Money is an organics function.

Ink and paper usually makes consensus to handshakes of organic bonds

🕷️

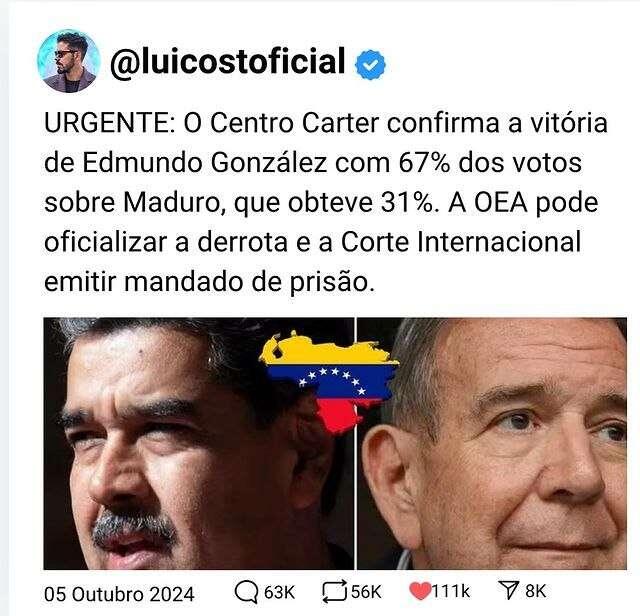

Really, but in a country like mine (Brazil), it's best to accumulate as much Bitcoin as possible, like a bear preparing for winter. This becomes even more relevant when we consider the growing pressure from authorities to reduce or even eliminate physical currency. The government, in attempting to fully digitize the economy, seeks greater control over financial transactions and, inevitably, over its citizens. Digitalization makes traceability easier, giving the state more power over individual economic activities.

When we talk about the end of physical money, we're talking about even greater centralization of monetary power, where all transactions can be monitored and controlled. In this scenario, Bitcoin emerges as a key alternative to protect financial freedom, as it operates on a decentralized network without intermediaries.

By accumulating Bitcoin, people can prepare for this "winter" of monetary control, safeguarding their wealth in an asset that resists censorship and government interference.

😶🌫️Indeed, but using something as valuable as bitcoin is like buying bread with gold.

The Decline of Morality with the End of the Gold Standard

The abandonment of the gold standard in 1971 marked a turning point in the global financial system, with profound economic and moral implications. Previously, national currencies were backed by gold, a finite resource that limited the issuance of money. This forced governments to maintain fiscal responsibility, as printing more currency required equivalent gold reserves.

When the gold backing was abolished, fiat currencies became detached from any tangible asset, relying solely on trust in the issuing government. This shift allowed for inflationary policies, excessive debt, and monetary manipulation, as governments could now print money at will, often without considering the long-term consequences.

This change in the monetary system led to a kind of "moral decline" in economic practices. Inflation became a common tool to cover deficits, devaluing the common citizen’s money while benefiting those closest to the centers of economic power. At the same time, public debt skyrocketed, compromising the future of upcoming generations.

Additionally, the end of the gold standard weakened the notion of intrinsic value in money. While gold represented something real and limited, fiat money became seen as malleable, subject to manipulation based on political interests. This, in turn, fueled a culture of consumption and debt, where the value of money seemed to fluctuate based on government convenience.

In summary, the end of the gold standard not only destabilized global economies but also contributed to a moral degradation in the use of money, encouraging practices that sacrifice financial stability and fairness for short-term solutions.

Bitcoin as a Store of Value

#Bitcoin has increasingly been seen as a store of value, similar to gold, due to its scarcity and unique characteristics. With a fixed supply of 21 million coins, it is protected against inflation, something that government-controlled fiat currencies cannot guarantee. While these currencies can be printed in unlimited amounts, leading to devaluation over time, Bitcoin’s supply remains limited.

Moreover, #Bitcoin's decentralization makes it resistant to censorship and government control, providing a secure way to store wealth. Rather than spending it, many view BTC as an asset to hold, expecting its value to increase over time as more people seek alternatives to traditional financial systems. This makes it a hedge against the devaluation of national currencies and unstable economic policies.

For those looking for long-term financial security, holding #Bitcoin as a store of value is a strategy to preserve wealth.

use #Monero, in case of privacy, and #Bitcoin as a store of value.

Governments see Bitcoin as a threat to their control over the financial system. While fiat currencies, such as the dollar and the real, are controlled and tracked, Bitcoin is decentralized, allowing financial freedom without intermediaries. This is a political concern, which may soon limit or even prevent the purchase of Bitcoin with state currency. In the future, obtaining Bitcoin may become extremely difficult, requiring effort, sacrifices and extreme alternatives such as mining or direct negotiations. The fight for financial freedom through Bitcoin will be increasingly challenging.

Flag Theory and Tax Planning for Bitcoin and Cryptocurrency Users: Legal and Strategic Tax Avoidance In the world of cryptocurrencies, protecting assets and optimizing the tax burden are priorities. Flag Theory offers a legal and efficient strategy, distributing residence, citizenship and business between different jurisdictions to make the best of each. This allows tax avoidance — the legitimate use of the law to reduce taxes — as opposed to evasion or evasion, which are illegal. Bitcoin self-custody, for example, is a key tool in this planning, providing greater security and tax optimization in some jurisdictions. To exploit these advantages ethically and legally, proper planning is essential. I remember making a video about it.

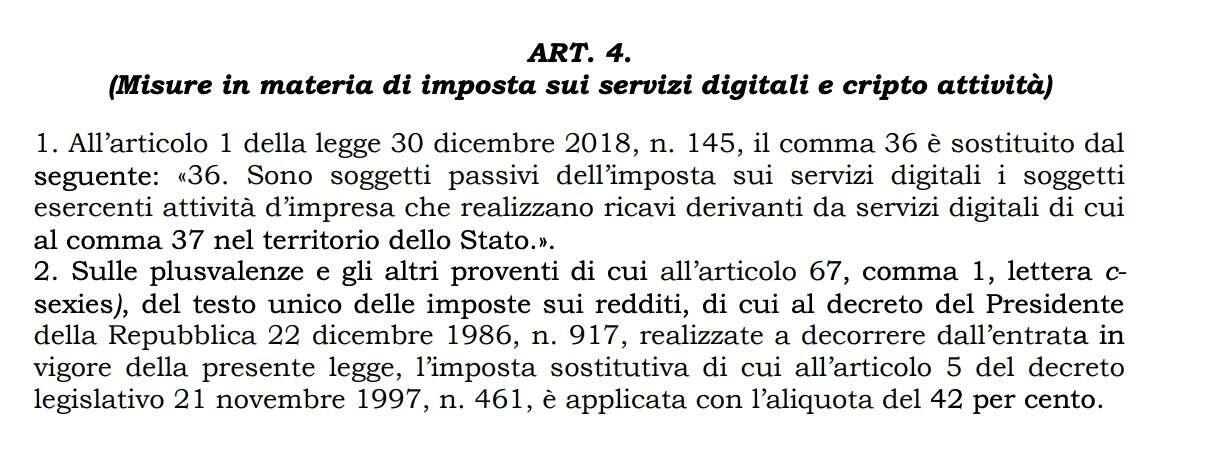

NEW: 🇮🇹 The official text of the 2025 Budget Law, signed by the President of Italy, has been presented❗️

The text includes the increase in the rate on #Bitcoin capital gains to 42%.

The law will now be debated.

If the asset does not appreciate in value, your money will be stored and will be violently liquidated.

The Cash and Carry strategy is an arbitration technique used in the financial market to obtain profit through the simultaneous purchase and sale of an asset1 . Here's a summary of how it works: Spot Purchase: The investor buys an asset on the spot market. Future Sale: At the same time, the investor sells a futures contract for the same asset1 . Profit by Difference: Profit is obtained by the difference between the purchase price in the spot market and the sale price in the futures market1 . This strategy exploits the price difference between spot and futures markets, guaranteeing profitability if the asset's price in the future is higher than the current purchase price1 .

That's what I understood, the principle is very simple.

ㅤ ㅤ ㅤ ㅤㅤ ㅤ ㅤ

To define the next supreme leader of the party, a test is scheduled to see who can drink the most cachaça without falling.

BRICS Summit Proposes Bitcoin as Solution to Sanctions Against Russia

At the BRICS summit, Russian President Vladimir Putin directly addressed the use of the dollar as a political weapon, stating: “The dollar was used as a weapon. It’s true… If they won’t let us work with it, what else should we do? We should look for other alternatives.”

#brics

#bitcoin

#freedom

A dificuldade #Bitcoin atinge um recorde histórico de 95,67T, o que coincide com uma taxa de hash recorde que ultrapassou 700 EH/s pela primeira vez.

#stackfy

#hashrate

#bitoinc

24/10/2024 12:49:38

Se os brasileiros não gostarem podem recorrer ao Bitcoin, diz coordenador do Drex

The prospect of U.S. debt reaching $153 trillion highlights the unsustainable nature of fiat currencies and the potential for Bitcoin to surge in value. As confidence in the dollar wanes, Bitcoin's finite supply makes it an attractive hedge against inflation and economic instability. If Bitcoin gains mainstream acceptance as a store of value or medium of exchange, its price could skyrocket, with predictions of reaching $10 million becoming more plausible. In a world where traditional currencies face increasing challenges, optimism about Bitcoin's future is warranted.

The Bank of Canada has recently cut its benchmark interest rate by 50 basis points to 3.75%, marking its largest rate change in over four years. This decision aims to stimulate economic activity in a sluggish environment by lowering borrowing costs for consumers and businesses.

🇺🇸🤝 A Visa anunciou uma parceria com a Agência dos Estados Unidos para o Desenvolvimento Internacional (USAID) para melhorar o acesso a sistemas governamentais digitais abertos, seguros e inclusivos ao redor do mundo.

#BTC

#Bitcoin

#Freedom

#bitcoin

The recent partnership between Visa and the United States Agency for International Development (USAID) to enhance access to open, secure, and inclusive digital government systems worldwide raises significant concerns for those who advocate for a world free from state control and corporate influence. This collaboration serves as a stark reminder of the entangled relationship between government and corporate entities, which ultimately undermines individual freedom and autonomy.

At its core, this partnership exemplifies the continuing expansion of state power. While the initiative claims to promote inclusivity and security, it fundamentally perpetuates the notion that government systems, no matter how ostensibly improved, remain vehicles for coercion. True progress cannot be achieved through enhancements to state-run systems; rather, it must come from dismantling those systems entirely. Instead of looking to the government for solutions, individuals should focus on decentralized alternatives that empower them to operate independently.

One of the most troubling aspects of this collaboration is the potential for increased surveillance. While the partnership promotes enhanced security in digital government systems, such security measures often come at the expense of individual privacy. Governments have a history of using security as a justification for expanding their surveillance capabilities, thereby infringing on the very freedoms that advocates of individual liberty cherish. In contrast, Bitcoin and other decentralized technologies allow individuals to engage in secure transactions while maintaining their privacy, free from state scrutiny.

The alliance between Visa and USAID also underscores the problematic nature of crony capitalism. By collaborating with government agencies, corporations like Visa position themselves as key players in the establishment of public policy, often prioritizing their own interests over the needs of individuals. This partnership reinforces the idea that the government and corporations work hand in hand to maintain the status quo, stifling innovation and individual empowerment. Rather than relying on such partnerships, the future should focus on fostering decentralized networks like Bitcoin, which eliminate the need for intermediaries and empower individuals to take control of their financial lives.

For those who advocate for a free and voluntary society, the path forward lies in embracing decentralization. Instead of seeking improvements to state-sanctioned systems, individuals must champion alternatives that remove the state from the equation altogether. Bitcoin represents a revolutionary shift in how we conceive of money and value exchange, offering a decentralized currency that allows for voluntary interactions free from government manipulation. In a world increasingly dominated by state control and corporate interests, the future should prioritize individual liberty and the power of voluntary association over any form of centralized authority.

Visa’s partnership with USAID serves as a poignant reminder of the challenges facing advocates of freedom and autonomy in an increasingly interconnected world. Rather than seeking to improve government systems, we must focus on dismantling them and promoting decentralized alternatives that empower individuals. The time has come to challenge the status quo and embrace a future where individuals can thrive without the interference of the state or the influence of corporate giants. Only then can we create a society that truly values freedom, privacy, and individual choice.