One In Five Gen-Z/Millennial Women Identify As LGBTQ+

One In Five Gen-Z/Millennial Women Identify As LGBTQ+

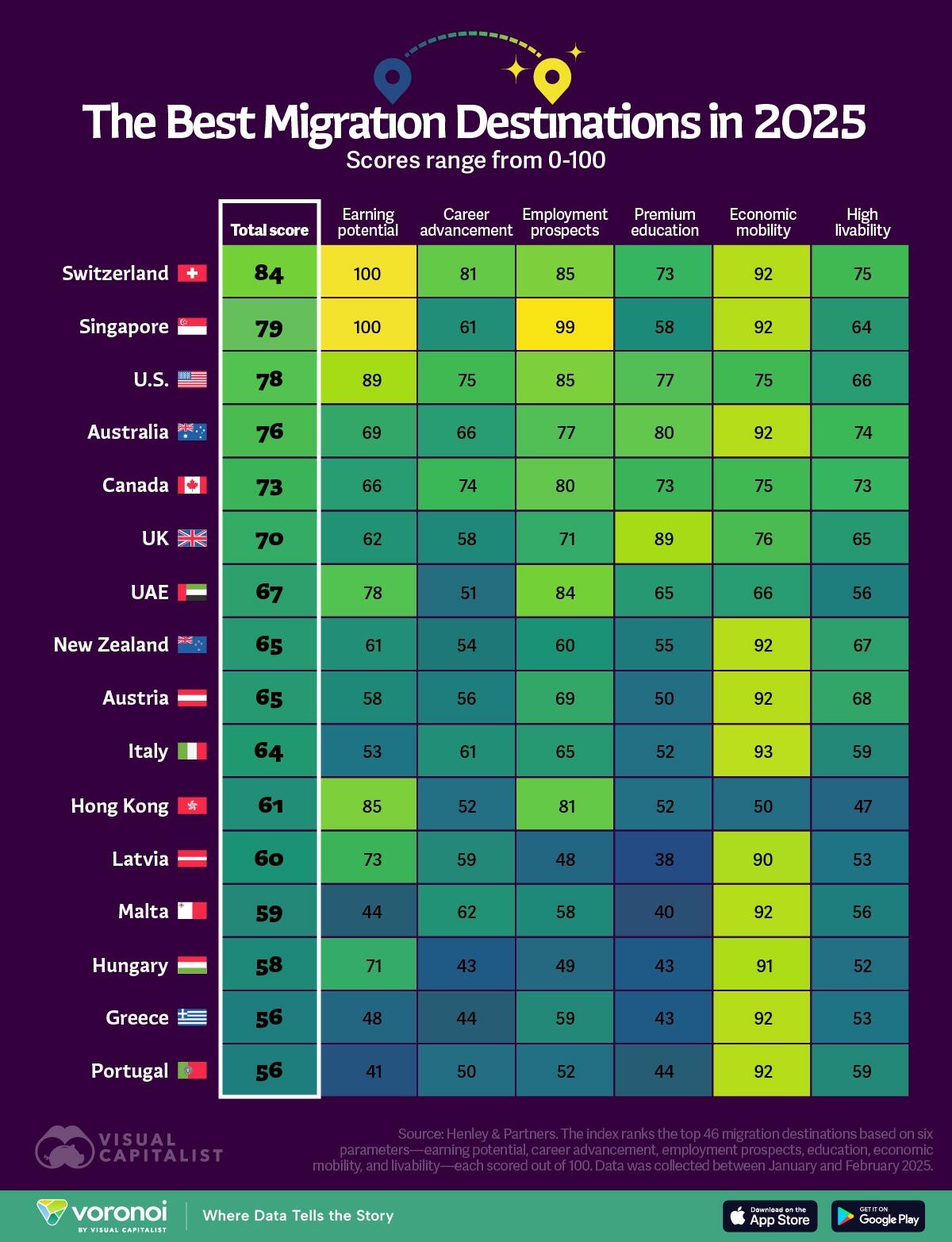

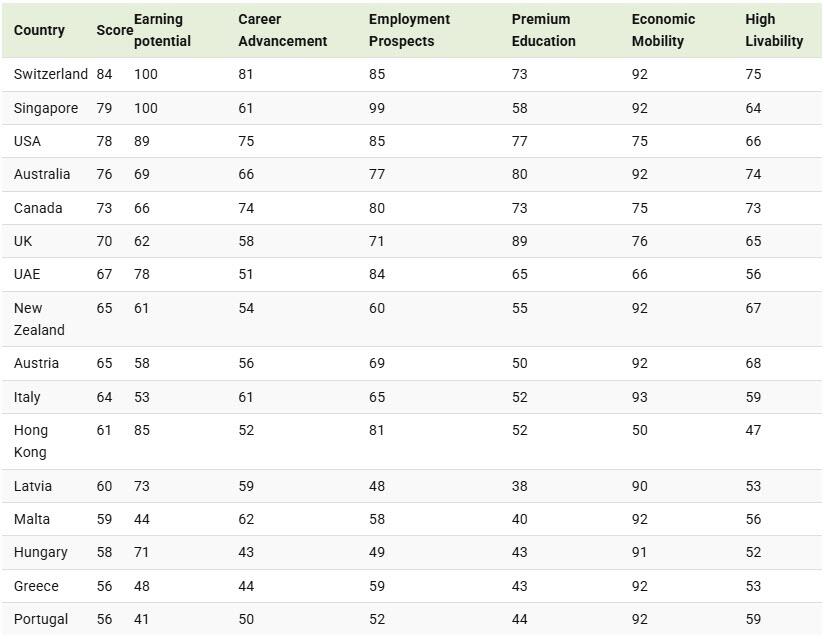

Parsing through a Goldman note on the online dating sector, particularly focusing on Match Group (MTCH), Bumble (BMBL), and Grindr (GRND), the industry remains on a healthy upward growth trajectory. However, mature online dating markets are slowing, while emerging regions (Asia ex-China) drive new user adoption. While Hinge outperforms Tinder, Bumble is restructuring its growth strategy, and Grindr continues penetrating the LGBTQ+ community.

Goldman analysts Eric Sheridan and Julia Fein-Ashley provided clients with the key takeaways of what's currently happening across the online dating industry:

We continue to forecast the directly addressable online dating user TAM to grow at a 4% CAGR from 2024-2029;

Expect Asia ex-China to contribute to a large portion of new dating users and slower growth from more mature markets (i.e. UCAN [United States and Canada]/Europe growing at a 1% CAGR from 2024-2029); &

Forecast Hinge to increase penetration in the addressable user market, driven partially by continued focus on the international opportunity (and scaling in new international regions/markets).

Sheridan leveraged third-party data and industry sources that found the latest trends:

Industry: UCAN user preferences continue to shift towards intentional dating and community/friendship oriented apps (a theme of industry narrowing at the application layer);

GRND: the LGBTQ+ userbase size at Tinder/Hinge remains less scaled than Grindr &

BMBL: commentary around Bumble's decision to discontinue/sunset the Fruitz app.

Instead of analyzing the entire note, we highlight two interesting trends.

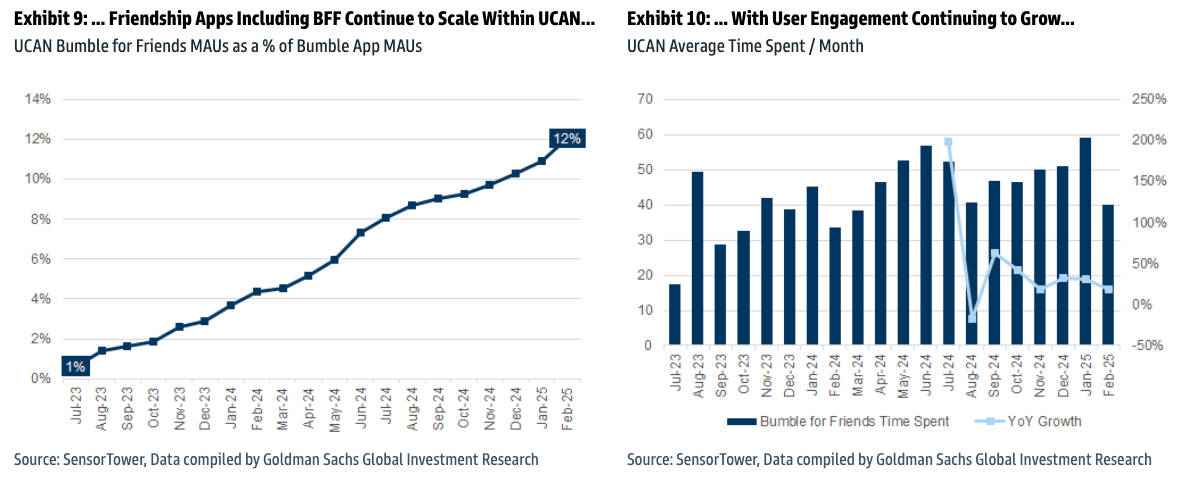

The first is Bumble for Friends. This app helps users build platonic relationships rather than romantic connections and has seen rapid growth over the last 18 months.

More from the analysts:

Bumble for Friends (BFF) has continued to scale over the past 18 months, both in MAUs (now in double digits as a % of Bumble App MAUs in UCAN) and engagement (Exhibit 10). We view this as an area of increasing focus at Bumble, with mgmt. noting their increased focus on the friendship/community opportunity and shift in focus away from other apps (i.e. discontinuing Fruitz and Official apps

While BFF tends to have less of an impact on the number of total paying users, we view the app as providing a low-pressure alternative to dating apps and an additional acquisition channel specifically targeting younger (Gen Z) users.

?itok=IEGfgxPt

?itok=IEGfgxPt

The second is this...

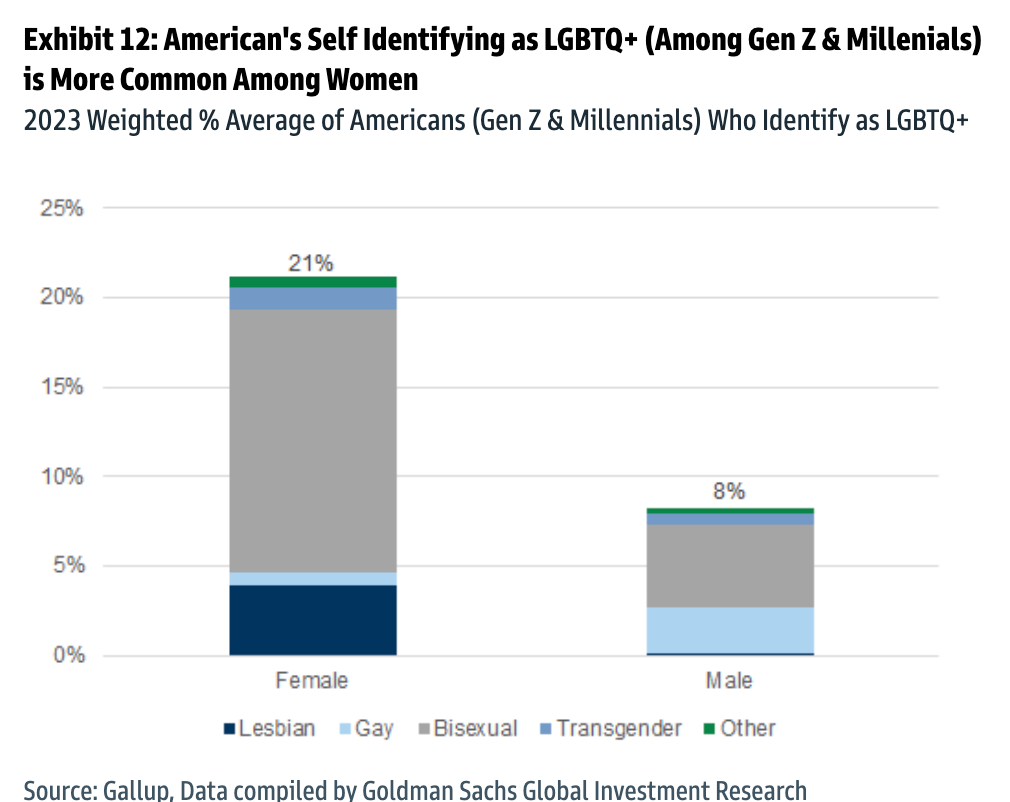

"This, paired with LGBTQ+ identification being more common among American women (Exhibit 12) highlights that addressable user penetration rates at Grindr are likely higher than Tinder/Hinge (even when factoring in differences among addressable LGBTQ+ population)," the analysts noted.

1 in 5 Gen Z & millennial women!

?itok=60nZ88e3

?itok=60nZ88e3

It's not a surprise after 15 years of woke propaganda jammed down the throats of all generations.

When you peel back the rainbow shell of the woke and well-funded Pride Month conglomerate, you find something deeply insidious. Their profits come at a steep cost: the well-being of vulnerable children.

These corporations aren't allies, they're opportunists. They've discovered… https://t.co/Lnl3Y2Euot

— Gays Against Groomers (@againstgrmrs) https://twitter.com/againstgrmrs/status/1807085427301498907?ref_src=twsrc%5Etfw

To sum up, younger generations increasingly rely on friendship apps rather than engaging in real-world exchanges at bars, restaurants, churches, and other public areas, making eye contact, and simply saying "hello"—a tradition that has existed for thousands of years. Additionally, 15 years of woke has led to 1 in 5 women identifying as LGBTQ+ (maybe we're missing a few letters and numbers).

* * *

'Flash' Sale! We're super gay for these https://store.zerohedge.com/complete-2-day-emergency-survival-backpack/

at ZH Store! Grab a sack, or two!

https://store.zerohedge.com/complete-2-day-emergency-survival-backpack/

https://cms.zerohedge.com/users/tyler-durden

Mon, 03/17/2025 - 14:20

https://www.zerohedge.com/technology/gen-z-loves-friendship-apps-lgbtq-identity-surges-among-women

Far-Left French MEP Demands Return Of Statue Of Liberty As US No Longer Stands For Its Values

Far-Left French MEP Demands Return Of Statue Of Liberty As US No Longer Stands For Its Values

A far-left French MEP has called on the United States to return the Statue of Liberty, claiming the nation clearly doesn’t appreciate the monument or what it stands for.

?itok=G167j3Hk

?itok=G167j3Hk

French MEP Raphaël Glucksmann made the provocative remark on Sunday while addressing approximately 1,500 activists at his Place Publique party congress.

Glucksmann criticized certain American political decisions, claiming that the U.S. had forsaken the values of liberty that the statue represents.

“Give us back the Statue of Liberty,” Glucksmann declared, targeting “Americans who have chosen to switch to the side of tyrants.”

He particularly condemned U.S. President Donald Trump’s administration for what he claimed was the dismissal of researchers in their pursuit of scientific freedom, suggesting that if the U.S. no longer values liberty, the statue would be more fitting in France.

“You have been given it as a gift, but apparently you despise it. So she will be very comfortable here at home,” Glucksmann said of the famous landmark.

His remarks were met with cheers from his supporters.

The Statue of Liberty, designed by French sculptor Auguste Bartholdi with engineering contributions from Gustave Eiffel, was gifted by the French people to the United States to commemorate their alliance during the American Revolutionary War. Unveiled on Oct. 28, 1886, the statue has since stood as a symbol of American democracy and freedom on Liberty Island in New York Harbor.

A vocal supporter of Ukraine, Glucksmann also criticized Trump’s disengagement from the conflict between Ukraine and Russia. He expressed concerns over the global rise of far-right movements, which he linked to Trump, Russian President Vladimir Putin, and French right-wing leader Marine Le Pen. In response, he called for “democratic resistance” to counter what he termed the “Trump and Musk fan club” in France.

Glucksmann further extended an invitation to American researchers who feel restricted by their country’s policies, stating:

“If you want to fire your best researchers, if you want to dismiss those who, through their freedom, innovation, and sense of inquiry, have made your country the world’s leading power, then we will welcome them.”

His party has distributed a flyer urging the creation of a political force to uphold the French values of “Liberty, Equality, Fraternity” by launching “training programs” to counter right-wing ideologies.

* * *

White House Spokesperson Caroline Leavitt made her feelings clear... "It’s only because of the United States of America that the French are not speaking German right now. They should be very grateful..."

White House Press Secretary Leavitt:

It’s only because of the United States of America that the French are not speaking German right now.

They should be very grateful. https://t.co/w0tcpQ2XEz

— Clash Report (@clashreport) https://twitter.com/clashreport/status/1901687852028551259?ref_src=twsrc%5Etfw

https://cms.zerohedge.com/users/tyler-durden

Mon, 03/17/2025 - 14:00

Retail Sales Disappoint In February, Despite Major Downward Revisions

Retail Sales Disappoint In February, Despite Major Downward Revisions

https://www.zerohedge.com/personal-finance/january-us-retail-sales-tumble-most-almost-2-years

)...

BofA retail sales preview based on real-time card spending data: not pretty https://t.co/avlFVTHDe0

— zerohedge (@zerohedge) https://twitter.com/zerohedge/status/1901597809012318238?ref_src=twsrc%5Etfw

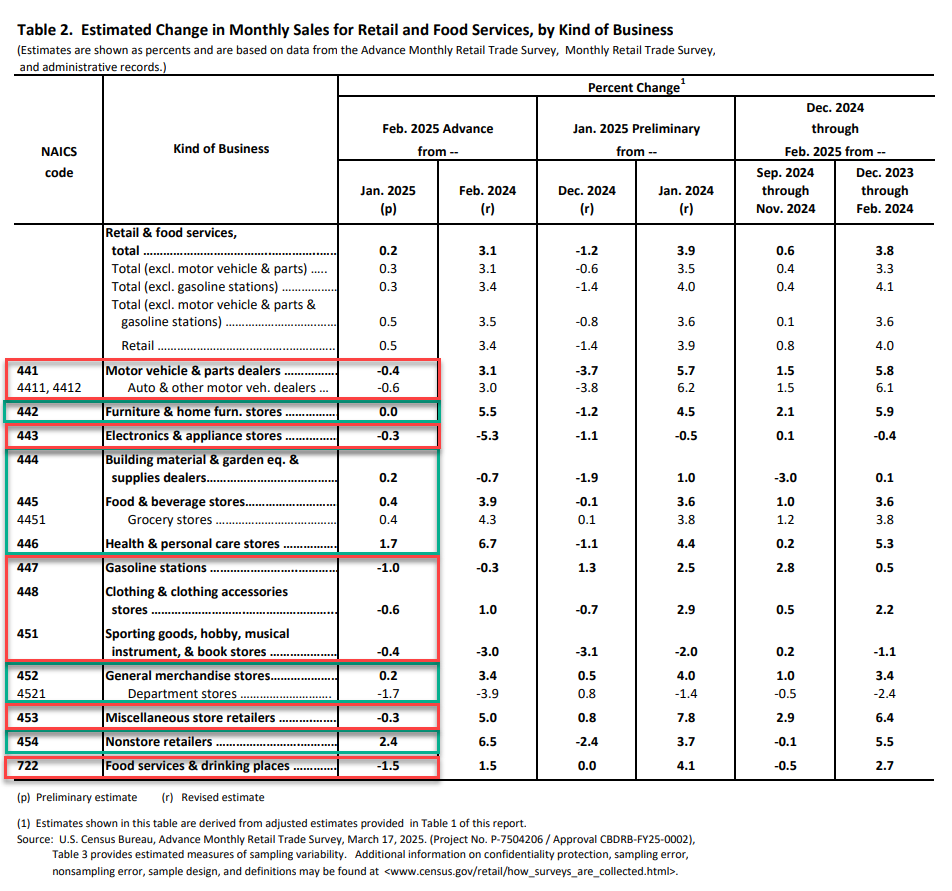

Following last month's 0.9% MoM plunge, which was revised down a 1.2% MoM drop, February saw retail sales disappoint (rising just 0.2% MoM vs +0.6% MoM exp)...

?itok=PpA0ZDID

?itok=PpA0ZDID

Source: Bloomberg

Food Services & Gas Stations saw the biggest drop in nominal sales...

?itok=9MmVieRy

?itok=9MmVieRy

Core retail sales met expectations (+0.3% MoM) but also saw downward revisions...

?itok=LGiNxtpw

?itok=LGiNxtpw

Source: Bloomberg

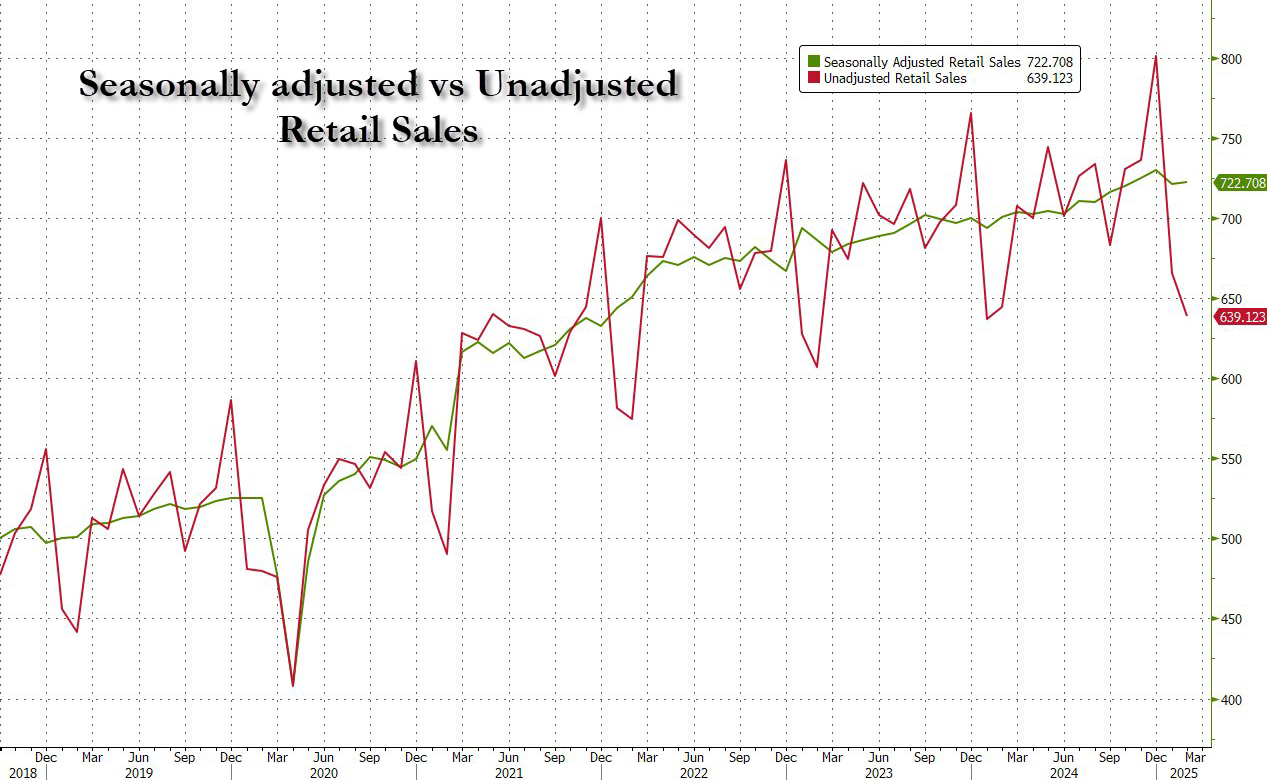

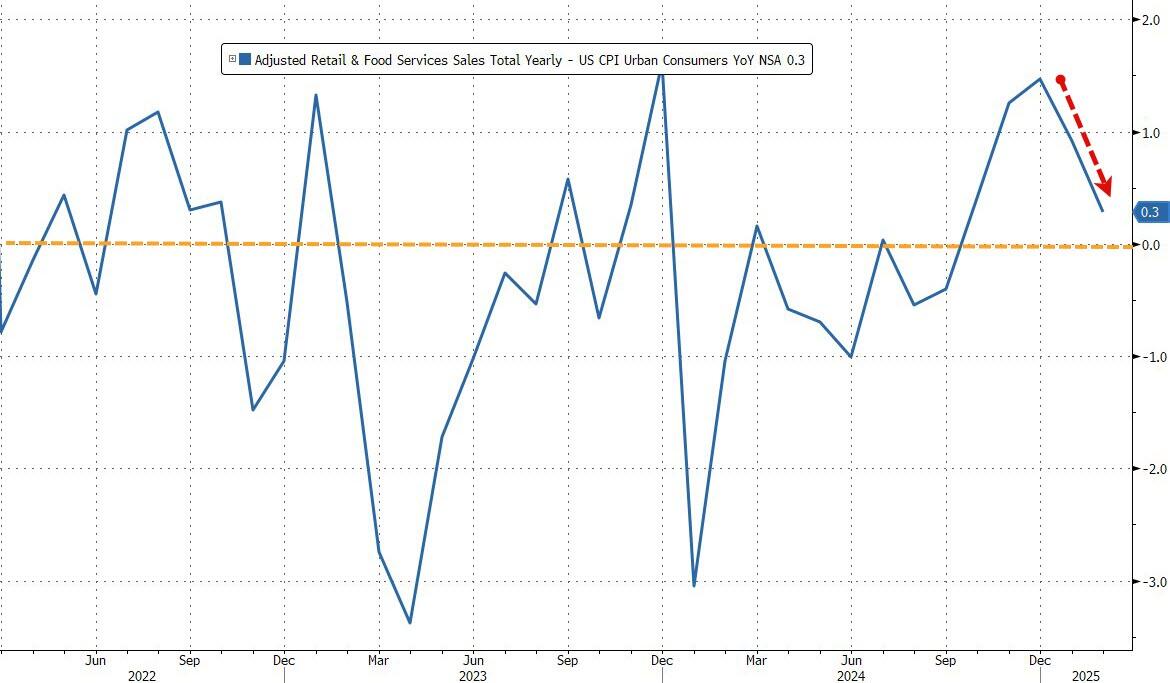

On a non-seasonally-adjusted basis, retail sales are actually down YoY...

?itok=jvrx3Iua

?itok=jvrx3Iua

Source: Bloomberg

Adjusted roughly for inflation,. real retail sales is basically flat year-over-year...

?itok=PUCLHT39

?itok=PUCLHT39

Source: Bloomberg

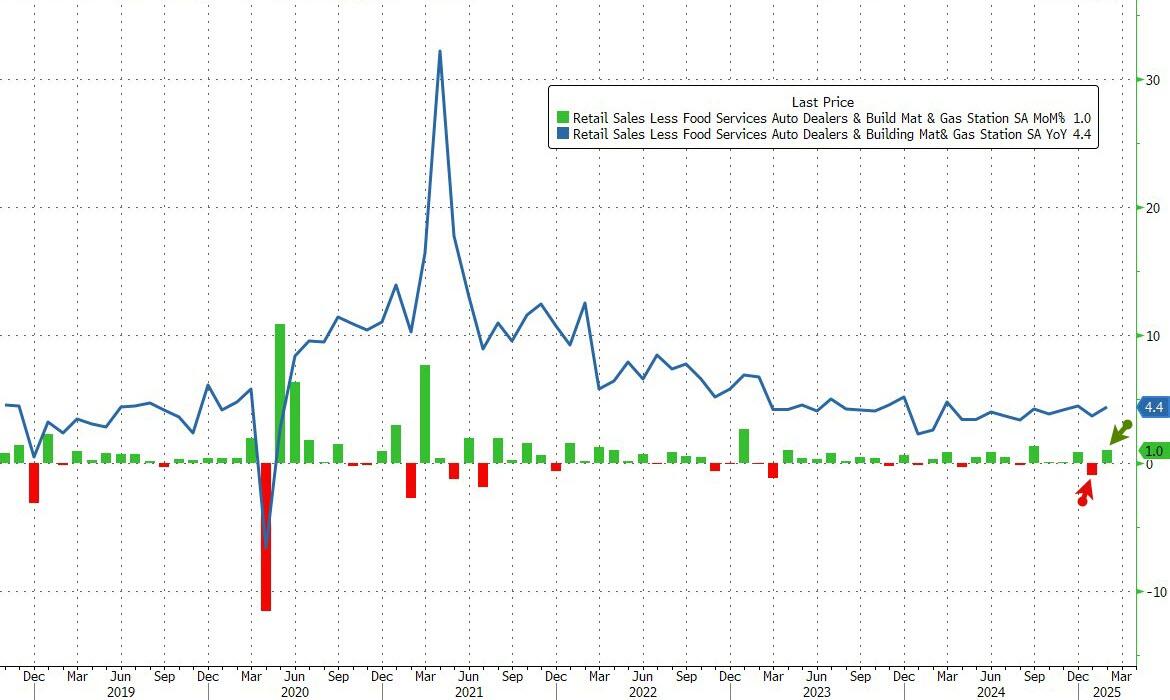

Finally, on the bright side, Retail Sales Control Group - which is used for GDP calculations - surged 1.0% MoM in February (more than double the 0.4% rise expected), after puking a revised lower 1.0% MoM in January...

?itok=5RzJcv3c

?itok=5RzJcv3c

Source: Bloomberg

So,while headline sentiment may be weak, this is a solid report for signaling economic growth.

Trump learning from Biden: January revised much lower, means lower base and can beat estimates

— zerohedge (@zerohedge) https://twitter.com/zerohedge/status/1901613563443114004?ref_src=twsrc%5Etfw

https://cms.zerohedge.com/users/tyler-durden

Mon, 03/17/2025 - 08:38

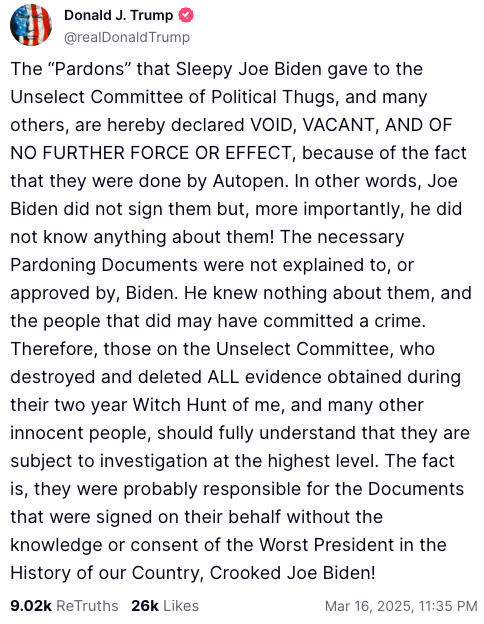

Trump Declares Biden's Autopen-Signed Pardons "Void"

Trump Declares Biden's Autopen-Signed Pardons "Void"

Ten days or so after the Heritage Foundation's Oversight Project disclosed that nearly every document bearing former President Biden's signature during his first term had been signed by an autopen—https://www.zerohedge.com/political/could-bombshell-discovery-render-all-bidens-presidential-actions-null-and-void

—questions arose over whether executive orders and pardons could be deemed invalid, as we noted that Biden's staff likely leveraged his rapid cognitive deterioration to sign those documents via autopen.

?itok=OQRGV4kh

?itok=OQRGV4kh

Overnight, President Trump declared that the 11th-hour pardons, including those given to members of Congress who investigated the January 6 insurrection, were "void, vacant, and of no further force or effect, because of the fact that they were done by autopen." Some of those last-minute pardons include Deep Staters, such as former Representative Liz Cheney, retired General Mark Milley, and government scientist Anthony Fauci.

"The "Pardons" that Sleepy Joe Biden gave to the Unselect Committee of Political Thugs, and many others, are hereby declared VOID, VACANT, AND OF NO FURTHER FORCE OR EFFECT, because of the fact that they were done by Autopen," https://truthsocial.com/@realDonaldTrump/posts/114175908922736427

late Sunday night.

The president continued: "In other words, Joe Biden did not sign them but, more importantly, he did not know anything about them! The necessary Pardoning Documents were not explained to, or approved by, Biden. He knew nothing about them, and the people that did may have committed a crime."

He went on to say that members of that House committee are "subject to investigation at the highest level"...

"Therefore, those on the Unselect Committee, who destroyed and deleted ALL evidence obtained during their two year Witch Hunt of me, and many other innocent people, should fully understand that they are subject to investigation at the highest level. The fact is, they were probably responsible for the Documents that were signed on their behalf without the knowledge or consent of the Worst President in the History of our Country, Crooked Joe Biden!"

Here's the full statement:

?itok=gA4j04ML

?itok=gA4j04ML

Trump told reporters aboard Air Force One late last night: "It's not my decision — that'll be up to a court — but I would say that they're null and void, because I'm sure Biden didn't have any idea that it was taking place, and somebody was using an auto pen to sign off and to give pardons."

🚨 REPORTER: “Are those [autopen] pardons from the former President now null and void?”

TRUMP: “I would say that they're null and void because I'm sure Biden didn't have any idea that it was taking place … What they did is criminal.” https://t.co/R9OD7kAtJb

— Chief Nerd (@TheChiefNerd) https://twitter.com/TheChiefNerd/status/1901530391598555271?ref_src=twsrc%5Etfw

. . .

https://cms.zerohedge.com/users/tyler-durden

Mon, 03/17/2025 - 08:30

https://www.zerohedge.com/political/trump-declares-bidens-autopen-signed-pardons-void

Futures Fall After Bessent Says "Not Worried" By Slide In US Stocks

Futures Fall After Bessent Says "Not Worried" By Slide In US Stocks

Futures are lower to start the week - but well off the lowest levels of the session - following the best day for US stocks since November, as the market digests trade war news and the Trump Put remains absent. Over the weekend, https://www.zerohedge.com/markets/bessent-says-market-corrections-are-healthy-offers-no-guarantees-there-wont-be-recession

recent stock declines as healthy, reinforcing the view that President Donald Trump’s administration is unlikely to step in to boost markets (the Fed is a different matter). Trump also reminded investors over the weekend that he would be imposing both broad reciprocal tariffs and additional sector-specific tariffs on April 2. As of 8:00am ET, S&P futures are down -0.2% having been down as much as 0.6% earlier; Nasdaq futures are down 0.1% as Mag 7 stocks edged lower, though Nvidia gained before its much anticipated conference on artificial intelligence. Europe’s Stoxx 600 index rose 0.4%, extending its year-to-date outperformance against US stocks. In global news, Trump will speak with Russian President Vladimir Putin on Tuesday about ending the war in Ukraine. So far the Ukraine ceasefire news is having a muted impact. Trump also said reciprocal tariffs and additional sector-specific tariffs will hit on April 2. Meanwhile, the US retail operator of Forever 21 filed for bankruptcy after years of poor performance. Bond yields are lower as the curve bull flattens while the USD falls to fresh 4 month lows. Commodities are bid higher led by Ags and Energy, following the latest stimulus vows from China. Today’s macro data focus is on Retail Sales where a stronger number may give the market comfort in trying to create a relief rally and the Fed on Weds could be supportive too.

?itok=Nic1LjIp

?itok=Nic1LjIp

In premarket trading, Tesla leads losses among Mag 7 stocks (Alphabet -0.1%, Amazon +0.3%, Apple -0.2, Microsoft -0.4%, Meta +0.1%, Nvidia +1.4% and Tesla -0.5%), DocuSign rose 1% after William Blair upgraded the e-signature software firm to outperform, noting market opportunity for the company’s Intelligent Agreement Management platform. Incyte (INCY) sinks 14% after reporting topline results from a Phase 3 clinical trial program evaluating the safety and efficacy of povorcitinib. Here are some other notable premarket movers:

Netflix (NFLX) gains 1% as MoffettNathanson turns bullish, saying the company’s ability to better monetize its engagement remains an underappreciated aspect of its scale.

Norwegian Cruise Line (NCLH) rises 4% after JPMorgan upgraded the stock to overweight, noting that management signaled during an investor conference that there were no detectable changes in demand and that their 2025 outlook was cautious. The stock is down 25% year-to-date.

Science Applications (SAIC) climbs 10% after the government IT services contractor posted 4Q results and provided guidance.

Sprouts Farmers Market (SFM) climbs 1% after Deutsche Bank raised its rating to buy from hold following the stock’s recent pullback.

Bessent told NBC’s Meet the Press Sunday that he’s not worried by the slump in US stocks, after about $5 trillion was wiped from the S&P 500’s value and the index tumbled into a correction. “Corrections are healthy,” he told NBC. Traders still don’t seem convinced. His comments are a blow to those harboring hopes that President Donald Trump will seek to cushion the market impact of his policies.

“This statement caused some alarm for many Wall Street types who had been counting on Bessent to be the second Trump administration’s ‘voice of reason’ on economic policy,” said Benjamin Picton, a strategist at Rabobank. The comments effectively dash prospects that policymakers will throw “liquidity bones to financial markets whenever they showed signs of wobbling,” Picton added.

Meanwhile, fears of a protracted global trade war are benefiting haven assets, with gold holding close to record highs around $3,000 an ounce, and Treasury yields edging lower. Bund yields dropped five basis points as jitters mounted over Tuesday’s parliamentary vote on Germany’s landmark spending package.

Another source of concern is the US threat of “unrelenting” military strikes on Yemen’s Houthi militants, who said they would respond by targeting US vessels in the Red Sea. The events lifted Brent crude futures above $71 a barrel, while European shipping stocks, including AP Moller-Maersk A/S and Hapag-Lloyd AG, gained.

It's a busy week on the macro front as the Federal Reserve, Bank of England and the Bank of Japan are set to hold policy meetings. While they are not expected to change interest rates, investors will watch in particular for any clues from the Fed on what kind of support could be offered to the economy. Swaps see high odds of three Fed cuts this year, but Fed chair Jerome Powell faces the task of assuring investors the economy remains on solid footing, while signaling policy support will be provided when required. US retail sales data due later Monday are expected to reinforce the picture of a slowing economy, following on from below-forecast inflation readings last week.

In Europe, the Stoxx 600 rose 0.4%, with energy and utilities shares leading gains after China said it would take steps to revive consumption, while consumer products and retail stocks are the biggest laggards. Here are the biggest movers Monday:

Phoenix Group shares rise as much as 7.8%, the most since May, after the insurance and pension fund company delivered operating profit ahead of expectations and upgraded its outlook through to 2026

ProSieben shares climb as much as 5%, the highest intraday since July. The German media company is nearing a deal to give General Atlantic up to 10% in the firm through a convertible bond

CVS Group advances as much as 13%, the most since Sept. 2021, following an upgrade of the veterinary health company to outperform by RBC based on factors including strong Australian margins

U-blox rises as much as 9.3% to the highest since July, after the Swiss semiconductor company signed an agreement to divest its Cellular business to Trasna

Forterra shares rise as much as 3.5% after the building products company was upgraded by analysts at Peel Hunt, who argue there is major earnings upside when volumes recover

QinetiQ shares drop as much as 22%, the most on record, after analysts warned of sharp cuts to consensus after the company downgraded growth expectations for this year and next

Energean slides as much as 11% after the oil and gas company warned Carlyle has not yet obtained regulatory approvals in Italy and Egypt for a deal to buy a portfolio of assets from the London-listed company

Siltronic slides as much as 4.7% as Jefferies cuts its rating on the semiconductor equipment manufacturer to hold from buy, cautioning that the outlook remains difficult

Stocks across Asia also rose, pulled higher by a rebound in technology shares and a sense of optimism over China’s plans to boost consumption. The MSCI Asia Pacific Index gained as much as 1.2%, with chip makers TSMC and Samsung Electronics giving it the biggest boost as they tracked a recovery in US tech shares Friday. Benchmarks in Hong Kong, Japan and South Korea all moved higher. The biggest news for traders to digest came from China, after a weekend report from the state news agency said Beijing will promote “reasonable growth” in wages and set up a mechanism to adjust the minimum salary, something it seems to do every other months. A raft of economic data also showed signs of recovery in the economy, including a pickup in retail sales. The response of mainland Chinese stocks was muted. Although a gauge of Chinese shares listed in Hong Kong rose around 0.6%, the onshore benchmark CSI 300 Index drifted lower. The market appeared underwhelmed with a Monday press conference. Elsewhere, we get the Bank of Japan’s policy decision due on Wednesday, with the central bank widely expected to keep rates steady.

“China’s latest measures reinforce that boosting consumption is a top priority this year, with a multi-pronged approach involving several ministries and a host of different measures,” said Charu Chanana, chief investment strategist at Saxo Markets. “This could help to broaden out the momentum we have seen in China stocks this year, primarily led by tech.”

In FX, the Bloomberg Dollar Spot Index is set for a second daily loss and is down 0.2%, hitting a fresh four-month low as investors awaited US retail sales and manufacturing data for further clues on the state of the world’s biggest economy. The Norwegian krone is the best performer among the G-10 currencies, rising 0.9% against the greenback. The pound and euro rise 0.3% each.

In rates, treasuries are slightly richer across the curve, following a wider bull-flattening rally seen across bunds which find support from short covering flow ahead of Tuesday’s vote on the spending package. 10-year Treasury yields drop 3 bps to 4.28% in a slight bull-flattening move. Gilts are steady. Bunds rally, led by longer-dated maturities before Tuesday’s vote in the Bundestag on the spending package. German 30-year yields fall 8 bps to 3.13%. Treasury auctions this week include $13 billion 20-year bonds Tuesday and $18 billion 10-year TIPS Thursday.

In commodities, Bitcoin is little changed around $83,500. Spot gold climbs $12 to near $3,000/oz having topped that level for the first time on Friday. WTI rises 1% to $67.80 a barrel.

Looking at today's calendar, US economic data calendar includes March Empire manufacturing, February retail sales (8:30am), January business inventories and March NAHB housing market index (10am). Fed officials are in external communications blackout ahead of March 19 policy announcement

Market Snapshot

S&P 500 futures down 0.6% to 5,607.50

STOXX Europe 600 up 0.4% to 548.55

MXAP up 0.9% to 187.43

MXAPJ up 0.9% to 586.91

Nikkei up 0.9% to 37,396.52

Topix up 1.2% to 2,748.12

Hang Seng Index up 0.8% to 24,145.57

Shanghai Composite up 0.2% to 3,426.13

Sensex up 0.4% to 74,153.00

Australia S&P/ASX 200 up 0.8% to 7,854.06

Kospi up 1.7% to 2,610.69

German 10Y yield little changed at 2.85%

Euro little changed at $1.0880

Brent Futures up 0.6% to $70.99/bbl

Gold spot up 0.0% to $2,985.40

US Dollar Index little changed at 103.71

Top Overnight News

Treasury Secretary Scott Bessent said he’s not worried about the recent downturn that’s wiped trillions of dollars from the equities market as the US seeks to reshape its economic policies. “I’ve been in the investment business for 35 years, and I can tell you that corrections are healthy, they are normal,” Bessent said Sunday on NBC’s Meet The Press. “I‘m not worried about the markets. Over the long term, if we put good tax policy in place, deregulation and energy security, the markets will do great.” BBG

Trump and Russia’s Vladimir Putin will speak tomorrow as the US presses for a deal on Ukraine. Trump said much of the discussion will be about territory. BBG

US President Trump invoked the Alien Enemies Act against Tren De Aragua which he declared is attempting and threatening invasion against the US, while he said any Venezuelans aged 14 or older who are TDA members and not US citizens or lawful permanent residents are liable to be “apprehended, secured and removed as alien enemies”.

Voters are souring on the economy even as Trump’s second term boosted positivity about the US as a whole, an NBC News poll showed. The Democratic Party got its lowest approval in the poll’s history at 27%. BBG

US Senate voted 54-46 to pass the stopgap funding bill to keep the government funded through September 30th, while President Trump signed the budget appropriations bill into law.

Trump’s trade war w/Europe risks damaging an economic relationship worth ~$9.5T (in terms of goods/services trade and foreign direct investment). WSJ

US President Trump’s administration was reportedly considering a new travel ban that would impact 43 countries, with a draft plan developed by the State Department several weeks ago: NYT

Oracle is accelerating discussions with the White House on a deal to run TikTok’s US business. Politico

Chinese consumption, investment and industrial production beat estimates at the start of the year, pointing to signs of economic resilience. However, Beijing’s consumption-focused press conference underwhelmed. Bloomberg Economics called the plan to boost spending “skeletal.” BBG

China’s economic data for Jan/Feb comes in ahead of plan, including industrial production (+5.9% vs. the Street +5.3%) and retail sales (+4% vs. the Street +3.8%). RTRS

Plans are being made for global CEOs to meet Xi Jinping on March 28 following an upcoming forum in Beijing, people familiar said. BBG

GIR revised our 2025 and 2026 earnings to $262 and $280 respectively (previously $268 and $288), reflecting growth of 7% in both 2025 and 2026 (vs. 9% and 7% previously). Furthermore, we now expect the S&P 500 will trade at a forward P/E of 20.6 by year-end vs. 21.5 previously. Our revised 3-, 6-, and 12-month S&P 500 price targets are 5600 (-1%), 5900 (+5%), and 6500 (+15%). GIR

OECD Economic Outlook, Interim Report March 2025; cuts global growth outlook - cites trade tensions

A more detailed look at global markets courtesy of Newsquawk

APAC stocks began the week on the front foot following last Friday's resurgence on Wall St and amid encouraging Chinese activity data but with gains capped owing to geopolitical tensions after the US conducted strikes on Yemen's Houthis and with participants awaiting this week's central bank decisions. ASX 200 gained with the advances led by notable strength in the commodity-related sectors and following encouraging data from Australia's largest trading partner. Nikkei 225 climbed at the open despite the lack of obvious catalysts, while Japan's largest labour union anticipates an average 5.46% wage increase this year which would surpass 5% for the second consecutive year and would be the highest in 34 years but is still below the union's 6.09% pay increase demand. Hang Seng and Shanghai Comp were positive with sentiment underpinned following recent support pledges and after encouraging Chinese activity data in which Industrial Production topped forecasts and Retail Sales matched estimates. However, gains in the mainland were limited as data also showed an increase in Urban Unemployment and House Prices remained in deep contraction territory.

Top Asian News

China's State Planner Vice Chair says consumption is improving, though consumer confidence remains weak.

PBoC detailed measures to improve the quality and efficiency of financial services and will grow the financial ecosystem that supports tech innovation, while state media reported that China should choose the right timing and strength for monetary easing.

China’s State Council released a special action plan to boost domestic consumption which includes measures to increase residents’ income, pensions and wages, as well as establishing a childcare subsidy scheme and increasing revenue from land reform including rural areas.

China’s NDRC said it is to encourage foreign investment in technology and manufacturing with the state planner to release an expanded list of industries it seeks to attract foreign investment in.

China's stats bureau spokesperson said China's economy remains resilient but achieving the 2025 growth target will not be easy and the external environment is becoming more complex and severe. The spokesperson added that China's property market faces some pressures, despite signs of stabilising but they expect China's consumer prices to improve further and expect Q1 economic operations to be steady. Furthermore, it was stated that macroeconomic policies will provide more support for the economy and the employment situation remains largely stable with the rise in the February jobless rate still within normal ranges.

PBoC says Official says it will use policy tools such as reserve requirement ratio and relending and discount facilities.

Dozens of foreign CEOs set to attend Beijing's CDF business summit this month; some expected to meet President Xi, according to Reuters sources.

CAICT says shipments of phones within China are down 14.3% Y/Y in January. Shipments of foreign-branded phones, such as Apple (AAPL) -20.6% Y/Y.

European bourses (STOXX 600 +0.3%) opened mixed, and traded indecisively on either side of the unchanged mark; though sentiment gradually picked up as the morning progressed. European sectors hold a positive bias, but with the breadth of the market fairly narrow. Energy takes the top spot, lifted by underlying strength in oil prices; the complex is buoyed by heightened geopolitical tensions after the US struck Houthi targets. On that, the militant group said it would continue naval operations until the Gaza blockade is lifted and aid is let in. Basic Resources benefits from the risk tone, and after constructive Chinese activity data overnight, with particular focus on the stronger-than-expected Industrial Production data. US equity futures (ES -0.4%, NQ -0.4%, RTY -0.6%) are lower across the board, with slight underperformance in the RTY, giving back some of the significant strength seen on Wall Street on Friday. Intel's (INTC) new CEO plans to overhaul the chip design and manufacturing business, plans to restart AI efforts and produce chips at annual cadence as it looks at further cuts, Reuters reports.

Top European News

ECB's de Guindos says that the administration of US President Trump has increased economic uncertainty due to tariff deregulation. Trade was is bad for the global economy. Effect of tariffs on inflation may be compensated by lower economic activity. Believes inflation is converging on 2% and everything is going in the "right direction". Increased uncertainty has made the current situation more opaque compared to six months ago. Spain will need to spend 2.7% GDP on Defence in four years and raise its budget by EUR 6bln per year. Seeing a decrease in services inflation due to evolution of wages, should lead overall inflation to the 2% target.

UK Chancellor Reeves is to pledge to change the law to restrict merger investigations by the Competition and Markets Authority, according to FT.

Britain’s largest regulators will be given performance reviews by ministers and set targets for cutting red tape and growing the economy, according to The Times.

Moody’s raised Greece’s sovereign rating from Ba1 to Baa3; Outlook revised to Stable from Positive and affirmed Spain at A; Outlook Stable. It was also reported that Fitch affirmed France at AA-; Outlook Negative, affirmed Portugal at A-; Outlook Positive, and affirmed Poland at A-; Outlook Stable.

German Economy Ministry says economic weakness continues at the start of 2025 amid subdued domestic/foreign demand and increased uncertainty.

German Ifo institute has lowered their economic forecasts to 0.2% for 2025 and 0.8% in 2026.

FX

USD net softer vs. peers in what has been a weekend lacking in incremental newsflow on the trade front aside from Trump reiterating that he has no intention of creating exemptions on steel and aluminum tariffs, adding that he will impose reciprocal and sectoral tariffs on April 2nd. Focus is also on the US government averting a shutdown. DXY is currently tucked within Friday's 103.57-104.09 range, ahead of US Retail Sales.

EUR is steady vs. the USD and tucked within Friday's 1.0830-1.0912 range. Incremental macro drivers over the weekend for the EZ are lacking and therefore markets are bracing for the outcome of tomorrow's vote in the Bundestag on the German reform package. ECB's de Guindos remarked that he believes inflation is converging on 2% and everything is going in the "right direction". However, this provided little traction for the EUR.

GBP is a little firmer and trades within a 1.2926-58 range, in what has been a catalyst-thin session thus far, but has focus remains on Thursday's BoE meeting.

JPY is a little lower and the marginal G10 underperformer today, partly thanks to slightly positive risk tone following constructive Chinese data which has lifted Antipodeans and European stocks. USD/JPY currently towards the mid-point of a 148.47-149.09 range.

Antipodeans continue to extend on the upside on Friday, with gains today facilitated by the constructive Chinese activity data and after China unveiled a special action plan to boost consumption.

PBoC set USD/CNY mid-point at 7.1688 vs exp. 7.2199 (Prev. 7.1738)

Fixed Income

EGBs bid with OATs outperforming after Fitch left France's rating alone on Friday. More broadly, benchmarks bid with yields weighed on by pressure in European gas benchmarks ahead of the Putin-Trump call. Action which has lifted OATs by over 70 ticks at best with Bunds not far behind.

Bunds also potentially acknowledge further complaints lodged with the Constitutional Court ahead of Tuesday's Bundestag vote on fiscal reform, reform which Merz believes will pass though he acknowledges it will be close; firmer by over 50 ticks and just shy of the 128.00 mark.

USTs await US Retail Sales before the latest update to Atlanta Fed's GDPnow tracker which is currently running at -2.4% though the gold-adjusted figure is -0.4%. Firmer by a handful of ticks but essentially contained with yields mixed and the curve flatter.

Gilts are following EGBs but magnitudes are much less pronounced. UK specifics light once again but the clock counts down to next week's OBR update and before that a welfare reform announcement.

Crude

Crude is on a stronger footing today, with gains attributed to heightened geopolitical tensions after the US struck Houthi targets. Further for the region, the militant group said it would continue naval operations until the Gaza blockade is lifted and aid is let in. Brent'May currently sits at the upper end of a USD 70.68-71.80/bbl range.

European gas is lower, after optimistic updates from Trump over the weekend, where he said he would speak to Russian President Putin on Tuesday.

Precious metals are mixed, with spot gold firmer by around USD 7/oz, whilst silver is a little lower. The yellow-metal has slipped below the USD 3,000/oz mark, to currently trade at the upper end of USD 2,982.36-2,994.12/oz range; upside today has been facilitated by the aforementioned heightened geopolitical tensions.

Base metals are mixed, with the complex failing to materially benefit from the constructive Chinese activity data overnight, where Industrial Production printed above expectations but with Urban unemployment and House Prices remaining at subdued levels. 3M LME Copper is a little firmer today and trades within a USD 9,776.45-9,845.35/t range. Elsewhere, Trump reiterated his firm stance on tariffs, stating there would be no exemptions on steel and aluminium duties and confirming reciprocal and sectoral tariffs will be imposed on April 2nd.

Iraq agreed to double electricity imports from Turkey.

India's February Gold imports at USD 2.3bln; February oil imports at USD 11.8bln

Geopolitics: Middle East

US President Trump ordered the US military to launch ‘decisive and powerful’ military action against Houthis in Yemen and told Iran to end support for Houthis immediately, while the Pentagon said US strikes against Houthis will last days or weeks., Furthermore, it was later reported that the death toll from the US attacks on Yemen reached 53.

US Defence Secretary Hegseth said the US campaign will be unrelenting, while he added that Iran has been enabling the Houthis far too long and they better back off.

US Secretary of State Rubio commented that the US military campaign in Yemen will go on until the Houthis no longer have the capability to strike ships and said there is no way Houthis would have the ability to attack shipping unless they had support from Iran.

US Secretary of State Rubio spoke with Russian Foreign Minister Lavrov on Saturday and told him about US operations against Houthis, while Lavrov stressed the need for an immediate cessation of the use of force against Yemen Houthis and said it is important for all parties to engage in political dialogue in order to find a solution that avoids further bloodshed, according to Reuters.

Yemen’s Houthis said naval operations will continue until the Gaza blockade is lifted and aid is let in, while the group said it targeted a US aircraft carrier with ballistic missiles and drones in the Red Sea but showed no proof, according to Reuters.

Iranian Revolutionary Guards top commander Salami said Tehran will respond decisively and destructively to any enemy taking threats into action and noted that Yemen’s Houthis take strategic and operational decisions on their own, according to state media.

Israeli air strike killed nine in Gaza amid ceasefire disputes. It was separately reported that the Israeli PM’s office said Israel will continue Gaza ceasefire talks in accordance with the US proposal for the immediate release of 11 living hostages and half of the dead. Furthermore, an Israeli delegation was in Egypt discussing hostages with senior Egyptian officials and PM Netanyahu moved to dismiss the head of the Shin Bet security service, according to the PM’s office cited by Reuters.

Syria’s military fired rockets and shells at Lebanon on Sunday after accusing Iran-backed Hezbollah of executing three Syrian army personnel, according to Bloomberg.

Geopolitics: Ukraine

Ukrainian President Zelensky said Ukraine’s partners must define a clear position on security guarantees and the path to peace must begin unconditionally, while he added there must be a foreign troop contingent based on Ukraine soil as part of a peacekeeping arrangement and the question of territory is complex and should be discussed later.

Russian Defence Ministry said Russia will demand Kyiv's neutral status and NATO's refusal to accept Ukraine in a peace treaty on Ukraine, while Russia opposes any troops in Ukraine as part of post-conflict guarantees, not just NATO troops. Furthermore, it was stated that the issue of unarmed observers as part of post-conflict international support for Ukraine may be discussed only once a peace treaty is worked out.

US President Trump said he will be speaking with Russia's President Putin on Tuesday and may have something to announce on Ukraine-Russia talks by Tuesday. Trump added that land and power plants are the focus of talks toward a Russia-Ukraine deal and they are already talking about "dividing up certain assets" between the two sides.

US President Trump said it feels like Russia is going to make a deal with them and stated that they had pretty good news coming out of Russia. Trump also announced that General Kellogg was appointed as Special Envoy to Ukraine and will no longer be an envoy to Russia.

US envoy Witkoff said differences between Ukraine and Russia have narrowed and they had positive discussions with Russian President Putin, while Witkoff said he expects Trump and Putin to speak this week and that US negotiating teams will meet with Ukrainians this week and will also meet with Russians.

UK PM Starmer said following a meeting with world leaders that they reaffirmed commitment to Ukraine’s long-term security and agreed that Ukraine must be able to defend itself and deter future Russian aggression, while they agreed military planners would convene again in the UK this week to progress practical plans for how militaries can support Ukraine’s future security. Furthermore, Starmer said they will accelerate military support, tighten sanctions on Russia’s revenues and will continue to explore all lawful routes to ensure that Russia pays for the damage it has done to Ukraine, as well as commented that Putin’s response to the ceasefire proposal is not good enough.

Russia launched an air attack on Ukraine's capital of Kyiv and the Russian Defence Ministry said its forces retook control of two settlements in Russia’s Kursk region.

Ukrainian drone attack targeted energy facilities in Russia's Astrakhan region and sparked a fire, according to the regional governor.

Geopolitics: Other

Azerbaijan’s Defence Ministry said Armenian forces opened fire on Azeri positions on Sunday, while Armenia’s Defence Ministry said the statement by Azerbaijan does not correspond to reality.

North Korea said its nuclear forces will 'exist forever' and criticised G7 states for nuclear hegemony, while it will steadily update and strengthen its nuclear armed forces and said demand by G7 for North Korea to abandon nuclear weapons is a provocation. It was also reported that North Korea condemned the US deployment of additional stealth fighter jets to Japan, according to KCNA.

US Event Calendar

08:30: Feb. Retail Sales Advance MoM, est. 0.6%, prior -0.9%

08:30: Feb. Retail Sales Ex Auto MoM, est. 0.3%, prior -0.4%

08:30: Feb. Retail Sales Control Group, est. 0.3%, prior -0.8%

08:30: March Empire Manufacturing, est. -2.0, prior 5.7

10:00: Jan. Business Inventories, est. 0.3%, prior -0.2%

10:00: March NAHB Housing Market Index, est. 42, prior 42

DB's Jim Reid concludes the overnight wrap

This morning we’ve launched our latest global market survey, which we’re doing on a quarterly basis now. We ask simple questions to tease out your thoughts on tariffs, whether your view on Germany has changed, your preference for US or European equities, whether the US equity correction is over just as it began, and a few other topical questions. We would very much appreciate all responses. They are all anonymous. We’ll publish the results later this week. The link to fill it in is here.

A reminder that late last week we launched our Deutsche Bank Research Institute (DBRI), a new offering designed to provide valuable insights for corporates, investors and policymakers navigating today’s complex and rapidly evolving global landscape. The Institute will connect the world to Europe and Europe to the world, across geopolitics, macroeconomics, technology, and the evolving corporate landscape. The new Institute website is here and is open to the public so you can share widely. It contains the inaugural “What Germany’s economy needs now” paper which outlines a series of necessary reforms which will demand a historic effort from the next government. Hopefully the huge fiscal stimulus package that will likely get approved this week (more later) will give them the opportunity to implement these reforms. See the English version here and the German here.

It’s a busy week for central bank watchers with decisions due from the Fed, the BoJ (both Wednesday) and the BoE (Thursday), amongst others. Economic data highlights include retail sales in the US (today), various US housing data, labour market stats in the UK (tomorrow) and inflation in Japan (Friday) and Canada (tomorrow). After we had the white smoke of a deal on Friday, the spotlight will be on the vote around the huge proposed fiscal expansion in Germany. The Bundestag and the Bundesrat are expected to hold votes tomorrow and Friday, respectively, before the new Bundestag sits from March 25. We'll preview these below. Note that overnight Trump has said he'll speak to Putin tomorrow so that's another thing to watch

The full day by day week ahead is at the end as usual but let's preview a few of the key events. Firstly, the Fed is widely expected to stay on hold on Wednesday. In their preview (see "March FOMC preview: Patience is a virtue amidst cross currents"), our economists still expect limited guidance about the policy path ahead given all the extreme uncertainty. The statement is likely to announce a pause in QT beginning in April, and we expect forward guidance indicating that QT is expected to resume once the debt ceiling is resolved and the liability composition of the balance sheet normalises. There are risks that a slowing is announced rather than a pause. Our economists also expect the SEP to maintain two rate cut dots this year but with an upward drift in individual dots that could push the median dot to one cut as a risk. The economic projections will likely show higher inflation, somewhat weaker growth, and an unchanged forecast for the unemployment rate this year. Last week's inflation data looked softer on the surface but as our economists pointed out, they still point towards another strong core PCE print. Today’s retail sales will likely be the last piece of data influencing the Fed.

In terms of Germany, this week will be a landmark one with votes on the deal in the Bundestag tomorrow and the Bundesrat on Friday. With the deal agreed on Friday the bulk of the execution risk has been averted. Assuming it goes through, which must be now over 95% probability wise (on my crude guestimates), our economists believe this could lead to a fiscal stimulus of 3-4% of GDP by 2027 at the latest. So don’t underestimate how huge this package is. Our economists’ note here from Friday outlines the remaining risks both in terms of the vote and the constitutional court ruling around whether not enough time was provided to scrutinise the deal. However the legislation is covered by less than 20 pages of text, so we think the legal risk here is low. We also don’t think there is a large risk that the constitutional court rules against the legitimacy of this outgoing parliament given that most experts believe they have constitutional power until the last session. I still don’t think markets have fully caught up to how much of a game changer this will be for Germany over the next few years. Longer-term though our inaugural Institute paper suggests Germany should use this period to embark on significant structural reform. Hopefully the comfort of higher growth towards the latter part of this decade won’t reduce the likelihood of this.

Back to central banks, the BoJ is expected to keep rates steady and the current monetary policy framework maintained on Wednesday. See our economists’ preview of the meeting here. For the BoE, our UK economist expects the BoE to keep the Bank Rate unchanged at 4.5% (his full preview can be found here).

Asian equity markets have begun the week on the front foot after mixed China data but in anticipation of a domestic 30-point action plan to stimulate consumer spending and bolster stock and real estate markets. There is a press conference at 3pm local time (7am GMT so just after we go to print). As I check my screens, the KOSPI (+1.52%) is leading gains in the region with the Hang Seng (+1.07%), Nikkei (+1.20%), and the S&P/ASX 200 (+0.83%) also notably higher. Mainland Chinese stocks are more mixed with the CSI (-0.24%) lower but with the Shanghai Composite (+0.19%) edging higher. S&P 500 (-0.55%) and NASDAQ 100 (-0.59%) futures are slipping after the strong rally on Friday but are also being weighed down by an interview with Bessant over the weekend who suggested stock market corrections are normal and didn't suggest the administration is going to shy away from what it would see as difficult but necessary changes to the economy.

Coming back to China, industrial output accelerated at a faster pace in the first two months of 2025, advancing +5.9% (v/s +5.3% expected) while retail sales rose by +4.0% in the January-February period from a year ago, against market expectations for a +3.8% y/y growth. Fixed asset investment rose by +4.1% on a year-to-date basis, beating the +3.2% growth estimated by Bloomberg. The unemployment rate rose to 5.4% in February (v/s +5.1% expected), the highest level in two years. Meanwhile, new home prices dipped -0.1% versus a month earlier after two months of relatively steady prices indicating that the nation’s property slump lingers despite the country’s latest efforts to prop up the market. Used-home prices dropped -0.34%, the same pace as the previous month, and fell -0.1% from January in top-tier cities. The market has moved on to focus on the announcement as we go to print.

Looking back at last week now and markets saw a fresh selloff as tariff uncertainty mounted and investors grew more cautious on the US outlook. That meant the S&P 500 fell -2.27% in what was also its 4th consecutive weekly loss. Moreover, if the index sees a 5th weekly decline this week, that would be the longest run of declines since the 2022 bear market. However, on Friday there was then a very sharp recovery, which saw the S&P 500 pare back its losses for the week to rise +2.13% on the day, marking its best daily performance since Trump’s election victory back in November. And there were other signs by the weekend that market volatility was easing, as the VIX index closed at 21.77pts, which was its lowest level since the start of March.

Nevertheless, that recovery on Friday wasn’t enough to save most assets from a significant slump, with US HY spreads (+30bps last week) posting their biggest move wider last week since the turmoil last summer. Those losses were echoed around the world, albeit to a lesser extent, and Europe’s STOXX 600 fell -1.22% (+1.14% Friday) in its worst week of 2025 so far. Notably, Friday even saw gold prices move above the $3,000/oz mark for the first time intraday, before closing slightly beneath that at $2,984/oz.

There were also big moves in European sovereign bond markets, as Germany’s CDU leader Friedrich Merz reached an agreement with the Greens on proposals to amend the constitutional debt brake to allow more borrowing. That meant yields continued to push higher in Europe, with those on ten-year bunds up +3.9bps last week (+2.1bps Friday) to 2.87%, whilst the French 10yr OAT yield was up +1.3bps (+1.0bps Friday) to 3.57%.

For US Treasuries, it was a more stable story, with the 10yr yield up +1.1bps last week (+4.4bps Friday) to 4.31% despite having traded as low as 4.15% early last Tuesday. Friday's rise in yields came amid a significant jump in inflation expectations in the University of Michigan’s preliminary index for March. It showed 1yr expectations rising to +4.9% (vs. +4.3% expected), which is their highest since November 2022. And 5-10yr expectations also jumped up to a 32-year high of +3.9% (vs. +3.4% expected). In turn, that led investors to dial back their expectations for Fed rate cuts this year, with just 65bps priced in by the December meeting at the close, the fewest in over two weeks. The UoM survey continues to show extreme polarisation of inflation and economic views along party lines but the rise in expectations overall and from Independent voters is starting to be a concern.

https://cms.zerohedge.com/users/tyler-durden

Mon, 03/17/2025 - 08:16

https://www.zerohedge.com/markets/futures-fall-after-bessent-says-not-worried-slide-us-stocks

China Maps Out Latest Plan To Boost Consumption, Raise Incomes: Here's Why All Such Prior Plans Have Been Failures

China Maps Out Latest Plan To Boost Consumption, Raise Incomes: Here's Why All Such Prior Plans Have Been Failures

It feels like every 3 months China comes up with another zany plan to boost the economy and kickstart consumption, which spikes stocks for a few days, but promptly goes nowhere, is quickly forgotten... only to be replaced with another zany plan 3 months later, and so on.

Today was no exception to this laughable cadence - which has achieved absolutely nothing but https://www.zerohedge.com/economics/china-slumps-deflation-again-first-negative-core-cpi-print-2021

- and in a Sunday statement by Beijing State Council we learned that China will take steps to revive consumption by boosting people’s incomes, the official Xinhua News Agency reported.

Other just as vague measures include "stabilizing the stock and real estate markets, and offering incentives to raise the country’s birth rate, as the government tries to ease the deflationary pressures afflicting the economy."

Of course, we have heard all of these over and over and over, and nothing at all has changed in the past 4 years. So we kinda doubt that anyone will care this time, but we are confident that HFT and various algos who have the memory of a goldfish will push Chinese stocks higher for at least a few days before the sellers inevitably take the upper hand again.

According to Xinhua, Beijing will promote “reasonable growth” in wages and establish a sound mechanism for adjusting the minimum wage. It will also look at setting up a childcare subsidy system, as well as strengthening how investment can support consumption.

Other highlights of the plan include:

Enlarge variety of bond-related products suitable for individual investors

Adopt multiple measures to promote increase in farm incomes

Raise financial help for some students

Appropriately increase the basic pension for retirees

Ensure timely and full distribution of unemployment benefits

Support tourist attractions in expanding services and the reasonable extension of business hours

Support opening of duty-free shops in cities where conditions permit

Boost support for trade-in programs

Lower the interest rate on housing provident fund loans at an appropriate time

Scale back restrictions on consumption in an orderly manner

Accelerate the development of new technologies and products such as smart wearables and autonomous driving

More details are https://www.nytimes.com/2025/03/16/business/china-consumption.html

, but they may well be moot: after all, invigorating consumption has been a challenge for the government since the end of the pandemic and everything Beijing has thrown at the problem has sunk into a seemingly unquenchable deflationary vortex. Retail sales have been anemic while consumer prices fell into deflation in February for the first time in over a year, although the latest macroeconomic dump suggests that things may be turning after all key data printed just slightly better than expected:

*CHINA JAN.-FEB. RETAIL SALES RISE 4% Y/Y; EST. 3.8%

*CHINA JAN.-FEB. FIXED INVESTMENT RISES 4.1% Y/Y; EST. 3.2%

*CHINA JAN.-FEB. INDUSTRIAL OUTPUT RISES 5.9% Y/Y; EST. 5.3%

At annual parliamentary meetings this month, the country’s leadership made boosting consumption their top priority for the first time since President Xi Jinping came to power over a decade ago.

Ahead of the announcement, Chinese stocks rallied the most in two months on Friday after the State Council, China’s cabinet, announced that officials from the finance ministry, the central bank and other government departments plan to hold a press conference Monday on measures to boost consumption.

In a series of posts on X, China watcher Michael Pettis https://x.com/michaelxpettis/status/1901284566192832642

in China, explaining why so far all attempts to kickstart the economy have failed.

He starts by observing the above - namely that the government and Communist Party issued a lengthy list of planned initiatives on Sunday to get people to spend more, including larger pensions, better medical benefits and higher wages, but they "assigned many of these tasks to the country’s local governments, many of which are struggling under enormous debts and plummeting revenues from the sale of state land."

This, according to Pettis, is the problem with every attempt to boost the consumption share of GDP.

He then notes that the sustainable way to boost consumption is to increase the share of GDP retained by households. But increasing their share requires explicit or implicit transfers from either businesses or government. If the household share rises, after all, someone else's share must decline.

And while Beijing wants local governments to absorb said transfers, given their precarious cashflow positions, for now they can do so mainly by placing new burdens on households or businesses, e.g. through taxes, layoffs, fees, or cutbacks on existing services.

As a result, the net impact on households is reduced, and the remaining costs are absorbed by businesses. The former doesn't help boost consumption, and the latter, by indirectly forcing businesses to absorb the costs, is bad for the economy.

The only other way to do so involves forcing local governments either to transfer to households a large part of the substantial assets they control, or to liquidate those assets in order directly or indirectly pay for higher household income.

The problem, according to Pettis, is that this implies a radical transformation of the relationship between Beijing and local governments and between local governments and the households and businesses in their jurisdiction, and given the sheer extent of the needed transfers, it will be very difficult.

This is why, for all the years of posturing and promising to boost consumption, it has been impossible for China to make much progress to reboot the economy. Since Beijing has to raise the household share of GDP by 10% at the very least, that means an equivalent reduction of someone else's share.

Pettis also notes that many analysts insist that China will choose to avoid rebalancing altogether, but they miss the point. These levels of imbalance simply cannot be sustained if neither China nor the rest of the world can absorb the growing gap between consumption and production.

At the end of the day, China will rebalance one way or another. The important question is how it rebalances: whether an increase in the household share of GDP will occur in the form of a debt crisis and a sharp contraction in GDP, as occurred in the US in the early 1930s... or through many years of stable consumption growth and much lower GDP growth, as occurred in Japan after 1990, or of a surge in consumption that keeps GDP growth stable (which would be historically unprecedented).

These are arithmetically the only three ways to rebalance. And since all are extremely painful, either acutely now or chronically over the long-term, no surprise then that Beijing just keeps pretending it will do something while merely kicking the can until it is finally one day forced to do something.

https://cms.zerohedge.com/users/tyler-durden

Sun, 03/16/2025 - 22:45

Getting Out Of Forever Wars

Getting Out Of Forever Wars

https://realclearwire.com/articles/2025/03/14/getting_out_of_forever_wars_1097553.html

,

A Pragmatic Approach to Protecting U.S. Security Interests

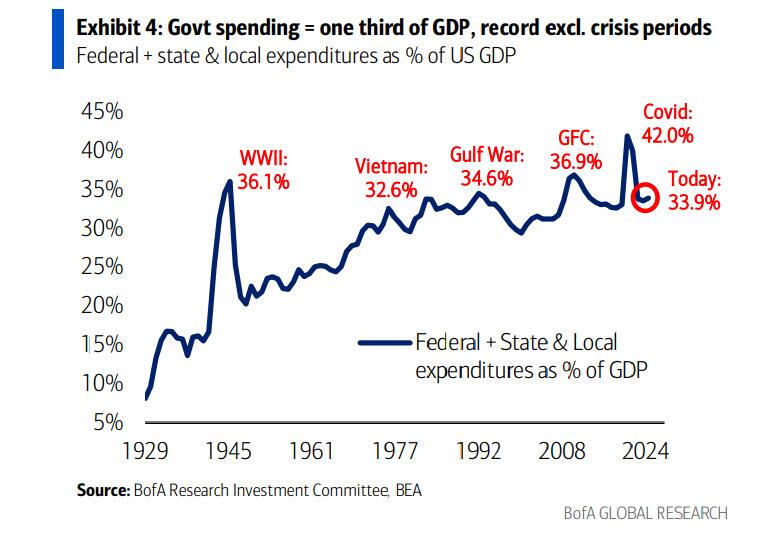

?itok=UJbs7i9M

Introduction

Since the 9/11 attacks, the United States has been mired in "forever wars"—prolonged conflicts with no clear victory, draining trillions of dollars, thousands of lives, and economic vitality. A 2023 Pew poll shows 54% of Americans favor reducing overseas military commitments, with 83% prioritizing domestic needs—a clear call for change.

The U.S. can no longer afford years of military overreach. A pragmatic strategy emphasizing diplomacy, allied burden-sharing, and strategic restraint is essential to protect national interests without exhausting finite resources.

The Overwhelming Cost of War

The post-9/11 wars have exacted a staggering toll. Brown University’s Costs of War Project https://watson.brown.edu/costsofwar/papers/summary

the U.S. has spent $8 trillion—38% of 2020’s GDP—on conflicts in Iraq, Afghanistan, Pakistan, and Syria, equating to $24,000 per citizen.

Future interest on this debt could add $2.2 trillion to the national debt by 2050, burdening future generations. Human losses are equally dire: 7,000 service members and 8,000 contractors killed, 55,000 injured, and 940,000 total deaths from direct violence, with 3.6 million more dying indirectly in war zones.

Beyond numbers, the mental health crisis is profound. Veterans and active-duty personnel from these conflicts have died by suicide at four times the rate of combat losses—over 28,000 since 2001, according to 2022 VA https://www.mentalhealth.va.gov/docs/data-sheets/2024/2024-Annual-Report-Part-2-of-2_508.pdf

– mainly driven by post-traumatic stress disorder and repeated deployments.

Adding to the exhausting cost of conflict, caring for these veterans will cost $2.2-$2.5 trillion by 2050. These financial and human costs prove the wars’ unsustainability; constrained resources and public concerns require the U.S. to reassess its global security approach.

Rethinking Overseas Commitments

The U.S. maintains 750 military facilities across 80 countries, per a 2021 International Institute of Strategic https://www.iiss.org/online-analysis/online-analysis/2022/09/overseas-bases-and-us-strategic-posture/#:~:text=While%20this%20is%20only%20about,budget%20%E2%80%93%20to%20maintain%20and%20sustain

that 91% of post-9/11 operations relied on these bases. Yet, they’ve often fueled instability—think of the disorder stemming from Iraq’s insurgency or Afghanistan’s collapse—rather than the security they were supposed to provide. This sprawling footprint, born of Cold War logic, no longer aligns with today’s fiscal environment, demanding a leaner, more practical approach.

A Pragmatic Path Forward

Some argue that overseas military bases help deter terrorism, but the evidence suggests otherwise. According to the https://www.cato.org/policy-analysis/terrorism-immigration-risk-analysis-1975-2023

(2023), the probability of dying in a U.S. terrorist attack is just 1 in 150 million.

Since 9/11, America has experienced nine https://www.cato.org/policy-analysis/terrorism-immigration-risk-analysis-1975-2023#uniqueness-911

, resulting in a total of 44 deaths. In contrast, during the same period, the U.S. military suffered over 7,000 fatalities and 55,000 injuries in Iraq and Afghanistan, raising questions about the purpose of military operations overseas.

The cost alone is staggering. According to a Cato Institute https://www.cato.org/commentary/what-does-america-really-gain-excess-military-bases

, a conservative baseline for total overseas basing costs is $80 billion annually, with some estimates reaching $100-$150 billion. This reflects differing indirect expenses, like troop support, highlighting the obscurity of overseas spending.

A 2023 RAND https://www.rand.org/content/dam/rand/pubs/research_reports/RRA1100/RRA1125-2/RAND_RRA1125-2.pdf

also found that 30% of bases lack strategic purpose. A 25% reduction, focusing on outdated Cold War sites and unproductive Middle East efforts, would save $15 billion annually.

However, completely withdrawing is unwise; bases in Japan and Germany still deter Russia and China and allow forces to posture when needed. Closing outdated posts in stable regions—like parts of Europe or Asia—frees billions for pressing domestic defense needs.

The use of hard power has become overextended, yielding little success and eventually weighing heavily on the American public. A more effective strategy entails carefully reducing America’s overseas presence, reallocating resources, and reprioritizing homeland defense.

Strengthening Homeland Defense

President Trump’s campaign emphasized ending long-term military engagements, reducing overseas commitments, and reprioritizing defense strategies to enhance defending the homeland.

His 2025 executive https://www.whitehouse.gov/presidential-actions/2025/01/the-iron-dome-for-america/

from advancing adversaries. However, these initiatives currently face funding challenges.

The FY2024 defense https://www.defense.gov/news/releases/release/article/3326875/department-of-defense-releases-the-presidents-fiscal-year-2024-defense-budget/

($850 billion) allocates $69 billion to overseas operations—defending allies—while just $29.8 billion (3.5%) boosts missile defense, unchanged since 2019.

Redirecting even half of that $69 billion could modernize defenses, aligning spending with existential risks over foreign entanglements.

However, missile defense is not the only way to protect the nation. It also demands attention to vulnerabilities closer to home, such as securing the borders—another pillar of homeland security.

Securing the Border

Border security, a neglected homeland priority, ties directly to resource reallocation. In FY2024, Customs and Border Protection (CBP) https://homeland.house.gov/2024/10/24/startling-stats-factsheet-fiscal-year-2024-ends-with-nearly-3-million-inadmissible-encounters-10-8-million-total-encounters-since-fy2021/

$130 billion, challenging public safety and straining national security.

To help tackle this unprecedented challenge, President Trump's recent executive https://www.whitehouse.gov/presidential-actions/2025/01/securing-our-borders/

, which declare a national emergency at the southern border and direct the military to support the Department of Homeland Security (DHS) in safeguarding the nation's territorial integrity, highlight the priority of protecting the homeland.

DHS has also ramped up the activities of Immigration and Customs Enforcement (ICE), leading to a significant 627% increase in the detainment of criminal aliens since January. This surge has prompted DHS to request additional military assistance to aid the detainment process. As a result, more military troops are being deployed to support CBP along the border, and the military detention facility at Guantanamo Bay is being repurposed to accommodate the detention of criminal migrants.

While reallocating military resources from overseas commitments to border security can effectively address domestic threats without requiring additional spending, as illustrated by Secretary of Defense Hegseth's recent decision to https://www.defense.gov/News/News-Stories/Article/article/4072698/hegseth-addresses-strengthening-military-by-cutting-excess-refocusing-dod-budget/

eight percent of the FY26 defense budget toward homeland priorities, this approach also highlights a more significant imbalance in U.S. defense spending.

Burden Sharing Security

Disproportionate global security commitments add to the problem, as the U.S. must push NATO allies to meet their 2% GDP defense spending target—America https://usafacts.org/articles/what-is-nato-and-what-does-it-cost-to-be-a-member/

twice their combined total from 2014 to 2022.

Leading allies, like the United Kingdom and Germany, spend less as a share of https://www.imf.org/en/Publications/fandd/issues/Series/Back-to-Basics/gross-domestic-product-GDP

—a U.S.-only defense investment and activity used to counter China that costs $10B annually.

The United States can no longer bear the burden of defending others. It must reassess its global security stance and agreements to ensure that costs are shared equitably. A balanced use of projecting power is needed to secure American influence abroad.

Balancing Power Projection

America’s decades-old philosophy of fighting its battles on someone else’s property remains vital to national security. A platform that can project US power quickly and support those efforts remains relevant.

Overseas “power projection https://www.army.mil/standto/archive/2020/01/17/#:~:text=Strategic%20Power%20Projection%20encompasses%20the%20U.S.%20Army's,anywhere%20in%20the%20world%20at%20any%20time.

”—like overseas mobility bases and carriers in the Pacific—are necessary, enabling rapid response and sustainment to a crisis. However, basing that does not support projecting power should be reconsidered for closure. Trimming these frees funds for soft power—diplomacy and economic leverage—that achieves similar ends at a lower cost.

Harnessing Soft Power

Soft power—persuading through attraction, not force—offers a sustainable edge. Diplomacy can preempt conflicts that mimic hard power wins, such as the https://www.theguardian.com/world/2023/jun/18/sudan-warring-sides-agree-to-new-ceasefire-after-fighting-intensifies

.

Diplomacy can also secure trade deals, such as the 2020 U.S.-Japan Trade https://www.fas.usda.gov/topics/japan-trade-agreement#:~:text=The%20U.S.%2DJapan%20Trade%20Agreement,or%20receive%20preferential%20tariff%20access.

, which cut tariffs and secured U.S. farm exports to counter China’s trade dominance. Yet, while diplomacy can secure trade wins to help balance its trade, its effectiveness diminishes when multilateral agreements lead to persistent inequities.

For example, the Asian-Pacific Economic Cooperation (APEC), a multilateral trade agreement, incurred a https://ustr.gov/countries-regions/japan-korea-apec/apec#:~:text=U.S.%20goods%20exports%20to%20APEC,(%2497.7%20billion)%20over%202023.

, America’s total global goods and services deficit was $918.4 billion in 2024, up $133.5 billion from $784.9 billion in 2023.

This unsustainable trend indicates that the U.S. needs to rethink its negotiating approach in line with more equitable agreements that work directly with each partner, making adherence and fairness more manageable.

However, diplomacy and trade agreements alone cannot guarantee a nation's security. Economic strength is vitally important and underwrites all its activities, making it essential to influence, leverage, and safeguard its interests.

Prioritizing Economic Security

has fueled energy exports, supporting Europe against Russia and countering Iran. Energy independence and growth are critical in maintaining America’s edge over rivals and securing its position as a preeminent global power.

However, the U.S. must address significant financial challenges, including its $34 trillion national https://fiscaldata.treasury.gov/americas-finance-guide/national-debt/

over China, purchasing power parity, or how much your currency can buy, shows that China leads by 23% and is growing. More concerning is that experts predict that China will surpass the total U.S. economy by 2040.

Remaining a global leader requires economic security and realigning priorities. Protecting against rising financial challenges and economic juggernauts like China means redirecting excessive global commitments to infrastructure and tech, not unproductive overseas commitments.

Conclusion

The post-9/11 wars have cost the United States $8 trillion, nearly a million lives directly and indirectly, and decades of overstretched resources—losses no nation can sustain indefinitely. To secure its interests, the U.S. must pivot from endless military entanglements to a strategy of calculated restraint: reducing outdated overseas commitments, redirecting funds to homeland defense and economic resilience, and leaning on diplomacy and allied cooperation to project influence.

This shift isn’t retreat—it’s recalibration. By prioritizing what strengthens the nation, from border security to soft power, America can safeguard its future without repeating its past mistakes.

Major General Don McGregor (USAF, ret.) is a combat veteran and an F-16 fighter pilot. While serving as a General Officer in the Pentagon, he was the National Guard Director of Strategy, Policy, Plans, and International Affairs, advising a four-star Joint Chiefs of Staff member.

https://cms.zerohedge.com/users/tyler-durden

Sun, 03/16/2025 - 22:10

https://www.zerohedge.com/political/getting-out-forever-wars

Pentagon Says Operations 'Continue' Overnight Against Yemen's Houthis

Pentagon Says Operations 'Continue' Overnight Against Yemen's Houthis

Update(2125ET): In the overnight hours (local), the US military has launched what appears to be a second wave of airstrikes on Yemen. US Central Command posted a new video Sunday saying that operations "continue"...

CENTCOM forces continue operations against Iran-backed Houthi terrorists... https://t.co/zEWykoDKQR

— U.S. Central Command (@CENTCOM) https://twitter.com/CENTCOM/status/1901428374486089974?ref_src=twsrc%5Etfw

"The United States and Iran-backed Houthi rebels in Yemen are both vowing escalation after the U.S. launched airstrikes to deter the rebels from attacking military and commercial vessels on one of the world’s busiest shipping corridors," AP writes.

Like with similar strikes under Biden - and now with Trump - where's Congress? What authorization is there for a new war in the Middle East?

When you've lost the hawkish FoxCon pundit Ann Coulter...

Why did we have to do this? Is it part of our constitution that we must be bombing someone at all times? https://t.co/WUt63jF7uS

— Ann Coulter (@AnnCoulter) https://twitter.com/AnnCoulter/status/1901351594186133622?ref_src=twsrc%5Etfw

* * *

Yemen's Health Ministry now says that 32 people, including children, died after Saturday's major US airstrikes pounded Sanaa, with President Donald Trump warning the Houthis not to attack ships passing through the Red Sea.

But on Sunday, that's precisely what the Houthis did: a Houthi military announcement claimed the group carried out "a qualitative operation" on the US aircraft carrier Harry S Truman. "Our forces targeted the Truman aircraft carrier with 18 ballistic and cruise missiles and a drone," a spokesman said.

?itok=FNb4Wuun

?itok=FNb4Wuun

Nasruddin Amer, deputy head of the Houthi media office, described that Saturday's US air strikes - which reportedly hit some 170 sites - won’t deter the Shia armed group back by Iran.

Amer pledged more attacks on Red Sea shipping will come: "Sanaa will remain Gaza’s shield and support and will not abandon it no matter the challenges," he said.

But later in the day Sunday an unnamed Pentagon official was quoted in Reuters as rejecting the Houthi claim. The official dismissed the claim of that a missile and drone attack came close to hitting the USS Harry S Truman.

A subsequent Fox report said that US warships shot down any inbound Houthi drones, and that they were not a serious threat.

Saturday's strike on Yemen not only resulted in civilian deaths, but a reported over 100 injured, as President Trump vowed to “use overwhelming lethal force” while warning Iran to "immediately" cut its support.

"Your time is up, and your attacks must stop, starting today. If they don’t, hell will rain down upon you like nothing you have ever seen before," the president said on Truth Social.

"I have ordered the US military today to launch a decisive and powerful military operation against the Houthi terrorists in Yemen,” he said, adding that he's willing to use "overwhelming lethal force until we have achieved our objective."

An American defense official denied the Houthi statement:

Houthis: We attacked the US aircraft carrier USS Harry Truman with 18 BALLISTIC MISSILES and drones

‘We will not hesitate to target all US warships in Red Sea and Arabian Sea’https://t.co/eOHQ2c5AI4

— Open Source Intel (@Osint613) https://twitter.com/Osint613/status/1901336863010414825?ref_src=twsrc%5Etfw

The Houthis' leader last just Friday had declared a four-day deadline before attacks on shipping would resume. That four day timeline had ended by close of Tuesday, which means the Red Sea could be soon fiery scene of drone and missile attacks out of Yemen once again.

Since 2023 over 100 missile and drone attacks on commercial vessels have occurred in the Red Sea and the Gulf of Aden. The Houthis have also downed several MQ-9 Reaper drones operated by the Pentagon.

https://cms.zerohedge.com/users/tyler-durden

Sun, 03/16/2025 - 21:25

https://www.zerohedge.com/geopolitical/houthis-claim-ballistic-missile-attack-uss-truman-carrier

Behind The White House's Decision To Ignore Activist Judge, Let Plane Full Of Deported Criminals Continue To El Salvador

Behind The White House's Decision To Ignore Activist Judge, Let Plane Full Of Deported Criminals Continue To El Salvador

Update (2112ET): The Trump administration says it disregarded a judge's order to turn around two planeloads of Venezuelan criminals because the flights were over international waters and therefore the ruling did not apply, Axios reports, citing two senior officials - one of whom made clear that it's "Very important that people understand we are not actively defying court orders."

?itok=QY8rAm0d

?itok=QY8rAm0d

The Trump administration argues that US District Judge James Boasberg overstepped his authority when he issued an order blocking the president from deporting roughly 250 alleged Tren de Aragua gang members under the Alien Enemies Act of 1789, a wartime law that gives the executive branch immense power to deport noncitizens without judicial hearings.

"This is headed to the Supreme Court. And we're going to win," a senior White House official told Axios, adding "It's the showdown that was always going to happen between the two branches of government."

"And it seemed that this was pretty clean. You have Venezuelan gang members ... These are bad guys, as the president would say."

Axios then cites Democrat attorney Mark S. Zaid...

this guy...

I've gotten clearances for guys who had child porn issues

— Mark S. Zaid (@MarkSZaidEsq) https://twitter.com/MarkSZaidEsq/status/962537227757682688?ref_src=twsrc%5Etfw

...who posted on X "Court order defied. First of many as I've been warning and start of true constitutional crisis," adding that it could eventually lead to another Trump impeachment, according to Axios.

According to the report, White House Deputy Chief of Staff Stephen Miller "orchestrated" the flights in the West Wing in tandem with DHS Secretary Kristy Noem.

More via Axios:

The timeline: The president signed the executive order invoking the Alien Enemies Act on Friday night, but intentionally did not advertise it. On Saturday morning, word of the order leaked, officials said, prompting a mad scramble to get planes in the air.