Russia Says UK & France Behind Latest Attack On Its Energy Infrastructure

Russia Says UK & France Behind Latest Attack On Its Energy Infrastructure

There's been another reported attack on the Sudzha pipeline infrastructure in Russia’s Kursk Region on Friday. Foreign Ministry spokeswoman Maria Zakharova conveyed to journalists a Russian military assessment saying a metering facility was "de facto destroyed" in a Ukrainian HIMARS attack.

But unlike some of the prior Ukrainian attacks on the area, the Kremlin is directly blaming the West, going to far as to say that orders for the new strike came directly from European capitals.

?itok=r_IcENBo

?itok=r_IcENBo

We "have reasons to believe that targeting and navigation were facilitated through French satellites and British specialists input [target] coordinates and launched [the missiles]," Zakharova https://www.rt.com/russia/614920-uk-ukraine-attack-violation/

, as cited in national media.

"The command came from London," she emphasized, describing it as part of a West-backed "terror" campaign meant to degrade and destroy Russia's energy infrastructure.

The Kremlin has concluded this demonstrates that Kiev is "impossible to negotiate with," she explained. The Ukrainians have done nothing to actually uphold the energy ceasefire put forward by Trump, despite that Zelensky "publicly supported" it, she said, suggesting it was all an empty game.

"Over the past 24 hours, the Kyiv regime continued its attacks on Russian energy infrastructure using various types of drones and HIMARS multiple rocket launchers," the Russian military had also described.

Russia has alleged Ukraine launched rockets on the Sudzha facility, which had already been damaged in an earlier attack this week, along with nearly 20 drones launched at an oil refinery in the southern Saratov region.

Ukraine is meanwhile denying the Russian allegations, instead suggesting it's a false flag orchestrated https://www.themoscowtimes.com/2025/03/28/russian-army-accuses-ukraine-of-attacking-sudzha-gas-metering-station-a88520

:

On Friday, Ukraine denied claims that its forces fired on the gas metering station Sudzha and accused Russia's military of striking the facility.

"Russia has again attacked the Sudzha gas transmission system in the Kursk region, which they do not control," Andriy Kovalenko, an official who is responsible for countering disinformation, said on social media.

The two sides have traded blame for violating the energy ceasefire on basically a daily basis since it was proclaimed. It seems to have barely held, if at all, despite ongoing pledges from both sides to uphold it.

Large fire at the scene of the metering station attack...

Kiev has launched another assault on the Sudzha gas metering station, signaling that Zelensky has no desire at all to reduce tensions with Russia or pursue Trump’s peace plan. https://t.co/H4fe75lU5u

— Ian Miles Cheong (@stillgray) https://twitter.com/stillgray/status/1905599847169663439?ref_src=twsrc%5Etfw

The US has claimed that it is not providing intelligence for long-range attacks inside Russia by Ukraine, but only intelligence which is defensive in nature. However, Europe is still in maximum support mode, as President Macron and Prime Minister Starmer put together a 'coalition of the willing' to defend Ukraine.

https://cms.zerohedge.com/users/tyler-durden

Sat, 03/29/2025 - 08:45

Communist Revolutionary Arrested In Connection With Vegas Tesla Firebombing Attack

Communist Revolutionary Arrested In Connection With Vegas Tesla Firebombing Attack

The Democratic Party nurtures Communist revolutionaries like 36-year-old Paul Kim, who was arrested this week after shooting and firebombing a Tesla collision center in Las Vegas, Nevada.

🚨 https://twitter.com/hashtag/BREAKING?src=hash&ref_src=twsrc%5Etfw

: The accused terrorıst who firebombed a Tesla showroom in Las Vegas has been ARRESTED, per PD

FAFO is in order!

36-year-old Paul Kim was charged with arson and possession of an explosive device

MAKE AN EXAMPLE OUT OF HIM! 20 YEARS!

Kim allegedly used Molotov… https://t.co/wj7CuIIIlJ

— Nick Sortor (@nicksortor) https://twitter.com/nicksortor/status/1905289948128743658?ref_src=twsrc%5Etfw

LVMPD officers arrested Paul Kim on Wednesday night on charges including arson and possessing an explosive device. LVMPD announced the arrest at a press conference on Thursday afternoon.

?itok=8bxAO9Tg

?itok=8bxAO9Tg

LVMPD told reporters that a review of Kim's social media profiles indicates the suspect has ties to radical extremist groups, including the Communist Party USA, Revolutionary Communist International, Hidden Palestine & Palestine Action.

NEW: Paul Hyon Kim faces a slew of charges for shooting & firebomb attack at Vegas Tesla dealership

Cops say the alleged domestic terrorist has ties to Communist Party USA, Revolutionary Communist International, Hidden Palestine & Palestine Actionhttps://t.co/RAG1fzJRIz

— Breaking911 (@Breaking911) https://twitter.com/Breaking911/status/1905373794451013730?ref_src=twsrc%5Etfw

Libs of TikTok found Kim's social media posts from the early BLM riot days, voicing his support for the Democratic Party's NGOs that facilitated the color revolution of destruction across the nation in 2020.

This appears to be the FB account belonging to Paul Kim, the dude who was arrested for allegedly setting a Tesla location on fire. He advocated for people to donate to help get violent BLM rioters get out of jail.

The Democratic Party is the party of violence. https://t.co/272okDDvAI

— Libs of TikTok (@libsoftiktok) https://twitter.com/libsoftiktok/status/1905323490669887530?ref_src=twsrc%5Etfw

Attorney General Pamela Bondi released a https://www.justice.gov/opa/pr/nevada-resident-arrested-and-charged-connection-violent-tesla-arson-las-vegas

shortly after Kim was arrested and charged in the connect with the Tesla attack:

"The Department of Justice has been clear: anyone who participates in the wave of domestic terrorism targeting Tesla properties will suffer severe legal consequences. We will continue to find, arrest, and prosecute these attackers until the lesson is learned."

FBI Director Kash Patel stated:

"As promised, acts of violence and vandalism will not be tolerated, and today law enforcement personnel acted quickly to arrest an individual on charges including arson. Under Attorney General Bondi's leadership, we will continue to pursue these investigations with the full force of law and will bring to justice anyone responsible for these attacks."

There's a race against time to defund and dismantle the Democratic Party's rogue network of NGOs that plan an imminent color revolution to "kill" the Tesla brand and send the market capitalization of the American company into a "death spiral."

Tesla Takedown Organizers Plan Color Revolution To "Kill" Brand & "Death Spiral" For Investors https://t.co/JIf80uPeEt

— zerohedge (@zerohedge) https://twitter.com/zerohedge/status/1903184890750980240?ref_src=twsrc%5Etfw

The wave of violence and destruction by Democrats nationwide—targeting Tesla, much of it caught on camera—comes as the party’s poll numbers plunge to record lows.

Even CNN had to admit that its own party had imploded.

?itok=Woon117v

?itok=Woon117v

What the party of revolutionary activists fails to realize is that the Overton Window shifted last year - so burning and destroying buildings, cars, and city blocks - like BLM riots - is no longer the socially acceptable norm. Doubling down on hate and violence will haunt the party in the next election cycle.

Like this:

Another lunatic who is committing violence against a Tesla ! This is insane and has to stop. 🛑 https://t.co/3m3xZh319C

— Kathleen Winchell ❤️🤍💙🇺🇸🇺🇸 (@KathleenWinche3) https://twitter.com/KathleenWinche3/status/1903370884137513140?ref_src=twsrc%5Etfw

BREAKING: MORE TRANS VIOLENCE

The person arrested for the vandalization and attempted arson of a Tesla dealership in CO is a MAN PRETENDING TO BE A WOMAN.

The media are all referring to him as a "woman" https://t.co/MVKrrZ9zij

— Libs of TikTok (@libsoftiktok) https://twitter.com/libsoftiktok/status/1894825641931112511?ref_src=twsrc%5Etfw

The Tesla attacks are getting worse.

Arson. Molotov cocktails. Bouts of gunfire.

This isn't new. The Left has used violence as a political tool for decades.

Only one thing can stop this. In the words of Pat Buchanan: "Force, rooted in justice, and backed by moral courage." 🧵 https://t.co/hajT2vFJ5c

— Eric Schmitt (@Eric_Schmitt) https://twitter.com/Eric_Schmitt/status/1902777703767400750?ref_src=twsrc%5Etfw

Anyone who tells you trans violence isn’t a problem is lying to you.

They’re even spray painting “trans rights are human rights” on the side of Tesla showrooms.

All they’re doing is exposing the woke mind virus to more and more Americans every day. This is backfiring. https://t.co/IyhNWF8iYv

— Nick Sortor (@nicksortor) https://twitter.com/nicksortor/status/1902740238021140645?ref_src=twsrc%5Etfw

Another FAFO Tesla terrorist arrested.

It’s name is Shaydan Hessner 👈

Make it famous for all the wrong reasons 👇 https://t.co/xqXPopeXaI

— ♥️🇺🇸 𝓒𝓪𝓽𝓲𝓪 🇮🇹♥️ (@CB618444) https://twitter.com/CB618444/status/1905598211831611881?ref_src=twsrc%5Etfw

GRAPHIC CONTENT: The Tesla terrorists are getting more and more insane… https://t.co/iiDFfElyAT

— Libs of TikTok (@libsoftiktok) https://twitter.com/libsoftiktok/status/1902858535534301324?ref_src=twsrc%5Etfw

Tesla Terrorist KAREN identified as Kamelia Enzer, a millionaire and spouse of Jeff Enzer -Lead Engineer DocuSign.

The Karen has been charged!

Cops say it may be road rage 🤦♀️

🎥 Daily Mail https://t.co/KDiviwULPE

— ATX Irish Gal 🙏🏼🇺🇸❤️ (@Notmyfault99) https://twitter.com/Notmyfault99/status/1905568803175481407?ref_src=twsrc%5Etfw

Who wants to bet that this fat fvck damaging the Tesla with his wheelchair is currently a SNAP and other government handouts recipient?https://t.co/DLMjI9S2sh

— I Meme Therefore I Am 🇺🇸 (@ImMeme0) https://twitter.com/ImMeme0/status/1904862263019724946?ref_src=twsrc%5Etfw

NOW: Police move Pro-Palestine protesters as they flip off the CYBERTRUCK passing by as they march against ICE arrest of Former Columbia University student Mahmoud Khalil

Video by https://twitter.com/peterhvideo?ref_src=twsrc%5Etfw

— Oliya Scootercaster 🛴 (@ScooterCasterNY) https://twitter.com/ScooterCasterNY/status/1899212779862495323?ref_src=twsrc%5Etfw

NYPD is asking for the public’s help in identifying these 2 individuals who carved a swastika and the word “Nazi” in a Cybertruck in Brooklyn.

Do you recognize them?

Call NYPD crime stoppers at 1-800-577-8477. https://t.co/JWktT6Hd6z

— Libs of TikTok (@libsoftiktok) https://twitter.com/libsoftiktok/status/1905661084054245485?ref_src=twsrc%5Etfw

. . .

https://cms.zerohedge.com/users/tyler-durden

Fri, 03/28/2025 - 15:00

https://www.zerohedge.com/political/communist-revolutionary-arrested-vegas-tesla-firebombing-attack

Rickards: Trump & The Fate Of The Dollar

Rickards: Trump & The Fate Of The Dollar

https://dailyreckoning.com/trump-and-the-fate-of-the-dollar/

What is the Mar-a-Lago Accord? And what would a Mar-a-Lago Accord mean for the value of the U.S. dollar?

We begin our analysis with the name itself. Mar-a-Lago Accord is an echo of the three major international currency accords since the original Bretton Woods Agreements reached in 1944.

?itok=EaVekEL-

?itok=EaVekEL-

Accords Through The Years

The first was the Smithsonian Agreement in December 1971. This came in the aftermath of President Nixon’s decision on August 15, 1971, to end the convertibility of U.S. dollars into physical gold by U.S. trading partners at the fixed rate of $35.00 per ounce. The major countries in the global system (U.S., UK, France, Germany, Italy, Japan, Netherlands, Sweden, Switzerland, Canada, Belgium, and Netherlands) met at the Smithsonian Institution in Washington DC to decide how to reopen the gold window.

The main U.S. goal was to devalue the dollar. In the end, the price of gold was increased by 8.5% to $38.00 per ounce (revalued to $42.22 per ounce in 1973), which equaled a 7.9% dollar devaluation. Other currencies were revalued against the dollar, including a 16.9% upward revaluation of the Japanese yen.

The effort to reopen the gold window failed. Instead, major countries moved to floating exchange rates, which remains the norm to this day. Gold moved to free market trading and is currently about $3,050 per ounce. That gold price represents a 98.8% devaluation of the dollar measured by weight of gold since 1971.

The period from 1971 to 1985 was tumultuous in foreign exchange markets including the Petrodollar agreement (1974), the Herstatt Bank collapse (1974), the sterling crisis (1976), U.S. hyperinflation (50% from 1977-1981), a gold price super-spike (1980), and a major global recession (1981-1982). By 1983, inflation was subdued, the dollar was gaining strength, and strong economic growth was achieved in the U.S. under Ronald Reagan.

The next major economic gathering on foreign exchange was the Plaza Accord in September 1985. This was convened by U.S. Treasury Secretary James Baker at the Plaza Hotel in New York and included the U.S., Germany, the UK, Japan and France. At the time, the dollar was at an all-time high relative to other currencies. The dollar had even strengthened against gold, which had dropped in price from $800.00 per ounce in January 1980 to around $320.00 per ounce in 1985.

The purpose of the meeting was to devalue the dollar in stages. In this respect, the meeting was a success. Importantly, the method of devaluation was to be gradual and it was to be accomplished by central bank and finance ministry interventions in the foreign exchange markets. It was not a fiat devaluation; it was a finesse.

In practice, the market interventions were quite few. Once foreign exchange traders got the message, they took the dollar where it needed to go on their own. No foreign exchange dealer wanted to be on the wrong side of the trade if the central banks decided to intervene on any particular day.

The Louvre Accord, signed on February 22, 1987, among the U.S., UK, Canada, France, Japan and Germany was, in effect, a victory lap following the Plaza Accord. Between 1985 and 1987, the dollar did devalue against other currencies. The dollar also fell against gold, which rose from $320 per ounce to $445 per ounce by the time of the meeting. It was mission accomplished for Treasury Secretary James Baker. The purpose of the Louvre Accord was to lock down the accomplishments of the Plaza Accord, stop further dollar depreciation, and return to a period of relative stability in foreign exchange markets.

This accord was also a success. The dollar was mostly stable after 1987, despite the introduction of the euro in 2000 (the euro bounced between $0.80 and $1.60 in the early 2000s. Today it’s $1.09, which is not far from its original valuation of $1.16).

The other wild card was gold. After hitting bottom at around $250 per ounce in 1999, gold surged to $1,900 per ounce in 2011, a 670% gain for gold and a de facto devaluation of the dollar when measured by weight of gold. The period of relative stability in foreign exchange markets lasted until 2010 when a new currency war was unleashed by President Obama.

A New Mar-A-Lago Accord

Which brings us to discussion of a possible new international monetary conference in the chain of conferences from the Smithsonian Agreement to the Plaza Accord to the Louvre Accord. Given Donald Trump’s dominance on the world economic scene today and his love of ornate architecture of the kind seen at the Plaza Hotel and the Louvre (Trump owned the Plaza Hotel from 1988 to 1995),it’s not a stretch to expect that Trump would convene any new world monetary conference at his equally ornate Mar-a-Lago club in Palm Beach, Florida.

The first discussion of a Mar-a-Lago Accord appears in Chapter Six of my book https://www.amazon.com/Aftermath-Secrets-Wealth-Preservation-Coming/dp/0735216959/ref=sr_1_1

(2019), published six years ahead of current attention to the topic. That chapter is titled “The Mar-a-Lago Accord” and contains extensive discussion of the evolution of the international monetary system starting in 1870, including the more recent accords noted above.

It then moves through my private meetings with IMF head John Lipsky and Treasury Secretary Tim Geithner with a focus on a possible new gold standard and the attempted replacement of gold by the Special Drawing Right (SDR), created in 1969 and used among IMF members ever since. It ends with the classic 1912 quote from Pierpont Morgan that, “Money is gold, and nothing else.” and recommends that investors acquire physical gold for their portfolios. The dollar price of gold has risen 120% since that recommendation.

Today’s vogue in Mar-a-Lago Accord research began with a November 2024 https://www.hudsonbaycapital.com/documents/FG/hudsonbay/research/638199_A_Users_Guide_to_Restructuring_the_Global_Trading_System.pdf

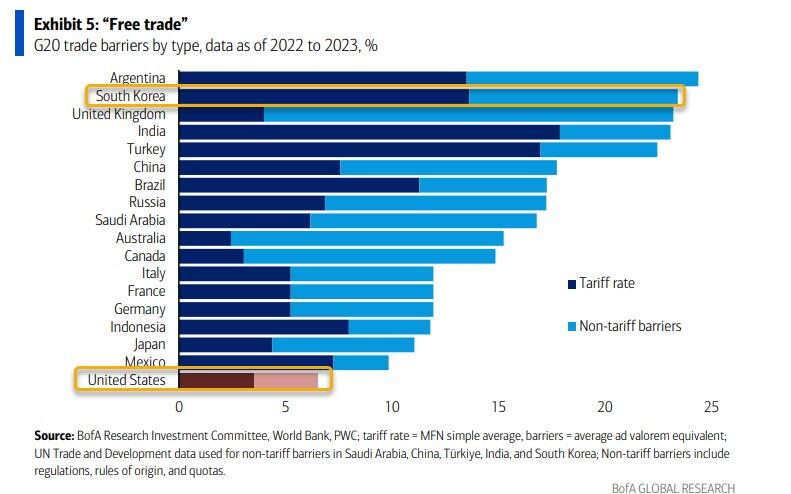

written by Stephan Miran titled “A User’s Guide to Restructuring the Global Trading System”, published by Hudson Bay Capital. Although the title refers to the trading system, it explains how currency devaluation can be used to offset the impact of tariffs and refers to “persistent dollar overvaluation.”

From there, it’s a short leap to the ghost of the Plaza Accord and the need for a new Mar-a-Lago Accord. (Shortly after the paper was published, Trump appointed Miran as Chair of his Council of Economic Advisors, which gives his views added weight).

Issuance of 100-Year Bonds

In the currency section of the paper (pages 27-34), Miran not only suggests a devaluation of the dollar; he proposes that the U.S. issue 100-year bonds. In Miran’s view, 100-year bonds will be attractive to foreign reserve managers and will reduce any dollar selling needed to prop up their own currencies. Those long-term dollar holdings will mitigate short-term dollar devaluation in a way that moves the entire international monetary system toward a desirable equilibrium. Miran specifically uses the term Mar-a-Lago Accord to describe his proposed system.

There are many more technical details in Miran’s plan that we don’t have room to discuss in this article. These include use of the Treasury’s Exchange Stabilization Fund, the Fed’s Bank Term Funding Program, and Fed currency swap lines. Miran also suggests using the International Emergency Economic Powers Act of 1977 (IEEPA) to impose withholding taxes on interest payments to foreign holders of Treasury securities (a form of capital controls) as a way to discourage trading partners from holding Treasuries and therefore a way to devalue the dollar.

Trading partners would be evaluated using a traffic-light system. Countries would be ranked green (friendly), yellow (neutral) and red (adversary). Green countries would get U.S. military protection and the most favorable tariffs, yellow would get reciprocal tariffs, and red countries would get no security help, punitive tariffs and possible capital controls.

A Financial Catastrophe in the Making

In effect, Miran is trying to have it both ways. He wants to devalue the dollar and at the same time keep the dollar at the center of the International Monetary System. Nixon did this in 1971 and Baker did it in 1985. With regard to Miran, one cannot resist a paraphrase of Lloyd Bensen – “Stephan, you’re no Jim Baker.” The success of the Plaza Accord depended entirely on close cooperation of the major country finance ministries. No such cooperation exists today given sanctions on Russia, tariffs on China and the U.S. isolation of the EU with respect to the War in Ukraine.

Since Miran’s paper, the topic has spun completely out of control. A recent MarketWatch https://www.marketwatch.com/story/wall-street-cant-stop-talking-about-the-mar-a-lago-accord-heres-how-the-currency-deal-would-work-f8fbbda0

says “Wall Street can’t stop talking about the ‘Mar-a-Lago Accord.’”Some analysts propose that gold on the Federal Reserve’s balance sheet (actually a gold certificate) would be revalued from $42.22 per ounce to the market price (now $3,050 per ounce) with the “profit” added to the Treasury General Account. Another idea is to use U.S. assets such as land and mineral rights to collateralize U.S. debt.

As of now, no one knows what a Mar-a-Lago Accord would actually be or whether it will even happen, so it’s impossible to describe the impact. Still, the best-known version of the plan would have unintended consequences that could lead to a global financial catastrophe.

There’s no need to force holders to swap short-term debt for long-term debt. You simply let the short-term debt mature and replace it with new 100-year bond issues through the existing primary dealer underwriting system. No coercion is needed; there would be huge demand for 100-year debt.

Dollar devaluation does not fight potential inflation from tariffs (there isn’t any). It actually causes inflation by increasing the cost of imported goods. Any gold price mark-up on the Fed’s books is simply an accounting entry. The suggested “audit” of Fort Knox by Trump and Elon Musk (if it happens) will be nothing more than a staged photo-op. Gold has a world price entirely unaffected by accounting games between the Treasury and the Fed.

Again, the Mar-a-Lago Accord as it’s envisioned today would cause a global financial crisis. That’s because it fails to understand the importance of short-term Treasury debt as collateral for inter-bank lending and derivatives. Substituting 100-year Treasury debt for short-term Treasury bills would make those bills scarce. Treasury bills are the most liquid collateral in the world and are at the root of the Eurodollar system and the $1 quadrillion derivatives market. Scarcity of Treasury bills would implode bank balance sheets and lead to the greatest banking crisis in history.

The big winner in this context is gold. The BRICS are moving toward gold as fast as they can. Investors can do the same. Don’t be left behind.

https://cms.zerohedge.com/users/tyler-durden

Fri, 03/28/2025 - 14:40

https://www.zerohedge.com/geopolitical/rickards-trump-fate-dollar

Putin Floats Plan For UN To Govern Ukraine Until Elections Held

Putin Floats Plan For UN To Govern Ukraine Until Elections Held

Amid weeks of peace talks between the US and Russia focused on Ukraine, but which largely haven't gotten anywhere (other than an energy ceasefire which quickly appeared to be broken), President Putin has presented a big-picture idea which could result in ceasefire.

The Russian leader on Friday proposed a "transitional administration" for Ukraine under the auspices of the UN. The immediate aim would be ceasefire leading toward "democratic" election, followed by the negotiation of a peace agreement with the new authorities.

"We could, of course, discuss with the United States, even with European countries, and of course with our partners and friends, under the auspices of the UN, the possibility of establishing a transitional administration in Ukraine," Putin https://www.dw.com/en/ukraine-updates-putin-suggests-un-administration-of-ukraine/live-72065497

while visiting the northwestern Russian city of Murmansk.

?itok=nEi_gxV6

?itok=nEi_gxV6

He laid out that "we could discuss the possibility of introduction of temporary governance in Ukraine," while Ukraine holds "democratic elections, to bring to power a capable government that enjoys the trust of the people."

After this, he explained, the two warring sides would "start talks with them about a peace treaty." Putin has in the recent past complained that Zelensky is 'illegitimate' and thus can't legally be negotiated with, since he has canceled democratic elections on an indefinite basis.

As examples of where a temporary UN governance scheme has been implemented before, Putin held out "several cases of what is called external government," in East Timor, Papua New Guinea, and parts of the former Yugoslavia.

But anonymous Trump admin officials quickly dismissed the idea, for example with https://www.nbcnews.com/news/world/putin-trump-russia-ukraine-zelenskyy-un-guinea-timor-yugoslavia-rcna198520

reporting that the White House has "dismissed Russian President Vladimir Putin's suggestion that peace talks in Ukraine should depend on the country being governed by the United Nations while new elections are held."

And Reuters has cited a White House national security spokesperson who dismissed Putin’s proposal, saying that "Ukraine’s government was determined by its constitution and citizens."

The Ukrainian government did not immediately respond to Putin's plan, but will no doubt reject it based on maintaining sovereignty, and given Zelensky has not relented on demands for a new election, nor has he ordered his forces to retreat.

"That’s just one of the potential options."

🚨🇷🇺 PUTIN: THE U.N. COULD TEMPORARILY GOVERN UKRAINE

In a stunning statement, Putin said the United Nations could temporarily govern Ukraine in order to “hold democratic elections” and “bring power to a capable government.”

Putin:

"That’s just one of the potential options."… https://t.co/K8VjSiGwV5

— Mario Nawfal (@MarioNawfal) https://twitter.com/MarioNawfal/status/1905408242521702573?ref_src=twsrc%5Etfw

Putin in the fresh remarks where he floated the UN-administration plan had some other interesting comments, directed specifically at his US counterpart https://www.dw.com/en/ukraine-updates-putin-suggests-un-administration-of-ukraine/live-72065497

:

Putin also praised US President Donald Trump, saying, "In my opinion, the newly elected president of the United States sincerely wants an end to the conflict for a number of reasons."

He stressed that Moscow favored "peaceful solutions to any conflict, including this one, through peaceful means, but not at our expense."

Putin also praised Russian troops for "holding the strategic initiative" throughout the war. "There are reasons to believe that we will finish them off," he said, adding that "the Ukrainian people themselves should understand what is happening."

As for the war, drones have continued to fly across the border in both directions on a nightly basis. Even though a 'partial ceasefire' is supposed to be on - protecting both countries' energy infrastructure - it doesn't look as if this is actually sticking.

Moscow has on repeat occasions this week accused Kiev of attack its energy sites. Simultaneously, Russian missiles have rained down on Ukrainian cities.

https://cms.zerohedge.com/users/tyler-durden

Fri, 03/28/2025 - 14:20

https://www.zerohedge.com/geopolitical/putin-presents-un-should-govern-ukraine-until-elections-held

Trump Says He Will Continue Bombing Yemen For A 'Long Time'

Trump Says He Will Continue Bombing Yemen For A 'Long Time'

https://news.antiwar.com/2025/03/27/trump-says-he-will-continue-bombing-yemen-for-a-long-time/

President Trump on Wednesday https://www.timesofisrael.com/trump-the-houthis-want-peace-because-theyre-getting-the-hell-knocked-out-of-them/

have been "very successful" and vowed the bombing campaign would continue for a "long time."

The US started bombing Yemen again on March 15 in response to the Houthis, officially known as Ansar Allah, announcing they would reimpose a blockade on Israeli shipping due to Israeli ceasefire violations in Gaza.

?itok=VEW7OOTl

?itok=VEW7OOTl

Since the Trump administration launched the bombing campaign, the Houthis have restarted attacks on US warships and resumed firing missiles at Israel, operations they ceased when the Gaza ceasefire went into effect on January 19. Despite this, President Trump claims the Houthis want "peace."

"The Houthis are looking to do something. They want to know, ‘How do we stop? How do we stop? How can we have peace?’ The Houthis want peace because they’re getting the hell knocked out of them," https://www.youtube.com/watch?v=_YTgd1ugpGM

reporters in the Oval Office.

"They want us to stop so badly… They’ve got to say, ‘No mas.’ But I can only say that the attacks every day, every night… have been very successful beyond our wildest expectations… We’re going to do it for a long time. We can keep it going for a long time," the president said.

The Houthis’ message has been that they https://news.antiwar.com/2025/03/17/yemenis-hold-massive-pro-palestine-rallies-in-face-of-us-airstrikes/

and that their attacks won’t stop unless there is a ceasefire in Gaza and an end to the Israeli blockade on aid and all other goods entering the Palestinian territory.

"The Yemeni Armed Forces affirm that the American aggression will only increase the Yemenis’ steadfastness and resilience, and that the confrontations over the last few days were only the beginning of what will be a gradual expansion of defensive operations in the coming days," https://www.saba.ye/en/news3457230.htm

when announcing new attacks on US warships and on Israel.

Trump also claimed that the Houthis are being "hit harder than they have ever been." But from 2015 to 2022, the Houthis faced a brutal US-backed Saudi-UAE war against them, which involved a heavy bombing campaign, a blockade, and a ground campaign. Trump supported the war during his first term in office and https://news.antiwar.com/2019/04/16/trump-vetoes-congressional-resolution-to-end-yemen-war/

passed by Congress that would have ended US involvement in the conflict.

Trump said that President Biden should have attacked the Houthis, disregarding the fact that the Biden administration launched a bombing campaign on Yemen from January 2024 to January 2025. The message from the Trump administration has been that Biden didn’t hit Yemen hard enough, and Trump’s bombing campaign https://www.timesofisrael.com/new-us-campaign-against-yemens-houthis-far-more-intense-than-under-biden/

Bombing Yemen Is Not America First, Here's Why https://t.co/a0T6kmnmmS

— zerohedge (@zerohedge) https://twitter.com/zerohedge/status/1905429673858789633?ref_src=twsrc%5Etfw

The Trump administration’s bombing campaign has taken a heavy toll on civilians, with at least 25 killed in just the first week, https://news.antiwar.com/2025/03/25/us-killed-25-civilians-in-first-week-of-renewed-bombing-campaign-in-yemen/

, where National Security Advisor Mike Waltz claimed the Houthis’ "top missile guy" was located.

https://cms.zerohedge.com/users/tyler-durden

Fri, 03/28/2025 - 14:00

https://www.zerohedge.com/geopolitical/trump-says-he-will-continue-bombing-yemen-long-time

Futures Slide, Gold Soars Ahead Of Inflation Data Amid Tariff Turmoil

Futures Slide, Gold Soars Ahead Of Inflation Data Amid Tariff Turmoil

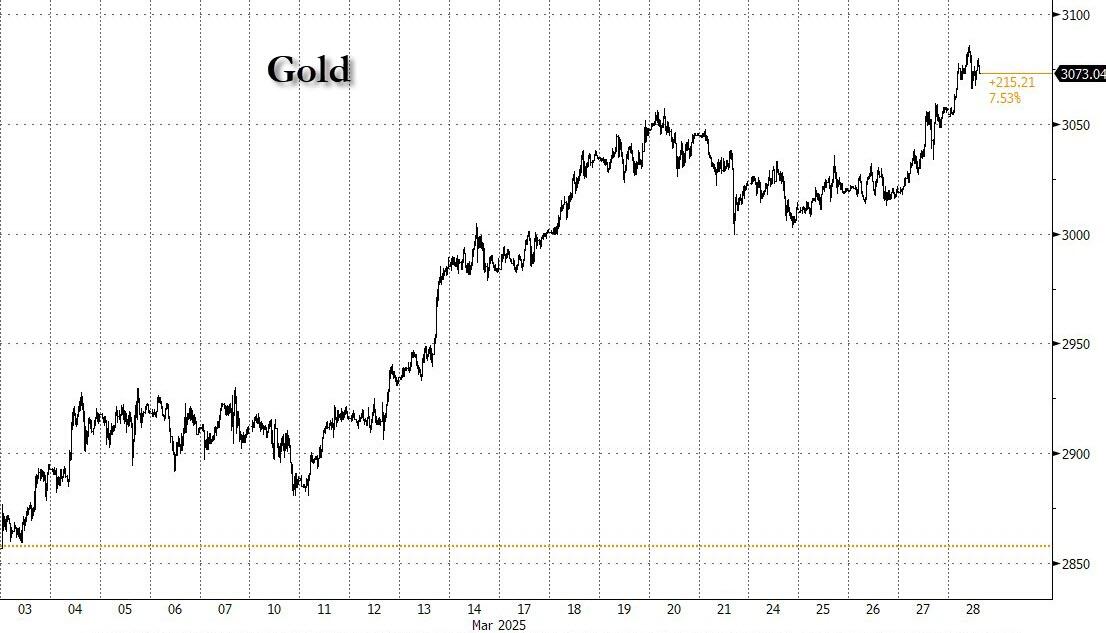

US equity and global stock markets slumped while gold topped a fresh all time high as investors braced for today's core PCE report, the Fed's preferred inflation metric, and continued to worry about the lasting economic damage of the trade war amid daily tariff news and a halt in progress on the geopolitical front, as the market now awaits the April 2 tariff announcements. As of 8:00am ET S&P futures are down 0.2% but off session highs, with the Nasdaq lagging -0.4% and small caps modestly higher; Mag 7 names are mostly lower premarket: AAPL -0.7%, AMZN -0.5%, while TSLA +1.6%. European and Asian stocks are also lower: Bond yields are lower and the USD trades near session highs. Commodities are mixed with base metals all lower this morning, but gold is making a new record high rising above $3,080 per ounce. Brent trades near session highs above $74/bbl. Looking ahead today, we will get PCE data for February at 8:30am (consensus expects headline and core PCE up 0.3% MoM, and 2.7%/2.5% YoY headline/core) followed by UMich survey data at 10am. Following the data, we will hear from Fed voter Barr and non-voter Bostic.

?itok=0U7iCchy

?itok=0U7iCchy

In premarket trading, Lululemon plunged 13% after the activewear maker’s annual forecasts for sales and profit disappointed, stoking worries that growth will continue to be weak in its American markets. Tesla is the top gainer among the Magnificent Seven (Alphabet -0.1%, Amazon -0.5%, Apple -0.7%, Microsoft -0.3%, Meta -0.1%, Nvidia +0.5% and Tesla +1.2%). US Steel (X) gains 5% after Semafor reported that the company is in active talks with Nippon Steel about a deal that would preserve their proposed merger citing unidentified people familiar with the matter. Here are some other notable premarket movers:

Argan Inc. (AGX) climbs 12% after the builder of power plants posted 4Q revenue that climbed 41% from the year-ago period.

Beam Therapeutics (BEAM) rises 4% after a Bank of America analyst upgraded the drug developer to buy, citing trial data of its investigative therapy for a genetic disease that can cause lung and liver damage.

CureVac (CVAC) jumps 12% after the biotech firm said the European Patent Office had upheld the mRNA patent at the center of its legal battle with BioNTech.

Hudson Pacific Properties (HPP) gains 7% after BMO raised the office REIT to outperform, saying its recent $475 million CMBS transaction helps provide “breathing room” on 2025 debt maturities.

Nio Inc. ADRs (NIO) falls about 2% as the Chinese electric vehicle maker’s upsized share sale plan raised investor concern about dilution.

Oxford Industries (OXM) declines 12% after the owner of Tommy Bahama and Lilly Pulitzer gave a disappointing forecast for the current fiscal quarter.

Rocket Lab (RKLB) rises 9% after the space company was selected by the US Space Force for a $5.6 billion program.

The Metals Company (TMC) gains 15% after the seabed mining company asked the Trump administration for approval to harvest the ocean floor for critical metals in international waters controlled by a United Nations-affiliated organization.

WR Berkley (WRB) climbs 5% after Mitsui Sumitomo Insurance agreed to buy 15% of outstanding shares in the US insurer.

Overnight, Defense Sec Hegseth said to allies in his first official trip to Asia that the Trump Administration is set to "truly prioritize and shift to this region...in a way that is unprecedented." China's Xi continued to try woo international investors noting in a meeting with 40+ global business leaders that "we are providing a transparent, steady and predictable policy environment,” calling the nation a “favorite destination” for foreign investors. “Embracing China is embracing opportunities.” (BBG). After the close yesterday, Fed voter Collins said it looks “inevitable” that tariffs will boost inflation, at least in the near term, adding it’s likely appropriate to keep interest rates steady for longer (BBG). A 7.7 magnitude earthquake has struck in Myanmar, the most powerful in a century, causing buildings to shake and triggering evacuations in Vietnam and Thailand, with at least one tower collapsing in Bangkok.

It’s been a rough quarter for US equities, with the S&P 500 getting ready to close out the first three months of the year with a 3.2% loss, the worst performance since 2023. Today's reading for the US core personal consumption expenditures price index is expected to rise 0.3% in February, an unchanged pace compared with the previous month, according to the median economist forecast. With President Trump threatening to unleash so-called reciprocal tariffs next week, money managers say they’re turning neutral, stepping back or de-risking their portfolios.

“Tariffs are creating a lot of fears in the market, not just the level of the tariffs but the way they are implemented as well,” Valerie Genin, head of investments at Barclays Private Bank Monaco told Bloomberg TV. “It seems like investors are just digesting now that tariffs have lose-lose implications for all parties.”

Meanwhile in Europe, stocks are set for their third week of losses this month, as investors brace for US tariff announcements next week pushing the Stoxx 600 index 0.4% lower on Friday. Most sub-indexes on the Stoxx 600 regional benchmark notch declines. Banks lead the underperformance, while the real estate sector is a rare outperformer. Still, banks are the standout winner this quarter with a 26% advance as investors are counting on more strong earnings, share buybacks and M&A to drive gains. Here are the biggest movers Friday:

Ubisoft shares jump as much as 12% after the video game maker said it will carve out a unit into a subsidiary with an enterprise value of about €4 billion, with Tencent to invest €1.16 to acquire a 25% stake in the new entity

UK retailers are outperforming on Friday, after sales unexpectedly grew for a second month in February to suggest consumer confidence is returning; among the biggest gainers are B&M (+1.8%), Kingfisher (+2.2%), and ASOS (+1.1%)

Grupo Catalana Occidente shares soared as much as 18% and to a record high after controlling shareholder Inoc launched takeover offer for all shares of the Spanish insurer

SSE shares rise as much as 1.9% after the energy and utility company announced it is promoting current Chief Commercial Officer Martin Pibworth to become its next chief executive

WH Smith shares slide as much as 3.1% after the company agreed to sell its struggling high street business at a price that JPMorgan said is at the lower end of expectations. The firm also said it is trading in line with market expectations

Energiekontor, a German wind and solar parks project developer, sees its shares decline over 10%, the most since August after it reported disappointing results; shareholders will be subject to a significant reduction in dividends

Rational shares drop as much as 1.9%, extending their drop following the muted growth outlook posted on Thursday. Analysts at Warburg cut their price target on the German company due to the softer outlook for this year

Earlier in the session, Asian equities suffered their biggest drop in a month, as concerns increased over a possible growth slowdown in the US stemming from new tariffs. Trading was halted in Thailand following an earthquake. The MSCI Asia Pacific Index fell as much as 1.4%, with most markets in the red. Toyota, Samsung Electronics and Mitsubishi UFJ were among the biggest drags. South Korean and Japanese stocks led the selloff, as ex-dividend trading exacerbated the impact of the hit to sentiment from US taxes on imports. President Donald Trump’s imposition of a blanket 25% levy on auto imports, and threats for similar action in other areas, have ramped up investor anxiety over the scope of the reciprocal tariffs that he intends to announce next week. The Hang Seng Tech Index, which has rallied this year on the back of Chinese technology advancements, fell to the brink of a correction amid broad risk-off sentiment.

In FX, the Bloomberg Dollar Spot Index is flat. JPY and GBP are the strongest performers in G-10 FX; SEK and NZD underperform. The greenback supported by month-end demand while it also modestly enjoys haven dynamics amid escalating trade tensions, a Europe-based trader says. The euro sank to session lows around 1.077 after traders ramped up bets on ECB interest-rate cuts as Spanish and French CPI undershot expectations. Money markets now price in about 60bps of easing by December.

In rates, treasuries hold gains in early US session led by long-end tenors with yields lower by about 4bp, arresting this week’s dramatic curve steepening. US yields are richer by at least 1bp across maturities with 2s10s curve flatter by ~2.5bp, 5s30s by ~2bp; 10-year near 4.33% is ~3bp lower on the day, with bunds and gilts in the sector outperforming by 1bp and 3bp. Core European bond markets lead after Spanish and French CPIs rose less than estimated, prompting traders to price in more easing by ECB. Focal point of US session is February personal income and spending data, which embeds PCE price index, inflation gauge targeted by the Fed.

In commodities, the non stop record highs in gold are the big story again: spot gold rose roughly $15 to trade near $3,072/oz after it hit a fresh record. Crude futures are steady. WTI drifts 0.1% lower to trade near $69.88. Brent is flat at $74.02.

?itok=5RshhSy9

?itok=5RshhSy9

Today's US economic calendar includes February personal income/spending (8:30am), March final University of Michigan sentiment (10am) and March Kansas City Fed services activity (11am). Fed speaker slate includes Barr (12:15pm) and Bostic (3:45pm)

Market Snapshot

S&P 500 futures down 0.4% to 5,714.00

STOXX Europe 600 down 0.3% to 544.66

MXAP down 1.0% to 186.56

MXAPJ down 0.7% to 584.82

Nikkei down 1.8% to 37,120.33

Topix down 2.1% to 2,757.25

Hang Seng Index down 0.6% to 23,426.60

Shanghai Composite down 0.7% to 3,351.31

Sensex down 0.5% to 77,227.72

Australia S&P/ASX 200 up 0.2% to 7,982.01

Kospi down 1.9% to 2,557.98

German 10Y yield little changed at 2.72%

Euro down 0.2% to $1.0777

Brent Futures down 0.3% to $73.80/bbl

Gold spot up 0.4% to $3,069.18

US Dollar Index little changed at 104.37

Top Overnight News

Elon Musk commented that their goal is to reduce the deficit by USD 1tln and will achieve most of that objective within a 130-day tenure, while he added that legitimate recipients of Social Security benefits will receive more, not less money, according to Fox News.

Global bonds rallied as European consumer price data came in softer than expected and investors awaited data on the Federal Reserve’s favored inflation gauge.

Inflation in France and Spain undershot expectations, supporting calls for more interest-rate cuts by the European Central Bank.

The Zuffenhausen district of Stuttgart has been the heart of Porsche AG since the 1930s, and the sports car maker remains overwhelmingly Made in Germany, making it potentially the biggest loser in Donald Trump’s trade war.

UK retail sales increased for a second month in February, suggesting consumer confidence is returning in a surprise boost for Chancellor of the Exchequer Rachel Reeves.

The rally in European banking stocks shows few signs of cooling down after another stellar quarter.

Fed's Collins (2025 voter) said she is cautiously and realistically optimistic about the economy and stated the economy started 2025 in a good place. Collins said inflation had come down but was still elevated at the start of the year, and the outlook now is much cloudier for inflation and growth. She noted it is inevitable that tariffs will increase inflation in the near term and it remains a question how long tariff-driven inflation will last. Furthermore, she said inflation risks are on the upside and she strongly supported the Fed's decision to hold rates steady, while she expects the Fed will likely hold rates steady for longer given the outlook and stated that watching inflation expectations and sentiment data is important right now.

Fed's Barkin (2027 voter) said the current moderately restrictive stance is a good place to be and if conditions shift, the Fed can adjust. Barkin said given recent high inflation, tariffs could have more of an impact on prices, but still not known where rates will settle or how affected countries' businesses and consumers will respond. Barkin also commented that the direction of federal policy changes may be known, but the extent and how they net out in the economy remains uncertain, while he added federal policy changes create instability in the near term and the Fed is waiting for uncertainty to clear before acting.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly pressured amid the ongoing themes of tariffs and growth concerns heading closer to next week's 'Liberation Day' and with markets also bracing for the latest US PCE Price Index. ASX 200 traded rangebound and was just about kept afloat by strength in consumer staples and the commodity-related sectors with gold miners rejoicing after the precious notched another fresh record high. Nikkei 225 underperformed and dipped beneath the 37,000 level as automakers continued to suffer from Trump's recent auto tariff proclamation and with firmer-than-expected Tokyo CPI data supporting the case for the BoJ to continue with future policy adjustments. Hang Seng and Shanghai Comp failed to sustain the early resilience and slipped into negative territory amid a deluge of earnings and tariff uncertainty, while it was also reported that China rejected US President Trump's offer of tariff waivers in exchange for a TikTok deal.

Top Asian News

Chinese President Xi said, at a meeting with foreign CEOs, that foreign firms' investment plays an important role and China was, is and will certainly be an ideal, safe and promising investment destination for foreign business people. Xi added they will ensure that foreign-funded enterprises have fair access to factors of production in accordance with the law and maintaining a stable, healthy, and sustainable development of China-US relations is in the fundamental interests of the two peoples. Xi also stated that blocking someone else's path will only block your own path in the end and blowing out other people's lights will not make your own lights brighter. Furthermore, he said economic and trade frictions should be properly resolved through equal dialogue and consultation, and noted that China will handle China-US relations in accordance with the principles of mutual respect, peaceful coexistence and win-win cooperation.

China is to promote high-quality development of the aluminium sector and will actively respond to trade frictions, according to a plan by ten government departments cited by Global Times.

Japanese PM Ishiba said the impact of US auto tariffs on the Japanese economy could be very big.

Bank of Japan March Meeting Summary of Opinions noted one member said inflation is somewhat overshooting expectations and a member said wage hikes in spring wage talks are somewhat exceeding last year's figures, with nominal wages rising at a pace in line with the achievement of the BoJ's price goal. There was the opinion that they don't have enough data to gauge the impact of the January policy change and recent long-term rate moves on the economy, while it was reiterated that the BoJ will continue to hike rates if economy and prices move in line with forecast, but should not have a preset idea on specific policy management. A member stated that for the time being, the BoJ must scrutinise US policy impact on the global economy and markets, as well as the effect of BoJ's past rate hike on Japan's economy, then move to the next rate hike, while a member said they must adjust the degree of monetary support nimbly to avoid a buildup of financial excess. Furthermore, there was an opinion that when they next hike rates, they must consider shifting the monetary policy stance to neutral from accommodative, and at the next meeting, they must scrutinise inflation expectations, the chance of upside price risk materialising, and progress in wage hikes when setting monetary policy.

European bourses started Friday trade on a cautious note, Euro Stoxx 50 -0.6%, after APAC stocks were pressured on tariff and growth concerns overnight, and ahead of next week’s "Liberation Day", and with markets also bracing for US PCE inflation data later today. Note, the risk tone took a hit generally on the morning's earthquakes in Myanmar. Sectors are mainly in the red, Banks lag with German names lagging while softer yields assist Real Estate names.

Top European News

Magnitude 6.9 (initially reported 7.72/7.4) earthquake occurs in Myanmar, via GFZ; reports of buildings shaking in Bangkok & Hanoi. Thereafter, magnitude 6.37 earthquake occurs in Myanmar, via GFZ; shocks reported in the Yunnan Province of southwest China and in Bangkok.

ECB's de Guindos says disinflation process is continuing, goal is for it to be reached in the coming months; caution is even more important at times of uncertainty. Trade war would mostly impact economic growth.

ECB Consumer Expectations Survey (Feb): See inflation in next 12 months at 2.6% (prev. 2.6%); 3y ahead sees 2.4% (prev. 2.4%). Consumers’ nominal income growth expectations over the next 12 months increased to 1.0% in February from 0.9% in January.

FX

DXY is attempting to claw back some of yesterday's lost ground with the USD currently firmer vs. all peers ex-JPY into PCE. Index remains within yesterday's 104.07-65 range.

JPY is the current best performer after firmer-than-expected Tokyo CPI data, which is seen as a leading indicator for national price trends and effectively supports the case for further BoJ policy normalisation. USD/JPY has pulled back from the overnight peak @ 151.21 and made its way back onto a 150 handle. The next downside target comes via Thursday's low @ 150.05.

EUR is under modest pressure and has faded gradually from the 1.08 mark against the USD. No reaction to the morning's data points or ECB speak. Thursday's base at 1.0732 and then the 200-DMA at 1.0729.

GBP flat despite a blip higher on the morning's better-than-expected Retail Sales and upward revisions to dated GDP metrics. While this lifted Cable to a 1.2968 peak it proved fleeting.

Antipodeans softer given the risk tone though action is limited given the lack of specific drivers for the region.

PBoC set USD/CNY mid-point at 7.1752 vs exp. 7.2591 (Prev. 7.1763).

Fixed Income

A firmer start to the session for the benchmarks given the tepid risk tone overnight and risk aversion entering the market on the sizable earthquakes in Myanmar.

USTs hit a 110-24 peak but since pulled back modestly but remains comfortably clear of the overnight 110-15 base. The session ahead is focussed on US PCE.

Bunds bid, USTs hit a 110-24 peak but since pulled back modestly but remains comfortably clear of the overnight 110-15 base. The session ahead is focussed on US PCE. Prelim. French and Spanish inflation this morning cooler than forecast, but spurred no move; ECB SCE maintained the inflation view.

Gilts gapped higher by 25 ticks as the Gilt open roughly coincided with the high point in USTs and Bunds as the complex generally continued to climb on the broad risk tone. Since, the benchmark has eased slightly from highs but remains above the 91.00 mark. No hawkish follow through from the Retail and GDP data this morning.

Commodities

Crude futures choppy with initial downside on broader risk aversion. Since, the benchmarks briefly moved into the green but only by around USD 0.10/bbl with the move fleeting and the benchmarks now essentially unchanged. WTI May at the top of a USD 69.53-70.05/bbl band, Brent May in-fitting in USD 73.63-74.15/bbl parameters.

Precious metals mostly firmer despite the firmer USD, benefitting from the risk tone as discussed into key events. Spot gold is currently off highs in a USD 3,054.42-3,086.21/oz intraday range.

Base metals are mostly lower, tracking sentiment, 3M LME copper resides in a USD 9,741.70-9,855.15/t range at the time of writing. Dalian iron ore prices also dipped overnight but still notched a weekly gain as hot metal output continued to increase in March - used as a gauge for iron ore demand.

Geopolitics: Middle East

Israeli military said it intercepted one launch from Lebanese territory and another one was detected.

Israeli Defense Minister said if there is no peace in Kiryat Shmona and the Galilee communities, there will be no peace in Beirut, according to Asharq News. It was separately reported that Israel's Defence Minister holds Lebanon responsible for firing on Galilee and said Israel will respond forcefully against any threats.

Iran's ambassador in Baghdad said US President Trump's message to Tehran included a request to dissolve or merge the Popular Mobilization Forces, which is unacceptable to us, while the ambassador added they refuse to negotiate on their ballistic missiles and the decision to dissolve the PMU is an Iraqi decision which he thinks is impossible, according to Sky News Arabia.

"Lebanese media: Israeli warplanes fly over Beirut", according to Sky News Arabia; thereafter, the Israeli Military says it will release an urgent statement to Beirut residents soon.

Geopolitics: Ukraine

Russia and US teams may meet regarding Ukraine in Riyadh in mid-April, according to TASS.

Russian President Putin suggested the possibility of placing Ukraine under temporary administration to allow for elections and signature of accords, according to Russian news agencies. Putin said Russia stands for resolving Ukraine conflict through peaceful means and wants to work with Europe on resolving Ukraine conflict, but the EU is acting inconsistently. It was separately reported that Putin said Russia welcomes a peaceful resolution to the Ukraine conflict "but not at our expense", according to CGTN Europe.

White House said governance in Ukraine is determined by its constitution and the people of Ukraine.

Russian Defence Ministry says Ukraine continued attacks on Russian energy infrastructure, according to Ria; attacked the Sudzha gas metering station on Friday and almost destroyed it; thereafter, Ukraine said Russia conducted the attack.

Ukrainian Deputy PM confirms Ukraine has received new US draft of the minerals deal.

Geopolitics: Other

CK Hutchison Holdings (0001 HK) will not go ahead with the expected signing of a deal next week to sell its two strategic ports at the Panama Canal, according to SCMP.

US Secretary of State Rubio warned if Venezuela attacked Guyana or Exxon (XOM), "it would be a very bad day" for them. It was also reported that the Guyanese President agreed with the US to further integrate energy production after a meeting with US Secretary of State Rubio.

US Defense Secretary Hegseth said during a visit to the Philippines that he and US President Trump want to express the ironclad commitment they have to the mutual defence treaty and are very committed to the Philippines-US alliance, friendship and cooperation they have. Hegseth added that friends need to stand shoulder to shoulder to deter conflict and ensure that there's freedom of navigation in the South China Sea, and noted that deterrence is necessary around the world, but specifically in this region considering the threats from the Communist Chinese. Hegseth later announced they are doubling down on the US-Philippines partnership and agreed on the next steps to re-establish deterrence in the Indo-Pacific with the US to deploy advanced capabilities to the Philippines.

US Event calendar

08:30: Feb. PCE Price Index MoM, est. 0.3%, prior 0.3%

Feb. PCE Price Index YoY, est. 2.5%, prior 2.5%

Feb. Core PCE Price Index MoM, est. 0.3%, prior 0.3%

Feb. Core PCE Price Index YoY, est. 2.7%, prior 2.6%

08:30: Feb. Personal Income, est. 0.4%, prior 0.9%

Feb. Personal Spending, est. 0.5%, prior -0.2%

Feb. Real Personal Spending, est. 0.3%, prior -0.5%

09:00: Bloomberg March United States Economic Survey

10:00: March U. of Mich. Sentiment, est. 57.9, prior 57.9

March U. of Mich. Current Conditions, est. 63.5, prior 63.5

March U. of Mich. Expectations, est. 54.1, prior 54.2

March U. of Mich. 1 Yr Inflation, est. 4.9%, prior 4.9%

March U. of Mich. 5-10 Yr Inflation, est. 3.9%, prior 3.9%

11:00: March Kansas City Fed Services Activ, prior 2

DB's Jim Reid concludes the overnight wrap

Markets struggled yesterday as tariff fears remained at the forefront of investors’ minds, with concern mounting ahead of the April 2 deadline for reciprocal tariffs. Notably, several automakers took a hit given the 25% tariff announcement on Wednesday night. But more broadly, there were signs that investors were becoming increasingly concerned about the stagflationary consequences. Indeed, yesterday saw the US 1yr inflation swap (+9.1bps) hit a 2-year high of 3.11%, even as the real yield on 2yr Treasuries (-11.1bps) fell to its lowest since August 2022 at 0.73%. This combination of elevated growth uncertainty and inflation fears saw gold prices hit a new closing record of $3,057/oz yesterday, and overnight they’ve seen further gains up to $3,074/oz.

In terms of the last 24 hours, one of the main fears is that the reciprocal tariffs could lead to a big round of escalation beyond the initial US tariffs. For example, shortly before we went to press yesterday, President Trump said in a post that if the EU worked with Canada “in order to do economic harm to the USA, large scale Tariffs, far larger than currently planned, will be placed on them both”. Separately, Japan’s Prime Minister Ishiba said yesterday that “We must consider appropriate responses, and naturally all options are on the table”. And Canadian Prime Minister Carney said that he’d convened the Cabinet Committee on Canada-US relations “in response to President Trump’s attack on our workers and our industries.” Carney said that “nothing is off the table” but that the Canadian government would respond based on what the US does on April 2.

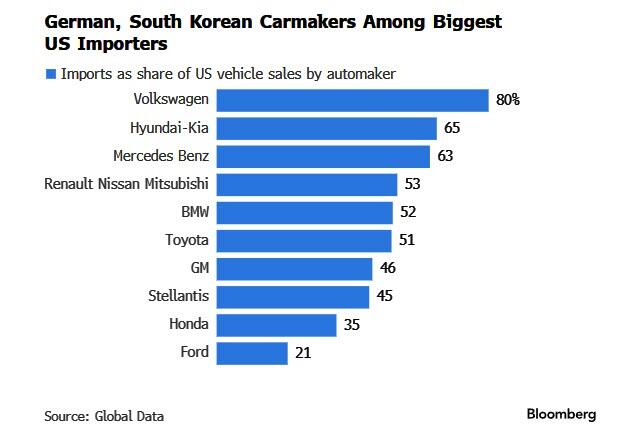

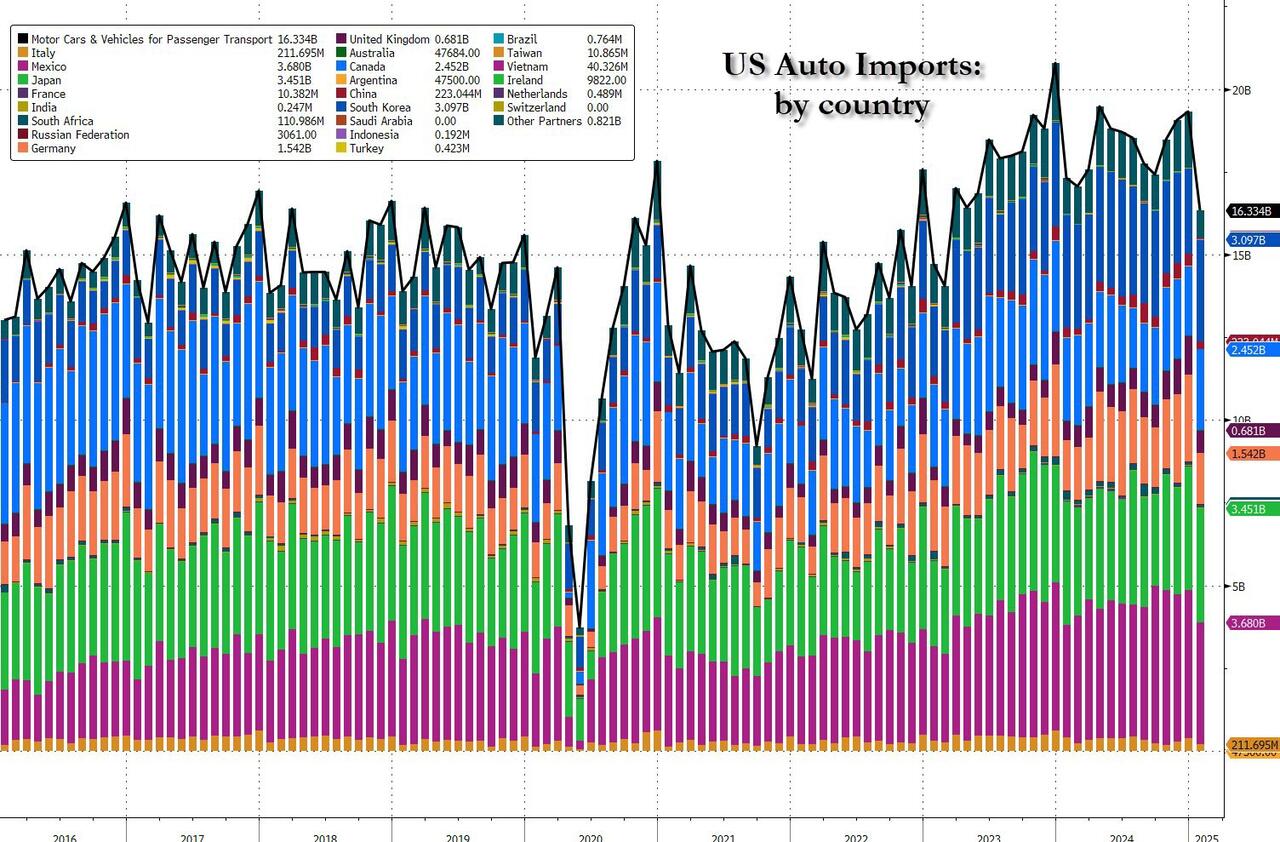

Against that backdrop, automakers struggled yesterday, with Ford (-3.88%) and General Motors (-7.36%) both losing significant ground. That was echoed across the world, and in Europe, the tariff announcement meant the STOXX Automobiles and Parts Index fell -1.09% to a fresh two-month low. That tariff uncertainty also dragged down equities more broadly, with both the S&P 500 (-0.33%) and the STOXX 600 (-0.44%) losing ground for a second day running. And with just two business days of Q1 left, the S&P 500 is on track to post its first quarterly decline in six quarters, having shed -3.20% since the start of the year.

The tariffs also meant that US Treasuries faced several hurdles, particularly with investors moving to price in more inflation. In fact by the close, the 10yr yield (+1.1bps) was up to a one-month high of 4.36%, as was the 30yr yield (+2.1bps) at 4.72%. By contrast, fears about the growth impact led investors to price in more Fed rate cuts this year, and the 2yr yield fell -2.6bps to 3.99%, even as inflation breakevens rose. In turn, that meant the 2s30s yield curve moved up to its steepest level in over 3 years. And this pattern was evident elsewhere, with the German 2s30s yield curve also up to its steepest since July 2022, at 106bps.

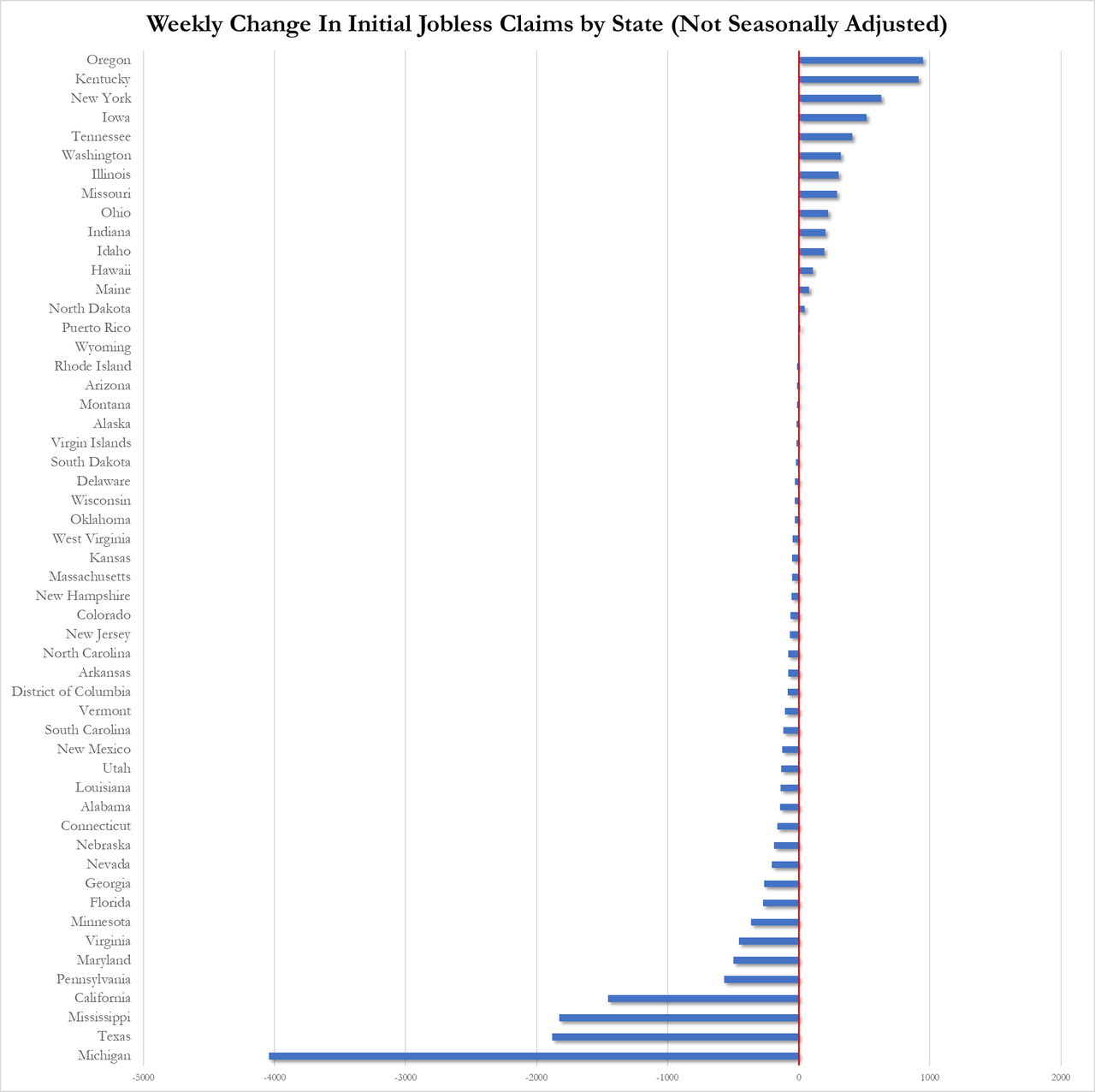

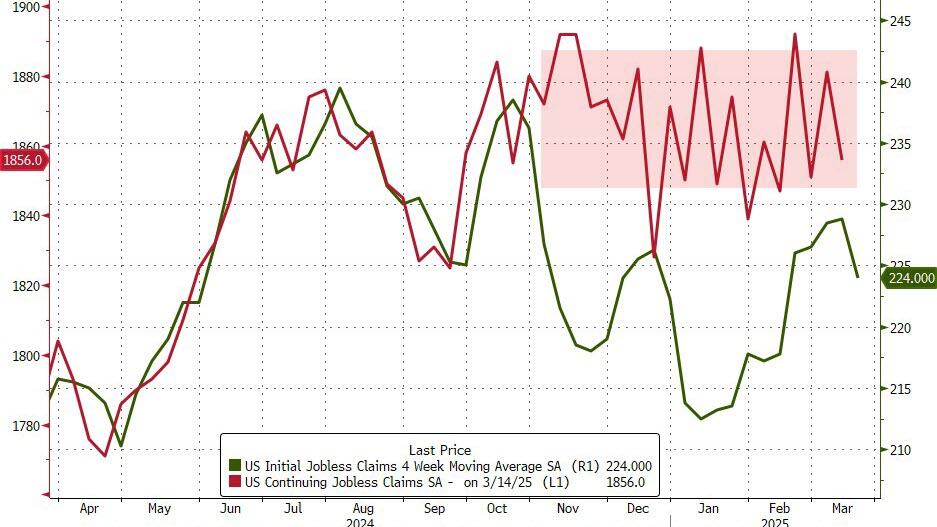

Despite the weakness among key assets, yesterday actually brought a respectable set of US economic data, which continued to point away from a sharp slowdown. For instance, the weekly initial jobless claims were at 224k over the week ending March 22 (vs. 225k expected), meaning there were still no obvious signs of a deterioration in the labour market. At the same time, we also got the third estimate of Q4 GDP, which was revised up a tenth, and now shows an annualised growth rate of +2.4%. So it continued the recent theme whereby the hard data is still holding up, even if some of the surveys have pointed to a weaker performance.

Here in the UK, gilts sold off in the aftermath of the government’s Spring Statement, with the 10yr yield (+5.1pbs) moving up more than its global counterparts yesterday. The rise took it up to 4.78%, its highest level since mid-January, whilst the 10yr real yield (+2.7bps) hit a post-2009 high of 1.35%. So that added to concerns that the government would need to announce further fiscal tightening later this year to keep within their fiscal rules, potentially repeating the pattern from the Spring Statement where higher yields and lower growth wiped out the fiscal headroom. As a reminder, our UK economist (link here) thinks that likely economic downgrades later in the year will lead to further fiscal consolidation.

Elsewhere in Europe, sovereign bonds rallied as investors were more concerned about the negative growth impact from the tariffs. So that led investors to dial up the likelihood of further ECB rate cuts, with the amount of further cuts priced by the December meeting up +2.8bps on the day to 58bps. And in turn, yields fell across the curve, with those on 10yr bunds (-2.2bps), OATs (-2.2bps) and BTPs (-1.8bps) all moving lower.

Overnight in Asia, the major equity indices have seen sizeable losses, with the Nikkei (-2.34%) and the KOSPI (-2.14%) both slumping. In Japan, matters weren’t helped by the Tokyo CPI report for March, which came in stronger than expected at +2.9% (vs. +2.7% expected). In addition, the measure excluding fresh food and energy moved up to +2.2% (vs. +1.9% expected), the strongest in a year. In turn, that’s added to the momentum for further rate hikes from the BoJ, and the Japanese Yen has strengthened +0.10% this morning against the US Dollar. Elsewhere in Asia, the Hang Seng (-0.85%), the Shanghai Comp (-0.65%) and the CSI 300 (-0.42%) have all experienced losses as well.

To the day ahead now, and there are several data releases to look out for. In the US, there’s PCE inflation for February, along with the University of Michigan’s final consumer sentiment index for March. Meanwhile in Europe, we’ll get the French and Spanish flash CPI prints for March, along with German unemployment for March and UK retail sales for February. From central banks, we’ll hear from the Fed’s Barr and Bostic, along with the ECB’s Nagel, and Muller.

https://cms.zerohedge.com/users/tyler-durden

Fri, 03/28/2025 - 08:26

Publicity Stunt? Nikola Founder Trevor Milton Claims Trump Pardon In Bizarre Video

Publicity Stunt? Nikola Founder Trevor Milton Claims Trump Pardon In Bizarre Video

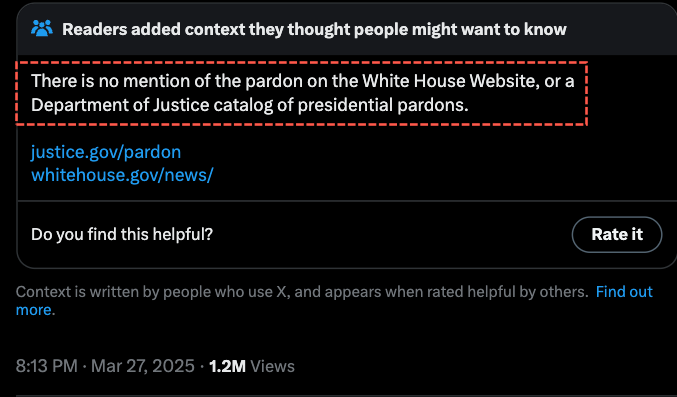

Trevor Milton—founder and former CEO of the now-bankrupt Nikola—claimed on X late Thursday that President Trump had issued him a "full and unconditional pardon" and said the president "called me personally."

Quick refresher on Milton: In 2023, a jury found him guilty of lying to investors about Nikola's electric and fuel cell semi-truck technology and sentenced him to four years in prison.

Nikola was first exposed by short seller Nathan Anderson, founder of https://www.zerohedge.com/markets/place-joy-short-seller-nathan-anderson-will-wind-down-hindenburg-research-after-7-years

, after the startup released a 2020 promotional video, which showed its Nikola One truck rolling down a hill to simulate full functionality.

?itok=gE9_rrou

?itok=gE9_rrou

Last month, Nikola filed for https://www.zerohedge.com/markets/nikolas-wild-ride-ends-shares-halted-following-bankruptcy-filing

in the US Bankruptcy Court for the District of Delaware. The defunct-startup also filed a motion seeking permission to pursue an auction and sale process under Section 363 of the US Bankruptcy Code.

Back to Milton, he wrote on X:

"This pardon is not just about me—it's about every American who has been railroaded by the government, and unfortunately, that's a lot of people. It is no wonder why trust and confidence in the Justice Department has eroded to nothing... I saw firsthand the tactics they use to guarantee convictions. I am incredibly grateful to President Trump for his courage in standing up for what is right and for granting me this sacred pardon of innocence."

Today I was issued a full and unconditional pardon by https://twitter.com/realDonaldTrump?ref_src=twsrc%5Etfw

himself. He called me personally to tell me.

This pardon is not just about me—it’s about every American who has been railroaded by the government, and unfortunately, that’s a lot of people. It is no wonder… https://t.co/qpT0jjI6Fy

— Trevor Milton (@nikolatrevor) https://twitter.com/nikolatrevor/status/1905412785661772107?ref_src=twsrc%5Etfw

Milton's video was immediately fact-checked by Community Notes, which pointed out that multiple U.S. government databases did not show evidence of a pardon.

"There is no mention of the pardon on the White House Website, or a Department of Justice catalog of presidential pardons."

?itok=QQS6jCWu

?itok=QQS6jCWu

Separately, Milton's media team released a press release through PR Newswire, declaring:

"Founder of Nikola Motor Company, Trevor Milton, Pardoned by President Trump."

Here's EV blog https://electrek.co/2025/03/27/trevor-milton-claims-hes-been-pardoned-but-really-its-just-an-ad-for-a-documentary/

take on the situation:

So, despite us seeing no evidence yet that this pardon is actually real, maybe it's an attempt to https://en.wikipedia.org/wiki/Inception

the idea of a pardon into the empty headcase of a vain ignoramus who for some reason has access to the pardon pen (despite there being a clear Constitutional remedy keeping insurrectionists like himself away from it).

It also seems quite similar to a proposed tactic by another corporate criminal, Sam Bankman-Fried. Fried had planned to "Go on Tucker Carlsen [sic], come out as a republican" in an attempt to angle for a pardon, again playing on the vanity, credulousness and love of fraud shown by the idiot-in-chief.

But then, in the last line of the press release, we get to what is perhaps the real point of this stunt – it ends with a link to a trailer for a documentary which purports to exonerate Milton. Kind of strange that someone would need to release a documentary making the case for exoneration when one has already been exonerated, isn't it?

So, for these reasons, we think that this pardon didn't actually happen.

. . .

https://cms.zerohedge.com/users/tyler-durden

Fri, 03/28/2025 - 08:05

White House Withdraws Stefanik Nomination To UN Ambassador

White House Withdraws Stefanik Nomination To UN Ambassador

(emphasis ours),

President Donald Trump has withdrawn the nomination of Rep. Elise Stefanik (R-N.Y.) to be U.S. ambassador to the United Nations.

?itok=y0qVcrbP

?itok=y0qVcrbP

Trump https://truthsocial.com/@realDonaldTrump/posts/114235745233828789

on Truth Social on March 27, citing the narrow majority the GOP has in the House.

“As we advance our America First Agenda, it is essential that we maintain EVERY Republican Seat in Congress. We must be unified to accomplish our Mission, and Elise Stefanik has been a vital part of our efforts from the very beginning,” he wrote.

“I have asked Elise, as one of my biggest Allies, to remain in Congress to help me deliver Historic Tax Cuts, GREAT Jobs, Record Economic Growth, a Secure Border, Energy Dominance, Peace Through Strength, and much more, so we can MAKE AMERICA GREAT AGAIN.

“With a very tight Majority, I don’t want to take a chance on anyone else running for Elise’s seat.”

Trump said Stefanik will join his administration “in the future.”

The GOP has a narrow majority in the House as it looks to pass Trump’s legislative agenda.

The Epoch Times has reached out to Stefanik’s office for comment.

Stefanik served as the House GOP conference chairwoman. She stepped down from the role due to Trump nominating her to be ambassador to the U.N. She was succeeded by Rep. Lisa McClain (R-Mich.). Trump said Stefanik will rejoin House GOP leadership. It is unclear which role she would be in.

The Epoch Times has reached out to McClain for comment.

House Speaker Mike Johnson (R-La.) said Stefanik will be invited to rejoin House GOP leadership. What the role will be is unclear.

“It is well known Republicans have a razor-thin House majority, and Elise’s agreement to withdraw her nomination will allow us to keep one of the toughest, most resolute members of our Conference in place to help drive forward President Trump’s America First policies,” he wrote in a https://x.com/SpeakerJohnson/status/1905330013244915791

on social media platform X.

“There is no doubt she would have served with distinction as our ambassador to the United Nations, but we are grateful for her willingness to sacrifice that position and remain in Congress to help us save the country. I will invite her to return to the leadership table immediately.”

During her nomination hearing, Stefanik https://www.theepochtimes.com/us/in-nomination-hearing-stefanik-criticizes-anti-semitic-rot-in-un-5796356

what she said is the “anti-Semitic rot” at the U.N., given its stance toward Israel.

“The U.S. is the largest contributor to the U.N. by far,” she said. “Our tax dollars should not be complicit in propping up entities that are counter to American interests, anti-Semitic, or engaging in fraud, corruption, or terrorism.”

The committee advanced her nomination to the Senate floor by voice vote on Jan. 30.

Stefanik has been one of Trump’s staunchest allies in Congress. She was the first member of Congress to endorse his 2024 campaign.

She was first elected to represent New York’s 21st Congressional District in 2014. At that time, she was the youngest woman elected to Congress in U.S. history.

https://cms.zerohedge.com/users/tyler-durden

Thu, 03/27/2025 - 23:55

https://www.zerohedge.com/political/white-house-withdraws-stefanik-nomination-un-ambassador

A Blueprint For Dismantling The Fed

A Blueprint For Dismantling The Fed

https://mises.org/mises-wire/how-end-fed

So much has been written about why we should end the Federal Reserve, and with the recent public demand for an audit, the message has finally reached the masses. Hopefully, if such an audit manifests, it will be the first step toward ultimately dismantling the Federal Reserve. (We should start with the extremely shady Bank Term Funding Program). But very little has been written about how to end the Federal Reserve, and that is what I wish to address here.

.jpg?itok=GSJveadq

.jpg?itok=GSJveadq

The How

You may read through my proposed plan and disagree with me on the details. But we must agree on this point: The key objective is to minimize any fluctuations in the current money supply as best we can. This can be done in a delicate manner that might even go unnoticed by the market, outlined in 5 steps:

1. Revoke All Federal Reserve Monetary Policy Privileges

The Federal Reserve should no longer have the ability to directly manipulate the money supply. Repeal the Federal Reserve Act.

2. Lock Down All Debt Assets on the Federal Reserve Balance Sheet

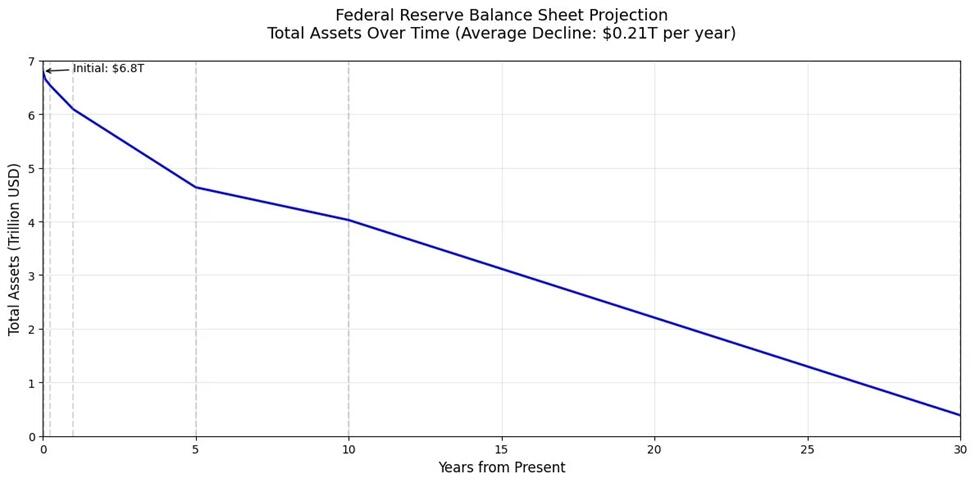

This refers to all assets on the balance sheet with a contractual expiration, such as US Treasuries, mortgage-backed securities, and other loan types. These assets make up roughly 99 percent of the Fed’s balance sheet. Rather than selling them, they should be allowed to expire naturally over the next 30 years—the longest duration of USTs and MBSs. During this period, the Fed may still collect interest payments on these assets and reinvest them to prevent removing those funds from the monetary base.

3. Gradually Sell Off Non-Expiring Assets

Any assets on the Federal Reserve’s balance sheet that lack a contractual expiration should be sold off gradually over a period of 1 to 5 years. At present, I have been unable to find a reliable estimate of how much of this asset type exists, but I suspect it is relatively small—possibly less than a billion dollars.

4. The Federal Reserve Becomes a True Private Institution with No Special Legal Privileges

The Federal Reserve should operate as a fully private institution, stripped of any special legal banking privileges. Its only remaining advantages would be its established market position, its role in facilitating bank-to-bank lending, the interest payments from existing assets on its books, and its historical significance. This is far more than it deserves, but the primary objective must be to dismantle its power without triggering economic catastrophe.

5. If the Federal Reserve Cannot Function as a Private Bank

If the Federal Reserve fails to maintain its market position—which is likely, given that it has never truly faced competition—then major banks will need to determine among themselves how to facilitate interbank lending. They may assign central banking functions to other private institutions, operating within the limits of private banking law. Alternatively, the market may simply deem the Federal Reserve obsolete, allowing it to wither away naturally. Either outcome would be entirely acceptable.

The Balance Sheet Details

As of this writing, the Federal Reserve holds $6.8 trillion on its balance sheet. This follows a sharp 25 percent reduction from its previous $8.9 trillion over the past two years—a decrease of $2.1 trillion. In other words, the Fed initially printed $8.9 trillion and used this newly-created money to purchase assets in the market.

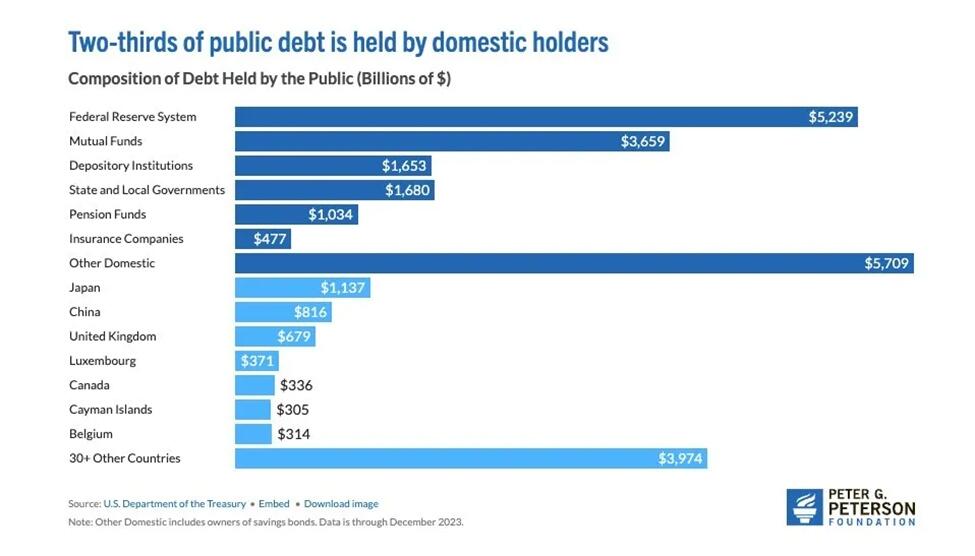

What has the Federal Reserve been buying? Primarily US debt. Our financial system functions like an ouroboros, with the Federal Reserve acting as a perpetual buyer of new government debt—funded by printed money. As of this writing, the Fed holds approximately $5 trillion of the national debt and artificially inflates domestic demand for it. Ending the Federal Reserve would severely restrict the government’s ability to create new debt, forcing a fundamental shift in government spending policy:

?itok=suYkBjWU

?itok=suYkBjWU

Fed Balance Sheet Composition

Currently, $4.2 trillion of the Federal Reserve’s balance sheet consists of US Treasury bonds (USTs), while another $2.2 trillion is made up of mortgage-backed securities (MBS). Together, these two asset classes account for $6.4 trillion, or about 94 percent of the total balance sheet. The remaining 6 percent is a mix of various other debt securities, including corporate debt, federal agency debt, and other loan types, all of which also have contractual expiration dates.

Natural Expiration of Debt Assets

Let’s consider the potential consequences of abandoning current monetary policy and requiring the Federal Reserve to let its debt assets naturally roll off the balance sheet. Debt contracts have expiration dates, meaning that once they reach maturity, they expire worthless and can simply be removed from the balance sheet without active intervention. This approach would gradually shrink the Fed’s holdings over time, reducing its influence on the financial system without the immediate shock of mass asset sales.

Here is a projection of the balance sheet over the next 30 years under this plan:

?itok=6pb3upZR

?itok=6pb3upZR

Projection of Assets Naturally Expiring on Fed Balance Sheet.

The debt expirations are front-loaded, meaning the Federal Reserve’s balance sheet would experience a sharp initial decline before tapering off over time. In the first year, we would see a significant 10 percent reduction, which would gradually level out to a 1.7 percent decrease per year. On average, the decline would be around 3.1 percent annually.

This projection assumes the Fed has purchased debt with an evenly distributed range of expiration dates across different maturity groups, which is likely accurate. In reality, the actual decline would be somewhat more volatile due to variations in the composition of the Fed’s holdings.

Not Quantitative Tightening

The key advantage of this approach is that it differs from traditional quantitative tightening. No funds would be actively removed from banks’ reserves—those reserves would remain at their current levels. Instead, the Federal Reserve’s balance sheet would shrink passively as debt assets naturally expire, avoiding the disruptive liquidity drain that comes with aggressive asset sales.

To fully understand this, a brief crash course in quantitative tightening (QT) is necessary. Admittedly, there is a certain genius to the way Federal Reserve monetary policy operates. When the Fed tightens, it sells assets from its balance sheet to primary dealers (large banks) on the open market. The Federal Reserve essentially functions as a “bank for big banks,” where major US banks store their reserves much like a savings account. These reserves not only remain at the Fed but also earn interest, just like a traditional savings account. This structure allows the Fed to influence liquidity in the financial system without directly impacting the day-to-day operations of commercial banks, making its monetary policy more indirect but highly effective.

When the Fed sells assets to primary dealers, it sells to banks that already have reserve accounts at the Fed. This means the money used to purchase these assets is already parked at the Federal Reserve. When the Fed either sells securities or allows them to mature without reinvesting, two things happen simultaneously: 1) the Fed’s assets decrease as the securities leave its balance sheet; 2) the bank’s reserve account at the Fed decreases by the same amount. These two changes cancel each other out, effectively removing that portion of the monetary base from circulation. This is how quantitative tightening (QT) functions—it contracts the money supply by destroying reserves, rather than directly pulling cash from the economy.

The key difference in my proposed approach is that the Fed would continue receiving interest payments on its remaining assets for the duration of their terms. The most realistic scenario is that these funds will be used to pay interest on reserves held by banks at the Fed, allowing normal banking operations to continue without disruption. However, unless the Fed finds an alternative revenue source, the interest on reserves rate can be expected to gradually decline over the next 30 years as assets roll off the balance sheet. This slow adjustment provides banks with ample time to determine how to manage their reserves in a post-Fed environment.

Inflationary vs. Deflationary Pressures

One likely outcome of this transition would be an increase in business investment by big banks. The interest on reserves paid by the Fed has historically discouraged banks from investing in the open market. From the bank’s perspective, why would I go make a risky investment into some startup, or some business which could hit rough waters and default, when I could just park my assets at the Fed and make a risk-free 4.4 percent? Basically, the Fed has been paying banks to not loan you money.