PepsiCo Prints "Rare" Earnings Miss As Volatility & Uncertainty Mount

PepsiCo Prints "Rare" Earnings Miss As Volatility & Uncertainty Mount

It's rare for PepsiCo to miss Bloomberg Consensus earnings estimates. Still, the soda and snack giant has stumbled amid growing uncertainty surrounding the trade war and waning consumer sentiment—factors that ultimately prompted the company to lower its full-year earnings outlook.

The maker of Pepsi beverages and Frito-Lay snacks missed the consensus estimate, with Barclays analyst Lauren Lieberman calling the miss "exceedingly rare to see PEP results fall short of consensus expectations and while the miss was just 1c, we think it exemplifies just how challenging things are at the company today given in the past decade-plus, there's always been a way to deliver the bottom line."

Here's a snapshot of Pepsi's 1Q25 earnings:

Core EPS: $1.48 (vs. $1.61 YoY), slightly below Bloomberg Consensus expectations of $1.49

Reported EPS: $1.33 (vs. $1.48 YoY), missed the estimate of $1.48

Operating Profit: $2.58B, down 4.9% YoY, missed $2.78B estimate

Revenue: $17.92B, down 1.8% YoY, beat $17.77B estimate

Organic Revenue Growth: +1.2% (vs. +2.7% YoY), above +0.53% estimate

Capex: $603M, below $657M estimate

Convenient Foods Volume: -3%

Regional Breakdown:

Foods North America: $6.21B

Latin America Foods: $1.66B

EMEA: $2.39B

International Beverages: $759M

PepsiCo Beverages North America: $5.88B (vs. $5.87B YoY, beat $5.83B estimate)

"As we look ahead, we expect more volatility and uncertainty, particularly related to global trade developments," CEO Ramon Laguarta stated.

?itok=yj8um3SD

?itok=yj8um3SD

The common theme among US companies has been a reduction in or complete withdrawal of guidance (https://www.zerohedge.com/markets/american-air-yanks-full-year-guidance-trade-wars-hinder-travel-demand-prediction

) due to tariff uncertainty. Pepsi slashed its EPS outlook for the year due to mounting macroeconomic headwinds but maintained its organic revenue growth forecast and shareholder return targets.

Here's more color on the changing outlook:

Core EPS: Now expected to decline 3% YoY (previously expected a low-single-digit increase)

Core EPS (constant currency): Now flat YoY (previously expected mid-single-digit growth)

Organic Revenue: Still expects a low-single-digit increase

Tax Rate: Core annual effective tax rate expected at ~20%

Shareholder Returns: Still targeting ~$8.6 billion in total cash returns for the year

Goldman analysts Bonnie Herzog and Ethan Huntley, along with others, provided clients with their initial summary of the mixed earnings report, indicating a "Q1 topline beat but a slight EPS miss - FY25 EPS guide lowered given tariffs & macro pressures."

Here's more color on their take:

Investor expectations heading into PEP's Q1 print were quite low, dragged largely by ongoing concerns over the health of the consumer which have pressured consumption trends - as seen in recent scanner data trends, particularly for FLNA. And as expected, PEP's Q1 results were soft with +1.2% organic revenue growth (vs our/cons ests of +0.9%/+0.6%), though the planned timing and phasing of certain productivity initiatives weighed on core operating margins - leading to a slight EPS miss at $1.48 (vs our/FactSet cons ests of $1.50/$1.49). Further, given expected higher supply chain costs related to tariffs, elevated macroeconomic volatility, and a subdued consumer backdrop, PEP lowered its FY25 f/x neutral EPS growth to ~flat y/y (vs +MSD growth prior) but maintained its organic sales guidance of +LSD% (vs our/Visible Alpha cons ests of +2.5%/+2.3% ahead of the print). Surprisingly given the weaker dollar, PEP continues to expect a ~3pt headwind from f/x to impact reported net revenue and EPS growth and therefore expects core EPS growth of -~3% implying FY25 EPS of ~$7.92 (vs $8.16 last year, and vs our/FactSet cons est of $8.29/$8.26 into the print). Furthermore, PEP restated its financial segments this morning making it difficult to analyze their new segmented results vs expectations. However, PEP's PBNA segment delivered 1% organic sales (vs our/cons ests of +0.5%/-0.1%) and 14% operating profit growth and PEP's new PepsiCo Foods North America (PFNA, comprised of the former FLNA and QFNA) delivered -2% organic sales and -7% f/x neutral operating profit growth. While optically concerning, we think today's results could serve as a clearing event - helping to reset investor expectations at a much more realistic level. However, we expect the stock to underperform today.

Taking a step back, Q1 organic sales growth was up +1.2% (vs our/cons ests of +0.9%/+0.6%) - despite the benefits of an easier y/y compare (1Q24 organic sales growth of +2.7%, with vols -2%) - driven by healthy price/mix and relative strength internationally. As expected, the top-line growth continued to be driven by net price realization (+3% vs our +1.8% est), reflecting mgmt's continued efforts to offset inflationary cost pressures with strong revenue management actions. That said, organic volumes were under pressure, as expected, down -2% (vs our/cons ests of -0.9%/-1.5%) - and were sequentially weaker than Q4 (-1%).

By segment, PEP's PBNA segment delivered 1% organic sales (vs our/cons ests of +0.5%/-0.1%), with price mix of +2% and volumes down -1%. PFNA organic topline growth was down -2%, with price mix of +1% and volumes down -3%. Internationally, PEP's new International Beverages Franchise (IB Franchise) organic topline growth was up +7%, with healthy +5% volume growth and price mix of +2%. EMEA organic topline growth was up a solid +8%, driven by price mix of +16% with volumes -8%. Elsewhere, Latin America Foods (LatAm Foods) organic topline growth was up +3%, driven by price mix of +3% with volumes down -0.5%. Lastly, Asia Pacific Foods organic topline growth was down -1%, driven by healthy volumes of +3.5%, albeit offset by price mix (-4%). Moving down the line, gross margins were broadly flat y/y at 55.7% (vs our/cons ests of 55.8%/55.5%), while Op margins were down ~50bps y/y to 15.6% (vs our/cons ests of 15.7%/15.8%), as SG&A expenses as a % of sales were up ~60bps y/y to 40.1%. As a result, PEP delivered Q1 core f/x neutral EPS growth that was down -4% to $1.48 (vs our/cons ests of $1.50/$1.49).

Bottom Line - We maintain our Buy rating on PEP as we believe it remains well positioned given its strong brand portfolio (esp. Frito Lay) and long-term growth opportunities in Beverages, particularly given its impressive revenue growth management capabilities, its owned distribution network and superior supply chain, which ensures the right (& affordable) products are available when & where needed. Overall, we continue to believe PEP should be able to deliver sustainable average annual +MSD% organic sales growth in the next decade - despite some potential near-term headwinds.

Here's more commentary from other Wall Street desks (courtesy of Bloomberg):

Barclays (equal-weight), Lauren Lieberman

"It is exceedingly rare to see PEP results fall short of consensus expectations and while the miss was just 1c, we think it exemplifies just how challenging things are at the company today given in the past decade-plus, there's always been a way to deliver the bottom line," Lieberman writes

PEP's reduced annual EPS guidance reflects higher supply chain costs (tariffs); in prepared remarks, PEP also discussed upping commercial investments

PEP mentioned two new areas of focus for cost savings within the new Pepsi Foods North America division: "optimizing and right-sizing" the supply chain and the "go-to-market footprint"; increasing efficiencies in transportation & logistics

Both of these are "critical points" given its outsized investment in Frito over the past five years, which has generated a "disappointing ROI," according to Lieberman

JPMorgan (neutral), Andrea Teixeira

Expects negative stock reaction to the "sizeable net tariff impact" and macro/consumption volatility

It's the first time PEP misses EPS estimates in "many years"

Core EPS guidance lowered by a "very high magnitude" despite the company's plan to take mitigating actions

North America savory snacks volumes were down 4% in 1Q, worse than Teixeira's -3.5% estimate, and will likely "remain the key concern for investors as far as calling for a potential inflection given the several headwinds (low-income consumer under pressure, GLP-1, etc)"

Bloomberg Intelligence, Kenneth Shea

Higher-than-expected supply-chain costs related to global trade volatility were the "key factor" to 8% drop in 1Q adjusted EPS

Shea blames the "lingering weakness" in the PepsiCo Foods North America segment as the main reason for the EPS guidance cut

Piper Sandler (overweight), Michael Lavery

NA Food segment remains challenged, while organic revenue growth in international business continues to be healthy, growing 5% in the quarter, driven by beverages

Lavery said she expects to hear more about productivity savings progress and promotional outlook for the salty snack category on the company's earnings call

Also hopes to better understand what tariff assumptions are included in PEP's updated guidance

Additional headlines from the Pepsi CEO:

PEPSI CEO: WORKING ON 'RIGHT-SIZING' COST OF FRITO LAY PRODUCTS

PEPSI CEO: CONSUMERS IN CHINA, MEXICO 'HURTING A BIT'

PEPSI CEO ON DYE BANS: SHIFTING ENTIRE PORTFOLIO NATURAL COLORS

PEPSI CEO: TRANSITION TO NATURAL COLORS IN NEXT FEW YEARS

PEPSI CEO: EXPECTING LIMITED IMPACT IN US SNAP PROGRAM CHANGES

PEPSI CEO: DEVELOPING PROTEIN PRODUCTS, KEY FOR GLP-1 USERS

Proteins for GLP-1 users??

https://cms.zerohedge.com/users/tyler-durden

Thu, 04/24/2025 - 10:20

https://www.zerohedge.com/markets/pepsico-prints-rare-earnings-miss-volatility-uncertainty-mount

US Existing Home Sales Weakest March Since Great Financial Crisis

US Existing Home Sales Weakest March Since Great Financial Crisis

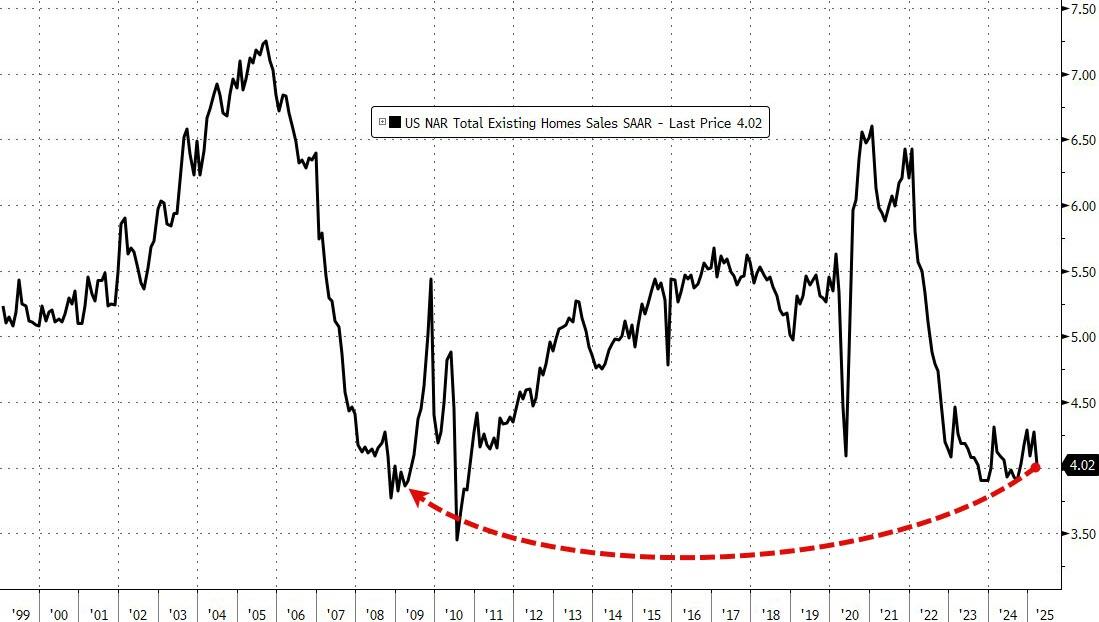

Following an unexpectedly large jump in February (biggest in a year), existing home sales were expected to drop significantly in March, and they did. Existing home sales fell 5.9% MoM (considerably worse than the 3.1% MoM drop expected) reversing the upwardly revised 4.4% MoM rise in February, dragging sales down 2.4% YoY...

?itok=u_p5GRBH

?itok=u_p5GRBH

Source: Bloomberg

This is the weakest March sales pace since 2009... and biggest MoM drop since Nov 2022.

?itok=5AEUJI46

?itok=5AEUJI46

Source: Bloomberg

The drop in sales aligns perfectly with the lagged rebound in mortgage rates, which suggests the next two months will see an improvement before weakness resumes...

?itok=UevPcwAS

?itok=UevPcwAS

Source: Bloomberg

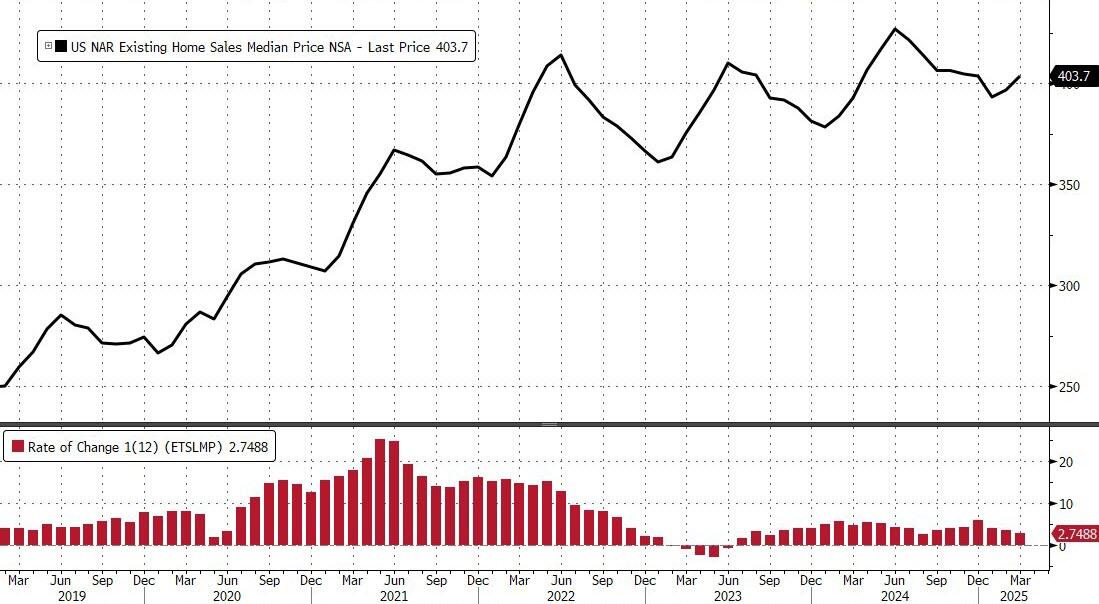

The median sales price increased 2.7% from a year ago to $403,700, a record for the month of March and extending a run of year-over-year price gains dating back to mid-2023.

?itok=9KPq7VhJ

?itok=9KPq7VhJ

Source: Bloomberg

The gain in prices largely reflected more sales activity for homes priced above $1 million, NAR Chief Economist Lawrence Yun said on a call with reporters. However, he also noted that the size of the increase was relatively mild compared to wage growth.

Finally, while home prices are at record highs, on a 'real' inflation adjusted basis (relative to gold, we mean), they are at 12 year lows...

?itok=o6o3uFCh

?itok=o6o3uFCh

If you had 129 ounces of gold right now, would you swap them for a 'used' house?

https://cms.zerohedge.com/users/tyler-durden

Thu, 04/24/2025 - 10:11

Anduril Co-Founder Warns: U.S. Munitions Stockpile Would Last One Week In Hot Conflict

Anduril Co-Founder Warns: U.S. Munitions Stockpile Would Last One Week In Hot Conflict

The United States would deplete its munitions stockpile if it entered into genetic warfare against a global superpower, Anduril co-founder Trae Stephens warns.

Stephens, who co-founded of the cutting-edge defense startup alongside Palmer Luckey, dropped the chilling warning on Auren Hoffman’s World of DaaS podcast.

“The reality is, if we got into a hot conflict with a great power, we would run out of munitions in a week,” Stephens told Hoffman. “We’ve built these capabilities that are incredibly exquisite, incredibly custom, with really complicated supply chains.”

Anduril co-founder https://twitter.com/traestephens?ref_src=twsrc%5Etfw

: "If the U.S. got into a hot conflict with a great power, we would run out of munitions in a week."

"You see situations like Ukraine where we deplete not only available inventory, we also deplete our own inventory." https://t.co/DD3mz7H04j

— Josh Caplan (@joshdcaplan) https://twitter.com/joshdcaplan/status/1914782383401848891?ref_src=twsrc%5Etfw

Stephens, who is also a partner at Peter Thiel’s venture capital fund Founders Fund, pointed out that the U.S. is struggling to supply Saudi Arabia with enough Patriot missiles to counter daily Houthi attacks, leaving the the Middle East Kingdom to seek out additional inventories from other nations due to limited availability.

“What that means is, our partner nations, like Saudi Arabia, for example, which is fighting this ongoing conflict with the Houthis—they’ve got stuff being shot into their sovereign territory, creating havoc on a daily basis,” Stephens explained. “We cannot sell them enough Patriot missiles. They literally have to go to other partner nations and try to buy their inventory of Patriot missiles”

Stephens also highlighted that in cases like Ukraine, the U.S. is rapidly depleting both its own and available inventories of military capabilities to support the war effort, with limited resupply options, as manufacturers resort to calling retirees back to rebuild assembly lines.

“Then you see situations like Ukraine, where we deplete not only the available inventory but also our own inventory of the capabilities we’re sending to support the war effort, with no ability to actually resupply,” the technology executive said. “The Primes are literally calling people out of retirement to rebuild assembly lines to make some of these capabilities.”

reported back in November 2024:

The wars in Ukraine and the Middle East are eating away at critical U.S. weapons stockpiles and could hamper the military’s ability to respond to China should a conflict arise in the Indo-Pacific, the top U.S. commander for that region said Tuesday. Head of U.S. Indo-Pacific Command Adm. Samuel Paparo cautioned Tuesday that the U.S. providing or selling billions of dollars worth of air defenses to both Ukraine and Israel is now impeding his ability to respond in the Indo-Pacific, such as if China invades Taiwan.

“It’s now eating into stocks, and to say otherwise would be dishonest,” Paparo https://apnews.com/article/ukraine-weapons-taiwan-missiles-stockpiles-28564bbed21f72b9a3c6b3cd9c086bc7

the Brookings Institution last year.

Stephens’ stark warning echoes a recent interview with Luckey, who stressed that rebuilding the U.S. manufacturing base is not only feasible but critical to counter rising global volatility.

“If we can't make the things that we need to maintain our quality of life, then we are actually just subservient to our adversaries,” Luckey, who leads Anduril as CEO, told legendary music producer Rick Rubin on his Tetragrammaton podcast.

.https://twitter.com/PalmerLuckey?ref_src=twsrc%5Etfw

supports tariffs on China, affirming that reindustrialization is both "absolutely" possible and necessary.

"If we can't make the things that we need to maintain our quality of life, then we are actually subservient to our adversaries." https://t.co/x4LwS5T8t1

— Josh Caplan (@joshdcaplan) https://twitter.com/joshdcaplan/status/1913282742512501058?ref_src=twsrc%5Etfw

“Is there a possibility that over time America could get back its manufacturing base? Absolutely,” Luckey told Rubin. “The problem that we did, I mean there's a million problems, but what we did is hollowed out our country by allowing China into the World Trade Organization and allowing American companies to outsource manufacturing to China without penalty, without import tariffs, without any reason to not do it.”

“Why wouldn't you, if you're allowed to just send it to another country where everything's cheap, where it's dirt cheap and there's no environmental regulations and no labor laws, why wouldn't you do that? And we've been able to get a bunch of cheap shit over the last 50 years as a result,” the startup billionaire added. “That has helped the United States. Everyone's able to buy cheap TVs and cheap cars and cheap stuff because of China's rise. The flip side of that is that there's no more manufacturing in the United States.”

https://cms.zerohedge.com/users/tyler-durden

Thu, 04/24/2025 - 09:55

Nintendo Switch 2 Frenzy: "Selling Out" Across US Retailers As Tariffs Won't Impact Pricing

Nintendo Switch 2 Frenzy: "Selling Out" Across US Retailers As Tariffs Won't Impact Pricing

U.S. families with young gamers can breathe a sigh of relief this week as Goldman analysts told clients that the upcoming Nintendo Switch 2 won't see price hikes due to the ongoing trade war.

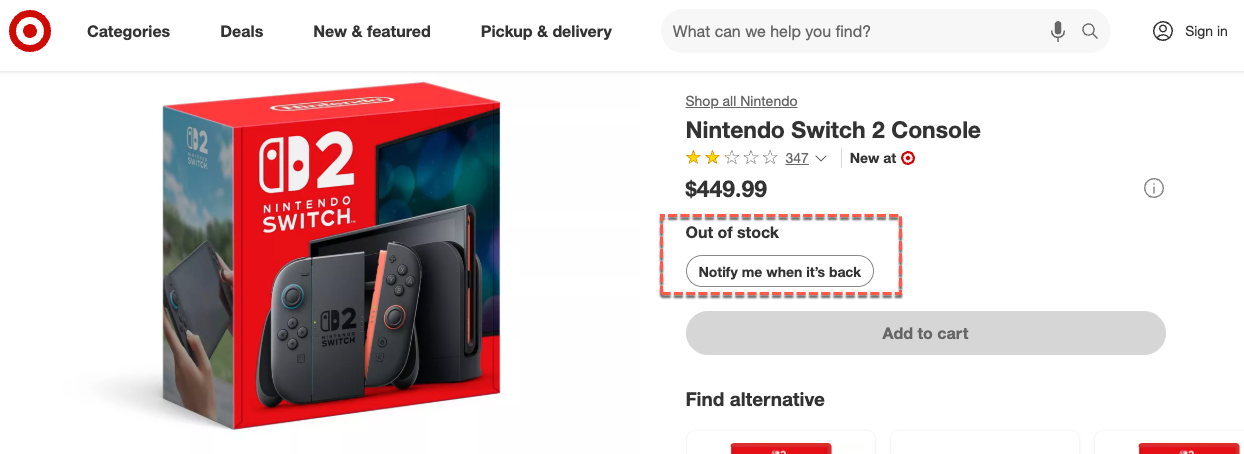

Nintendo's hotly anticipated Switch 2 is now available for pre-orders at major U.S. retailers as of early Thursday morning.

According to the tech blog https://www.tomsguide.com/live/news/nintendo-switch-2-pre-orders-live-updates-retailers-to-check

, demand for the new console is so intense that major retailers' websites are crashing, with "sold out" notifications appearing across some platforms operated by Walmart, Target, and Best Buy.

?itok=KvswGX4U

?itok=KvswGX4U

Nintendo Switch 2 will retail for $449, with the Mario Kart World bundle costing $499.

?itok=r_9XkbDJ

?itok=r_9XkbDJ

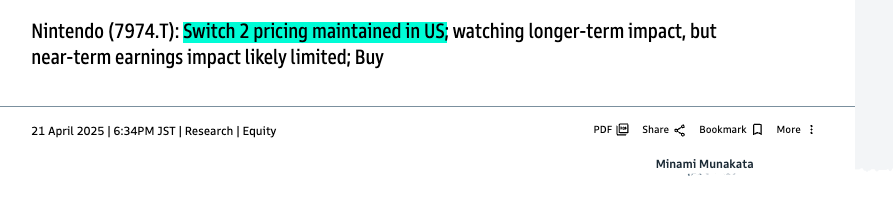

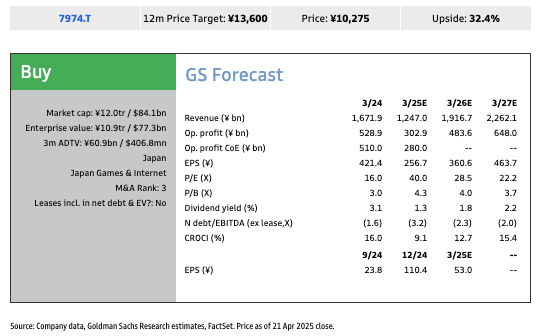

The good news for U.S. families who are avoiding tariff landmines as President Trump tries to negotiate an 'America First' trade deal with the Communist Chinese is that Goldman gaming analysts Minami Munakata and Haruki Kubota said console prices will remain at pre-trade war levels.

?itok=5Dodhc7f

?itok=5Dodhc7f

Here's more color on this from Munakata:

On April 18 (U.S. time), Nintendo announced that pre-orders for the Nintendo Switch 2 will begin in the U.S. on April 24. The company had originally planned to begin pre-orders on April 9 but announced on April 5 (U.S. time) that it was postponing the start of pre-orders following the Trump administration's announcement of new tariff policies.

The console price will be US$449.99, as originally announced. However, prices for peripherals, such as controllers and cameras, have been raised by around 5%-10% from the initially announced prices, and the company said that further price revisions are possible depending on changes in the market environment.

Munakata explained to clients Nintendo's move to keep console prices at pre-trade war prices "makes sense in view of potential medium- to long-term impact on software sales."

She continued:

We believe the decision to keep the console price unchanged reduces the need for concern about the impact on unit sales forecasts. Growth in the installed base for game hardware is essential for sales of game software, which accounts for the majority of Nintendo's profits. While US-bound hardware, which we assume will be shipped from Vietnam, will likely face a cost increase due to the 10% universal tariff (reciprocal tariff is paused), we view Nintendo's decision to prioritize a smooth launch for the Nintendo Switch 2 by keeping the console price unchanged in the U.S. (one of its most important markets) as a reasonable one, given the focus on long-term growth of the Nintendo Switch 2 platform.

Separately, an overnight report from Bloomberg stated that the demand for Switch 2 in Japan has been "overwhelming."

Nintendo President Shuntaro Furukawa wrote on X:

"We have received 2.2 million applications for the lottery sale at our official online store for customers in Japan alone, which is far larger than what we had anticipated. As such, we apologize that a significant number of the applicants won't be selected."

Uh oh...Nintendo President Shuntaro Furukawa has publicly apologized for underestimating Switch 2 demand in Japan after the lottery system there received 2.2 million applications. They are expecting that a "significant number" of people will not be selected to purchase a console. https://t.co/tZ3XPQW9i9

— Nintendeal (@Nintendeal) https://twitter.com/Nintendeal/status/1915118857553113169?ref_src=twsrc%5Etfw

Pelham Smithers of Japan-focused equity research house Pelham Smithers Associates said Japan accounts for about a third of the global Switch installation base, which implies 6.6 million pre-orders globally.

Back to Goldman's Munakata, she provided more details about Nintendo's tariff impact:

A Bloomberg report on April 10 suggested that over 1 mn game consoles were exported from Vietnam to the U.S. in Jan-Feb 2025 (we believe that Nintendo accounts for the majority of game consoles produced in Vietnam, and that most US-bound Nintendo hardware is produced there). Based on the report, Nintendo may be able to build up inventory to meet most of its U.S. demand for FY3/26 before the end of the tariff pause (90 days from April 9). We believe this means the potential negative earnings impact from lower hardware profitability is likely to be limited in the near term (our FY3/26 Nintendo Switch 2 shipment assumption is 6 mn units for the Americas and 14.5 mn units overall).

Near-term earnings impact likely limited, but watching news flow for any medium- to long-term impact.

On the other hand, if the announced 46% tariff gets imposed on exports from Vietnam after the tariff pause, we believe extended imposition of reciprocal tariffs by the Trump administration could still put downward pressure on Nintendo's earnings over the medium to long term. If the impact of the tariffs were to be passed on through higher selling prices, this could lead to a lower unit sales outlook for hardware. If Nintendo were to absorb the costs while keeping the selling price unchanged, this could lower hardware profitability. In either case, the tariffs could put downward pressure on Nintendo's earnings, so we will continue to monitor news flow related to tariffs.

Despite the tariff impacts, Munakata remained "Buy" rated on Nintendo...

Our 12-month target price of ¥13,600 is unchanged, and we maintain our Buy rating.

?itok=VCZqBe74

?itok=VCZqBe74

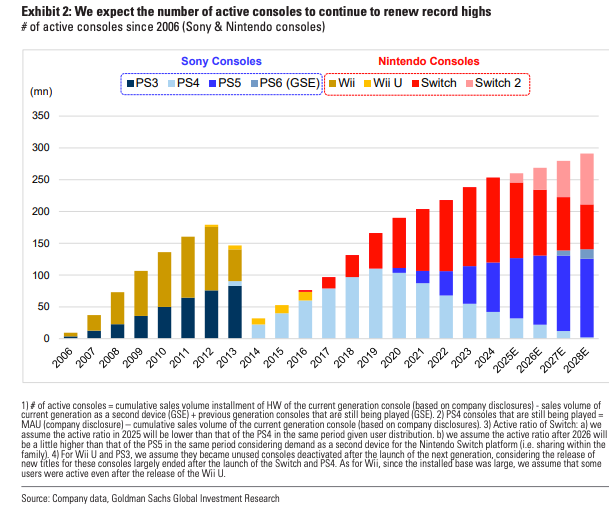

Last month, Munakata wrote a note stating that Switch 2 will "https://www.zerohedge.com/technology/nintendo-shares-jump-after-goldman-sees-switch-2-unlocking-dormant-users

" and send "the number of active consoles to continue to renew record highs."

?itok=3lfcyvx5

?itok=3lfcyvx5

Separately, https://www.zerohedge.com/technology/grand-theft-auto-6-priced-100-gaming-analyst-believes-so

later this year is expected to provide additional tailwinds for the gaming industry, which had been stuck in a rut for years but appears to have entered a renewed growth trajectory in 2024.

The good news is that Switch 2 remains at pre-trade war prices.

https://cms.zerohedge.com/users/tyler-durden

Thu, 04/24/2025 - 09:20

NPR: Abrego Garcia Was "Living Quietly" In Maryland Before He Was Deported

NPR: Abrego Garcia Was "Living Quietly" In Maryland Before He Was Deported

Yesterday, I tweeted out after hearing a segment on National Public Radio on the case of Kilmar Abrego Garcia. NPR https://www.npr.org/2025/04/23/nx-s1-5373746/federal-judge-blasts-trump-stonewalling-deportation-case

that there was no evidence presented that Abrego Garcia was an MS-13 member and that “he had been living quietly in Maryland” before he was suddenly arrested and deported.

?itok=47DcYoJ5

?itok=47DcYoJ5

While many disagree on the handling of the case, few would agree that Abrego Garcia who was reported for spousal abuse and suspected of human trafficking was “living quietly in Maryland.”

Anyone listening to the radio program would have been left with an incomplete and distorted account of the case.

The print story used the same language as the radio segment. NPR claimed that Abrego Garcia

“was granted protection by an immigration judge in 2019 that should have prevented his deportation. He had been living quietly in Maryland with his wife and three children and working in construction until Immigration and Customs Enforcement officers arrested and deported him last month.”

I have previously said that I believe the Administration should have returned Abrego Garcia to the United States for a correct and prompt deportation. If he were to be brought back, I cannot see any barrier to Abrego Garcia not only being deported but deported back to El Salvador.

NPR leaves out a couple of facts in its passing reference to his being “granted protection by an immigration judge.”

Abrego Garcia already had a hearing at which the judge found evidence that he was an MS-13 member. It was not only based on his being arrested with MS-13 gang members and wearing clothing associated with the gang. It was also based on a confidential source connected to the gang. After losing at his hearing, Abrego Garcia then lost on appeal.

The only reason that Abrego Garcia was not removed is that he said that he was being threatened by a gang that could harm him in El Salvador. That gang, however, reportedly no longer exists.

More importantly, President Trump has declared MS-13 a Foreign Terrorist Organization, which bars the use of the justification for his not being removed. In other words, he has little factual or legal foundation under his original claims to remain in the country.

However, putting the merits aside, NPR’s portrayal of Abrego Garcia was bizarre. He was repeatedly accused of https://www.foxnews.com/politics/maryland-man-kilmar-abrego-garcia-exposed-police-records-violent-repeat-wife-beater

. The court record states:

“Per the Prince Georges County Police Gang Unit, ABREGO-Garcia was validated as a member of the Mara Salvatrucha (MS13) Gang. Subject was identified as a member of the Mara Salvatrucha MS-13, “Chequeo” from the Western Clique a transnational criminal street gang. This information was provided by tested source who has provided truthful accurate information in the past. See Prince Georges County Police Department (Gang Sheet).”

Abrego Garcia was also suspected of human trafficking. Indeed, the description of the stop leaves one astonished that he was allowed to simply drive away. According to DHS:

“On Dec. 1, 2022, Abrego Garcia was stopped by the Tennessee Highway Patrol for speeding. Upon approach to the vehicle, the encountering officer noted eight other individuals in the vehicle. There was no luggage in the vehicle, leading the encountering officer to suspect this was a human trafficking incident. Additionally, all the passengers gave the same home address as the subject’s home address. During the interview, Abrego Garcia pretended to speak less English than he was capable of and attempted to put the encountering officer off-track by responding to questions with questions. When asked what relationship he had with the registered owner of the vehicle, Abrego Garcia replied that the owner of the vehicle is his boss, and that he worked in construction…

The encountering officer decided not to cite the subject for driving infractions but gave him a warning citation for driving with an expired driver’s license. Abrego Garcia’s driver’s license was a MD “Limited Term Temporary” license. The encountering officer gathered names of other occupants in the vehicle but could not read their handwriting. The officer did not pursue further information due to no citation being issued.”

So Abrego Garcia, an undocumented immigrant, was stopped with an expired license in a car with eight others and no luggage on a trip from Texas to Maryland. He gave a false statement and the officer suspected human trafficking but let him go.

It is now being https://justthenews.com/government/courts-law/hlddeported-el-salvadoran-drove-vehicle-owned-alien-previously-plead-guilty

that the person whom Abrego Garcia described as his “boss” at a construction job was Jose Ramon Hernandez Reyes, an illegal migrant previously convicted of human smuggling. The black 2001 Chevrolet Suburban belonged to Hernandez Reyez.

One can reasonably object that there was no final adjudication of these claims from spousal abuse to human trafficking to gang membership. However, it strains credulity to claim that Abrego Garcia was living a “quiet” life in Maryland. The complaint of his wife that he was a wife-beater alone would seem to contradict NPR’s claim.

The claim has that certain “https://thehill.com/homenews/media/513902-cnn-ridiculed-for-fiery-but-mostly-peaceful-caption-with-video-of-burning/

” quality to it . . . except NPR just decided to leave out the “fiery” and the “mostly” parts.

NPR repeating a false claim that the Supreme Court rejected the claim the government was involved in censorship — despite the express statement of the Court to the contrary.

NPR has long been accused of showing bias in its coverage. It is now https://jonathanturley.org/2025/02/02/this-is-npr-npr-faces-reckoning-on-what-it-is/

for the news outlet.

https://cms.zerohedge.com/users/tyler-durden

Thu, 04/24/2025 - 09:05

https://www.zerohedge.com/political/npr-abrego-garcia-was-living-quietly-maryland-he-was-deported

Massive Buying Of Boeing Aircraft Sends US Durable Goods Orders Soaring In March

Massive Buying Of Boeing Aircraft Sends US Durable Goods Orders Soaring In March

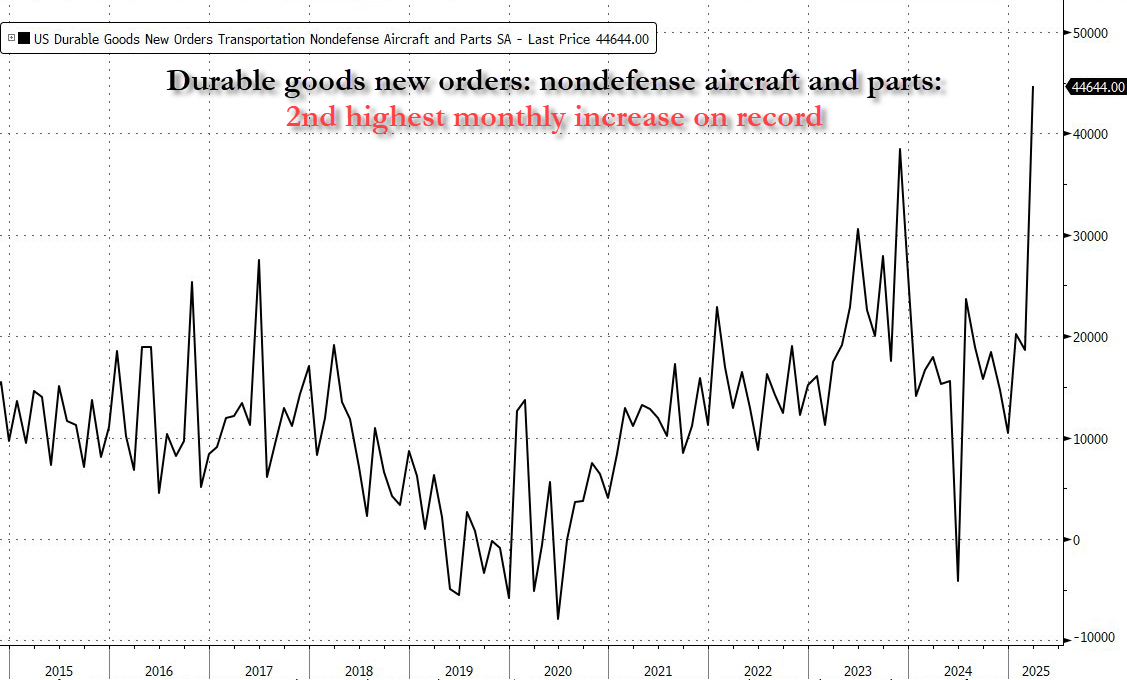

US Durable Goods Orders printed a massive 9.2% MoM surge in preliminary March data, massively beating the +2.0% MoM expectation) and pulling orders up 10.9% YoY - the highest since Jan 2022. This is the third straight month of strong orders...

?itok=1t3bsjxm

?itok=1t3bsjxm

Source: Bloomberg

That is a four sigma beat of expectations...

?itok=Du6uiAFY

?itok=Du6uiAFY

Source: Bloomberg

But... and its a big but!

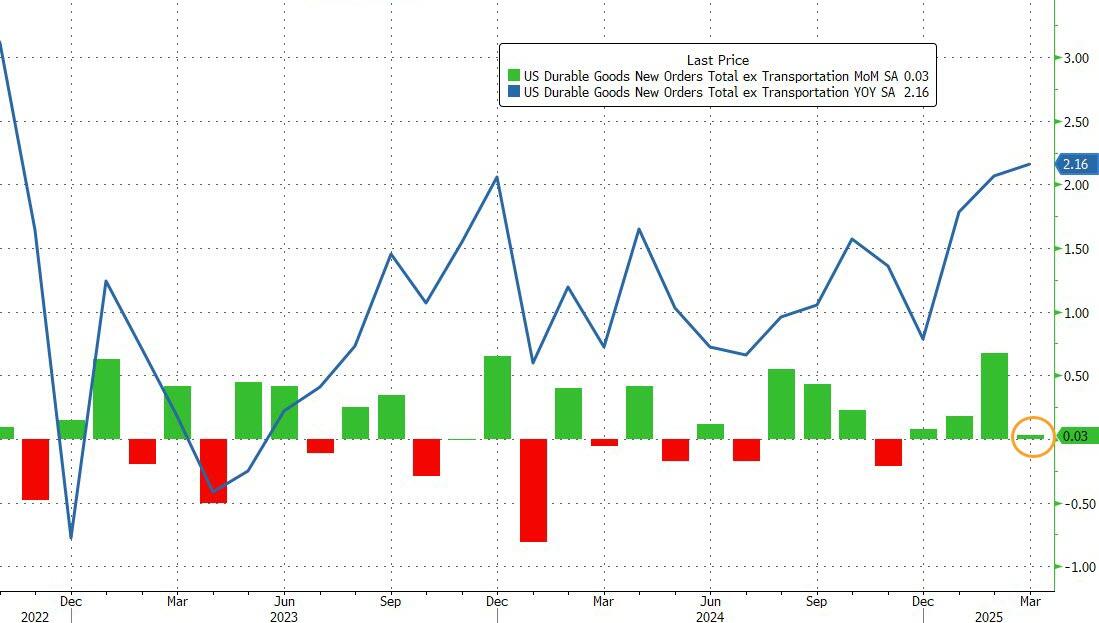

Ex-Transportation, durable goods orders were unchanged MoM (rising 2.2% YoY)...

?itok=OzSUVbC1

?itok=OzSUVbC1

Source: Bloomberg

And so - all of the gains in the headline orders print were due to a 139% surge in orders for commercial aircraft and parts...

?itok=DOxWAKLP

?itok=DOxWAKLP

Source: Bloomberg

Boeing Co. said it received 192 orders in March, the most since the end of 2023 and up from 13 in the previous month. At the same time, China recently ordered its airlines not to take further deliveries of Boeing jets as the trade war escalates.

However, non-defense capital goods shipments including aircraft, which feed directly into the equipment investment portion of the gross domestic product report, dropped 1.9%, the most since October.

?itok=EbU1ePKN

?itok=EbU1ePKN

What will The Atlanta Fed GDPNOW forecast do with this massively mixed big picture data?

https://cms.zerohedge.com/users/tyler-durden

Thu, 04/24/2025 - 08:53

"Vladimir, STOP!" Trump Responds To 'Massive' Russian Missile Strike On Kiev, Leaving 9 Dead

"Vladimir, STOP!" Trump Responds To 'Massive' Russian Missile Strike On Kiev, Leaving 9 Dead

Amid stalled US-led peace talks, Russia launched a massive overnight attack on Ukraine, including raining down ballistic missiles on the center of Kiev, unleashing large-scale death and destruction.

At least nine people have been reported killed and over 70 injured in the capital city, in what was one of the largest and deadliest missile strikes on Ukraine in months. Some other cities, including Kharkiv, were also hit.

?itok=mSwu96IW

?itok=mSwu96IW

Anti-aircraft systems began engaging inbound missiles and drones at about 1am local time. But after drones and missiles were able to make it through, several buildings - including a factory - and a house, as well as cars, were set on fire.

BBC https://www.bbc.com/news/articles/cd7v0lgg18xo

, "An apartment block was completely flattened during the attack and the windows of surrounding buildings were blown out and balconies ripped down."

"Russia has launched a massive combined strike on Kyiv," Ukraine’s state emergency service announced on Telegram. "According to preliminary data, nine people were killed, 63 injured."

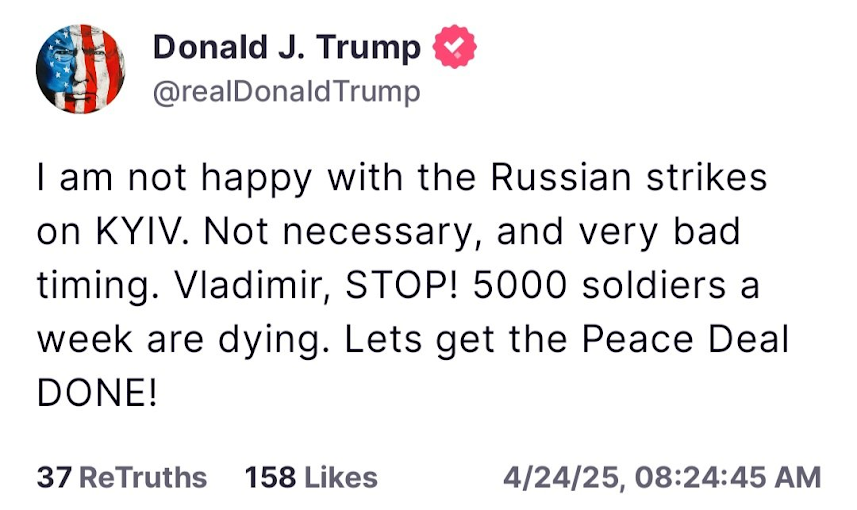

President Trump early Thursday condemned the attack, saying he's "not happy" with the Russian move. "Vladimir, STOP!" he wrote on Truth Social. "5000 soldiers a week are dying. Let's get the Peace Deal DONE!"

?itok=MppVNU3n

?itok=MppVNU3n

A large rescue effort has been underway given a missile head a densely populated area, with Ukraine’s interior minister, Ihor Klymenko, saying of Svyatoshinsky district of Kiev, "Mobile phones can be heard ringing under the ruins. The search will continue until everybody is got out. We have information about two children who cannot be found at the scene of the incident."

Ukrainian officials have cited that some 70 missiles and up to 150 drones were used against several cities in the devastating overnight attack.

BBC footage from the Russian attack in Kyiv last night.

According to available information, at least 8 people were killed during the strikes in the Ukrainian capital.

Ukrainian Air Force informed that Russia launched 11 Iskander-M/KN-23 ballistic missiles, 37 Kh-101… https://t.co/zucVYlpWi9

— Status-6 (Military & Conflict News) (BlueSky too) (@Archer83Able) https://twitter.com/Archer83Able/status/1915350700424392816?ref_src=twsrc%5Etfw

This new Thursday attack on the capital was the deadliest since last year's July 8 attack on Kiev, which left 34 people dead and 121 injured.

It comes after the Zelensky government has expressed frustration that the White House should be more concerned and standing by Ukraine's side, instead of holding bilateral talks toward diplomatic normalization with Russia.

The latest Trump and Zelensky back-and-forth has focused on Crimea. Trump on Wednesday slammed the Ukrainian leader for rejecting a US proposal that would see Kiev give up all claims on Crimea. Trump pointed out that Crimea "was lost years ago" and that Zelensky has "no cards to play".

Zelensky then cited the 2018 "Crimea declaration" by Trump's then secretary of state Mike Pompeo, which laid out that the United States "rejects Russia's attempted annexation".

Emotions have run high today. But it is good that 5 countries met to bring peace closer. Ukraine, the USA, the UK, France and Germany. The sides expressed their views and respectfully received each other’s positions. It’s important that each side was not just a participant but… https://t.co/lDFV5WK8tw

— Volodymyr Zelenskyy / Володимир Зеленський (@ZelenskyyUa) https://twitter.com/ZelenskyyUa/status/1915120034487189631?ref_src=twsrc%5Etfw

"There is nothing to talk about. This violates our Constitution. This is our territory, the territory of the people of Ukraine," Zelensky had initially told reporters of the question of giving up Crimea permanently.

But Vice President JD Vance had also articulated while traveling in India, "We’ve issued a very explicit proposal to both the Russians and the Ukrainians, and it’s time for them to either say yes or for the United States to walk away from this process."

Kyiv is under Russian attack. 21 people are hospitalized, including a pregnant woman and three children. https://t.co/IQZw9TkV8I

— Marta Havryshko (@HavryshkoMarta) https://twitter.com/HavryshkoMarta/status/1915195583931048024?ref_src=twsrc%5Etfw

He emphasized "The only way to really stop the killing is for the armies to both put down their weapons, to freeze this thing and to get on with the business of actually building a better Russia and a better Ukraine."

Freezing the war now would certainly give Russian forces a huge advantage, given the immense territory in the East they now hold, and this is in large part why Zelensky is refusing such a deal.

https://cms.zerohedge.com/users/tyler-durden

Thu, 04/24/2025 - 08:45

https://www.zerohedge.com/geopolitical/russia-launches-massive-missile-strike-kiev-leaving-9-dead

WTF Are CEOs Waiting For? Jobless Claims Refuse To Buckle To 'Recession' Narrative

WTF Are CEOs Waiting For? Jobless Claims Refuse To Buckle To 'Recession' Narrative

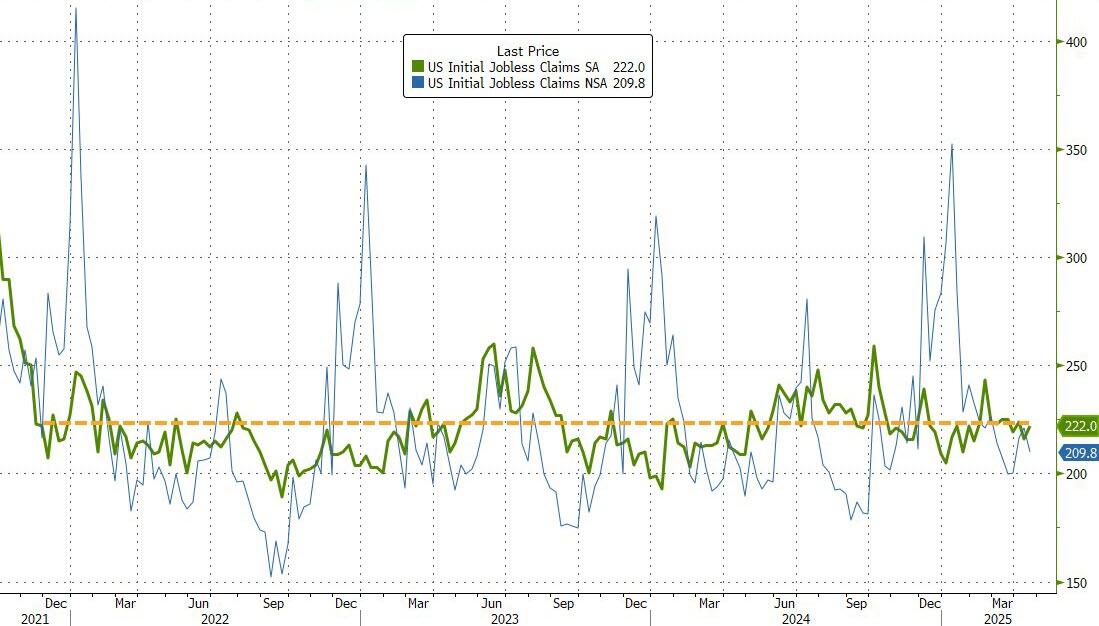

The number of Americans filing for jobless benefits for the first time rose very modestly to 222k last week. Since Nov 2021, jobless claims have barely blipped higher (or lower), despite the recent tsunami of calls for imminent recession...

?itok=FDbIQQfe

?itok=FDbIQQfe

Source: Bloomberg

Continuing jobless claims dropped to 3 month lows...

?itok=GaTDJDau

?itok=GaTDJDau

Source: Bloomberg

But here's the big picture - despite CEO panic, employment remains unquestionably strong...

?itok=sidequYs

?itok=sidequYs

Source: Bloomberg

So are these CEOs delinquent in their roles? Why aren't they firing 1000s of staff? Or are they just full of shit in their public prevarications?

https://cms.zerohedge.com/users/tyler-durden

Thu, 04/24/2025 - 08:39

Futures Drop On Tariff Concerns As Dollar Slides

Futures Drop On Tariff Concerns As Dollar Slides

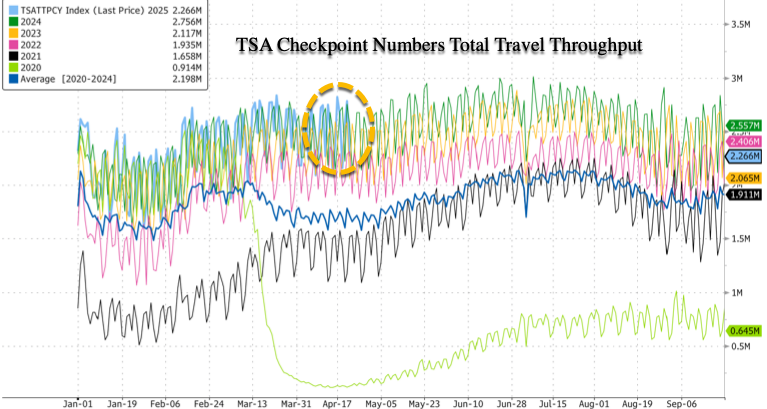

It's risk-off price action this morning, with US equity futures lower, rates rallying across the curve, macro credit opening softer, while the USD trades broadly lower. The two-day rally in US stocks fizzled amid mixed Trump signals on China tariffs as the president floated a fresh levy timeline while simultaneously denying easing efforts and Beijing called for full rollback of all US duties. As of 8:00am S&P futures slipped -0.3% as China maintained a defiant stance over tariffs imposed by Trump, but were off session lows as investors continue to live headline to headline; Nasdaq futures dropped 0.2% with all Mag7 names in the red; NVDA (-1.5%), TSLA (-1.6%), and AAPL (-1.2%) are leading the losses. With Trump reigniting tariff volatility, IBM warning on federal cuts and China denying trade talks entirely, the rotation out of US risk remains intact. Europe was mixed, Real Estate (+1.16%) and Autos (+0.71%) outperforming but Banks (-0.76%) and Travel (-0.69%) lagged. Overnight, China responded to the recent headlines regarding “US-China talk”: Beijing pointed out that “there are absolutely no negotiation on the economy and trade between China and the US and called to cancel all the unilateral measures on China. Meanwhile Trump downplayed the idea of millionaire tax rate, one that some Republicans sees as a way to pay for the economic package (BBG). Bond yields are lower and USD is weaker; 2-, 5-, 10-yr yields are 4.5bp, 4.8bp, 3.3bp lower. The dollar extended its decline (-0.56%), with gold climbing (+1.3%) as investors hedge against prolonged US policy risk. VIX is flat (+0.28%), MOVE dipped (-1.48%) and USYC2Y10 (+1.6%) suggesting caution is returning despite the bounce in crude (+0.74%) copper (+0.57%) and gold (+1.4%). Flows are risk-off: SPY -$1.98B, QQQ -$689M and IWM -$614M, while GLD picked up another +$643M and XLU +$109M. Looking ahead today, we have durable good orders, initial and jobless claims, existing home sales, as well as non-voter Kashkari speaking.

In premarket trading, Mag 7 stocks fall (Tesla -0.6%, Nvidia -0.3%, Meta -0.5%, Apple -0.2%, Amazon -0.3%, Alphabet -0.2%, Microsoft -0.06%). IBM slumped 6.8% after 1Q results failed ease investor concerns. Chipotle fell 3.6% after the Mexican restaurant chain lowered its full-year outlook after quarterly sales declined for the first time in almost five years. Comcast fell 3% after reporting first-quarter losses of pay-TV and broadband customers that exceeded analysts’ estimates, a reflection of the growing competition from streaming companies and wireless providers. Here are some other notable premarket movers:

Alaska Air (ALK) tumbles 6.5% after the carrier’s 2Q forecast for adjusted earnings per share trailed the average analyst estimate.

Edwards Lifesciences (EW) climbs 3% after the medical device maker boosted its sales forecast for the full year.

Hasbro (HAS) gains 6% after the toymaker posted 1Q profit that beat estimates.

Impinj (PI) climbs 17% after the semiconductor device company reported first-quarter results that beat expectations and gave a positive revenue forecast.

Procter & Gamble (PG) falls 1.8% after the consumer products company cut its core earnings per share growth forecast for the full year.

Robert Half (RHI) tumbles 15% after the staffing services company reported first-quarter EPS that missed the average analyst estimate and noted that US trade policy is weighing on business confidence.

ServiceNow (NOW) rallies 8% after the software company reported first-quarter results that beat expectations and gave an outlook that is seen as strong.

Southwest Air (LUV) drops 4% after the carrier said it is not reiterating its 2025 or 2026 Ebit guidance as a result of weakening consumer spending and “macroeconomic uncertainty.”

Texas Instruments (TXN) rises 9% after the chipmaker reported first-quarter results that beat expectations and gave an outlook that is seen as strong.

Tractor Supply (TSCO) falls 4% after the farm-store chain reported sales for the first quarter that missed the average analyst estimate.

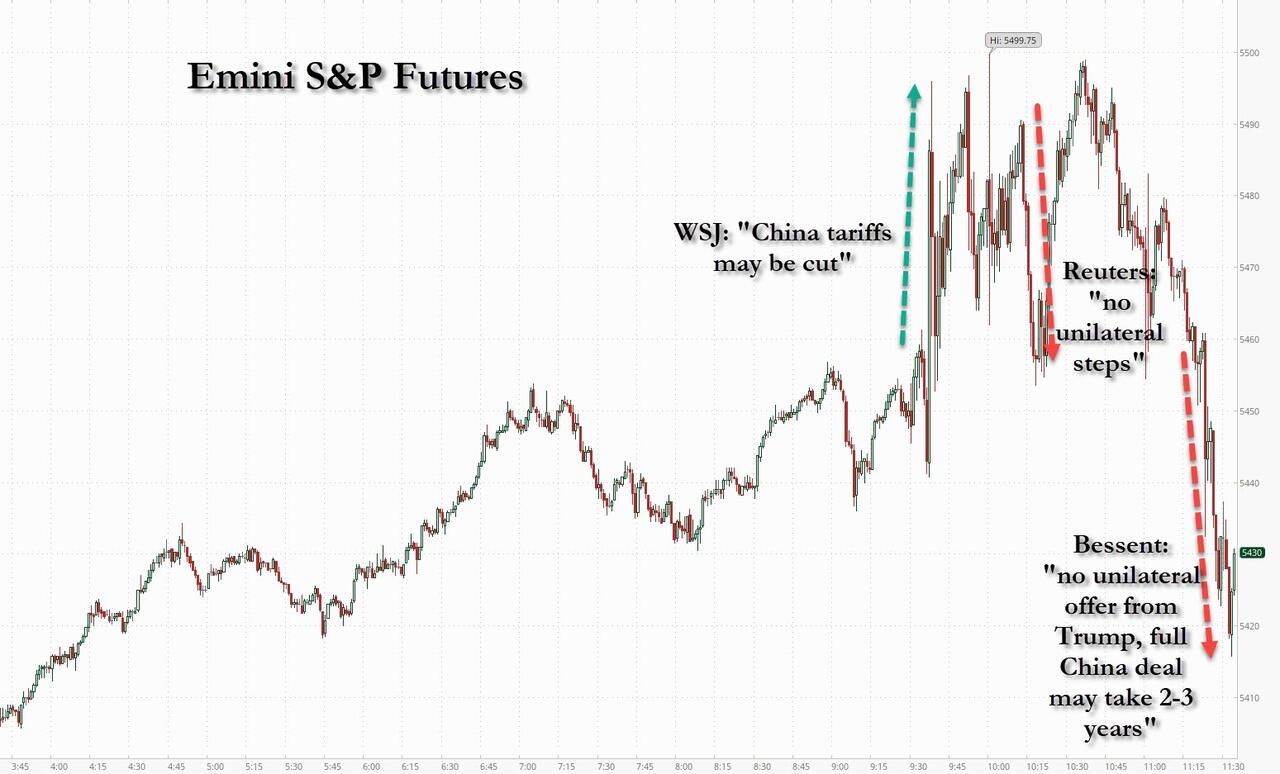

Stocks are struggling to extend Wednesday’s global rally, which was spurred by signs Trump is rethinking the most aggressive elements of his stances on trade and the Federal Reserve. The market moves underscore how investors are grappling to keep up with pronouncements from officials in the administration and frequent back-and-forth by Trump on his tariffs. Bessent tempered some of the optimism over that development, as he said the US was not looking to unilaterally lower tariffs and that a full trade deal could take two to three years. China, in turn, said Thursday that the US should revoke all unilateral tariffs and that Washington needs to show sincerity if it wants to hold trade negotiations.

“In terms of geopolitical risk, there’s a chance that we have reached a bottom, even if that’s not necessarily the case for markets,” said Francois Antomarchi, a fund manager at Degroof Petercam asset management. “Trump has touched the limits of what he can inflict on corporate America. That being said, there’s always a possibility he starts acting on another political front and triggers more volatility.”

Overnight, we continued to see mixed messages on trade negotiations, with President Trump saying last night that China may receive a new levy rate in two to three weeks, while China’s Foreign Ministry denied both countries are in talks and said the US should revoke all unilateral tariffs. Also had reports that the US is considering reducing certain tariffs targeting the auto industry although Trump said he wasn’t. CNBC reported that EU officials have warned that there’s still a lot of work that needs to get done before a trade deal can be reached with the US. Japan is hoping to finalize an agreement around the Group of Seven summit in June, however, they are likely going to resist Trump efforts to form trade bloc against China.

“You’re just seeing conflicting statements and noise coming from the US, where the overall narrative is just all over the place,” said Peter Kinsella, head of foreign-currency strategy at Union Bancaire Privee Ubp SA in London. “It’s impossible to trade.”

Deutsche Bank strategists were the latest to slash their year-end S&P 500 target by 12%, citing the blow to US companies from tariffs. While the new target of 6,150 points leaves 14% upside from Wednesday’s close, it means the index will only recover losses sustained since its February peak. Up until this change, the Deutsche Bank team had one of the most bullish views for the benchmark.

“With the potential impact of the announced tariffs large and likely to fall disproportionately on US companies, we lower our S&P 500 EPS estimate for 2025 from $282 to $240,” the strategists wrote in a note, adding that the consensus view is at risk of further downgrades.

Europe's Stoxx 600 is down 0.4% with bank, retail and technology shares posting the largest declines.Real Estate (+1.16%) and Autos (+0.71%) outperform but Banks (-0.76%) and Travel (-0.69%) lag. Germany’s IFO Survey was better (for both current and expectations) helping push the euro higher. Here are the biggest movers on Thursday:

Galderma shares climb as much as 7.9% after the Swiss dermatology company reaffirms its core Ebitda margin forecast for the full year, which RBC flags as positive given it includes the impact of US tariffs

Beijer Ref shares gain as much as 9.8% to touch a one-month high, after the Swedish industrial cooling and ventilation firm posted strong earnings. Analysts praised the company’s solid organic growth

Indivior shares gain as much as 8.1% after the UK drugmaker posted earnings. Jefferies welcomed the 1Q beat and reiterated guidance, with expectations for a second-half rebound driven by Sublocade support

Belimo rises as much as 10% after the Swiss manufacturer of heating, ventilation and air conditioning upwardly revises its guidance for the full year. Analysts note particular strength in US data center demand

Inchcape shares plummet as much as 17%, marking their worst drop since 2008, after the automotive distributor posted a drop in organic sales and added a caveat to its guidance as tariffs inject more uncertainty

Kering shares fall as much as 6.9% following a sales miss which analysts said showed that its key Gucci brand continues to struggle. The update raised doubts that the French luxury group can bounce back in 2H

BNP Paribas shares dropped 2.2%, making it one of the worst performing banks in Europe, after the French lender reported a drop in first-quarter net income despite record result from equities trading

Nokia shares fall as much as 5.8% after the telecom equipment firm reported weaker-than-expected 1Q earnings and said reaching the top end of its guidance now appears more challenging

Dassault Systemes shares slide as much as 9.7%, to the lowest intraday since 2020. The software company issued a mixed first-quarter report, as softness in licenses driven by broader macro uncertaint

Worldline shares slide as much as 8.8% after the payments firm removed its previous full-year guidance, citing management’s limited tenure and macro-related uncertainty

Husqvarna shares fall as much as 7.7%, the most since April 7, after the Swedish garden and outdoor equipment firm reported weak earnings and announced its CEO would depart

Thales shares fall as much as 6.1% after the French defense company’s orders were softer than expected in the first quarter — according to Jefferies. JPMorgan highlights some weakness in non-defense divisions

EssilorLuxottica shares fall as much as 3% after the Ray-Ban maker’s earnings fell in line with expectations, not enough to push the outperforming stock any higher as macro headwinds marred the update

Earlier in the session, Asian stock rally took a breather on Thursday as investors digested the latest commentary from the Trump administration on its tariff plan. The MSCI Asia Pacific Index edged lower after a five-day run of gains. Shares in Taiwan, South Korea and Hong Kong fell. Stock benchmarks in Japan bucked the trend to gain about 1%, buoyed by carmakers on news that the US is considering whether to reduce certain tariffs targeting the auto industry. While signs that President Donald Trump is easing up on his tough stance against China and the Federal Reserve drove a relief rally globally on Wednesday, the momentum cooled after Treasury Secretary Scott Bessent cast doubt on a timely resolution to the US-China trade war. A reduction in US import tariffs is “conditional on China coming to the table and perhaps then after a two to three-year period we could see a bilateral trade deal in the works,” said Chris Weston, head of research at Pepperstone. “For now, the collective takes the news flow to mean that we’ve seen the worst of tariff policy.”

In FX, the Bloomberg Dollar Spot Index fell 0.4%, snapping a two-day winning streak after China also demanded that the US revoke all unilateral tariffs; ongoing tensions underscored the risks stemming from aggressive US tariffs. The euro rises 0.6%, helped by stronger-than-expected German IFO data although Rehn’s comments saw it pullback from the highs. The Norwegian krone is leading G-10 currency gains against the dollar, rising 1.2%. The Canadian dollar underperforms, albeit still up 0.3%. USD/JPY fell as much as 0.8% to 142.31.

“The dollar rebound this week doesn’t represent much more than a squeeze on speculative short dollar positions generated by the ‘no intention to fire Powell’ headlines and signs of back peddling on some of the tariff items,” said Ray Attrill, head of foreign-exchange strategy at National Australia Bank Ltd. “It doesn’t change the negative big picture view of the dollar”

In rates, the 10-year Treasury yield fell 3bps to 4.35%, sliding back toward a 4.24% touched on Wednesday, its lowest since April 8. Treasuries hold modest curve-steepening gains in early US trading, led by German government bonds which are also higher, having extended gains after ECB’s Rehn said they shouldn’t rule out a larger interest-rate cut. German 10-year borrowing costs fall 3 bps. Gilts are also higher, albeit lagging peers. Bund curve steepened as traders priced in additional ECB easing. The US session includes a 7-year note auction, last coupon sale until May 5, following good demand for Wednesday’s 5-year offering.

In commodities, oil prices advance, with WTI rising 0.6% to $62.60 a barrel. Gold jumps $50 to around $3,336/oz. Bitcoin falls 1% to below $93,000.

On today's calendar, we have Initial Jobless Claims and Durable Goods at 8:30am, Existing Home Sales at 10am, and Kansas City Fed Manf at 11am. Fed’s Kashkari speaks at 5pm. We get another slew of EPS and $44bn 7yr UST auction at 1pm.

Market Snapshot

S&P 500 mini -0.3%

Nasdaq 100 mini -0.3%

Russell 2000 mini -0.2%

Stoxx Europe 600 -0.3%

DAX -0.5%

CAC 40 -0.6%

10-year Treasury yield -3 basis points at 4.35%

VIX +1 points at 29.49

Bloomberg Dollar Index -0.3% at 1225.41

euro +0.5% at $1.137

WTI crude +0.8% at $62.74/barrel

Top Overnight News

Factories in China have begun slowing production and furloughing some workers as the trade war unleashed by Trump dries up orders for products ranging from jeans to home appliances. With most Chinese goods now facing US Duties of at least 145%, some factory owners say American customers have cancelled or suspended orders, forcing them to cut production. FT

US House Republicans will seek a $150bln Pentagon spending hike as part of their party-line mega bill: Politico.

Trump said he might call Jerome Powell and reiterated the Fed chair is making a mistake by not lowering rates. Cleveland President Beth Hammack said slowing the pace of the Fed’s balance-sheet runoff may let it continue for longer. BBG

Trump and House Speaker Mike Johnson signal opposition to a new 40% tax bracket for those earning $1M+, likely putting a “nail in the coffin of the idea.” Politico

BofA Institute Total Card Spending (Week-to-Apr-19th): +3.1% (Y/Y) (prev. 2.3%); said easter continues to be a major retail event for the US

Trump is planning to spare carmakers from some of his most onerous tariffs, on another trade war climbdown. The move would exempt car parts from the tariffs that Trump is imposing on imports from China. Exemptions would leave in place a 25% tariff Trump imposed on all imports of foreign made cars and a separate 25% levy on parts would also remain and is due to take effect from May 3. FT

Marco Rubio refuted a Politico story that reported the White House may lift sanctions on Russian energy assets as part of a Ukraine peace deal. Overnight, Russia hit Kyiv with one of the heaviest aerial strikes this year. BBG

China on Thursday said that there were no ongoing discussions with the U.S. on tariffs, despite indications from the White House this week that there would be some easing in tensions with Beijing. “If the U.S. really wants to resolve the problem ... it should cancel all the unilateral measures on China,” Ministry of Commerce Spokesperson He Yadong told reporters. CNBC

Japanese bonds and stocks are set to draw the biggest combined monthly foreign inflows on record, adding to signs global funds are seeking alternatives to US assets. BBG

EU officials warn that there’s still a lot of work that needs to get done before a trade deal can be reached with the US. CNBC

The ECB will probably have to cut rates further and shouldn’t exclude a larger reduction, Governing Council member Olli Rehn said. BBG

Fed's Hammack (2026 voter) said uncertainty is a big issue in the economy and is causing businesses to pause, while she added that an incredibly high bar exists for the Fed to step in and they have not seen the need for Fed market intervention. Hammack also commented that recent market troubles were a risk transfer and that markets were functioning, as well as noted it is not a good time to be pre-emptive amid policy uncertainty and reiterated now is a good time for monetary policy to take its time.

Tariffs/Trade

China's Vice Premier He Lifeng said the nation must face up to the new situation of the US tariff increase on China; need to increase policy supply and solve practical problems.

China's Foreign Ministry spokesperson, on US trade talks, said "As far as I know, China and the US have not consulted or negotiated on the issue of tariffs, let alone reached an agreement," via Global Times.

China's MOFCOM said any content about China-US economic and trade talks is "groundless and has no factual basis" If US really wants to resolve the issue, it should life all unilateral tariff measures against China.

China Foreign Ministry spokesperson Gou said China and the US are not yet in talks on tariffs; will fight tariff war "if we have to" Respect is condition for any talks to happen. Tariffs disrupt TWO rules, and harm people of all countries.

China's MOFCOM held a meeting with foreign firms to discuss the impact of US tariff increases on the investment and operations of foreign enterprises in China; committed to further opening-up, with policies that are stable, consistent, and predictable.

US President Trump said it depends on China how soon tariffs can come down and they have spoken to 90 countries regarding tariffs already. Trump said if they don't have a deal, they will set tariffs and could set the tariff for China over the next two or three weeks, while he suggested that there is daily direct contact between US and China. Furthermore, Trump commented that they don't want cars from Canada and that car tariffs from Canada could go up, as well as noted that they are working on a deal with Canada and will see what happens.

It was earlier reported that US President Trump is to exempt carmakers from some US tariffs in which he was said to be planning to spare carmakers from some of his most onerous tariffs, in another trade war climbdown following intense lobbying by industry executives over recent weeks, according to FT.

White House Economic Advisor Hassett said the USTR has 14 meetings scheduled this week with foreign trade ministers and there are 18 written offers from trade ministers, while he stated China is open to talks.

PBoC Governor Pan said in Washington that there are no winners in trade wars and tariff wars, while he added that unilateralism and protectionism have no way out and are not in the interests of anyone. Furthermore, Pan said China will adhere to opening up and firmly supports free trade rules and the multilateral trading system.

Chinese embassy in the US posted a statement from an official saying “Our doors are open, if the US wants to talk. If a negotiated solution is truly what the US wants, it should stop threatening and blackmailing China and seek dialogue based on equality, respect and mutual benefit. To keep asking for a deal while exerting extreme pressure is not the right way to deal with China and simply will not work."

China Customs will no longer supervise goods and articles included in the management of drugs, veterinary drugs, and medical devices, while it will no longer supervise import and export of microbial agents for environmental protection with these goods to no longer be supervised as special items entering and leaving China.

Japan Economic Minister Akazawa plans to visit the US for tariff talks from April 30th, while it was also reported that the US told Japan it cannot give special treatment regarding tariffs during talks held earlier this month, according to NHK citing multiple Japanese government sources.

Taiwan's representative to the US said Taiwan is willing to increase purchases of weapons and energy from the US to reduce its trade deficit.

White House said regarding the EU fine on Meta (META) and Apple (AAPL) that novel forms of economic extortion will not be tolerated.

Swiss Economy Minister said he held a productive meeting with USTR Greer to discuss bilateral trade relations and is looking forward to future exchanges and continued collaboration.

Chile’s President said the best way to respond to this trade war is not with high-sounding statements, while they are not going to respond with retaliation and are going to respond with greater integration. Furthermore, he said they must continue working hard to facilitate customs processes and promote investments to improve logistics.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were ultimately mixed despite the positive handover from Wall Street - the risk momentum waned overnight as trade uncertainty lingered owing to the mixed signals from the US. ASX 200 was led higher by outperformance in mining stocks and tech, with gold producers buoyed by a rebound in the precious metal. Nikkei 225 advanced at the open but gradually pared most of the gains following firmer Services PPI data from Japan and after a report that the US told Japan it cannot give it special treatment regarding tariffs during talks held earlier this month. Hang Seng and Shanghai Comp were subdued following the mixed signals from the US as a report noted the White House was mulling cutting China tariffs by around half to de-escalate the trade war although officials declared they are not considering something unilaterally. Furthermore, President Trump stated it depends on China how soon tariffs can come down and if they don't have a deal, they will set the tariff but said they are having daily talks with China.

Top Asian News

PBoC to sell CNY 600bln of 1yr medium-term lending facility (MLF) loans on Friday April 25th.

China issued its new market access "Negative List" in which the number of items in the negative list was reduced to 106 from 117, while China's 2025 negative list for market access removed eight national access restrictions and partially liberalises eight national measures including for telecommunications services, TV production, pharmaceuticals, internet information services for drugs and medical devices, and forest seed imports.

South Korea Information Protection Agency said DeepSeek transferred user information and prompts without permission, according to Yonhap.

European bourses (STOXX 600 -0.8%) opened with modest losses, but sentiment gradually deteriorated as the morning progressed, to display a clear negative bias. European sectors opened mixed but now display a bit more of a negative picture. Real Estate takes the top spot, alongside strength in Energy; although upside is very modest. Tech is the clear underperformer today, given the risk-tone and as traders digest the latest earnings from Dassault Systemes, which slumped after downgrading its 2025 margin outlook. The banking sector is pressured by post-earning losses in BNP Paribas, whilst the Luxury sector is hit after poor Kering results. US equity futures (ES -0.6% NQ -0.8% RTY -0.6%) are entirely in the red, in-fitting with the broader risk tone; the NQ lags, with sentiment in the Tech sector hit after IBM (-8% pre-market) results. Focus now turns to US Durable Goods, Jobless Claims and earnings from the likes of Alphabet and Intel.

Top European News

ECB's Rehn said should not rule out a larger rate cut; risks are beginning to materialise There are few good arguments to pause rate cuts. Defence outlays will not have much impact on medium-term inflation.

FX

DXY has pulled back with the USD lower vs. all peers after gaining yesterday on account of hopes on the trade front and more conciliatory language from President Trump re Fed Chair Powell. In terms of the latest state-of-play, Trump said it depends on China how soon tariffs can come down and they have spoken to 90 countries regarding tariffs already. Trump added that if they don't have a deal, they will set tariffs and could set the tariff for China over the next two or three weeks. Note, China this morning said they are not yet in trade talks with the US.

EUR is firmer vs. the USD and the best performer across the majors with the EUR benefitting from its status as the most liquid alternative to the USD. On the trade front, not a great deal has changed for the EU with the Trump administration focusing more on the likes of India and China. Elsewhere, ECB speak has continued to lean towards suggesting that tariffs will weigh on inflation in the Eurozone. German IFO data exceeded expectations but failed to have any material sway on the EUR given the headwinds facing the nation. EUR/USD is currently stuck on a 1.13 handle and within yesterday's 1.1308-1.1440 range.

USD/JPY pulled back from the 143.00 territory after rallying yesterday owing to the positive risk appetite and stronger buck, while recent data showed firmer Services PPI from Japan. On the trade front, Japanese Economic Minister Akazawa plans to visit the US for tariff talks from April 30th. USD/JPY has delved as low as 142.56 but is still some way clear of Wednesday's trough at 141.49.

GBP is firmer vs. the USD but to a lesser extent than most peers. Newsflow out of the UK remains on the light side. However, on the trade front, UK Chancellor Reeves said the UK will not rush trade talks with the US and will not relax food standards to secure a deal. BoE's Lombardelli is both due later. Cable is currently stuck at the top end of a 1.32 handle and within Wednesday's 1.3234-1.3339 range.

Antipodeans are both a touch firmer vs. the broadly weaker USD with little in the way of newsflow from Australia or New Zealand. As such, direction for both will likely be dictated by trade developments and the broader risk tone.

Barclays said its passive month-end rebalancing model shows strong dollar buying against all majors.

PBoC set USD/CNY mid-point at 7.2098 vs exp. 7.3111 (Prev. 7.2116).

Fixed Income

US paper is higher alongside downside in stocks and following a choppy session yesterday which saw T-notes ultimately settle lower. In terms of the latest state-of-play for trade, Trump said it depends on China how soon tariffs can come down and they have spoken to 90 countries regarding tariffs already. Trump added that if they don't have a deal, they will set tariffs and could set the tariff for China over the next two or three weeks. Note, China this morning said they are not yet in trade talks with the US. For today's docket, data releases include US durables and weekly claims figures, whilst Kashkari is due to deliver remarks - a 7yr note offering is also due. Jun'25 USTs currently sit towards the bottom-end of Wednesday's 110.18+ to 111.18+ range.

Bunds are firmer on the session after a session of losses on Wednesday on account of the upbeat risk tone that was triggered by optimism on the trade front and Trump remarks re Powell. ECB speak has continued to lean towards suggesting that tariffs will weigh on inflation in the Eurozone, albeit there is a high level of uncertainty surrounding forecasts. ECB's Rehn has suggested that the GC should not rule out larger cuts than 25bps. German IFO data exceeded expectations but failed to have any material sway on prices given the headwinds facing the nation. Jun'25 Bunds are currently towards the middle of yesterday's 131.11-131.93 range with the 10yr yield @ 2.477% vs. yesterday's 2.454-2.518% range.

UK paper is sitting just above the unchanged mark after a choppy session yesterday which saw initial gains (triggered by the UK DMO issuance adjustment and soft UK PMI data) reversed following the strong risk tone in the market. On the trade front, UK Chancellor Reeves said the UK will not rush trade talks with the US and will not relax food standards to secure a deal. A strong UK 2043 outing had little impact on Gilts, and currently trade within Wednesday's 92.34-93.29 range.

Norwegian Sovereign Wealth Fund CEO said it has not gone massively to buy stocks but individual portfolio managers have been able to buy more "if they wanted to"; have not changed view on USTs.

UK sells GBP 1.75bln 4.75% 2043 Gilt: b/c 3.38x (prev. 2.97x), average yield 5.155% (prev. 5.232%) & tail 0.3bps (prev. 0.5bps).

Italy sells EUR 3bln vs exp. EUR 2.5-3.0bln 2.55% 2027 BTP: b/c 1.65x (prev. 1.55x) & gross yield 2% (prev. 2.38%).

Commodities

A firmer session in the crude complex this morning following yesterday's slump in prices on account of the OPEC+ discord after Kazakhstan said it cannot lower oil output and prioritises domestic interest over the cartel's. WTI resides in a USD 62.11-63.00/bbl range while its Brent counterpart resides in a USD 65.95-66.81/bbl range.

Once again a mixed picture across precious metals with spot gold now the gainer whilst spot silver and palladium falter. Little new to add aside from the ongoing theme of tariff uncertainty, with investors rushing back into the yellow metal following two days of heavy losses. Spot gold currently resides in a USD 3,305.37-3,367.69/oz parameter.

Base metals are trading modestly firmer on the back of a softer Dollar but upside remains capped by lingering trade uncertainty. 3M LME copper resides in a USD 9,352.03-9,413.80/t range at the time of writing.

Geopolitics: Middle East

Israel's army carries out a series of bombing operations in the city of Rafah in the southern Gaza Strip.

Geopolitics: Ukraine

Ukrainian air defence units were active around Kyiv and witnesses reported several explosions and drones in the air, while the second largest city of Kharkiv was also under missile attack with explosions heard.

US Treasury Secretary Bessent met with Ukraine's PM Shmyhal and Finance Minister Marchenko, while he reaffirmed US dedication to secure peace and emphasised the need to conclude technical talks and sign an economic partnership between the US and Ukraine as soon as possible.

Geopolitics: Other

Russia said it may resume nuclear tests in response to similar measures from Washington, via Al Arabiya.

China's Military said it monitored US warship's transit in Taiwan Strait on Apr 23.

US Event Calendar

8:30 am: Apr 19 Initial Jobless Claims, est. 222k, prior 215k

Apr 12 Continuing Claims, est. 1868.5k, prior 1885k

8:30 am: Mar P Durable Goods Orders, est. 2%, prior 1%

Mar P Durables Ex Transportation, est. 0.3%, prior 0.7%

Mar P Cap Goods Orders Nondef Ex Air, est. 0.1%, prior -0.2%

Mar P Cap Goods Ship Nondef Ex Air, est. 0.2%, prior 0.8%

8:30 am: Mar Chicago Fed Nat Activity Index, est. 0.12, prior 0.18

10:00 am: Mar Existing Home Sales, est. 4.13m, prior 4.26m

Mar Existing Home Sales MoM, est. -3.05%, prior 4.2%

Central Bank speakers

5:00 pm: Fed’s Kashkari Speaks in Moderated Discussion

DB's Jim Reid concludes the overnight wrap

I'm on my way to Luxembourg this morning. It's always a very pleasant trip apart from the fact that it's the one time a year I go on a small twin propellor plane. Last time in extreme turbulence I think I clung onto my colleague Mark Wall as we came into land. Fortunately for Mark the weather looks pretty calm today!

Markets are a little bumpier in Asia this morning and reversing a little after a relentlessly bullish run since Easter. Yesterday saw a further positive batch of headlines on the trade war with Trump saying “We’re going to have a fair deal with China”, as the WSJ reported that the China tariffs could be slashed down towards 50-65%. That would be less than half the 145% rate that’s in place right now, and that led to a lot of excitement that US policy would move in a more predictable direction from here. In fact we're moving back closer towards Trump's campaign pledges of a 10% universal baseline tariff and a 60% tariff on China, albeit 2 weeks into a 90-day reprieve on the more aggressive reciprocal tariffs.

The latest positive developments collectively led to a huge sigh of relief in markets, and meant several assets unwound their tariff-driven moves. Equities climbed as a result, with the S&P 500 (+1.67% after +2.51% Tuesday) posting consecutive gains of above 1% for the first time since November 6, the day after Trump’s election win. Indeed, it now means the S&P has pared back more than half of its losses since the closing low on April 8. And in Europe it was much the same story, and the STOXX 600 (+1.78%) also posted a solid advance, having now risen by nearly 10% (+9.98%) since its closing low on April 9. That said, the S&P 500 is still -5.20% down since April 2 and volatility remains high as the index gave up about half of yesterday’s +3.44% peak intra-day gain as investors struggled to gauge just how much tariff reversal was likely, with Bessent saying there was no unilateral offer to cut tariffs on China. So we’re not quite out of the woods yet.

We’ll have to see what happens from here, but a large part of the optimism has come about because investors think the US administration will relent more. That view was supported by the WSJ’s report yesterday, which suggested the China tariffs could be slashed lower. So that seemed to back up Trump’s own comments on Tuesday evening that the China tariffs would “come down substantially”, and that “we’re going to be very nice and they’re going to be very nice, and we’ll see what happens.” The WSJ report also floated the idea of a tiered approach, saying that one possibility was for a 35% tariff on items that weren’t a national security threat, and a 100% tariff on strategic items. Shortly after yesterday’s close the FT also reported that the US administration was planning to exempt car parts from some of the most onerous tariffs, avoiding stacking 20% China fentanyl and 25% steel and aluminium levies on top of the 25% auto tariffs.

For US Treasuries, the tariff relief and the latest Powell comments led to a further flattening of the curve. Long-term Treasuries continued to recover, with the 10yr Treasury yield down -1.9bps to 4.38% and the 30yr yield (-5.5bps) seeing an even bigger decline to 4.82%. On the other hand, the 2yr yield rose +5.3bps to 3.87%, its highest since April 11 as investors dialed back prospects for near-term Fed cuts. A rate cut was 57% priced by the June meeting as of yesterday’s close, down from 78% on Monday.

The dollar index (+0.94%) strengthened for a second day running, continuing to pick up from its three-year low on Monday after Trump’s critical comments about Powell. And although it might seem anomalous that the currency is strengthening even as long-term interest rates were falling, the moves demonstrated that investors were becoming more optimistic on US assets more broadly, with greater confidence in their safe haven status again. So that reversed the moves we saw after Liberation Day, when bonds and the currency were selling off simultaneously, in a manner reminiscent of the UK in late-2022 when Liz Truss was Prime Minister.

Elsewhere, the other big focus yesterday was on the April flash PMIs from around the world, which offered an initial indication on how the global economy was reacting to the tariffs. Overall, they showed a clear but modest deterioration, and in the US at least, they were still above the 50-mark separating expansion from contraction. So that helped to alleviate fears about an imminent recession, and the broader market rally demonstrated that investors are still sceptical that we’re heading for a sharp downturn. In terms of the numbers themselves, the US composite PMI was down to 51.2, which was the weakest print since December 2023. Meanwhile the Euro Area composite PMI just about remained in expansionary territory at 50.1, but that was also the weakest print since December.

More broadly, there were several signs across different asset classes that the recent market stress was easing. In particular, the VIX index (-2.12pts) closed at 28.45, its lowest level since Liberation Day itself on April 2. Another was US HY spreads (-26bps) which also reached their tightest level since Liberation Day, at 371bps. At the same time, yesterday also saw investors move out of several assets that had done incredibly well since the Liberation Day announcements. For instance, gold prices (-2.73%) fell back to $3,288/oz, having closed at a record high on Monday. In addition, the Swiss Franc was the worst-performing G10 currency, weakening -1.41% against the US Dollar. And European sovereign bonds also struggled significantly, with 10yr bund yields (+5.5bps) rising back up to 2.49%, alongside smaller moves for 10yr OATs (+2.5bps) and BTPs (+2.1bps).

As mentioned at the top, this week's rally is reversing a bit in Asia with the Hang Seng (-1.26%) the biggest underperformer with the CSI (-0.08%) and the Shanghai Composite (-0.10%) also seeing slight losses. Elsewhere, the KOSPI (-0.46%) is also edging lower as South Korea’s GDP data showed an unexpected contraction for the first quarter (more below). However the Nikkei is higher (+0.82%) alongside the S&P/ASX 200 (+0.60%). S&P 500 (-0.25%) and NASDAQ 100 (-0.24%) futures are also lower with 10yr USTs -2.3bps lower trading at 4.36% as I type.

Early morning data showed that South Korea's economy unexpectedly contracted in the first quarter (-0.2%), shrinking for the first time since the second quarter of 2024 and missing forecasts for a gain of 0.1%. The weak data will increase calls for the Bank of Korea (BOK) to cut interest rates again as soon as next month as policymakers worry about the consequences of Trump's tariff policies.

To the day ahead now, and data releases include the Ifo’s business climate indicator from Germany, and in the US we’ll get the weekly initial jobless claims, existing home sales for March, and the preliminary durable goods orders for March. Otherwise from central banks, we’ll hear from the Fed’s Kashkari, the ECB’s Nagel, Lane, Simkus and Rehn, and the BoE’s Lombardelli.

https://cms.zerohedge.com/users/tyler-durden

Thu, 04/24/2025 - 08:27

https://www.zerohedge.com/market-recaps/futures-drop-tariff-concerns-dollar-slides

American Air Yanks Full Year Guidance As Trade Wars Hinder Travel Demand Prediction

American Air Yanks Full Year Guidance As Trade Wars Hinder Travel Demand Prediction

American Airlines https://news.aa.com/news/news-details/2025/American-Airlines-reports-first-quarter-2025-financial-results-CORP-FI-04/default.aspx

a mixed first-quarter report, highlighted by an earnings beat, continued debt reduction, and firm performance in its loyalty program and international markets. However, mounting economic uncertainty and softening passenger demand—compounded by the ongoing trade war—prompted the airline to withdraw its full-year guidance.

"The actions American has taken over the past several years to refresh our fleet, manage costs and strengthen our balance sheet position us well for the uncertainty our industry is facing," AA CEO Robert Isom stated in a press release.

?itok=KZh2OXb8

?itok=KZh2OXb8

Isom pointed out, "The resiliency of the American Airlines team, combined with the investments we have made to differentiate our network, product and customer experience, give us extreme confidence in our ability to navigate the current environment and deliver strong results for the long term."

Here's the breakdown of 1Q25 earnings:

Headline Takeaways:

Revenue and Earnings Beat Estimates: Operating revenue of $12.55B slightly beat Bloomberg Consensus estimates ($12.53B), and the adjusted loss per share (59c) was narrower than forecasted (69c).

Improving Bottom Line: While the adjusted net loss of $386M is up 71% YoY, it's still significantly better than the consensus estimate of a $468.8M loss.

Operational Weakness:

Decline in Passenger Metrics

Passenger Revenue: Down .6% YoY to $11.39B, slightly beating the $11.36B estimate.

Available Seat Miles (ASM) and Revenue Passenger Miles (RPM) declined YoY, showing reduced capacity and demand.

Load Factor (80.6%) fell short of expectations (81.9%) and last year's level (81.5%), indicating weaker aircraft utilization.

Cost Pressures:

Cost per Available Seat Mile (CASM) rose 2.9% YoY to 18.34c, outpacing revenue growth and squeezing margins.

Passenger Yield rose 1.4% YoY, which may help offset some of the cost pressure, but is not keeping pace with inflation or cost increases.

Fleet Growth:

Aircraft Count increased 2.3% YoY to 1,552, signaling long-term confidence despite short-term weakness.

Overall Takeaway:

Positives: Narrower-than-expected losses, slight revenue beat, and modest improvement in yields.

Negatives: Declining traffic and capacity metrics, rising costs, and weaker operational efficiency.

Structural challenges, including demand and cost inflation, linger for the airline heading into the second half of the year...

Perhaps that's why management pulled its full-year earnings guidance: