Watch Live: Fed Chair Powell Explains How He Found The "Stag" & The "Flation"

Watch Live: Fed Chair Powell Explains How He Found The "Stag" & The "Flation"

Having met the expectations of leaving rates unchanged, and confirming their 'patience', the big question is - can Jay Powell avoid all the traps being set for him in the press conference?

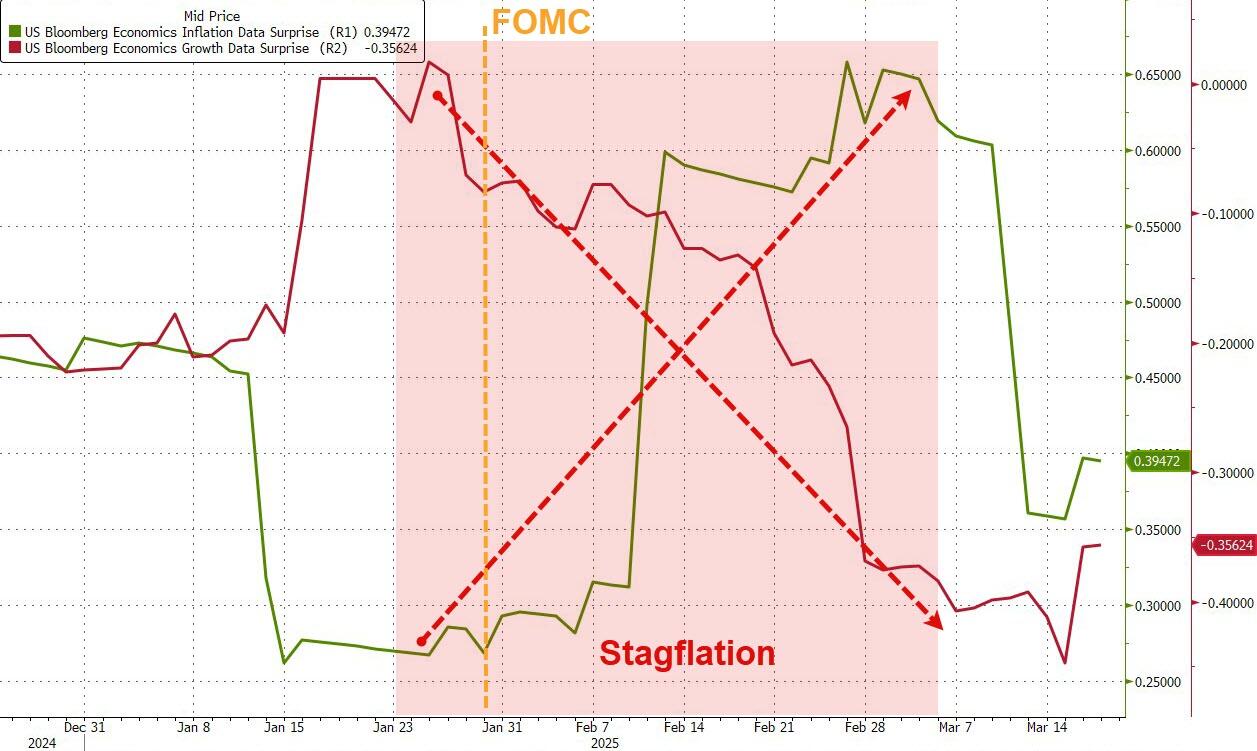

Growth expectations are tumbling - so cut, right?

But Trump wants lower rates... so they can't do what he wants.

Inflation data has been wildly noisy (and expectations are soaring) - so hike rates, right?

But Dems would love The Fed to hike rates now and kill Trump's economy before we get to the 'good stuff'... so they can't do that.

?itok=3F8q_NV-

?itok=3F8q_NV-

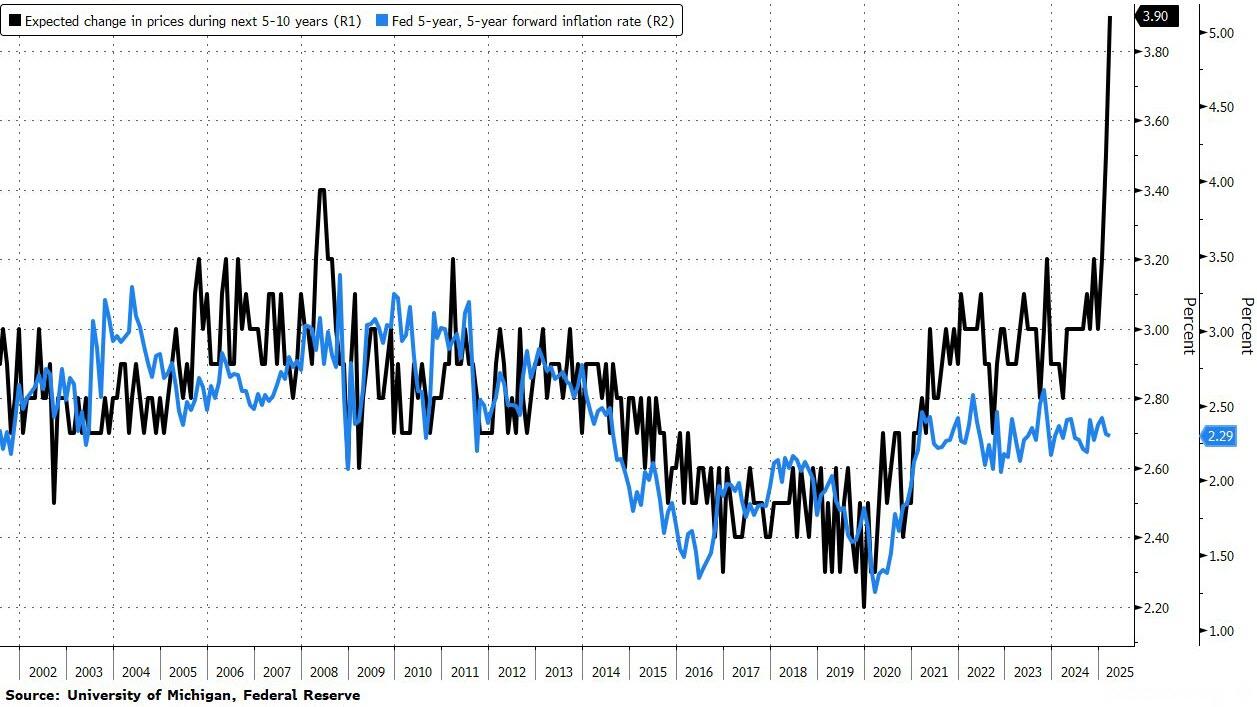

...(and will Powell shrug off the insane partisanship seen in the UMich inflation data that he once praised so highly)

?itok=E-Umd7Uj

?itok=E-Umd7Uj

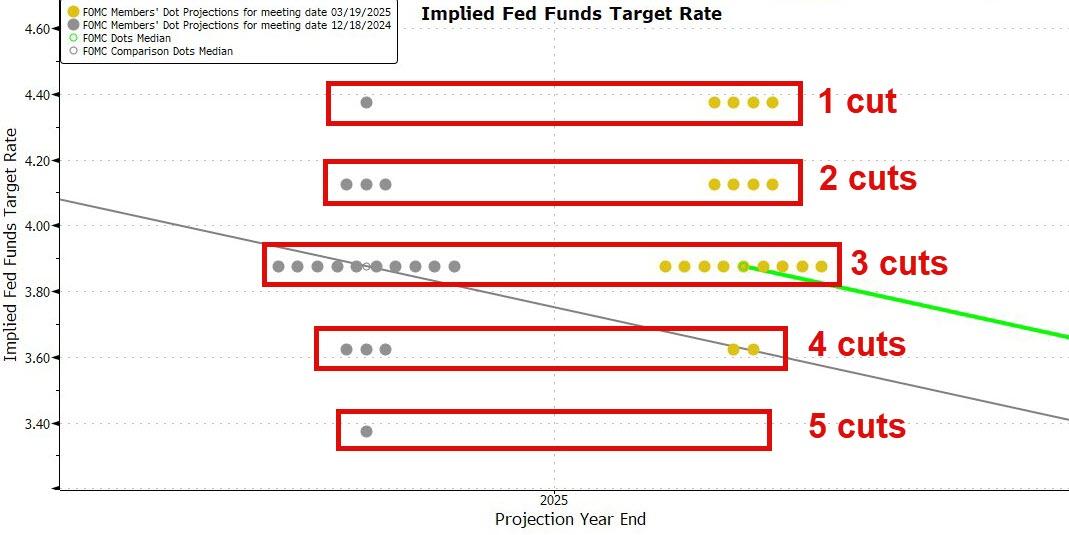

It appears that Fed Chair Powell has found the "stag" and the "flation" after all, given the adjustments to The Fed's forecast:

?itok=Hav5zvnh

?itok=Hav5zvnh

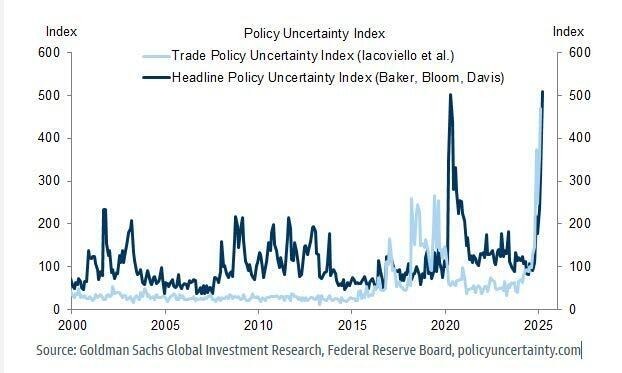

Fiscal policy uncertainty is extremely high - so cut rates to offset that tension, right?

But that would mean an implicit 'defense' of these policy moves... and Lizzy Warren will have a cow.

?itok=Y0EdIxMF

?itok=Y0EdIxMF

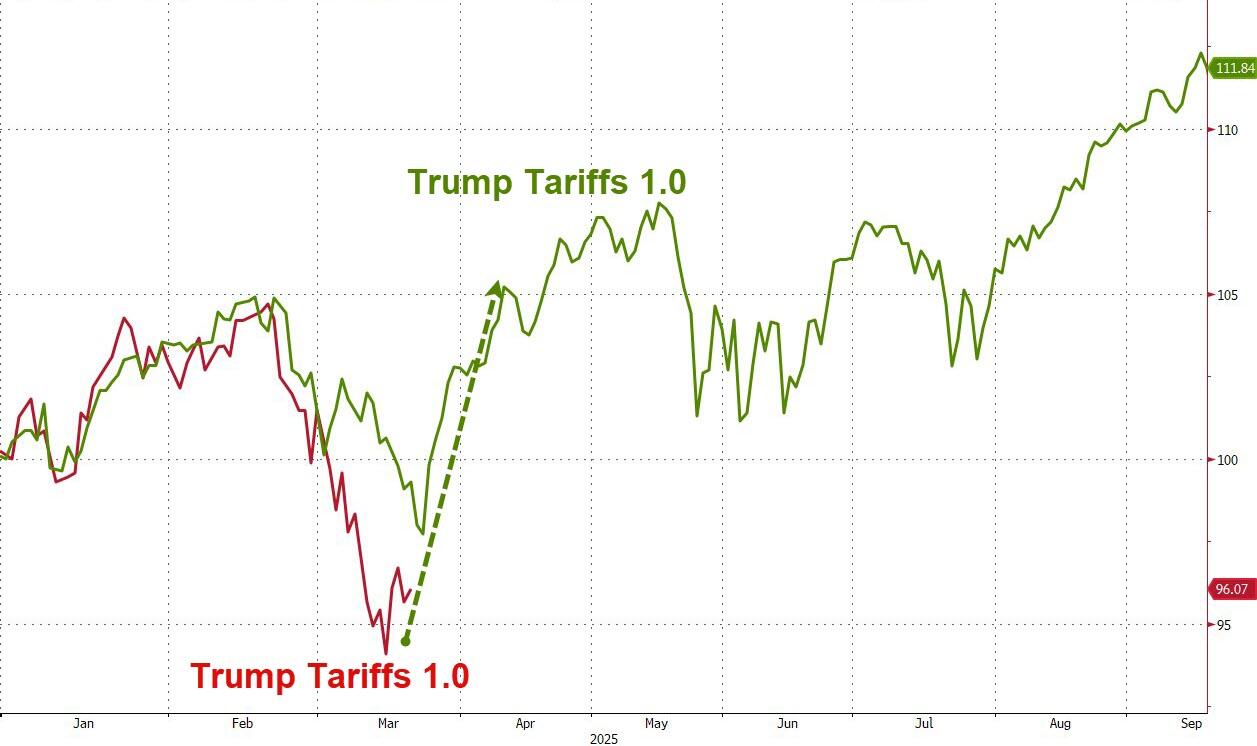

Of course, The Fed has already front-run Trump's policy prescription by shifting its dots (lower) and PCE forecast (higher) on tariff fears. The timing is right though for a Powell Put save by talking up the tapering of QT...

?itok=43n13Z0T

?itok=43n13Z0T

All the shifts in the dots are hawkish... will Powell acknowledge that?

?itok=FOx9yN0m

?itok=FOx9yN0m

Watch The Fed Chair hold his press conference here live (due to start at 1430ET):

https://cms.zerohedge.com/users/tyler-durden

Wed, 03/19/2025 - 14:25

https://www.zerohedge.com/markets/watch-live-will-fed-chair-unleash-powell-put

The Fed's Dilemma

The Fed's Dilemma

As previewed earlier, today's Fed decision should be a relatively quiet affair, with the Fed still in wait-and-see mode (https://www.zerohedge.com/markets/march-fomc-preview-markets-are-hunt-clarity

).

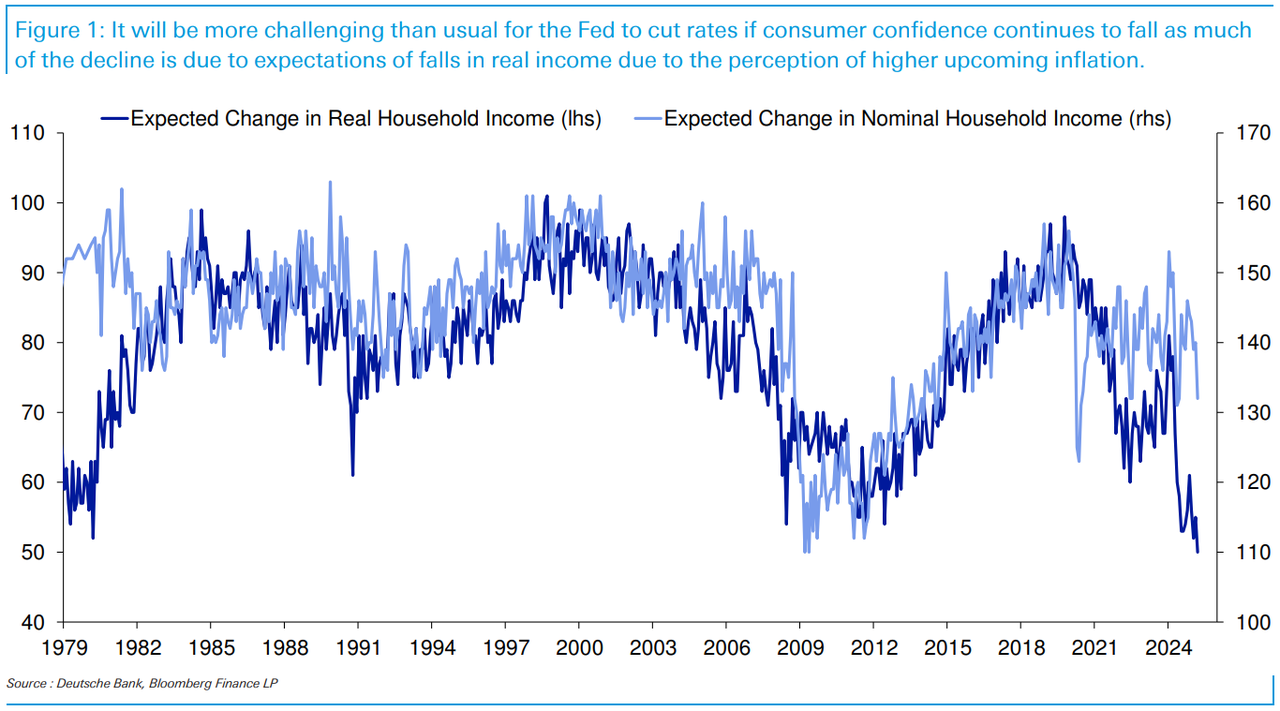

Meanwhile, data like that shown in the latest chart of the day from DB's Jim Reid highlights a dilemma the Fed may face in the coming months. The latest University of Michigan survey (released last Friday) revealed that consumers’ real income expectations over the next one to two years reached the lowest point in the survey’s 47-year history.

?itok=3MKjWV1a

?itok=3MKjWV1a

Given that nominal income expectations have held up better, it’s clear that the perception of impending inflation is the primary cause. This is also reflected in the inflation expectation series. Currently, these inflation expectations are highly polarized by political affiliation, suggesting that at least half the electorate will ultimately be proven wrong regarding future inflation. However, the risk is that, in aggregate, these expectations will begin to influence behaviour.

Therefore, if expectations of future real incomes are at these all-time lows due to inflation expectations, cutting rates in the future to offset declining consumer confidence becomes more complex. The Fed likely hopes that a significant portion of the population will soon feel more optimistic and less concerned about inflation, which is unlikely since it has now become vogue to express one's Trump Derangement Syndrome by predicting triple if not quadruple digit inflation, when in reality the higher inflation in decades was under the administration of Biden's autopen.

One final point: as we noted earlier today on X, if Democrats truly expect 6.5% inflation in one year as they reportedly professed https://www.zerohedge.com/markets/panicking-democrats-send-umich-inflation-expectations-highest-32-years?commentId=67d43c4ab84ea4001df35864

, then they should be unleashing a historic spending spree that wipes out their savings as their purchasing power - assuming they are right in their inflation forecasts - will crater over the next 12 months, courtesy of orange man's evil inflation.

?itok=vVvjTZEW

?itok=vVvjTZEW

So unless we see a massive consumption binge driven by Democrats, it is safe to say either the (very liberal) UMich survey numbers are intentionally manipulated for political reasons, or Democrats' answers are purposefully wrong and misleading, meant to influence the market and the Fed.

In any case, that surging inflation expectation would be bullshit and the Fed can and should ignore it.

In today's FOMC presser, can someone pls ask Powell if Dems (polled by UMich) see 6% inflation in 1 year, why aren't they spending all their saving right now ahead of what they reportedly see as a record loss in purchasing power?

— zerohedge (@zerohedge) https://twitter.com/zerohedge/status/1902386326265360643?ref_src=twsrc%5Etfw

https://cms.zerohedge.com/users/tyler-durden

Wed, 03/19/2025 - 13:55

Ukraine Quickly & Intentionally Broke Putin-Trump Deal On Energy Targets: Moscow

Ukraine Quickly & Intentionally Broke Putin-Trump Deal On Energy Targets: Moscow

During Tuesday's Trump-Putin phone call, which lasted some 90-minutes, the White House said that President Putin committed to a halt of attacks on Ukraine's energy infrastructure for a period of 30-days. The Kremlin readout https://www.zerohedge.com/markets/putin-demands-halt-western-military-aid-ukraine-ahead-trump-call

to acknowledge and agree to this.

Less than 24 hours later, Russia has accused Ukraine of already breaking the Trump agreement. Russia's defense ministry on Wednesday https://www.rt.com/russia/614485-ukraine-violate-ceasefire-trump/

Ukraine attack an oil transfer facility in Russia’s Krasnodar Region that services an international pipeline operation partially owned by American investors.

?itok=3EIdjnQ0

?itok=3EIdjnQ0

The ministry described that the overnight attack saw three kimikaze drones target the site near the village of Kavkazskaya. The site transfers crude to a pipeline operated by the Caspian Pipeline Consortium (CPC), an international firm which has among its partners US giants Chevron and Mobil, Russia's RT notes.

The drone impact reportedly set fire to an oil reservoir, which has reportedly taken emergency crews a long time to extinguish. Local reports say crews are still battling the blaze.

Moscow is describing the attack as part of an intentional efforts to thwart any advancement of a peace or ceasefire agreement between Russia and the US.

"Clearly, this was a premeditated provocation by the Kiev regime aimed at derailing the US president’s peace initiative," the Russian military stated soon after.

There indeed doesn't appear to be any meaning ceasefire on at the moment, but the concession Trump was able to get from Putin marks a first of the war...

Ceasefire, what ceasefire? Russia kept pummeling Ukrainian cities overnight, hitting a hospital in Sumy among other targets. Ukraine struck a key Russian crude oil pipeline facility in northern Caucasus. Photo left — Ukrainian hospital. Video — the Kavkazskaya pumping facility. https://t.co/oZpADfPA48

— Yaroslav Trofimov (@yarotrof) https://twitter.com/yarotrof/status/1902247642433741130?ref_src=twsrc%5Etfw

The Russian readout of Tuesday's Trump call included the following: "During the conversation, Trump proposed a mutual agreement between both sides to refrain from striking energy infrastructure for 30 days. Putin welcomed the initiative and immediately instructed the Russian military to comply."

However, Russia has yet to agree to refrain from other attacks, and is likely to continue hitting Ukraine hard so long as drones keep flying across the border.

Ukraine's Zelensky says he soon expects to hold a phone call with President Trump. His position has remained that nothing can be agreed to ceasefire-wise without Kiev's direct participation and input.

Below are more geopolitical developments on Wednesday, via Newsquawk:

* * *

Geopolitics: Middle East

Israeli army attacked Khan Yunis and conducted heavy shelling in the southern Gaza Strip, according to Al Jazeera.

Hamas leader said continuation of the Israeli bombardment of Gaza will lead to the death of many Israeli prisoners and the movement is communicating with mediators to force Israel to respect its commitments to the ceasefire.

US bombed targets in areas east of Hodeidah in Yemen and there were at least 10 US strikes that targeted areas in Yemen, according to Houthi media.

Geopolitics: Ukraine

Russia's Medvedev said the Putin-Trump call showed there is only Russia and the US in the 'dining room' eating a 'Kyiv-style cutlet' as a main course.

US Special Envoy Witkoff said talks with Russia on the Ukraine war will take place on Sunday in Jeddah.

Ukrainian President Zelensky said Russia launched over 40 drones targeting civilian infrastructure and it is precisely such night attacks by Russia that destroy Ukraine’s energy and civilian infrastructure. Zelensky added the fact that Tuesday night attacks were no exception shows the need to continue pressure on Russia for the sake of peace, as well as noted that Russian President Putin de facto rejected the proposal for a complete ceasefire and it would be right for the world to reject any attempts by Putin to drag out the war in response.

UK PM Starmer spoke with Ukrainian President Zelensky on Tuesday evening and discussed progress US President Trump had made towards a ceasefire in talks with Russia, according to Downing Street.

Regional governor in Russia's Belgorod region said the situation remains difficult, a day after Russia said its forces had thwarted Ukrainian attempts to push across the border in Belgorod. It was separately reported that a drone attack sparked a fire at an oil depot in Russia's Krasnodar region, according to regional authorities.

UK Foreign Secretary said the EU and UK are to accelerate shipments of arms to Ukraine ahead of a potential full ceasefire, according to Bloomberg.

Russian Defence Ministry says Ukraine attacked Russia's energy infrastructure overnight, according to IFAX; CPC Kropotkinskaya oil pumping station stopped operating after damage, according to Tass.

Ukraine State Railways in the Dnipropetrovsk region says Russian forces have attacked its power system on Wednesday morning.

Finland President Stubb says if Russia refuses to agree, will need to increase its efforts to strengthen Ukraine and ratchet up pressure on Russia to convince it to come to the negotiating table.

Ukrainian President Zelensky says he hopes a ceasefire will eventually be implemented; says Russian President Putin's words are at "odds with reality", in relation to the halt on energy strikes. Will speak to US President Trump on Wednesday.

Geopolitics: Other

US Secretary of State Rubio warned unless Venezuela's government accepts a flow of deportation flights, the US will impose new and escalating sanctions, while Venezuela's government said sanctions are an economic war and responsible for hardships.

https://cms.zerohedge.com/users/tyler-durden

Wed, 03/19/2025 - 09:00

The Face Of The Tolerant Left...

The Face Of The Tolerant Left...

https://modernity.news/2025/03/18/the-face-of-the-tolerant-left

During the never ending ‘Orange man bad’ protests outside the White House, a woman stood on the podium and summed up the mindset of deranged leftism.

?itok=8oiDAlSW

?itok=8oiDAlSW

It’s anyone’s guess as to what this protest is specifically against, there’s signs about ‘trans troops’ and a woman with bright red hair and a t-shirt saying “Fuck Trump” carrying a sign saying “Veterans Bow to No King.”

Whatever, it doesn’t even matter.

The woman in the footage declares that while she isn’t promoting violence for one second, because leftists would nevvvvvvver do that, if President Trump isn’t removed from office “there will be violence.”

WH protest: "Remove this president or there will be violence" https://t.co/IqihuZ4ZEI

— End Wokeness (@EndWokeness) https://twitter.com/EndWokeness/status/1901686175800103276?ref_src=twsrc%5Etfw

Just wow.

Ummm, this sounds a lot like calling for violence WHILE saying you’re not calling for violence.

🤔

— Gerald A (@GmorganJr) https://twitter.com/GmorganJr/status/1901708510993236357?ref_src=twsrc%5Etfw

Not promoting violence, but there will be violence if we don’t get our deranged way.

“I’m not promoting violence, but I’m promoting violence” – wow!! She should be arrested for that. https://twitter.com/FBI?ref_src=twsrc%5Etfw

— Jennifer Jacobson (@jen7j7) https://twitter.com/jen7j7/status/1901697172363772382?ref_src=twsrc%5Etfw

"We will be violent, but it is your fault for causing it" 🙄 https://t.co/pvOyAWpgFr

— Based Electrician⚡️🇺🇲 (@RyanHugeBrain) https://twitter.com/RyanHugeBrain/status/1901688224071983242?ref_src=twsrc%5Etfw

It perfectly encapsulates their insane outlook.

There’s already violence. The left are violent people and the Democrat Party supports them. They prove it over and over again. The president will not be removed so go ahead and show us what violence you have in mind this time.

— Proud American (@JimSTruthBTold) https://twitter.com/JimSTruthBTold/status/1901687768650272832?ref_src=twsrc%5Etfw

What happened to the sanctity of ‘Democracy’?

The same people who cried about "threats to democracy" are now openly calling for violence because they lost. These are not protesters, they’re sore losers throwing a tantrum. Cry harder snowflakes 😂🤣

— Unknown Ruler (@unknownruler8) https://twitter.com/unknownruler8/status/1901700345908076600?ref_src=twsrc%5Etfw

They are so ensconced inside their bubble world that they don’t understand their words have consequences.

This is a clear threat. This is not exercising free speech, this is inciting violence and this woman should be arrested and charged appropriately.

— Apinions Vary (@apinionsvary) https://twitter.com/apinionsvary/status/1901686607847047670?ref_src=twsrc%5Etfw

I’m not promoting violence but get me the manager over here right away or there will be violence.

Ok, Karen

— Vince Langman (@LangmanVince) https://twitter.com/LangmanVince/status/1901721748409647193?ref_src=twsrc%5Etfw

While these deranged idiots screech forever, there are a million other weirdos out there doing this sort of thing and much worse:

Face of the tolerant left. https://t.co/YiIgcTN3rr

— m o d e r n i t y (@ModernityNews) https://twitter.com/ModernityNews/status/1901949773474639951?ref_src=twsrc%5Etfw

The face of the tolerant left. https://t.co/LAPUhiHxDa

— m o d e r n i t y (@ModernityNews) https://twitter.com/ModernityNews/status/1901949460520808496?ref_src=twsrc%5Etfw

The face of the tolerant left.

* * *

Your support is crucial in helping us defeat mass censorship. Please consider donating via https://pauljosephwatson.locals.com/support

.

https://cms.zerohedge.com/users/tyler-durden

Wed, 03/19/2025 - 08:40

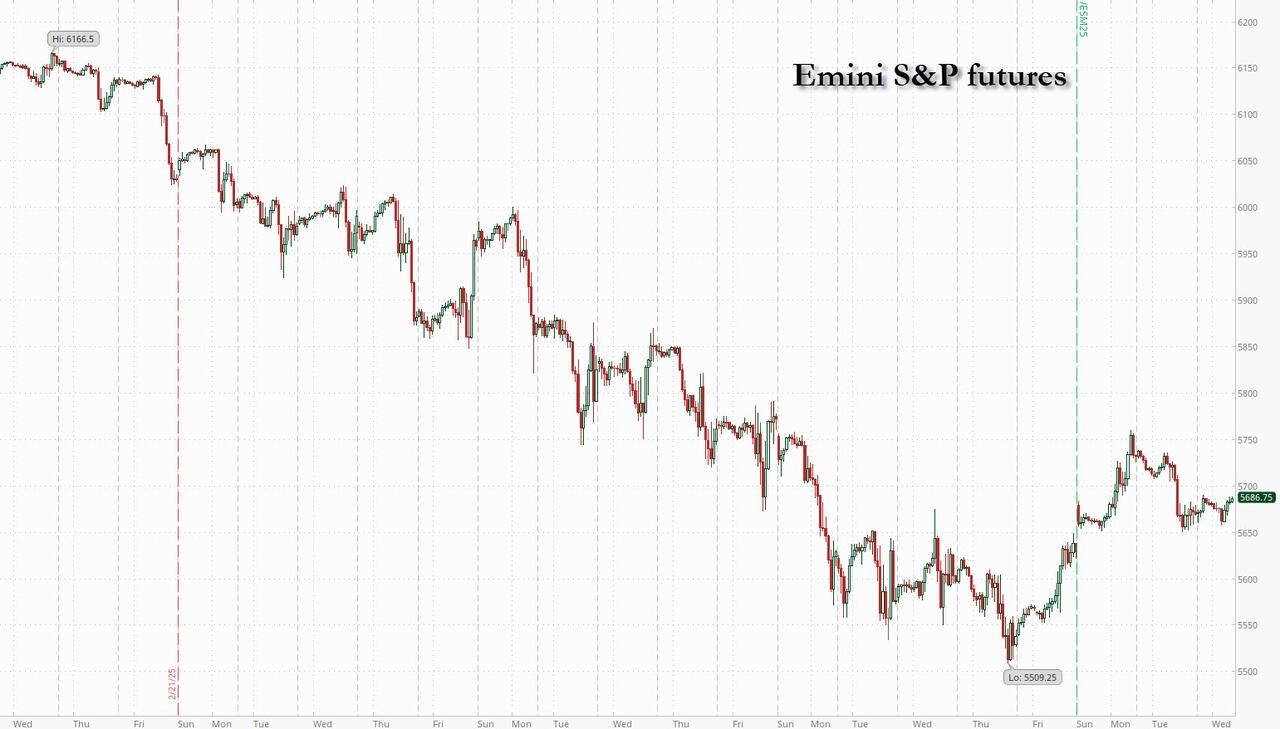

Futures Rise With All Eyes On Fed

Futures Rise With All Eyes On Fed

US equity futures are higher into Fed day, rebounding from Tuesday's losses, with both tech and small caps outperforming, while European stocks inch higher having recovered from an earlier drop after Turkey assets and FX imploded following the latest political crackdown in the banana republic. As of 8:00am ET, S&P and Nasdaq futures are 0.3% higher with all Mag7 names higher premarket led by TSLA (+3%) after the electric-vehicle maker received California’s approval to start carrying passengers. NVDA rose +1% after CEO Jensen Huang promised a clearer payoff to customers. The shares had dropped 3.4% Tuesday. China ETF KWEB is outperforming QQQ pre-mkt on Tencent earnings. Financials are also catching a bid with bond yields flat and the USD is higher for the first time in 4 sessions, boosted in part by the 10% plunge in the Turkey lira, which is spilling over across EMs. Commodities are weaker as 3 complexes are under pressure; WTI is flat reversing an earlier loss on Ukraine energy-based de-escalation. Reuters is https://www.reuters.com/world/us-suspends-some-efforts-counter-russian-sabotage-trump-moves-closer-putin-2025-03-19/

that the US is suspending some multi-agency and multi-country efforts to counter Russian sabotage, potentially to help a deal move through. Today’s pre-market rally may gain strength depending on whether the FOMC dots are modestly lowered, whether Powell’s press conference is seen as dovish and any adjustments to QT.

?itok=PivhARpC

?itok=PivhARpC

In premarket trading, Tesla is leading gains among the Magnificent Seven stocks after the electric-vehicle maker was granted approval in California to begin carrying passengers in its vehicles in a step toward ride-hailing services (Alphabet +0.3%, Amazon +0.2%, Apple +0.3%, Microsoft +0.2%, Meta +0.1%, Nvidia +1% and Tesla +3%). Black Diamond Therapeutics (BDTX) rises 27% after the company entered into a licensing agreement with Servier, a pharmaceutical group governed by a non-profit foundation. Here are some other notable premarket movers:

Cargo Therapeutics (CRGX) soars 19% after appointing Anup Radhakrishnan as interim CEO to lead the company through a reverse merger or other business combination.

General Mills (GIS) slips 3% after the packaged-food company cut its organic net sales forecast for the full year.

Gilead Sciences (GILD) drops 2% after the Wall Street Journal reported that the US Department of Health and Human Services was weighing plans to cut federal government funding for domestic HIV.

HealthEquity (HQY) drops 14% as fraud-related costs weighed on results.

Signet Jewelers (SIG) jumps 14% after the owner of Kay Jewelers said sales are recovering following a disappointing holiday season

StoneCo (STNE) climbs 10% after the Brazilian fintech posted 4Q adjusted net income that beat.

Venture Global (VG) gains 6% after Bloomberg reported that the Trump administration is prepared to give the company conditional approval to export natural gas from a planned facility in Louisiana that had stalled under former President Joe Biden.

Today's main event is the FOMC decision (full https://www.zerohedge.com/markets/march-fomc-preview-markets-are-hunt-clarity

), where the Fed is expected to hold interest rates steady, while its latest dot plot should offer clues on the central bank’s thinking on the economy. Powell’s news conference will also be scrutinized for his views on the potential impact of the trade tariffs and how much support could be offered to the economy this year.

“Investors continue to search for a policy circuit breaker, either from the White House or the Fed,” said Robert Griffiths, an equity strategist at L&G Investment Management. Griffiths noted the Fed’s dovish pivot in late-2019 had come after a 30% drop in the Nasdaq, a far steeper decline than the index has suffered this year. What’s more, the full impact of the tariffs on inflation and the economy remains unclear, implying “the Fed’s ability to act pre-emptively on this occasion is extremely limited,” he added.

Meanwhile, geopolitics remains front and center and adds a fresh layer of worry, as the Gaza truce ended, Russia rejected Trump’s ceasefire proposal in Ukraine and Turkey ignited a selloff in its markets by detaining a key opposition figure. The lira plunged more than 10% to record lows and the main equity index dropped after the detention of Istanbul mayor Ekrem Imamoglu.

Europe's Stoxx 600’s three-day winning streak stalled, with Turkey-exposed stocks such as BBVA and ING posting losses; technology and energy shares were the best performing sectors, while mining and personal care stocks are the biggest laggards. The Stoxx 600 is now up 0.1%, led by gains in consumer products, technology and energy names. Here are the biggest movers Wednesday:

Softcat shares rally as much as 13% to the highest since June, after the UK IT reseller raised guidance for operating profit growth and reported first-half results that beat estimates

Cargotec gains as much as 7.5%, the most in almost five months, as Danske Bank lifts its rating on the Helsinki-listed cargo-handling equipment maker to buy from hold

Bridgepoint shares rise as much as 5.6% after being upgraded to buy by analysts at Citi, who argue the risk-reward profile looks attractive following the stock’s recent underperformance

M&G shares rise as much as 4.5%, hitting their highest level in almost a year, after the investment manager’s results for 2024 came in better than expected, according to Jefferies

Saab drops as much as 7.2%, slipping from yesterday’s record closing high, as Danske Bank double-downgrades to sell and says valuation is “perhaps not attractive enough” to reflect potential headwinds

Compass Group shares fall as much as 6.1%, hitting the lowest level since Oct. 15, after BNP Paribas Exane downgraded the stock to underperform from outperform

Raysearch falls as much as 13%, the most since Aug. 29 2022, after the Swedish medical technology firm’s CEO Johan Lof sold some of his Class B shares in the company at a 10.1% discount vs. Tuesday’s close

Pan African Resources shares fall as much as 6.8% in London, after Tembo Capital Mining Fund sold its entire stake at a discount to the last close

Ferrexpo falls as much as 15% in London, the most since Feb. 20, after the miner reported revenue for the 2024 full year that missed the average analyst estimate

Steyr Motors drop 61% in Frankfurt, paring 1170% rally over previous 12 days, after majority owner Mutares said it plans to sell further shares in the company

Earlier in the session, Asian stocks were mixed as traders await more clues on the economic outlook from the Federal Reserve’s policy decision later Wednesday. Indonesian stocks bounced back from Tuesday’s steep selloff. The MSCI Asia Pacific Index erased earlier gains of as much as 0.4% to trade little changed. While the US central bank is expected to hold interest rates steady, officials may offer more clarity amid President Donald Trump’s tariff threats and fears of a US recession. Chinese benchmarks were mixed as uncertainties lingered over Beijing’s policy-direction in boosting consumer spending and stoking local demand. In a note Monday, Bank of America strategists warned of a “meaningful correction” for China’s stock rally, given its similarities with the 2015 boom-and-bust cycle. Meanwhile, Japanese shares gained after the central bank held rates steady as expected. South Korea’s stock benchmark also climbed, ahead of an imminent verdict in the impeachment of Yoon Suk-Yeol.

In FX, the Bloomberg Dollar Spot Index climbs 0.3%. The Swedish krona is the weakest of the G-10 currencies, falling 0.7% against the greenback. The euro retreated from five-month highs, after gains sparked by Germany’s plan for hundreds of billions of euros in debt financing. Lawmakers green-lit the package in Berlin on Tuesday. The yen is down 0.3% after the Bank of Japan kept its benchmark rate unchanged and cited worries over the potential impact from US tariff policies. The Turkish lira fell by more than 12% to a fresh record low after the detention of President Recep Tayyip Erdogan’s most prominent rival stoked concern that recent investor-friendly economic policies may be rolled back. It has since trimmed some losses.

In rates, treasuries dip, pushing the 10 Year Treasury yield 1bp higher to 4.29%, marginally cheaper on the day, trailing German counterparts by 3bp; US curve spreads are likewise little changed in muted trading conditions ahead of Fed decision. Bunds pared an earlier rally, although German 10-year borrowing costs are still down 3 bps at 2.78%. Traders have been piling into hawkish hedges that anticipate the central bank remaining on hold through June; Fed-dated OIS contracts currently price in around 58bp of easing by year-end with the first move fully priced by the July policy meeting

In commodities, oil prices are unchanged, reversing an earlier loss after Russian President Vladimir Putin declined Donald Trump’s bid for a 30-day ceasefire in Ukraine, agreeing instead to limit attacks on the country’s energy infrastructure. WTI is flat at $66.75 a barrel. Spot gold is steady around $3,036/oz having hit another record high earlier today. Bitcoin rises 2% to around $83,700.

On today's calendar, besides the all important FOMC decision, it's quiet: we get MBA mortgage applications (which dropped 6.2% after jumping 11.2% last week) and the January TIC flows at 4pm.

Market snapshot

S&P 500 futures up 0.3% to 5,627.50

STOXX Europe 600 down 0.1% to 553.60

MXAP little changed at 189.77

MXAPJ down 0.2% to 594.00

Nikkei down 0.2% to 37,751.88

Topix up 0.4% to 2,795.96

Hang Seng Index up 0.1% to 24,771.14

Shanghai Composite little changed at 3,426.43

Sensex up 0.3% to 75,491.07

Australia S&P/ASX 200 down 0.4% to 7,828.25

Kospi up 0.6% to 2,628.62

German 10Y yield little changed at 2.78%

Euro down 0.3% to $1.0908

Brent Futures down 0.7% to $70.10/bbl

Gold spot down 0.1% to $3,032.05

US Dollar Index up 0.28% to 103.53

Top Overnight News

The Fed’s quarterly dot plot due today may look hawkish, with Bloomberg Intelligence calling it a coin flip whether the median will show one or two 25-bp cuts this year. Traders are pricing in at least three. The central bank is expected to keep the key rate unchanged. BBG

WSJ's Timiraos wrote central banks can lower rates because of good or bad news and the window for ‘good’ cuts is closing due to new inflation risks, while he noted that most officials are expected to pencil in one or two rate cuts this year but projections are likely to obscure how the Fed’s wait-and-see holding pattern has undergone an important reset because of the threat of an expansive trade war that sends up prices.

Tesla (TSLA +3.6% in premarket) receives the first approvals in California needed to run a fleet of robotaxis in the state. RTRS

A federal judge ruled that Elon Musk probably exercised unconstitutional power in orchestrating DOGE’s efforts to shutter USAID. The White House said it will appeal. BBG

US crude inventories rose by 4.59 million barrels last week, API data is said to show. That would take total holdings to the highest since July if confirmed by the EIA. Trump will meet with oil industry execs later today. BBG

Volodymyr Zelenskiy will have a phone call with Donald Trump today, he said. Earlier, US officials told European counterparts they’ll need to be involved in negotiations given its sanctions on Russia, people familiar said. BBG

The lira sank after Istanbul’s mayor was detained at his home this morning. Ekrem Imamoglu is widely seen as Recep Tayyip Erdogan’s main rival and a top contender for the presidency. Turkish lenders were said to have sold about $8 billion to support the currency. BBG

Chinese banks are slashing rates on consumer loans to record lows as policymakers ramp up stimulus to stabilize growth and counter US President Donald Trump’s tariffs. Lenders across the wealthier areas of Shanghai, the nation’s financial capital, and Hangzhou, a key tech hub, are engaged in a price war, offering annual interest rates as low as 2.58% on loans to fuel restaurant visits and shopping, according to online ads. That compares to rates as high as 10% about two years ago. BBG

Euro-area inflation was revised down in February, strengthening calls for the ECB to continue cutting rates. CPI rose 2.3%, less than the 2.4% Eurostat first flagged. BBG

Indonesia’s securities regulator eased share buyback rules after this week’s stock rout. The benchmark equity index closed higher for the first time in five sessions. The central bank held its key rate at 5.75%, as expected, and said it sees one cut this year. BBG

The Bank of Japan kept interest rates steady on Wednesday and warned of heightening global economic uncertainty, suggesting the timing of further rate hikes will depend largely on the fallout from potentially higher U.S. tariffs. But Governor Kazuo Ueda also said rising food costs and stronger-than-expected wage growth could push up underlying inflation, highlighting the central bank's attention to mounting domestic price pressures. RTRS

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed as the region lacked firm conviction following the negative handover from Wall St and as participants braced for central bank announcements including the BoJ decision which lacked any major fireworks. ASX 200 was subdued for most of the session and finished lower in the absence of any fresh bullish catalysts. Nikkei 225 initially benefitted from recent currency weakness which helped the index shrug off disappointing machinery orders and weaker-than-expected trade data to briefly reclaim the 38,000 level. However, the index then gradually pared its gains following the lack of surprises from the BoJ's unsurprising decision to maintain rates at 0.50%, Hang Seng and Shanghai Comp were choppy with participants cautious as they digested recent earnings releases and with tech stocks contained heading into Tencent's results due later today.

BOJ

Policy Announcement: maintained its short-term interest rate target at 0.5%, as expected with the decision made by unanimous vote. BoJ said Japan's economy is recovering moderately, albeit with some weak signs, while consumption is increasing moderately as a trend and inflation expectations are also heightening moderately. BoJ stated they must be vigilant to the impact of financial and FX market moves on Japan's economy but added that Japan's economy is likely to continue growing above potential. Furthermore, it expects underlying inflation to converge towards a level consistent with the price target in the latter half of the three-year period projected under the Outlook Report but noted uncertainty surrounding Japan's economy and prices remains high.

Ueda: will adjust the degree of easing if its economic and price outlook is realised; not pessimistic about Q1 GDP growth compared to its recent forecast. Still the BoJ's view that the neutral rate has a wide range, BoJ has still not narrowed-down what the neutral rate is. The BoJ will respond 'nimbly' if there are abnormal long-term yield moves; adds that we are not in such a situation now. This Shunto result is largely in line with its view from January, wage trends are 'on track', or slightly stronger. There was a view at today's meeting that there was upward pressure on inflation. Will not raise interest rates when the economy is in bad shape.

Top Asian News

Tencent Holdings (TCEHY) (CNY) Q4 adj. net of 55.3bln (exp. 53.3bln), revenue 172.5bln (exp. 168.7bln); to raise dividend and buyback

European bourses kicked off the session on the backfoot amid a bout of general risk pressure following the European cash open with a few factors potentially influencing though there was not one clear driver; Stoxx 600 -0.1%. Sectors are mostly negative with Basic Resources lagging on pressure in Rio Tinto (-0.9%) after it pushed back on calls for a unified listing in Australia. Stateside, futures are firmer across the board but only modestly so; ES +0.3%, NQ +0.3%. Early doors, the benchmarks were knocked as part of a broader risk move with numerous factors potentially exerting influence; namely, Putin-Trump digestion and potential breach of the energy ceasefire, Ueda’s hawkish language, Turkish turmoil and ongoing tariff uncertainty. More broadly, focus remains on the Fed. NVIDIA's (+1%) GTC saw a flurry of partnership announcements, Apple's (+0.2%) Siri AI may miss Spring launch target, Oracle (+0.4%) mulls a stake in TikTok US, JPMorgan (+0.2%) hikes its dividend, Morgan Stanley (-0.1%) to cut jobs, Citi (+0.4%) lowers bonuses.

Top European News

UK Chancellor Reeves is planning a new multi-billion pound public spending squeeze in next week's Spring Statement, following an announcement on Tuesday of GBP 5bln in welfare cuts, according to FT.

Irish Central Bank warned of significant impact from higher tariffs and cannot rule out a recession, while it lowered its GDP growth forecast for 2025 to 4.0% from 4.2% and 2026 forecast to 4.0% from 4.5%.

TRY and Turkish equities pressured after the detention of Imamoglue. Borsa Istanbul temporarily halted trading.

Head of France's BNIC Cognac lobby says French Foreign Minister plans to visit China at the end of March.

FX

USD is firmer vs. peers as we count down to the FOMC. Focus for the meeting is on the dot plot, Powell/statement commentary on tariffs and the US economy in addition to anything on QT. DXY at the upper-end of a 103.25-103.71 band.

EUR/USD lower early doors, hit by EUR/JPY action during the Ueda presser. Down to a 1.0874 base at worst. Specifics for the bloc a little light after the Bundestag vote and ahead of the Bundesrat on Friday.

JPY choppy but ultimately softer in wake of the BoJ where rates were kept on hold, as expected. The subsequent presser sparked some JPY strength as Ueda turned slightly more hawkish throughout it and as the risk tone deteriorated. USD/JPY currently firmer but off best in a 149.15-150.15 band.

Sterling on the backfoot given JPY action with general USD strength also factoring. Pressure which comes despite favourable EUR/GBP movement. For the UK, specifics are light as we count down to the BoE on Thursday. Cable finds itself at the lower-end of a 1.2958-1.3004 band and pulling back from Tuesday's 1.3010 YTD peak.

TRY hit by the arrest of the likely main opposition candidate to Erdogan, with USD/TRY hitting a record 41.0132 peak after this.

Antipodeans are both extending on the downside seen yesterday with the latest leg lower coinciding with selling in European equity futures ahead of the cash open. From a fundamental perspective, little reaction was seen from the relatively stable Australian Leading Index and softer-than-expected New Zealand Current Account data.

Fixed Income

Benchmarks bid early doors as the risk tone deteriorated with, as discussed elsewhere, no one factor behind this. Since, as sentiment recovers, benchmarks are off best with USTs just into the red, Gilts near-unchanged and Bunds around 30 ticks off best.

JGBs came under pressure into and after the BoJ itself. Thereafter, Ueda’s press conference began with him sitting on the fence and as such JGBs got back to their 138.25 peak before pulling back sharply to a 138.07 base, where it remains, as Ueda turned slightly more hawkish.

USTs hit a 110-27 peak on the deterioration in the risk tone, stalling just before the proceeding sessions’ 110-29 and 110-30 respective highs. Specifics a touch light this morning as we digest the readout from Putin-Trump and count down to the FOMC; USTs back toward 110-20+ lows most recently.

Bunds are firmer but also off best as the general fixed income rally seen in the European morning takes a slight breather and with Bunds specifically also acknowledging dual tranche supply.

Gilts find themselves back to trading between USTs and Bunds after leading the action for a change on Tuesday. Focus for today, aside from the above macro points, is on PMQs where details will be sought on the disability reform Labour announced and whether the cost savings from this go far enough to restore headroom.

Commodities

Crude futures remain under pressure after Tuesday’s constructive geopolitical developments, with both WTI and Brent trading at weekly lows of USD 66.21/bbl and USD 69.90/bbl respectively.

Trump-Putin talks were described as productive, with the leaders agreeing on a temporary halt to energy infrastructure strikes and immediate talks on a complete ceasefire. However, it does appear that this agreement may have already been breached by Russia, with attacks reported on power supplies in the Dnipropetrovsk region this morning. Most recently, IFX citing Russia’s Defence Ministry reports that Ukraine attacked Russian infrastructure overnight.

Dutch TTF is firmer, supported by the lack of a full ceasefire in Ukraine, along with reports of Russian and Ukrainian breaches of this energy agreement, as mentioned in the crude section.

Spot gold has given back some of the gains from Tuesday, with the yellow metal still comfortably clear of the USD 3k/oz mark, but shy of the USD 3045/oz ATH which printed after the Putin-Trump call.

Base metals are, broadly speaking, little changed with the risk tone tentative as we count down to the FOMC and updates on the multiple other in-focus macro drivers.

US Private Inventory Data (bbls): Crude +4.6mln (exp. +0.9mln), Distillate -2.1mln (exp. -0.3mln), Gasoline -1.7mln (exp. -2.4mln), Cushing -1.1mln.

Geopolitics: Middle East

Israeli army attacked Khan Yunis and conducted heavy shelling in the southern Gaza Strip, according to Al Jazeera.

Hamas leader said continuation of the Israeli bombardment of Gaza will lead to the death of many Israeli prisoners and the movement is communicating with mediators to force Israel to respect its commitments to the ceasefire.

US bombed targets in areas east of Hodeidah in Yemen and there were at least 10 US strikes that targeted areas in Yemen, according to Houthi media.

Geopolitics: Ukraine

Russia's Medvedev said the Putin-Trump call showed there is only Russia and the US in the 'dining room' eating a 'Kyiv-style cutlet' as a main course.

US Special Envoy Witkoff said talks with Russia on the Ukraine war will take place on Sunday in Jeddah.

Ukrainian President Zelensky said Russia launched over 40 drones targeting civilian infrastructure and it is precisely such night attacks by Russia that destroy Ukraine’s energy and civilian infrastructure. Zelensky added the fact that Tuesday night attacks were no exception shows the need to continue pressure on Russia for the sake of peace, as well as noted that Russian President Putin de facto rejected the proposal for a complete ceasefire and it would be right for the world to reject any attempts by Putin to drag out the war in response.

UK PM Starmer spoke with Ukrainian President Zelensky on Tuesday evening and discussed progress US President Trump had made towards a ceasefire in talks with Russia, according to Downing Street.

Regional governor in Russia's Belgorod region said the situation remains difficult, a day after Russia said its forces had thwarted Ukrainian attempts to push across the border in Belgorod. It was separately reported that a drone attack sparked a fire at an oil depot in Russia's Krasnodar region, according to regional authorities.

UK Foreign Secretary said the EU and UK are to accelerate shipments of arms to Ukraine ahead of a potential full ceasefire, according to Bloomberg.

Russian Defence Ministry says Ukraine attacked Russia's energy infrastructure overnight, according to IFAX; CPC Kropotkinskaya oil pumping station stopped operating after damage, according to Tass.

Ukraine State Railways in the Dnipropetrovsk region says Russian forces have attacked its power system on Wednesday morning.

Finland President Stubb says if Russia refuses to agree, will need to increase its efforts to strengthen Ukraine and ratchet up pressure on Russia to convince it to come to the negotiating table.

Ukrainian President Zelensky says he hopes a ceasefire will eventually be implemented; says Russian President Putin's words are at "odds with reality", in relation to the halt on energy strikes. Will speak to US President Trump on Wednesday.

Geopolitics: Other

US Secretary of State Rubio warned unless Venezuela's government accepts a flow of deportation flights, the US will impose new and escalating sanctions, while Venezuela's government said sanctions are an economic war and responsible for hardships.

US Event Calendar

07:00: March MBA Mortgage Applications, prior 11.2%

14:00: March FOMC Decision

16:00: Jan. Total Net TIC Flows

DB's Jim Reid concludes the overnight wrap

Welcome to FOMC decision day which we'll preview later. Ahead of that, the air continues to deflate from the tech balloon (or bubble depending on your view) with the interesting question being whether this would have happened without the tumultuous trade headlines of the last month. The market is understandably fixated with how negative the trade headlines have been for US equities but the reality is that in February when the S&P 500 was only down -1.42%, the Mag-7 were down -8.77%. So don’t underestimate the tech sell-off as being the primary reason for US equity weakness of late.

This sell-off continued yesterday with the Mag-7 down -2.47% to the lowest levels since September, dragging the S&P down -1.07%. Tesla (-5.34%) and Nvidia (-3.43%) again lagged, while Meta (-3.73%) became the last of the Mag-7 to fall into the negative territory YTD. The rest of the Mag-7 are down by between -9% and -44% YTD. Overall the Mag-7 is down -16.19% so far this year, with the S&P 500 -4.54%. Interestingly the equal weight S&P 500 (-1.00% YTD) is only slightly lower, so outside of the Mag-7 it's just a small sell-off so far. So when we think about the US market falls this year I would say sentiment changes towards the Mag-7 are a bigger impact domestically than the trade headlines even if both matter.

Over the other side of the pond your crystal ball would probably have been launched in the bin had you predicted that the DAX (+17.44% YTD) would be up as much at this stage of the year in absolute terms and especially versus the Mag-7 and the overall US market. However the news out of Germany continues to be positive with the CDU/SPD/Greens yesterday achieving the two-thirds majority needed for the debt brake reform containing the huge potential defence spending boost, and the €500bn infrastructure fund. So it was another day of European out-performance with the DAX (+0.98%) and the STOXX 600 (+0.61%) strong but with the IBEX (+1.58%) and FTSE-MIB (+1.31%) even stronger showing the halo impact of German spending. European bond yields largely held steady, with 10yr bund yields -0.8bps lower, but with the Euro (+0.21%) edging higher and to a fresh five-month high of 1.0945.

Incoming German Chancellor Friedrich Merz’s next test will be Friday’s vote in the Bundesrat – the second chamber comprising the 16 state governments – at 8:30AM GMT. As we said on Monday, the hurdle for the constitutional amendments to pass the Bundesrat is lower than it was in the Bundestag, especially as Bavaria has confirmed that it will support the package. So the execution risk is declining still further from already low levels.

Back to the US, and today brings the Federal Reserve’s second policy decision of 2025 and their latest Summary of Economic Projections. For the headline decision, we expect the Fed to hold rates steady and, given heightened uncertainty, provide limited guidance about the policy path ahead. And in a closer call, our US economists expect the Fed to announce a pause in QT beginning in April, coupled with forward guidance indicating that QT should resume once the debt ceiling is resolved. For details, see their Fed preview here. Although this is unlikely to be an exciting meeting, plenty has happened since the last meeting so the press conference could see a whole host of challenging questions for Powell. We suspect they will mostly be answered with a straight, non-commital bat, but will make for interesting viewing.

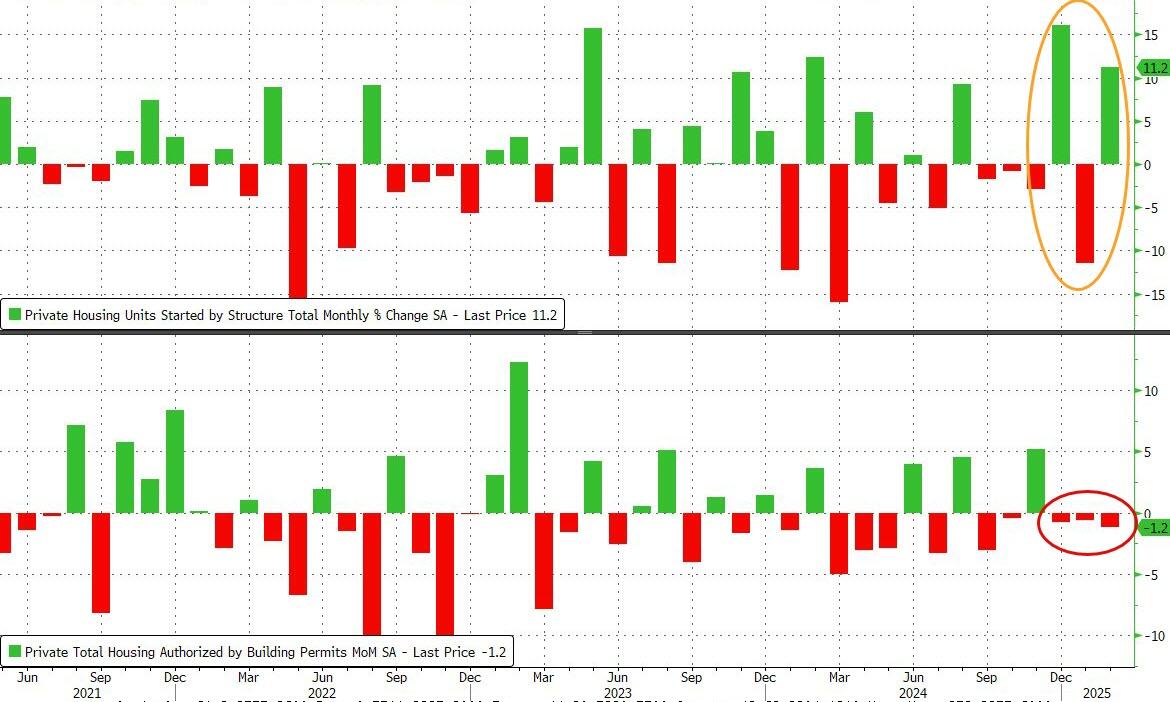

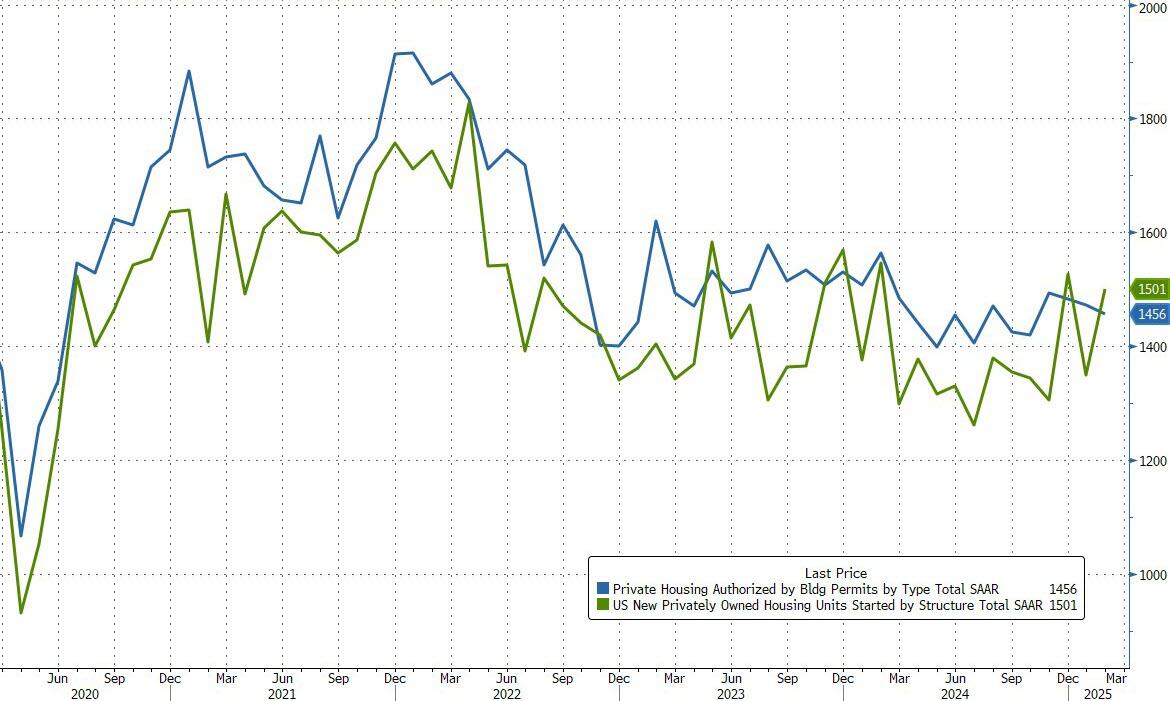

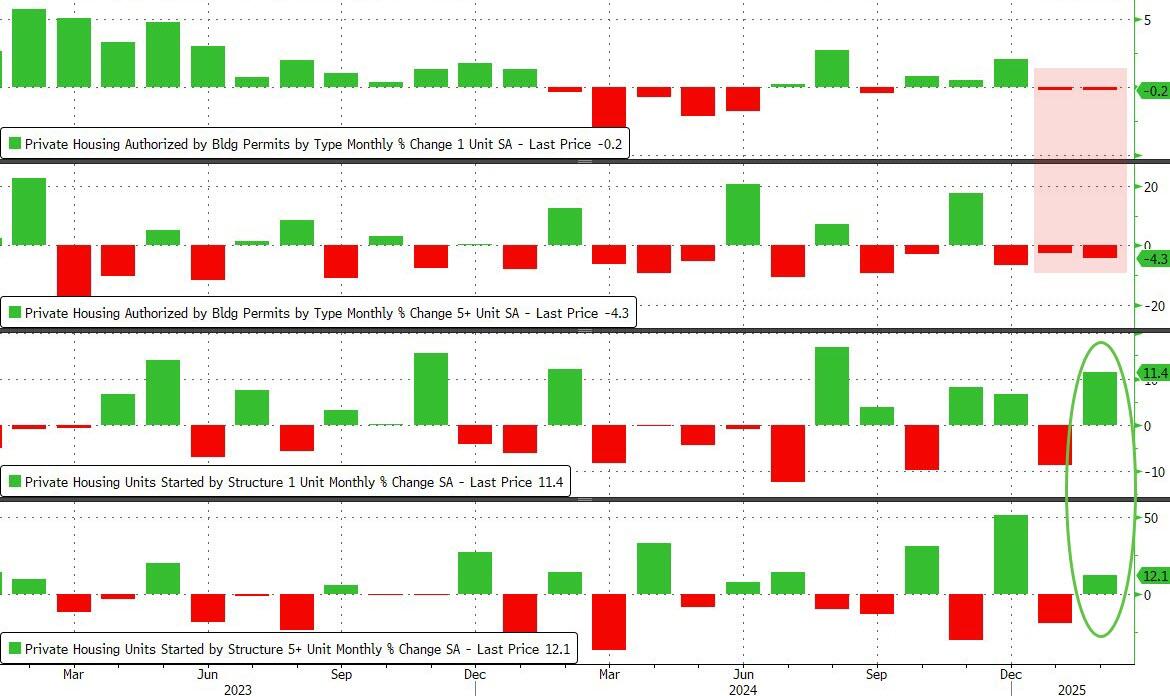

Ahead of that, the latest slew of US data yesterday leaned a little hawkish. Industrial production accelerated to +0.7%m/m (+0.2% expected) from +0.3%m/m in January, and manufacturing production rose +0.9%m/m (+0.3% expected). US housing starts increased +11% to a seasonally adjusted rate of 1.50mn units in February (+1.4% expected), though building permits were more in-line and tend to be more indicative of the underlying trends with starts often weather influenced. Meanwhile, monthly import prices came hotter at +0.4% m/m (vs. 0.0% expected), which included a sizeable jump in imported international airfares (+0.9%) that should add a little upside to next week’s core PCE print.

With all that data, market expectations of Fed rate cuts edged lower, with the amount of easing priced in by the December meeting (-1.2bps to 59bps) falling to its lowest level in three weeks. At the longer end of the rates curve, 10yr Treasury yields swung around but ultimately fell amid the risk off tone with 10yr yields down -1.5bps to 4.29%. The modest rally in Treasuries was also helped by a solid 20yr auction that saw $13bn of bonds issued at 4.63%, -1.4bps below the pre-sale yield. This morning in Asia 10yr USTs have edged back up a basis point.

In geopolitical news, the anticipated Trump-Putin call delivered only one element of definitive progress, with Moscow agreeing “to mutually refrain from attacks on energy infrastructure facilities for 30 days”. While both US and Russian readouts struck a constructive tone, Putin declined the US proposal for an unconditional ceasefire that Ukraine had agreed to, with the Kremlin emphasising that a “key condition” for working towards resolution of the conflict was “the complete cessation of foreign military aid and the provision of intelligence information to Kyiv”. Later in the day, Ukraine’s President Zelenskiy said that the Trump-Putin call showed Russia wasn’t ready for a truce.

The signal of a pause in strikes against energy targets did help Brent crude close -0.72% lower on the day at $70.56/bbl. It had earlier been +1.5% higher intra-day after Israel said it would continue to strike Hamas targets across Gaza but had already reversed this gain by the time headlines from the Trump-Putin call came through. Lastly, Gold continued to set new record highs, rising +1.14% to $3,035/oz amidst Middle East tensions escalating once more.

Asian equity markets are fairly quiet this morning with the KOSPI (+0.70%) leading with the Nikkei (+0.06%) fairly flat after the BoJ left policy unchanged at their meeting. The press conference will start just around the time this hits your inboxes. Chinese markets are all broadly flat but S&P 500 (+0.19%) and NASDAQ 100 (+0.29%) futures are edging back up.

In the statement accompanying the BoJ decision, they cited concerns about the impact of US trade policies on Japan's economic recovery, noting continued uncertainty around economic activity and prices. The Yen and JGBs are relatively unmoved so far.

In terms of data, Japanese exports climbed +11.4% y/y in February (v/s +12.6% expected) up for a fifth straight month driven by strong demand from both the US and China. It followed a revised increase of +7.3% in January. Imports fell -0.7% y/y in February, marking its first drop in three months and compared with the Bloomberg estimate of a +0.8% gain. As such, Japan’s trade balance switched back into the black, with a surplus of ¥584.5 billion (v/s ¥688.3 billion expected).

To the day ahead, aside from the Fed decision, the EU commission will be presenting its White Paper on defense today, with EU leaders expected to discuss their ReArm EU plan on Thursday and Friday. We’ll also get data on Eurozone Q4 labour costs. For earnings releases, expect Tencent, Vonovia, Ping An Insurance and General Mills.

https://cms.zerohedge.com/users/tyler-durden

Wed, 03/19/2025 - 08:27

https://www.zerohedge.com/market-recaps/futures-rise-all-eyes-fed

Trump Admin Considering Banning Travel From Dozens Of Countries: Memo

Trump Admin Considering Banning Travel From Dozens Of Countries: Memo

(emphasis ours),

President Donald Trump’s administration has been weighing a travel ban on citizens from dozens of countries, according to an internal memorandum.

?itok=czXCH28T

?itok=czXCH28T

The memo, which was viewed by Reuters, lists 41 countries, divided into three groups.

One group, which includes Afghanistan, Iran, Syria, Cuba, and North Korea, would be set for a full visa suspension.

The five countries in the second group—Eritrea, Haiti, Laos, Myanmar, and South Sudan—would face partial suspensions that would impact tourist and student visas as well as other immigrant visas, with some exceptions.

The third group of 26 countries, including Belarus and Pakistan, would be considered for a partial suspension of U.S. visa issuance if their governments “do not make efforts to address deficiencies within 60 days,” the memo said.

A White House official did not deny that the new travel restrictions are being considered. The official told The Epoch Times in an email that no decision has been made yet.

The State Department did not respond to a request for comment by publication time.

In his first term, Trump https://www.theepochtimes.com/us/new-us-travel-ban-on-8-countries-is-indefinite-and-tailored-2319323

travel restrictions on citizens of eight countries due to security concerns.

Under the Immigration and Nationality Act, a president can “suspend the entry of all aliens or any class of aliens” whenever he “finds that the entry of any aliens or of any class of aliens into the United States would be detrimental to the interests of the United States.”

Hawaii officials sued over the restrictions, arguing they went beyond those allowed by the act.

Courts blocked the order before the U.S. Supreme Court in 2018 https://www.theepochtimes.com/article/supreme-court-upholds-trumps-travel-ban-2-2575287

that the president was able to limit admissions from the countries.

“By its plain language, [the act] grants the President broad discretion to suspend the entry of aliens into the United States,” Justice John Roberts wrote at the time. “The President lawfully exercised that discretion based on his findings—following a worldwide, multi-agency review—that entry of the covered aliens would be detrimental to the national interest.”

After being sworn in on Jan. 20, Trump directed the attorney general and other top officials to identify countries around the world “for which vetting and screening information is so deficient as to warrant a partial or full suspension on the admission of nationals from those countries” pursuant to the act.

While campaigning for the 2024 election, Trump floated a travel ban on citizens from several countries, including Libya and Somalia, as well as “anywhere else that threatens our security.”

Reuters contributed to this report.

https://cms.zerohedge.com/users/tyler-durden

Wed, 03/19/2025 - 08:05

https://www.zerohedge.com/political/trump-admin-considering-banning-travel-dozens-countries-memo

Will They Ever Learn? Democrats Are Losing Popularity For A Good Reason

Will They Ever Learn? Democrats Are Losing Popularity For A Good Reason

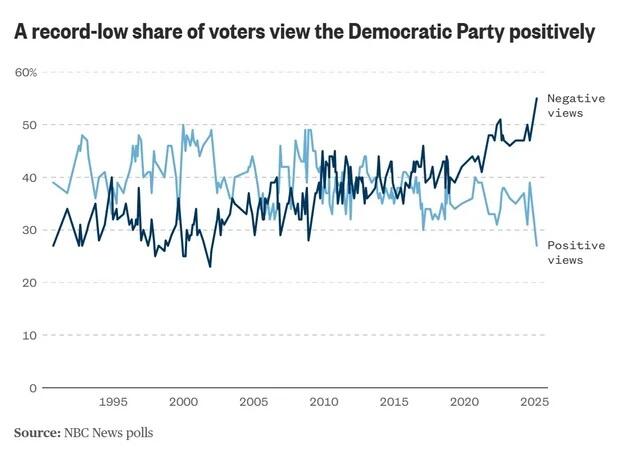

Democrats have hit all time low approval ratings in a pair of polls on Sunday, coming after three months of incessant obstructions against the Trump Administration and attempts to insight civil unrest among leftist activists.

found 27% of registered voters say they view the party favorably − the lowest favorability rating for Democrats in NBC polls going back to 1990. Only 7% of survey respondents said they said they have a "very positive" view of the party.

Another poll https://s3.documentcloud.org/documents/25563079/cnn-poll-political-parties.pdf

similarly found 29% of voters view Democrats in a positive light, the lowest in CNN's polling since 1992. Among Democrats and Democratic-leaning independents, 63% said they have a favorable view of the party.

?itok=HrNur3yd

?itok=HrNur3yd

In the wake of their embarrassing election beat down in 2024 when they lost the House, the Senate and the Oval Office, Democrats have been scrambling to find new leadership. They have not, however, tried to find a new identity, and this is likely a big reason why they continue to plummet in popularity with average Americans.

Playing the role of woke vigilantes fighting for DEI and transgender propaganda in public schools caused a large number of independents and moderates to run from the Democrats like the plague in 2024, but as usual they have chosen to double down instead of engaging in self reflection. The party's image as "champion of the marginalized" has spiraled out of control, with many Dem officials trying to justify every abhorrent behavior from widespread destruction of private property to stopping the deportation of terrorists.

Democrats claim that the reason for their precipitous drop in approval is that they "just aren't fighting Donald Trump hard enough..."

Democrat Sen. Chris Murphy is spot on here: The American people want us to fight Donald Trump harder — because if we don’t, we’ll lose our Democracy. https://t.co/zBhyeBet8z

— Sarah Jane Winfoot 🇭🇹 (@SJWinfoot) https://twitter.com/SJWinfoot/status/1901431279511363857?ref_src=twsrc%5Etfw

In other words, they argue that they need to do more of the same while ignoring the fact that a majority of US voters chose Trump specifically to institute government audits, cut waste, secure the borders and deport illegal aliens. Democrats are attacking Trump for keeping his campaign promises.

This is another classic case of leftists claiming they love "democracy" while treating the American public as if they're stupid. Progressives think they know what's best for everyone and they will never concede that they might be wrong. This is the real reason why they're unpopular.

?itok=TdGVlLYY

?itok=TdGVlLYY

Meanwhile, the latest polls also show Donald Trump's approval https://nypost.com/2025/03/16/us-news/trump-hits-highest-approval-hes-ever-had/?utm_campaign=nypost&utm_medium=social&utm_source=twitter

in large part due to his border policies and government cuts. Though, the survey also shows Americans want the President to do more on the economy. To be fair to Trump, three months is not a lot of time to fix four years of record stagflation, and the fix (deflation) is sure to cause a lot of public uncertainty as well.

The 2024 election was not a tight and contested race; it wasn't even close. The people have spoken and they resoundingly rejected far-left ideology. Democrats have chosen a path of provocation, disruption and sabotage instead of making peace and accepting their losses with dignity. This kind of blind zealotry isn't going to win them any elections anytime soon, but it might just cause extreme division and violence. Perhaps that's all they want.

https://cms.zerohedge.com/users/tyler-durden

Wed, 03/19/2025 - 07:45

https://www.zerohedge.com/political/will-they-ever-learn-democrat-party-popularity-hits-record-lows

Goldman Slashes US Immigration Forecast As 'America First' Agenda Takes Hold

Goldman Slashes US Immigration Forecast As 'America First' Agenda Takes Hold

Vice President JD Vance spoke earlier to companies working "in the national interest" at the American Dynamism Summit, sponsored by venture capital firm Andreessen Horowitz. In his address, he highlighted the significant progress achieved in just two months under a competent administration in securing the southern border and strengthening national security—following the previous administration's globalist policies that sparked an illegal alien invasion crisis.

"Last month, migrant crossings were down 94%, to their lowest number all time, and that happened just in two months of serious border enforcement... Last month, for the first time in over a year, the majority of job gains went to American citizens born on US soil," VP Vance told the crowd at the summit in Washington, DC, earlier this morning.

.https://twitter.com/VP?ref_src=twsrc%5Etfw

— Rapid Response 47 (@RapidResponse47) https://twitter.com/RapidResponse47/status/1901994037982220342?ref_src=twsrc%5Etfw

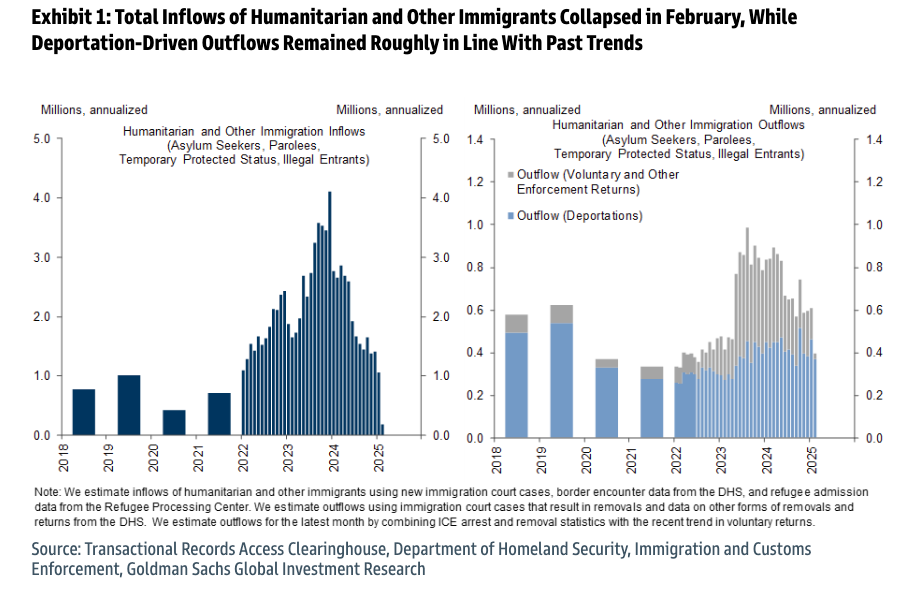

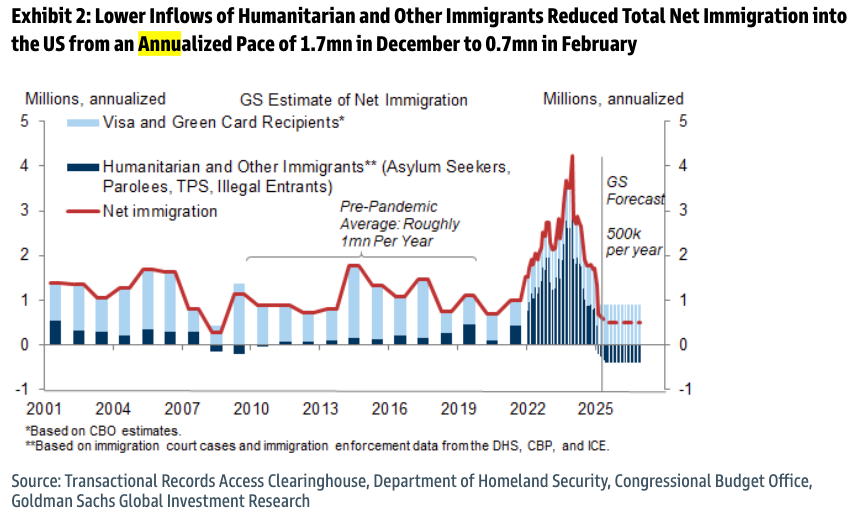

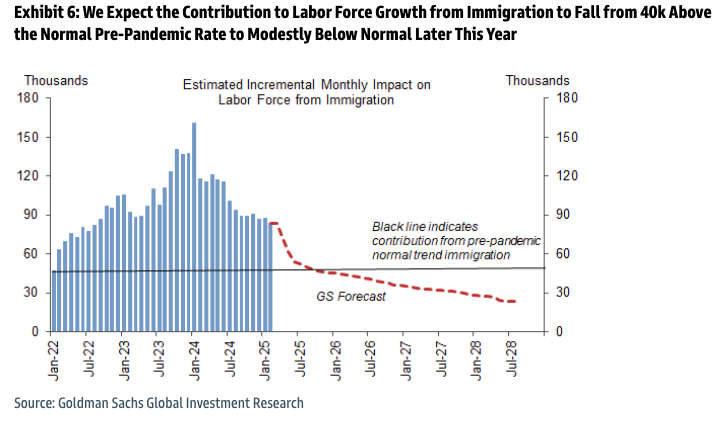

Providing more context on VP Vance's immigration figures, analysts from Goldman, including Jan Hatzius, Alec Phillips, and others, stated that US immigration policy has tightened significantly over the past two months, reducing the annualized inflow of humanitarian and other non-visa immigrants from 1.4 million to 200k. They noted that while deportation levels remained stable, total net immigration fell from 1.7 million in December to 700k in February.

Given the faster-than-expected decline in immigration, the analyst expects net inflows to reach 500k by the end of the year, down from a previous estimate of 750k. The contribution of immigration to labor force growth is also expected to slide and provide more job opportunities for Americans.

Further color from analysts...

How Much Has Immigration Fallen Since the Inauguration?

Immigration policy in the US tightened considerably in the first two months of 2025. We estimate that this resulted in a decline in annualized inflows of humanitarian and other immigrants (asylum seekers, parolees, people receiving temporary protected status, and illegal entrants; this includes all immigrants other than visa and green card recipients) to an annualized 0.2mn in February, down from 1.4mn in December 2024 (left, Exhibit 1).

While official statistics from Immigration and Customs Enforcement (ICE) show a moderate increase in arrests of unauthorized immigrants since early January, the increase has not led to a notable change in the number of deportations. The right side of Exhibit 1 shows that total immigrant outflows due to deportations remained in line with past trends. The number of outflows due to voluntary and other enforcement returns—which tend to be proportional to immigration inflows—declined over the past two months as inflows moderated.

?itok=-FyMaB-N

?itok=-FyMaB-N

Even though the number of deportations did not increase meaningfully, the sharp decline in immigration inflows still brought net immigration into the US down to an annualized pace of 0.7mn in February, from 1.7mn in December 2024 (Exhibit 2).

?itok=-yei465H

?itok=-yei465H

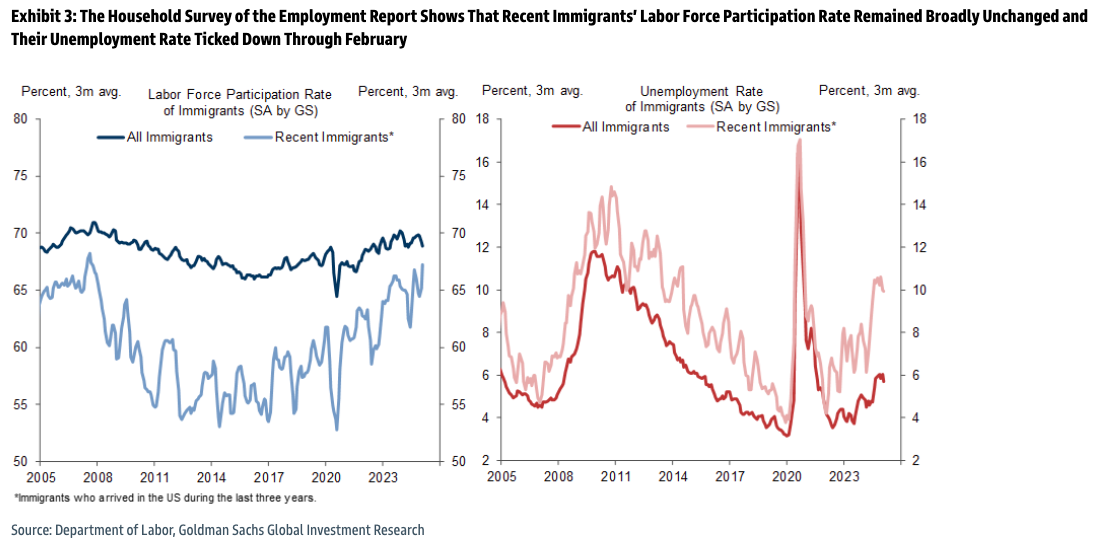

In our prior report, we highlighted the risk that the immigration crackdown might not only reduce inflows of new immigrants but might also make unauthorized immigrants already in the US afraid to go to work or make their employers afraid to employ them. So far, the labor market data that we use to monitor this risk have shown mixed evidence.

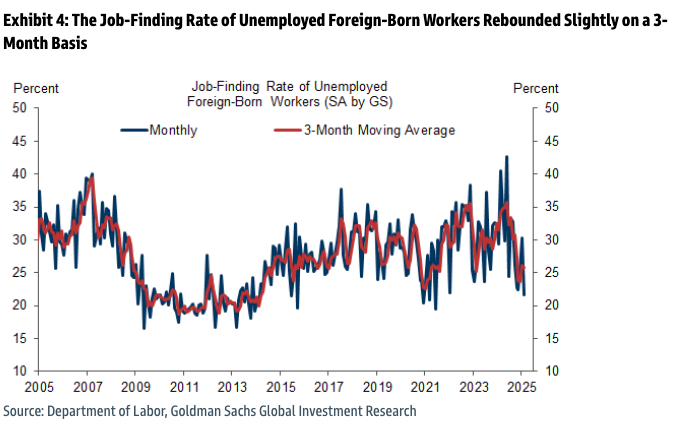

The individual-level micro data behind the household survey of the employment report indicate that recent immigrants' labor force participation rates remained roughly unchanged (left, Exhibit 3) and their unemployment rates declined slightly (right, Exhibit 3), and that the job-finding rates of all immigrants rebounded on a 3-month basis (Exhibit 4). Taken at face value, this suggests that the immigration crackdown has not yet adversely affected labor market conditions for recent immigrants.

?itok=8q7lZi8o

?itok=8q7lZi8o

?itok=D1okmBW4

?itok=D1okmBW4

However, the household survey data might miss some of the negative labor market consequences of the immigration crackdown because immigrants who are most likely to have been negatively affected might also have been afraid to respond to the survey.

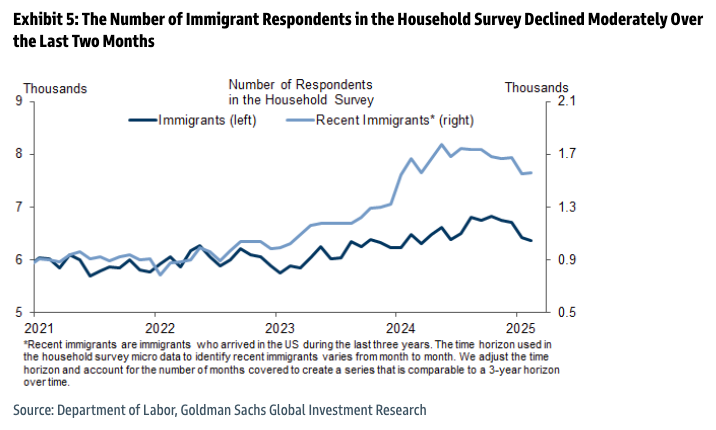

Indeed, we find that the number of immigrant respondents to the household survey—particularly those who arrived over the past three years—declined moderately over the last two months (Exhibit 5).

?itok=3SGhKHVO

?itok=3SGhKHVO

Given these changes, we are lowering our immigration forecast for the end of 2025 to 500k from our previous baseline of 750k (dashed line in Exhibit 2), though we see considerable uncertainty around the estimate, as the number of deportations depends not only on the policy in place but also on the actual enforcement intensity.

Seperatly, jobs data showed President Trump's 'America First' agenda was beginning to take shape:

Native-Born workers increased by 284K to 130.1 million

Foreign-born workers dropped by 84K to 31.7 million https://t.co/EQB042u8NT

— zerohedge (@zerohedge) https://twitter.com/zerohedge/status/1898011013502341316?ref_src=twsrc%5Etfw

This is good news for American workers, circling back to the Goldman note:

?itok=c4N0U6nl

?itok=c4N0U6nl

Trump is opening up the spigot of jobs for the American workers as the migration inbound trends slow and outbound trends persist... This is America First.

https://cms.zerohedge.com/users/tyler-durden

Wed, 03/19/2025 - 06:55

AG Bondi Declares "Swarm Of Violent Attacks" On Tesla As Domestic Terrorism

AG Bondi Declares "Swarm Of Violent Attacks" On Tesla As Domestic Terrorism

Update:

US Attorney General Pam Bondi released a https://www.justice.gov/opa/pr/attorney-general-bondi-statement-violent-attacks-against-tesla-property

overnight, calling the "violent attacks" on Tesla showrooms, service centers, Supercharger networks, and vehicles "nothing short of domestic terrorism."

"The swarm of violent attacks on Tesla property is nothing short of domestic terrorism. The Department of Justice has already charged several perpetrators with that in mind, including in cases that involve charges with five-year mandatory minimum sentences," Bondi stated in a press release.

She continued: "We will continue investigations that impose severe consequences on those involved in these attacks, including those operating behind the scenes to coordinate and fund these crimes."

The latest domestic terrorism attack on Tesla occurred at a service center in Las Vegas early Tuesday morning. Below, we provide readers with dramatic footage (previous post), along with images of the crime scene—featuring one key indication suggesting far-left groups were behind the arson attack.

?itok=_xYEAY_T

?itok=_xYEAY_T

The very fact that the Democrats and their leftist groups are attacking an American company because they are displeased with Elon Musk's DOGE effort to reform the bloated and corrupt federal government—captured by unelected Deep Staters—shows that the so-called party of 'love' is in a massive crisis. Cornered and desperate, Democrats have now resorted to violence.

Those are terrible optics, Democrats. Terrible optics.

Violence is never the answer, yet here we are...

DEVELOPING: Video provided to the Review-Journal shows several https://twitter.com/Tesla?ref_src=twsrc%5Etfw

vehicles engulfed in flames after Las Vegas police say they were set on fire by an individual early Tuesday morning.

UPDATES→ https://t.co/sZQr9j1E5A

— Las Vegas Review-Journal (@reviewjournal) https://twitter.com/reviewjournal/status/1902010578903941330?ref_src=twsrc%5Etfw

Musk on Sean Hannity...

🚨 Elon Musk just SLAMMED the Democrats for violently attacking Tesla

"I always thought that Democrats were supposed to be the party of empathy and caring, and yet they are burning down cars, firebombing dealerships..."

"There is some kind of mental illness going on because… https://t.co/rzW84MXVQH

— Nick Sortor (@nicksortor) https://twitter.com/nicksortor/status/1902175283115127196?ref_src=twsrc%5Etfw

Why haven't Democrats condemned the terror attacks?

* * *

Far-left violence targeting Tesla dealerships, Supercharging networks, and individual Teslas continued early Tuesday morning, with multiple vehicles set on fire at a Tesla service center in Las Vegas.

Local media outlet https://www.8newsnow.com/news/local-news/multiple-vehicles-set-on-fire-at-tesla-center-in-las-vegas-police-say/

reported the Tesla Collision Center in the 6000 block of Badura Avenue, near Jones Boulevard and the 215 Beltway, had several vehicles set on fire in the parking lot by an individual around 0245 local time.

DEVELOPING: Video provided to the Review-Journal shows several https://twitter.com/Tesla?ref_src=twsrc%5Etfw

vehicles engulfed in flames after Las Vegas police say they were set on fire by an individual early Tuesday morning.

UPDATES→ https://t.co/sZQr9j1E5A

— Las Vegas Review-Journal (@reviewjournal) https://twitter.com/reviewjournal/status/1902010578903941330?ref_src=twsrc%5Etfw

"LVMPD Communications received information that an individual had set several vehicles on fire in the parking lot and caused damage to the property," Las Vegas police said.

FBI spokeswoman Sandy Breault for the Las Vegas field office told reporters that agents are on the scene and investigating the fire.

One citizen journalist posted images from the crime scene, showing doors of the Tesla building spray painted with the message: "Resist."

... and there's the political motive.

Tesla cars set on fire in Las Vegas at Badura and Jones. Graffiti on front window of building says "Resist". Photos taken 3/18/25 at 7am https://t.co/cLj9RfGi7Z

— Emperor Batsteg (@batsteg) https://twitter.com/batsteg/status/1902000356114198855?ref_src=twsrc%5Etfw

President Trump has previously stated that leftist attacks on Tesla will be labeled domestic terrorism, and perpetrators will "go through hell." ...

BREAKING: Trump announced any violence against Tesla dealerships would be labeled as domestic terrorism!

GOOD! https://t.co/YBCeOmF0Jb

— Gunther Eagleman™ (@GuntherEagleman) https://twitter.com/GuntherEagleman/status/1899554088506753084?ref_src=twsrc%5Etfw

Latest incidents:

Musk called it "extreme domestic terrorism..."

Encouraging destruction of Teslas throughout the country is extreme domestic terrorism!! https://t.co/8TCNIbrQxA

— Elon Musk (@elonmusk) https://twitter.com/elonmusk/status/1902084259197939834?ref_src=twsrc%5Etfw

Even if you hate Elon and Trump, you have to admit this is domestic terrorism.

The Tesla attacks are getting way out of hand, and people have gone insane.

The far left continues to escalate things, and this is not going to end well.https://t.co/FOoBteT5pU

— Michael Oxford - AKA The Santa Cruz Mountain Goat (@SCMountainGoat) https://twitter.com/SCMountainGoat/status/1900003712686580114?ref_src=twsrc%5Etfw

MORE TESLA TERRORISM

A masked man vandalized a Tesla location in South Carolina with spray paint writing “F*** Trump” and “long live Ukraine.” He then set charging stations on fire with Molotov cocktails and accidentally set himself on fire too.

The suspect is still at large.… https://t.co/bL5PG2yXoY

— Libs of TikTok (@libsoftiktok) https://twitter.com/libsoftiktok/status/1899595188084855106?ref_src=twsrc%5Etfw

President Trump says he will be labeling violent attacks on Tesla locations as acts of “domestic terrorism.” https://t.co/qlyfp5fWYW

— Libs of TikTok (@libsoftiktok) https://twitter.com/libsoftiktok/status/1899553206113305022?ref_src=twsrc%5Etfw

Leftist activists are targeting the American company with arson attacks at showroom locations and Supercharging networks, while deranged lone-wolf liberals are vandalizing Teslas in parking lots, parking garages, and on city streets—driven by rage—all because the Trump administration and Elon Musk's DOGE are eliminating Deep State fraud and waste.

MORE LGBTQ TERRORISM

Erin L. White, a self-identified "She/They" was arrested for allegedly vandalizing a Tesla service center in Buffalo Grove, IL.

White allegedly used spray paint to write "Trump Sold US," "F*ck Elon Musk," and "Trans Rights are Human Rights" on the front… https://t.co/Pq2vCvdBaf

— Libs of TikTok (@libsoftiktok) https://twitter.com/libsoftiktok/status/1901764182795538542?ref_src=twsrc%5Etfw

The coordinated attacks being launched on Tesla are now being called acts of terrorism.

This began with organized protests at Tesla dealerships, then escalated into threats of violence and arson. And now, the Trump admin. is saying it could be a form of domestic terrorism. https://t.co/zyNK3EWCqm

— EpochTV (@EpochTV) https://twitter.com/EpochTV/status/1900297070617244100?ref_src=twsrc%5Etfw

Imagine brainwashing your young adult children to think Trump and Elon are “literally Hitler” only to have them turn into little entitled activists who go out and vandalize Tesla vehicles, charging stations and dealerships which results in felony domestic terrorism charges… https://t.co/bATMF3BiJ1

— Lucy Riles (@LucyRiles) https://twitter.com/LucyRiles/status/1901404129894813781?ref_src=twsrc%5Etfw

This is all a terrible look for Democrats as they defend the corrupt status quo and their unhinged voters attack an American company. The Justice Department might want to investigate if there is any foreign influence in these attacks against the American company.

Sequoia partner Shaun Maguire https://x.com/shaunmmaguire/status/1902073126349131958

on X, "this is all anarchoterrorism."

https://cms.zerohedge.com/users/tyler-durden

Wed, 03/19/2025 - 06:49

Harold Hamm: "Drill, Baby, Drill" Needs $80 Oil

Harold Hamm: "Drill, Baby, Drill" Needs $80 Oil

https://oilprice.com/Energy/Crude-Oil/Harold-Hamm-Drill-Baby-Drill-Needs-80-Oil.html

Harold Hamm: would need an oil price of around $80 per barrel to cover the cost of drilling wells.'

U.S. Energy Secretary Wright: the administration isn’t targeting a specific price of oil, but it works to bring back common sense and pro-energy policies in America.

Scott Sheffield: The cash breakeven price, including dividends, is $50-$55 for U.S. oil companies, and “that $50 oil is not going to work.

U.S. shale needs much higher oil prices than $50 per barrel, and even higher than the current WTI Crude price in the high $60s, for a “drill, baby, drill” boom, oil tycoon and Trump campaign donor Harold Hamm says.

?itok=0WmJ_voX

?itok=0WmJ_voX

American producers, especially those pumping crude outside the Tier 1 inventory in the best Permian locations, would need an oil price of around $80 per barrel to cover the cost of drilling wells.

“There are a lot of fields that are getting to the point that’s real tough to keep that cost of supply down,” Hamm told Bloomberg Television in an interview on the sidelines of the CERAWeek conference in Houston.

“When you get down to that $50 oil that you talked about, then you’re below the point where you’re going to ‘drill, baby, drill,’” the shale pioneer added.

Over the past few days, there has been a lot of talk of $50 oil and the shale industry.

The Trump Administration appeared to be pointing to $50 as a price that would be low enough for American energy prices to drop but still good enough for U.S. shale to prosper.

However, the industry and Wall Street banks beg to differ.

They say that $50 oil is so low that it would see production curtailments as the average cash breakeven price, including dividends, is estimated at $50-$55 per barrel of oil.

And the industry is definitely not prepared to cut dividends after diligently working for a few years to boost shareholder returns and make U.S. oil stocks attractive again.

U.S. Secretary of Energy Chris Wright told the https://www.ft.com/content/6b7f0af8-6c59-44bb-b07a-43d4768b96fd

last week that shale producers could increase production even if oil prices fell to $50 per barrel as the sector continues to innovate and boost efficiency gains.

“New supply is going to drive prices down. Companies are going to innovate, drive their prices down and consumers and suppliers will bounce back and forth,” Wright, a former boss at fracking firm Liberty Energy, told FT.

At CERAWeek by S&P Global, Secretary Wright said the administration isn’t targeting a specific price of oil, but it works to bring back common sense and pro-energy policies in America.

The Trump Administration believes that eased permitting and lighter regulatory burdens on U.S. oil and gas producers would lead to more production even at lower oil prices.

But industry veterans, from Harold Hamm to Scott Sheffield, the founder of Pioneer Natural Resources which was sold to Exxon last year, don’t think prices lower than $60 would work.

Oil executives cheered the pro-energy agenda of the Trump Administration, welcoming the lifting of the Biden LNG permit freeze and the start of the process to repeal the so-called methane fee.

However, they are quietly concerned that oil prices at current levels are already on the verge of making money much more difficult.

Pioneer’s founder and industry veteran Sheffield has some advice for the U.S. oil firms.

“You’ve really got to hunker down,” Sheffield told a Bloomberg Television https://www.bloomberg.com/news/articles/2025-03-11/shale-pioneer-sheffield-warns-oil-chiefs-of-grim-times-ahead

on last week.

Oil prices are likely to fall into the range of $50 to $60 per barrel, Sheffield says, noting that American producers will struggle at these prices.

The cash breakeven price, including dividends, is $50-$55 for U.S. oil companies, and “that $50 oil is not going to work,” Sheffield told https://www.cnbc.com/video/2025/03/11/pioneer-natural-ceo-scott-sheffield-on-trumps-tariffs-impact-on-steel-business-and-oil-prices.html

.

Other industry executives, as well as investment banks, also believe that $65 oil and below would present challenges to U.S. shale to keep production steady, let alone “drill, baby, drill.”

Saad Rahim, chief economist at commodity trader Trafigura, told https://www.bnnbloomberg.ca/markets/oil/2025/03/12/top-oil-traders-turn-bearish-on-prices-seeing-oversupply/

that “$60 feels too low for much of the industry to work.”

With https://oilprice.com/oil-price-charts/#WTI-Crude

.

“A drop into the upper $50s likely results in a bigger psychological impact with the rig count potentially falling ~75 and production down” by more than 300,000 barrels a day (bpd), according to Gruber.

Shale costs will also go up with the U.S. import tariffs on steel and aluminum, executives including Hamm say.

The U.S. has steelmakers “but they can’t supply it all,” Hamm told Bloomberg, referring to the steel pipes the industry uses to drill wells.

https://cms.zerohedge.com/users/tyler-durden

Wed, 03/19/2025 - 06:30

https://www.zerohedge.com/energy/harold-hamm-drill-baby-drill-needs-80-oil

Advocacy Group Calls For US Probe On Non-English Speaking Migrant Truck Drivers After Deadly Austin Crash

Advocacy Group Calls For US Probe On Non-English Speaking Migrant Truck Drivers After Deadly Austin Crash

Local police in Austin, Texas, have arrested truck driver Solomun Weldekeal Araya, 37, in connection with the horrific 19-vehicle crash that left five people dead and 12 injured. The incident highlights rising concerns over America's highways flooded with potentially unqualified migrant truck drivers.

Inbox: According to a reliable internal source, Solomun Weldekeal Araya, an 18-wheeler driver who was arrested and is facing intoxication charges after a North Austin crash that claimed five lives, was a contract driver on a work visa.

He was transporting items from an… https://t.co/EC3ZMLoA2s

— Sarah Fields (@SarahisCensored) https://twitter.com/SarahisCensored/status/1901172449376383175?ref_src=twsrc%5Etfw

According to an affidavit obtained by https://www.kvue.com/article/news/crime/austin-crash-i35-driver-failed-sobriety-test-drugs-responsible-affidavit-solomun-araya/269-b2ae3db3-87ee-4b14-8e9c-a0bc562d79dc

, one witness described Araya's 18-wheeler plowing into stopped traffic along a stretch of highway in North Austin. The person said it was as if the truck driver forgot to brake. Police said Araya is behind bars at the Travis County Jail.

Austin-Travis County EMS wrote on X at the time of the horrific crash on Thursday night that several people were "pinned in their vehicles" following the "collision involving multiple vehicles and a semi-truck."

"5 patients (3 adults, 1 child, 1 infant) have been pronounced deceased on scene," Austin-Travis County EMS wrote on X.

1/2 https://twitter.com/hashtag/ATXTrafficFatality?src=hash&ref_src=twsrc%5Etfw

FINAL Vehicle Rescue on N Ih 35: 17 patients & 17 vehicles involved.

5 patients (3 adults, 1 child, 1 infant) have been pronounced deceased on scene.https://twitter.com/hashtag/ATCEMSMedics?src=hash&ref_src=twsrc%5Etfw

transported 11 patients:

2 adults to St. David’s Round Rock w/life threatening injuries.

— ATCEMS (@ATCEMS) https://twitter.com/ATCEMS/status/1900455997870612802?ref_src=twsrc%5Etfw

According to KVUE, police stated that the driver showed signs of intoxication following the crash despite a preliminary breathalyzer test showing a Blood Alcohol Concentration of 0.00. However, Araya displayed "all six" signs of intoxication and failed a field sobriety test. Authorities raised concerns that he may have ingested depressants before the accident.

According to the advocacy group https://americantruckers.com/

on X, a critical detail about this crash, which reposted a video from the accident scene, is that the driver "barely spoke English."

🚨Austin Truck Crash Kills 5 and Injures 11 - Possible Non-Citizen Truck Drivers Involved🚨

American Truckers United believes there is a 90% chance at least one of the truck drivers was a non-citizen truck driver. The accident investigation should include a background on the… https://t.co/GcBU8EHGbJ

— American Truckers (@atutruckers) https://twitter.com/atutruckers/status/1900542044172361947?ref_src=twsrc%5Etfw

"Experts say he was almost certainly on a Non-Domicile CDL. Special interest groups have flooded our roads with unvetted, unqualified, untrained drivers, endangering us all!" American Truckers said, adding:

DEMAND AN IMMEDIATE INVESTIGATION into this driver's licensing, vetting, and training—or lack thereof!

MORE CRITICALLY, LAUNCH A NATIONAL PROBE into the entities allowing illiterate, ill-trained operators onto our highways!

RESTORE SAFETY, SECURITY, AND INTEGRITY TO OUR ROADS—ACT NOW BEFORE MORE LIVES ARE LOST!

ATU has confirmed: the driver behind today’s horrific Austin, TX crash—killing 5 and injuring 11—barely spoke English. Experts say he was almost certainly on a Non-Domicile CDL. Special interest groups have flooded our roads with unvetted, unqualified, untrained drivers,… https://t.co/uByIPPp5j3

— American Truckers (@atutruckers) https://twitter.com/atutruckers/status/1900724530395459785?ref_src=twsrc%5Etfw

Another X user pointed to the nonprofit Global Impact Initiative, saying that ...

CDL training for Refugees. 501c3 ( of course )