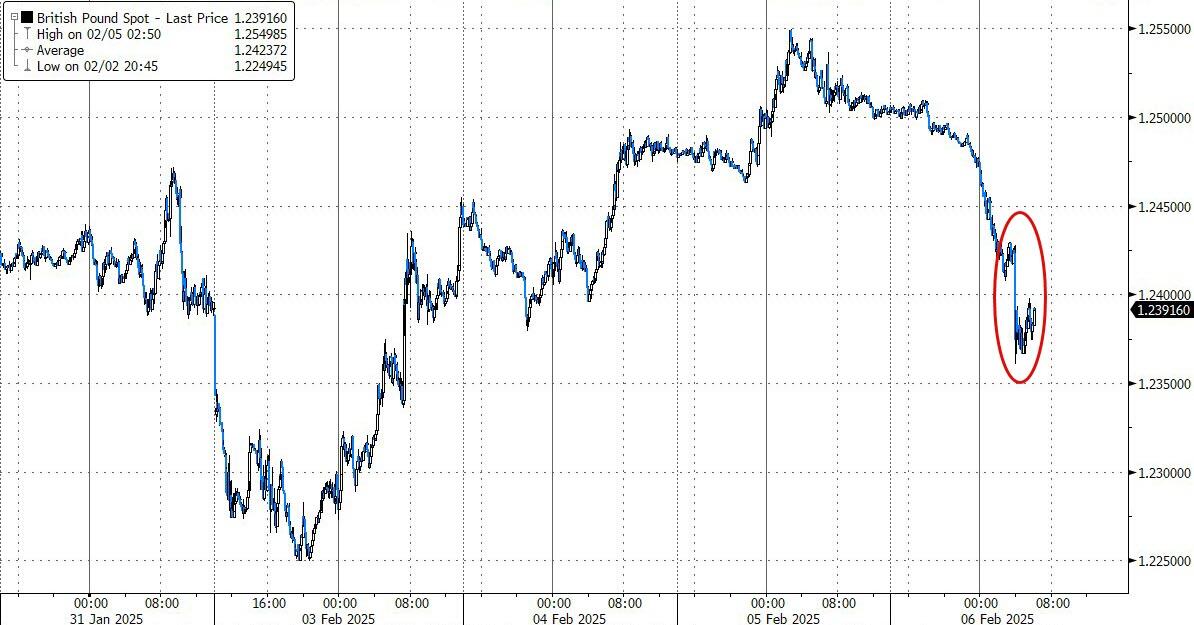

That hurt the pound, which extended declines versus the dollar dropping as much as 1.2% to $1.2361. It was the worst-performer among major currencies on Thursday. Two-year gilt yields fell as much as seven basis to 4.07%.

?itok=rO-UlOnK

?itok=rO-UlOnK

In response to the rate cut, Matthew Landon, strategist at JP Morgan Private Bank said that "at the margin, we interpret this is a green light for the market to price a lower terminal rate." He added that "today’s cut from the Bank of England was broadly expected, though the accompanying statement contained some mixed signals.”

The MPC’s decision to reduce its rate to the lowest level since June 2023 represents a reprieve for the more-than-half-a-million homeowners coming off five-year fixed mortgage deals this year. Reeves called the decision “welcome news,” but expressed disappointment with the broader outlook provided by the bank saying she was “still not satisfied with the growth rate.”

Rob Wood, chief UK economist for Pantheon Macroeconomics, said he placed “more weight” on the bank’s hawkish inflation forecasts, a relatively strong pay settlements survey and its overall guidance “than the votes of two outliers.”

Bailey seemed to support that view in remarks to reporters after the decision: “I would not overinterpret any other moves in voting patterns,” he said, adding that “it’s important that the view on the future path of interest rates is based on the economic fundamentals.”

Also behind the change was a downgrade to the bank’s estimate of UK growth capacity, which makes faster growth inflationary. It halved its estimate to 0.75% this year but expects potential growth to return to 1.5% from 2026. The bank blamed the downgrade on persistently weak productivity and suggested Labour’s increased spending on the National Health Service may make the position worse.

There were no material changes to the bank’s forecasts following Reeves’ recently announced plans to boost growth by relaxing regulations and waving through infrastructure projects.

“It is hard to see the Bank of England materially stepping up its pace of easing until it sees how the increase in National Insurance is digested by the economy in the spring,” said Luke Bartholomew, deputy chief Economist at Abrdn. “However, the Bank’s signals today suggest there is scope for several more rate cuts this year, given the weak growth outlook, and we continue to see rates below 3% over the next two years.”

https://cms.zerohedge.com/users/tyler-durden

Thu, 02/06/2025 - 09:15

Initial Jobless Claims Tick Higher Off Multi-Decade Lows

Initial Jobless Claims Tick Higher Off Multi-Decade Lows

Initial jobless claims rose very marginally off near multi-decade lows last week (from 208k to 219k) and slightly higher than the 213k expected...

?itok=Yya860cF

?itok=Yya860cF

Source: Bloomberg

Continuing claims continue to oscillate around 1.9 million Americans (decoupling from initial claims stronger trend)...

?itok=xY9LnEJm

?itok=xY9LnEJm

Source: Bloomberg

Finally, we can't but notice this jobless claims data series seems decoupled from various other labor market realities still... such as The Conference Board's Jobs-Plentiful/Hard-to-Get series...

?itok=GpRQcwQc

?itok=GpRQcwQc

Source: Bloomberg

So, strong ADP, strong jobless claims, weak JOLTS, weak Conf Board... tomorrow's NFP is anyone's guess still!

https://cms.zerohedge.com/users/tyler-durden

Thu, 02/06/2025 - 08:35

https://www.zerohedge.com/markets/initial-jobless-claims-tick-higher-multi-decade-lows

Futures Fluctuate Amid Disappointing Earnings As Dollar, Yields Rise

Futures Fluctuate Amid Disappointing Earnings As Dollar, Yields Rise

US equity futures are slightly higher despite heavyweights such as including Ford and Qualcomm slumping in premarket trading after disappointing earnings while tech underperformed on mixed Mag7/Semis pre-mkt price action. As of 8:15am, S&P 500 futures were little changed after erasing an early gain fueled by Treasury Secretary Scott Bessent’s comment that the Trump administration is focusing on bringing down the Treasury 10-year yield. Contracts on the Nasdaq 100 were unchanged. Bond yields and the USD finally reverse recent losses and rise this morning while commodities are stronger across all of Ags, Energy, and Metals ex-Precious. Scott Bessent said that the Administration is focused on lowering the 10Y yield rather than the Fed Funds rates; the best way to decrease yields is through a lower budget deficit. In other news, HON is splitting into 3 companies. Today’s macro focus is on Jobless data and the BOE decision. The Fed speaker slate includes Waller (2:30pm) and Logan (5:10pm), and we get earnings from Amazon after the close.

?itok=RzKHgKRh

?itok=RzKHgKRh

In premarket trading, Qualcomm, the world’s biggest seller of smartphone processors, fell more than 5% on investor concern that demand for the devices will cool. Ford also tumbled more than 6% after warning that US tariffs would weigh on US carmakers’ profits. Skyworks Solutions, a chip supplier to Apple Inc., plunged more than 20% after saying competition in the industry is intensifying. Apple shares also retreated. Meanwhile, Honeywell International Inc. slid more than 5% after saying it will split into separate publicly traded companies following pressure from an activist investor. here are all the notable premarket movers:

Apple (AAPL) edges 0.5% lower after disappointing updates and smartphone commentary from two of its key suppliers, including Qualcomm and Skyworks.

Arm Holdings (ARM) slips 3% after the chip-design company provided a tepid outlook, underlining concerns about the pace of spending on AI.

Bausch + Lomb Corp. (BHC) declines 4% after the eye-health company said it won’t go private at this time.

Bristol Myers Squibb Co. (BMY) slips 3% after releasing sales and profit forecasts for 2025 below Wall Street’s expectations — a sign the company’s return to growth may take longer than anticipated.

Chinese stocks listed in the US are broadly higher as analysts say Beijing’s retaliatation to Donald Trump’s tariffs is relatively measured and appears to be aimed at increasing its bargaining power at trade talks. Alibaba (BABA) +1.5%, Nio (NIO) +1%, PDD (PDD) +1%

Coherent (COHR) rises 13% after the semiconductor device company reported results and guidance ahead of expectations.

FormFactor (FORM) a provider of test and measurement equipment designed for chipmakers, drops 25% after providing a 1Q profit forecast that’s well short of estimates.

Impinj (PI) sinks 21% after forecasting first quarter revenue that trailed the average analyst estimate.

Molina (MOH) falls 5% after the managed-care company reported quarterly adjusted earnings per share that fell below Wall Street expectations.

Peloton Interactive Inc. (PTON) rises 13% after reporting that cost cuts have bolstered profit more than anticipated, even as its revenue continues to shrink.

Qualcomm (QCOM) falls 4% amid investor concerns that demand for new smartphones will cool in 2025. Analysts, however, note that the results for the first quarter were positive.

Salesforce (CRM) slips 1% after the software company announced management changes. It created a new role naming its lead board director, Robin Washington, as president and chief operating and financial officer (COFO), effective March 21.

Skyworks Solutions (SWKS) plunges 30% after the semiconductor device company reported its first-quarter results and outlook.

Symbotic (SYM) slides 17% after the factory automation technology company gave guidance that missed the average analyst estimate.

Tapestry Inc. (TPR) rises 14% after the company raised its guidance again for the year on stronger-than-expected sales at its biggest brand Coach.

Tesla (TSLA) is set to extend losses, falling 1.6%, after sales plummeted 59% last month in Germany, adding to indications that Elon Musk’s political activities are hurting the carmaker’s business in major EV markets.

TTM Tech (TTMI) rises 17% after first-quarter forecasts for adjusted EPS and revenue topped the average analyst estimates at the midpoints.

Under Armour (UAA) climbs 9% after the company raised its annual profit guidance, signaling that its turnaround strategy is working.

Yum! Brands (YUM) rises about 2% as sales surpassed expectations, powered by growth at Taco Bell as the fast-food chain continues to sidestep a slowdown that has plagued many competitors.

In an interview on Fox Business, Bessent said that when it comes to the Federal Reserve, “I will only talk about what they’ve done, not what I think they should do from now on.” He repeated his view that expanding energy supply will help lower inflation. But some investors said 10-year yields are unlikely to go much lower while sticky prices and a resilient economy damp expectations of further Fed policy easing.

The 10-year Treasury yield ticked about two basis points higher on Thursday, though it’s still close to a one-month low. “It is difficult to see the 10-year yield come down a lot unless the economy slows significantly,“ said David Zahn, a senior vice president at Franklin Templeton Investment Management. “If that happens, which isn’t what they want, then I can see 10-year yields going lower.”

While there was some news relief out of the White House, which did not make any major announcements overnight, more earnings are expected today, with Amazon.com Inc. due to release results after the close. US data on jobless claims will also on traders’ radar today, with the payrolls report due tomorrow.

Europe’s Stoxx 600 benchmark rose 0.8% to an intraday record after another batch of solid corporate updates from the region. Health care and banks are among the best performing sectors after strong results from AstraZeneca and Societe Generale. A. P. Moller-Maersk A/S surged almost 9% after announcing a $2 billion buyback. Miners are leading gains as iron ore prices climb over 2%. UK stocks outperformed and the pound fell after the Bank of England cut interest rates, as expected, and traders added to bets on further easing. In economic news, German factory orders surged in December, adding to evidence that the outlook for the beleaguered sector may be improving. Here are the most notable European movers:

European miners rise after positive earnings from companies including Anglo American, Boliden and ArcelorMittal. Prices for iron ore and base metals also climbed on expectations of a Chinese demand recovery following Lunar New Year holidays

Societe Generale shares jumped as much as 10% after the French lender reported what analysts say are good results that help confirm the recovery in French retail banking

AstraZeneca shares rose as much as 5.6%, the most since April, after the drugmaker reported better-than-expected core EPS and revenue for the fourth quarter, and provided guidance for 2025

Siemens Healthineers shares jumped as much as 7.7%, to the highest since March 2022, after the German medical technology company reported better-than-expected earnings and revenue for the first quarter

ArcelorMittal shares rose as much 6.7%, to the highest intraday since April, after the world’s biggest steelmaker outside China reported Ebitda for the fourth quarter that beat the average analyst estimate

Maersk shares gained as much as 11%, the most since March 2020, after the Danish shipping giant’s fourth-quarter results beat estimates. The announcement of a buyback program worth as much as $2 billion is positive, Barclays said

Orsted shares gained as much as 7.9%, the most since October, after the Danish offshore wind giant cut its investment plans by 25%

ING Groep NV declined as much as 4.2% after the lender missed 4Q profit estimates on higher costs, while net interest income declined 5% from a year earlier as lower policy rates weighed

Soitec shares slumped as much as 32%, to the lowest since March 2020, after the wafer maker reduced its outlook for fiscal 2025 and said growth for fiscal 2026 will be “quite limited”

IMI shares dropped as much as 2.7% after the engineering company said it is currently responding to a cyber security incident involving unauthorized access to the company’s systems

Kering shares fell as much as 3.8% after the luxury-goods maker said it’s ending its collaboration with Sabato de Sarno, the creative director of its Gucci label

Earlier in the session, Asian equities rose, on track for a third day of gains, boosted by technology shares as a sense of calm returned after gyrations earlier in the week on global trade tensions. The MSCI Asia Pacific Index advanced as much as 0.4% Thursday to the highest since December 17. Tech firms TSMC and Samsung Electronics were among the top contributors after their customer Nvidia jumped 5% on positive news for its new Blackwell chip. BYD also led the region higher after Cailianshe reported the Chinese carmaker will hold an event Monday to introduce its smart-driving strategy. Chinese equities rebounded from Wednesday’s losses on tariff concerns. Tech shares tied to AI and robotics climbed amid continued optimism on industry developments, even as e-commerce stocks remained weak on concerns over regulations for shipments to the US.

In FX, the Bloomberg Dollar Spot Index rises 0.3% and the Japanese yen is flat having pared an earlier advance seen after BOJ board member Naoki Tamura flagged the need for two or more interest rate hikes by early next year.

In rates, treasuries are slightly cheaper on the day into early US session, having pared small declines amid UK bond rally. Gilts outperform after Bank of England cut rates by 25bp to 4.5% in a 7-2 vote, with dissenters favoring a half-point cut. US session includes weekly jobless claims data at 8:30am New York time. US yields are as much as 2bp higher across maturities, with curve spreads mostly holding Wednesday’s dramatic flattening move; 10-year around 4.44% is ~2bp cheaper on the day, trailing bunds and gilts in the sector by 1bp and 4bp. Gilts shook off early weakness to outperform their US and German peers, most notably at the short-end of the curve ahead of the Bank of England decision. UK two-year yields fall ~3 bps to 4.12%. The pound is also the weakest of the G-10 currencies, falling 0.7% against the greenback having extended the lows after UK construction PMI came in notably below estimates. US and German borrowing costs are slightly higher on the day.

In commodities, WTI rises 1% to $71.70 a barrel. Spot gold falls $6 to around $2,860/oz. Bitcoin climbs 2% to near $99,000.

Looking to the day ahead now, one of the main highlights was the Bank of England’s policy decision where the central bank cut rates by 25bps as expected and left space for more rate cuts, sending the pound tumbling. Central bank speakers will include BoE Governor Bailey, BoC Governor Macklem, the ECB’s Nagel and Escriva, and the Fed’s Waller and Logan. Otherwise, data releases include the weekly initial jobless claims from the US, Euro Area retail sales for December and German factory orders for December. Finally, earnings releases include Amazon.

Market Snapshot

S&P 500 futures up 0.2% to 6,101.50

MXAP up 0.2% to 184.67

MXAPJ up 0.5% to 579.21

Nikkei up 0.6% to 39,066.53

Topix up 0.2% to 2,752.20

Hang Seng Index up 1.4% to 20,891.62

Shanghai Composite up 1.3% to 3,270.66

Sensex down 0.3% to 78,050.59

Australia S&P/ASX 200 up 1.2% to 8,520.71

Kospi up 1.1% to 2,536.75

STOXX Europe 600 up 0.8% to 542.63

German 10Y yield little changed at 2.39%

Euro down 0.4% to $1.0363

Brent Futures up 0.6% to $75.04/bbl

Gold spot down 0.3% to $2,857.93

US Dollar Index up 0.38% to 107.99

Top Overnight News

Treasury Secretary Scott Bessent told Fox Business that the Trump administration wants to make the 2017 tax cut permanent, and added that Trump wants lower interest rates and is focused on the 10-year treasury yield. Furthermore, he said Trump is not calling for the Fed to lower interest rates and interest rates will take care of themselves if they get energy costs down and deregulate economy. He gave no indication he was in favor of direct intervention. BBG

US government vessels will now be able to transit the Panama Canal without charge fees, according to the State Department, which added it’ll save “millions of dollars a year.” BBG

The Trump administration’s offer to buy out federal employees is said to have attracted over 40,000 sign-ups, about 2% of the workforce. It expects more applications by the end of the day deadline. BBG

US lawmakers are reportedly pushing to ban Chinese AI start-up's DeepSeek app from US government devices over security concerns, according to WSJ sources.

US President Trump's USTR nominee Greer says US needs an active and pragmatic trade policy to foster growth; resilient supply chains are critical; US needs robust manufacturing base.

Honeywell International is preparing to split into three independent companies, marking the end of an era for one of America’s last big industrial conglomerates. Honeywell announced Thursday plans to separate its aerospace division from its automation business and move ahead with plans to spin off its advanced-materials arm. WSJ

Fed's Jefferson (voter) said they need to look at the totality of the net effect of the Trump administration's influence on policy goals and he is happy to keep policy at the current level of restrictiveness until there is a better sense of the totality of impacts. Jefferson also stated that even with a 100bps decline, the Fed's rate is still restrictive, which allows the Fed to be patient and wait to see the net effect of policy changes.

Fed released 2025 stress test scenarios which include heightened stress in commercial and residential real estate, as well as corporate debt markets.

Treasury Secretary Bessent said the Trump administration wants to make the 2017 tax cut permanent, while he added that Trump wants lower interest rates and is focused on the 10-year treasury yield. Furthermore, he said Trump is not calling for the Fed to lower interest rates and interest rates will take care of themselves if they get energy costs down and deregulate economy.

Naoki Tamura of the BOJs policy board on Thursday called for potentially faster interest-rate increases, sending the yen to its strongest level against the dollar in eight weeks. He stated said that the central bank should raise rates to 1% or higher in the fiscal half starting in October and that that level is likely consistent with a neutral rate setting that is neither restrictive nor stimulating for the economy. WSJ

Japan has “completely” ended deflation and it’s natural for the central bank to proceed with rate hikes to normalize policy, according to former BOJ Governor Haruhiko Kuroda. BBG

The UK’s SONIA rose for five sessions through Tuesday — the first consecutive gains since April — reflecting the BOE’s ongoing efforts to drain excess liquidity from the financial system.

The BOE cut rates by 25 bps to 4.5% today as expected. The big surprise was that two members of the Monetary Policy Committee voted for 50 basis point cut. BOE’s Bailey confirmed taking ‘gradual and careful’ approach to cuts. BBG

Manufacturing orders in Germany rose in December on the back of aerospace orders, although any tentative signs of a recovery for the struggling industrial sector face the imminent threat of tariffs from the U.S. German factory orders for Dec come in strong at +6.9% M/M (vs. the Street +2%). WSJ

Earnings

Arm Holdings (ARM) -3.5%: Beat, Q4 guidance aligned with forecasts defying anticipation of a stronger guide.

Ford (F) -4.7%: Q4 beat, 2025 guide cautious.

Qualcomm (QCOM) -5.1%: Q1 beat, attention on slowing smartphone demand.

ArcelorMittal (MT NA) +5.7%: Q3 soft Y/Y, expects higher demand in FY25 Y/Y.

AstraZeneca (AZN LN) +5.3%: Q4 Beat.

Hannover Re (HNR1 GY) -1.2%: FY mixed, confirms guidance.

ING (INGA NA) -2.5%: Q4 mixed, NII beat.

Maersk (MAERSKB DC) +8.5%: Q4 & FY24 beat.

Pernod Ricard (RI FP) +2.6%: H1 miss, cuts FY guidance given China and US challenges.

Siemens Healthineers (SHL GY) +5.9%: Q1 beat, affirms guidance.

SocGen (GLE FP) +9.4%: Q4 beat, EUR 872mln buyback.

Volvo Car (VOLCARB SS) -8.7%: Q4 Revenue beat, expects a continued weak market in 2025.

Linde PLC (LIN) Q4 2024 (USD): adj. EPS 3.97 (exp. 3.93), Revenue 8.3bln (exp. 8.4bln)

A more detailed look at global markets courtesy of Newsquawk

APAC stocks followed suit to the gains on Wall St where sentiment was underpinned amid a softer yield environment and the lack of trade war escalation. ASX 200 outperformed with the index led higher by strength in financials, consumer discretionary and gold-related stocks. Nikkei 225 advanced at the open and reclaimed the 39,000 level but then briefly pared the majority of the gains owing to yen strength and comments from hawkish BoJ board member Tamura. Hang Seng and Shanghai Comp conformed to the constructive mood in the region amid a lack of major escalation on the trade front with the US Postal Services flip-flopping on suspending parcels from Hong Kong and China, while China initiated a WTO dispute complaint regarding US tariffs although this was as previously announced. SK Innovation (096770 KS) - Expects about KRW 6tln in capex this year, adds a delay in EV market demand growth recovery is expected in the short term due to the Trump administration and automakers recalibrating their electrification business.

Top Asian news

BoJ Board Member Tamura said they need to raise rates in a gradual and timely manner and that a 0.75% rate would still be negative in real terms, while he added the BoJ must raise rates to levels deemed neutral on a nominal basis which is at least around 1% and must raise rates to at least around 1% in the latter half of fiscal 2025.

Tamura said he personally does not think BoJ's past massive monetary easing had a positive effect as a whole given its strong side effects and they must scrutinise whether prolonged monetary easing could cause problems such as excessive yen falls and housing price spikes.

Furthermore, he said the BoJ shouldn't persist in achieving 2% inflation as long as Japan is experiencing moderate price rises, as well as commented that he has no preset idea about the pace of interest rate hikes and the pace of interest rate hikes may not necessarily be once every half year.

European bourses (Stoxx 600 +0.7%) began the session modestly firmer across the board, and continued to climb higher as the morning progressed. European sectors hold a strong positive bias, with only a couple of industries in the red with losses minimal. Basic Resources is the clear outperformer in Europe today; Anglo American (+4%) after its Q4 Production Update. Healthcare is lifted by post-earning strength in AstraZeneca (+4.9%).

Top European News

UK PM Starmer wants to "axe Rachel Reeves in bombshell reshuffle", according to Express. "In a shock move, the Prime Minister is considering moving Home Secretary Yvette Cooper to the Treasury to boost the country’s economic fortunes". "Insiders say an 'active process is going on' as Sir Keir considers how and when to execute a reshuffle, which is most likely to happen in the Spring".

ECB's Cipollone says there is still room for adj. rates downward. US tariffs on China could force the dumping of goods in Europe, weighing on growth and inflation. Soft landing remains the main scenario, no recession seen.

UK Citi/YouGov inflation survey: 12-month ahead 3.5% (prev. 3.7%), 5-10 years ahead 3.7% (prev. 3.9%)

FX

DXY is firmer vs. all peers after a run of three negative sessions for the DXY, spurred on by greater optimism on the trade front, which brought US yields lower. Today sees the release of weekly claims figures and remarks from Fed's Waller, Daly and Jefferson. DXY holds around the 108 handle with a session high at 108.05.

EUR/USD has made its way back onto a 1.03 handle after venturing as high as 1.0442 yesterday. ECB's Cipollone highlighted that US tariffs on China could force the dumping of goods in Europe, weighing on growth and inflation. 1.0357 is the current session low with not much in the way of support until the 1.03 mark.

JPY is on the backfoot vs. the USD but to a lesser extent than peers on account of hawkish comments from BoJ hawk Tamura overnight who put forward his view that the Bank needs to raise rates to at least around 1% in the latter half of fiscal 2025. USD/JPY went as low as 151.82 overnight (lowest since 12th Dec) but has since returned to a 152 handle.

GBP is softer vs. the USD and to a lesser extent the EUR in the run-up to today's BoE policy announcement. Expectations are for a 25bps rate cut via an 8-1 vote split. Attention will be on any tweaks to forward guidance and how macro projections in the accompanying MPR indicate how loose/tight the MPC views current policy. Cable has made its way back onto a 1.24 handle and back below its 50DMA at 1.2498.

Antipodeans are both on the backfoot vs. the USD in quiet newsflow as a run of three consecutive sessions of gains comes to a halt.

PBoC set USD/CNY mid-point at 7.1691 vs exp. 7.2535 (prev. 7.1693).

Reuters Poll: Short bets on the KRW, MYR & THB at lowest since October 31st, bearish bets on INR at highest since mid-July 2022.

Fixed Income

USTs are in the red, weighed on overnight in tandem with JGBs on hawkish commentary from BoJ’s Tamura (hawk) who stated they must raise rates to at least around 1% in the latter half of FY25. More broadly, the benchmark is trimming some of the upside seen on Wednesday with yields picking back up after their pullback. Thus far, USTs down to a 109-16 base vs Wednesday’s 109-29 peak; if the move extends, support factors at 109-02 before the figure and then 108-25+. US Jobless Claims, Challenger Layoffs and a few Fed speakers due.

Bunds are in the red and spent much of the morning towards the 133.14 session low. Pressure which comes as the complex unwinds some of the pullback in yields that was a feature of yesterday’s session for global benchmarks. Aside from Construction PMIs, docket has been light; currently trading around 133.41 vs peak at 133.53.

Gilt downside in-fitting with peers, but to a much lesser extent as we count down to the BoE, Newsquawk preview available. A poor set of data and general lifting in the fixed income complex has brought Gilts just into the green. Gilts were pulled off lows by a particularly dire UK Construction PMI for January. A release which saw Gilts jump from 93.55 to 93.70 and thereafter to a 93.84 peak, which then continued to make a session high at 93.93. Thereafter, it was reported that PM Starmer is said to be considering removing Chancellor Reeves and replacing her with current Home Secretary Cooper.

On Wednesday, PM Bayrou survived (as expected) the two censure motions against him which means the 2025 Budget has now passed the National Assembly. However, there are still numerous hurdles to parts of the budget ahead. The passing was well received with the OAT-Bund 10yr yield spread dipping below 70bps yesterday evening and again this morning. However, OATs thereafter found themselves the modest EGB underperformer with the spread widening back to near 73bps ahead of chunky supply, which was well received and sparked an EGB rally with the spread narrowing back to 70bps.

Spain sells EUR 6.19bln vs exp. EUR 5.5-6.5bln 2.40% 2028, 3.10% 2031, 4.00% 2054 Bono & EUR 0.57bln EUR 0.25-0.75bln 1.15% 2036 I/L.

France sells EUR 13bln vs exp. EUR 11-13bln 3.20% 2035, 1.25% 2036, 1.25% 2038, and 3.25% 2055 OAT Auction.

Commodities

Modest upside in crude benchmark after the sell-off yesterday. Action this morning wasn't dictated by any fresh macro headlines, although crude experienced a few upticks and broke out of overnight ranges in the first half of the European session as volumes picked up. Brent Apr resides in a USD 74.60-74.98/bbl parameter.

Soft trade across precious metals amid a more constructive risk tone but also alongside a surging dollar. Spot gold resides in a USD 2,848.97-2,873.34/oz range.

Mixed trade across base metals despite the firmer Dollar but amid the mostly constructive risk sentiment across the broader market. 3M LME copper resides in a USD 9,267.85-9,356.00/t.

Qatar sets March marine crude OSP at Oman/Dubai + USD 2.9/bbl; land crude OSP at Oman/Dubai + USD 2.75/bbl

Citi lifts its 2025 average forecast for Gold to USD 2900/oz (prev. 2800/oz); 0-3month target upgraded to USD 3000/oz, 6-12 target maintained at USD 3000/oz.

Oil and gas traders likely to seek waivers from China over tariffs that Chinese govt plans to impose on US crude and LNG, according to Reuters sources.

Japan is reportedly seeking exemptions from steel import tariff being considered by India, according to Reuters sources, citing Chinese overcapacity.

Geopolitics: Middle East

Israeli occupation forces stormed Balata refugee camp east of Nablus in the West Bank, according to Al Jazeera.

Israeli PM Netanyahu questioned what was wrong with the idea of allowing Gazans to leave, while he added that the idea should be pursued and done.

Geopolitics: Other

US Defense Secretary Hegseth held a call with Panama's President Mulino and they agreed to expand cooperation between the US military and Panama's security forces. It was separately reported that the State Department announced that US government vessels can now transit the Panama Canal without charge fees although the Panama Canal Authority later said it has not made any changes to charge fees.

US Event Calendar

07:30: Jan. Challenger Job Cuts -39.5% YoY, prior 11.4%

08:30: Feb. Initial Jobless Claims, est. 213,000, prior 207,000

08:30: Jan. Continuing Claims, est. 1.87m, prior 1.86m

08:30: 4Q Nonfarm Productivity, est. 1.2%, prior 2.2%

08:30: 4Q Unit Labor Costs, est. 3.4%, prior 0.8%

DB's Jim Reid concludes the overnight wrap

It’s that time of the year…. I took my first hay fever tablet yesterday as the itchy eyes begun. Since I moved out of polluted London 15 years ago and into the country, I’ve gone from having no allergies to having terrible ones every year, always starting some time between mid January and mid February. Let's hope the drugs work this year.

After a severe allergic reaction on Monday after the tariff news, markets continued to be relatively sedated yesterday as investors continued to price out the chance of aggressive tariffs, whilst the ISM services index showed inflationary pressures were weaker than expected. That meant the US dollar (-0.35%) continued to fall, reaching its lowest level in the last week, and the prospect of lower inflation also helped to bring down Treasury yields, with the 10yr yield (-9.4bps) down to 4.42%. On that around the time of the US close Treasury Secretary Bessent said in an interview with FOX that while President Trump wanted lower rates, they were both focused on the 10yr yield not the Fed policy rate, adding that policies to boost energy supply and reduce the budget deficit would help achieve this. He implied that the "jumbo rate cut", referring the 50bps cut in September, helped create the bond sell-off. So this was an important interview and all other things being equal will encourage a flattening bias. However as Bill Clinton's political advisor James Carville famously said back in 1993 when referring to the afterlife "... I want to come back as the bond market. You can intimidate everybody". So this is new important news that shows the Trump administrations' attitude to monetary policy and yields. However at the end of the day their fiscal and supply side policies and how they impacts growth, supply and inflation will still be the most important.