The Destruction Of The Democrats' Main Grifting Engine Is A Sight To Behold

The Destruction Of The Democrats' Main Grifting Engine Is A Sight To Behold

https://www.kunstler.com/p/springs-frightful-awakening

“The notion that Europe is able to pose a military threat to Russia does not even qualify as trashy propaganda for sub-zero IQs.”

- Pepe Escobar

“The left became hideously, ostentatiously, unapologetically corrupt (as ruling parties tend to do). They sold out bigtime and got bigtime rich. You want to know why none of them want to cut waste anymore? because they’re the ones stealing it.”

- El Gato Malo on Substack

In my quiet backwater of the Hudson Valley, an early spring drives all creation violently. The peaceful sleep of winter ends in twitches and spasms. The ground breaks open like one big egg and all living things emerge: green shafts of the crocus, scuttling sowbugs, slithering snakes, sleek garlic shoots, ‘possums in the compost bucket, ticks are back on the cat’s face, the ice in the river cracks in frightening booms, hungry songbirds infest the bare roadside lilacs, tiny voices trill darkly in the woods, a lone early moth in its first rapture of flight meets the pitiless windshield.

You can feel it. The northern hemisphere of this planet shudders, rattles, and rolls into the most tumultuous spring in memory. Everything is in play, turning, turning, while forgotten consequence rises on vengeful wings like an aggrieved god of yore. Nothing will be as it was. A most wicked spell has been broken. What does it feel like to be able to think again?

Messrs Trump and Putin sincerely seek to end the age’s stupidest war in Europe’s dumbest country, while the European Union and its outlier Great Britain go ostentatiously more insane every week. They bethink themselves storybook conquerors out of some retrograde history written by gibbering globalists. Macron and Friedrich Merz propose a grand invasion of Russia, as if Napoleon and Hitler had never existed, and they aim to get it done on about three days’ worth of ammunition. You first, Emmanuel, Merz insists. Non, non, pas de tout, Macron demurs with a deep bow.

Keir Starmer, Knight Commander of the Order of the Bath, and PM of an empire in late-stage sclerosis, does jumping jacks with pom-poms across the channel to cheer on France and Germany in their quixotic quest to conquer of Russia. “Go get’um lads!” he cries. Think of Sir Keir as a Monty Python archbishop as written by George Orwell under the direction of Franz Kafka — there’s what’s left of your jolly old England!

?itok=gGJTMJ_c

?itok=gGJTMJ_c

Meanwhile Ursula von der Leyen rehearses her part as the wannabe Joan of Arc in this political psychodrama. Her sweet grandmother’s face will smile placidly as the flames tickle her penitent’s robe. She was born for this. A million deracinated Congolese perform the twerk mazurka around her flaming pyre while the muezzins sing out the call to prayer from every minaret around Brussels. Her Hanoverian ancestors weep for Ursula through the mists of the centuries. Was Satan himself behind the contract she signed with Pfizer for as much as 4.6 billion doses of Covid-19 vaccine at a cost of €71-billion? Where did the money come from and where exactly did it go, and what did Ursula finally have to show for it? The European Court of Auditors had a look at this tangled web and blew their lunches all over the rue Alcide De Gasperi in Luxembourg City. Snails, champignon, and shards of puff pastry on the ancient stone steps. A disgrace.

You are not compelled to understand all these occult machinations roiling Europe at the moment, except to see that the continent wants to turn itself into the world’s premiere slaughterhouse once again after a seventy-year hiatus from the exciting frolics of World War Two. Almost everyone who lived through that episode is dead now. The cultural memory has faded. Europe is sick of lollygagging in the café, nibbling effete palmier and tartelette. They apparently want to wade across the chilly Vistula River and race to the east, like berserkers, hacking off Slavic limbs and heads along the way.

No, it is not true that Donald Trump’s ancestors invented the trumpet, but shrill brassy notes resound all over America these days as his enemies ululate and rend their garments. Liz Warren is yelling from streetcorners like her head’s going to blow plumb off her shoulders. Randi Weingarten was keening on MSNBC like an oboe with a broken reed. The entire two month-long spectacle has been a musical extravaganza. The President and his sidekick, Elon, keep coming at the country’s resident blob-of-evil like pit-bulls on a pack of wild hogs. Shreds of bacon have been flying all over the Beltway. I could have told you years ago that the blob was mostly lard and little meat. Now you know. It’s a sight to behold for the ages.

Yet, strange things keep happening day by day.

?itok=v24uS4cX

?itok=v24uS4cX

The Democratic Party’s main grifting engine, the USAID, was deconstructed weeks ago, yet we hear that just this week USAID workers were ordered to go back into their offices to shred all their documents. Did they have anything to hide, ya think?

Questions:

1) federal janitors pried the nameplate off the building back in February, and we must suppose that somebody also locked the joint up, or what?.

2.) How did these former USAID workers propose to get in the building and do their dirty-work?

3.) Why have we not heard that the FBI or the US Marshals Service was dispatched to prevent such a document shredding party?

I wouldn’t worry too much about those cheeky federal judges around the country declaring and ordering this-and-that on Mr. Trump’s campaign to fire federal workers and close down useless agencies. This is a last-gasp ultimate lawfare operation.

Let’s assume that Norm Eisen, Mary McCord, Marc Elias, and associates of theirs are the ringmasters in that circus. They will eventually be indicted for all manner of lawbreaking, possibly up to treason. And the SCOTUS will eventually put a sharp end to the judges’ monkeyshines.

Judges do not administer executive action out of the executive branch. And Guess what: lawfare is not law. It’s just dirty-fighting dressed up in abstruse ceremonial language.

https://cms.zerohedge.com/users/tyler-durden

Fri, 03/14/2025 - 16:20

https://www.zerohedge.com/political/destruction-democrats-main-grifting-engine-sight-behold

Harvard Prof Calls For Firing Of Any Faculty Not Supporting "Gender-Affirming" Policies

Harvard Prof Calls For Firing Of Any Faculty Not Supporting "Gender-Affirming" Policies

The anti-free speech movement in the United States was largely an outgrowth of higher education where viewpoint intolerance has taken hold of many schools. Indeed, intolerance and orthodoxy are often defended on the left in the name of tolerance and pluralism. https://www.hks.harvard.edu/faculty/timothy-patrick-mccarthy

that any faculty who do not support “gender-affirming care” should be stripped of their academic titles and fired.

?itok=ySXdA-eJ

?itok=ySXdA-eJ

Many academics and citizens oppose “gender-affirming” policies on religious or other grounds. Some believe that school-enforced policies inhibit debate over gender dysphoria and the basis for various treatments and protections on both sides. McCarthy believes that no such debate should be allowed among faculty, declaring that “there’s a particular place in hell for academics who use their academic expertise and power to distort and do violence to people in the world.” He was targeting two professors at NYU who are affiliated with groups critical of surgical and chemical interventions for gender dysphoria.

Professor McCarthy offered the usual nod to free speech and academic freedom before eviscerating both in his comments. He admitted that “a level of suspicion and inquiry into medical practices is healthy,” but then dismissed such views as harmful and mere efforts to “poison the waters.”

There was a time when such intolerance was directed against the left and groups ranging from feminists to those in the LGBT community. Now, it has become a badge of honor, the expected bona fides that show the correctness and firmness of one’s views.

The irony is crushing. Harvard’s Kennedy School https://www.hks.harvard.edu/faculty/timothy-patrick-mccarthy#:~:text=Timothy%20Patrick%20McCarthy%20is%20an,Leadership%2C%20and%20Higher%20Education%20Concentration.

states that McCarthy “was the first openly gay faculty member” at the public policy school “and still teaches the school’s only course on LGBTQ matters.” When I first went into teaching, I had friends who still remained in the closet out of fear that their sexual orientation would undermine their chances for tenure or advancement. Likewise, far-left academics associated with the critical legal studies (CLS) movement were viewed as “poisoning the waters” of higher education and rightfully blocked from teaching.

The left has now adopted the same intolerance and orthodoxy once used against it. Indeed, it has been far more successful in purging the faculty ranks of conservatives, libertarians, and dissenters. As we have previously discussed, Harvard is particularly notorious for this purging of both its faculty and student body.

This year, Harvard again found itself dead last among 251 universities and colleges in the Foundation for Individual Rights and Expression (FIRE) annual ranking.

The Harvard Crimson has documented how the school’s departments have virtually eliminated Republicans. In one study of multiple departments last year, they found that more than 75 percent of the faculty self-identified as “liberal” or “very liberal.”

Only 5 percent identified as “conservative,” and only 0.4% as “very conservative.”

According to Gallup, the U.S. population is roughly equally divided among conservatives (36%), moderates (35%), and liberals (26%).

So, Harvard has three times the number of liberals as the nation at large, and less than three percent identify as “conservative” rather than 35 percent nationally.

According to the last student survey, only 9 percent of the class identified as conservative or very conservative.

Notably, despite Harvard’s maintenance of an overwhelmingly liberal faculty and student body, even liberal students feel stifled at Harvard. Only 41 percent of liberal students reported being comfortable discussing controversial topics, and only 25 percent of moderates and 17 percent of conservatives felt comfortable in doing so.

Among law school faculty who donated more than $200 to a political party, 91 percent of the Harvard faculty gave to Democrats.

Professor McCarthy appears right at home in his public call for a further purging of faculty ranks.

This is an area that has deeply divided the country, as was evident in the last election. Higher education should play a critical role in that debate by allowing faculty and students to engage with each other in civil and substantive debate. Instead of spending so much time and effort trying to silence those with opposing views, the left could instead focus on refuting these claims. Instead, it is replicating that same pattern of cancellations, deplatformings and firings that marked the last decade. It is the same approach used against academics who questioned aspects of COVID policies including mask efficacy doubts, natural immunity theories, opposition to the closing of schools, opposition to the six-foot rule, and the lab theory on the virus’s origin. They were also removed from faculties and associations. Yet, many of these views have since been vindicated.

What was lost was not just free speech and academic freedom, but a rigorous debate that might have helped us avoid some of the costs of unsupported COVID policies. For example, some of our closest allies listened to skeptics on the need to close schools and opted to keep young children in school. They were able to avoid the massive educational and psychological costs that we incurred in this country. Much like Professor McCarthy, these skeptics were accused of “poisoning the waters” and spreading harmful ideas or disinformation.

There is no difference between the intolerance of figures like Professor McCarthy from those who once sought the same measures against liberals, homosexuals, or feminists. Now firmly in control of higher education, many on the left are using their power to win public debate through retribution, coercion, and attrition. In the process, they are destroying the very essense of higher education for not just our students but ourselves.

Jonathan Turley is the Shapiro professor of public interest law at George Washington University and the author of “https://www.amazon.com/exec/obidos/ASIN/1668047047?tag=simonsayscom

.”

https://cms.zerohedge.com/users/tyler-durden

Fri, 03/14/2025 - 15:00

DOGE, Elon Musk Must Hand Over Documents, Answer Written Questions, Says Judge

DOGE, Elon Musk Must Hand Over Documents, Answer Written Questions, Says Judge

(emphasis ours),

The Department of Government Efficiency (DOGE) and Elon Musk must give records to attorneys general that sued them, in addition to answering written questions, a federal judge ruled on March 12.

?itok=gVoU0k0o

?itok=gVoU0k0o

The U.S. government must give New Mexico’s attorney general and 12 other state prosecutors who sued it numerous documents, including those that DOGE and Musk created or edited regarding the termination of federal workers, U.S. District Judge Tanya Chutkan https://www.documentcloud.org/documents/25560165-chutkan-order-on-doge/

.

Chutkan largely granted discovery requests from the attorneys general, who say that the actions by Musk as DOGE’s public face are unconstitutional in part because he was not confirmed by the U.S. Senate.

After the judge in February https://www.theepochtimes.com/us/judge-rejects-request-to-block-doge-from-government-data-5812309

Chutkan should grant expedited discovery so they could confirm that Musk and DOGE “are directing actions within federal agencies that have profoundly harmed the States and will continue to harm them” as they prepare a motion for a preliminary injunction.

Government lawyers opposed the motion. “The material the States seek is not relevant to their claims; nor should the Court require such discovery on an expedited timeframe before it has even had a chance to adjudicate the Government’s motion to dismiss,” the lawyers https://s3.documentcloud.org/documents/25560176/opposition-to-motion-in-doge-case.pdf

.

Chutkan https://s3.documentcloud.org/documents/25560164/chutkan-opinion-on-doge.pdf

she was granting expedited discovery because it was “reasonable and necessary to evaluate Plaintiffs’ request for injunctive relief.”

She turned aside government arguments that expediting discovery to support the forthcoming injunction motion was not a sufficient reason to speed up discovery.

“Courts in this jurisdiction ... have consistently found that preliminary injunction proceedings are exactly the kind of circumstance warranting expedited discovery,” Chutkan said.

The case centers on DOGE’s authority or purported lack thereof, and whether it has been working with or directing agencies to cut personnel and agreements.

In one filing in the case, a White House official https://www.theepochtimes.com/us/elon-musk-not-doge-employee-has-no-decision-making-authority-white-house-5811974

as its acting administrator.

DOGE has been assisting various agencies that have terminated tens of thousands of workers since Trump was sworn in on Jan. 20, according to Trump, Musk, and agency officials.

Under the new order, which does not apply to Trump, the government must https://s3.documentcloud.org/documents/25560177/proposed-discovery-in-doge-case.pdf

on obtaining access to and making changes to federal databases, lists, and summaries regarding the cancellation of federal agreements, as well as documents created or edited in relation to the termination of federal workers.

The deadline for discovery is 21 days.

DOGE must also identify every individual who has served as the administrator of DOGE, or the functional head of DOGE since Trump took office; every person who is part of DOGE; and all agencies for which DOGE or Musk canceled or directed the cancellation of grants and contracts or the termination of employees, the judge ruled.

Chutkan denied the plaintiffs’ request for two depositions, which the attorneys general said would be planned based on the government’s discovery production.

“[E]ven though Plaintiffs agree not to seek to depose President Trump or Musk, the court recognizes that depositions impose a heavier burden than written discovery,” the judge said. “If Defendants fail to adequately respond to Plaintiffs’ written discovery, Plaintiffs may renew their requests for depositions.”

This is the second order this week requiring DOGE to produce records. A different federal judge on March 10 https://www.theepochtimes.com/us/judge-says-doge-must-produce-records-on-operations-5823455

DOGE to comply with a Freedom of Information Act request, finding that it has been acting independently from the president.

A third U.S. judge in February https://www.theepochtimes.com/us/judge-orders-doge-employee-to-answer-questions-under-oath-5817505

a DOGE worker to sit for a deposition in a separate case that also seeks to block DOGE from accessing some government systems.

https://cms.zerohedge.com/users/tyler-durden

Fri, 03/14/2025 - 14:20

FBI Investigating "Alarming Rise In 'Swatting' Incidents" Targeting Conservative Influencers

FBI Investigating "Alarming Rise In 'Swatting' Incidents" Targeting Conservative Influencers

FBI Director Kash Patel on Friday responded to a string of 'swatting' incidents targeting conservative media figures in recent days, which came on the heels of the https://www.zerohedge.com/political/infowars-reporter-brutally-murdered-outside-austin-residence

of InfoWars reporter Jamie White.

?itok=cnXImmoM

?itok=cnXImmoM

Multiple conservative content creators, including InfoWars host Chase Geiser, Nick Sotor, Gunther Eagleman, 'Catturd,' and Trump impersonator Shawn Farash, have been targeted in swatting incidents, which typically entail fake or prank phone calls to emergency services that trigger an armed response from police officers to a particular address.

"I want to address the alarming rise in ‘swatting’ incidents targeting media figures. The FBI is aware of this dangerous trend, and my team and I are already taking action to investigate and hold those responsible accountable," Patel wrote on X Friday morning.

I want to address the alarming rise in ‘Swatting’ incidents targeting media figures. The FBI is aware of this dangerous trend, and my team and I are already taking action to investigate and hold those responsible accountable.

This isn’t about politics—weaponizing law enforcement…

— FBI Director Kash Patel (@FBIDirectorKash) https://twitter.com/FBIDirectorKash/status/1900536072871768094?ref_src=twsrc%5Etfw

On Wednesday, Geiser posted on X that he was "was just swatted again moments ago, just before 2AM," and that police officers "used a PA system to call me by name and order me to walk out of my house."

Geiser was swatted twice within a twelve hour period, the first time Tuesday afternoon and again early Wednesday morning just before 2AM. https://x.com/realchasegeiser/status/1899543983056990346

on the Alex Jones Show, noting that he and his family weren’t at home when the police showed up at his house. Geiser said when he met the police in his driveway, they were still receiving 311 messages about his property. “So there was a campaign of swatting my property,” he told Jones.

After the second incident, the Info Wars reporter https://x.com/realchasegeiser/status/1899722289446305907

that “6 to 8 police officers used a PA system to call me by name and order me to walk out of my house.”

I was handcuffed in the middle of the street, presumably at gunpoint though I couldn’t tell because of the light being shined on my face.

I was then led into the house where my wife was woken up and we were informed that they received a call from someone pretending to be me and threatening to kill my family. -https://amgreatness.com/2025/03/13/multiple-conservative-influencers-swatted-in-the-past-few-days/

"I was handcuffed in the middle of the street, presumably at gunpoint though I couldn’t tell because of the light being shined on my face. I was then led into the house where my wife was woken up and we were informed that they received a call from someone pretending to be me and threatening to kill my family."

Swatted for a second time in 12 hours. Here’s the video.

Long live InfoWars. https://t.co/H0nIt8NjcC

— Chase Geiser (@realchasegeiser) https://twitter.com/realchasegeiser/status/1899736616488308765?ref_src=twsrc%5Etfw

Nick Sortor, another conservative influencer with over 900,000 followers on X, wrote on Thursday that his family members were swatted.

"A dozen cops attempted to kick my dad’s door in at gunpoint,” he said Thursday, adding that “This is literal ... terrorism. And the FBI should treat it as such."

"In my dad’s case, the caller told police my dad was killing my entire family, requiring them to intervene with deadly force. This is nothing short of attempted murder. They wanted the police to kill my father."

Both my dad and my sister were swatted tonight.

A dozen cops attempted to kick my dad’s door in at gunpoint.

This is literal fucking terrorism. And the FBI should treat it as such.

Before calling in the swat, this dumbshit sent my sister an email calling me a Nazi, of course.… https://t.co/LVNgXZ16Im

— Nick Sortor (@nicksortor) https://twitter.com/nicksortor/status/1900063384927653947?ref_src=twsrc%5Etfw

Also Thursday, conservative influencer Gunther Eagleman wrote on X that "my house was just swatted," and that someone had "called in a fake hostage situation."

"Fortunately, I have good relations with law enforcement, and extra patrols will be added. I don’t tolerate threats and will find the culprit."

The gloves are off. First off, my family is safe.

My house was just swatted. Some ignorant fuck called in a fake hostage situation.

Fortunately, I have good relations with law enforcement, and extra patrols will be added. I don’t tolerate threats and will find the culprit.…

— Gunther Eagleman™ (@GuntherEagleman) https://twitter.com/GuntherEagleman/status/1900266427116110090?ref_src=twsrc%5Etfw

On Thursday night, Elon Musk favorite "Catturd" was swatted at his Texas residence, according to journalist Breanna Morello.

🚨BREAKING🚨https://twitter.com/catturd2?ref_src=twsrc%5Etfw

was swatted for a fourth time last night.

Many conservatives aren’t willing to go on the record when they’re swatted.

I can confirm about 6 incidents in the last 48 hours.

What’s the FBI doing about this?

Well I asked, but the FBI has not issued a…

— Breanna Morello (@BreannaMorello) https://twitter.com/BreannaMorello/status/1900512287343136985?ref_src=twsrc%5Etfw

Conservative radio host Joe Pags was also swatted.

Yes -- my family and I were swatted. This is how it went down. Including the video I saw on my front door camera at 2:35am. How would you have reacted? This has to stop https://t.co/uP5DeF6hSc

— Joe Pagliarulo Pag (@Joeshowtalk) https://twitter.com/Joeshowtalk/status/1900374449553023461?ref_src=twsrc%5Etfw

Farash thanked Patel, offering to provide any information that "can be helpful."

Thank you! We were swatted yesterday and are very happy to hear that this is a priority at the FBI. If there is anything that we can do or any info we can provide that can be helpful we'd be more than happy to share it

— Shawn Farash (@Shawn_Farash) https://twitter.com/Shawn_Farash/status/1900541096997921276?ref_src=twsrc%5Etfw

My wife and I were swatted tonight.

We are totally safe.

Thank you to everyone who checked in.

We are going to do whatever is necessary to find out who is behind these coordinated attacks and hold them accountable to the fullest extent.

Thank you all for the support! https://t.co/TRYsx0PF1d

— Shawn Farash (@Shawn_Farash) https://twitter.com/Shawn_Farash/status/1900355986390446449?ref_src=twsrc%5Etfw

In response to the swattings, Sen. Mike Lee (R-UT) called it "pure domestic terrorism."

Swatting = pure domestic terrorism https://t.co/S8p9B23oHy

— Mike Lee (@BasedMikeLee) https://twitter.com/BasedMikeLee/status/1900375328196861962?ref_src=twsrc%5Etfw

US Attorney for the District of Columbia Ed Martin released a statement Thursday night following the swattings.

"Swatting is a violent criminal act," he posted on X, adding "If any perpetrators are discovered in the District of Columbia or originate from here, you will be arrested, we will put you in jail and prosecute you to the fullest extent of the law."

Swatting is a violent criminal act.

If any perpetrators are discovered in the District of Columbia or originate from here,

you will be arrested,

we will put you in jail and prosecute you to the fullest extent of the law.https://twitter.com/hashtag/NoOneIsAboveLaw?src=hash&ref_src=twsrc%5Etfw

— U.S. Attorney Ed Martin (@USAEdMartin) https://twitter.com/USAEdMartin/status/1900346037589491998?ref_src=twsrc%5Etfw

https://cms.zerohedge.com/users/tyler-durden

Fri, 03/14/2025 - 14:00

Putin Calls For All Ukrainians In Kursk To Surrender, 'Sympathetic' To Trump's Request To Spare Lives

Putin Calls For All Ukrainians In Kursk To Surrender, 'Sympathetic' To Trump's Request To Spare Lives

Update(1358ET): The Kremlin has responded to President Donald Trump’s request that the lives of the Ukrainian troops encircled in Russia’s Kursk Region be spared, which was conveyed in a Friday Truth Social post by the president. Moscow says it is "sympathetic" to this request, and the pattern in the battle to retake Kursk has been to take POWs if weapons are laid down.

At the same time President Putin has called immediate surrender of all Ukrainian troops remaining on Russian soil. Trump had acknowledged that “thousands of Ukrainian troops" are "completely surrounded by the Russian military” in the southwest Kursk region.

Putin said during a National Security Council meeting on Friday that Russian forces guarantee their lives if they lay down their arms, according to https://www.rt.com/russia/614241-putin-urges-kiev-kursk/

translation:

Putin responded that he was aware of Trump’s request, adding that Russia was willing to consider it. “If they lay down their arms and surrender, [we] will guarantee them their lives and dignified treatment in accordance with international law and Russian legal norms,” the president said.

But Putin also emphasized the “numerous crimes against civilians” in the region, also has hundreds of thousands of citizens have fled over the last six months of the Kursk occupation on risky operation ordered by Zelensky.

The Ukrainian leader has meanwhile rejected that he will cede territory in Ukraine for the sake of peace, and is demanding a 'strong response' from the US. But clearly Trump's own words suggest he's not ready to order some kind of greater intervention on Kiev's behalf.

* * *

President Trump has revealed Friday that he has held the second phone call of his current administration with Russian President Vladimir Putin on the prospect of ending the Ukraine war. The call, held Thursday, included a plea by Trump for Russia to spare the lives of Ukrainian soldiers currently surrounded in the Kursk region. Such a direct appeal like this by Trump is unprecedented.

"We had very good and productive discussions with President Vladimir Putin of Russia yesterday" - Trump began a statement on Truth Social, before continuing, "and there is a very good chance that this horrible, bloody war can finally come to an end..."

?itok=I9Eva7os

?itok=I9Eva7os

That's when he stated in all caps, "But, at this very moment, thousands of Ukrainian troops are completely surrounded by the Russian military, and in a very bad and vulnerable position."

"I have strongly requested to President Putin that their lives be spared. This would be a horrible massacre, one not seen since World War II. God bless them all!!!" - Trump ended with.

Aside from the rare or even unprecedented nature of such a direct appeal from a sitting US President for Putin to spare the lives of Ukrainian soldiers, this a first top-level US acknowledgement that Ukraine is rapidly losing in its cross-border Kursk operation.

Already as of Wednesday there were widespread reports that https://www.zerohedge.com/geopolitical/ukraine-losing-its-trump-card-key-kursk-town-liberated-russian-troops

is underway, and it's been confirmed that the key town of Sudzha has been taken back by Russian forces, along with well over a dozen towns and settlements in rapid fashion.

The amount of Russian territory the Ukrainians still hold there has suddenly shrunk at least four-fold, and by many accounts Russian operatives continue closing in. Even the Financial Times has admitted that the writing is https://www.ft.com/content/f3b3d3f9-2c55-45f4-a11d-2e12feeb1018

:

Kyiv’s forces managed at one point to seize some 1,300 sq km of Russian territory. But over the first few weeks the area they were able to hold became a narrow wedge.

“It is no secret that the zone of our incursion, it should have been wider,” Kariakin said. “A wide area along the border would have been much more comfortable.” Instead, Russian troops surrounded Ukraine’s occupying forces on three sides. It was a precarious position and became increasingly difficult to hold.

War analysts consider it highly debatable and uncertain whether the risky cross-border gambit which started in August actually translated to any strategic advantage across the broader war theater:

For Andriy Zagorodnyuk, a former defense minister of Ukraine, the Kursk operation “served its purpose”: it diverted elite Russian forces and prevented them from opening up another front, he said. Others question whether the benefits outweighed costs to Ukraine’s defense effort on the eastern front.

The tragic 'cost' has been tens of thousands of Ukrainian troops lost to an operation which had little to no chance of success in the first place.

"High chance" of peace, Trump said...

❗️Trump stated that he spoke with Putin on Thursday

Trump asked Putin to SPARE the surrounded Ukrainian troops in the Kursk region.

Trump also noted that there are HIGH CHANCES of resolving the situation around Ukraine. https://t.co/bI2aTGBfYz

— Sputnik (@SputnikInt) https://twitter.com/SputnikInt/status/1900545081968333004?ref_src=twsrc%5Etfw

Sending masses of troops to invade and occupy Russian territory was essentially a suicide operation to begin with, for which Zelensky has come under intense internal and international criticism. Kiev has had to take more extreme measures to round up men to send to the front lines of late, and there have been reports of a lot of resistance and conscription officers roam the streets.

https://cms.zerohedge.com/users/tyler-durden

Fri, 03/14/2025 - 13:58

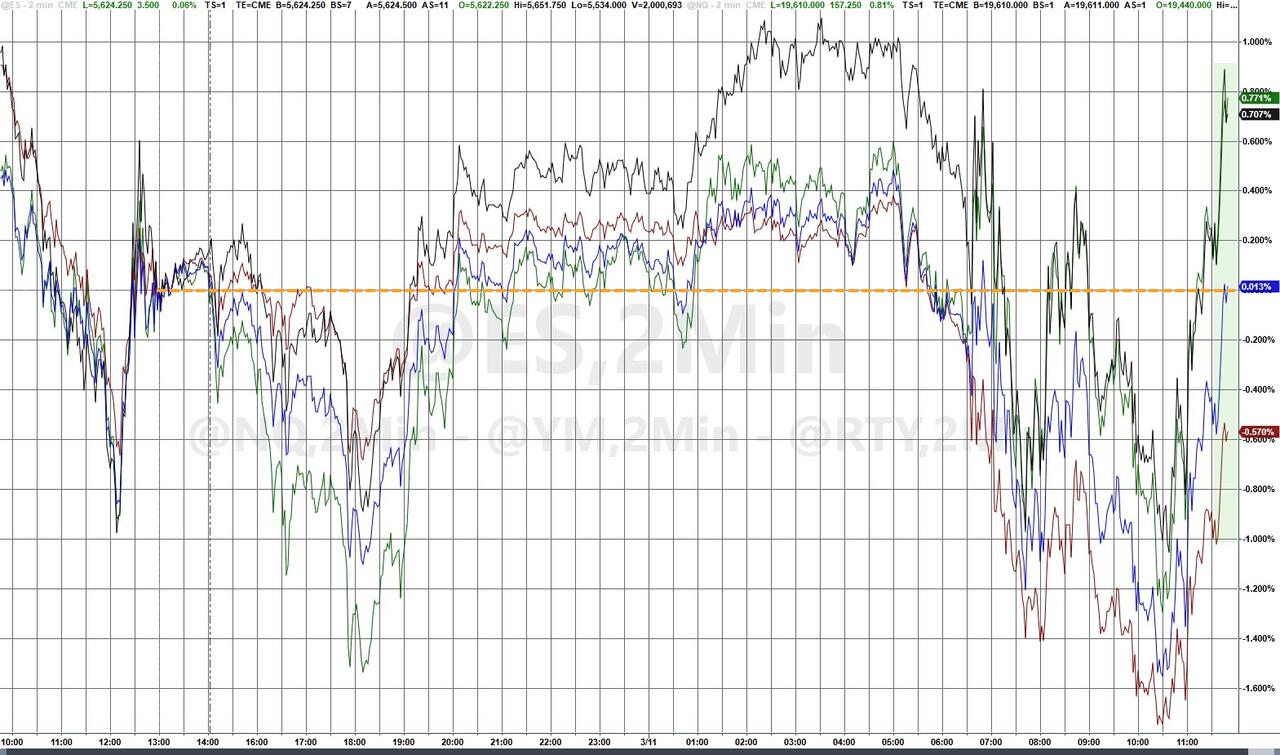

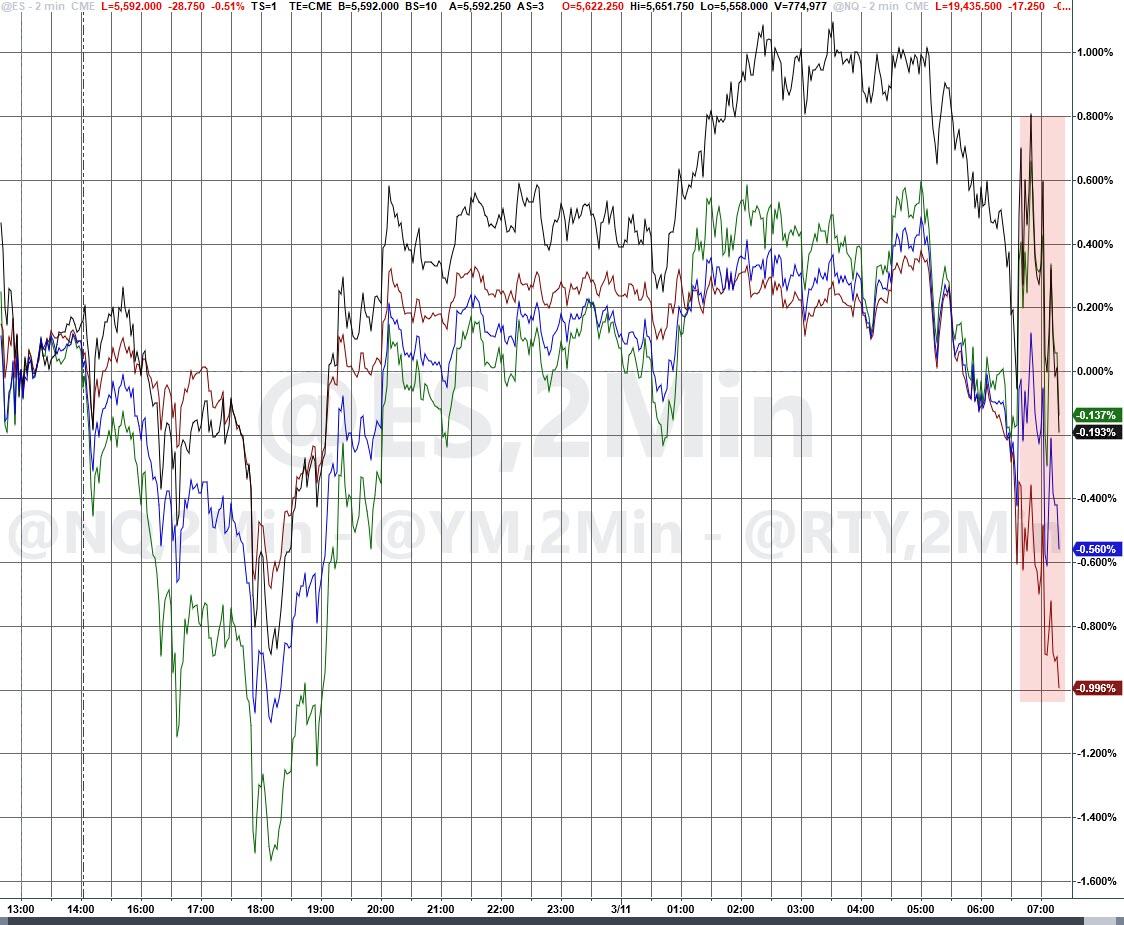

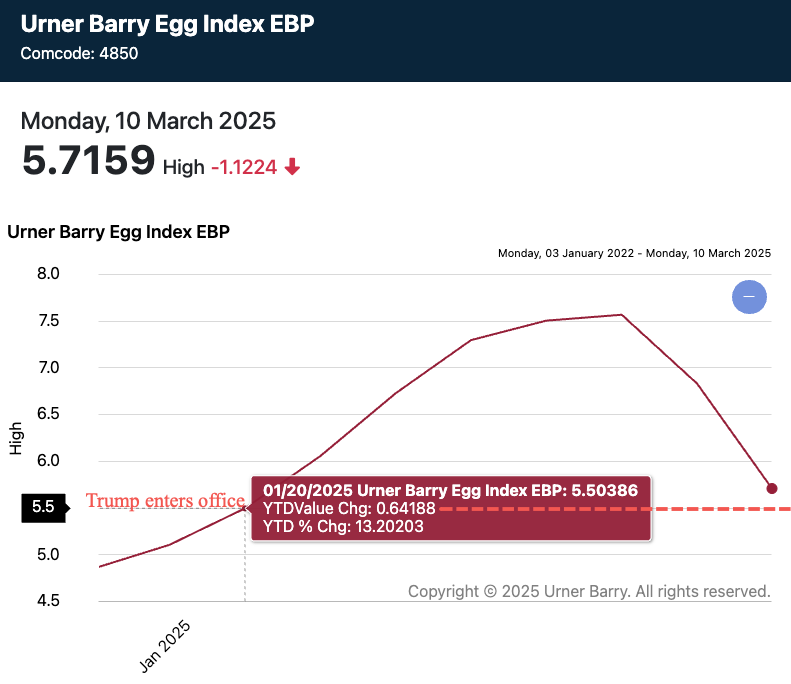

Futures, Yields, Gold All Jump After Schumer Caves To Keep Government Open

Futures, Yields, Gold All Jump After Schumer Caves To Keep Government Open

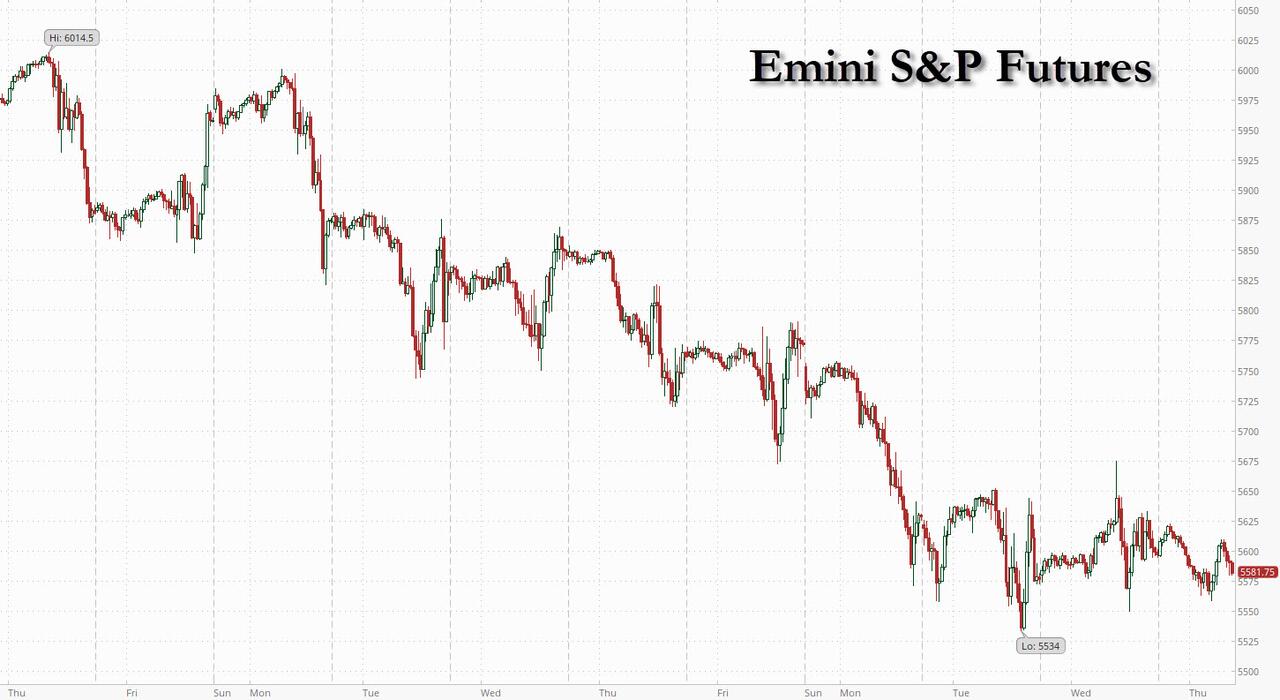

US equity futures and global stocks rose as the threat of a US government shutdown receded, removing at least one element of uncertainty confronting investors. Meanwhile, gold hit a record above $3,000 an ounce as the precious metal already anticipates the stimulus flood that is coming over the horizon.As of 8:00am S&P futures are higher by 0.9% as a stopgap funding bill is set to pass in Congress after top Senate Democrat Chuck Schumer caved and opted not to block the measure. That helped lift the mood after the benchmark index extended its three-week rout beyond a 10% correction on Thursday. Nasdaq 100 futures advanced 1.2% with Nvidia leading premarket gains among the Mag7. In Europe, the Stoxx 50 advances 1.3% with outperforming sectors including consumer staples and materials; Asian stocks were also higher. Bond yields are 1-3bp higher this morning; the USD fell as the EUR surged after politicians agreed to a deal to drown Germany in debt to fund "military spending." Commodities are higher led by Oil (WTO +1.0%) and Iron (+1.5%). Since yesterday’s close, there has been some positive developments on macro policies: meeting between Lutnick and Ontario’s Ford was viewed as positive; the US government managed to avoid the shutdown. Internationally, China will hold a press briefing next Monday to outline some additional measures boost consumer; Japan announced the largest pay hike in over three decades (+5.36% average pay gain and +3.84% base pay vs. 3.8% JPMe vs. 3.7% last year), a positive catalyst for consumption growth, yet not enough to push the yen higher. Today's calendar includes March preliminary University of Michigan sentiment at 10am where consensus expects a 63.0 print.

?itok=wtvmuP2-

?itok=wtvmuP2-

In premarket trading, Nvidia is leading gains among the Magnificent Seven stocks as the group attempts to stage a rebound after the S&P 500 tumbled into its first 10% correction in almost two years. Alphabet +0.9%, Amazon +1.2%, Apple +0.5, Microsoft +0.7%, Meta +1.5%, Nvidia +2% and Tesla +1.7%. Applied Optoelectronics surges 55% after the maker of fiber-optic networking products entered a warrant agreement with Amazon. Ulta Beauty jumped 6% after reporting earnings per share for the fourth quarter that beat the average analyst estimate. Here are some other notable premarket movers:

Crown Castle rises 5% after agreeing to sell separate parts of its fiber business to an EQT AB fund and Zayo Group Holdings Inc. for a combined value of $8.5 billion.

DocuSign jumps 9% after the e-signature software company posted quarterly results that beat expectations and gave a billings outlook that’s seen as positive.

Gogo rises 13% after the in-flight broadband company forecast revenue for 2025 that beat the average analyst estimate.

Peloton Interactive gains 6% as Canaccord upgrades its rating and says the company is set to reap the benefits of being the “clear leader” in the connected fitness market.

Radius Recycling soars 110% after Toyota Tsusho’s US unit, Toyota Tsusho America, agreed to buy all shares in cash for $30 a share.

Rubrik surges 18% after the data security software company gave an outlook that is stronger than expected.

Semtech rises 12% after the semiconductor device company gave an outlook that’s seen as better than feared.

Xponential Fitness drops 31% after the franchiser of boutique fitness brands gave disappointing full-year forecasts.

Spot gold briefly rose above $3,000/oz for the first time while broader risk sentiment improved after Senate Democratic leader Chuck Schumer dropped his threat to block a Republican spending bill, thus lowering the chances of a US government shutdown on Saturday.

“It looks like the budget bill is still going through despite some opposition from Democrats and this has lifted sentiment in the US and probably there is also some spillover effect to Europe,” Julius Baer & Co. economist Sophie Altermatt said. “This might be just some reprieve, given we had so many uncertainties with erratic policy moves in the US,” she added.

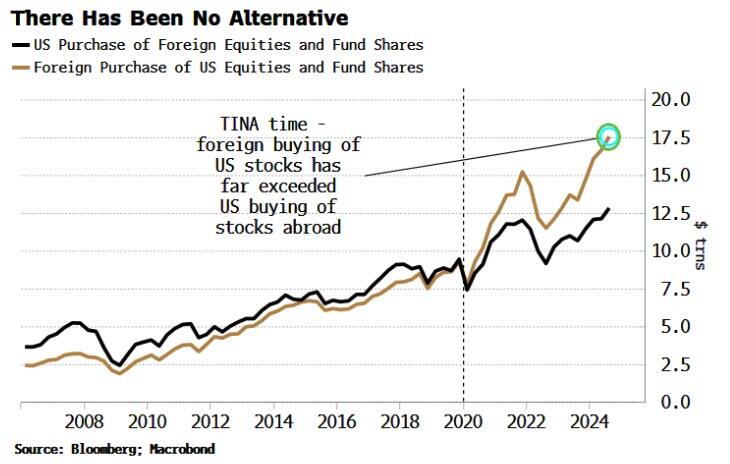

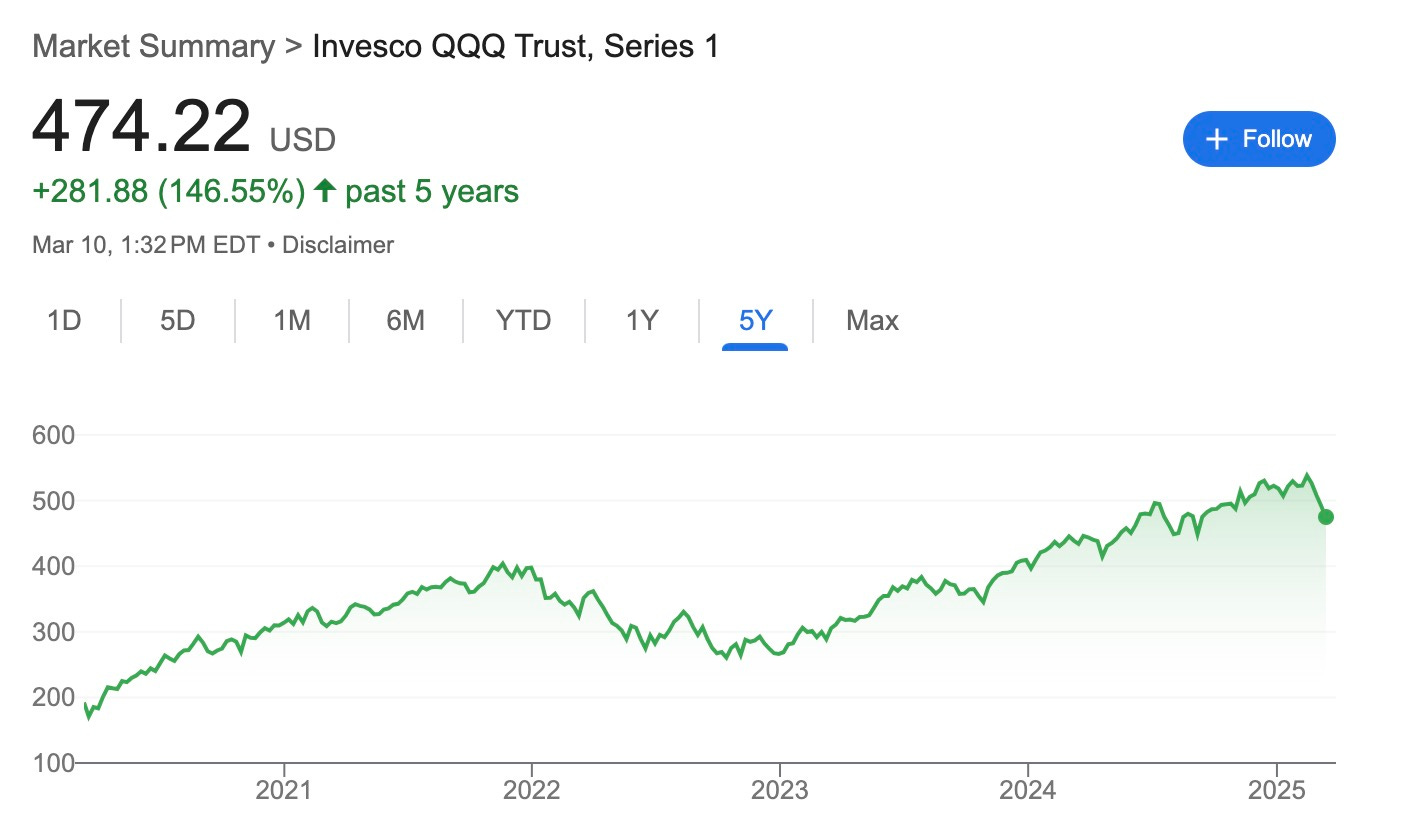

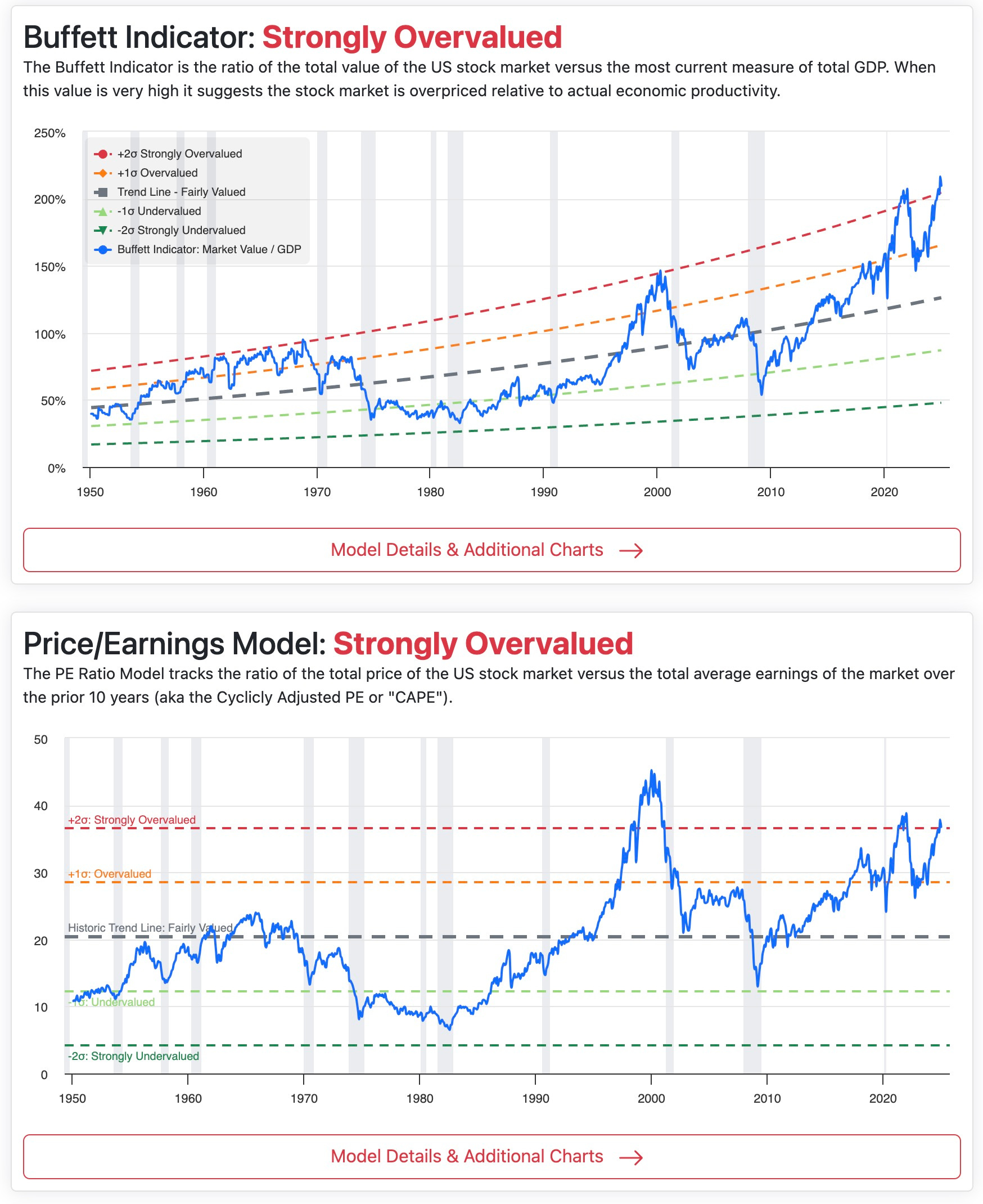

Avoiding a government shutdown would remove a concern for traders, already fretting over threats to the world economy from President Donald Trump’s tariff war. Two months into Trump’s presidency, $5 trillion has been erased from US stocks. Those risks are spurring demand for haven assets, with investors the most bullish on Treasuries relative to stocks for at least three years, according to Bloomberg Markets Live Pulse survey. It’s also pushed gold to successive record highs, with the yellow metal now up more than 14% year-to-date.

“Gold is in a secular bull market,” said Peter Kinsella, head of foreign exchange strategy at Union Bancaire Privee UBp SA, who expects prices to reach $3,300 an ounce by year end. “For sure, that’s down to uncertainty caused by US trade policies but central bank demand is also a big factor.”

Some strategists reckon relief could be on the horizon for risk assets after the recent selloff. While the S&P 500 has plunged 10% off its February peak into correction territory, Bank of America’s Michael Hartnett said there’s unlikely to be a slide into a new bear market: “Fresh declines in stock prices will provoke flip in trade and monetary policy,” Hartnett wrote in a note, recommending buying the S&P 500 at 5,300 points, a 4% drop from current levels.

In Europe, German conservative leader Friedrich Merz reached a tentative agreement with the Green party on a debt-funded spending package for defense and infrastructure. The deal needs to be approved by party lawmakers and would release defense spending from debt restrictions and set up a €500 billion fund for infrastructure investment.

The Stoxx 600 climbs 0.4% as miners gained on expectations of economic support measures from China, even as benchmark indexes headed for a second straight week of declines. Carlsberg jumps on an upgrade from RBC, while Kering sinks after appointing a new artistic director to its key Gucci brand. Here are the biggest movers Friday:

Carlsberg gains as much as 4.1% after it and its peer Heineken were upgraded to outperform at RBC, noting the companies have been “prudent” in setting expectations in what is in an unusually “opaque” outlook

Adecco gains 3.6% and Hays gains 7% after BNP Paribas Exane upgraded Adecco to outperform, and double upgrades Hays to outperform, as staffing agencies are moved to the top of broker’s sub-sector preferences

Sectra gains as much as 12%, the most since December 2023, after the Swedish healthcare and cybersecurity firm reported 3Q earnings which beat expectations on most metrics, including revenues and profit

European sectors with heavy China exposure are getting a boost on Friday as the Chinese benchmark stock index rallied the most in two months on expectations of economic support from Beijing

Brunello Cucinelli shares rise as much as 3.7% as a broadly in-line set of earnings from the Italian luxury goods maker demonstrated its resilience against a tough backdrop for the broader sector

Kering falls as much as 10%, the biggest one-day drop in a year, after the luxury goods maker caught investors off-guard with its surprise appointment of Demna Gvasalia as Gucci’s new artistic director

Universal Music Group slumps as much as 11% after shareholder Pershing Square offloaded shares in the music company at a discount to yesterday’s close. Shares have fallen below the offer price

BMW falls as much as 4.5% after the German automotive firm reported disappointing guidance and missed expectations in its 4Q report, with analysts flagging the firm’s margin outlook as a particular disappointment

Swiss Life shares fall as much as 6.2%, the most in a year. The financial services company reported results that matched expectations, but were deemed insufficient by analysts

Bodycote slumps as much as 18%, the most in five years, after the heat-treatment specialist delivered its FY results, with analysts cite automotive and industrial weakness for likely mid-single-digit cuts

GN Store Nord shares are among the worst performers in the Stoxx 600 Health Care Index on Friday morning, after Bernstein re-initiated coverage of the stock with an underperform rating

El.En shares dropped as much as 8.5% in Milan trading, the most since May 16, after the Italian medical devices company reported FY earnings, indicating a “complex” outlook for 2025

Earlier in the session, Asian equities also advanced, propelled by a rally in Chinese shares as investor optimism for more policy support rose ahead of a press briefing on government efforts to boost consumption. The MSCI Asia Pacific Index rose as much as 0.9%, with Tencent and Alibaba among the biggest boosts. China’s onshore CSI 300 Index and Hong Kong’s Hang Seng China Enterprises Index each jumped more than 2%. China optimism rose on the announcement that officials from the finance ministry, commerce ministry, central bank and other government bodies are scheduled to hold a briefing on consumption Monday. The news provided traders further assurance that Beijing is determined to fix one of the weakest links in the economy. Word of the press conference “fanned expectations” for policy support, said Shen Meng, a director at Beijing-based investment bank Chanson & Co. “But if it falls short of providing details on increasing income, such optimism may weaken to some extent.” Stocks in Japan and Australia also rose, and US futures rebounded following the S&P 500’s drop into a technical correction Thursday. Rising prospects for a stopgap funding bill to avoid a US government shutdown provided some reassurance for markets amid continued concerns over economic growth and tariffs.

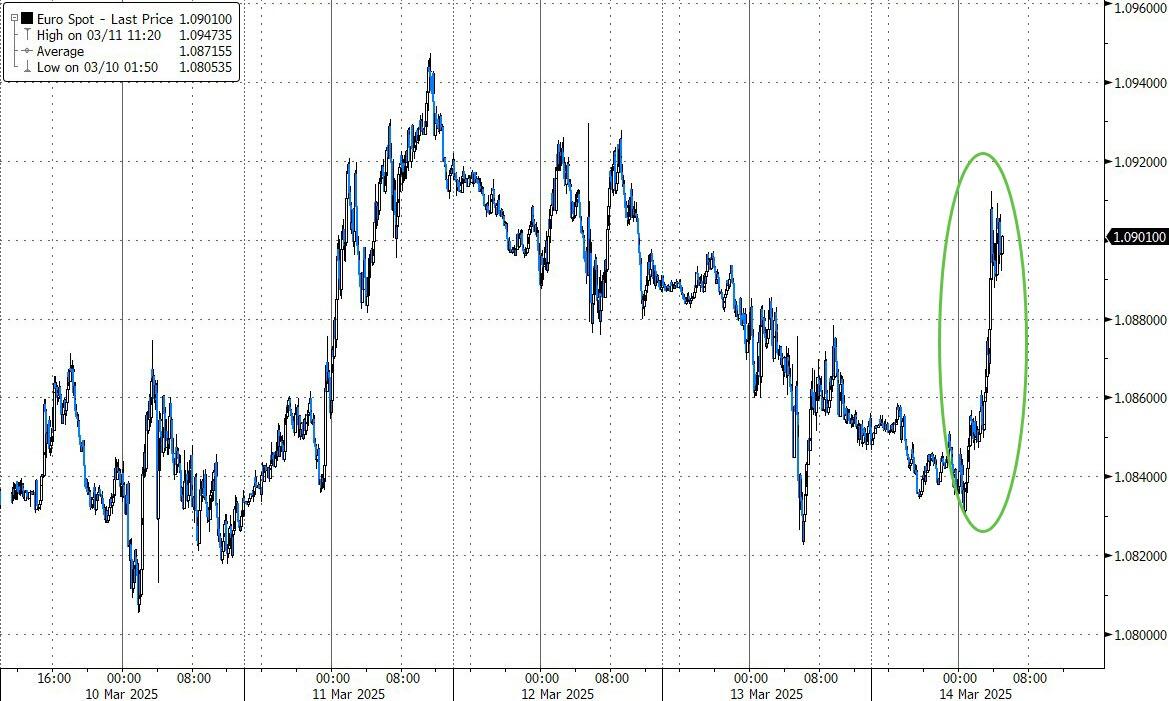

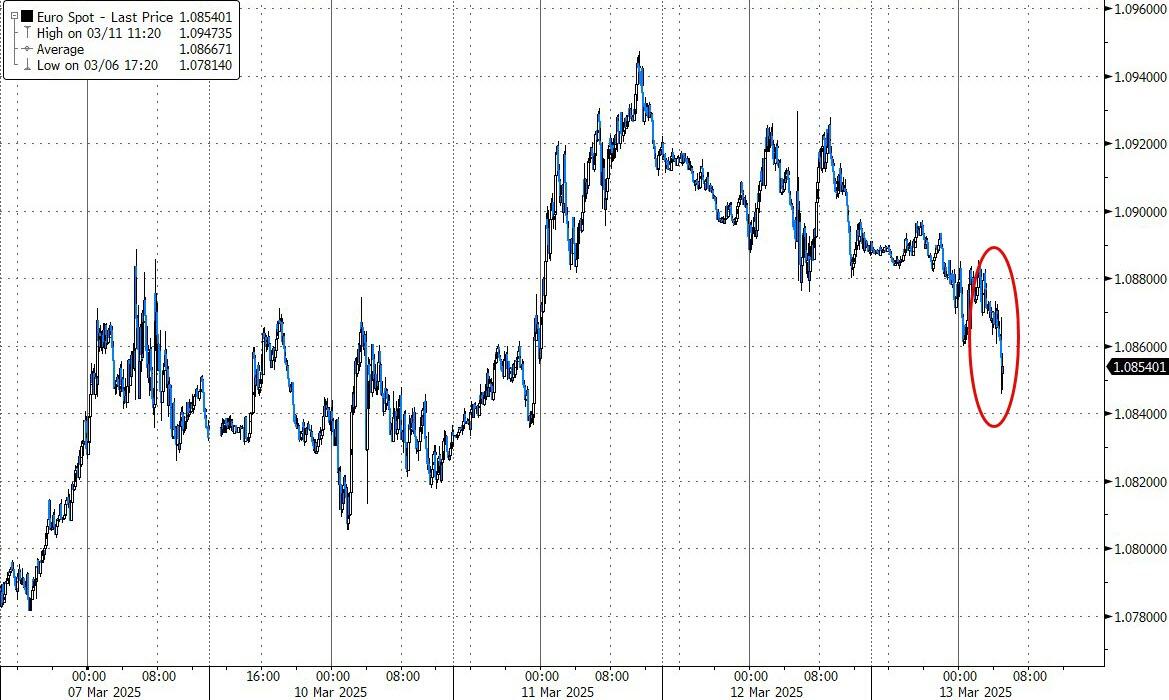

In FX, the Bloomberg Dollar Spot Index drops; The Japanese yen is the weakest of the G-10 currencies, falling 0.7% against the dollar even as Japan’s largest labor union group said its workers secured the highest pay deal in more than three decades. The pound falls 0.2%, extending its drop after data showed the UK economy unexpectedly shrank at the start of 2025. The Euro jumped above 1.09 after German conservative leader Friedrich Merz reached a tentative agreement with the Green party on a debt-funded spending package for defense and infrastructure. The deal needs to be approved by party lawmakers and would release defense spending from debt restrictions and set up a €500 billion fund for infrastructure investment.

In rates, treasury futures trend lower into the early US session. Treasury yields are cheaper by 1bp to 3bp across the curve with 10-year trading around 4.18%, cheaper by 3bp on the day with bunds lagging by 4bp in the sector and 10-year French bonds lagging 2bp. Bunds slid to lows of the day and French 30-year yields rose to the highest since 2011, after a report that German parties have reached an agreement with the Greens on a debt package. Advance in US stock futures adds to cheapening pressure on Treasury yields with University of Michigan sentiment data the focus for the US session.

In commodities, WTI rises 1% to ~$67 a barrel. The upbeat mood is evident elsewhere as Bitcoin climbs rises 3% toward $83,000. Gold traded briefly at a record price just above $3000 before modestly fading gains.

Looking at today's calendar, the US economic data calendar includes March preliminary University of Michigan sentiment at 10am. Fed officials are in external communications blackout ahead of March 19 policy announcement.

Market Snapshot

S&P 500 futures up 0.9% to 5,576

STOXX Europe 600 up 0.4% to 542.64

MXAP up 0.5% to 185.46

MXAPJ up 0.9% to 581.19

Nikkei up 0.7% to 37,053.10

Topix up 0.6% to 2,715.85

Hang Seng Index up 2.1% to 23,959.98

Shanghai Composite up 1.8% to 3,419.56

Sensex down 0.3% to 73,828.91

Australia S&P/ASX 200 up 0.5% to 7,789.68

Kospi down 0.3% to 2,566.36

German 10Y yield little changed at 2.88%

Euro little changed at $1.0854

Brent Futures up 0.9% to $70.51/bbl

Brent Futures up 0.9% to $70.51/bbl

Gold spot up 0.0% to $2,990.02

US Dollar Index little changed at 103.93

Top Overnight News

US equity futures are rallying after Senate Democratic leader Chuck Schumer dropped his threat to block a key spending bill, cutting the risk of a disruptive March 15 shutdown. BBG

US Senate Minority Leader Schumer said he will vote to keep the government open and not shut it down. It was separately reported that multiple US Democratic Senators and aides indicated sufficient Democratic support for cloture on the House-passed continuing resolution in Friday morning’s vote: Punchbowl.

US President Trump is to sign executive orders on Friday at 12:00EDT/16:00GMT.

US Vice President Vance said can never predict the future but thinks the economy is strong when asked if he could rule out a recession, according to a Fox News interview,

US Treasury Secretary Bessent said they hopefully won't get a recursive 'Biden-flation' and said they are very vigilant and it could happen again. Bessent added that before they can bring down inflation, they also want to help affordability and as they bring down inflation, they want to bring the absolute price level down through deregulation and bringing down interest rates for house payments and car payments.

Merz Said to Reach Tentative Deal With Greens on German Debt: BBG

Ontario Premier Doug Ford lauded his Thursday meeting with Commerce Secretary Howard Lutnick as “positive” and “productive” after their public rift over tariffs on imported goods. “We shared a tremendous amount of views back and forth, and I’m feeling very positive,” Ford told reporters outside the U.S. Department of Commerce building. The Hill

Chinese stocks jumped on Friday after Beijing promised new measures to help consumers, defying a Wall Street sell off and pushing the country’s main stock index into positive territory for the year. Chinese authorities announced late on Thursday that they would hold a press conference on “boosting consumption” on Monday. FT

China is increasingly concerned not just about US tariffs, but also the risk that Washington will direct other countries (like Mexico, Brazil, etc.) to ramp duties on Chinese imports as well. NYT

China may slash pay by 50% for fund managers who underperform their benchmarks, people familiar said, as part of a broader overhaul of the country’s mutual fund industry. BBG

Ukrainian drones attacked Moscow for the second day in a week, as US special envoy Steve Witkoff left the country, Russian news services reported. The attacks also triggered a massive fuel tank fire at one of Russia’s biggest oil refineries. BBG

The UK economy unexpectedly shrank 0.1% in January, hit by declines in manufacturing and construction. The pound slipped. BBG

Investors are the most bullish on Treasuries relative to stocks in at least three years, according to a MLIV survey. As tariff policies threaten US exceptionalism, some 77% see bonds giving a better volatility-adjusted return over the next month. BBG

Tariffs/Trade

Canada's Finance Minister LeBlanc said they agreed to continue discussions in the meeting with US Commerce Secretary Lutnick, while they have been clear that they will not reopen USMCA provisions on dairy and didn't discuss that with Lutnick.

Canada's Industry Minister Champagne said there was a mutual understanding that there is an impact on both sides of the border from tariffs and they talked about issues around economic security and national security with US Commerce Secretary Lutnick. Furthermore, they talked about Canadian aluminium steel and how they can help the US

Ontario's Premier Ford said they had a productive meeting with US Commerce Secretary Lutnick and will have another meeting next week, while he feels temperatures are decreasing and said it was the best meeting they had since tariff talks began.

ECB President Lagarde said US President Trump's policy decisions cause concern and warned trade conflict will damage the worldwide economy, according to an interview with BBC.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly positive as risk sentiment gradually improved following the negative lead from Wall St where the S&P 500 slipped into a technical correction amid tariff concerns after President Trump threatened 200% tariffs on EU wine and champagne. ASX 200 gained as strength in mining, materials, resources and utilities atoned for the losses seen in the energy, financials and tech industries. Nikkei 225 staggered at the open with pressure from recent currency strength but then recovered soon after as the yen steadily pared its recent gains. Hang Seng and Shanghai Comp advanced with the Hang Seng resuming the outperformance which has helped the index notch gains of around 22% so far this year, while the PBoC reiterated support pledges and stated that it will lower rates and the RRR at a 'proper time', keep liquidity ample and guide social financing costs lower.

Top Asian News

China's financial regulator said financial institutions should boost financial support for consumption and will provide loan renewal support to eligible personal consumption loan borrowers.

DeepSeek is focusing on research over revenue and customers from sectors such as healthcare and finance bought API access to DeepSeek’s R1 and V3 models. Furthermore, DeepSeek's founder declined to entertain interest from China’s tech giants and venture and state-backed funds to invest in the group for the time being, while it may find limited access to NVIDIA's (NVDA) new generation of more advanced chips a potential bottleneck in the long run and could consider future partnerships that can help solve this issue, according to FT citing sources.

Rengo, Japan's largest labour union, says first-round data shows average wage hike of 5.46% in FY25 (demand of 6.09%); initial wage hike exceeds 5% for the second straight year.

Chinese regulators have issued a requirement for the labelling of AI generated content.

China Feb YTD Aggregate Financing (CNY) 9.29tln (exp. 9.757tln); M2 Money Supply 7% (exp. 7%); New Yuan Loans 6.14tln (exp. 6.38tln)

European bourses are mostly firmer, in what has been a choppy session thus far; initial weakness at the cash open has been entirely pared with indices generally towards the top end of the day's ranges. European sectors hold a slight positive bias; Basis Resources tops the pile, buoyed by strength in the metals complex, amid the risk sentiment and strong Chinese price action overnight. Media is found at the foot of the pile. Consumer Products is also higher today, benefiting from the strength in Chinese trade overnight; though Kering (-13%) slips after appointing Demna as Gucci's artistic director, a move JP Morgan brands as "controversial".

Top European News

Germany's CDU/CSU to hold special parliamentary faction meeting this afternoon, according to Reuters sources

Goldman Sachs cuts its UK 2025 GDP growth forecast to 0.9%, down from 1.0% previously.

DIW institute says the German economy is expected to stagnate in 2025, down from the previously expected growth of 0.2%; economy expected to grow by 1.1% in 2026, down from the previously expected 1.2%

BoE/Ipsos Inflation Attitudes Survey - February 2025. Median expectations of the rate of inflation over the coming year were 3.4%, up from 3% in November 2024.

UK PM Starmer reportedly suffered a cabinet uprising over planned welfare and public spending cuts, but insisted tough choices are needed and said he will not bend fiscal rules to allow more borrowing, according to FT.

EU Diplomatic Service proposes that member nations deliver military aid to Ukraine in 2025 worth at least EUR 20bln and potentially up to EUR 40bln, via Reuters citing a paper; aid to be provided in line with nations economic "weight".

ECB's Villeroy says will be inflation to 2% this year in Europe; EU has the resources to retaliate against the US admin tariffs on wine and liquor.

EU Envoys agree to remove three individuals from the sanctions list, agree to renew sanctions on more than 2400 individuals and entities.

FX

USD is flat after trading firmer for most of the European morning; now currently towards the lower end of a 103.79-104.09 range. Trade updates on Thursday included President Trump noting he will not change his mind on the April 2nd tariffs. As for US Government shutdown developments, things seem to be improving with US Senate Minority Leader Schumer suggesting he will vote to keep the government open and not shut it down. Focus ahead will be on the US UoM survey and then Trump executive orders thereafter.

EUR is firmer and trading towards the upper end of a 1.0831-1.0875 range. There has been little by way of trade updates, after Trump threatened the EU with 200% tariffs on alcoholic products on Thursday, if the EU do not remove their countermeasures on the US. Focus today will be on any potential updates on German spending plans, after the debate in the prior session - Reuters reported that Germany's CDU/CSU is to hold a special parliamentary faction meeting this afternoon - a report which may be attributed to the modest upside in the Single-Currency; elsewhere, focus will be on a Fitch credit review on France.

JPY is the clear underperformer today, with early morning losses facilitated by the risk-on mood; have peer CHF is also a touch softer. Further pressure was seen after Japan's largest labour union, Rengo, said the first-round data shows an average wage hike of 5.46% in FY25 (demand of 6.09%). There spurred some further pressure in the JPY, with USD/JPY lifting from 148.65 to briefly top 149.00.

GBP is subdued in reaction to the regions softer than expected GDP figures, which saw the UK unexpectedly contract in January; the downside was primarily driven by a slowdown in manufacturing. However, such an outturn was not entirely unexpected given the jump seen in December's release. Money market pricing incrementally moved dovishly, and is ultimately unlikely to have too much of an impact for the BoE as it remains focussed on inflation and other price points. Cable saw some modest downside on the release, and currently trades towards the lower end of a 1.2918-59 range.

Antipodeans are the best performing G10 currencies today, benefiting from the positive risk tone, which was lifted by remarks by a China's financial regulator who said financial institutions should boost financial support for consumption and will provide loan renewal support to eligible personal consumption loan borrowers.

Fixed Income

USTs hold a slight downward bias, in-fitting peers; currently sitting in a 110-24 to 110-31 range. Some of the bearish action stems from the positive risk tone, as well as a weaker-than-average 30yr auction on Thursday. Trade updates on Thursday included President Trump noting he will not change his mind on the April 2nd tariffs. As for US Government shutdown developments, things seem to be improving with US Senate Minority Leader Schumer suggesting he will vote to keep the government open and not shut it down. Focus ahead will be on the US UoM survey and then Trump executive orders thereafter.

Bunds are on the backfoot by around 12 ticks, and currently just off the day's trough at 127.15. As above, pressure stems from the risk tone and as markets digest the latest Trump threats on the EU (200% tariffs on alcohol, should the EU not remove their countermeasures). For Germany, Wholesale Prices jumped Y/Y whilst German inflation figures were revised a touch lower. And on German spending, updates have been light thus far CDU/CSU is to hold special parliamentary faction meeting this afternoon, according to Reuters sources, Scheduled EU-specific events are light for the remainder of the day, but focus will be on Fitch's credit review on France.

Gilts are flat but still outperforming today, with gains facilitated by the softer-than-expected UK GDP figures, which saw the UK surprisingly contract in January. A softer print than the market had been looking for, driven primarily by a slowdown in manufacturing. However, such an outturn was not entirely unexpected given the jump seen in December's release. Gilts are flat, but have held a downward bias in-fitting with peers; currently in a 91.67-92.03 range.

JGBs are modestly higher as Japanese paper reacted to the latest Rengo update, with initial data pointing towards 5.46% avg. wage hike vs demands of 6.09%. Initial hawkish reaction as it highlights the continued wage pressures in the region, but this proved short-lived as it was less than initial demands.

Commodities

Crude is on a firmer footing with WTI and Brent currently higher by around USD 0.74/bbl and USD 0.70/bbl respectively. Upside today stems from a paring of the prior day's losses and in tandem with the pick up in sentiment. On Russia/Ukraine, Russian President Putin supported the idea of a ceasefire but stressed that the ceasefire must lead to a final settlement of the conflict and solve the root causes of the conflict. More recently, Russia's Kremlin said it held late night talks with US Envoy Witkoff; Russia and the US will determine a timing of Russian President Putin/Trump call once Witkoff has briefed Trump. Brent'May currently in a USD 70.00-70.75/bbl range.

Spot gold is on a firmer footing, and has made a fresh ATH just above the USD 3k mark. ANZ sets its short-term price target of USD 3,050/oz.

Base metals are entirely in the green, with the complex boosted by the risk tone and support measure commentary from China overnight.

Russian Deputy Prime Minister Novak says global oil demand will rise during driving season and OPEC+ takes this into account; resumption of gas exports to Europe via Nord Stream pipelines is irrelevant for now. No talks about possible resumption of Russian oil exports to Germany via the Druzhba pipeline.

Qatar lowered the May term price for Al-Shaheen crude oil to USD 1.29/bbl above Dubai quotes.

Russian President Putin and Saudi Arabia's Crown Prince MBS discussed cooperation in OPEC+, as well as US-Russia ties and the Ukraine conflict.

US President Trump’s administration unlocked a USD 4.7bln loan for TotalEnergies (TTE FP)

Geopolitics: Middle East

Israel's Channel 12 quoted an Israeli source stating if there is no progress in negotiations within the next two days, the team will return to Israel, according to Al Jazeera.

US and Israel look to Africa for resettling Palestinians uprooted from Gaza, according to AP.

UN Security Council agreed to the Russia and US-drafted statement condemning widespread violence in Syria's Latakia and Tartus, while the statement called for Syria's interim authorities to protect all Syrians, regardless of ethnicity or religion and to hold the perpetrators of the mass killings accountable.

Geopolitics: Ukraine

Russia's Kremlin says it held late night talks with US Envoy Witkoff, conveyed signals to US President Trump via Witkoff, Russia and the US will determine a timing of Russian President Putin/Trump call once Witkoff has briefed Trump. There are grounds for cautious optimism. Both sides understand there is a need for such a call. Putin got information from US Envoy on US thinking on Ukraine. Putin is in solidarity with Trump's position but there is a lot of work to do

Ukraine Foreign Minister says the nation has begun forming a team to develop ways to control a possible ceasefire.

EU Foreign Policy chief Kallas said she is quite optimistic G7 can reach accord on a joint communique and if they cannot agree on G7 communique, it shows division between member countries. Kallas also said it is most likely that Russia will say yes to the US proposal for a ceasefire with Ukraine but with conditions and the US is telling G7 members they understand the Russians may want to extend the process by blurring the picture. Furthermore, she said the red line is Ukraine giving away territory and that territorial integrity is an important element, as well as noted that without the EU, any deal cannot be implemented because there are elements for which Europe has the card.

Saudi Crown Prince MBS and Russian President Putin spoke on the phone and the Saudi Crown Prince affirmed the kingdom's commitment to exerting all efforts to facilitate dialogue and achieve a political solution to the Ukraine crisis.

Geopolitics: Other

Senior officials from China, Iran and Russia hold talks in Beijing over Iran's nuclear issues, according to CCTV.

US Pentagon has been tasked with providing military options to ensure US access to the Panama Canal, according to CNN.

US President Trump said they are going to have to make a deal on Greenland and thinks the annexation will happen, while he added the US is going to order 48 icebreakers.

US Event Calendar

10:00: March U. of Mich. Sentiment, est. 63.0, prior 64.7

March U. of Mich. Current Conditions, est. 64.4, prior 65.7

March U. of Mich. Expectations, est. 63.0, prior 64.0

March U. of Mich. 1 Yr Inflation, est. 4.3%, prior 4.3%

March U. of Mich. 5-10 Yr Inflation, est. 3.4%, prior 3.5%

DB's Jim Reid concludes the overnight wrap

After my promise of an exciting special announcement, yesterday we announced the launch of the Deutsche Bank Research Institute (DBRI), a new offering designed to provide valuable insights for corporates, investors and policymakers navigating today’s complex and rapidly evolving global landscape. The Institute will connect the world to Europe and Europe to the world, across geopolitics, macroeconomics, technology, and the evolving corporate landscape. Going forward, we will be delivering more in-depth analysis through engaging and accessible formats, including videos, podcasts, webinars, events and reports, which will be available on our new public Institute website.

The inaugural paper for DBRI is called “What Germany’s economy needs now”, which lays out how the country’s economic prosperity has been under severe pressure from geopolitical and technological changes, which have exposed Germany’s structural weaknesses. It outlines a series of necessary reforms which will demand a historic effort from the next government. The challenges beyond the fiscal injections are enormous but the good news is that Germany has its future prosperity and security in its own hands. You can read the English version here and the German version here. Stand by for more papers over the coming weeks and months from our new Deutsche Bank Research Institute.

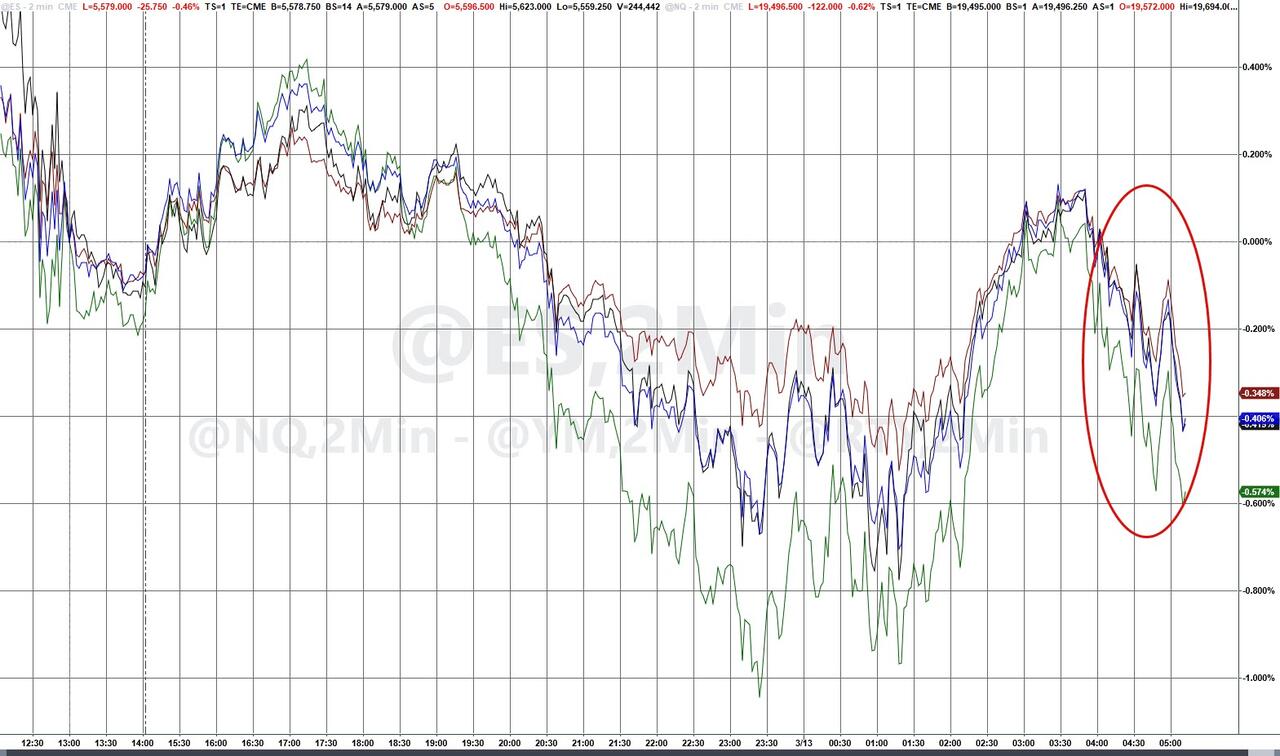

The market sell-off resumed in earnest yesterday, with the S&P 500 (-1.39%) down to another 6-month low and into technical correction territory, with the index down -10.13% from its peak as recently as February 19. This is the first correction since October 2023, and Bloomberg reported that this was the seventh-fastest correction in data back to 1929, taking just 16 sessions for it to happen. Other asset classes also continued to struggle, with US HY spreads (+22bps) reaching their widest level since August, at 335bps. And as investors poured into perceived safe havens, gold prices (+1.85%) hit a record high of $2,989.

Once again, the main driver was a fresh volley of tariff threats from President Trump, who made several posts criticising the EU yesterday. In terms of the latest, President Trump said that if the EU continued with its 50% tariff on American whisky, then the US would respond with a 200% tariff on EU wines, champagnes and alcoholic products. That immediately caused issues for several European beverage companies, with Pernod Ricard (-3.97%) posting the worst performance in France’s CAC 40 yesterday, and Remy Cointreau (which produces cognac) fell -4.67%. More broadly though, President Trump’s comments reignited fears that the EU could soon face a much more serious trade escalation, particularly with reciprocal tariffs set for April 2. Indeed, earlier in his post on the 200% tariff, he described the EU as “one of the most hostile and abusive taxing and tariffing authorities in the World, which was formed for the sole purpose of taking advantage of the United States”. Bear in mind that President Trump has said he considers VAT to be like a tariff, so that could cause considerable issues for EU member states.

Matters weren’t helped yesterday by the potential threat of a US government shutdown, with funding set to run out at midnight tonight. However, after the US close, the Democratic Senate Minority Leader Chuck Schumer said that he would vote to advance the Republican bill rather than see a shutdown. So that’s helped futures to recover a decent amount of ground this morning, with those on the S&P 500 up +0.76%. The Republicans do have a majority in both chambers of Congress, but in the Senate they only have a 53-47 margin, and require 60 votes to prevent a filibuster happening, so they had to get at least some Democratic support to pass their funding bill.

Nevertheless, that news came too late to prevent US markets taking a fresh hit yesterday, with the S&P 500 (-1.39%) now down -10.13% from its record high, and surpassing the 10% threshold that makes it a technical correction. Moreover, the decline for this week alone now stands at -4.31%, which if realised would be the worst weekly performance since the week of SVB’s collapse two years ago. As in recent days, the Magnificent 7 (-2.49%) led the declines, moving back into bear market territory having shed -20.25% since its December peak. And even though tech led the losses, it was still a broad-based decline, with the equal weighted S&P 500 (-1.00%) struggling as 78% of its constituents lost ground on the day.

Whilst investors were concerned about tariffs and the latest shutdown threat, there was little respite from the latest PPI inflation data either. To be fair, it was softer than expected, with monthly headline PPI flat (vs. +0.3% expected), taking the year-on-year rate down to +3.2% (vs. +3.3% expected). But the problem was that the components that feed into PCE inflation (the Fed’s target measure) were relatively stronger, which added to concern that the Fed would struggle to meaningfully cut rates this year. The 10y Treasury yield traded as much as +3.8bps higher on the day following the release, but the bond sell-off turned into a rally as risk sentiment soured, with 10yr yields down -4.3bps to 4.27% by the close. At the front end, 2yr yields were -3.1bps lower to 3.96%.

Over in Europe, there were fresh developments over Ukraine as discussions around a ceasefire continued. Russian President Putin said on the ceasefire proposal that “The idea itself is correct and we certainly support it, but there are issues that we need to discuss”, in particular mentioning that Ukraine could use the ceasefire to mobilise and re-arm. So that fit with expectations that Russia would softly push back against the idea of a ceasefire without preconditions. Later on, Ukrainian President Zelenskiy criticised President Putin's comments as "very manipulative". President Putin was also due to meet US envoy Steve Witkoff last night but we have not yet heard any comments from that meeting.

Elsewhere in Europe, the other big story for markets has been the start of the debate in the German Bundestag on changing the constitutional debt brake. The debate is being conducted with the old pre-election Bundestag, where the combination of the CDU/CSU, the SPD and the Greens still have a two-thirds majority. It still isn’t clear whether the Greens will offer support to the proposals, although talks are still ongoing. Nevertheless, the debate did include frustration between Merz and the Greens, with Merz saying “What more do you want than what we have proposed to you?”

Meanwhile, Katharina Dröge, co-leader of the Green caucus in the Bundestag, said that “If you now wonder why the talks between us and you are going the way they are, then we can tell you: Because we don’t trust in your word”.

With all that going on, European assets echoed the global risk-off move yesterday. That saw the STOXX 600 (-0.15%) post a modest decline, although there were bigger losses for France’s CAC 40 (-0.64%) and the German DAX (-0.48%). In the meantime, the move into perceived safe havens meant German bunds outperformed their counterparts, with 10yr yields down -2.3bps, in contrast to those on 10yr OATs (+0.5bps) and BTPs (+1.3bps) which rose slightly.

Overnight in Asia, markets are performing well as it looked like the US would avoid a government shutdown. Moreover, Chinese markets got a fresh boost after it was announced that several government bodies would host a press conference on Monday about boosting consumption. So those developments helped support the major indices across the region, with gains for the Nikkei (+0.89%), the Hang Seng (+1.89%), the CSI 300 (+2.24%) and the Shanghai Comp (+1.56%). The main exception to that has been South Korea’s KOSPI, which has fallen -0.28%. Meanwhile in Japan, the country’s 30yr government bond yield (+3.0bps) moved up to its highest level since 208, at 2.61%.

Lastly, there wasn’t much other data yesterday, although the US weekly initial jobless claims were better than expected over the week ending March 8, falling to 220k (vs. 225k expected). Moreover, the continuing claims for the week ending March 1 fell to 1.870m (vs. 1.888m expected).

To the day ahead, and US data releases include the University of Michigan’s preliminary consumer sentiment index for March, along with UK GDP for January. Central bank speakers include the ECB’s Escriva and Cipollone.

https://cms.zerohedge.com/users/tyler-durden

Fri, 03/14/2025 - 08:17

Bund Yields Spike As Germany's Merz Reportedly Reaches Debt Deal With Greens

Bund Yields Spike As Germany's Merz Reportedly Reaches Debt Deal With Greens

German conservative leader Friedrich Merz has reportedly reached a tentative agreement with the Green party on the giant debt-funded spending package for defense and infrastructure.

As a reminder, Merz’s Christian Democratic-led bloc and the SPD are rushing to secure a supermajority in parliament to approve sweeping constitutional amendments that would release defense spending from debt restrictions and set up a €500 billion ($542 billion) fund for infrastructure investment.

The agreement on Friday spelled out that the infrastructure funding would be earmarked for new projects - and that €100 billion will be channeled to the government’s existing climate and transformation fund, according to news organization RND, which appears to have been the bargain that Merz offered to get the Greens on board.

Handelsblatt reported earlier that an agreement had been reached.

The deal needs to be approved by party lawmakers.

The result of all this is a stronger euro (for now)...

?itok=YOSlh0i7

?itok=YOSlh0i7

“Game on again for the euro,” said Brad Bechtel, head of FX at Jefferies, adding that peace talks for Ukraine are adding to the currency’s momentum. “The market is cautiously optimistic that we are progressing in the right direction.”

...but bund yields are also spiking to recent highs...

?itok=Z2eL4y8V

?itok=Z2eL4y8V

Merz said late Thursday that he’s “very optimistic” that the landmark debt-spending package will be approved after a parliamentary debate on Thursday laid bare a deep rift with the Greens.

“What more do you want than what we have proposed to you?” Merz asked, prompting jeers from the party.

“The headlines are providing some comfort that the Greens are on board with the proposals,” said Evelyne Gomez-Liechti, a strategist at Mizuho International Plc, adding that markets had been pricing some chance of the agreement not passing through.

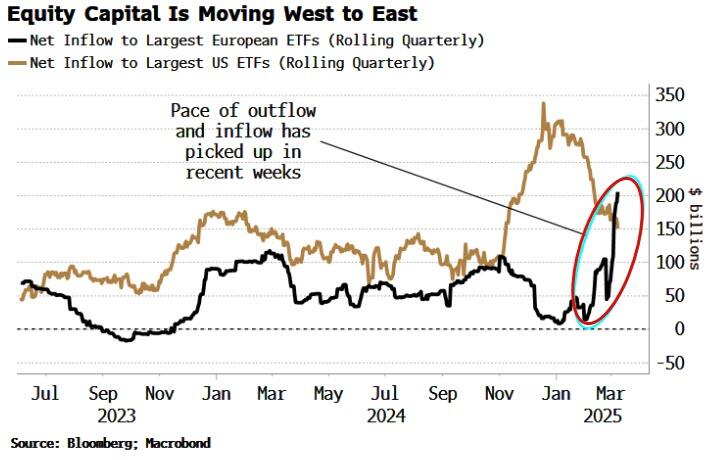

As Goldman Sachs Alberto Bacis notes, the narrative prevailing over the last 10 days is the following:

Germany has pivoted towards a fiscal expansionary stance > they have plenty of room > defense and infrastructure spending will generate a massive growth turnaround for Germany and rest of the block, bringing the following externalities:

1/ ECB must remain restrictive

2/ Inflation will fly

3/ Sky is the limit for investments

Bank of America’s sentiment survey published earlier Friday showed investors turned underweight on core euro-area fixed income for the first time since 2023.

“Core Europe duration longs collapsed as future economic growth and bond supply get priced in,” BofA strategist Ralf Preusser and colleagues wrote in a note earlier.

https://cms.zerohedge.com/users/tyler-durden

Fri, 03/14/2025 - 08:12

Judge Temporarily Blocks Trump's Yanking Of Clearances From Law Firm Tied To Steele Dossier

Judge Temporarily Blocks Trump's Yanking Of Clearances From Law Firm Tied To Steele Dossier

A federal judge on March 12 agreed to temporarily block President Donald Trump’s executive order stripping security clearances from employees at a prominent Washington law firm that was involved in generating the controversial Steele dossier.

?itok=qY465YHd

?itok=qY465YHd

the order on March 6, citing law firm Perkins Coie’s work during the 2016 election, when Hillary Clinton’s campaign and the Democratic National Committee (DNC) paid the firm more than $1 million to hire opposition research company Fusion GPS. Trump’s order also targeted the firm’s policies promoting workforce diversity, equity, and inclusion.

Perkins Coie sued the Trump administration on Tuesday, arguing that the president’s order violated the firm’s rights of free speech, free association, and due process under the Constitution.

During a Wednesday hearing in Washington, U.S. District Judge Beryl Howell said she would grant the firm’s request for a temporary restraining order against the president’s order, which also sought to limit Perkins Coie’s work with federal contractors.

Trump ordered a government review aimed at ending all contracts the firm currently holds with any federal agencies and a review seeking to cancel contracts with its clients. The order also limits its lawyers’ ability to access government officials or retain security clearances.

In its lawsuit, Perkins Coie wrote that seven of its clients, including a major government contractor, had already pulled back legal work following Trump’s order or were planning to, resulting in “significant revenue” losses for the firm.

Government officials have also blocked or discouraged the firm’s attorneys from participating in meetings due to Trump’s order, according to the lawsuit.

In 2016, after receiving funding from the DNC and Clinton campaign, Fusion GPS hired Christopher Steele, a retired British counterintelligence specialist, to gather research into allegations that Trump’s 2016 campaign had conspired with the Russian government to win the presidential election.

Steele’s research was compiled into a dossier that BuzzFeed News published without his consent in 2017. The outlet was criticized for not first independently verifying many of the report’s salacious allegations, which sparked scrutiny among many journalists.

While some of the dossier’s more general findings—including that Russia was working to get Trump elected and sought to influence some of his associates—were later corroborated by U.S. intelligence agencies and special counsel Robert Mueller’s investigation, the report has been largely debunked, and no one in the president’s orbit was ever formally accused of conspiring with Russia.

Trump previously sued Clinton, Perkins Coie, and others, alleging they conspired to rig the 2016 election against him. A federal judge in Florida dismissed the lawsuit in 2022.

In February, Trump similarly https://www.theepochtimes.com/us/trump-suspends-security-clearances-for-law-firm-employees-tied-to-jack-smith-prosecutions-5816289

the suspension of security clearances for employees at Covington & Burling LLP, a Washington-based law firm that worked on former special counsel Jack Smith’s investigations of Trump.

https://cms.zerohedge.com/users/tyler-durden

Thu, 03/13/2025 - 14:45

White House Mum On If Trump Will Extend Sanctions Waiver Allowing Russian Oil Sales To EU

White House Mum On If Trump Will Extend Sanctions Waiver Allowing Russian Oil Sales To EU

Far-reaching EU sanctions have already placed a https://www.consilium.europa.eu/en/policies/sanctions-against-russia-explained/

on 90% of European oil imports from Russia. Some few European countries are heavily dependent, while most are not. For this reason during the Biden administration the US issued a temporary Treasury exemption allowing sanctioned Russian banks to process European payments for oil sales. But as of Wednesday that exemption expired, and at this time no one in Europe can purchase Russian oil.

The fact that the Trump administration has not renewed the exemption portends more economic pain to come for Russa, added to ongoing punitive efforts of the West toward starving funding for its war machine.

?itok=Tdr5FbCL

?itok=Tdr5FbCL

It is as yet unclear whether the White House still intends to extend the waiver, but without doubt it's being held out as leverage to induce Moscow to agree to the proposed 30-day Ukraine war ceasefire which came out of US officials' meeting with Zelensky government representatives in Jeddah.

At this moment the administration remains mum, but here's what Fox Senior White House correspondent Jacqui Heinrich wrote Wednesday, hours after the waiver https://x.com/JacquiHeinrich/status/1899908759008522731

:

Unclear if President Trump reissued waiver on Russian General License 8L - allows other countries to buy Russian oil using US dollar, US payment system. Biden’s waiver expired at midnight.

If POTUS did NOT reissue it, oil prices could rise by $5/barrel by some estimates… but if he DID, POTUS could face some of the same criticism Biden faced, saying it played to Putin’s hand. The White House Press Secretary told us she did not believe it has been reissued but would check on it.

Treasury, State, and WH did not have answers for us yesterday ahead of the deadline.

Meanwhile Reuters has highlighted Gazprom's rapid decline after its almost total loss of European markets amid the https://www.reuters.com/business/energy/gazproms-grandeur-fades-europe-abandons-russian-gas-2025-03-13/

:

Gazprom's Europe-facing export arm considers selling lavish offices, sources say

Down to just a handful of employees, job cuts also approved at headquarters, sources say

European buyers cast doubt on return to Russian gas in case of Ukraine peace

Russia's gas exports to China unlikely to replace European market losses

BREAKING: Trump had cut off all Russian oil sales to EU!

Treasury has ended the Biden exemption that allowed sanctioned Russian banks to process European payments for oil sales. Now no one in Europe can purchase Russian oil https://t.co/zOCqzlc0Di