Russia & The US' Diplomatic Choreography At The UN Shows Their Commitment To A "New Détente"

Russia & The US' Diplomatic Choreography At The UN Shows Their Commitment To A "New Détente"

https://korybko.substack.com/p/russia-and-the-us-diplomatic-choreography

Any claims of Russia “backstabbing” or “selling out” China are absurd and driven by a desire to sow discord...

?itok=8uldLl5M

?itok=8uldLl5M

The “https://korybko.substack.com/p/why-might-russia-repair-its-ties

in supporting the latter’s more neutral one in the Security Council.

This diplomatic choreography was clearly coordinated between Putin and Trump to show the entire world that they’re committed to the “New Détente”. In parallel with what was unfolding on the world stage, each leader also spoke highly about the future of their economic ties, with Trump hyping everyone up to expect “https://x.com/TrumpDailyPosts/status/1894131688990806161

in Riyadh.

It was foreseen in early January that “https://www.zerohedge.com/geopolitical/creative-energy-diplomacy-can-lay-basis-grand-russian-american-deal#:~:text=No%20one%20should%20assume%20that%20everything%20proposed%20below%20will%20enter%20into%20force%2C%20but%20these%20suggestions%20could%20help%20move%20their%20talks%20along.

”, which readers can learn more about from the preceding hyperlinked analysis. The two dozen compromises suggested near the end have already been agreed upon in part as proven by the US withholding Article 5 guarantees from NATO countries’ troops in Ukraine, ruling out its membership in NATO, discussing energy cooperation with Russia, and flirting with other forms of sanctions relief.

Unlike what some have claimed, Trump isn’t trying to pull a so-called “https://www.msn.com/en-us/news/world/washington-s-embrace-of-putin-aims-to-drive-wedge-between-moscow-and-beijing/ar-AA1zy1Ry

” by incentivizing Russia to turn against China like his predecessor half a century ago incentivized China to turn against the erstwhile USSR, which is unrealistic to expect in any case. Rather, as explained in the analysis about creative energy diplomacy, the purpose is to incentivize Russia into placing limits on its resource and eventually military cooperation with China in order to erode its strategic advantages vis-à-vis the US.

From Trump’s view, this will avert the scenario of Russia turbocharging China’s superpower rise and thus even the odds of reaching a grand deal with the People’s Republic that’ll be more in the US’ favor, while Putin sees this as managing the global balance of power. From his perspective, Russia is incentivizing the US into relieving pressure upon it and unofficial paying reparations for the proxy war via investments into its resource industry https://archive.is/qqctD

, all while redirecting the US’ military focus elsewhere.

The Kissinger-inspired pragmatism behind this arrangement is predictably opposed by each country’s most zealous supporters, both at the civil society and state levels, but more on the US’ side than Russia’s. Furthermore, even though China officially supports the emerging Russian-US rapprochement, it’s likely still very suspicious of this process but is playing it cool for now in order to not attract negative attention. These trends must be managed by both parties in order for their envisaged “New Détente” to succeed.

Trump is ignoring his powerless opponents at the civil society level and European state one while purging his much more powerful opponents at the domestic (“deep”) state level https://revers.press/andrewkorybko-eng/tpost/hmt8szdk21-the-bulldozer-revolution-now-against-us

, with the outcome of Trump’s efforts in turn shaping what Putin will ultimately do. Since nothing tangible has been achieved thus far, the Russian leader doesn’t seem to be doing anything other than sending positive signals, but that could change if Trump agrees to the compromises that Putin requires for cutting a deal.

In that scenario, Russian publicly funded media’s narratives towards the US and the New Cold War more broadly could drastically shift, which would be expected to also influence the information products of those Russian-friendly members of the https://thealtworld.com/andrew_korybko/a-review-of-the-most-common-roles-in-the-alt-media-community

who take their cues from the Kremlin. To be clear, these figures and outlets are free-thinkers, but they trust Putin and the media that’s under his authority for guidance to better understand the global systemic transition and specific processes therein.

Dissident elements might no longer be platformed by Russian publicly funded media nor invited to Russia for conferences since their views would no longer conform with the Kremlin’s so that could motivate them to rethink their opposition to the “New Détente” in furtherance of their career interests. No such potentially high-profile dissent is expected at the domestic (“deep”) state level though due to the differences between Russia and the US’ systems so https://korybko.substack.com/p/was-pepe-escobar-duped-by-a-foreign?utm_source=publication-search#:~:text=This%20group%20believes,complex%20multipolarity%20(%E2%80%9Cmultiplexity%E2%80%9D).

are expected to easily fall into line.

As regards China’s speculative suspicions of the Russian-US rapprochement, Trump, Putin, their top diplomats, and other representatives are expected to make a concerted effort to allay their counterparts’ fears about this process in order to avoid an overreaction that could worsen China’s ties with each. That said, China is known for reacting calmly even to events that it disapproves of so no significantly negative response is expected, though Chinese-friendly Alt-Media figures might be a totally different story.

It's entirely possible that they’d either be tacitly encouraged to fearmonger about the “New Détente”, including by sensationally claiming that Russia “sold out” to the US, or might interpret everything on their own this way and sincerely believe that expressing these views somehow helps China. In any case, it can’t be ruled out that the Alt-Media Community might bifurcate into Russian-friendly and Chinese-friendly halves wherein the influential Iranian-led Resistance segment aligns with the latter out of spite.

That last prediction is predicated on how upset many of these figures are after “https://korybko.substack.com/p/russia-dodged-a-bullet-by-wisely

” as Israel systematically destroyed their regional network in West Asia over the course of the latest war. That outcome could be offset though if Iran later enters into its own “New Détente” with the US, after which it too could signal to its like-minded Alt-Media allies to shift their narratives like Russia might have earlier done by then.

All the insight shared thus far is conditional on the “New Détente” succeeding, the odds of which are increasing by the day as shown by the latest Russian-US developments and their respective leaders’ statements, hence the need to forecast the impact that this could have on the information sphere. The best-case scenario is that the pro-Chinese part of the Alt-Media Community doesn’t overreact on its own or is encouraged by China to respond that way so that the US can then more easily reach a deal with it.

Putin also endorsed Trump’s bold proposal for halving their defense budgets if everything works out between them, with the Russian leader even https://timesofindia.indiatimes.com/world/us/putin-calls-donald-trumps-proposal-to-halve-defence-spending-a-good-proposal-us-cuts-50-we-cut-50/articleshow/118543108.cms

that China do so too if it’s interested. He therefore clearly wants to promote or even help broker a Sino-US deal for resolving the root causes of their own security dilemma exactly as he and Trump are trying to do with theirs. Any claims of Russia “backstabbing” or “selling out” China are accordingly absurd and driven by a desire to sow discord.

If everything evolves along the trajectory that was outlined in this analysis, then the onus will be on China and to a lesser extent on Iran whether to get with the program by negotiating their own comprehensive deals with the US or to continue to defy it at the expense of jeopardizing world peace. Russia and the US’ diplomatic choreography at the UN, and Putin and Trump’s arguably coordinated economic-resource partnership statements, show that they trust each other and truly want peace.

China and Iran have repeatedly expressed that they trust Russia, both at the national and leadership levels, so it would be a moment of truth for them whether they’d then follow its lead by entering into their own talks with the US or go the opposite way in a sign that they never really trusted Russia. Whatever they do will in turn inform Russian policymakers, Putin chief among them, of their true intentions and could thus lead to pragmatic and peaceful recalibrations of Russia’s policy towards them.

https://cms.zerohedge.com/users/tyler-durden

Tue, 02/25/2025 - 23:25

Democratic Policies At Work: "Almost Half" Of Seattle's Homeless Population Is Not From Seattle

Democratic Policies At Work: "Almost Half" Of Seattle's Homeless Population Is Not From Seattle

A new study from the Discovery Institute’s Fix Homelessness reveals the devastating consequences of Seattle’s failed policies, which have not only failed to address homelessness but have actively worsened the crisis, https://mynorthwest.com/ktth/ktth-opinion/seattle-homeless-outsiders/4047310

.

Driven by progressive ideology rather than practical solutions, city leaders have fostered a system that attracts homeless individuals from outside the region while keeping them trapped in cycles of addiction, crime, and dependency.

Rather than tackling the root causes, these policies have invited more homelessness, turning the issue into a manufactured disaster rather than a problem to be solved.

The study reveals that nearly half of the city’s homeless population became homeless outside of Seattle or King County, drawn in by the city’s permissive policies—free tents, open-air drug use, and a refusal to enforce encampment laws. An overwhelming 86.6% were born elsewhere, and 80.2% didn’t even attend high school in the area.

?itok=H-moJFQN

?itok=H-moJFQN

The https://mynorthwest.com/ktth/ktth-opinion/seattle-homeless-outsiders/4047310

says that rather than addressing addiction and mental health, Seattle relies on the failed “Housing First” model, which prioritizes subsidized housing over real treatment. Instead of helping, the city warehouses the homeless, trapping them in cycles of dependency.

KTTH's Jason Rantz argues that Seattle’s homelessness crisis isn’t about a lack of funding—it’s about failed priorities. The study shows the city has abandoned emergency shelters and recovery programs in favor of “supportive housing,” leading to a 282% spike in overdose deaths between 2020 and 2023.

Nearly half of King County’s 2023 overdose deaths were among the homeless, many in these housing units.

Like San Francisco and Los Angeles, Seattle spends billions while the crisis worsens. Leaders refuse to require addiction treatment before granting housing and have let encampments overrun parks and neighborhoods. Their one-size-fits-all approach ignores addiction and mental illness, trapping people in cycles of dependency.

Real solutions exist: prioritize treatment over subsidized housing, stop incentivizing homelessness, and enforce the law, Rantz says. Despite a Supreme Court ruling allowing cities to ban encampments, Seattle refuses to act. Until it abandons failed progressive policies, the crisis will only grow—and it won’t stay within city limits.

https://cms.zerohedge.com/users/tyler-durden

Tue, 02/25/2025 - 23:00

https://www.zerohedge.com/markets/almost-half-seattles-homeless-population-not-seattle

Ukraine Tentatively Agrees To Trump's Rare Earth Mineral Deal

Ukraine Tentatively Agrees To Trump's Rare Earth Mineral Deal

Update(1348ET): Ukraine has tentatively agreed to Trump's mineral rights access deal, Financial Times is reporting in breaking headline. The devil will of course be in the details, given as recently as Sunday Zelensky was openly resistant to the terms offered so far.

"Kyiv has agreed terms with Washington on a minerals deal that Ukrainian officials hope will improve relations with the Trump administration and pave the way for a long-term US security commitment," https://www.ft.com/content/1890d104-1395-4393-a71d-d299aed448e6

early Tuesday afternoon.

"Ukrainian officials say Kyiv is now ready to sign the agreement on jointly developing its mineral resources, including oil and gas, after the US dropped demands for a right to $500bn in potential revenue from exploiting the resources," the report continues.

But again nothing appears to be ultimately finalized, and there will yet be plenty of haggling over what exactly this will look like. Snippets of draft agreements have been leaked, but little in the way of the more controversial details.

"The minerals agreement is only part of the picture. We have heard multiple times from the US administration that it’s part of a bigger picture," Olha Stefanishyna, Ukraine’s deputy prime minister and justice minister who has led the negotiations, told the same publication.

As we detailed below, Europe is actually offering its own rival version, which could be part of yet more efforts to stall and sabotage a Washington deal. President Putin himself is also touting discussions over "major" cooperation with US companies, including on access to Russia's rare earth minerals.

The US has said 'no' to NATO membership for Ukraine, even as some European leaders continue to push this dubious future scenario. Zelensky has even talked stepping down if this could guaranteed future NATO membership, but also as Ukraine's parliament has extended his mandate, with no new elections on the horizon.

* * *

In a wide-ranging new interview with Russia 1 TV, President Vladimir Putin touted that his country is in talks with the United States over cooperating on "major" joint economic projects.

The Monday remarks came two weeks following his first phone call with President Trump after the US leader took office for the second time. "Some Russian and American companies are in contact and discussing major projects," Putin https://www.rt.com/business/613264-putin-russia-us-projects-trump/

.

This is being confirmed by the US side as well, given Trump in a Truth Social post also revealed that major "economic development transactions which will take place between the US and Russia" are in the works. He said that ongoing discussions are "proceeding very well" — coming off last week's bilateral Riyadh talks led by Secretary of State Marco Rubio and Russia's Sergey Lavrov.

?itok=30x4DQyg

?itok=30x4DQyg

Putin has also this week been taking steps to make Russia an inviting place for US companies to operate once again, after well over 1,000 of them have curtailed or closed up operations in the wake of the Ukraine war's start.

"For many years, US trade policy has been tied to sanctions. We consider these sanctions illegal and harmful to global trade," Putin described said in the interview.

As for which areas the US and Russia might cooperate on, Putin didn't detail the talks down the that level, but did tease that Russia is ready to work with "foreign partners" including companies on mining minerals.

That's when https://www.bbc.com/news/articles/c4gdx7488g5o

in the interview that we [Russia] "undoubtedly have, I want to emphasize, significantly more resources of this kind than Ukraine" and said: "We would be ready to offer this to our American partners… if they showed interest in working together."

"As for the new territories, it's the same. We are ready to attract foreign partners to the so-called new, to our historical territories, which have returned to the Russian Federation," he added. This provocative statement appeared to reference the four annexed territories in Ukraine's east: Donetsk, Kherson, Luhansk and Zaporizhzhia.

Western media has described that this is an "eye-catching" move by the https://www.bbc.com/news/articles/c4gdx7488g5o

:

He also suggested that Russia and the US could collaborate on aluminium production in Krasnoyarsk, in Siberia, where one Russian aluminium maker, Rusal, has its largest smelters.

The televised comments followed a cabinet meeting on Russia's natural resources.

On Tuesday, Kremlin spokesman Dmitry Peskov told journalists the proposal opened up "quite broad prospects", adding that the US needed rare earth minerals and Russia had "a lot of them".

Offering the US access to minerals is an eye-catching move by Putin, given how much pride the Kremlin has taken in keeping Russia's natural wealth in Russian hands. In 2023 Putin accused the West, particularly the US, of trying to "dismember" Russia to gain access to its natural resources.

We've certainly come a long way from the Biden administration goal of 'weakening Russia' - to use the words of former Defense Secretary Lloyd Austin.

🇷🇺🇺🇸 Putin reveals that Russia and the U.S. could launch joint aluminum mining projects in Krasnoyarsk, requiring $15B in investment.

One of the past problems in Russia-U.S. relations? A lack of deep business ties—Moscow mostly traded with the EU. Now, the strategy seems clear:… https://t.co/GeqMoFDFby

— Brian McDonald (@27khv) https://twitter.com/27khv/status/1894120962360062074?ref_src=twsrc%5Etfw

Meanwhile, as the White House aggressively pursues a final deal for access to Ukraine's mineral deposits, including rare earths, Zelensky has appeared to resist.

Europe has at the same time offered its own alternative deal which Zelensky is likely to favor. Europe's Commissioner for Industrial Strategy Stéphane Séjourné https://www.politico.eu/article/critical-minerals-rare-earths-deal-eu-not-donald-trump/

.

* * *

Below are more highlights from Putin's Russia 1 interview, paraphrased and translated via https://www.rt.com/news/613259-putin-interview-trump-zelensky/

...

’Toxic’ Zelensky and Ukrainian statehood

Putin described Ukrainian leader Vladimir Zelensky as a “toxic figure” for Ukrainian society, claiming that his irrational orders, driven by obscure political motives, have led to “unjustifiably high losses, if not catastrophic ones.”

Putin suggested that if Zelensky, whose five-year presidential term expired in May 2024, were to face new elections, he would have no chance of winning: “His chances of winning are absolutely zero – unless, of course, something is blatantly rigged.”

He argued that Zelensky’s popularity has collapsed and that he is actively avoiding peace negotiations with Russia in order to maintain his hold on power: “If negotiations start, this will sooner or later lead to lifting martial law. And as soon as that happens, elections must be held.”

‘Rational’ Trump

Putin suggested that Trump sees Zelensky as an obstacle to stabilizing Ukraine and securing a peace deal: “Trump likely understands that Zelensky is a destabilizing factor. He wants to bring Ukrainians back together, consolidate its society, and create conditions for the survival of the Ukrainian state.”

Addressing claims that Trump’s position on Ukraine plays into Russia’s hands, Putin strongly disagreed: “In the current situation, strange as it may seem, we would be more interested in [Zelensky] sitting there and further corrupting the regime with which we are in an armed conflict. And from the point of view of strengthening Ukrainian statehood, it is necessary to act in a completely different direction – to bring to power those who will enjoy the trust of the people of Ukraine.”

The Russian president also commented on Trump’s political style, rejecting the notion that the US president acts based purely on emotion: “No, of course not. His actions are based on cold calculation and a rational approach to the situation.”

?itok=YmQVWbiZ

?itok=YmQVWbiZ

The role of Europe

Putin argued that European politicians are “shackled” by their past commitments and are unable to change their approach to Ukraine without losing credibility: “Unlike the newly elected US president, European leaders are tied to the current regime in Kiev. They are too invested and have made too many promises.”

He criticized Europe’s reaction to recent US-Russia diplomatic interactions, saying: “Their response was emotional and lacked practical meaning. Instead of addressing real issues, they focus on maintaining appearances.”

While dismissing demands by EU officials to have a say in Russia-US negotiations, Putin acknowledged that European involvement could be useful in broader discussions: “Their participation is welcome, of course. We never refused to engage with them.”

He also noted that Moscow values the efforts of non-European actors, such as BRICS nations, in promoting peace: “Not only Europeans but other countries as well have the right to participate, and we respect that.”

Military and trade relations with the US

Putin responded positively to Trump’s proposal to cut defense spending, indicating Moscow’s openness to negotiations: “We are not against it. The idea is good: the US cuts by 50%, we cut by 50%, and if China wants, they can join later.”

Commenting on US trade policies, Putin criticized American sanctions but acknowledged that each country sets its own trade priorities: “For many years, US trade policy has been tied to sanctions. We consider these sanctions illegal and harmful to global trade.”

Regarding Trump’s shift toward tariffs, Putin said he understood the reasoning behind the move: “Each country determines independently what is beneficial… I can understand the logic – to move production back home, create jobs, force taxes to be paid… But at some point, of course, these actions will encounter certain difficulties associated with inflationary pressure.”

Putin also confirmed that “some Russian and American companies are in contact and discussing major projects” but did not specify details.

* * *

As for Europe's newly touted 'rival' rare earths deal being discussed with Ukrainian leadership, some observers might see this as yet another attempt of Washington's European allies to sabotage Trump's maneuvering toward peace. Critics have said Trump is essentially forcing Ukraine to give up its future economic sovereignty. But Trump has said the US must be paid back for the many billions in weapons sent throughout the war.

https://cms.zerohedge.com/users/tyler-durden

Tue, 02/25/2025 - 13:48

US Egg-Laying Hen Population Implodes, Wholesale Egg Prices Hit New Record

US Egg-Laying Hen Population Implodes, Wholesale Egg Prices Hit New Record

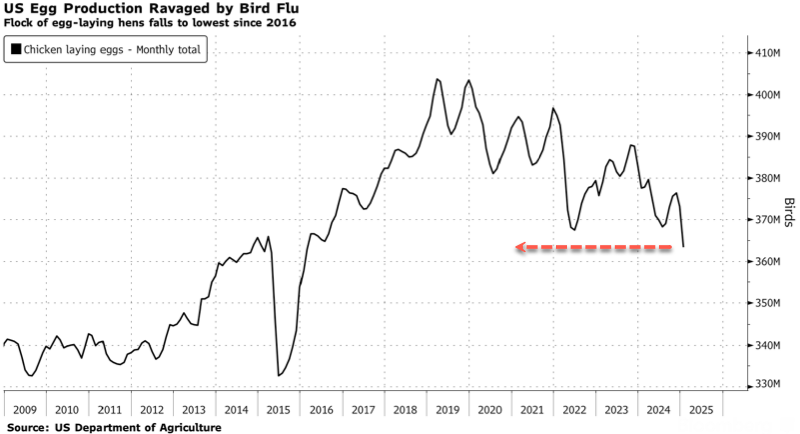

Under the Biden-Harris administration, farmers were forced to cull tens of millions of egg-laying hens to contain the bird flu outbreak. As a direct result, the nation's total egg-laying flock has plunged to its lowest level in nearly a decade, driving wholesale egg prices to record highs.

Trump stated this week that Secretary of Agriculture Brooke Rollins will take action on soaring egg prices, adding, "We inherited all the problems."

Trump is correct in saying the egg-flation mess was "inherited," as the latest https://www.bloomberg.com/news/articles/2025-02-24/egg-laying-hens-at-nine-year-low-as-bird-flu-decimates-us-flock

data shows that the nation's egg-laying hen population fell to its lowest level since 2016 last month. This decline was driven by farmers being forced to cull flocks under Biden's first term to curb the bird flu outbreak.

?itok=ZW6cSUR-

?itok=ZW6cSUR-

"It was important to me to see firsthand an egg-laying farm facility implementing strong biosecurity measures. We have a lot of work to do as we combat avian flu, help our poultry industry recover, and bring the price of eggs down for all Americans. More coming mid-week on this," Rollins wrote on X on Monday.

It was important to me to see firsthand an egg laying farm facility implementing strong biosecurity measures. We have a lot of work to do as we combat avian flu, help our poultry industry recover, and bring the price of eggs down for all Americans. More coming mid-week on this.… https://t.co/rB699lGYoM

— Secretary Brooke Rollins (@SecRollins) https://twitter.com/SecRollins/status/1894111868790477231?ref_src=twsrc%5Etfw

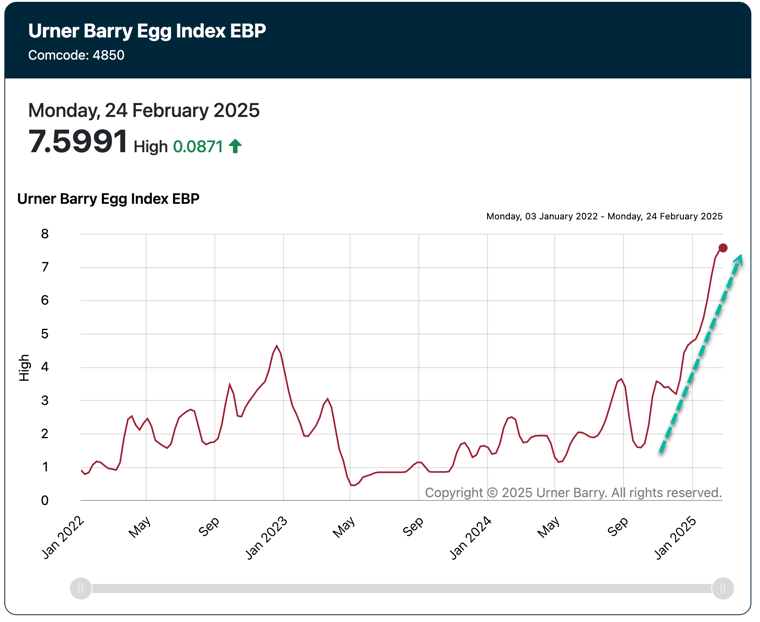

Monday's print of the Urner Barry Egg Index EBP shows wholesale prices jumped to $7.56, a new record high. Since late Decemeber, wholesale prices have jumped to new record highs by the week, with reports of egg shortages nationwide.

?itok=nCTxFVMQ

?itok=nCTxFVMQ

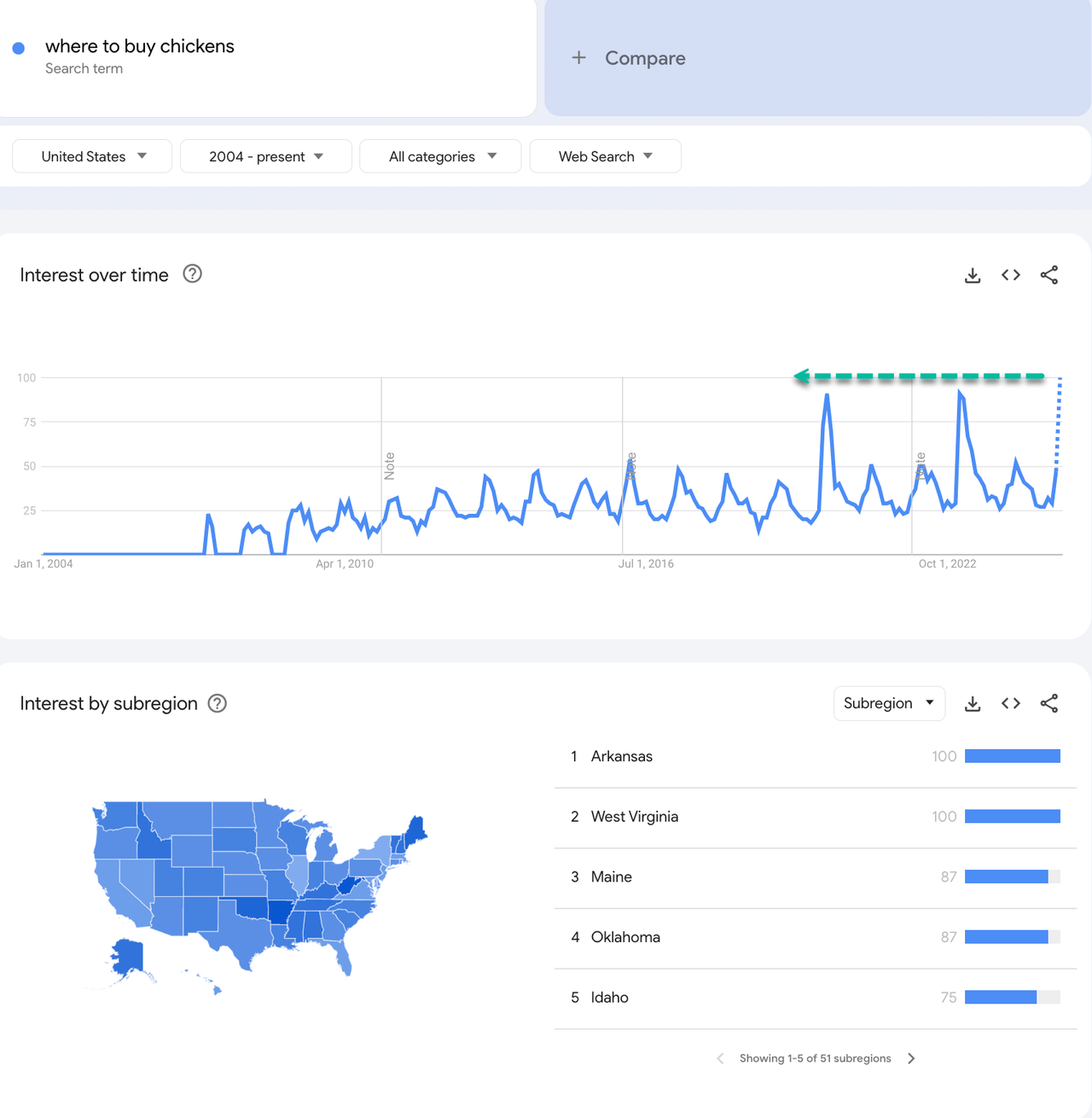

We advised readers at the start of the month:

Time To Build Backyard Chicken Coop As Wholesale Egg Prices Hit New Record Highs https://t.co/nJiB1tYvNO

— zerohedge (@zerohedge) https://twitter.com/zerohedge/status/1886907623951282551?ref_src=twsrc%5Etfw

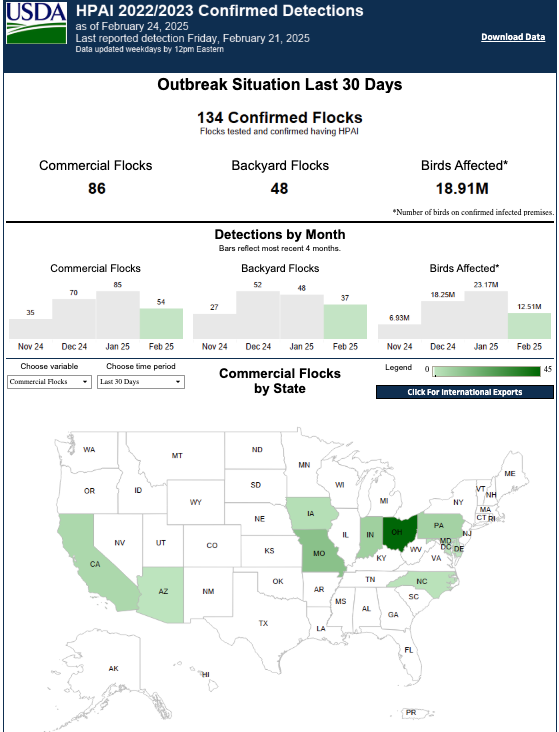

According to the https://www.aphis.usda.gov/livestock-poultry-disease/avian/avian-influenza/hpai-detections/commercial-backyard-flocks

, 19 million birds across the Lower 48 have been infected by avian influenza over the last 30 days.

?itok=ev_JlFPj

?itok=ev_JlFPj

It's time to set up those chicken coops, folks.

?itok=ci9XkTvG

?itok=ci9XkTvG

Panic searching on Google.

?itok=AayKYaIO

?itok=AayKYaIO

And don't forget honeybees and victory gardens—become self-sufficient and take back control of your own food supply chain instead of relying on mega-corporations that poison food with https://www.zerohedge.com/medical/cooking-oils-used-millions-linked-cancer-second-study-week

.

https://cms.zerohedge.com/users/tyler-durden

Tue, 02/25/2025 - 13:20

Watch: FCC Chairman Brendan Carr Scales 1,800-Foot Tower

Watch: FCC Chairman Brendan Carr Scales 1,800-Foot Tower

The chairman of the Federal Communications Commission scaled an 1,865-foot tall broadcast tower on Monday, which he filmed and posted to X.

?itok=NnRC-QZT

?itok=NnRC-QZT

"If we are going to continue to expand connectivity we need a lot more tower climbers. It’s a great job. It’s a good-paying job and it’s a career," said Carr, who strapped on a harness and took at 20-minute ride in a lift called a "pan," before transferring to the tower.

— Brendan Carr (@BrendanCarrFCC) https://twitter.com/BrendanCarrFCC/status/1894084159036944706?ref_src=twsrc%5Etfw

, only around 200 people climb and maintain these broadcast towers nationwide.

— Brendan Carr (@BrendanCarrFCC) https://twitter.com/BrendanCarrFCC/status/1894214001325641764?ref_src=twsrc%5Etfw

"It is always a fun experience to get up in the air and hang with a tower crew," said Carr, who complimented tower technician Hasani Hogan, an Army veteran.

"What a guy. It shows his bravery, his abilities and his commitment to the broadcast industry and our guys that do this. He has done it before and is willing to do it again," said Carr.

?itok=V1TxhA3m

?itok=V1TxhA3m

https://cms.zerohedge.com/users/tyler-durden

Tue, 02/25/2025 - 08:10

https://www.zerohedge.com/political/watch-fcc-chairman-brendan-carr-scales-1800-foot-tower

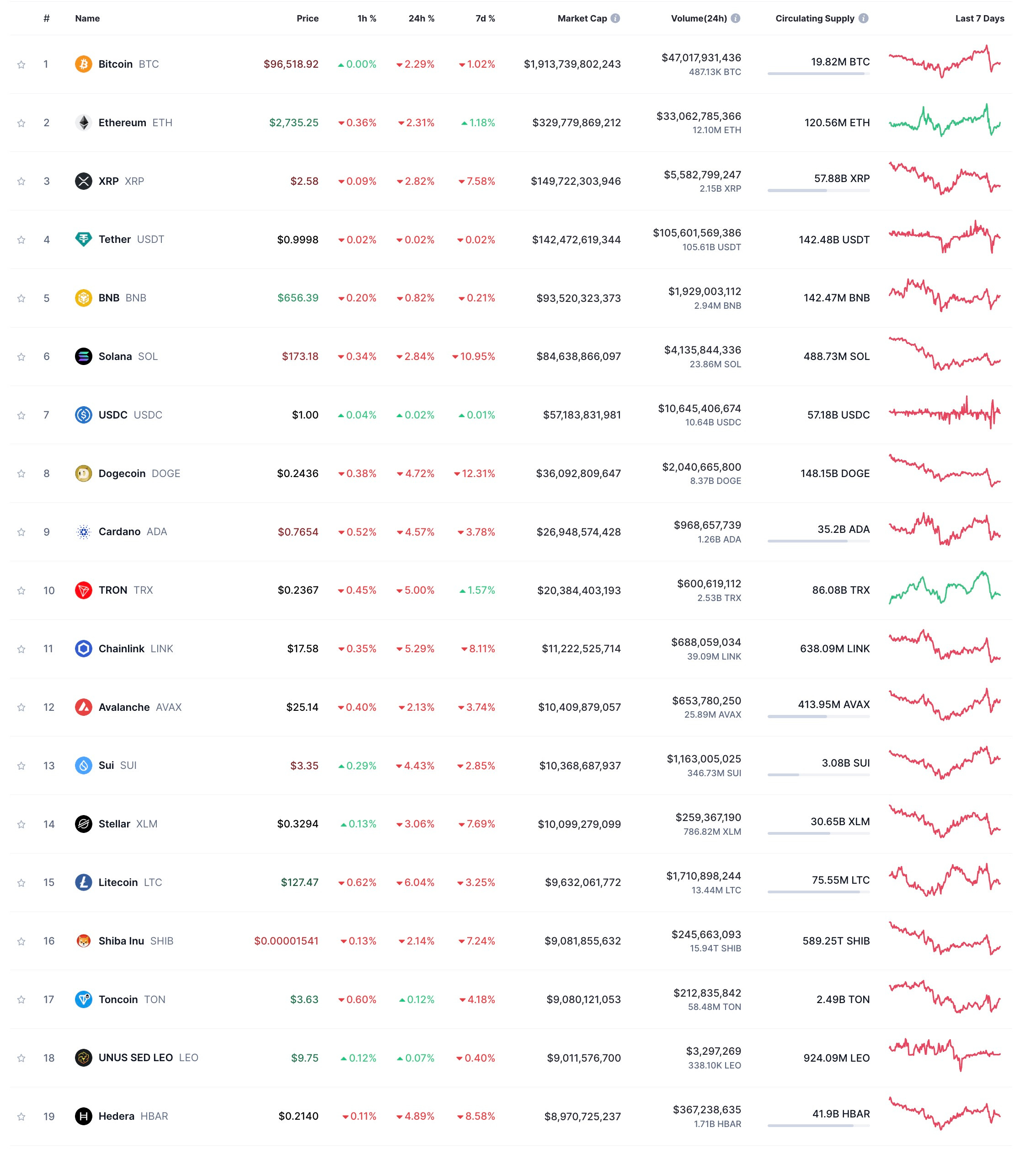

Futures Drop As Momentum Massacre Crushes Bitcoin

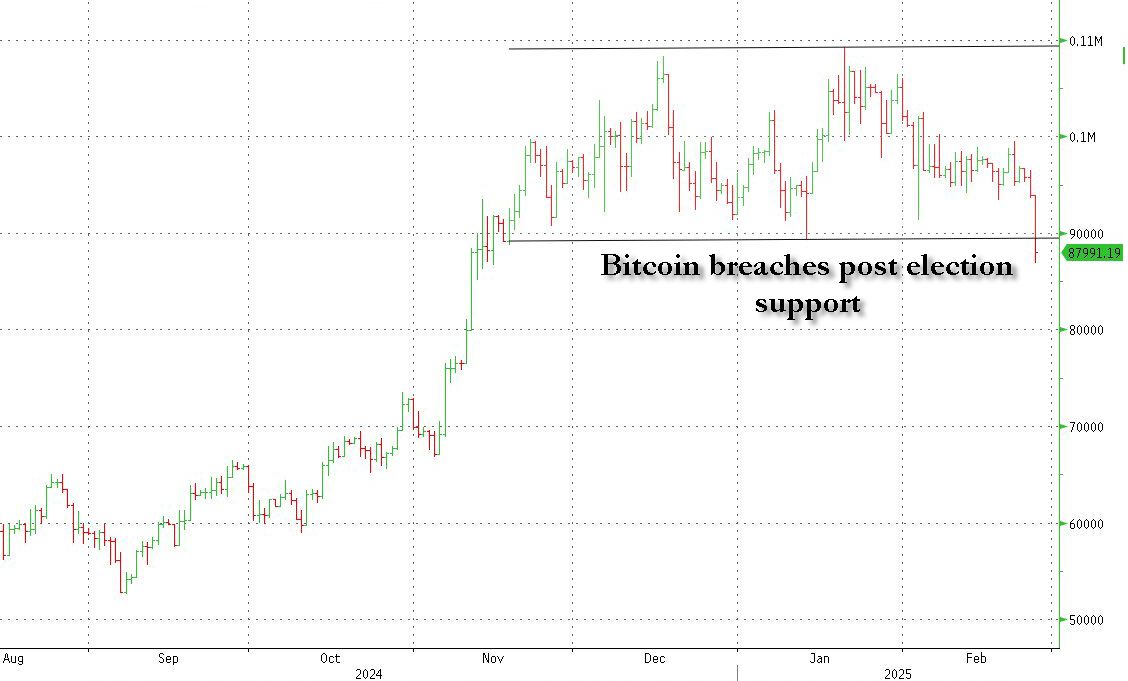

Futures Drop As Momentum Massacre Crushes Bitcoin

US equity futures, and Asian markets are lower as the recent tech-led selloff on Wall Street accelerated, sparking further risk-off behavior and momentum liquidations, and spilling over into bitcoin which plunged to a 3 month low breaking below its post election support. As of 7:00am, S&P futures are down 0.3% and are outperforming Nasdaq futs which are down 0.5%; sentiment was dented after Trump said that Canada/Mexico tariffs would be implemented on-time. Mag7 names and semis are lower with NVDA down 1.6%; Europe's ASML and STMicroelectronics also Bloomberg reported that the Trump admin is planning to expand efforts to limit China's technological advancements, including tougher semiconductor curbs and pressuring allies to escalate restrictions on China's chip industry. The ongoing stock rout sparked a rally in Treasuries that has pushed US 10-year yields down 6 bps to 4.34%. Traders also added to their Federal Reserve interest-rate cut bets with ~53 bps of easing now priced in by year end; the USD is flat. Commodities are mostly lower with crude/gasoline higher. Today’s macro data focus is on Housing, regional Fed activity indicators, and Consumer Confidence.

?itok=pvLrmUTK

?itok=pvLrmUTK

Meanwhile Bitcoin tumbled 7%, dropping below $90,000 and sliding to a 3 month low of $88,000 breaking post-election support levels, as the recent momentum massacre sparked a brutal crypto selloff; meanwhile DeepSeek reopened access to its core programming interface after nearly a three-week suspension.

?itok=ePawN2KM

?itok=ePawN2KM

In premarket trading, Nvidia led premarket losses among the Mag 7 stocks after Bloomberg News reported that Donald Trump’s administration is pressuring US allies to escalate their chip restrictions on China (Nvidia -1.3%, Alphabet -0.7%, Amazon, Alphabet, Microsoft, Meta and Apple were falling less than 1%, Tesla was little changed). US-listed Chinese stocks broadly rebound, with Alibaba rising 3.8% following its biggest drop since 2022; JD.com is up 1.8%, PDD +1.4%, Baidu +0.8%, Bilibili +2.8%. here are some other notable premarket movers:

Chegg shares tumble 22%, after the education technology company’s first-quarter projections for revenue and adjusted Ebitda trailed Wall Street expectations.

Hims & Hers Health shares slide 18% in premarket trading after the telehealth company reported fourth-quarter results and said it will soon stop selling some compound weight-loss drugs. While the results were solid, Piper Sandler noted that there was a high level of uncertainty for 2025.

Cryptocurrency-exposed stocks slide as Bitcoin tumbles below $90,000 to hit the lowest level since mid-November, paring the gains seen since Donald Trump’s election to the White House. MicroStrategy -5.9%, Coinbase -5.6%, Riot Platforms -4.4%, MARA Holdings -6%, Bit Digital -6.6%, CleanSpark -5.8%, Hut 8 Mining -6.7%

Zoom Communications shares fall 5%, after the communications software company gave a forecast that is modestly weaker than expected.

As broad-based selling swept markets, the VIX Index touched its highest level this year at just below 20. There didn’t appear to be a single catalyst for the selling - the suddenly pervasive pessimism was correctly described here two days ago in "https://www.zerohedge.com/markets/goldman-traders-hit-panic-button-perfect-storm-amid-positioning-valuation-breadth

"- although concerns are mounting that President Trump’s policies will hurt global economic growth. Uncertainty on trade policies has prompted investors to pare risk and switch to havens like Treasuries or gold. Trump signaled Monday that tariffs on Mexican and Canadian imports will go ahead.

“At the moment there’s a lot of uncertainty reigning in the background which is making it challenging for investors to navigate,” said Alexandra Morris, an investment director at Skagen AS. “The whole tariff discussion is the main negative catalyst.”

Nvidia’s earnings report on Wednesday could be yet another catalyst to unleash volatility given its outsized impact on the broader market.

“Bear in mind that the market impact of Nvidia’s results have often proved to be as significant as US jobs reports over the last couple of years,” Deutsche Bank AG strategist Jim Reid wrote in a note to clients.

In Europe, tech stocks also underperformed but have been offset by gains in healthcare and banks with the Stoxx 600 rising 0.3%. European defense stocks rose after Bloomberg reported that Germany’s chancellor-in-waiting Friedrich Merz is in talks with the Social Democrats to approve up to €200 billion in special defense spending. Unilever shares fell after the company announced in a surprise move that CEO Hein Schumacher would step down and pass the reins to CFO Fernando Fernandez. Here are the biggest movers Tuesday:

Smith & Nephew shares rise as much as 10%, the most since August, after reporting 4Q sales that beat estimates. The report is likely to reassure investors, RBC said, flagging particular strength in orthopaedics in the US

Novo Nordisk rises as much as 5.2%, to the highest since Dec. 20, after US firm Hims & Hers Health said it will soon stop selling some compound weight-loss drugs rivaling the Danish company’s offering

Galp Energia shares jump as much as 7.9%, the most in 10 months, after the company reported success at its latest exploration well off Namibia, boosting confidence in the company’s broader Namibia play

Thyssenkrupp shares rise as much as 15% in Frankfurt, to the highest since October 2023, after Citi increased its price target, citing the potential value unlock from the company’s marine and steel businesses

Dormakaba shares gain as much as 3.9%, to the highest level since 2021, after the Swiss security company lifted profit guidance slightly and posted solid results

European semiconductor stocks drop after Bloomberg reported that the Trump administration is pressuring US allies to escalate their chip restrictions on China

European mining stocks fell after iron ore, copper and aluminum dropped in response to moves by the US to restrict Chinese investments

Unilever shares drop as much as 3.4% in London trading after the consumer goods company said Hein Schumacher would step down as chief executive officer and board director

SIG Group shares tumble as much as 13%, the most in five years, after the Swiss carton-packaging maker reported subdued full-year results. Analysts cite falling profitability, low growth in the Americas

European automakers underperform after passenger-car registrations dropped in January, while electric vehicle sales jumped; total sales in the region declined 2.1% year on year

Earlier in the session, Asian stocks fell as US President Donald Trump’s continued attempts to pressure China and other nations dented investor sentiment. The MSCI Asia Pacific Index slid as much as 1.4% before paring some losses. Chinese stocks whipsawed throughout the day, showcasing the volatility sparked by uncertainties around Trump’s actions. His administration is said to be sketching out tougher versions of US semiconductor curbs and pressuring key allies to escalate their restrictions on China’s chip industry. According to Bloomberg, Trump officials recently met with their Japanese and Dutch counterparts about restricting Tokyo Electron Ltd. and ASML Holding NV engineers from maintaining semiconductor gear in China, according to people familiar with the matter. This comes after a directive set the stage for a more muscular use of the Committee on Foreign Investment in the United States, or CFIUS, a secretive panel that scrutinizes proposals by foreign entities to buy US companies or property, to thwart Chinese investment. The Hang Seng Tech Index had slumped as much as 4.4%, pacing losses for Chinese equities in New York. The gauge later erased most of its decline as more than $1 billion worth of money poured into Hong Kong stocks from China. JPMorgan strategists said US moves to limit investment in China tech may trigger a reversal in mainland stocks after the recent rally, while some investors saw an opportunity buy on dips. TSMC, Hitachi and Alibaba were among the biggest drags on the regional gauge. Most national benchmarks were in the red.

In FX, the Bloomberg Dollar Spot Index rises 0.1%. The Aussie and kiwi dollars underperform, falling 0.4% each.

In rates, bonds surged, pushing the yield on 10-year Treasuries down six basis to 4.34%. The treasury rally sent yields to YTD lows, fueled by risk aversion tied to the potential for US tariff policies to dent economic growth. Swap spreads are notably tighter, a sign that receiving flows are a driver. In short-term rates, Fed-dated OIS revert to fully pricing in two 25bp rate cuts by year-end. US yields are near session lows, 6bp-8bp richer across maturities with gains led by the belly, steepening 5s30s spread by 2bp; 10-year touched 4.32% and outperforms German counterpart by 7bp, UK by 3bp. 10- and 30-year swap spreads are nearly 2bp tighter on the day; Dallas Fed President Lorie Logan during London morning said the central bank when it stops balance-sheet runoff should purchase more shorter-term than longer-term securities to mirror the composition of Treasury issuance. A widely-watched gauge of the attractiveness of German debt fell to the most negative on record, reflecting expectations for higher borrowing to fund big outlays on defense spending. Gilts followed Treasuries higher, with UK 10-year yields falling 3 bps to 4.53%. German 10-year borrowing costs are flat at 2.47% as bunds were held back by reports of emergency defense spending.

In commodities, oil prices are steady with WTI near $70.80 a barrel. Spot gold falls $10 to $2,941/oz. Bitcoin tumbled below $90,000 to hit the lowest since mid-November as investors stepped back from one of the most popular Trump trades.

Looking at today's calendar, we get the February Philadelphia Fed non-manufacturing activity (8:30am), December FHFA house price index and S&P CoreLogic home prices (9am), February consumer confidence and Richmond Fed manufacturing index (10am) and February Dallas Fed services activity (10:30am). Fed speaker slate also includes Barr (11:45am) and Barkin (1pm)

Market Snapshot

S&P 500 futures down 0.1% to 5,994.50

STOXX Europe 600 up 0.3% to 555.01

MXAP down 1.1% to 187.58

MXAPJ down 1.3% to 589.62

Nikkei down 1.4% to 38,237.79

Topix down 0.4% to 2,724.70

Hang Seng Index down 1.3% to 23,034.02

Shanghai Composite down 0.8% to 3,346.04

Sensex up 0.2% to 74,613.76

Australia S&P/ASX 200 down 0.7% to 8,251.91

Kospi down 0.6% to 2,630.29

German 10Y yield little changed at 2.47%

Euro little changed at $1.0472

Brent Futures little changed at $74.81/bbl

Gold spot down 0.4% to $2,940.73

US Dollar Index little changed at 106.64

Top Overnight News

Donald Trump’s administration is sketching out tougher versions of US semiconductor curbs and pressuring key allies to escalate their restrictions on China’s chip industry, an early indication the new US president plans to expand efforts that began under Joe Biden to limit Beijing’s technological prowess. BBG

President Donald Trump’s Federal Trade Commission will “vigorously” sue to block illegal mergers, the agency’s new chairman said Monday, highlighting support for the repeated deal challenges during the Biden era. BBG

President Donald Trump said on Monday that tariffs on Canadian and Mexican imports are "on time and on schedule" despite efforts by the countries to beef up border security and halt the flow of fentanyl into the U.S. ahead of a March 4 deadline. RTRS

French President Emmanuel Macron said a truce in Ukraine could come in “weeks” after meeting with Trump at the White House but added that a deal “must not mean a surrender of Ukraine.” BBG

Fed's Goolsbee (2025 voter) said if the administration enacts policies that drive up prices, the Fed has to take them into account by law, while he added that auto parts suppliers have expressed concerns about tariffs and before the Fed can go back to cutting rates, it needs more clarity. Furthermore, Goolsbee said the full details of the administration’s policy package are still to be determined and they have to take a wait-and-see posture.

Fed's Logan (2026 Voter) does not comment on monetary policy in prepared remarks; says once quantitative tightening ends, it would make sense to overweight purchases of shorter dated securities; floats idea of discount window loan facility.

Elon Musk said subject to the discretion of the President, employees will be given another chance and a failure to respond a second time will result in termination.

Tesla’s European sales plunged 45% year on year in January to fewer than 10,000, as rival carmakers saw a surge in EV demand. It began rolling out driver-assistance capabilities in China. BBG

BofA Global Markets President DeMare says clients are doing less today than Q4 and the beginning of the year; still a good quarter even with client uncertainty, via Bloomberg TV. Says if they do not see productivity from AI, then investments will be scaled back.

China is increasing scrutiny of outbound investments by domestic companies as well as their use of proceeds from Hong Kong share sales, people familiar said. BBG

South Korea’s central bank lowered its policy rate by 25bp, as expected, and trimmed its growth forecast for the country as it resumed easing to support a sagging economy. WSJ

MSFT - Goldman reiterates its Buy rating, $500 PT, and leaves its estimates for $88bn/91bn in FY25/26 CapEx unchanged following recent reporting that Microsoft has potentially delayed or canceled some of its AI data center leases. While unconfirmed, GS believe this reporting emphasizes what the company has already telegraphed: that as a responsible capital allocator, Microsoft continues to invest in AI capacity prudently with an eye towards returns. GIR

A gauge measuring the attractiveness of German bonds hit a record low, in anticipation of more debt sales. BBG

Tariffs/Trade

US President Trump's team is seeking to tighten chip controls on China with the US said to be pressing Japan and Netherlands to align on China restrictions, while it is weighing tighter controls on Nvidia (NVDA) chip exports to China, as well as considering more restrictions on SMIC (981 HK) and CXMT. Furthermore, US officials reportedly met with Japanese and Dutch counterparts to restrict Tokyo Electron (8035 JT) and ASML (ASML NA) engineers from maintaining semiconductor equipment in China, according to Bloomberg.

Mexico studies tariffs on China in a bid to strike a deal with US President Trump, while Mexican President Sheinbaum said she sees agreements with the US by Friday and that Mexican officials are in Washington studying possible China levies, according to Bloomberg.

WTO panel is to examine measures adopted by Turkey targeting Chinese EV imports.

French President Macron said he hoped he convinced Trump on trade and noted that they do not tariff the US, while he added that they don't need a trade war and the urgency is to increase security expenditure.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded lower following the weak handover from the US where the tech sector led the declines and risk appetite was sapped amid ongoing uncertainty surrounding tariffs and geopolitics. ASX 200 retreated with underperformance seen in the tech, consumer discretionary and financial sectors, while defensives showed resilience and energy was also lifted following a jump in Woodside Energy's profit. Nikkei 225 slumped at the open on return from the long weekend but was off worse levels as shares of Itochu, Marubeni, Mitsubishi, Mitsui and Sumitomo rallied following reports late last week that Berkshire Hathaway plans to gradually raise its investments in Japanese trading houses. Hang Seng and Shanghai Comp conformed to the negative mood amid headwinds from trade frictions with the US seeking to tighten chip controls on China and after the PBoC's MLF operation resulted in a net drain of CNY 200bln. Nonetheless, Chinese markets were well off today's worst levels as the heavy slump at the open spurred some dip buying.

Top Asian News

PBoC conducted a CNY 300bln 1-year MLF operation with the rate kept at 2.00% for a net drain of CNY 200bln.

Huawei improved production of AI chips and achieved a yield close to 40% which marks a breakthrough for China's tech goals, according to the FT.

Bank of Korea cut its base rate by 25 basis points to 2.75%, as expected, with the rate decision unanimous and interest rates for the special loan programme were also lowered. BoK said US tariff policies, Fed policies, and stimulus measures by the Korean government are some of the uncertainties for the economy, while it noted it is necessary to remain cautious about high FX volatility. BoK Governor Rhee stated that four board members said current policy rates could be maintained for the next three months and two board members said further rate cuts are possible for the next three months, while Rhee added that the market consensus expecting two more rate cuts this year aligns closely with the central bank's views.

PBoC Advisor says Chinese CPI will decline moderately in February; changes in external environment will increase pressure on expanding domestic demand this year.

Opposition Japan innovation party (ISHIN) agrees on details of LDP, Komeito Coalition's revised state budget, according to a party official; revised state budget would pave way for passage of JPY 115tln FY2025-26 budget.

China's MOFCOM urges the EU to stop listing Chinese enterprises and to cease spreading false accusations against China; China will take necessary measures to firmly protect the legitimate rights and interests of Chinese enterprises.

European bourses (STOXX 600 +0.2%) are mostly modestly firmer vs. an entirely negative open; sentiment gradually improved as the morning progressed, paring some of the early-morning losses following a negative APAC handover. European sectors are mixed vs opening mostly lower. Healthcare tops the pile, with Novo Nordisk (+4%) shares on the front foot. Tech is the clear underperformer today, after Bloomberg reported that US President Trump's team is seeking to tighten chip controls on China; it was also said that US officials reportedly met with Japanese and Dutch counterparts to restrict Tokyo Electron and ASML engineers from maintaining semiconductor equipment in China.

Top European News

ECB's Nagel says inflation outlook is fairly encouraging; persistent core and services inflation warrants caution, via Bloomberg; German economy in "stubborn" stagnation; ECB should take one step at a time and not rush more cuts. Hopes for swift formation of the new German economy.

ECB's Kazaks says "I think we have to continue cutting rates", via Bloomberg; will take rate cuts "step by step", rate path to hinge on Trump policies. Must be cautious as we near the end of the terminal rate. Joint borrowing instrument needed for big investments. Europe at a critical point, need to invest in defence.

Reuters poll: 66/66 expect the BoE to hold rates at 4.5% in March with a median view of a cut in Q2 to 4.25%.

FX

After a pick-up late in the US session yesterday, DXY is a touch lower in early European trade. Trump was able to provide the dollar with some support yesterday after stating that he will be proceeding with tariffs on Mexico and Canada. Today's data slate sees the release of US Conference Board consumer confidence which is expected to slip to 102.5 from 104.1. Today's speaker slate includes Fed's Barr and Barkin. DXY is currently within a 106.56-79 range and above yesterday's YTD low at 106.12.

EUR is trivially firmer/flat vs. the USD with focus in Europe primarily on the political landscape in the wake of the fallout of the German Federal Election and the subsequent coalition-building process. From a monetary policy perspective, the latest ECB Euro Area Indicator of Negotiated Wage Rates showed Q4 wage growth slow to 4.12% from 5.43% but had little sway on EUR. Note ECB’s Schnabel is due to speak at 13:00GMT. EUR/USD is currently tucked within Monday's 1.0453-0528 range.

USD/JPY initially edged higher overnight and briefly reclaimed the 150.00 status but then faded the gains amid the broad downbeat risk tone across the APAC region and Japanese Services PPI data which slightly accelerated as expected. USD/JPY has delved as low as 149.20 with the next downside target coming via Monday's YTD low at 148.84.

GBP is flat vs. the USD and EUR with macro newsflow light for the UK. We heard yesterday from BoE's Dhingra who remarked that if rates are lowered by 25bps at a quarterly pace, you will still be in restrictive territory all of this year. That being said, she is very much viewed as s dovish outlier on the MPC. Of greater interest today is comments from BoE Chief Economist Pill. Currently trading within a 1.2607-38 range.

Antipodeans are both a touch softer vs. the USD. AUD/USD is down for a third consecutive session after printing a YTD peak at 0.6408 last Friday. Fresh macro drivers are lacking for Australia with attention instead turning to January inflation data due overnight with consensus looking for weighted CPI Y/Y to hold steady at 2.5%.

PBoC set USD/CNY mid-point at 7.1726 vs exp. 7.2530 (prev. 7.1717).

RBI is seen as likely to be selling USD's to stop the INR's downside, via Reuters citing traders.

Fixed Income

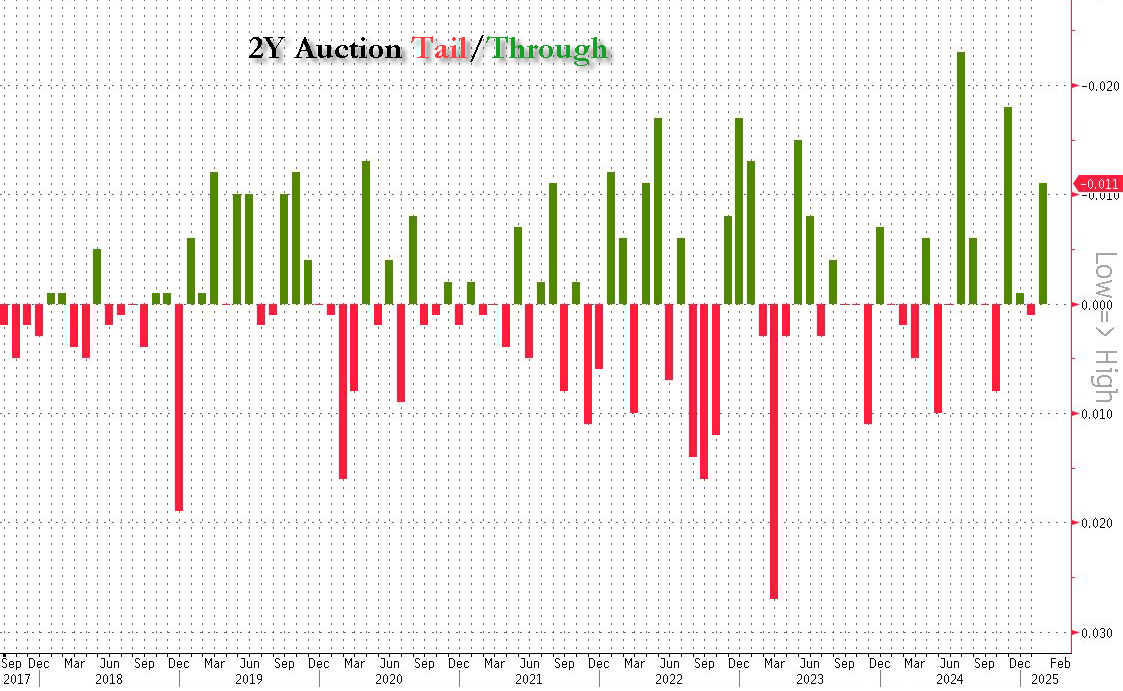

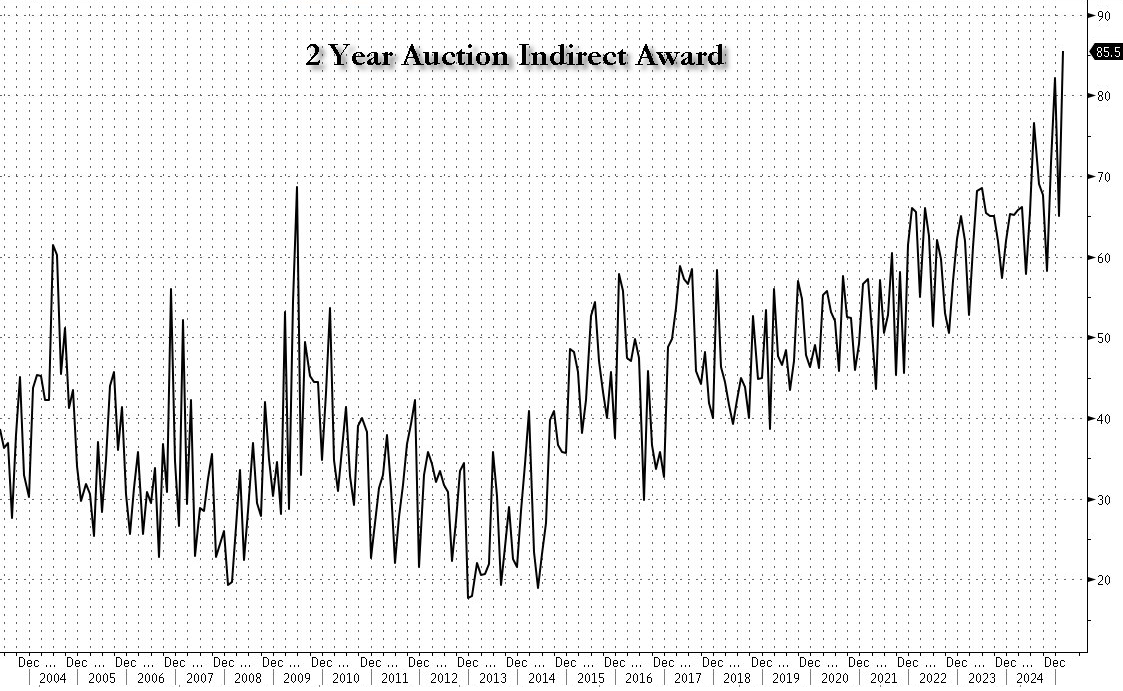

USTs are firmer, picked up a touch on Monday’s strong 2yr outing before grinding marginally higher overnight and then lifting back above the 110-00 mark to a 110-09 peak in the European morning, a high the benchmark has remained in proximity to since. Ahead, the speakers continue with Barr & Barkin due before POTUS signs his latest executive order. Amidst that, the US will sell 70bln of 5yr notes; follows a 2yr which saw a slightly softer b/c than the prior but still a strong level of demand, particularly for the indirect figure.

Bunds towards the top-end of a 131.87-132.45 band with the benchmark essentially flat as participants continue to digest the German election and await clues on coalition talks; the high printed just before the EZ wage tracker as the general risk tone took another modest leg lower. On the latter, the figure moderated from the prior in-fitting with proxies while an extensive text release from ECB’s Nagel largely focussed on the Bundesbank's accounts while monetary comments were in-fitting with his hawkish bias. No reaction to either event. A well received German Green Bund outing also had little impact.

Gilts are firmer, somewhere between USTs and Bunds in terms of magnitude as the benchmark acknowledges both the tepid risk tone and reports suggesting the UK could get involved in European-wide defence spending; a source cited by the FT said the UK Treasury “is interested in” the idea of a rearmament bank for such funding. Given that structuring spending in this way would limit the impact on Reeves’ fiscal position. Gilts find themselves in the green and holding towards the top-end of a slim 92.67-91 band.

UK sells GBP 1.6bln 1.125% 2035 I/L Gilt: b/c 3.52x (prev. 3.12x) and real yield 1.115% (prev. 1.128%).

Germany sells EUR 1.495bln vs exp EUR 1.5bln 1.80% 2053 Green Bund: b/c 2.4x (prev. 2.6x), average yield 2.73% (prev. 2.84%) & retention 0.33% (prev. 24.60%)

Italy sells EUR 2.75bln vs exp. EUR 2.5-2.75bln 2.55% 2027 & EUR 1.5bln vs exp. EUR 1.25-1.5bln 1.80% 2036 BTP€i

German 10-year spread to swaps hit the most negative on record, according to Bloomberg.

Saudi Arabia offers Middle East's first sovereign Euro Green Bond, via Bloomberg; 7-year Green Bond IPT mid swaps +155bps, 12-year Conventional Bond IPT mid swaps +175bps, according to IFR.

Commodities

Crude is a little firmer in what has been a lacklustre and choppy session for the complex thus far. Initially oil prices were subdued alongside the risk-off sentiment seen in early-European trade, but did improve a touch thereafter. More recently, prices have been choppy with Brent May currently trading in a USD 74.17-76/bbl parameter.

Subdued trade across precious metals despite the softer Dollar but with price action contained to tight ranges amid a lack of driver this morning. Spot gold remains at the record highs printed yesterday (USD 2,956.31/oz) with today's range currently between USD 2,929.64-2,953.42/oz.

Lacklustre trade across base metals despite the weaker Dollar but with the broader sentiment on the back foot and newsflow on the quieter side. 3M LME copper currently resides in a USD 9,424.95-9,500.05/t range after finding resistance at the half-round figure.

US President Trump commented on Truth that they want the Keystone XL Pipeline built and suggested easy approvals.

India could reportedly extend import curbs on low ash metallurgical coal used in steelmaking, according to Reuters sources.

IEA Director says Europe has been importing a lot of Russian LNG to help economies; might be a high time to replace it with LNG from Qatar beginning 2027.

Geopolitics

Russia's Kremlin says President Putin is "okay" with European peacekeepers in Ukraine, refers to earlier statement that such a move would be unacceptable. When asked about a possible US-Russia rare earths deal, says the US needs rare earth minerals, and "Russia has a lot". Many steps need to be taken to restore trust between the US and Russia. When asked about the UN vote on Ukraine on Monday, says it sees the US taking a much more balanced stance. Says European stance on Ukraine may become more balanced as a result of contacts with the US.

US President Trump said he emphasised the importance of the critical minerals and rare earth deal with Ukraine in meeting with French President Macron, while Trump added that he is in serious discussions with Russian President Putin about ending the war and talks are proceeding very well. Trump also said he was talking with French President Macron about trade deals at the White House and will meet with Ukrainian President Zelensky either this week or next to sign a minerals deal. Trump later said he had great conversations including with Russia on ending the Ukraine war and the meeting with French President Macron is another step forward towards ending the war.

French President Macron said they need something substantial for Ukraine and Europe, while he stated his message to US President Trump was to be careful and that they have to go fast but first need a truce in Ukraine. Macron also stated that he thinks he had a strong convergence with Trump on Ukraine and a truce could be reached in the coming weeks, as well as noted that it is feasible to establish a truce at least and start negotiating for peace. Furthermore, Macron said he is working with the UK on a UK-France proposal for presence to maintain peace with US backup and backstop, while he spoke with European leaders and that many are ready to be part of security guarantees.

UN General Assembly adopted the amended US-drafted Ukraine resolution that backs Ukraine's sovereignty and territorial integrity, while it approved all proposed European amendments to the US-drafted resolution on Ukraine and rejected the proposed Russian amendment to the US-drafted resolution on the Ukraine war anniversary. It was later reported that Russia failed at the UN Security Council to amend the US-drafted resolution on Ukraine and vetoed a European attempt to amend the US-drafted resolution on Ukraine, while the UN Security Council adopted the US-drafted resolution on Ukraine.

Poland scrambled aircraft to ensure airspace security after Russia launched strikes on Ukraine, while all of Ukraine was reportedly under air raid alerts as the air force warned of Russian missile attacks.

Russia Foreign Minister Lavrov to visit Iran on Tuesday, according to RIA.

US Event Calendar

08:30: Feb. Philadelphia Fed Non-Mfg, prior -9.1

09:00: Dec. S&P CS Composite-20 YoY, est. 4.41%, prior 4.33%

Dec. S&P/CS 20 City MoM SA, est. 0.40%, prior 0.41%

4Q House Price Purchase Index QoQ, est. 0.3%, prior 0.7%

10:00: Feb. Conf. Board Consumer Confidenc, est. 102.5, prior 104.1

Feb. Conf. Board Present Situation, prior 134.3

Feb. Conf. Board Expectations, prior 83.9

10:00: Feb. Richmond Fed Index, est. -3, prior -4

10:30: Feb. Dallas Fed Services Activity, prior 7.4

DB's Jim Reid concludes the overnight wrap

Morning from what promises to be a relatively warm and sunny day in Lisbon. Two consequences of Brexit hit me last night. One I had to queue for 75 minutes at immigration with a British passport and secondly when I got to the counter the officer said that he shouldn't let me in as I have no blank spaces left on my passport. He squeezed a stamp on a full page and let me in and warned me to get a replacement immediately. So in my hotel room last night I had to book an emergency passport appointment before a US trip next week. I had no idea the passport was full. It's only been an issue since Brexit as previously no European travel got stamped. To get an appointment though I needed to take a passport photo of myself on my phone in a dimly lit hotel room. 25 attempts later and I finally managed to get one that the online portal approved after balancing a table on my bed, putting the iPhone on it, the camera timer on and running to stand in front of the blank wall. The glamour of work travel.

While I was travelling and taking selfies, US markets tried to recover yesterday but ultimately struggled with the Magnificent 7 (-1.40%) closing at its lowest level since early December, which in turn left the S&P 500 -0.50% lower. Europe managed to again outperform the US, though the STOXX 600 was still down -0.08% even as the DAX (+0.62%) advanced. And with more negative sentiment coming to the fore, US Treasuries rallied across the curve, with the 10yr yield (-3.1bps) closing at a two-month low of 4.40%. This morning its edged lower again to 4.375%.

Those election results from Germany were a key market focus yesterday, as investors reacted to Sunday’s vote. As a reminder, the conservative CDU/CSU are the largest group in the new Bundestag, but the only two-party coalition that can reach a majority are the CDU/CSU and the SPD, given that they’ve refused to cooperate with the AfD. A coalition between the two seemed to be the goal for the CDU/CSU yesterday, with CDU leader Friedrich Merz saying that “I am determined to hold constructive, good, swift talks with the Social Democrats”. That’s a combination Germany has seen frequently in the last couple of decades, with the two governing together for three of Angela Merkel’s four terms, including from 2013-21. However, it’s clear that the SPD’s position as the only party able to provide a majority for the CDU/CSU offers them leverage in any negotiations, and SPD co-leader Lars Klingbeil said that “Whether the SPD enters a government isn’t yet clear”.

In the meantime, there was continued speculation about whether there might be some sort of reform to the debt brake. As it stands, the centrist parties (CDU/CSU, SPD and Greens) are just short of the two-thirds majority required to change the constitution. They could achieve that threshold with the left-wing Die Linke, but they favour lower defence spending and have said they’d only vote for that if investments were made in infrastructure. So there’s theoretically a compromise you could reach where they agree to exempt infrastructure from the debt brake, and that could create more space for defence spending in the core budget.

Another idea gaining momentum yesterday was that the centrist parties could even reform the debt brake in the current Bundestag, where the different centrist groups already have a two-thirds majority, and Merz said that “The German Bundestag is able to make decisions at any time”, although current finance minister Joerg Kukies said that it would “be a questionable political signal if constitutional amendments were now made with an old majority”. While this debate is in its early stages, our Germany economists argue that markets should start pricing in some probability of meaningful debt-brake reform in the next few weeks. Indeed, Bloomberg reported after Europe went home that Merz has opened talks with the SPD for special defence spending of as much as EUR 200bn before a formal coalition deal is made and before the new legislature sits on March 24th.

In terms of the market reaction, German equities saw a clear outperformance relative to their European counterparts. After a topsy-turvy session, the DAX was +0.62% by the close, having been up more than +1% in the European morning but then briefly falling into the red amid a broader risk-off move early in the US session. There was a stronger performance for the MDAX index of mid-cap stocks, which are more domestically concentrated, but even there the index was up +2.83% before paring that back to close +1.52% higher. Looking at the specifics, expectations for higher defence spending meant that Rheinmetall (+6.40%) was the strongest performer in the DAX again, bringing its YTD advance to +54.80%.

In my CoTD yesterday which went out late due to technical issues I discussed how the election continued a global trend (especially in Europe) where the establishment parties combined hit a record low share of the vote. In Germany support for the CDU/CSU and SPD combined has never been lower at 45.0%, down from 91.2% at the peak in 1976. In the UK election last year the combined vote for Labour and the Conservatives was the lowest in over a century and in the French elections at a similar time we saw support for the far right, far left and centrists broadly equal. We think mainstream parties are suffering due to ever lower economic growth, which along with wider inequality means that an increasing share of the electorate must be, by definition, exposed to negative growth in their world. Concerns over issues like immigration and globalisation are likely symptoms of this rather than the root cause.

Finally on the election, the Euro itself was fairly subdued yesterday, only seeing a modest +0.10% move against the US Dollar. Our FX strategists published an update yesterday after the German election, where they stay euro bearish on balance. However, their conviction on a sub-parity drop for the euro is now lower than it was, mainly because of incoming US fiscal news and the market’s resilience to absorbing tariff announcements without building a risk premium. Nevertheless they also don’t see a breakout higher for EUR/USD given the lack of sufficiently clear positive catalysts from Europe, particularly given the prospect of further ECB easing and persistent tariff risk.

Elsewhere in Europe, there was a lot of focus on Ukraine yesterday, with growing noises that the Ukraine and the US were moving closer to some sort of minerals deal. Ukraine’s Deputy PM Olga Stefanishyna said that “Ukrainian and U.S. teams are in the final stages of negotiations”, with Trump saying later on that “It looks like we’re getting very close” and that Zelenskiy could visit Washington in the next week or two to sign an agreement. Earlier Bloomberg reported that a draft text would see the US commit to a “free, sovereign and secure” Ukraine. Separately, in a meeting with France’s Macron, Trump claimed that Russia’s Putin would accept European peacekeepers in Ukraine. Macron suggested that he and Trump made “substantive steps forward” as he stressed the need for security guarantees for Ukraine, though Trump avoided any direct assurances on this front. So we’ve seen a more constructive tone compared to last week’s concerns that US-Russia talks would leave Ukraine and Europe out in the cold, but the path towards ending Russia’s war in Ukraine is still far from clear.

As mentioned at the top risk assets saw a bit of volatility yesterday. In the US, the S&P 500 (-0.50%) closed beneath 6,000 for the first time since mid-January, extending its -1.71% slump last Friday. This decline came due to a late sell-off that in part followed Trump’s suggestion that the delayed tariffs against Canada and Mexico “are going forward on time, on schedule”. That said, Bloomberg later reported that the fate of the 25% levies was still to be determined. The US equity decline was driven by tech stocks, with the Magnificent 7 down -1.40% ahead of Nvidia (-3.09% yesterday) reporting its results after the US close tomorrow. Bear in mind that the market impact of Nvidia’s results have often proved to be as significant as US jobs reports over the last couple of years, so it’s still a big event on the calendar. There were some news stories over the weekend around Microsoft (-1.03%) cancelling some leases for data centers which raised concerns about excess capex spending.

Otherwise, US Treasuries put in a fresh rally yesterday, as the broader risk-off tone pushed yields lower. Indeed, the 10yr yield (-3.1bps) closed at its lowest since early December, at 4.40%, and the 10yr real yield (-4.2bps) moved back beneath the 2% mark again. That came as investors also dialled up their expectations for Fed rate cuts this year, with the amount priced in by the December meeting up +3.6bps to 50bps.Meanwhile in Europe, 10yr yields were much steadier, with those on 10yr bunds, OATs and BTPs all +0.7bps higher on the day.

Asian equity markets are weaker overnight. There was a Bloomberg report that the Trump administration is seeking further curbs in Chinese investments in strategic sectors including technology, and especially in chips. The move has led to a decline in Chinese technology shares with the Hang Seng dropping more than -1% initially and tech titans including Alibaba and Tencent emerging as the biggest losers. As I check my screens, the Hang Seng (-0.62%) has partially recovered some of its earlier losses with the Shanghai Composite (-0.25%) also recovering. Elsewhere, the KOSPI (-0.49%) and the S&P/ASX 200 (-0.68%) are also trading lower with the Nikkei (-1.10%) leading the declines after reopening following yesterday’s holiday.

In monetary policy action, the Bank of Korea cut interest rates by 25 bps to 2.75%, its lowest since August 2022, as it strives to shore up economic growth amid weak domestic demand and uncertainties at home and abroad. The decision comes as South Korea continues to grapple with political uncertainty over the impeachment trial of President Yoon Suk Yeol.

There was very little other data yesterday, although Germany’s Ifo business climate indicator remained at 85.2 in February (vs. 85.8 expected). The expectations component did pick up to 85.4 (vs. 85.0 expected), but the current assessment reading fell back to 85.0 (vs. 86.3 expected).

To the day ahead now, and US data releases include the Conference Board’s consumer confidence for February, the FHFA’s house price index for December, and the Richmond Fed’s manufacturing index for February. From central banks, we’ll hear from the Fed’s Logan, Barr and Barkin, the ECB’s Nagel and Schnabel, and the BoE’s Pill.

https://cms.zerohedge.com/users/tyler-durden

Tue, 02/25/2025 - 07:30

https://www.zerohedge.com/precious-metals/futures-drop-momentum-massacre-crushes-bitcoin

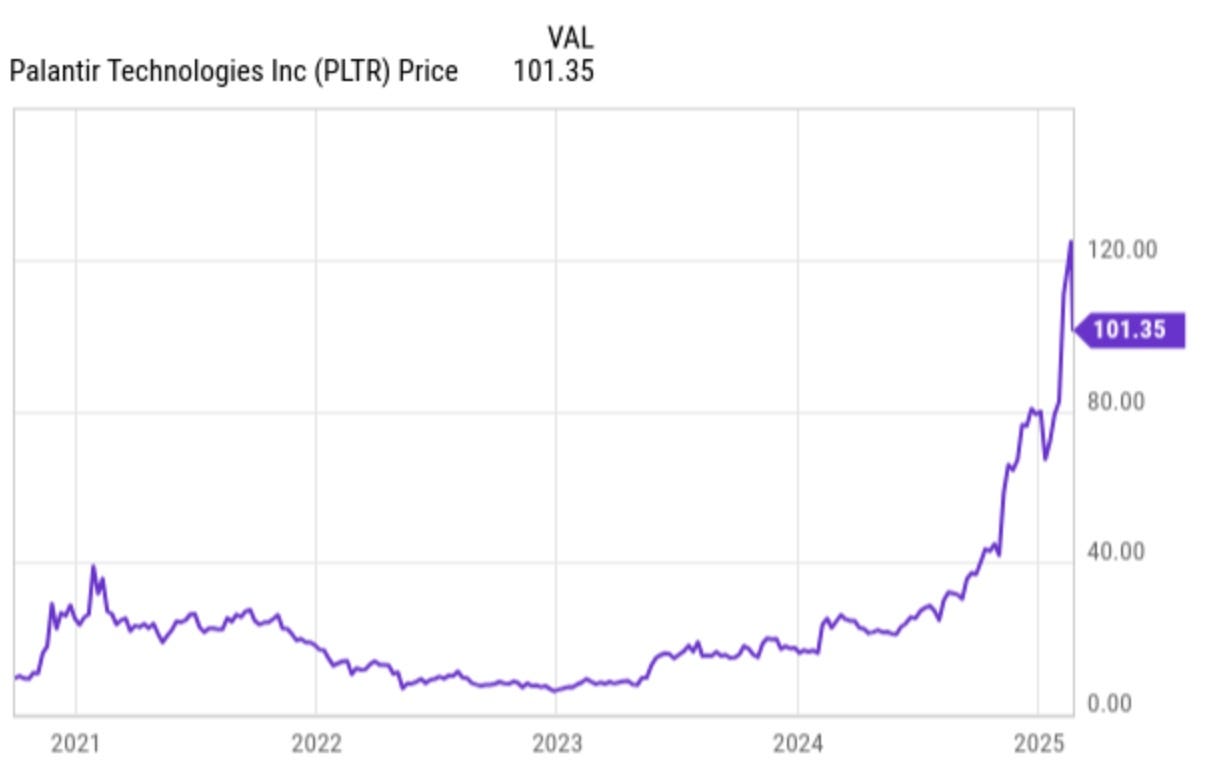

Trump Seeks Tougher Chip Controls On China To Curb Advancements

Trump Seeks Tougher Chip Controls On China To Curb Advancements

Asian main equity indexes declined on Tuesday, pressured by a mix of broad risk-off sentiment, US equity degrossing, unfavorable seasonality trends, some technical factors, and profit-taking. Fresh concerns over President Trump's 'America First' policies further weighed on sentiment.

A report last weekend indicated that the Trump administration directed the Committee on Foreign Investment in the US to restrict Chinese investments in strategic sectors to safeguard national security interests.

However, this note focuses on a new https://www.bloomberg.com/news/articles/2025-02-25/trump-administration-seeks-more-restrictions-on-china-tech-weighs-nvidia-curbs

report detailing Trump's efforts to curb China's chip advancements as AI enthusiasm erupts in the world's second-largest economy alongside soaring AI CAPEX spending.

Individuals familiar with Trump's upcoming chip restrictions on China informed Bloomberg about what's coming down the pipe:

Trump officials recently met with their Japanese and Dutch counterparts about restricting Tokyo Electron Ltd. and ASML Holding NV engineers from maintaining semiconductor gear in China, according to people familiar with the matter. The aim, which was also a priority for Biden, is to see key allies match China curbs the US has placed on American chip-gear companies, including Lam Research Corp., KLA Corp. and Applied Materials Inc.

The meetings come in addition to early discussions in Washington about sanctions on specific Chinese companies, other people said. Some Trump officials also aim to further restrict the type of Nvidia Corp. chips that can be exported to China without a license, Bloomberg News has previously reported. They're also having early conversations about tightening existing curbs on the quantity of AI chips that can be exported globally without a license, said some of the people, who asked not to be identified because the deliberations are private.

The timing of the new chip restrictions could "take months," according to Bloomberg, noting, "It remains to be seen whether allies will be more receptive" to additional restrictions on China's chip industry.

Goldman's Ananya Prakash in London commented on the ongoing trade situation:

Press reporting that Trump's administration is looking at tougher semiconductor curbs. GIR notes that the release highlights potential areas for increased scrutiny including US outbound investment to China, Chinese ADR standards, and companies on the Chinese Military Companies List. The memorandum suggests tighter controls on certain sectors like semiconductors and AI, possible changes to tax treaties, and stricter investment reviews.

Tokyo Electron shares closed down nearly 5% after the Bloomberg report.

Prakash provided clients with more color on semis action today:

Semis basket (GSSBSEMI) down 2.1% this morning, with its top constituents all down on the day as the US sketches out tougher versions of existing US semiconductor curbs against Beijing and pressures the Netherlands and Japan to escalate restrictions on China's chip industry. Most notably ASML down 3% today, following the news that Trump's team met with Japanese and Dutch counterparts, to discuss restricting ASML's engineers from servicing/maintaining their hardware, which is key in producing microchips.

The chart we're tracking is the PHLX Semiconductor Sector, which is trading 15% below its July 2024 peak.

?itok=sIvl4LzE

?itok=sIvl4LzE

Last week, Goldman's Fred Yin and Shubham Ghosh asked clients if https://www.zerohedge.com/markets/us-exceptionalism-over-alibaba-soars-ai-us-china-tech-valuation-gap-must-narrow

as the AI boom shifts to China...

US Exceptionalism Over? Alibaba Soars On AI As US-China Tech Valuation Gap "Must Narrow" https://t.co/2utJKaXsz0

— zerohedge (@zerohedge) https://twitter.com/zerohedge/status/1893022934492418424?ref_src=twsrc%5Etfw

Plus, there are mounting concerns about Microsoft data center order cancellations, per a new TD Cowen report. However, MSFT "https://www.zerohedge.com/markets/channel-checks-indicate-data-center-cancellations-report-bursts-ai-bubble

" the report.

https://cms.zerohedge.com/users/tyler-durden

Tue, 02/25/2025 - 07:20

https://www.zerohedge.com/technology/trump-seeks-tougher-chip-controls-china-curb-advancements

NCAAP Gives Kamala An Award... No One Knows Why

NCAAP Gives Kamala An Award... No One Knows Why

Authored by https://headlineusa.com/author/lcornelio/

,

The NAACP awarded former Vice Presidenthttps://headlineusa.com/tag/kamala-harris/

on Saturday one of its most prestigious honors, the Chairman’s Award - months after voters overwhelmingly rejected her presidential candidacy for the second time in a row.

Kamala Harris just got an award for being the first black woman to certify her own election loss:https://t.co/p4plKZDTsE

— End Wokeness (@EndWokeness) https://twitter.com/EndWokeness/status/1893526531751731308?ref_src=twsrc%5Etfw

The https://headlineusa.com/tag/NAACP/

, which aired on BET, recognized Harris’s supposed commitment to equality, justice and progress, despite tenure as California attorney general and San Franciso district attorney, where she jailed many black Americans for petty crimes.

Most infamously, Harris oversaw nearlyhttps://www.axios.com/2024/08/03/kamala-harris-prosecutor-district-attorney-record

for marijuana possession, yet she later appeared on The Breakfast Club to boast about her past use of the drug.

Seemingly unable to highlight a non-existent pro-justice record, Harris spent much of her speech throwing indirect jabs at President Donald Trump—the man who defeated her in the https://headlineusa.com/tag/2024-election/

.

“While we have no illusions about what we are up against in this chapter in our American story, this chapter will be written not simply by whoever occupies the oval office nor by the wealthiest among us. The American story will be written by you. Written by us. By we the people,” Harris pontificated.

This evening, I was honored to accept the NAACP’s Chairman’s Award.

I grew up inspired by the work of the NAACP — by all those who took up the fight for justice, equality, and opportunity. Their example is part of the reason I chose a life of public service.

At this moment,… https://t.co/lmRFCLUQTq

— Kamala Harris (@KamalaHarris) https://twitter.com/KamalaHarris/status/1893564154071654751?ref_src=twsrc%5Etfw

In true Harris fashion, she continued her metaphor-heavy word salad:

“Some see the flames on our horizons, the rising waters in our cities, the shadows gathering over our democracy and ask, ‘What do we do now?’”

She then offered what sounded like a reprise of her failed presidential campaign message.

“But we know exactly what to do, because we have done it before. And we will do it again. We use our power. We organize, mobilize. We educate. We advocate. Our power has never come from having an easy path,” she preached.

Despite the loud cheers at the NAACP Image Awards, the applause seemed detached from the reality of how most Americans view Harris, given her two failed bids for the presidency and ongoing low approval ratings.

In 2020, Harris unsuccessfully sought the Democratic nomination for president but withdrew before voting even began.

Voters rejected her candidacy once again even after inheriting the nomination from her embattled boss, former President Joe Biden.

As of Jan. 20, 2025, Harris had an average disapproval rating of 52.7 percent, according to https://projects.fivethirtyeight.com/polls/approval/kamala-harris/

.

https://cms.zerohedge.com/users/tyler-durden

Tue, 02/25/2025 - 06:55

https://www.zerohedge.com/political/ncaap-gives-kamala-award-no-one-knows-why

Born American? A Look At 'Birthright Citizenship'

Born American? A Look At 'Birthright Citizenship'

,

Our political class is aflame, and our lawyer-ocracy is up in arms over President Trump’s executive order limiting the scope of “birthright” (or “soil-based”) citizenship to children of permanent legal residents. Children born to tourists, students from other countries, and others here on a short-term basis, plus people here illegally, are no longer to be regarded as citizens of the United States merely because their mothers happened to be on American soil when they were born.

?itok=G1MS3hlO

?itok=G1MS3hlO

Is that constitutional? Does the U.S. Constitution demand that virtually everyone born on our soil (basically everyone except for the children of diplomats who, by convention, are under their home country’s laws) be considered a citizen by birth?

Most lawyers and law professors think that the answer is yes. But is it quite so clear? The 14th Amendment reads: “All persons born or naturalized in the United States, and subject to the jurisdiction thereof, are citizens of the United States and of the State wherein they reside.” Most of the discussion of this question thus far has focused on the meaning of the phrase “subject to the jurisdiction thereof,” and the prevailing view is that it was meant to include everyone who was, generally speaking, subject to American law. Although the Supreme Court has never ruled on the case of a child born to foreigners who are only here briefly, it has suggested that it would include them in the set of people who are citizens at birth.

Critics of this position hold that the amendment applies to cases in which the U.S. has complete jurisdiction over the person and note that there are ways that the scope of American jurisdiction over citizens and permanent residents is different than for people who are merely passing through – in being subject to the draft (and there had been a draft shortly before the amendment was ratified), to jury duty, and to many taxes (particularly since the people increased American jurisdiction by adding an income tax to the constitution in 1913), among other ways.

These discussions often turn to the debates in the Senate when they were drafting the amendment before sending it to the states so that the people, via their state legislatures, could decide if they wanted to add it to the Constitution. That’s a useful exercise, and it also would be helpful to see more discussion of what the people understood the amendment to mean when they had their state legislatures ratify it. Constitutional law is not legislation. The Constitution, including the amendments to it are the supreme law of the land because we, the people, made them so; so what we understood ourselves to be doing when we approved a text carries more weight than what senators understood themselves to be recommending to the people for approval. Our lawyers tend to think that’s too complicated. But it is not our job to make life easy for lawyers.