South Carolina Senate Votes To Oust State Treasurer Over $1.8 Billion Error

South Carolina Senate Votes To Oust State Treasurer Over $1.8 Billion Error

Members of the South Carolina Senate voted on April 21 to remove the state’s embattled treasurer for “willful neglect” of his duties, sending the matter to the state House for consideration.

The 33–8 vote followed an hours-long hearing of the full Senate, during which state Sens. Larry Grooms and Stephen Goldfinch, both Republicans, pushed for state Treasurer Curtis Loftis’s removal over a $1.8 billion accounting error.

?itok=pQn34dYd

?itok=pQn34dYd

South Carolina Treasurer Curtis Loftis prepares for a hearing in the state Senate, in Columbia, South Carolina, on April 21, 2025. Jeffrey Collins/AP Photo

“The big secret of Treasurer Loftis, the one that he’s kept hidden away, is that there are hundreds and hundreds and hundreds of millions of dollars in errors in the Treasury books today, and he doesn’t know how to fix them,” Grooms said in opening the hearing.

A state Senate Finance subcommittee https://www.scstatehouse.gov/CommitteeInfo/SenateFinanceMeetingHandouts/2025Session/Final%20Report.pdf

released last month said Loftis, a Republican, “failed to maintain the integrity” of South Carolina’s banking and investment records after state officials were alerted to an unexplained $1.8 billion in funds under his office’s exclusive control.

An outside forensic https://admin.sc.gov/sites/admin/files/Documents/OED/AlixPartners%20Final%20Report%20011525.pdf

determined that most of the funds in question were not real cash but the result of bookkeeping errors that followed the state’s transition to a new accounting system in the 2010s.

Loftis, now in his fourth term, was first elected treasurer in 2010 and has held the office since.

While two other public officials have resigned in connection with the state’s accounting issues, Loftis, Grooms said, “remains defiant and refuses to take responsibility for his failures.”

Loftis, defending his record, likened himself to President Donald Trump, who vociferously denounced various investigations related to his affairs.

“I’m inspired by President Trump, and I, too, will not back down,” Loftis said.

During prior Senate testimony, the treasurer indicated that the inexplicable funds not only existed but had been invested and were generating returns. After the audit, however, he claimed the report “validated what we’ve known all along,” a statement that Goldfinch derided as “a lie.”

The senator accused Loftis of attempting to cover up a serious error that he knew would damage his reputation.

Loftis’s attorneys downplayed the discrepancy as “an on-paper accounting error” and “an honest mistake.”

“AlixPartners reviewed more than 1 million documents and did not find a single piece of evidence suggesting wrongdoing by the treasurer,” noted Shawn Eubanks, an attorney in the treasurer’s office, referencing the firm that conducted the forensic audit.

Eubanks further held that the audit report provided “good news for the state” in that it found no missing or stolen funds.

“The treasurer’s books reconcile to the bank,” he said.

Loftis’s lawyers also criticized the Legislature’s efforts to oust him as a violation of both his due process rights and the will of the voters who elected him.

“Treasurer Loftis is the most popular statewide official in the history of South Carolina. This is a man who received 80 percent of the vote in the last election, a man who received overwhelming bipartisan support,” attorney Debbie Barbier said.

Decrying the proceedings as “drastic” and unprecedented, Barbier said lawmakers had stripped Loftis of his right to call and confront witnesses by using the state’s removal on address procedure rather than impeachment.

“They’re asking you to make this decision not based on a trial, not with witnesses, not with exhibits and documents and expert testimony and authentication of documents, not with rules of evidence, but based upon a one-and-a-half-hour presentation with video clips,” she said. “There is not one shred of proof and absolutely no evidence to support the removal of Treasurer Loftis.”

The more common impeachment process gives lawmakers the power to impeach and convict a statewide officer for “serious crimes or serious misconduct in office.” The South Carolina Constitution also provides an avenue to removal for “willful neglect of duty” or another “reasonable cause” deemed insufficient for impeachment. That process requires the governor to remove an officer “on the address of two-thirds of each house of the General Assembly” after a hearing.

If Loftis is removed, he would become the first state official in South Carolina’s 235-year history to be ousted under the provision.

It will now be up to the state House, also under GOP control, to decide whether to hold a hearing on the matter.

https://cms.zerohedge.com/users/tyler-durden

Tue, 04/22/2025 - 20:55

US Propane Tanker Diverts Chinese Port Call In Latest Warning Sign For China's Plastic Factories

US Propane Tanker Diverts Chinese Port Call In Latest Warning Sign For China's Plastic Factories

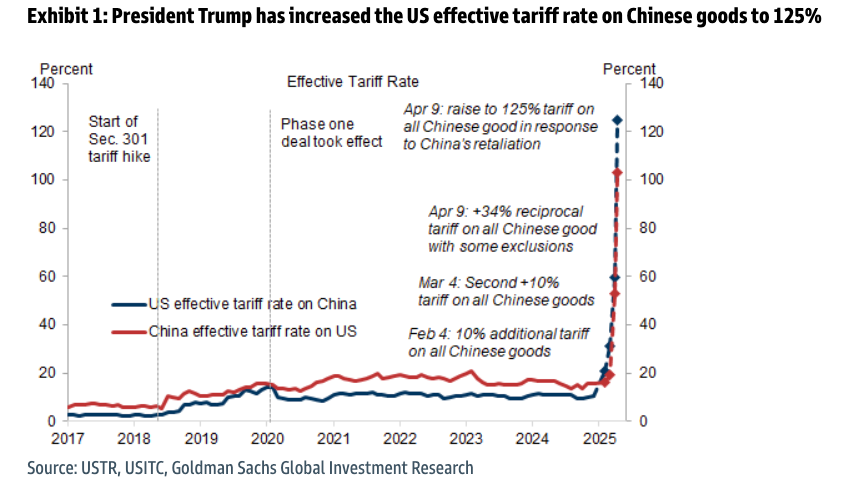

To begin the week, we highlighted a potential breaking point emerging in the global economy due to the escalating tariff war: Chinese plastics manufacturers—heavily reliant on U.S. petrochemicals—now face production halts as shipments are increasingly being diverted from the world's second-largest economy.

cites new ship-tracking data showing that a very large gas carrier hauling U.S. propane has diverted from its initial destination in China to a new port of call in Japan.

The data showed that BW Gemini is hauling 46,000 tons of propane from the U.S. The gas tanker left Phillips 66 Freeport LPG Export Terminal in late March and was initially headed for Yantai, China. However, in recent days, while traversing the Pacific Ocean, the port of call was changed to Imari, Japan.

?itok=hkYmsOlm

?itok=hkYmsOlm

There was no explanation for BW Gemini's sudden port calling switch from China to Japan, but in recent weeks, Beijing slapped 125% tariffs on all liquefied petroleum gas.

?itok=OssV0dM6

?itok=OssV0dM6

The tanker laden with U.S. propane brings the conversation full circle to our note on Monday (read: https://www.zerohedge.com/markets/chinese-plastics-factories-face-mass-closure-us-ethane-disappears

), which warned that the global plastics industry could soon be thrown into turmoil:

Chinese plastics factories that depend on a gas they mainly import from the U.S. are contending with the prospect of widespread shutdowns as the world's two largest economies bunker down for a prolonged trade war

The note titled "Chinese Plastics Factories Face Mass Closure As US Ethane Supply Evaporates" focused on ethane, a petrochemical feedstock to produce ethylene, one of the most critical building blocks in modern manufacturing.

?itok=iZ5dSiCY

?itok=iZ5dSiCY

Ethylene is the foundation for a wide range of downstream products, including:

Polyethylene (PE):

Low-Density Polyethylene (LDPE): Plastic bags, films, food wraps

High-Density Polyethylene (HDPE): Bottles, containers, pipes

Ethylene Vinyl Acetate (EVA): Shoe soles, foam products, adhesives

Industrial Chemicals:

Ethylene oxide: Used to produce ethylene glycol, the base for antifreeze and polyester

Styrene: For polystyrene plastics (packaging, insulation)

Vinyl chloride (via EDC): Used to make PVC for pipes, window frames, cables

Alpha-olefins: For synthetic lubricants and specialty polymers

Polyethylene is indeed one of the core inputs of the modern plastic economy. However, the deepening trade war is disrupting petrochemical shipments to China. If these disruptions persist over a prolonged period, China could face manufacturing slowdowns, potentially triggering ripple effects across the global economy. The IMF already https://www.zerohedge.com/markets/imf-slashes-global-gdp-forecasts-warns-trade-war-fallout-china-us

earlier...

https://cms.zerohedge.com/users/tyler-durden

Tue, 04/22/2025 - 20:30

How Junk Food Took Hold In The US And What RFK Jr. Is Doing About It

How Junk Food Took Hold In The US And What RFK Jr. Is Doing About It

“It’s not food. It’s food-like substances.”

?itok=qpJmkTJp

?itok=qpJmkTJp

Health and Human Services Secretary Robert F. Kennedy Jr. described the many manufactured food products offered that are high in calories but low in nutritional value.

“So, strawberry flavoring in food, but there’s no nutrients. It’s sugar.” Kennedy said. “Your body is craving that, but it doesn’t get filled up. It doesn’t give you nutrition, but you want to eat more.”

Kennedy, a longtime health advocate, has championed President Donald Trump’s call for “fresh thinking on nutrition” as part of the Make America Healthy Again https://www.whitehouse.gov/presidential-actions/2025/02/establishing-the-presidents-make-america-healthy-again-commission/

. The secretary spoke in Indianapolis on April 15 in support of Gov. Mike Braun’s announcement of nine health-related executive orders.

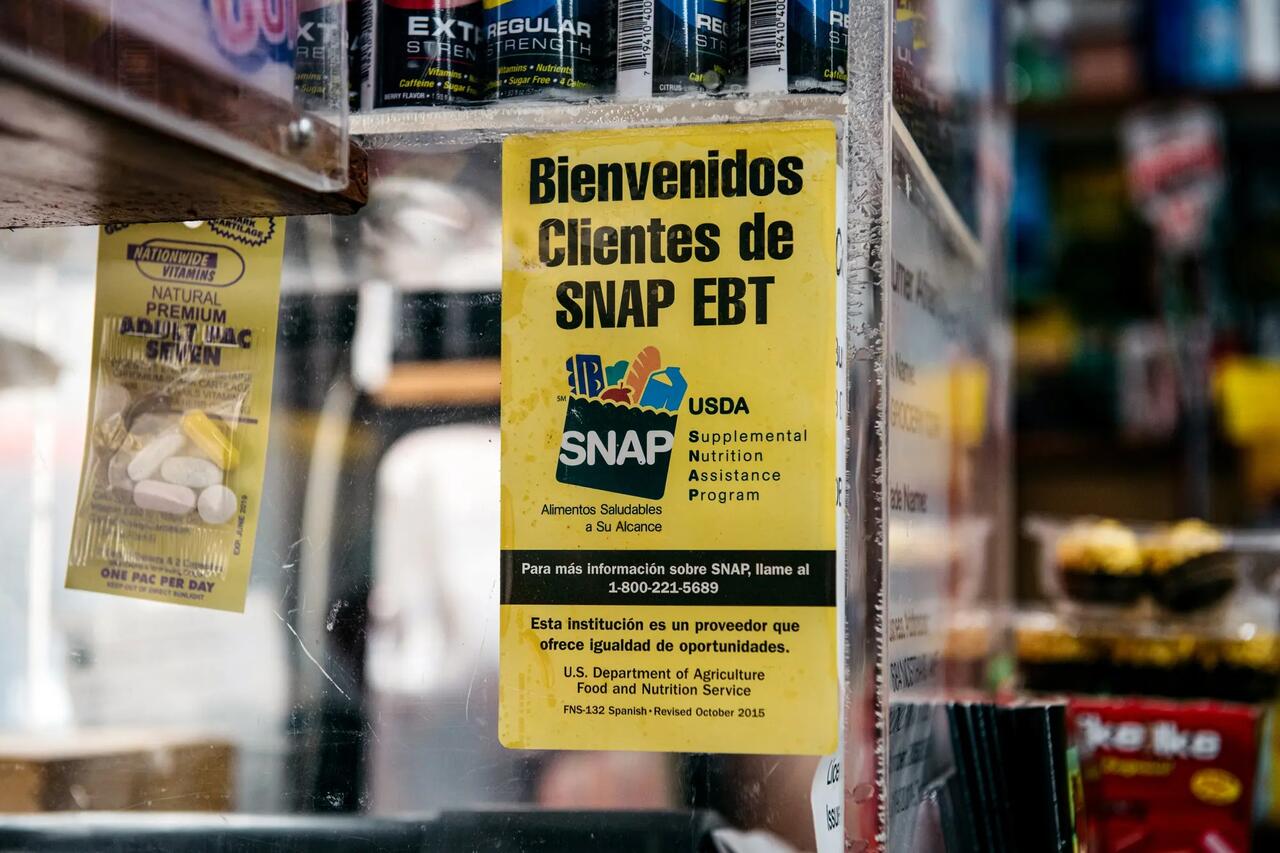

Kennedy has urged states to prohibit the use of Supplemental Nutrition Assistance Program (SNAP) funds to purchase certain foods with high sugar content but little nutritional value.

SNAP, colloquially known as food stamps, is a federal program administered by the states that helps nearly 42 million low-income Americans pay for food.

To change the list of foods eligible for purchase with SNAP funds, states must request a waiver from the U.S. Department of Agriculture (USDA). A handful of states, including Indiana, are doing that.

Advocates call this a commonsense way to promote better food choices.

Some critics say the initiative amounts to virtue signaling, a symbolic action unlikely to produce any positive effect.

Kennedy hopes it will fuel a movement toward healthier food consumption that will reverse the growing prevalence of obesity among Americans.

Junk Food Origins

Kennedy and others have blamed the glut of tasty but vacuous foods on big tobacco companies, which entered the food industry more than 60 years ago.

In the 1960s, R.J. Reynolds and Philip Morris, then the largest tobacco brands, began developing children’s beverages including Hawaiian Punch, Kool-Aid, Capri Sun, and Tang, according to a report from The BMJ, formerly the British Medical Journal.

“Tobacco executives transferred their knowledge of marketing to young people and expanded product lines using colours, flavours, and marketing strategies originally designed to market cigarettes,” a team of researchers https://europepmc.org/article/PMC/6890456#ref27

.

?itok=voC2KpYr

?itok=voC2KpYr

Vuse e-cigarette packages are displayed at Cigar N Vape in Brooklyn, N.Y., on Oct. 13, 2021. The Food and Drug Administration authorized the sale of R.J. Reynolds' Vuse Solo e-cigarette and its tobacco-flavored cartridges the prior day, saying data show the product may reduce smokers’ exposure to harmful chemicals found in traditional cigarettes. Michael M. Santiago/Getty Images

In May 1962, R.J. Reynolds’ director of research reported the status of product development in an internal memo.

The director described the result of taste tests for flavored drinks conducted with children in the same https://www.documentcloud.org/documents/25900452-rj-reynolds-memo-1962/

detailing the addition of artificial flavoring to chewing tobacco and cane sugar to cigarettes.

R.J. Reynolds and Philip Morris eventually went deeper into the food business, owning major brands Kraft, General Foods, and Nabisco for several years starting in the 1980s. There, they applied some of the same strategies to manufacturing other foods people find irresistible.

Researchers at the University of Kansas https://pubmed.ncbi.nlm.nih.gov/37682074/

that food companies owned by tobacco companies were much more likely than others to market “hyper-palatable” food products.

Hyper-palatable foods contain more of the things that make food taste good, such as fat, sugar, sodium, or carbohydrates, according to Tera Fazzino, an author of the Kansas study and associate director of the university’s Cofrin Logan Center for Addiction Research and Treatment.

These foods also have fewer of the nutrients that make us feel satisfied, Fazzino said in a 2023 interview. “As a result, hyper-palatable foods can be difficult to stop eating, even when we physically feel full.”

The researchers concluded, “Tobacco companies appear to have selectively disseminated hyper-palatable foods into the U.S. food system between 1988 and 2001.”

That triggered an industry wide shift, the researchers said. By 2018, foods high in fat, sodium, and carbohydrates had long been widely marketed regardless of whether or not the producers were previously owned by a tobacco company.

The result, according to Kennedy, is an obesity crisis that threatens the health and safety of all Americans.

?itok=7bVB3ejR

?itok=7bVB3ejR

Boxes of sugary cereal fill a store's shelves in Miami on April 16, 2025. Health and Human Services Secretary Robert F. Kennedy Jr. said that many manufactured food products are high in calories but low in nutritional value. Joe Raedle/Getty Images

“We have people who are obese who are at the same time malnourished, because the food that we’re eating is not nutrient-dense anymore,” Kennedy said. “It is threatening our national security: 74 percent of our kids cannot qualify for military service.”

Nearly 70 percent of American adults are either overweight or obese, according to a 2023 https://usafacts.org/articles/obesity-rate-nearly-triples-united-states-over-last-50-years/

by the federal government. Obesity rates have tripled over the last 60 years, while severe obesity has increased by a factor of 10.

Americans are not alone in this. More than 60 percent of Europeans are either obese or overweight, according to data https://pmc.ncbi.nlm.nih.gov/articles/PMC9107388/

by the National Institutes of Health. Worldwide, the prevalence of obesity has risen for decades.

States Respond

Indiana and Arkansas became the first states to submit waiver requests to the USDA, asking to exclude soda and candy from SNAP purchases. Both sent their requests on April 15.

Several other states have announced their intention to seek a waiver, and some are considering legislation to that effect.

Nebraska Gov. Jim Pillen sent a https://governor.nebraska.gov/gov-pillen-signs-letter-usda-requesting-removal-soda-energy-drinks-snap-purchases

to the Department of Agriculture on April 7 saying that the state intends to request a waiver on soda and energy drinks.

Idaho Gov. Brad Little signed a https://legislature.idaho.gov/sessioninfo/billbookmark/?yr=2025&bn=H0109

on April 15 requiring the director of the state Department of Health and Welfare to request a waiver on soda and candy.

State representatives in Tennessee passed a similar https://wapp.capitol.tn.gov/apps/BillInfo/Default.aspx?BillNumber=SB1154&GA=114

on March 26. Neither state’s senate has yet acted on the legislation.

Other states have failed to pass or have rejected legislation that mandates a waiver request.

?itok=14qLaAuN

?itok=14qLaAuN

Cans of Monster Beverage Corporation energy drinks fill a store's shelves in Miami on April 16, 2025. Sweetened beverages—including energy drinks, juices, and powder mixes—account for about 9 percent of SNAP food stamps spending. Joe Raedle/Getty Images

A West Virginia https://www.wvlegislature.gov/Bill_Status/bills_text.cfm?billdoc=hb2350%20intr.htm&yr=2025&sesstype=RS&i=2350

passed in the state Senate but was shelved by the House Committee on Human Resources on April 9.

Arizona Gov. Katie Hobbs on April 15 vetoed a https://www.azleg.gov/legtext/57leg/1R/bills/HB2165H.pdf

prohibiting “ultra-processed” foods in school lunches.

Support, Skepticism

Advocates of a SNAP ban on soda and candy, including some health professionals, see the policy as reasonable, even obvious.

“I think it just makes wise nutritional sense, business sense, common sense,” Christy Hope, an Indiana social worker, told The Epoch Times.

Hope has worked in an outpatient pediatric clinic as well as in a Medicaid office conducting eligibility screening.

“The benefits are intended to cover nutritional items,” she said.

SNAP benefits already https://www.fns.usda.gov/snap/eligible-food-items

foods served hot at the point of sale, alcoholic beverages, vitamins, food supplements, cleaning supplies, cosmetics, and personal hygiene products.

Nutrition and policy experts broadly agree that limiting consumption of high-calorie, low-nutrition foods is a worthy goal.

“I can see the hope to shift [people] away from foods that are ... ultra-processed, empty calories toward healthier options,” Bisakha Sen, a professor of health policy at the University of Alabama at Birmingham, told The Epoch Times. “I think there’s actually some unity on both sides of the political aisle on this.”

Yet she and others doubt the practical value of excluding soda and candy from SNAP purchases, especially when many already https://www.theepochtimes.com/business/families-struggle-with-high-food-costs-despite-snap-benefits-report-5656609

to find low-cost food options.

“If we start making a list of [foods] which are good for people and which are not, it will be a huge list,” Nikhil V. Dhurandhar, chair of nutritional sciences at Texas Tech University, told The Epoch Times. “It is not practical.”

Dhurandher likened a grocery store to a vast buffet. “If you remove one [sugary] food, there is some other food that’s going to take its place. I call that digging a hole in water.”

Richard Kahn, an adjunct professor of medicine at the University of North Carolina Medical School, says the SNAP exclusions amount to a “cheap, easy way to blame the other guy.”

According to Kahn, the idea that taxpayers will no longer subsidize the purchase of sugary foods is mistaken. “They’re [still] paying for sugar-sweetened beverages because we subsidize the agriculture industry,” he said.

?itok=vZuIijmS

?itok=vZuIijmS

A sign alerting customers about SNAP food stamps benefits is displayed in a grocery store in Brooklyn, N.Y., on Dec. 5, 2019. Health and Human Services Secretary Robert F. Kennedy Jr. has urged states to ban the use of SNAP funds for foods with high sugar content but little nutritional value, in efforts to promote healthier food consumption and reverse rising obesity rates among Americans. Scott Heins/Getty Images

Alternatives

Many nutrition and policy experts favor a holistic, all-of-society approach rather than one that targets behavior in just one group of people.

Some have suggested a tax on soda to discourage consumption. Others mentioned improving the nutritional value of school lunches. Sen. Bernie Sanders (I-Vt.) has suggested banning television ads for unhealthful foods targeting children.

Nana Gletsu Miller, an associate professor at the Indiana University School of Public Health, favors education over behavioral mandates.

“Based on the evidence for the effectiveness of nutrition education and the lack of evidence for the effectiveness of restriction of food choice, I suggest the former would be a better approach,” Gletsu Miller told The Epoch Times.

A deeper problem is the lack of affordable, nutritious food, according to Dr. Tamara S. Hannon, a professor of pediatrics at the Indiana University School of Medicine and director of its clinical diabetes program.

“It is the sale of health-harming products at a very low price without affordable and convenient options that is problematic. This policy does not address this issue,” Hannon told The Epoch Times.

Kennedy acknowledges that the broader health care landscape can work against healthy outcomes, yet he believes that can change.

?itok=Z8tYiw9n

?itok=Z8tYiw9n

Secretary of Health and Human Services Robert F. Kennedy Jr. speaks during a news conference at the Department of Health and Human Services in Washington on April 16, 2025. Alex Wong/Getty Images

“We can realign medical choices, both individual and institutional medical choices, with public health,” Kennedy told The Epoch Times at the Indianapolis press conference, adding that right now, “it’s totally misaligned.”

Achieving that will require a concerted effort at the federal, state, and local levels, Kennedy said.

“We can’t do this alone, but we’re getting tremendous help from the governors, from the grassroots,” Kennedy said.

“What’s happening here [in Indiana] is driving this movement, and it’s going to drive cultural change.”

https://cms.zerohedge.com/users/tyler-durden

Tue, 04/22/2025 - 20:05

https://www.zerohedge.com/medical/how-junk-food-took-hold-us-and-what-rfk-jr-doing-about-it

High-Ranking Democrat Hints At Revenge Against Countries Working With Trump

High-Ranking Democrat Hints At Revenge Against Countries Working With Trump

Rep. Jamie Raskin (D-MD) has threatened nations that, in his words, “enabled authoritarianism in our country,” warning that Democrats will not view foreign leaders favorably when his party regains power.

?itok=hm4OL88A

Raskin, Ranking Member of the House Judiciary Committee, referenced El Salvador’s President Nayib Bukele’s support for former President Donald Trump’s deportation policies.

“If and when we come back to power - and we will - we are not gonna look kindly upon people who facilitated authoritarianism in our country,” Raskin said on Pod Save America with host Tommy Vietor, according to the https://nypost.com/2025/04/20/us-news/dem-rep-jamie-raskin-threatens-countries-that-support-trump/

. Vietor, a former spokesman for President Barack Obama, shared that a Latin American policy researcher advised Democrats to “threaten action against any foreign government complicit in the extraordinary rendition of American citizens.”

“The whole idea that Bukele doesn’t have any power to return an American prisoner who was sent to him under an agreement where he’s getting paid $6 million by America is ridiculous,” Raskin https://nypost.com/2025/04/20/us-news/dem-rep-jamie-raskin-threatens-countries-that-support-trump/

. “He’s our legal agent in this dubious arrangement they created. Of course, he’s got the power to return them.”

the Alien Enemies Act of 1798 to deport illegal alien gang members to El Salvador. Some of these individuals have been detained in El Salvador’s Terrorism Confinement Center (CECOT) prison.

The Trump administration deported Carlos Abrego Garcia, a 29-year-old Salvadoran who illegally entered the U.S. in 2011, to El Salvador, initially calling it an "error," though officials later justified the action, alleging MS-13 ties—a claim his attorneys reject, the New York Post said.

Trump’s use of the Alien Enemies Act of 1798 has faced legal hurdles.

In March, Judge James Boasberg https://www.zerohedge.com/geopolitical/el-salvador-offers-swap-venezuelans-deported-us-political-prisoners-held-venezuela

a temporary restraining order to block the Trump administration’s use of the Alien Enemies Act for deporting alleged Venezuelan gang members to El Salvador without due process, citing violations of judicial orders. Facing administration defiance, he initiated contempt proceedings, alleging bad faith in rushing deportations, including that of Carlos Abrego Garcia, despite a 2019 court protection.

Bukele, during a recent White House meeting with former President Donald Trump, addressed the deportation of Carlos Abrego Garcia, https://fortune.com/2025/04/15/el-salvador-president-bukele-return-wrongly-deported-maryland-man/

he lacks the authority to return him to the U.S. and dismissing such requests as “preposterous.”

“Donald Trump is a convicted criminal. Could he be sent off to a foreign prison?,” Raskin said at another point in his discussion with Vietor.

“We’ve got to become the leaders of a nationwide popular movement to arrest the descent into fascism in America,” the House Democrat added. “These people really believe that democracy is defunct. They say we live in a constitutional America.”

https://cms.zerohedge.com/users/tyler-durden

Tue, 04/22/2025 - 19:40

Harvard Law School Professors Politicize The Rule Of Law

Harvard Law School Professors Politicize The Rule Of Law

,

A camp counselor picks favorites by lauding some campers regardless of how ordinary or even counterproductive their conduct while ignoring or disparaging other campers’ valuable contributions. A referee takes sides by giving all benefits of the doubt to one team. And a human rights activist flouts the rights shared by all persons by expressing outrage at and even exaggerating or outright fabricating abuses perpetrated by one set of combatants while turning a blind eye to atrocities executed by the opposing combatants.

?itok=J3Q60qIj

?itok=J3Q60qIj

The same goes for the rule of law in America – that is, a system in which individuals are subject to well established, general, and publicly promulgated rules that are equally enforced and impartially adjudicated. A group that defends law’s integrity against threats from one party but remains silent while the rival party repeatedly abuses the law over the course of many years to consolidate power and harm political opponents politicizes an essential principle that transcends the differences between partisans.

In this way, 96 voting members of the Harvard Law School faculty (active or emeritus) have called attention to their dubious dedication to the rule of law.

On March 29, this HLS faculty supermajority published online “https://drive.google.com/file/d/1aKzGVQxrotpNGblivMHsIdXnXwVDlJ3M/preview

.” Writing in their “individual capacities,” the professors explain that they took this extraordinary step because “American legal precepts and the institutions designed to uphold them are being severely tested, and many of you have expressed to us your concerns and fears about the present moment.” Despite their best efforts to demonstrate that they were not speaking for Harvard Law School – the professors declined to use the law school’s stationery and website, and they did not include their faculty titles in their signatures – the sheer number of signatories attested to the professors’ espousal of HLS orthodoxy.

A widely shared respect for the rule of law at Harvard Law School would be welcome. For decades, HLS has served as a premier platform for a variety of fashionable perspectives including critical legal studies, critical race theory, identity politics, and woke progressivism. In one way or another, all attack the rule of law’s claim to stand above politics. Some cutting-edge professors at HLS insist that in practice the rule of law is a fraud perpetrated by the powerful, a tool by which oppressors justify their power and lull the oppressed to accept their subordination.

The supermajority’s March 29 letter might suggest that the pendulum has shifted, inasmuch as the signatories say that they “share, and take seriously, a commitment to the rule of law: for people to be equal before it, and for its administration to be impartial.” This commitment, they stress, “is foundational to the whole legal profession, and to the special role that lawyers play in our society.”

The supermajority’s selective apprehensions, however, suggest that they are friends of convenience to the rule of law.

The HLS faculty do not explicitly mention President Trump or the Trump administration. But the professors highlight in four bullet points steps that “government leaders” are taking that imperil the rule of law:

single out lawyers and law firms for retribution based on their lawful and ethical representation of clients disfavored by the government, undermining the Sixth Amendment;

threaten law firms and legal clinics for their lawyers’ pro bono work or prior government service;

relent on those arbitrary threats based on public acts of submission and outlays of funds for favored causes; and

punish people for lawfully speaking out on matters of public concern.

The HLS professors acknowledge that “reasonable people can disagree about the characterization of particular incidents.” But they do not explain why their genuinely concerning allegations endanger the rule of law itself. Not every unlawful action threatens the foundations of equal liberty under settled and fairly administered law. Indeed, America’s separation of powers system anticipates executive overreach, and the Constitution gives Congress and the courts ample power to rein in the president.

Furthermore, over the last 15 years or so, Democrats, federal bureaucrats, and the D.C. power elite have repeatedly abused power to advance progressive priorities: For example:

In 2010, President Barack Obama’s IRS targeted conservative organizations to deny them tax-exempt status.

In 2012, Obama effectively legislated from the White House by creating through executive order the Deferred Action for Childhood Arrivals program (DACA) which eliminated the administration’s responsibility to enforce elements of immigration law.

In 2016, Obama administration FBI Director James Comey usurped the attorney general’s authority by publicly declaring that presumptive Democratic presidential nominee Hillary Clinton could not be reasonably prosecuted for conducting as secretary of state her email correspondence on her private server, including many chains containing classified information, several of which chains contained emails deemed “Top Secret.”

Also in 2016, Comey launched, on the flimsiest of pretexts, an investigation – fueled in part by Clinton campaign opposition research – into Republican nominee Donald Trump’s alleged collusion with Russia. The successor investigation led by Special Counsel Robert Mueller hamstrung the Trump administration for two years while concluding that the evidence did not show that candidate Trump collaborated with Moscow.

From 2021-2024, the Biden administration furtively maneuvered to protect Hunter Biden from prosecution for tax evasion, making false statements on a firearm purchase, and unlawful possession of a gun.

In 2022, President Joe Biden sought to usurp congressional authority by erasing through executive order approximately $400 billion in federal student-loan debt.

In 2023, the Biden Justice Department declined to prosecute President Biden for retaining classified documents for many years and in several locations, and for disclosing their contents to at least one individual who lacked clearance.

In 2023, as primary season approached, Democratic prosecutors filed against Trump four criminal indictments – some of which were based on novel and farfetched legal theories – in four jurisdictions for alleged unlawful conduct stretching back to 2016.

In 2025, federal district courts have promiscuously issued nationwide injunctions that go beyond the parties before them to prohibit the Trump administration from implementing its policies anywhere in the country.

Reasonable people can disagree about the characterization of these events. But the larger question remains: Where were the collective statements of the supermajority of HLS professors – or majority, or even a small minority – about the sanctity of the rule of law when a long train of abuses of law over many years benefited the Democratic Party?

The HLS professors also highlight perils to the rule of law stemming from Trump administration efforts to terminate green cards and visas of international students whose presence in the United States, according to a https://www.documentcloud.org/documents/25894225-dhs-documents-mahmoud-khalil/#document/p1

from Secretary of State Marco Rubio, creates “potentially serious adverse foreign policy consequences for the United States.” At Harvard “and many other universities, international students have reported fear of imprisonment or deportation for lawful speech and political activism,” the professors write. Such government action, they warn, would contravene the First Amendment, “which was designed to make dissent and debate possible without fear of government punishment.”

The HLS professors rightly demand that government scrupulously adhere to free-speech requirements. If only the Harvard 96 had shown such firmness in defense of free speech over the last several decades. Instead, elite campuses have made a habit of punishing departures from progressive orthodoxy with censorship, ostracism, denial of job opportunities, and more. Indeed, if safeguarding free speech were a priority for the HLS professors, they had no further to go than their own back yard to come to its aid. Harvard University recently finished dead last for the second consecutive year in the Foundation for Individual Rights and Expression (FIRE) https://www.thefire.org/research-learn/2025-college-free-speech-rankings

for protecting campus free speech. Yet this disgrace has not roused the HLS supermajority to action.

In a March 30 https://thenewdigest.substack.com/p/an-open-letter-to-my-students

to his students, which provides a trenchant reply to his HLS colleagues, Professor Adrian Vermeule observes that the supermajority’s “ideological blindness” makes its letter “deeply corrosive of the shared ideal of the rule of law.”

For instance, Vermeule notes, the signatories were nowhere to be found when Trump’s lawyers were prosecuted for representing him; when activists threatened Republican-appointed Supreme Court justices’ homes and families; and when outside the Supreme Court Senate Minority Leader Chuck Schumer threatened Justices Gorsuch and Kavanaugh with retribution for their rulings.

“The central vice of the collective letter, then, is that it is tendentious,” Vermeule concludes. “It attempts to appropriate a shared ideal and turn it to sectarian ends, implicitly aiming to define anyone who disagrees as an opponent of the rule of law altogether. In doing so, it runs the grave danger of causing or at least licensing anyone who does not agree with those sectarian ends to see all talk of the rule of law as a political sham.”

The Harvard Law School professors’ self-discrediting reflects decades of squandered moral, political, and intellectual capital. At this precarious moment, the nation desperately needs citizens capable of rising above the political fray to adopt a constitutional perspective. Alas, our professors keep demonstrating that they are among the least likely to provide that crucial civic service.

Peter Berkowitz is the Tad and Dianne Taube senior fellow at the Hoover Institution, Stanford University. From 2019 to 2021, he served as director of the Policy Planning Staff at the U.S. State Department. His writings are posted at PeterBerkowitz.com and he can be followed on X @BerkowitzPeter.

https://cms.zerohedge.com/users/tyler-durden

Tue, 04/22/2025 - 19:15

https://www.zerohedge.com/political/harvard-law-school-professors-politicize-rule-law

BYD Is Expanding Into Japan's Mini-Car Market

BYD Is Expanding Into Japan's Mini-Car Market

Chinese EV giant BYD is already expanding outside of China, into South America and...well, all over the world.

It's next stop looks like it's going to be deepening its offerings in Japan, where a crucial trade deal between the U.S. and Japan may hang in the balance somewhat. BYD plans to enter Japan's minicar market by 2026, challenging domestic dominance with a low-cost electric model tailored for the country, https://asia.nikkei.com/Business/Automobiles/Electric-vehicles/BYD-to-enter-Japan-s-mini-EV-segment-in-2026?utm_campaign=GL_asia_daily&utm_medium=email&utm_source=NA_newsletter&utm_content=article_link&del_type=1&pub_date=20250421190000&seq_num=3&si=79447

.

The company has finalized the design of the vehicle and is targeting a price of around 2.5 million yen ($17,700).

?itok=eLQ5gaeZ

?itok=eLQ5gaeZ

Minicars, or kei-jidosha, make up about 40% of Japan's auto market but have historically been tough for foreign automakers to crack. BYD’s push comes amid its global expansion, particularly in Southeast Asia, as it looks to boost its presence in Japan’s EV sector.

that BYD, which entered Japan in 2023 and has sold just 4,530 units as of March, is shifting strategy with its first vehicle designed exclusively for a foreign market.

The company plans to produce a Japan-specific electric minicar and is bringing in experts familiar with the local market.

Japanese minicars—defined as vehicles under 3.4 meters long and 1.48 meters wide—are popular for their affordability and tax benefits. The segment now includes electric options like Nissan’s Sakura and Mitsubishi’s ek X EV.

Not exactly Ford F-150s...

https://cms.zerohedge.com/users/tyler-durden

Tue, 04/22/2025 - 18:50

https://www.zerohedge.com/markets/byd-expanding-japans-mini-car-market

How Fragile Is The US Economy?

How Fragile Is The US Economy?

The U.S. economy is complex. So is the global economy. They are not just complicated but complex, and there is a difference.

Complications can be studied, understood, and possibly managed with systems of intelligence.

?itok=YusP5_u4

?itok=YusP5_u4

Complex systems evade that. There are too many moving pieces, uncertainties about the weight of causal factors, unanticipated secondary effects, the presence of relentless change, plus myriad exigencies of human choice.

Economics as a science and profession prefers to deal with solvable complications, which is why all models frame factors into buckets of causal relationships. The favorite phrase is Ceteris Paribus: when all else is equal. It means that such and such is true provided there are no other intervening changes and factors that make it untrue. This is how economic logic works.

It is an enormously valuable science for understanding unchanging conditions. It becomes less valuable once it purports fully to understand the whole while changing factors in the mix, Attempts to manage economic life set off forces no model can anticipate. Which forces? No one can predict those either.

Think of macroeconomics as a giant Jenga puzzle with blocks built out of every economic force you can name: monetary policy, government spending, debts and deficits, consumer demand, loan markets, financial markets, national affairs, international affairs, taxes, prices, expectations, confidence, exigencies of response to changes, entrepreneurial innovation, the shifting labor force, demographics, supply chains, natural resources, cost calculations, and so much more, up to possibly infinity.

As with the game Jenga, you can pull out one piece, several, maybe many, and the structure will still stand. The reason the game is fun is that no player knows for sure which pull of a block will send the whole thing tumbling all over the table. Everyone screams in amazement that it stood this long, and no one can explain for sure precisely why this one last move caused the collapse.

Perhaps that is not a satisfying way to think. Intellectuals don’t like to imagine there is some system outside of their understanding or control. That’s why they render every complex system as one that is merely complicated.

In 1945, F.A. Hayek wrote a piece in the American Economic Review that tried to explain this. It was called “https://www.econlib.org/library/Essays/hykKnw.html

.” It argued that too many economists assume away the very essence of the problem in need of solving:

“The peculiar character of the problem of a rational economic order is determined precisely by the fact that the knowledge of the circumstances of which we must make use never exists in concentrated or integrated form but solely as the dispersed bits of incomplete and frequently contradictory knowledge which all the separate individuals possess.”

He concluded: “To assume all the knowledge to be given to a single mind in the same manner in which we assume it to be given to us as the explaining economists is to assume the problem away and to disregard everything that is important and significant in the real world.”

Ouch.

This article became the most cited piece Hayek ever wrote, and one of the most often cited articles in the whole of economic literature. There was only one problem: taking it seriously would mean that most of what economics did would have to come to an end. In the intervening 80 years, not much has changed. Economics as a discipline has yet to absorb the lessons he offered.

I’m writing as many forces are colliding at once in the real world. Financial markets are terrified of an impending recession (supposing it is not here already). The new U.S. president is determined to deploy every tool to reconstruct trading relationships around the world, meaning mainly the tariff.

You can make a strong case for tariffs as a tool of revenue. There are conditions under which the tariff can operate as a tool of industrial protection, too. This is different. Tariffs bear the burden of rebuilding production processes that have unfolded over half a century.

The beef with the trading order as it existed for decades is that it depleted America’s manufacturing strength. It seemed as if China was becoming the producer to the world and not much was left for the United States, apart from the export of financial and data services plus raw materials.

In theory—and this was mapped out by the new head of the Council of Economic Advisors—the tariff could serve as a proxy for currency settlement that has eluded the world since 1973, when Nixon overthrew the gold standard.

The theory, as always, works on paper. But as with all models—perfect blueprints for navigating the Jenga tower of world economic affairs—we do well to ask what contingencies they are not foreseeing. Just how easy it will be to restore U.S. manufacturing using tariffs is highly contingent on an accurate reading of the extent to which U.S. standards of living are contingent on existing trading relationships.

No one has a clear answer on that.

That leaves financial markets guessing in a sea of uncertainty. They do not like that. As the new realities are starting to dawn—namely, the overthrow of 80 years of policy with a new plan hatched by just a handful of people—traders have become very nervous.

What exactly is the Fed’s role here? How many industries have to be bailed out given obvious sufferings? How much pain are we really willing to tolerate as we await the dawning of the new golden age?

These are hard questions. The soaring price of gold indicates a flight to safety. That’s not a vote of confidence in what is unfolding. A plan on this scale that once took the best and brightest the better part of 15 years to consider and deploy—speaking here of the Bretton Woods architecture built following World War II—is being unleashed in so many weeks, but with an even grander vision and the strong likelihood of prolonged retaliatory measures.

There is simply no possible way that every contingency has been considered here, and thus do we have this stop-and-start system of trade negotiations that looks very much like improvisation.

Looming large over all these efforts is the political timing. There are midterms. There is a presidential election in three and a half years. The last one was largely decided based on economics, the desire on the part of so many to stop the inflation and restart growth. Inflation has indeed been crushed. Not even the imposition of tariffs seems to have changed the real-time trajectory of downward prices.

How long can that last? No one knows for sure. We are in no-man’s land of policy impositions, and that stands atop great uncertainty about the implications of putting a hard stop on many decades of low-tariff or at least stable-tariff trade ambitions. We can argue about this all evening at a cocktail party, but real life doesn’t afford that luxury. This is real life now.

Again, economics is complex, meaning evasive of anyone’s full comprehension of the import of dramatic changes as pushed by a single regime. It’s for this reason in part that the default for policy bias should always be toward the old-fashioned values: balanced budgets, sound money, non-punishing taxes, and maximum freedom for enterprise. Freedom permits flexibility to adapt to change. Any other scheme open up potentially grave risks concerning the impact on people’s lives.

You can call me a worrywart, but my concerns are based on long experience and doubts about the “best laid plans.” I genuinely hope that I’ve failed to see the hidden genius underlying a global trade war. My deeper fear is that we are dealing with a beast that can bite back in ways that could ultimately be devastating long-term. We don’t know precisely what might cause this fragile system to buckle and fall.

Everything that Trump has accomplished, and it is a long and meritorious list, is at stake. If bungling the economic piece of this ends up provoking regime change, I don’t even want to contemplate the implications of the reign of left-revanchism. This is why I would counsel caution above all else in the imposition of huge plans and rather stick to the tried and true, which is more freedom above all else.

Views expressed in this article are opinions of the author and do not necessarily reflect the views of The Epoch Times or ZeroHedge.

https://cms.zerohedge.com/users/tyler-durden

Tue, 04/22/2025 - 18:25

'ATM' That Melts Gold Down, Sends Funds To Account Spotted In China

'ATM' That Melts Gold Down, Sends Funds To Account Spotted In China

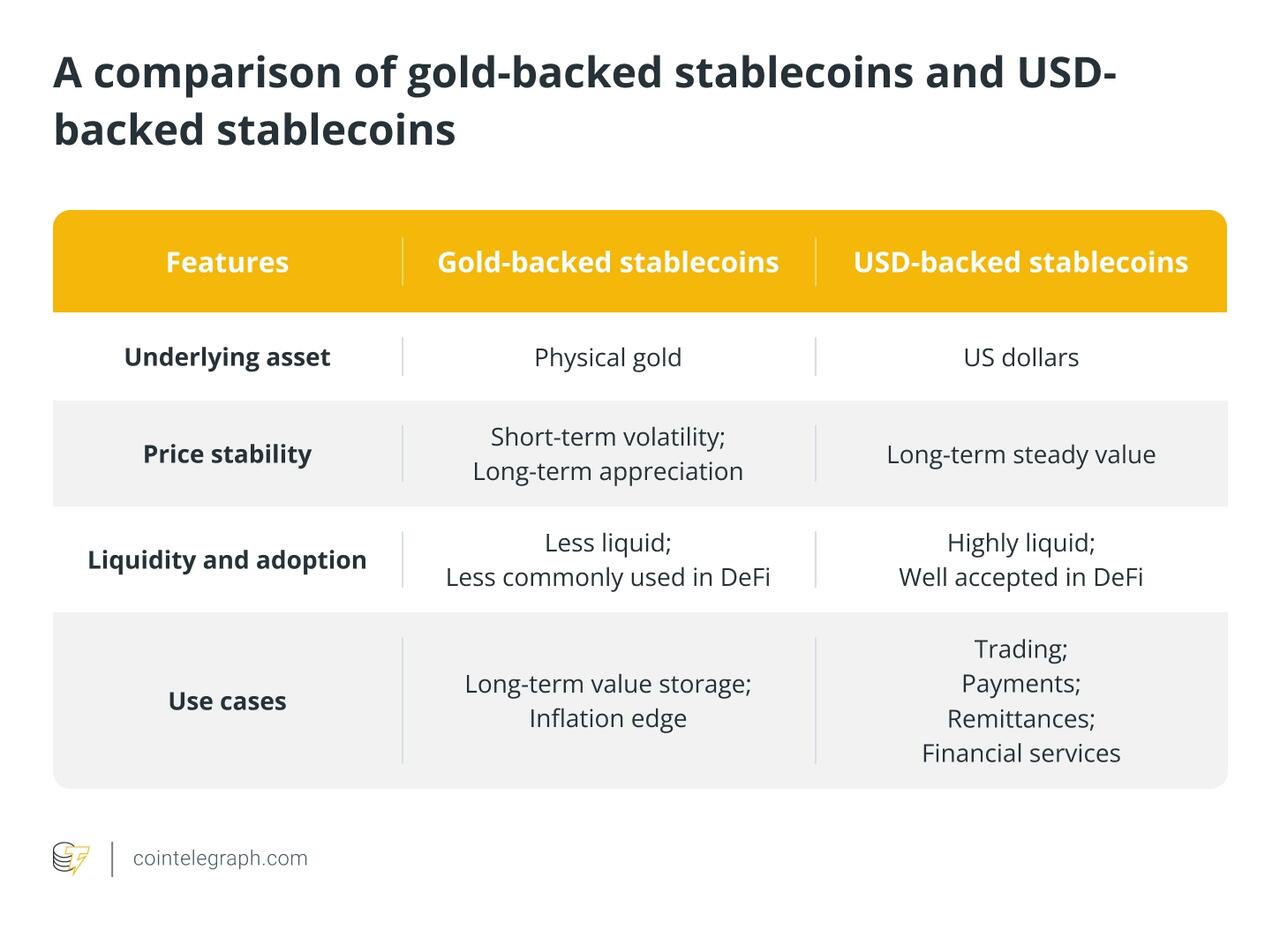

With Chinese traders continuing to send physical https://www.zerohedge.com/markets/gold-physical-premium-soars-shanghai-china-demand-accelerates

, a new 'ATM' has been spotted in Shanghai that accepts physical gold, melts it down, determines its purity and weight, and then sends funds to one's bank account within 30 minutes.

🇨🇳 LATEST: China unveils gold-to-cash ATMs that melt jewelry, verify purity, and transfer funds to bank accounts, all in just 30 minutes. https://t.co/mln1cC18O3

— Cointelegraph (@Cointelegraph) https://twitter.com/Cointelegraph/status/1914333563501084864?ref_src=twsrc%5Etfw

The machine, made by China's Kinghood Group, will accept any gold items weighing over three grams and at least 50% purity, and will process it and transfer the equivalent value straight into the seller's bank account within 30 minutes, according to https://www.msn.com/en-in/news/India/china-s-gold-atm-melts-jewellery-and-sends-money-in-30-minutes-check-here/ar-AA1DmGXL

, which notes that "No paperwork or ID is needed."

, people are lining up to cash in their old jewellery, reports mention. The demand is so high that users now need to book a slot to use the machine. Reports say all appointments are booked till May, reflecting its strong demand, as per Chinatimes.com.

In one demonstration, a 40-gram gold chain fetched 785 yuan (around Rs 9,200) per gram. The total payout? Over 36,000 yuan, or Rs 4.2 lakh, credited to the seller's account in half an hour, according to the publication.

Chairman of RPG Enterprises, Harsh Goenka, posted to X: "Gold ATM in Shanghai: Drop your jewellery, it checks purity, melts it, calculates value, and credits your account instantly," adding "If this comes to India, traditional gold lenders might need a new business model."

Gold ATM in Shanghai: Drop your jewellery, it checks purity, melts it, calculates value, and credits your account instantly.

If this comes to India, traditional gold lenders might need a new business model.

Transparency in. Exploitation out. https://t.co/KgjI7nxCP9

— Harsh Goenka (@hvgoenka) https://twitter.com/hvgoenka/status/1914314246671982738?ref_src=twsrc%5Etfw

https://cms.zerohedge.com/users/tyler-durden

Tue, 04/22/2025 - 18:00

https://www.zerohedge.com/commodities/atm-melts-gold-down-sends-funds-account-spotted-china

Andrew Cuomo Referred To DOJ For Criminal Prosecution

Andrew Cuomo Referred To DOJ For Criminal Prosecution

Authored by https://headlineusa.com/author/ksilva

,

Last October, the Select Subcommittee on the Coronavirus Pandemic has sent a criminal referral to the https://headlineusa.com/tag/justice-department

be charged with making false statements to Congress.

?itok=v2__JnVs

?itok=v2__JnVs

Unsurprisingly, the DOJ ignored the referral. Some six months later, House Oversight Committee Chairman James Comer, R-Ky., has asked Trump’s Justice Department to take a look at the matter again.

“To our knowledge, the Biden Administration ignored this referral despite clear facts and evidence. Accordingly, we request you review this referral and take appropriate action,” Comer said Monday in a letter to Attorney General Pam Bondi.

Andrew Cuomo LIED to Congress about his deadly nursing home scandal.

That’s why Chairman Comer (https://twitter.com/RepJamesComer?ref_src=twsrc%5Etfw

) for criminal charges.

Seniors in New York DIED under Cuomo’s must-admit nursing home order. https://t.co/FIZxp0ujgk

— Oversight Committee (@GOPoversight) https://twitter.com/GOPoversight/status/1914418616826577262?ref_src=twsrc%5Etfw

According to last year’s coronavirus subcommittee report, Cuomo had reviewed, edited, and even drafted portions of a purportedly independent and peer-reviewed New York State Department of Health report, which was used to support his deadly pandemic-era nursing home policies.

However, Cuomo told the subcommittee in his June transcribed interview that he had nothing to do with that report. Cuomo’s lie is why the House GOP wants him criminally charged.

“Andrew Cuomo is a man with a history of corruption and deceit, now caught red-handed lying to Congress during the Select Subcommittee’s investigation into the COVID-19 nursing home tragedy in New York,” Comer said Monday.

“This wasn’t a slip-up—it was a calculated cover-up by a man seeking to shield himself from responsibility for the devastating loss of life in New York’s nursing homes.”

The Cuomo administration came under significant scrutiny for a policy that at first required nursing homes to readmit recovering https://headlineusa.com/tag/coronavirus

patients in an effort to avoid hospitals from becoming overwhelmed. That was on top of state fatality figures that significantly undercounted the deaths.

In June, an investigation into https://headlineusa.com/tag/new-york

handling of the COVID-19 pandemic found former Gov. Cuomo’s “top down” approach of dictating public health policy through his office—rather than coordinating with state and local agencies—sewed confusion during the crisis.

In the state’s nursing homes, where some 15,000 people died, the administration’s lack of communication with agencies and facilities resulted in wasted resources and mistrust — not to mention anxiety for residents’ loved ones, according to the independent probe commissioned by current Gov. Kathy Hochul in 2022.

Cuomo resigned from office in August 2021, amid sexual harassment allegations, which he denies. Hochul, a fellow Democrat who had been Cuomo’s lieutenant, inherited the job and was reelected the follow year.

https://cms.zerohedge.com/users/tyler-durden

Tue, 04/22/2025 - 17:40

https://www.zerohedge.com/covid-19/andrew-cuomo-referred-doj-criminal-prosecution

Democrat County Attorney Lets Anti-Tesla Terrorist Off the Hook

Democrat County Attorney Lets Anti-Tesla Terrorist Off the Hook

,

So an unhinged leftist goes through downtown Minneapolis, casually walking his dog and keying Teslas as if it’s a hobby. Not just one or two vehicles, but six Teslas, to be exact, with damage totaling more than $20,000. Caught red-handed on video, arrested by police, and unequivocally identified as 33-year-old Dylan Adams, a state employee no less.

?itok=SUMn4Pyt

?itok=SUMn4Pyt

Seems like a slam-dunk criminal case, right? Wrong. Instead of holding him accountable, Hennepin County Attorney Mary Moriarty https://www.fox9.com/news/hennepin-county-attorney-wont-criminally-charge-tesla-vandal

.

Yes, you read that right. The man caused tens of thousands of dollars in damage, but rather than face criminal charges, Adams gets the warm embrace of “diversion.” According to Moriarty’s office, its priority is ensuring that he “keeps his job” and has the opportunity to pay restitution. Really? Is this what justice looks like now under liberal leadership—a coddling of the perpetrator while his victims are left wondering if their property even matters? This isn’t prosecutorial discretion; it’s left-wing activism.

?itok=ZUPx94to

?itok=ZUPx94to

As a Democrat affiliated with Minnesota’s DFL Party, Moriarity has https://en.wikipedia.org/wiki/Mary_Moriarty

championed leftist criminal justice reforms, including claims of racial disparities in marijuana stings and traffic stops, advocating for reduced incarceration, and emphasizing rehabilitation for juvenile offenders. Her tenure as Hennepin County Public Defender has been marked by clashes with establishment figures over her vocal stance on systemic racism. She also publicly identified as queer during her campaign, aligning herself with broader social justice movements.

This is a case study in everything wrong with progressive governance. Minneapolis police did their job. They identified a suspect, arrested him, and presented the case to the Hennepin County Attorney’s Office. But instead of enforcing the law, Moriarty turned it into a joke. The perpetrator is a state employee, a data analyst for the Department of Human Services. If that sounds familiar, it’s because bureaucrats like him are protected at all costs under leftist policies, and that protection comes at our expense.

Who benefits from this? It’s certainly not the victims, who now have to fight tooth and nail for restitution they may never see. And it’s certainly not law-abiding citizens who are left wondering if criminals face any real consequences anymore. This isn’t just a failure at the local level; it’s emblematic of a broader liberal obsession with excusing bad behavior. In their worldview, the criminal is somehow the real victim, and property crimes are treated as minor inconveniences instead of serious offenses.

But this wasn’t a random outburst of poor judgment. Adams systematically keyed cars targeting automotive “villains” like Tesla because Elon Musk has the audacity to want to root out wasteful spending from the government.

NEW: Minneapolis Police Department rips far-left DA Mary Moriarty for declining to charge a Minnesota government employee who caused $20,000 in damages to Teslas.

No wonder why Minneapolis is turning into a sh*t hole.

Police provided evidence of 33-year-old Dylan Bryan Adams… https://t.co/g7h7lnjnks

— Collin Rugg (@CollinRugg) https://twitter.com/CollinRugg/status/1914710507535393217?ref_src=twsrc%5Etfw

Even more infuriating, Moriarty’s office tried to spin this decision as a win for fairness and justice. “Our main priorities are to secure restitution for the victims and hold Mr. Adams accountable,” a spokesperson claimed.

Really? Because it seems like the only person with guaranteed benefits here is the guy who broke the law. The attorney’s office also claimed this diversion program would reduce the likelihood of repeat offenses. How? By letting him off with a slap on the wrist? Forgive us if we're skeptical of that logic.

This entire fiasco exposes the moral bankruptcy at the core of leftist ideology. These are the same people who excused the chaos and destruction of the BLM riots, who now clamor for the return of a deported MS-13 gang member, and who remain conveniently silent as Teslas are vandalized simply because the company’s CEO is aligned with Donald Trump. Time and again, Democrats show us exactly who they are: the party that coddles criminals and vilifies law-abiding Americans.

https://cms.zerohedge.com/users/tyler-durden

Tue, 04/22/2025 - 16:55

https://www.zerohedge.com/political/democrat-county-attorney-lets-anti-tesla-terrorist-hook

Tesla Misses Across The Board; Slams "Uncertainty" In Automotive Market, But Affirms Affordable Model "Remains On Track" For H1 2025

Tesla Misses Across The Board; Slams "Uncertainty" In Automotive Market, But Affirms Affordable Model "Remains On Track" For H1 2025

With everyone's attention turning to Mag7 heavyweight Tesla after hours (https://www.zerohedge.com/markets/tesla-q1-earnings-and-company-update-preview

), focus will be on whether outlook is reduced after weaker Q1 sales; other key focus points will be i) robotaxi launch, ii) FSD adoptions in China and Europe and iii) updates on lower priced vehicles/new launches. TSLA stock is down -53% from it’s December highs (-40% YTD) and given all the negative press of late (including ‘code red’ headlines yesterday) leave Goldman thinking that positioning and expectations are very low at this point.

To that point, Gene Munster, managing partner at Deepwater Securities, thinks Tesla’s investment case has little to do with how the company performs this year. Rather, investors are looking to 2026 and beyond and Tesla’s autonomy opportunity. “I expect $TSLA to be ugly tonight (11-12% auto gross margins ex credits, down from 13.6% in December) — and it probably doesn’t matter,” Munster said in a post on X ahead of the results.

Also as widely documented recently, amid backlash against Musk, some Tesla owners are opting to trade their vehicles in. While used vehicles are increasing in price by about 1% on average, Tesla models are seeing price drops of about 10%, according to iSeeCars.com, which may be a discussion point on the earnings call.

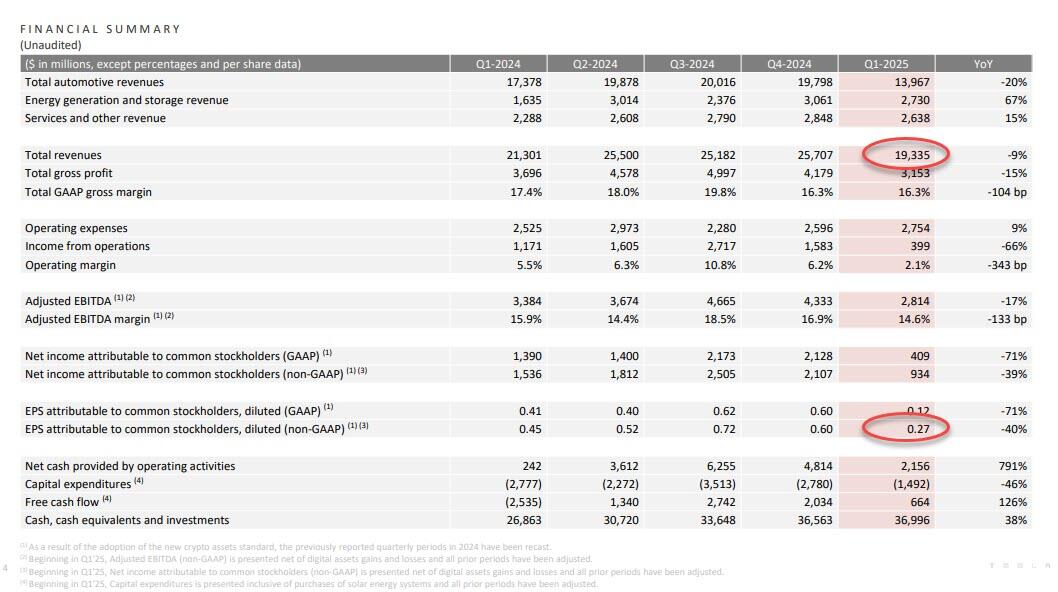

So with that in mind, Tesla shares close the day up 4.6%, with straddles pricing in a +/-10% move after earnings. Here is what the company just reported for Q1 moments ago. As Munster predicted, it was ugly.

Revenues $19.34BN, big miss to estimates of $21.37BN

EPS 27c, missing estimates of 43c

Gross margin 16.3% (down from 17.4% y/y), and beating estimates of 16.1%

Automotive gross margin ex reg credits 12.5%, beating estimates of 11.9%

Operating income $399 million, -66% y/y, missing estimates of $1.13 billion

Free cash flow $664 million (vs. negative $2.53 billion y/y) missing estimate $1.08 billion

Capital expenditure $1.49 billion (down -46% y/y), missing estimates of $2.49 billion

And visually:

?itok=UbGjqb2s

?itok=UbGjqb2s

Commentary and context from the investor letter (more below)

Will Revisit Our 2025 Guidance in Our Q2 Update

Leaves Out Return to Growth Forecast From Earnings Report

Rate of Growth Will Depend on A Variety of Factors

Tariff Landscape to Have A Larger Impact on Energy Unit

Says Difficult to Measure Impacts of Global Trade Policy

Actions to Stabilize in Medium to Long-Term

Sufficient Liquidity to Fund Our Product Roadmap

Plans for New Vehicles on Track for Start Prod in 1H '25

Uncertainty Could Impact Demand in Near Term

Sees More Affordable Models Lead to Less Cost Reduction

Despite Tariffs, Sees Increasing Need for Energy Storage

Tariffs to Impact Energy More Than Automotive

The company's Q1 investor letter was far more downbeat than investors had come to expect. Here is what Musk had to say about the company's highlights:

Uncertainty in the automotive and energy markets continues to increase as rapidly evolving trade policy adversely impacts the global supply chain and cost structure of Tesla and our peers. This dynamic, along with changing political sentiment, could have a meaningful impact on demand for our products in the near-term. We remain committed to expanding our business model to include delivering autonomous robots across multiple form factors and use cases – powered by our real-world AI expertise – to our customers and for use in our factories, as we navigate these headwinds.

The warnings continued, with an emphasis on the company's energy business:

AI is a major pillar of growth for Tesla and the broader economy and key to our pursuit of sustainable abundance. Furthermore, AI infrastructure is driving rapid load growth, which, along with traditional utility customer applications, is creating an outsized opportunity for our Energy storage products to stabilize the grid, shift energy when it is needed most and provide additional power capacity. While the current tariff landscape will have a relatively larger impact on our Energy business compared to automotive, we are taking actions to stabilize the business in the medium to long-term and focus on maintaining its health.

As Bloomberg expands on the bolded text, that must be because Tesla’s Megapack product, the massive batteries that store energy, uses LFP cells, which are largely imported from China.

But most troubling was the following segment, announcing that the company will only discuss 2025 guidance in the Q2 update next quarter:

It is difficult to measure the impacts of shifting global trade policy on the automotive and energy supply chains, our cost structure and demand for durable goods and related services. While we are making prudent investments that will set up both our vehicle and energy businesses for growth, the rate of growth this year will depend on a variety of factors, including the rate of acceleration of our autonomy efforts, production ramp at our factories and the broader macroeconomic environment. We will revisit our 2025 guidance in our Q2 update.

And then there was this ominous headline from Bloomberg:

*TESLA LEAVES OUT RETURN TO GROWTH FORECAST FROM EARNINGS REPORT

Investors will certainly be interested in seeing what Elon has to say about his close relationship with Donald Trump; here Bloomberg notes that the deck doesn’t mention Musk. But it does acknowledge “changing political sentiment” which “could have a meaningful impact on demand for our products in the near-term." It will be interesting if that’s the case in more than one region. There were many concerned that the Chinese consumer would champion domestic names due to Musk’s association with the Trump administration and its tariff policy.

While this barrage of warnings and negative news would have been enough to send the stock plunging after hours, the following section from the earnings report is what some are clinging to to explain why the stock is modestly higher after hours:

Plans for new vehicles, including more affordable models, remain on track for start of production in the first half of 2025. These vehicles will utilize aspects of the next generation platform as well as aspects of our current platforms and will be produced on the same manufacturing lines as our current vehicle lineup.

Tesla elaborates that "this approach will result in achieving less cost reduction than previously expected but enables us to prudently grow our vehicle volumes in a more capex efficient manner during uncertain times. This should help us fully utilize our current expected maximum capacity of close to three million vehicles, enabling more than 60% growth over 2024 production before investing in new manufacturing lines."

As for the company's Robotaxi product, the Cybercab, Tesla said it is scheduled for volume production starting in 2026.

One wonders how long the initial upside momentum in the stock price will persist once investors dig into this latest attempt to manage expectations.

For now, it is working and after swinging after hours, TSLA stock has tabilize modestly in the green, trading just around $238. Dave Mazza, CEO at Roundhill Financial, had this to say post results: “A lot of negative seems to be priced in if the Tesla numbers were that bad and the stock isn’t tanking.”

?itok=RqMte2jm

?itok=RqMte2jm

Full investor presentation below (https://digitalassets.tesla.com/tesla-contents/image/upload/IR/IR/TSLA-Q1-2025-Update.pdf

):

https://cms.zerohedge.com/users/tyler-durden

Tue, 04/22/2025 - 16:33

The 8 Narrative Fallacies That Drive American Politics

The 8 Narrative Fallacies That Drive American Politics

We live in a world rife with narrative fallacies intended to herd Americans and other Westerners towards Marxism.

?itok=CVjwroxK

?itok=CVjwroxK

Here’s a list of just a few of the fallacious narratives that drive politics to the left:

Poverty.

The claim is that poverty has never been worse. The truth is that poverty is at its lowest level of all time. Global poverty has seen significant declines over the past two centuries, particularly in terms of extreme poverty. Most of the world’s population lived in extreme poverty two hundred years ago, but today, that figure has dropped to about https://ourworldindata.org/extreme-poverty-in-brief

. This progress is largely attributed to economic growth and development in many regions, particularly due to American dynamism.

The Courts’ Role In Controlling Policy.

Weaponized use of the legal system is now de rigueur today for Democrats. Republicans are all criminals, we’re told. In this way, what Democrats can’t win at the ballot box may now be effectively undone by the courts.

In a delicious irony, https://nypost.com/2025/04/16/us-news/conservatives-gloat-after-trump-admin-refers-ny-ag-letitia-james-for-potential-prosecution/

in a first-of-its-kind civil fraud trial that ended with a $454 million judgment now on appeal.

Climate Change.

Is it about science or control? One has only to look at Europe today, where believers in climate change are reducing farming, restricting choice in how people travel, and trying to electrify everything with scarce “Green” energy that does not contribute to base load capacity, all while trying to get rid of your https://www.foxnews.com/media/liberal-outlets-say-dogs-actually-bad-environment

in the name of saving the planet.

American Colonialism.

Is America a slave nation and colonizer, or quite the opposite? Little is ever said about the massive internal struggle we had in righting the wrong of slavery, ending with what remains America’s costliest war, with perhaps 750,000 dead, https://www.pbs.org/kenburns/the-civil-war/civil-war-facts

of our entire population at the time. That would be the equivalent of 7 million dead today. Don’t you think we’ve already paid a high enough price for our mistakes?

Income Inequality.

America has the highest number of billionaires in the world; is that a good or bad thing? If you care about your own personal economy, it is best not to look at too many billionaires as a bad thing. Progressives don’t want you to know it, but the top 10% of taxpayers pay https://usafacts.org/articles/who-pays-the-most-income-tax/

, and the bottom half, less than 2%.

Universal (aka Socialized) Healthcare.

Will people live longer, better lives with universal healthcare, or maybe not? America already has universal healthcare. It’s called Medicaid, and it has https://abcnews.go.com/Politics/medicaid-largest-us-public-health-insurance-program/story?id=118189440

beneficiaries. However, on average, people of means live 14 years longer than Medicaid recipients. Could factors like lifestyle choices, environmental conditions, and prioritizing healthy living be more critical than government spending? The facts tell a revealing story of misplaced priorities.

Education.

Is there a correlation between spending money on education and creating thinking and functioning citizens? The US ranks in the https://www.pewresearch.org/short-reads/2017/02/15/u-s-students-internationally-math-science/

per pupil. Frighteningly, the trend line is flat to declining, the opposite of improving. Johnny can’t read, write, or do math anymore in a world dominated by those who can!

America as a Citizen of the World.

Does the world need America to lead or step back and let the world run itself? This is the key question we may be most divided on today.

Globalism has been a cancer that benefits government and big business. However, isolationism is effectively the opposite of globalism, and it would see America isolated and cut off from markets. Receding from leadership would automatically cede control to the strongest nation willing to step up and replace us. Unquestionably, that nation would be China. This would be the perfect setup for our economic destruction or, more likely, confrontation leading to WWIII. Rational minds must find the right balance between globalism and isolation.

Most popular progressive narratives ultimately attack the central premise that is a prerequisite for prosperity: economic growth and development by profit-seeking capitalists. Progressives largely eschew our history of success in favor of an ever-larger government that effectively decides what kind of growth and development there is to be through laws, regulations, financial incentives, and/or coercion, i.e., a Command Economy.

https://cms.zerohedge.com/users/tyler-durden

Tue, 04/22/2025 - 15:40

https://www.zerohedge.com/political/8-narrative-fallacies-drive-american-politics

'Building 7 Controlled Demolition?': Republican Senator Plans Shock 9/11 Hearings, Says 'My Eyes Have Been Opened'

'Building 7 Controlled Demolition?': Republican Senator Plans Shock 9/11 Hearings, Says 'My Eyes Have Been Opened'

Sen. Ron Johnson (R-WI) is raising eyebrows after revealing on Benny Johnson’s conservative podcast that he’s pushing for a congressional hearing to examine the September 11, 2001, terrorist attacks on the Twin Towers.

Johnson, who serves on the the Senate Permanent Subcommittee on Investigations, raised questions about the World Trade Center Building 7’s collapse, saying the documentary film, Calling Out Bravo 7 has sparked “an awful lot of questions.”

Senator Ron Johnson drops BOMBSHELL:

Tells us that 9/11 Hearings are being planned, Building 7 was potentially a "Controlled Demolition"

“Structural Engineers say that thing didn't come down in any other way than controlled demolition. Molten steel. Destruction of evidence. We… https://t.co/aBQzCakll7

— Benny Johnson (@bennyjohnson) https://twitter.com/bennyjohnson/status/1914372377112179056?ref_src=twsrc%5Etfw

“Well, start with Building 7,” Sen. Johnson told Johnson. “Again, I don’t know if you can find structural engineers other than the ones that have the corrupt investigations like NIST that would say that that thing didn’t come down in any other way than a controlled demolition.”

WTC Building 7:

- Minor office fire

- Not hit by a plane

- Building leaseholder Larry Silverstein says “Pull it”

- Collapsed at free fall speed into its own footprint (2.5 seconds)

No other building has ever collapsed at free fall speed due to fire. Controlled demolitions do https://t.co/0MrBNCKbjm

— LΞIGH (@LeighStewy) https://twitter.com/LeighStewy/status/1833929144981160417?ref_src=twsrc%5Etfw

“Who ordered the removal and the destruction of all that evidence? Totally contrary to any other firefighting investigation procedures. I mean, who ordered that? Who is in charge? I think there’s some basic information. Where’s all the documentation from the NIST investigation?” the Wisconsin lawmaker continued.

“Now, there are a host of questions that I want and I will be asking, quite honestly, now that my eyes have been opened up,” he added.

BUILDING #7 FLASHES AT THE TIME OF COLLAPSE — CONTROLLED DEMOLITION ?https://t.co/NU0Na0eOVs

— The_Real_Fly (@The_Real_Fly) https://twitter.com/The_Real_Fly/status/1701269155339530475?ref_src=twsrc%5Etfw

Johnson said he plans to work with former Rep. Curt Weldon (R-PA), who recently appeared on Tucker Carlson’s podcast to discuss 9/11, “to expose what he’s willing to expose.”

Rep. Curt Weldon Tried to Prevent 9-11, and The U.S. Government Shut Him Down https://t.co/5vAzCT4lQJ

— Tucker Carlson Network (@TCNetwork) https://twitter.com/TCNetwork/status/1912226670209016135?ref_src=twsrc%5Etfw

The senator’s comments prompted Johnson to ask: “So we may actually see hearings about this?”

“I think so,” the senator replied while referencing previous efforts to obtain unredacted FBI files on behalf of 9/11 families.

“We want to get those answers, those documents for the families,” the lawmaker replied. “Hopefully, now with this administration, we can find out what is being covered up.”

Sen. Johnson expressed optimism that the Trump administration will authorize the release of 9/11-related documents, despite prior unsuccessful efforts to declassify them.

“We want those made available in terms of what happened. What did the FBI know that happened? So we had engaged with that. It was on a bipartisan basis. We wanted to get those answers, those documents for the families,” Sen. Johnson said. “Again, we didn’t get squat from the FBI. So hopefully now with this administration, I think President Trump should have some interests being a New Yorker himself.”

“What actually happened in 9/11? What do we know? What is being covered up? My guess is there’s an awful lot being covered up in terms of what the American government knows about 9/11,” he added.

Very interesting to say the least...

FDNY announced they were told “it would be taken down” on this news clip. https://t.co/r57PvWUz6S

— Josh’s News, Memes, Photography, & Stuff (@joshbottweet) https://twitter.com/joshbottweet/status/1914527580214190204?ref_src=twsrc%5Etfw

https://cms.zerohedge.com/users/tyler-durden

Tue, 04/22/2025 - 15:20

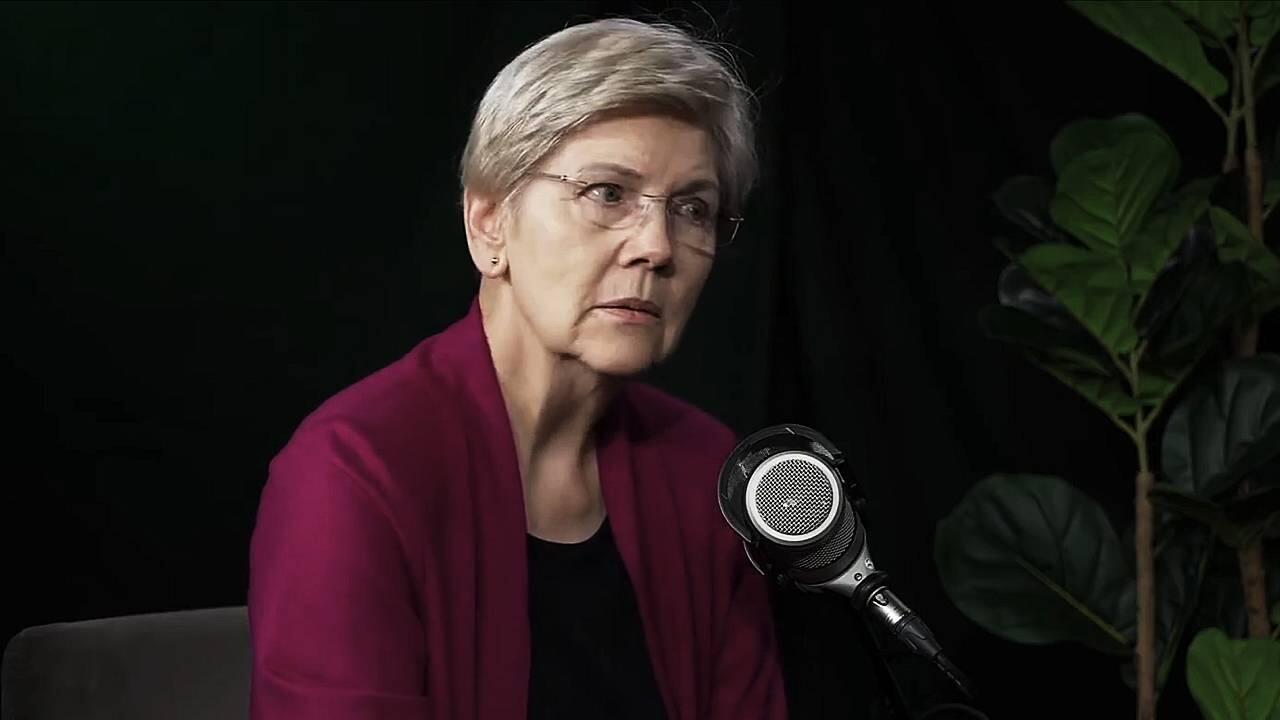

Watch: Mega Cringe Moment As Lefty Podcaster Calls Out Pocahontas Warren

Watch: Mega Cringe Moment As Lefty Podcaster Calls Out Pocahontas Warren

https://modernity.news/2025/04/22/mega-cringe-moment-as-lefty-podcaster-calls-out-pocahontas-warren/

Senator Elizabeth Warren was caught in a super awkward exchange with a lefty podcaster as she attempted to double down on defending her assertions last year that Joe Biden was mentally sharp.

?itok=K4dj8ZGk

?itok=K4dj8ZGk

When asked to explain her past statements prior to the complete break down of the Democrats last Summer, Warren actually attempted to double down.

Even podcaster Sam Fragoso wasn’t having it anymore, and called out Warren as she pathetically attempted to wriggle out of the conversation.

🚨Podcast host Sam Fragoso GRILLS Elizabeth Warren on her past defense of Biden's mental fitness — she DOUBLES DOWN and gets called out on it🚨

FRAGOSO: "Do you regret saying that President Biden had a mental acuity, he had a sharpness to him? You said that up until July of last… https://t.co/6YJY3U1sRX

— Jason Cohen 🇺🇸 (@JasonJournoDC) https://twitter.com/JasonJournoDC/status/1914384559996555604?ref_src=twsrc%5Etfw

“Do you regret saying that President Biden had a mental acuity, he had a sharpness to him?” Fragoso asked, noting “You said that up until July of last year.”

“I said what I believed to be true,” Warren responded.

Fragoso then asked Warren if she believed Biden was “as sharp” as she was, and she couldn’t contain her laughter.

“I said I had not seen decline,” Warren responded, giving the most obvious ‘boy, I know that was total BS’ look, before continuing “And I hadn’t at that point.”

"I said I have not seen decline." 🤣 https://t.co/hl0FP3Y2cq

— Justin Skibinski (@Justinskibs) https://twitter.com/Justinskibs/status/1914455609732112637?ref_src=twsrc%5Etfw

“You did not see any decline from 2024 Joe Biden to 2021 Joe Biden?” an exasperated Fragoso followed up.

“You know, the thing is, he — look, he was sharp. He was on his feet,” she responded, adding “I saw him [at a] live event. I had meetings with him a couple of times.”

Fragoso shot back, “Senator, ‘on his feet’ is not praise. He can speak in sentences’ is not praise.”

“Fair enough,” Warren replied, finally realising there was no point continuing to try to defend Biden.

Senator Speaks With Forked Tongue will not admit to speaking with a forked tongue

— Western Lensman (@WesternLensman) https://twitter.com/WesternLensman/status/1914441690364174446?ref_src=twsrc%5Etfw

It's so bad, her expressions and body language are something else

— ThēPrìcklyThìstle (@TheeThistle) https://twitter.com/TheeThistle/status/1914455077378482290?ref_src=twsrc%5Etfw

Their inability to speak the truth and the discomfort it brings them is truly mindblowing.

— Klay Thompson (@Thompsonklay) https://twitter.com/Thompsonklay/status/1914440239315120439?ref_src=twsrc%5Etfw

Completely flummoxed https://t.co/NnNaMm7LCw

— Western Lensman (@WesternLensman) https://twitter.com/WesternLensman/status/1914442111908503655?ref_src=twsrc%5Etfw

* * *

Your support is crucial in helping us defeat mass censorship. Please consider donating via https://pauljosephwatson.locals.com/support

.

https://cms.zerohedge.com/users/tyler-durden

Tue, 04/22/2025 - 15:00

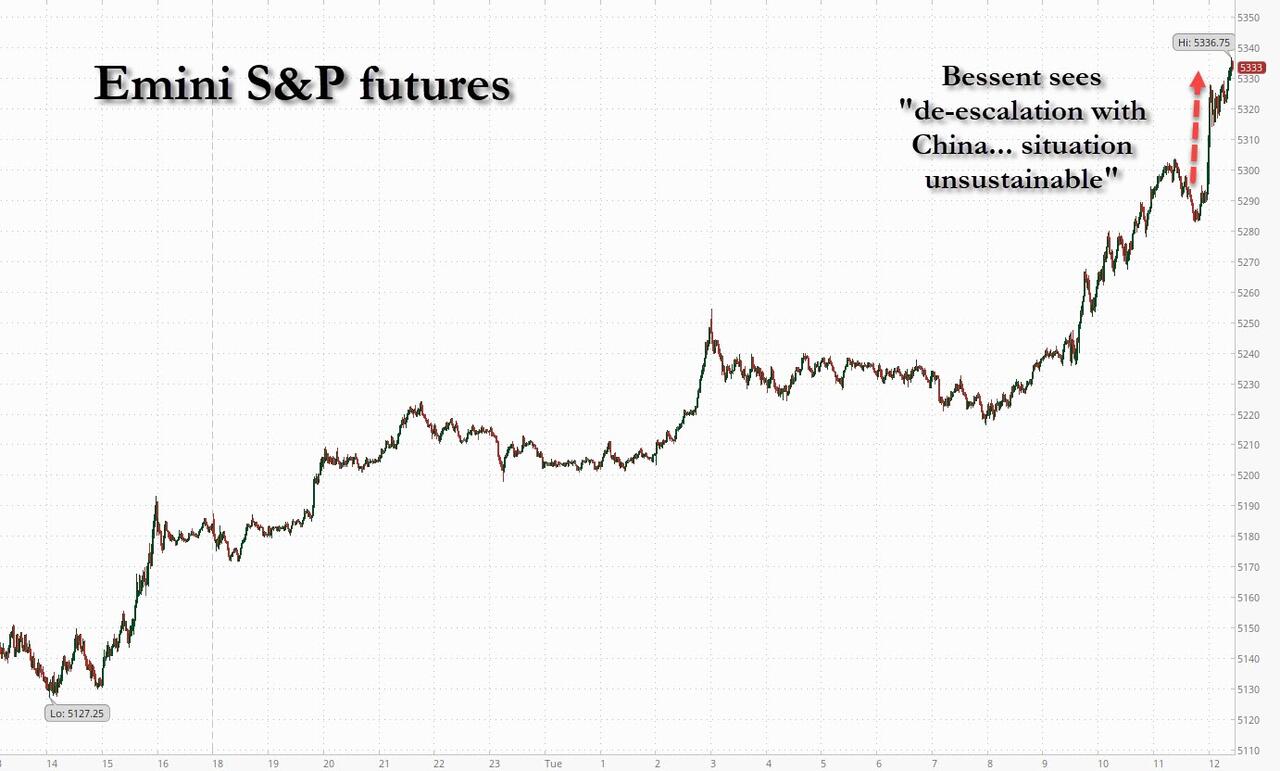

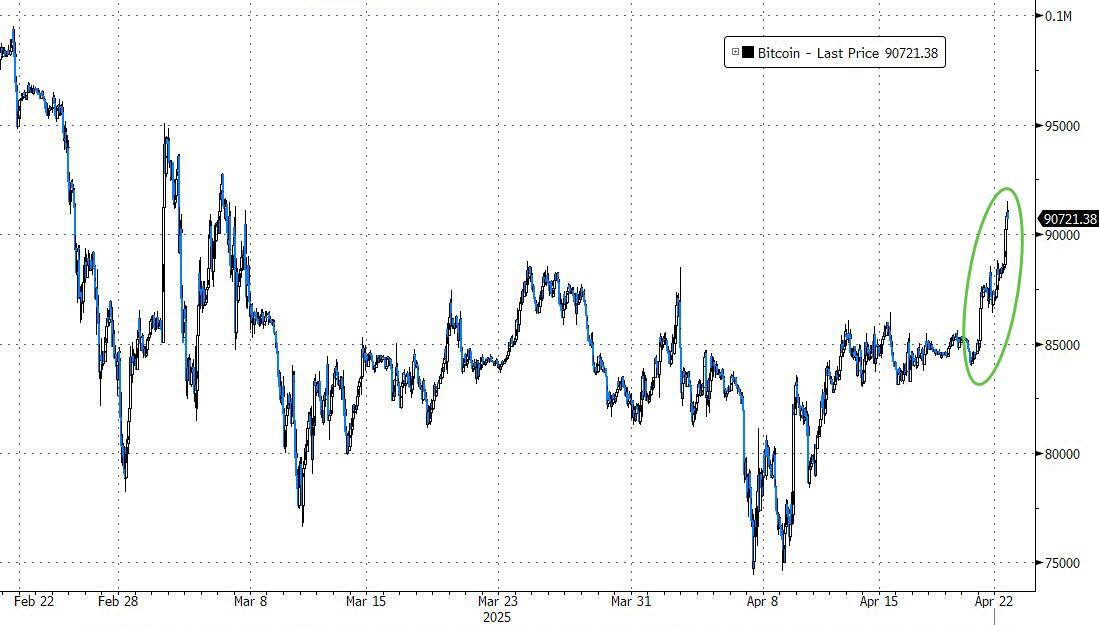

Stocks Reverse Bessent Gains On Report "It May Take Months To Hammer Out Final Trade Deals"

Stocks Reverse Bessent Gains On Report "It May Take Months To Hammer Out Final Trade Deals"

Update (1315ET): Shortly after the Bessent headlines moved stocks higher, https://www.politico.com/news/2025/04/22/white-house-is-close-on-japan-india-agreements-but-expect-them-to-be-light-on-specifics-00302762

, while The White House is closing in on general agreements with Japan and India to stave off massive U.S. tariffs, it “may take months to hammer out the final deals,” said one of the people, conceding, “these things are complicated.”

Worse still, the optimism on the initial Bessent headlines has been erased as his actual comments were far less hopeful:

BESSENT: REBALANCING OF CHINA ECONOMY TOWARDS CONSUMPTION AND U.S. ECONOMY TOWARDS MANUFACTURING IN TWO TO THREE YEARS WOULD BE A 'HUGE WIN' - RTRS

BESSENT SAYS CHINA NEGOTIATIONS WILL BE A 'SLOG', DESCRIBES CURRENT BILATERAL TRADE SITUATION AS AN EMBARGO -PERSON WHO HEARD JP MORGAN SESSION

And just like that all the gains are gone...

?itok=kP2aQ16I

?itok=kP2aQ16I