ADP Reports Biggest Disappointment In Job Gains In 2 Years In February

ADP Reports Biggest Disappointment In Job Gains In 2 Years In February

According to the latest data from ADP, hiring slowed to the smallest level of gains since July, with trade and transportation, health care and education, and information showing job losses. Small business employment also fell.

?itok=5JqWWyS9

?itok=5JqWWyS9

That was the biggest miss for ADP headline data since March 2023...

?itok=N5Fep-Sk

?itok=N5Fep-Sk

According to Nela Richardson, Chief Economist at ADP, "policy uncertainty and a slowdown in consumer spending might have led to layoffs or a slowdown in hiring last month. Our data, combined with other recent indicators, suggests a hiring hesitancy among employers as they assess the economic climate ahead."

Oddly, as we noted above, job losses were concentrated in Small Businesses... (we say oddly because we have seen Small Business Optimism explode higher since Trump was elected...)?

?itok=U8gSqY1W

?itok=U8gSqY1W

Perhaps more odd still is the fact that goods-producing firms saw a huge jump in job additions (Trump driving confidence in manufacturing with the biggest addition since Oct 2022) while Services was job additions tumble...

?itok=RRoMJvlR

?itok=RRoMJvlR

On the potentially positive side of the ledger - wage growth slowed for job-changers (and was flat for job-stayers)...

?itok=wNC0_rVe

?itok=wNC0_rVe

But given the levels of wage inflation (and labor weakness), it still has the stench of stagflation.

So, to sum things up:

Small biz optimism is thru the roof... but small biz see the most layoffs.

...and policy uncertainty is cited as the reason for weakness BUT manufacturers (which is where all the uncertainty is) added the most jobs since Oct 2022...

Is someone trying to force a confidence collapse narrative?

https://cms.zerohedge.com/users/tyler-durden

Wed, 03/05/2025 - 08:27

Futures Rise On Hope For Trade War Relief, Europe Soars, Bunds Crash On "Whatever It Takes" Stimulus

Futures Rise On Hope For Trade War Relief, Europe Soars, Bunds Crash On "Whatever It Takes" Stimulus

US equity futures are higher following comments from Commerce Secretary Howard Lutnick who seemed to suggest that a compromise on Canadia/Mexican tariffs could be announced today; and while Trump’s speech last night doubled-down on tariffs he but did not refute Lutnick’s comments; at the same time the US/Ukraine mineral deal also appears to be moving forward providing further de-escalatory relief for markets. As such, as of 8:00am, S&P 500 futures are up 0.3% while Nasdaq 100 contracts add 0.6% (both well off session highs) with all 7 of the Mag 7 higher and Semis are bid into MRVL earnings. Chinese stocks led a rally in Asia after Beijing set an ambitious economic growth target that boosted expectations of further stimulus.Finally, European stocks are surging (Dax +3%) after Germany unveiled plans to unlock hundreds of billions of euros for defense and infrastructure investments in a dramatic policy shift which has sent German bonds plunging by a near record 22bps. US Treasury yields are flat around 4.24% while the USD is weaker and commodities are mixed. Energy is lower, Ags higher, and precious over base. Today’s macro data focus is on ISM-Srvcs, Factory Orders, Mortgage Applications (up 20.4%), and ADP.

?itok=o_TV4Ejx

?itok=o_TV4Ejx

In premarket trading, Goldman and Citigroup rose more than 1%, while Tesla was poised to recover from a four-month low, and led gains among the Magnificent Seven stocks, putting the electric-vehicle maker’s stock on track to rebound after two sessions of losses (TSLA 1.6%, NVDA +1.5%, AMZN +0.8%, META +0.5%, GOOGL +0.6%, AAPL +0.3% and MSFT +0.3%). AeroVironment (AVAV US) shares are down 20% in premarket trading after the small unmanned aircraft maker slashed its FY forecasts. It also reported third-quarter results that missed expectations. Here are some other notable movers:

AppLovin Corp. (APP US) is downgraded to sell from neutral at Arete, which cites concerns over the firm’s e-commerce business

Carrier Global (CARR US)shares rise as much as 2.9% in US premarket trading after JPMorgan upgrades the heating and air conditioning equipment maker to overweight from neutral, seeing the stock as cheap enough

Moderna (MRNA US) shares rally 8.6% in premarket trading after Chief Executive Officer Stephane Bancel and Board Director Paul Sagan said they bought $6 million of stock, according to SEC filings

Palantir Technologies Inc. (PLTR US) shares are up 2.6% in premarket trading, after William Blair upgraded the AI software company to market perform from underperform

Shares of automakers, banks and chip firms jumped in premarket trading on Wednesday after Lutnick said the Trump administration may announce a pathway for tariff relief on goods from Canada and Mexico covered by a North American free trade agreement

US stocks capped their worst two-day slump since December on Tuesday, before the comments from Lutnick, who told Fox Business that Trump may offer a path to alleviate some tariff pressure. Traders will be watching data due later today for a snapshot of the state of the economy.

“The market doesn’t like uncertainty and tariffs will most likely continue to be an overhang risk,” Nataliia Lipikhina, EMEA equity strategy head at JPMorgan Private Bank, said on Bloomberg TV. “But if we are looking at earnings growth in the US, we actually see double-digit growth in 2025 and 2026. We are buyers of the dip at this point.”

In an address to Congress, Trump acknowledged that there may be an “adjustment period” to tariffs as he defended his policies to remake the US economy. Ten-year Treasury yields traded steady at 4.24%, while the dollar sank 0.4%.

On the corporate front, Blackrock Inc., the world’s biggest asset manager, led a consortium that will buy a controlling stake in Panama ports and a larger unit that has operations across 23 countries. It’s one of the biggest acquisitions of the year that marks a win for Trump, who had raised concerns over control of key ports near the Panama Canal.

European stocks are sharply higher on German military spending/debt brake removal, unlocking hundreds of billion of euros in defense and infrastructure spending. Shares in the region have also received a boost on hopes that the Trump administration may walk back some tariff measures and also on the increasing probability of a US/Ukraine mineral deal which is boosting the odds of a ceasefire. Construction and industrial sectors are leading the gains. Stoxx 600 rises 1.7% to 560.62 with 473 members up, 121 down and 6 unchanged. The DAX is up over 3% and set for its best day in over two years, the euro rises 0.6% and now trades above $1.07 for the first time since November. Here are some of the biggest European movers on Wednesday:

Germany’s defense, industrial and domestic stocks rise after chancellor-in-waiting Friedrich Merz said the country would unlock hundreds of billions of euros for defense and infrastructure investments.

European mining stocks and steelmakers are outperforming on Wednesday after commodity-hungry China set a bullish economic growth goal for 2025 and said it will cut output of steel in an attempt to ease a massive glut and restore profitability at mills.

Bayer shares gain as much as 6.5% after the German company reported sales and earnings for the fourth quarter that were ahead of expectations.

Campari shares rise as much as 6.3% as analysts point to the Italian spirits maker’s fourth-quarter sales beat and strength in its EMEA business and aperitifs.

Breedon Group shares jump as much as 15% after the building materials company delivered results just ahead of expectations.

Evonik shares jump as much as 11% after the specialty chemicals company said it expects earnings to grow in the current quarter.

Sandoz shares gain as much as 7% as biosimilars sales of the Swiss generic drugs maker came in slightly higher than anticipated and the company reaffirmed its mid-term outlook.

Games Workshop shares rise as much as 8.5% to hit a new record high after the Warhammer figurine maker said trading was better than expected in the first two months of 2025, which is set to see annual profit come in ahead of expectations.

Richter shares gain as much as 3.6% after the Hungarian pharmaceutical company said it plans to pay out 30%-50% of its adjusted net income in 2025-2030, providing “significant upside” to the dividend, as it focuses strategy on managing the patent cliff for its blockbuster Cariprazine drug.

Flutter shares rise as much as 3.4% in London after the FanDuel owner reported final results for 2024 in line with consensus and confident 2025 outlook.

Adidas shares fall as much as 3.9% after the sportswear company forecast FY25 operating profit that missed analyst estimates.

Lindt & Spruengli shares drop as much as 5.4% after Vontobel cut its recommendation on the chocolatier to hold from buy, citing a volatile market amid low US consumer confidence data and the strong run in the stock before results released this week.

Earlier in the session, Asian stocks rallied as China’s ambitious growth target raised prospects of more stimulus and the Trump administration indicated it may roll back some tariffs on its allies. The MSCI Asia Pacific Index rose as much as 1.1%, the most in three weeks, with Chinese technology stocks like Tencent and Meituan among the biggest boosts. Chinese stocks in Hong Kong rallied more than 3% after the National People’s Congress in Beijing set an economic growth target of about 5% for 2025, the third straight year it has maintained that goal. Stock benchmarks also rallied in Japan, Korea and Taiwan. Donald Trump’s administration showed willingness to walk back on the 25% tariff imposed on Canada and Mexico, two of its biggest trading partners. Hong Kong and China’s “major indexes do not look expensive, trading around historical means,” Citi strategists including Pierre Lau wrote in a note. “Valuations of China’s alternatives to the US’s magnificent-seven stocks look inexpensive, in our view,” he said. Elsewhere, India’s NSE Nifty 50 Index climbed, snapping a record-setting 10-day losing streak, while stocks fell in Australia.

While German and European stocks are surging, German bunds lead a near-record plunge in European government bonds after Germany unveiled plans to unlock hundreds of billions of euros for defense and infrastructure investments in a dramatic policy shift. German 10-year yields soar more than 22 bps to 2.72%, the biggest one day move since the failed bund auction in Nov 2011.

?itok=Xy5PyIYy

?itok=Xy5PyIYy

“Huge quantities of debt in the coming years is going to be quite disruptive for European bond markets, particularly the long end of the curve,” said Peter Kinsella, global head of FX strategy at Union Bancaire Privee Ubp SA in London. “We’ve not seen this type of issuance pretty much since the early 1990s when Germany was paying for reunification.

In the US, treasuries are steady as US trading gets under way with the curve steeper, as front-end yields are more than 3bps richer on the day with long end little changed. Treasury yield shift leaves 2s10s, 5s30s spreads steeper by 3bp-4bp; US 10-year yield around 4.23% is ~2bp lower on the day while Germany’s is higher by 22bp, after German policy shift to a massive debt-financed defense spending plan. US session includes February ADP employment and ISM services gauge, and possibility of Mars Inc. corporate bond sale exceeding $25 billion.

In FX, the Bloomberg Dollar Spot Index fell 0.6%, hitting its lowest since Dec. 9, led by falls versus the euro; EUR/USD jumped 0.9% to 1.0722, a level last seen on Nov. 11 after Germany pledged to unlock hundreds of billions of euros for defense and infrastructure spending; the Swedish krona takes top spot among G-10 FX, rising 1% against the greenback.

“The US economy could slow down further and force the Fed to resume its easing cycle in the second half of the year,” said Valentin Marinov, head of global FX strategy at Credit Agricole CIB. “The Fed may also have to put an end to its quantitative tightening programme to accommodate US President Donald Trump’s fiscal spending plans. This could erode the USD exceptionalism.”

In commodities, WTI falls 1.5% to $67.20 a barrel. Bitcoin rises 3% and above $90,000.

The US economic data calendar includes mortgage applications which soared by 20.4%, after dropping 6.4% last week; February ADP employment change (8:15am), S&P Global US services PMI (9:45am), January factory orders and February ISM services index (10am). Fed releases Beige book at 2pm. Fed speaker slate empty for the session

Market Snapshot

S&P 500 futures up 0.8% to 5,838.00

MXAP up 1.1% to 186.59

MXAPJ up 1.9% to 586.12

Nikkei up 0.2% to 37,418.24

Topix up 0.3% to 2,718.21

Hang Seng Index up 2.8% to 23,594.21

Shanghai Composite up 0.5% to 3,341.97

Sensex up 1.0% to 73,718.18

Australia S&P/ASX 200 down 0.7% to 8,141.11

Kospi up 1.2% to 2,558.13

STOXX Europe 600 up 1.5% to 559.12

German 10Y yield little changed at 2.68%

Euro up 0.9% to $1.0718

Brent Futures down 0.6% to $70.63/bbl

Gold spot down 0.1% to $2,915.13

US Dollar Index down 0.82% to 104.88

Top Overnight News

US President Trump said in his Address to the Joint Session of Congress that America is back and they have taken swift and relentless action and are just getting started. Trump announced he will create a new office of shipbuilding in the White House and will offer new tax incentives for shipbuilding, while he is fighting every day to make America affordable again and reiterated his call to drill for more oil. Furthermore, Trump said they will eliminate inflation by reducing all fraud, waste and theft of public money and stated that reciprocal tariffs will kick in on April 2nd.

President Donald Trump's administration is considering granting relief from his 25% tariffs on Canadian and Mexican imports to products that comply with the trade pact he negotiated with the two U.S. neighbors during his first term, Commerce Secretary Howard Lutnick said on Tuesday. RTRS

Trump called for ending the bipartisan $52 billion chip subsidy program, saying it’s a “horrible, horrible thing.” An end to subsidies will end up benefiting the Chinese AI and semiconductor sector. BBG

Border crossings along the US-Mexico border plummeted to the lowest level in decades during Feb, giving Trump a major victory. Axios

German borrowing costs surged by the most in 17 years as investors bet on a big boost to the country’s ailing economy from a historic deal to fund investment in the military and infrastructure. The yield on the 10-year Bund surged 21 bps to 2.69%, its biggest one day move since 2008. FT

Google is urging DOJ officials to back away from a push to break up the company, citing national security concerns, people familiar said. The Biden administration called for changes including the sale of its Chrome web browser, with hearings scheduled for next month. BBG

China’s NPC numbers are largely consistent w/recent media reports, including a GDP growth objective of around 5%, inflation around 2%, and a fiscal deficit target of 4%, while officials pledged to boost domestic consumption. WSJ

China’s Caixin services PMI comes in ahead of expectations for Feb at 51.4 (up from 51 in Jan and above the Street’s 50.7 forecast). BBG

BOJs Uchida said the BOJ can raise interest rates at a pace in line with dominant views among financial markets and economists, keeping alive expectations that there is a chance of a near term increase in borrowing costs despite Trump tariff risks. RTRS

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed following the whipsawing stateside on Trump's tariffs, subsequent retaliation and Commerce Secretary Lutnick's suggestion of a potential rollback, while the region also digested a slew of commentary from China’s Official Work Report and President Trump’s Address to the Joint Session of Congress. ASX 200 was dragged lower by underperformance in the consumer and energy sectors, while better-than-expected Australian GDP data failed to inspire a recovery. Nikkei 225 price action was initially choppy but gradually edged higher amid a weaker currency. Hang Seng and Shanghai Comp were positive after better-than-expected Chinese Caixin Services PMI data and with the attention on the NPC and the Official Work Report in which China maintained its annual growth target of around 5% and pledged measures including a boost in spending, while there was notable outperformance in Hong Kong where CK Hutchison surged by more than 20% after agreeing to sell its Panama Canal Ports stake to BlackRock.

Top Asian News

Foxconn (2317 TT) February revenue rose at a rate of +56.43% Y/Y (vs +3.2% Y/Y in January).

China targets 2025 GDP growth of around 5% and CPI at around 2%, while it sees the 2025 budget deficit at 4% of GDP and said it will adopt more proactive fiscal policy. China will re-capitalise major state banks with CNY 500bln from special treasury bonds and will issue CNY 1.3tln in ultra-long-term special treasury bonds in 2025 vs CNY 1tln in 2024, while it set the 2025 quota on local government special bonds at CNY 4.4tln vs. CNY 3.9tln in 2024, according to the Official Work Report.

China's NDRC said it will boost domestic demand and will promote integrated advancements in technological and industrial innovation and will use monetary policy instruments to adjust both the monetary aggregate and structure, while it added that China will lower banks' reserve requirement ratios and interest rates at the right timing. NDRC said China will support the fundraising of micro and small businesses, well accelerate efforts to foster a complete system of domestic demand and make domestic demand the main engine and anchor of economic growth.

China's financial regulator head said will support the property market, lengthen the white list, and ensure delivery of housing, while China will increase the supply of credit to more private enterprises and will reduce comprehensive financing costs of private enterprises. Furthermore, China approved an additional CNY 60bln of insurance funds for long-term investment in capital markets.

China Cabinet Research Office head said fully confident in achieving the 2025 economic growth target and that China’s economy has shown steady improvement over 2025 so far, while the official added that macro policy measures will provide strong support to the economy.

RBNZ Governor Orr resigned and Deputy Governor Hawkesby will be Acting Governor until March 31st, while RBNZ Chair Quigley said Governor Orr resigned for personal reasons and feels like 'he's done the job'.

European bourses (STOXX 600 +1.5%) are entirely in the green, with sentiment boosted by several factors, which include; a) Lutnick suggesting Trump will scale back Canada/Mexico tariffs, b) Germany agreeing to debt brake reform, c) China’s Official Work Report which maintained its annual growth target and pledged measures including a boost in spending. Price action today has really only been one way, and that’s upward; as it stands, indices generally reside at session highs. European sectors hold a positive bias, with the key movers today attributed to the aforementioned German debt brake reform agreement. Construction & Materials tops the pile, joined closely by Industrial Goods and Services, Autos and then Tech; the latter two, buoyed by the risk-tone given the optimism surrounding a rolling back of US tariffs on Canada/Mexico.

Top European News

UK Treasury has earmarked several billion pounds of draft spending cuts to welfare and other departments, via BBC citing sources; Treasury will inform the OBR of its "major measures" on Wednesday.

UK Chancellor Reeves is set to submit plans this week to the OBR detailing billions of GBP of spending reductions, according to the FT.

German new passenger car registrations (Feb) -6.4% to 203,434, according to KBA

FX

DXY is extending its downside for a third consecutive session as gains in the EUR act as a drag on the index. DXY has fallen from the 107.56 level seen at the start of the week to a current session trough at 104.85, taking out its 200DMA at 105.00 in the process. Headwinds for the DXY aren't just a case of EUR strength, it is also in the context of domestic weakness following a recent run of soft data prints. And on the trade front, US Commerce Secretary Lutnick suggested Trump could potentially reduce tariffs on Canada and Mexico, perhaps as soon as Wednesday. Today's data slate sees US ADP and ISM services PMI with the former taking place in the context of Friday's NFP print.

EUR is the clear outperformer across the majors with the obvious catalyst for recent price action being the latest updates out of Germany. To recap, the measures announced by Merz and others include a special EUR 500bln 10yr fund for infrastructure investments, changes to the debt brake to exempt defence spending of more than 1% of GDP, a loosening of the regional balanced budget requirement and a new instrument to provide EUR 150bln of loans. Subsequently, EUR/USD has surged from the circa 1.0388 level seen at the start of the week to a multi-month peak at 1.0722, brining it in touching distance of its 200DMA at 1.0725.

JPY is firmer vs. the broadly weaker USD. On the domestic front, BoJ Governor Ueda noted that diverging monetary policy stance among countries could potentially increase volatility, have destabilising effects on exchange-rate dynamics. Elsewhere, BoJ Deputy Governor Uchida said he does not have a preset idea in mind on the pace of future rate hikes and does not think it is good communication for the BoJ to judge whether market pricing of future moves are appropriate or not. USD/JPY has delved as low as 149.11 but stayed clear of yesterday's 148.08 YTD trough.

Cable is up for a third session in a row, clearing the 1.28 mark and its 200DMA at 1.2803, printing a fresh YTD peak at 1.2854. Newsflow for the UK remains on the light side asides from reporting via the BBC that the Treasury will inform the OBR of its "major measures" on Wednesday aimed at reducing spending by billions pounds.

Antipodeans both faded some of their recent gains as the greenback recouped lost ground and amid the mixed risk sentiment in Asia, while there was little reaction seen following better-than-expected Australian GDP data or from the announcement that RBNZ Governor Orr resigned.

Hotter-than-expected Swiss inflation metrics from Switzerland triggered a knee-jerk lower in EUR/CHF from 0.9470 to 0.9453 before paring almost all of the move. The release exceeded expectations but fell in-line with the SNB's Q1 projection of 0.3%.

PBoC set USD/CNY mid-point at 7.1714 vs exp. 7.2575 (prev. 7.1739).

Fixed Income

Bunds are under marked pressure following the CDU, CSU and SPD leaders announcing an agreement on the first phase of debt break reform which they hope to pass in the next week as such get through under the current Bundestag configuration where a two-thirds majority for constitutional reform can be attained. At most, the planned reform has weighed on Bunds by over 250 ticks to a 129.66 trough vs Tuesday’s 132.24 close. Since, Bunds have made their way off the 129.66 base and are back above 130.00 with support coming via downward revisions to some Final PMIs this morning, as the equity rally took a slight breather and on profit taking from the marked bearish action.

USTs are under modest pressure, following the lead from Bunds, but to a much lesser degree. Due to the German measures not having any direct fiscal implications for the US and as the region remains more focused on growth concerns; ISM Services & Factory Orders are the next points to watch on this alongside ADP ahead of Friday’s Payrolls. USTs have been down to a 110-27 base but have spent much of the European morning and APAC session holding at the 111-00 mark.

US yields are bid across the curve with the belly leading, as has been the case in recent sessions. On the trade front, US Commerce Secretary Lutnick suggested Trump could scale back the Mexican/Canada tariffs, and could be announced on Wednesday.

Gilts are softer following the lead from Bunds. Trading much closer to Bunds than USTs in terms of magnitudes with Gilts down to a 92.11 low at worst vs the 93.50 close on Tuesday. Pressure which comes as Gilts play catchup to the Merz announcement, with USTs having already reacted in Tuesday’s session, and as the focus returns to the UK’s own fiscal fortunes. On this, multiple outlets have reported that Chancellor Reeves is to present the OBR with her latest potential fiscal adjustments which the BBC, citing sources, reports include several billion pounds of draft spending cuts to welfare & other departments. Most recently, no move to a strong UK auction which saw a b/c in excess of 3x.

UK sells GBP 4.25bln 4.375% 2030 Gilt: b/c 3.39x (prev. 3.05x), average yield 4.311% (prev. 4.276%) & tail 0.3bps (prev. 0.5bps)

Commodities

Crude is on the backfoot, continuing the pressure seen in overnight trade which failed to materially benefit from the latest private sector inventory data which showed a surprise draw in headline crude. A softer Dollar, positive risk tone and China pledging to boost spending has failed to lift sentiment in the complex; focus may be on Ukrainian President Zelensky who said that Ukraine is ready to come back to the table to sign a minerals deal - tariff uncertainty and recent OPEC+ action also factor. Brent and WTI trading at USD 67.47/bbl and USD 70.55/bbl respectively.

Precious metals are mixed, with gold flat whilst Silver gains; the softer Dollar and China's Official Growth Report manages to keep the yellow-metal afloat, despite the risk-on mood. Gold trades indecisively but towards its USD 2,922/oz high, after remaining above the USD 2,900/oz mark for most of Monday’s session.

Base metals are entirely in the green, with the complex boosted after China's Official Growth Report which maintained a growth target of around 5% and pledged measures to boost spending. 3M LME Copper above the USD 9.5k mark compared to Tuesday’s USD 9.34k close.

Private inventory data (bbls): Crude -1.5mln (exp. +0.3mln), Distillate +1.1mln (exp. +0.2mln), Gasoline -1.2mln (exp. -0.4mln), Cushing +1.6mln.

5.6 magnitude earthquake in Oaxaca, Mexico, via GFZ.

Geopolitics: Middle East

White House said the Gaza reconstruction plan adopted by Arab states does not address the reality that Gaza is 'currently uninhabitable' and that President Trump stands by his proposal to rebuild Gaza 'free from Hamas'.

Russian President Putin agreed to act as a mediator between Iran and the US, according to Zvezda citing the Kremlin. It was also reported that a Kremlin aide said Iran was discussed at Russia-US talks in Riyadh and that Russia and the US agreed to hold separate talks on Iran, according to Interfax.

Geopolitics: Ukraine

US President Trump said in his Congress address that he received an important letter from Ukrainian President Zelensky who said he is ready to come back to the table and Ukraine is ready to sign a minerals deal.

US and Ukraine plan to sign minerals deal and President Trump has told advisers he wanted to announce the Ukraine minerals deal during Tuesday's speech to Congress, according to sources cited by Reuters although they cautioned that the deal had yet to be signed and the situation could change.

Geopolitics: Other

China's Coast Guard said the Philippines sent a civilian boat to deliver supplies to its 'illegally grounded' warship at Second Thomas Shoal, while China urged the Philippines to honour its commitments and work with China to manage the maritime situation.

US Event Calendar

07:00: Feb. MBA Mortgage Applications, prior -1.2%

08:15: Feb. ADP Employment Change 77,000, est. 140,000, prior 183,000

09:45: Feb. S&P Global US Composite PMI, est. 50.4, prior 50.4

Feb. S&P Global US Services PMI, est. 49.7, prior 49.7

10:00: Jan. Factory Orders, est. 1.7%, prior -0.9%

Jan. Factory Orders Ex Trans, est. 0.2%, prior 0.3%

10:00: Jan. Durable Goods Orders, est. 3.1%, prior 3.1%

10:00: Jan. Durables-Less Transportation, est. 0%, prior 0%

10:00: Jan. Cap Goods Ship Nondef Ex Air, est. -0.3%, prior -0.3%

Jan. Cap Goods Orders Nondef Ex Air, est. 0.8%, prior 0.8%

10:00: Feb. ISM Services Index, est. 52.5, prior 52.8

14:00: Federal Reserve Releases Beige Book

DB's Jim Reid concludes the overnight wrap

We've used the tagline that these are "days where decades are happening" in recent weeks and although that perhaps seems like an exaggeration, yesterday I truly believe it wasn't as last night Germany announced plans for one of the largest fiscal regime shifts in post-war history, perhaps with reunification 35 years ago being the only rival. Everything you thought you knew about Germany's economic prospects 3 months ago, or even 3 weeks ago, should be ripped up and you should start your analysis from fresh. This is game changing if it goes through.

As Merz himself said last night, "whatever it takes". More on this later but even before this it was a crazy day of volatility after the 25% Mexican and Canadian tariffs went through. The S&P 500 traded as low as -2.00% early in the session but was then +0.26% higher with 35 minutes of trading left before slumping again and closing -1.22% lower, wiping out its post election gains. Meanwhile the DAX (-3.54%) posted its worst day since 2022, having just experienced its strongest session since late-2022 (+2.64%) the previous day. DAX futures are back up +2.04% as I type this morning.

Meanwhile S&P 500 futures are trading +0.67% as I type, on the back Commerce Secretary Lutnick’s comments shortly after the US close yesterday that Trump might announce a pathway for some tariff relief on Mexico and Canada as soon as today. Lutnick said that with both Mexico and Canada “trying to show that they’ll do better”, Trump could decide to “meet in the middle some way and we’re going to probably announce that tomorrow “. That said, he appeared to rule out a full rollback or pause to the tariffs.

There was little softening in the tone on tariffs in Trump’s eagerly anticipated speech to Congress overnight. Trump said that "we need Mexico and Canada to do much more than they have done" on fentanyl, while also focusing on the April 2 date for reciprocal tariffs. When it comes to potential disruptions, Trump said “There’ll be a little disturbance, but we’re okay with that”. In other economic matters, Trump called for end to subsidies under the CHIPS Act, touted new energy and minerals projects and mentioned the goal of a balanced budget. But overall there were few striking announcements with Trump’s comments ranging from immigration to a new missile defence shield to suggesting that the US will get Greenland “one way or another”. On Ukraine, Trump acknowledged Zelenskiy’s comments earlier on Tuesday that Ukraine was ready to come to the negotiating table. However, Trump did not confirm if the minerals resource agreement would be revived, which reporting earlier in the day suggested he might do.

Turning back to the seismic fiscal news out of Germany last night. The leaders of the CSU/CSU and SPD announced an agreement to approve three material changes to the debt brake before the end of the outgoing parliament in which the centrist parties still hold a constitutional majority. Specifically , this includes a EUR 500bn SPV for infrastructure investment, an exemption from the debt brake for defense spending above 1% of GDP and a rise in the net borrowing cap for federal states from 0% to 0.35% of GDP. While recent reporting pointed to increased prospects of a change, the magnitude of the proposal, including the open-ended borrowing room for defence, is well beyond expectations. With party leaders explicitly referring to a "whatever it takes" moment and a determination to "rearm completely", our Germany economists think German defence spending could rise to at least 3% of GDP perhaps as early as next year. See their reaction here for more. One potential catch is that the Greens, whose support is needed for the constitutional majority, have not yet confirmed if they will support these changes. But our team strongly assumes that this will be the case, not least given the large infrastructure fund proposal.

Earlier in the day we also had an EU announcement on a new defence package ahead of the EU leaders summit tomorrow. The proposals would allow member states to significantly increase defence spending without triggering the EU’s deficit rules, and they also proposed a new instrument that would provide €150bn of loans for defence investment. While much less dramatic than the German news later in the day, this added to the sense of a developing paradigm shift in European defence. You can see our European economists’ take on the announcement here.

In terms of market implications, the German fiscal announcement has led our FX strategists to take an outright bullish view on the euro, targeting a 1.10 level against the dollar (link here), while our rates strategists see the much looser fiscal policy as favouring a short Bund view (link here) with a 10yr target of 3.0%. Meanwhile, our equity strategists (link here) see the events as confirming their case for an ongoing overweight of European equities, despite these having already posted the strongest outperformance versus the US at the start of a year since 2000. These moves have began to emerge in markets, with the euro ending yesterday’s session above 1.06 against the dollar for the first time since November, STOXX 50 futures trading +1.76% higher overnight and yields on bund futures around +10bps higher.

Moving on to review the different market moves yesterday that are now slightly out of date. Equities took a big hit as markets started to price in more aggressive tariff policies around the world. That included another slump for the S&P 500 (-1.22%), building on its -1.76% move the previous day. And in turn, the VIX index of volatility rose another +0.73pts to 23.51pts, its highest level of 2025 so far. The selloff was broad-based with the equal weighted S&P 500 (-1.63%) seeing its worst day of 2025 so far. Cyclical sectors underperformed, and banks took a particularly large hit, with the KBW Bank Index (-4.56%) posting its biggest daily decline since the regional bank turmoil of March 2023. The Magnificent-7 (-0.64%) and the small-cap Russell 2000 (-1.08%) saw more modest declines, though this still leaves the Mag-7 a full -15% beneath its post-election high.

Volatility was also visible in rate markets. A strong initial rally on the back of tariff news reversed over the course of the day, helped along by the German fiscal news and Lutnick’s comments. The amount of Fed rate cuts priced by year-end had spiked by more than 13bps to 85bps intra-day but reversed later on, with pricing down to 74bps as I type. Treasury yields saw a similar roundtrip , with 2yr yields down -11bps intra-day early in the US session but +4.1bps to 3.99% by the close, while 10yr yields closed +8.9bps higher at 4.245%. Earlier on in Europe, yields had been more steady, with those on 10yr bunds (+0.4bps) broadly flat, whilst those on 10yr OATs (+1.4bps) and BTPs (+2.4bps) moved higher.

European equities had seen a major slump yesterday, which saw the STOXX 600 (-2.14%) post its worst daily performance since early August. Most tariff-sensitive sectors saw a huge slump, with the STOXX Automobiles and Parts Index (-5.39%) suffering its worst daily performance since March 2022, just after Russia had launched their full-scale invasion of Ukraine. Obviously there are lots of moving part but German assets are likely to rebound strongly today.

Much of Asia is also bouncing with the Hang Seng (+1.72%) leading gains, rebounding strongly from the previous session losses after the National People’s Congress in Beijing set a 5% economic growth target for 2025, maintaining the target for a third consecutive year while laying out stimulus measures to boost its economy amid escalating trade tensions with the US (more below). Meanwhile, the KOSPI (+1.20%) is also strong but the Nikkei (+0.10%) and the Shanghai Composite (+0.10%) are only just higher. The S&P/ASX 200 (-0.69%) is bucking the regional positive trend despite economy picking up pace in the final three months of the year.

Coming back to China, Premier Li Qiang in a speech at the at the opening session of the National People’s Congress (NPC), acknowledged challenges posed by trade tensions as well as problems facing the Chinese economy. Meanwhile, the government report outlined plans to issue 1.3 trillion yuan ($179 billion) in ultra-long-term special treasury bonds in 2025 and another 500 billion yuan worth of special treasury bonds will be issued this year to support large state-owned commercial banks in replenishing capital. At the same time, Beijing raised its budget deficit target to 4% of GDP, from 3% last year, in line with our expectations. Additionally, Beijing revised down its annual consumer price inflation target to “around 2%” this year — the lowest in more than two decades — from 3% or higher in prior years.

Elsewhere, Australia’s GDP rose +0.6% q/q in the fourth quarter, in-line with market expectations while picking up from the +0.3% growth seen in the prior quarter, aided by robust public and private spending, along with a rebound in export demand. This strength in the Australian economy gives the RBA more headroom to keep rates high, given that inflation still remained sticky in the fourth quarter.

To the day ahead now, and data releases from the US include the ISM services index for February, the ADP’s report of private payrolls for February, and factory orders for January. Otherwise, we’ll get the final services and composite PMIs for February from around the world. From central banks, we’ll hear from BoE Governor Bailey, along with the BoE’s Pill, Greene and Taylor. And we’ll also get the latest Beige Book from the Federal Reserve.

https://cms.zerohedge.com/users/tyler-durden

Wed, 03/05/2025 - 08:20

Bond Vigilantes Blow Up German Bond Market After "Whatever It Takes" Fiscal Package

Bond Vigilantes Blow Up German Bond Market After "Whatever It Takes" Fiscal Package

last night saw Germany announce plans for one of its largest fiscal regime shifts in post-war history.

The leaders of CDU/CSU and SPD this evening https://www.faz.net/aktuell/politik/inland/sondierungen-union-und-spd-wollen-finanzpaket-in-milliardenhoehe-110335851.html

an agreement on an even more significant fiscal expansion than what anyone had expected at the beginning of the week. The plan is to make three material changes to the debt brake in the very near term, convening the outgoing parliament in which the centrist parties still hold a constitutional majority:

A EUR 500bn (11.6% of GDP in 2024) special purpose off-budget vehicle for infrastructure investment, that is planned to be disbursed over the next 10 years, and which amounts to roughly 1% of GDP in annual infrastructure spending (of which EUR 100bn will be allocated to the federal states).

A reform of the debt brake to exempt any defense spending in the main budget’s "Einzelplan 14", the budget of the Ministry of Defence, over and above 1% of GDP, effectively permitting open-ended borrowing for defense. Currently the Einzelplan 14 amounts to EUR 53.25bn (1.25% of nominal GDP in 2024). The current off-budget fund adds another EUR 25bn of defence funding but this would not be relevant for this part of the proposal. Thus apart from removing any constitutional limit on additional defence spending, 0.25% of GDP (EUR 11bn) of spending in Einzelplan 14 that surpasses the 1% threshold is freed up to fund other measures, for example tax reductions.

An increase in the structural deficit allowed for the states (Länder) from the current level of 0.0% of GDP to 0.35%, the same proportion as the federal level. Furthermore the proposal includes the formation of an expert commission tasked with creating a long-term reform proposal to structurally reform the debt brake by the end of 2025. This would have to be passed by the newly elected 21st Bundestag. It remains unclear if this reform proposal would supersede the announced measures to be passed in the 20th Bundestag or would add to them.

All elements require a two-thirds constitutional supermajority. The parties want to pass the agreed measures with the old 20th Bundestag parliament, before the newly elected 21st Bundestag (where the AfD has a potential blocking minority) is convened on March 25.

In keeping with recycled European aphorisms, party leaders, especially the Conservatives, explicitly referred to this decision as a "whatever it takes" moment and a determination to "rearm completely". According to DB's reading, tonight's robust rhetoric implies that the open-ended borrowing room for defense will be used at a pace that could bring German defence spending to at least 3% perhaps as early as next year (although the exact target may only be defined after the NATO summit in June).

Assuming it goes through, Deutsche Bank's Jim Reid warns that everything you thought you knew about Germany's economic prospects 3 months ago, or even 3 weeks ago, should be ripped up and you should start your analysis from fresh.

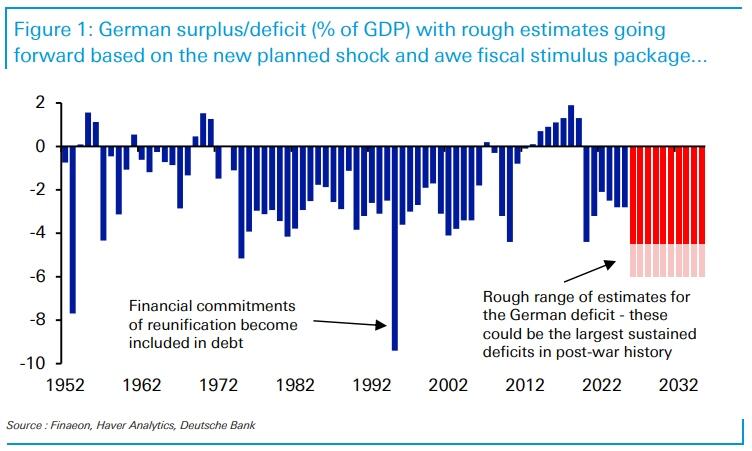

Today’s CoTD simply looks at Germany’s fiscal deficit through time and assumes an extra 3% deficit phased in over the next decade from current levels.

This is incredibly back of the envelope, but puts the planned move in some historical perspective.

Of course, if growth rebounds then this may reduce the deficit so there are a lot of moving parts. However, this could easily be a sustained fiscal stimulus unparalleled in Germany’s history. Germany will still likely have the lowest debt/GDP in the G7 as far as the eye can see.

?itok=ACeQkPE2

?itok=ACeQkPE2

We estimated that Germany could spend around $1.6tn before its debt/GDP equalled the second lowest (the US) in the G7.

This package has the potential to be in the magnitude of around $1tn over time and the US won’t stand still in terms of its debt over this period.

If you want a bit of fun, Germany could spend $8.5tn before its debt/GDP equalled Japan’s!

So don’t underestimate how important this news is. Your portfolio over time will thank you for it.

Indeed it will, if you were long bunds as zee bond vigilantes just sent Bund yields higher by over 24bps...

?itok=RwNIF0nE

?itok=RwNIF0nE

...the biggest yield jump in history for the German bond market...

?itok=tF-94mlp

?itok=tF-94mlp

that investors said the bond sell-off did not reflect concerns about the sustainability of Berlin’s debt, which at around 63 per cent of GDP is far lower than the level in other big western economies such as France, the UK and the US.

In contrast with recent rises in borrowing costs in countries such as the UK, which have threatened their fiscal plans, markets were pricing in a better growth trajectory that was boosting risky assets such as stocks at the expense of ultra-safe government debt.

“Yields are rising because of the perception that Germany is turning on the growth tap. It is very risk-positive,” said Karen Ward, a strategist at JPMorgan Asset Management.

We are not sure we're buying what these analysts are selling on this one - especially as we noted overnight that https://cms.zerohedge.com/markets/germany-unveils-historic-whatever-it-takes-fiscal-package-sending-swap-spreads-crashing

And remember, Europe is well-known for suffering sovereign debt crises at the worst possible time, and should inflation remain stubbornly sticky, the yield on new German debt may soon become unmanageable... which means the ECB will have to step in and monetize German deficit spending, as it did for much of the past decade. The only problem: it will first need a market and/or deflationary shock to greenlight such an intervention. Although in light of events in the past 5 years, we doubt very much that the Frankfurt-based central bank will have any problems coming up with yet another fake crisis to capitalize on.

This sudden (and urgent) surge in borrowing comes after Zelensky publicly snubbed Trump's deal in The Oval Office - prompting VP Vance to explain that this was a done deal... "someone got to him... likely it was our European allies"...

Yes! Lost in the temper tantrum thrown by pissy pants Zelensky is that this was a DONE DEAL. The signing was pro forma. Someone got to him. Likely it was our “European allies.”https://t.co/FwJujQHchA

— Cernovich (@Cernovich) https://twitter.com/Cernovich/status/1896751830379733394?ref_src=twsrc%5Etfw

Are we giving zee Germans too much credit for a 4D-Chess move? Did our "allies" force Zelensky to tank the deal with Trump at the last minute, to prompt a new 'crisis' (it worked with COVID, remember), enabling them to bypass the debt brake in the name of security, freedom, and whatever patriotic, democracy-saving narrative they choose next? Perhaps, but if the shoe fits (mixing analogies unapologetically) as the deadline for government change in Germany (March 24th) looms and the AfD's ability block this massive debt plan looms even larger indeed.

https://cms.zerohedge.com/users/tyler-durden

Wed, 03/05/2025 - 08:15

High-Frequency Data Signals Further Decline In Small Business Optimism

High-Frequency Data Signals Further Decline In Small Business Optimism

After US small-business optimism saw its https://www.zerohedge.com/markets/trump-victory-sends-small-business-optimism-soaring-most-44-years

amid rising macroeconomic uncertainty. With mounting trade tensions and consumer concerns, optimism among mom-and-pop shops may decline further.

Goldman's Will Nance, Rajul Bothra, and others cited new data from the Fiserv Small Business Index, a monthly indicator measuring small business performance across the US at national, state, and industry levels. Unlike traditional surveys, the index aggregates point-of-sale transaction data—including card, cash, and check transactions—from 2 million small businesses, offering some of the most real-time insights into consumer spending trends.

Fiserv's updated Small Business Index for February showed a further slowdown in consumer spending growth compared to January. NSA spending growth was just .2% (vs. 6.2% in January), while SA growth came in at 2.1% (vs. 4.9% prior). Adjusting for the leap year headwinds, NSA growth was a more modest 3.2%, while SA growth remained stable at 5.1%. Transaction growth also slowed to 1.2% NSA. Restaurants continued to show weakness.

?itok=hABZg895

?itok=hABZg895

Here's more color from the analysts:

Bottom Line:

Fiserv recently updated the Fiserv Small Business Index for the month of February. Spending growth saw a step down compared to January with 0.2% growth NSA (vs 6.2% growth in January) and 2.1% SA growth (vs 4.9% January). Adjusting for leap year headwinds, the step down was more modest at 3.2% NSA growth and stable when looking at 5.1% SA growth compared to the prior month. Transaction growth stepped down to 1.2% growth NSA. In terms of notable subsector trends, Restaurants continued to see weakness in spending and Retail sales saw a step down from January (adjusted for leap year). FI flagged that February is the first month since January 2023 in which retail average ticket sizes have increased year over year. This trend could point to either increasing prices on regularly purchased goods or the mix in goods purchased. In addition, FI noted service-oriented spending saw a modest decline, including Professional Services and Accommodation (Hotel spending) driven in part by cyclical performance. Overall, we see believe February looks stable on a seasonally adjusted basis, while the decline in NSA growth could be a negative for near term spending updates

February Results:

For the month of February, the Fiserv Small Business Index saw mixed trends in consumer spending with total SMB sales +0.2% yoy (3.2% adjusted for leap year, up +5.1% on a SA basis adjusted for leap year) vs 6.2% yoy in January. At the sector level, SMB retail sales remained relatively resilient but stepped down from January levels (2.2% in February adjusted for leap year vs 4.5% in January). Restaurant Spending (Food Services and Drinking Places) continued to see weakness in February at -4.8% (adj for leap year) vs to -1.8% in January.

From late 2024 into late February, bars, restaurants, arts, entertainment, and recreation small businesses recorded a noticeable spending slowdown. This trend suggests that despite a boost in small-business optimism following Trump's victory, consumers have abruptly cut back on discretionary spending—because the inflation storm triggered by Biden-Harris has not yet subsided.

?itok=aq5InwZj

?itok=aq5InwZj

?itok=0lASET0k

?itok=0lASET0k

Fiserv's mixed consumer data comes ahead of the next NFIB Small Business Optimism Index release, scheduled for next Tuesday. This may reflect ongoing uncertainty weighing on sentiment.

?itok=7qXMi_KJ

?itok=7qXMi_KJ

A https://www.zerohedge.com/markets/trade-wars-begin-all-you-need-know

" hangover appear to be what the Trump administration needs to slow inflation while simultaneously bringing borrowing costs down to cushion the landing.

BESSENT: WE'RE SET ON BRINGING INTEREST RATES DOWN-FOX NEWS INTERVIEW https://t.co/myf6n3tgMX

— zerohedge (@zerohedge) https://twitter.com/zerohedge/status/1896905555731796028?ref_src=twsrc%5Etfw

Maybe...

If you didn’t already understand the current White House’s approach from their budget, Bessent is telling you 🔊 loud & clear, if you care to listen👂.

This is what he is saying in plain English:

- They want to slow demand in the real economy & hence slow inflation, by… https://t.co/6GKUIekITj

— Cem Karsan 🥐 (@jam_croissant) https://twitter.com/jam_croissant/status/1896424533319426233?ref_src=twsrc%5Etfw

. . .

https://cms.zerohedge.com/users/tyler-durden

Wed, 03/05/2025 - 07:45

If We Set Aside Ideology, Is There Anything We Can Agree On?

If We Set Aside Ideology, Is There Anything We Can Agree On?

https://charleshughsmith.blogspot.com/2025/03/if-we-set-aside-ideology-is-there.html

Just the experiment of setting aside ideological certainties for a moment would be instructive.

Humans are hard-wired to prefer simplicity over complexity, and this is the foundation of ideology, which like mythology takes a complex world and radically simplifies it to an easily digestible construct. (I tease all this apart in my book https://amzn.to/3zM05T4

.)

Being social animals, humans are also hard-wired to quickly form loyalties to groups and gravitate to one camp. Very few football fans (if any) have zero loyalty to any team and have zero emotional stake (i.e. there's no team they hope loses and none they hope will win).

Uncertainty generates anxiety, and so we settle the real world's many uncertainties with internal certainty: an ideology is a simple sketch of how the world works, and we will defend this emotionally powerful construct even as evidence piles up that it doesn't accurately map all of the world's complexities. We will deny, rationalize and cherry-pick examples to "prove" our ideological certainties map the real world.

The problem with radically simplified constructs like mythologies and ideologies is they cannot possibly map the world accurately as complex, interactive systems don't reduce down to a simplified construct. So every ideological construct ends up denying, rationalizing and cherry-picking examples to cover the inherent weaknesses of simplifying the world into bite-sized constructs.

Our intense drive to establish and nurture loyalties leads to emotionally satisfying but often counter-productive convolutions, such as any enemy of my enemy is my friend and any friend of my enemy is my enemy.

The problems with ideological constructs are magnified in tumultuous times as ideologies map a rapidly shrinking share of the real world. The internally coherent ideology drifts further into incoherence, and our natural defense is not to become more open-minded (i.e. actively embrace uncertainty and entertain new ideas) but to cling even harder to the simplified certainties that generate our internal sense of self and certainty.

Since the faithful of competing ideologies are pursuing the same strategy to reduce anxiety, our loyalties clash with increasing intensity. That possibility that all the ideologies claiming to map the real world are increasingly detached from real-world dynamics doesn't occur to any true believer in any camp, for each believer remains confident (and when pushed, becomes ever more adamant) that their ideology is the one true construct that faithfully maps all of the real world's immense complexity.

Such is the power of these internally coherent constructs that we don't see them as belief structures, we see them as the bedrock of truth. We don't recognize our ideological beliefs as beliefs open to question, and so when challenged, we respond defensively: Ideology? What ideology? What I'm saying is the truth. Yes, true to us, but an accurate account / map of all the world's complexity? No.

To each believer in an ideology, the problem isn't that their ideology is not mapping the real world with sufficient accuracy to successfully navigate increasingly stormy seas. The problem is the other ideologies are obstructing our solutions, which are guaranteed to work if pursued with absolute purity. Compromises introduce fatal impurities and so of course they fail to fix what's broken.

If only all those misguided souls abandoned their wrong-headed beliefs and joined our temple, then we'd clear up all the real-world problems in no time. But alas, the fools insist on clinging to their completely misguided faith in false gods.

In this increasingly bitter environment, up becomes down and vice versa. Common sense--by definition, an attempt to map real world complexities based on practicalities rather than internally coherent constructs and loyalties--is tossed aside in favor of doubling down on the simplified precepts of the ideology.

We end up arguing about internally coherent simplifications, none of which do a productive job of mapping the real world, and accusations and raw emotions replace rationality. We are raging, spittle flying, demanding everyone agree with us that 100 angels can dance on the head of pin, not 10 and not 1,000.

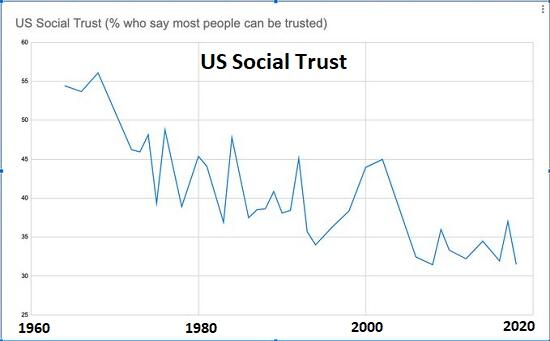

How can we trust anyone who so adamantly clings to such wrong-headed ideas? We can't, so social trust plummets accordingly.

?itok=rHzkpz9w

?itok=rHzkpz9w

Those without any ideological faith watch the emotional fireworks with stunned amazement. So you think Dallas should be nuked because you hate the Cowboys? Um, okay.... But does nuking the Cowboys really clear your team's path to the Super Bowl?

The more the real world unravels into complex uncertainties, the greater our need to cling to certainties as the source of our internal security and hope. Rather than see the failure of all internally coherent but increasingly incoherent constructs to map the real world as the core problem, we see those with different ideological beliefs as the problem.

If we managed to set all ideological beliefs and constructs aside for a brief moment, is there anything we might agree on? As a thought experiment, imagine an AI project tasked with providing solutions to the core threats to our future stability and security. Is there anything the program might suggest that we could agree on?

How about accountability and transparency? Can we agree on the practical value of making those wielding power accountable for their actions and decisions? Can anyone contest the practicality of demanding an honest, transparent, accurate accounting of public funds and publicly traded private-sector enterprises? Can anyone contest that transparency is the foundation of sound decision-making?

Just the experiment of setting aside ideological certainties for a moment would be instructive. The irony here is the more the real world changes in ways that don't map simplistic ideologies, the greater our urgency to cling even harder to the simplicities we've invested with our identity and loyalty, and the stronger our instinct to lash out at anyone who disagrees with us, as if their disagreement is the problem, rather than the real-world complexities that no simple construct can map with any functional utility.

Rather than nuking Dallas, maybe finding some sort of practical, common-sense middle ground might be the wiser course, even though it goes against every fiber of our hard-wired instincts to circle the wagons to defend the one true construct and declare those who disagree as the problem.

* * *

https://www.patreon.com/charleshughsmith

.

https://charleshughsmith.substack.com/

https://cms.zerohedge.com/users/tyler-durden

Wed, 03/05/2025 - 07:20

https://www.zerohedge.com/political/if-we-set-aside-ideology-there-anything-we-can-agree

"America Is Back" - 12 Takeaways From Trump 47's First Major Policy Speech To Congress

"America Is Back" - 12 Takeaways From Trump 47's First Major Policy Speech To Congress

President Donald Trump capped off his first six weeks in office with a 100-minute speech to a joint session of Congress

The March 4 address followed a blitz of more than 100 executive actions that impacted nearly every aspect of government and U.S. relationships with other nations.

?itok=NrfZTHZv

?itok=NrfZTHZv

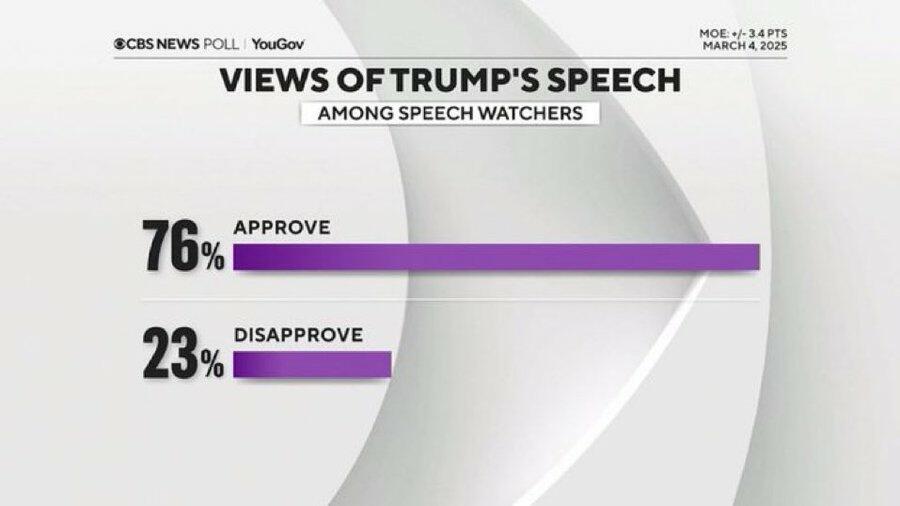

Americans largely approved of Trump's speech to a joint session of Congress.

?itok=6n0NrlE4

?itok=6n0NrlE4

are the highlights of the speech, which began with the statement “America is back” and ended with a call to “renew the unlimited promise of the American dream.”

1. Tax Cuts Promised for All Americans

Trump pledged across-the-board tax cuts, including personal income, corporate, and industry cuts.

After Republicans’ 2017 tax bill failed to make personal income tax cuts permanent, Trump says he is pushing lawmakers to ensure that this Congress does so.

Trump reiterated his campaign proposals to end taxes on tips, overtime pay, and Social Security benefits, and proposed zero interest on loans for American-made vehicles.

Trump encouraged Democrats to join Republicans in backing the legislation, suggesting they would face political consequences otherwise.

“I’m sure you’re going to vote for those tax cuts because, otherwise, I don’t believe the people will ever vote you into office,” he said.

Trump added that these tax cuts—which would total $4.5 trillion over a decade under the current House GOP plan—would be retroactive to Jan. 20, 2025.

?itok=ZXw-DD4c

?itok=ZXw-DD4c

Speaker of the House Mike Johnson (R-La.) delivers remarks after the House passed the Republican's budget resolution on the spending bill at the U.S. Capitol on Feb. 25, 2025. Kayla Bartkowski/Getty Images

2. Border Closed, Deportations Underway

Trump touted his administration’s efforts to secure the border, having signed 10 executive orders related to halting the flow of illegal immigrants and initiating mass deportation efforts nationwide to remove violent criminals from the country.

“Within hours of taking the oath of office, I declared a national emergency on our southern border, and I deployed the U.S. military and border patrol to repel the invasion of our country, and what a job they’ve done,” Trump said. “As a result, illegal border crossings last month were by far the lowest ever recorded.”

Trump said his rhetoric also helped encourage would-be illegal immigrants to reconsider their plans.

“They heard my words, and they chose not to come,” he said.

The president also highlighted his order designating cartels and transnational gangs as foreign terrorist organizations.

?itok=HBhpPg4l

?itok=HBhpPg4l

President Donald Trump holds a copy of an executive order honoring Jocelyn Nungaray, a 12-year-old girl who was killed by illegal immigrants, as he addresses a joint session of Congress at the U.S. Capitol on March 4, 2025. Win McNamee/Getty Images

3. Trump Touts ‘Common Sense Revolution’

Trump also announced a “common sense revolution,” including primarily through rooting out “woke” ideas from the government and federally-funded programs.

He referenced an https://www.theepochtimes.com/us/what-to-know-about-trumps-executive-order-on-gender-5797074

signed early in his second term declaring that the federal government recognizes only two sexes, based on biological sex at conception and not “gender ideology.”

Trump highlighted his executive order stripping federal funding for schools that allow males to compete in female sports. One order declared that it is the official policy of the United States that Title IX applies to women and not men who identify as transgender females.

The first gallery guest introduced by Trump was Payton McNabb, a female athlete who suffered injuries while playing volleyball against a male player.

Trump also referenced merit-based hiring—rather than hiring to meet diversity quotas—as part of his “common sense revolution” agenda.

?itok=YzE0zArT

?itok=YzE0zArT

Payton McNabb (C), former high school athlete who was injured by a volleyball spike from an opposing male player who identified as a transgender woman, is recognized by President Donald Trump as he speaks during an address to a joint session of Congress at the U.S. Capitol on March 4, 2025. Jim Watson/AFP via Getty Images

4. Tariffs Explained, ‘A Little Disturbance’

Trump said his trade policies will remain centered around tariffs that are designed to boost foreign investment in the United States and balance multi-billion-dollar trade deficits. The goal is to bring trillions of dollars into the president’s new “external revenue service.”

“If you don’t make your product in America,” Trump said, “you will pay a tariff, and in some cases, a rather large one.”

A series of tariffs—including 25 percent fees on goods from Canada and Mexico and 20 percent in addition to those already imposed on China—took effect on March 4, and across-the-board reciprocal tariffs are set to take effect on April 2.

“Other countries have used tariffs against us for decades, and now it’s our turn to start using them against those other countries,” Trump said.

While critics have suggested the tariffs could cause inflation, the president rejected the notion and said any impact would be temporary.

“There'll be a little disturbance, like we’re okay with that,” Trump said. “It won’t be much.”

5. DOGE Findings Highlighted

Trump praised the work of Elon Musk in leading the Department of Government Efficiency, which has announced savings of over $105 billion through contract cancellations, staff reductions, and identifying fraud and waste.

Trump listed a number of multi-million dollar projects related to diversity, equity, and inclusion (DEI) that had been terminated, and a $22 billion plan to provide housing and automobiles for illegal immigrants.

“We found hundreds of billions of dollars of fraud,” Trump said, noting that the Government Accounting Office has estimated that up to $500 billion in fraudulent payments are made annually.

“By slashing all of the fraud, waste, and theft we can find, we will defeat inflation, bring down mortgage rates, lower car payments and grocery prices, protect our seniors, and put more money in the pockets of American families,” Trump said.

?itok=zd6dDdOh

?itok=zd6dDdOh

White House senior advisor to the president Elon Musk attends President Donald Trump's address to a joint session of Congress at the U.S. Capitol on March 4, 2025. Madalina Vasiliu/The Epoch Times

6. Promises Balanced Budget

Trump also formalized plans to balance the federal budget during his second term.

“I want to do what has not been done in almost 24 years: Balance the budget,” Trump said. “We are going to balance the federal budget.”

A balanced federal budget is a longtime goal of many Republicans but it is not an issue Trump has historically addressed directly.

On Feb. 7, he first indicated interest in such a plan, writing “Balanced budget!” in all caps in a post on Truth Social.

Balancing the budget would require either substantial spending cuts or substantial increases in government revenues, whether from internal or external sources.

He said part of achieving this would be a “gold card” program under which foreigners or their employers could pay $5 million for a path to citizenship.

7. Victims Spotlighted

Trump also recognized several victims of illegal immigrant crime during his address.

The first was Laken Riley, a 22-year-old nursing student at the University of Georgia who was murdered by a Tren de Aragua gang member in February 2024.

Describing Riley as “brilliant” and “the best in her class,” Trump touted his signing of the Laken Riley Act—the first signature of his second term—which requires federal detention of illegal immigrants accused of certain crimes.

Trump then announced that a 34,000-acre national wildlife refuge near Houston will be renamed after 12-year-old Jocelyn Nungaray, also allegedly killed by Tren de Aragua gang members.

“The death of this beautiful 12-year-old girl and the agony of her mother and family touched our entire nation greatly,” Trump said.

Family members of both victims were in attendance at the speech.

?itok=J9rXbHki

?itok=J9rXbHki

Allyson and Lauren Phillips, the mother and sister of Laken Riley, listen as President Donald Trump addresses a joint session of Congress at the U.S. Capitol on March 4, 2025. Kayla Bartkowski/Getty Images

8. Direct Appeal to Greenlanders

Trump directly appealed to the people of Greenland to join the United States, which he said would benefit them and improve the security of the United States and the world.

“We strongly support your right to determine your own future,” Trump said. “And if you choose, we welcome you into the United States of America.”

Trump previously offered to buy Greenland from Denmark, which oversees it as an autonomous territory. The offer was snubbed by the Danes.

“We will keep you safe, we will make you rich, and together, we will take Greenland to heights,” Trump said.

The president said the island is important to national security.

“We’re working with everybody involved to try and get it, but we need it really for international world security,” Trump said. “And I think we’re going to get it one way or the other.”

9. Letter From Zelenskyy

The president described a letter he received from Ukrainian President Volodymyr Zelenskyy earlier in the day, suggesting the note could indicate the nations are closer to reaching a mineral deal.

Zelenskyy’s letter said that “Ukraine is ready to come to the negotiating table as soon as possible to bring lasting peace closer,” according to Trump.

The U.S.–Ukraine minerals deal fell apart after a tense exchange between Trump and Zelenskyy in the Oval Office on Feb. 28. Trump also paused all U.S. aid to Ukraine on March 3.

?itok=Z06rayUy

?itok=Z06rayUy

President Donald Trump greets Ukrainian President Volodymyr Zelenskyy at the White House in Washington on Feb. 28, 2025. Madalina Vasiliu/The Epoch Times

The note informed U.S. leaders that Ukraine is prepared to agree to a minerals deal that would see 50 percent of some natural resource revenues go to repay America for the approximately $175 billion appropriated to support Ukrainian defense efforts.

Trump has repeatedly called for an end to the conflict between Ukraine and Russia.

“I appreciate that he sent this letter,” Trump said. “Simultaneously, we’ve had serious discussions with Russia and have received strong signals that they are ready for peace. Wouldn’t that be beautiful?”

10. New Shipbuilding Office

Trump said a new White House Office of Shipbuilding is meant to counter China’s strides in the shipbuilding sector.

“We used to make so many ships. We don’t make them anymore very much, but we’re going to make them very fast, very soon,” Trump said. “It will have a huge impact.”

Historically a leader in the shipbuilding industry, the United States has seen its dominance wane in recent years, and China now accounts for more than 50 percent of global orders, according to U.N. Conference on Trade and Development data.

The president said tax incentives will help “resurrect” the industry and are meant to revitalize commercial and military ship production and bolster national security efforts.

11. Arrest of Top Terrorist Responsible for Abbey Gate

Trump made a surprise announcement that the top terrorist responsible for killing 13 U.S. service members during the bombing at Abbey Gate during the withdrawal from Afghanistan in 2021 is now in custody.

?itok=0tD3uph_

?itok=0tD3uph_

A sign with photos and names of the 13 service members killed in a terrorist attack at Abbey Gate is displayed during a news conference at the U.S. Capitol on Sept. 9, 2024. Kent Nishimura/Getty Images

“America is once again standing strong against the forces of radical Islamic terrorism,” Trump said. “Tonight, I am pleased to announce that we have just apprehended the top terrorist responsible for that atrocity, and he is, right now, on his way here to face the swift sword of American justice.”

The Abbey Gate bombing was allegedly carried out by a suicide bomber, affiliated with ISIS, who detonated an explosive vest at the Hamid Karzai International Airport in Kabul.

U.S. officials have identified the senior member of the ISIS terror group based in Afghanistan as Muhammad Sharifullah.

Sharifullah was turned over to U.S. authorities by Pakistan and was being brought to the United States for prosecution, Trump said.

12. Democrats Respond

Congressional Democrats criticized Trump from both within and outside of the House chamber where he spoke. Rep. Al Green (D-Texas) was escorted out of the chamber after standing up and yelling during Trump’s speech.

Green rose to speak and shook his cane toward the president about four minutes into the speech, but his words were quickly drowned out by chants of “USA! USA!” from Republican lawmakers.

?itok=a4ms28pi

?itok=a4ms28pi

He later said that he was “making it clear to the president that he had no mandate to cut Medicaid.”

Trump has said he won’t touch Medicaid.

Other Democrats protested with signs that read “Save Medicaid” and “Musk Steals.” Some congresswomen wore pink jackets as a statement about the purportedly harmful impact of Trump’s policies on women.

Following Trump’s speech, Sen. Elissa Slotkin (D-Mich.) gave a speech from her home state criticizing the president’s actions. “President Trump is trying to deliver an unprecedented giveaway to his billionaire friends,” she said.

Rep. Herb Conaway (D-N.J.) on NTD, The Epoch Times’ sister media outlet, pushed back on the idea of a golden age for America, stating that https://www.theepochtimes.com/business/us-annual-inflation-rate-jumps-to-3-percent-for-1st-time-since-june-5808158

of eggs and coffee. He also took aim at Trump’s tariffs, which he called “nothing but a tax on the American people.”

https://cms.zerohedge.com/users/tyler-durden

Wed, 03/05/2025 - 06:55

Ukraine: Is This Genuine Jingoism?

Ukraine: Is This Genuine Jingoism?

https://off-guardian.org/2025/03/03/ukraine-is-this-genuine-jingoism/

There was a https://www.bbc.co.uk/news/articles/c2019j0w9glo

!

Former actor and comedian President Zelensky and former reality television presenter Donald Trump went at it.

Trump made fun of his clothes, Zelensky warned that war would come to the US if Ukraine fell and called Vice-President JD Vance “bitch”.

Zelensky disrespected the office of the President or was bullied by big meanies depending on which color you voted for.

?itok=CAU4VC9_

?itok=CAU4VC9_

It’s all very serious, real stuff.

As serious and real as the traumatised faces Zelenksy and his First Lady were making during https://www.vogue.co.uk/news/article/olena-zelenska

.

The track-suited former “peace candidate” then either left the White House voluntarily or was told to leave, again depending who you voted for.

He then immediately flew to England for an “emergency last minute” meeting with Prime Minister Sir Keir Starmer and a totally off-the-cuffhttps://www.bbc.co.uk/news/articles/ce98v8mnxm3o

.

Then all the leaders of Western Europe – plus Justin Trudeau, who is still in office despite resigning weeks ago – had a big old struggle session with the new “leader of the free world”, and decided they don’t want to be friends with America anymore!

All this was impromptu and extempore.

posted to the official Twitter accounts of multiple European political leaders later that day at almost the exact same time.

The leaders of Europe are shocked – shocked! – that Trump would treat a “hero” like Zelensky so shabbily and will gladly pay to guarantee Ukraine’s security.

Starmer has even offered to put British boots on the ground and planes in the air to secure a ceasefire:

The jingoism is at a fever pitch, with the usual warmongers and reality-deniers salivating at the idea of young men who don’t know each other shooting each other for no reason.

This is what everybody wants you to think about.

It has flooded the news and social media world like nothing has since the early days of Covid.

And, not since those early Covid days, has the truth/coverage ratio been so low.

Even more so than most news, no reality makes it into the discourse, rather there is simply an endless exchanges of one set of myths banging against another. Two teams fighting with invisible swords.

Nobody is even mentioning nuclear war, except in stories about surviving it https://www.dailymail.co.uk/news/article-14346385/As-Putin-threatens-West-world-politics-spirals-control-expert-reveals-rebuild-civilisation-Nuclear-war.html

, which is weird.

But what do we think is really going on? Are we really headed to World War III?

Or is this the managed-decline of America is simply taking another step forward while the financial burden of the forever-war necessary to secure a dystopian global state is being shifted to the EU?

Whether that’s the only aim or not, it’s certainly what’s about to happen.

Predictably, all the “anti-billionaire”, “save the planet”, “eat the rich” pretend liberals are cheering it on.

Because they don’t really care about the billionaires who own Boeing or Lockheed Martin raking in their tax revenue, they don’t really care about the impact of war on the environment, and they don’t really care about the corrupt rich making bank on both sides of the supposed “conflict”.

They are just Pavlov’s Pundits, conditioned to disapprove of everything Donald Trump says he wants just because he says he wants it. Even peace.

Which isn’t to say Trump really wants peace. But you know what I mean.

Also, I wouldn’t rule out a “nuclear near miss” or a “limited nuclear engagement” to try and scare people into global cooperation or something. When the media gets this hysterical, everything is on the table.

https://cms.zerohedge.com/users/tyler-durden

Wed, 03/05/2025 - 06:30

https://www.zerohedge.com/geopolitical/ukraine-genuine-jingoism

BlackRock's Purchase Of Hong Kong-Owned Panama Ports Marks Victory For Trump's 'America First'

BlackRock's Purchase Of Hong Kong-Owned Panama Ports Marks Victory For Trump's 'America First'

President Trump may be handed a major geopolitical victory concerning the Panama Canal, as a new report indicates that a BlackRock-led consortium has agreed to purchase key ports near the canal currently operated by Hong Kong-based conglomerate CK Hutchison Holdings Ltd. The report follows Trump's repeated warnings about China's growing influence over the strategic waterway and comes one month after https://www.zerohedge.com/geopolitical/panama-mulls-port-deal-cancellation-china-after-rubios-sunday-rumble-canal

the Panamanian government for allowing Beijing to expand its influence in the region.

?itok=Wx7EPkxK

?itok=Wx7EPkxK

provided more color on BlackRock's deal to purchase the critical ports near the canal:

The agreement was reached alongside a deal in principle for BlackRock and its Global Infrastructure Partners unit, along with Mediterranean Shipping Co.'s ports division, to acquire units that hold 80% of the Hutchison Ports group, which operates 43 ports in 23 countries, the company said Tuesday in a statement.

The consortium will also acquire 90% of Panama Ports Co., which operates the two entryways in Balboa and Cristobal. CK Hutchison said it would receive cash proceeds of about $19 billion from the broader ports deal.

. . .

The deal includes the bulk of CK Hutchison's ports division, which produced 20% of the conglomerates earnings before interest and tax in the first half of last year and was the company's third-biggest business.

The port deal represents the largest infrastructure deal in BlackRock's history after it purchased Global Infrastructure Partners last year, marking a new move for the asset manager in critical infrastructure investing across developed and emerging markets.

Earlier, BlackRock CEO Larry Fink told the RBC Capital Markets conference audience that the port deal was a great opportunity and highlighted the company's "long relationship" with CK Hutchison.

Public forensics analysis of CK Hutchison shows several key risk factors, including forced labor concerns and high political exposure to Chinese state-owned enterprises.

?itok=5nJ3Qkl3

?itok=5nJ3Qkl3

Here's the upstream ownership profile of CK Hutchison Holdings. Notice some familiar names? Yes, BlackRock, hence Fink's comment at the RBC conference...