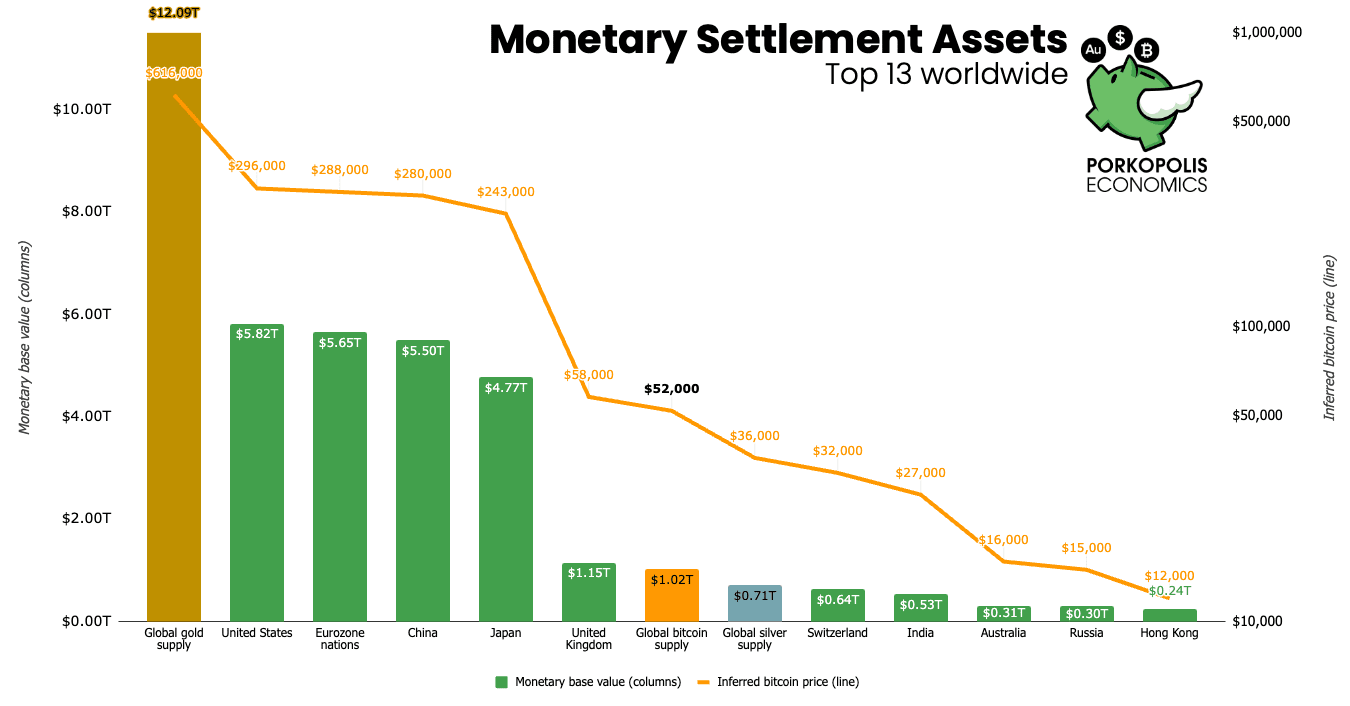

10/ Notice how there is only one more 'mid-major' currency left in #Bitcoin's path, before it gets to the Big Four.

That is the pound #sterling, and there is about 900 billion of them ($1.15 trillion equivalent) issued and outstanding by the central bank.

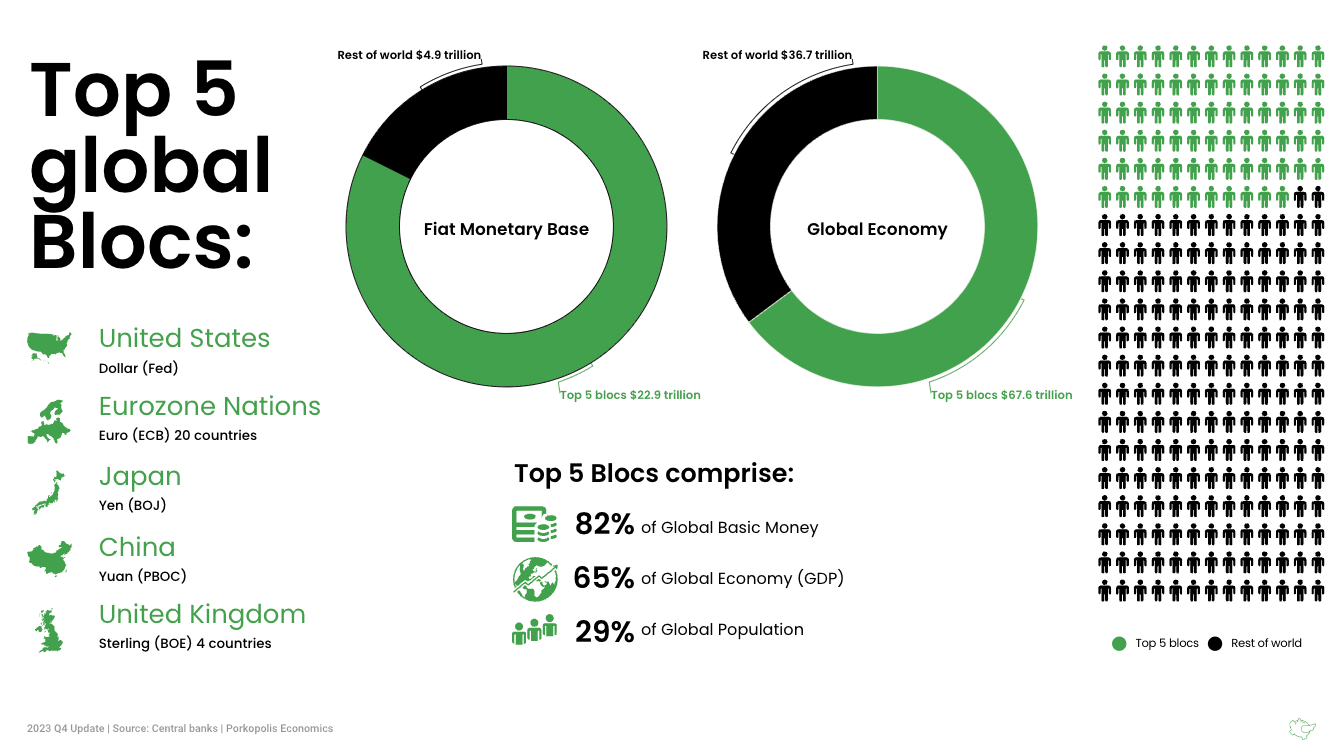

9/ Now let's back up and take a look at the top ten fiats, but layer in gold & silver (base money of the past), and #Bitcoin (base money of the future).

This is the whole enchilada. This is 🤜all the settlement money🤛 in the world.

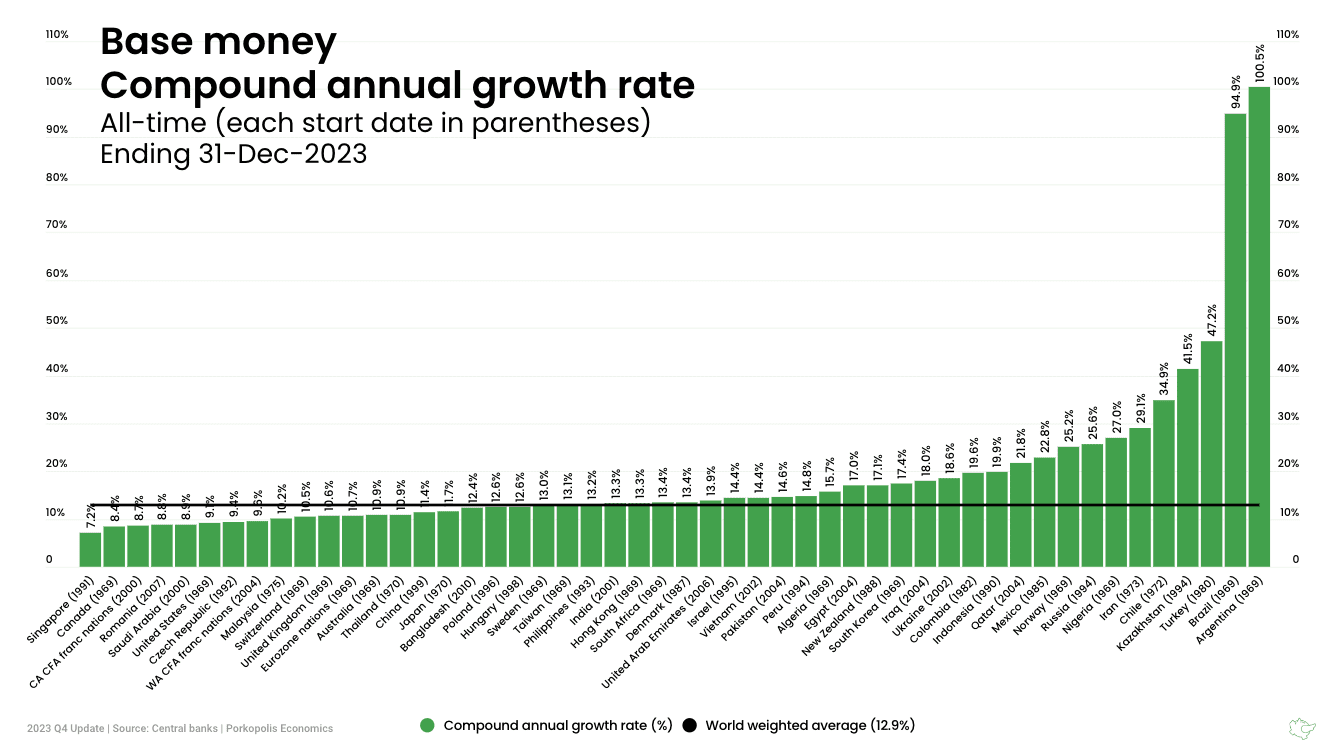

8/ However, if you want to understand the long-term trends of money printing, you need to measure the all-time growth of each currency's stock.

That chart is here. See how no money has 'negative growth' under this lens.

Due to compounding, it's about 1% per month, worldwide...

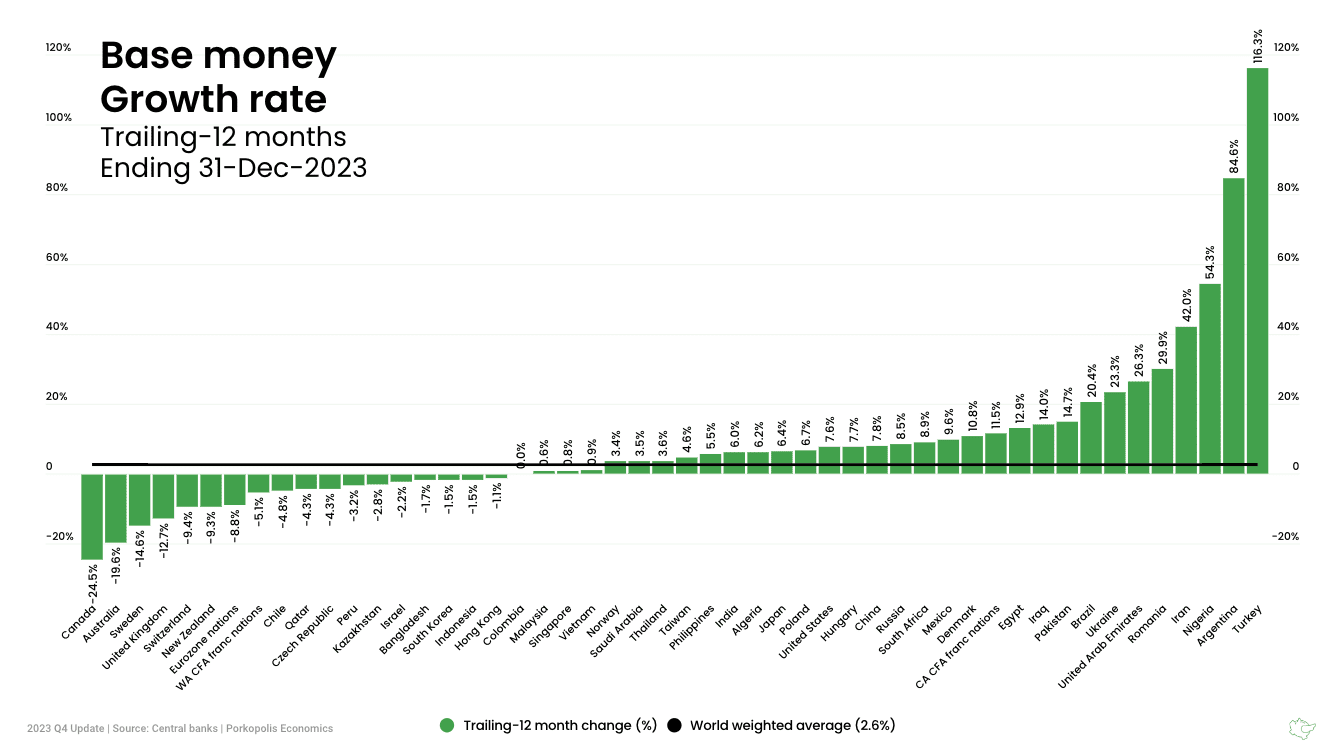

7/ Now for monetary inflation; or, in the classic sense, the 'growth in the stock' of base money.

Though central banks have indeed been shrinking the money supply (which causes a rise in interest rates), over the last year, the global stock of money still increased 2.6%.

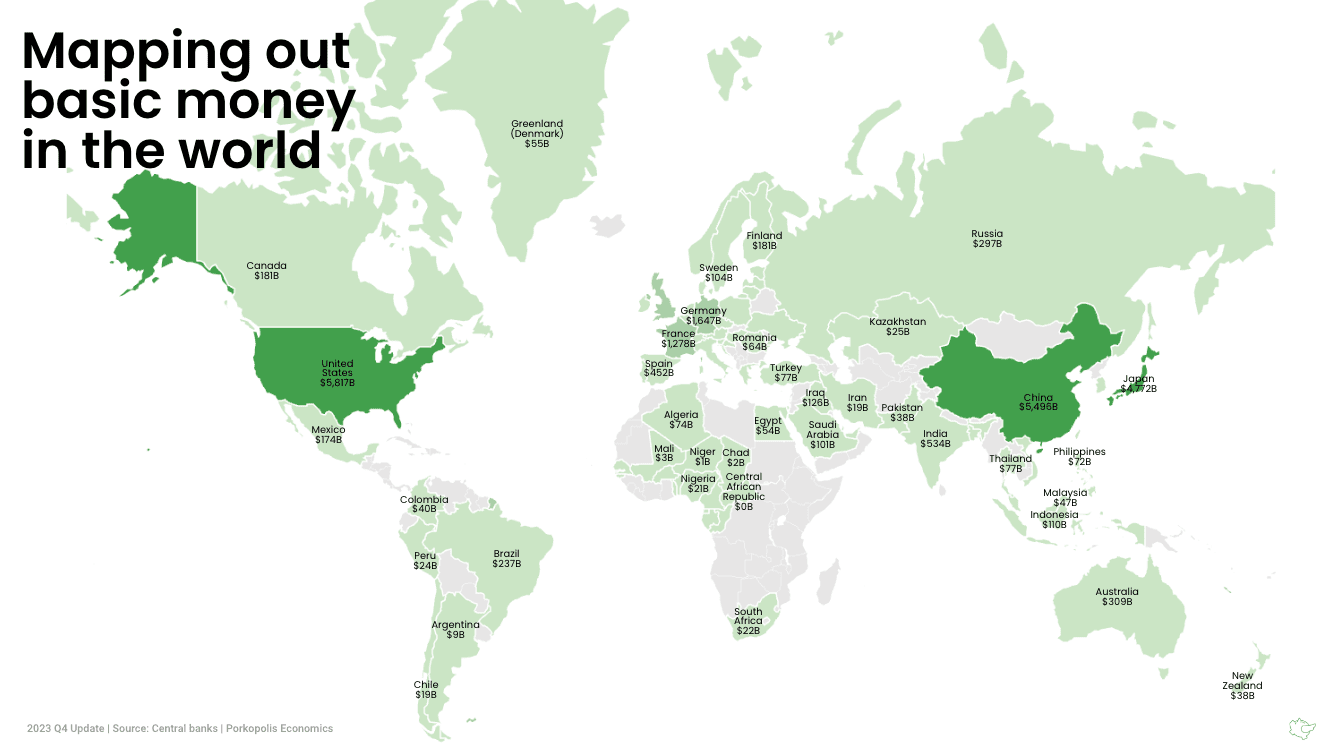

6/ We can map out this basic money across the world.

The totals for the eurozone nations (those using the euro) are disaggregated here, but together the bloc is the second largest money supply in the world.

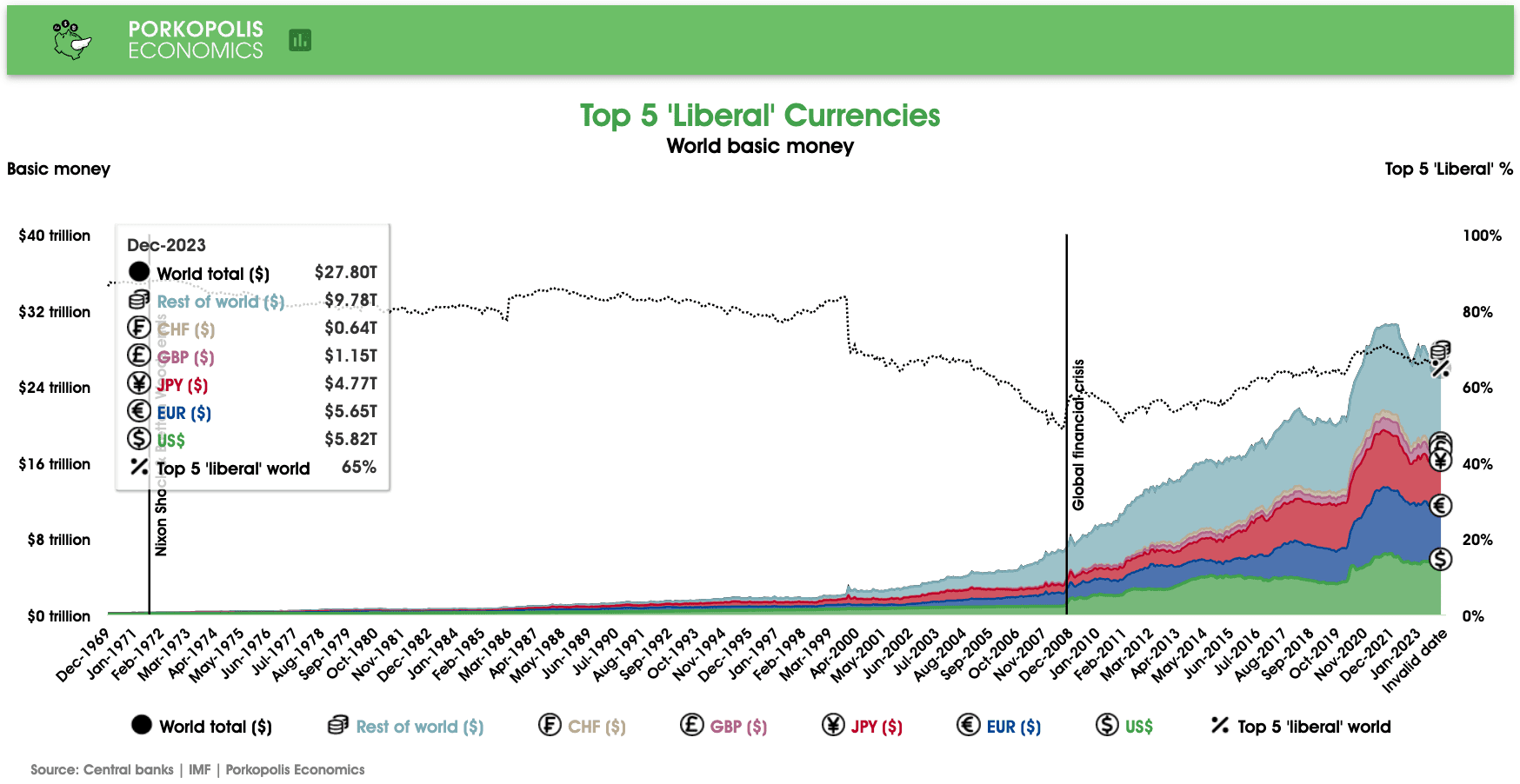

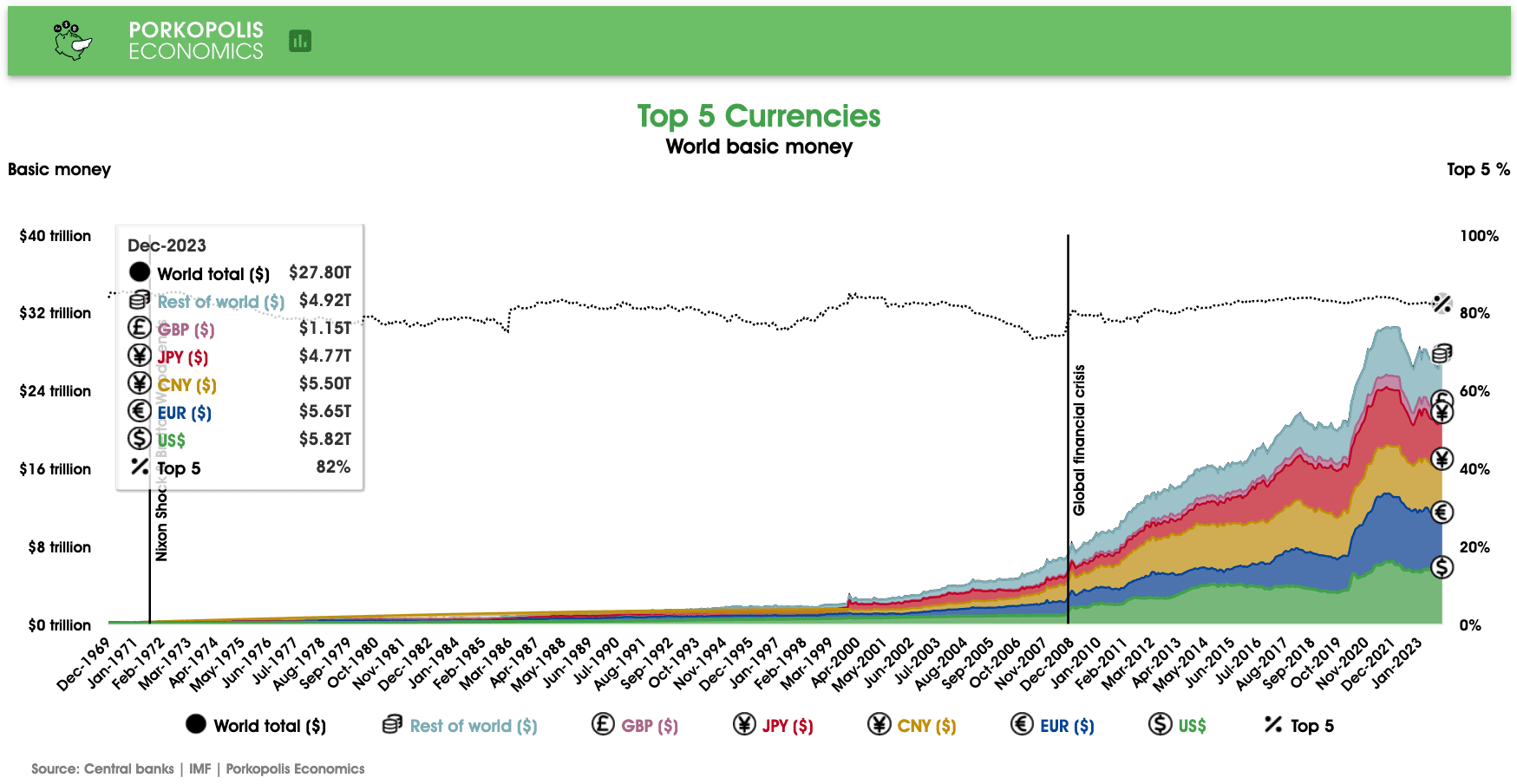

5/ Now for how this bloc looks across time, back to the end of the modern gold standard at the beginning of the 1970s...

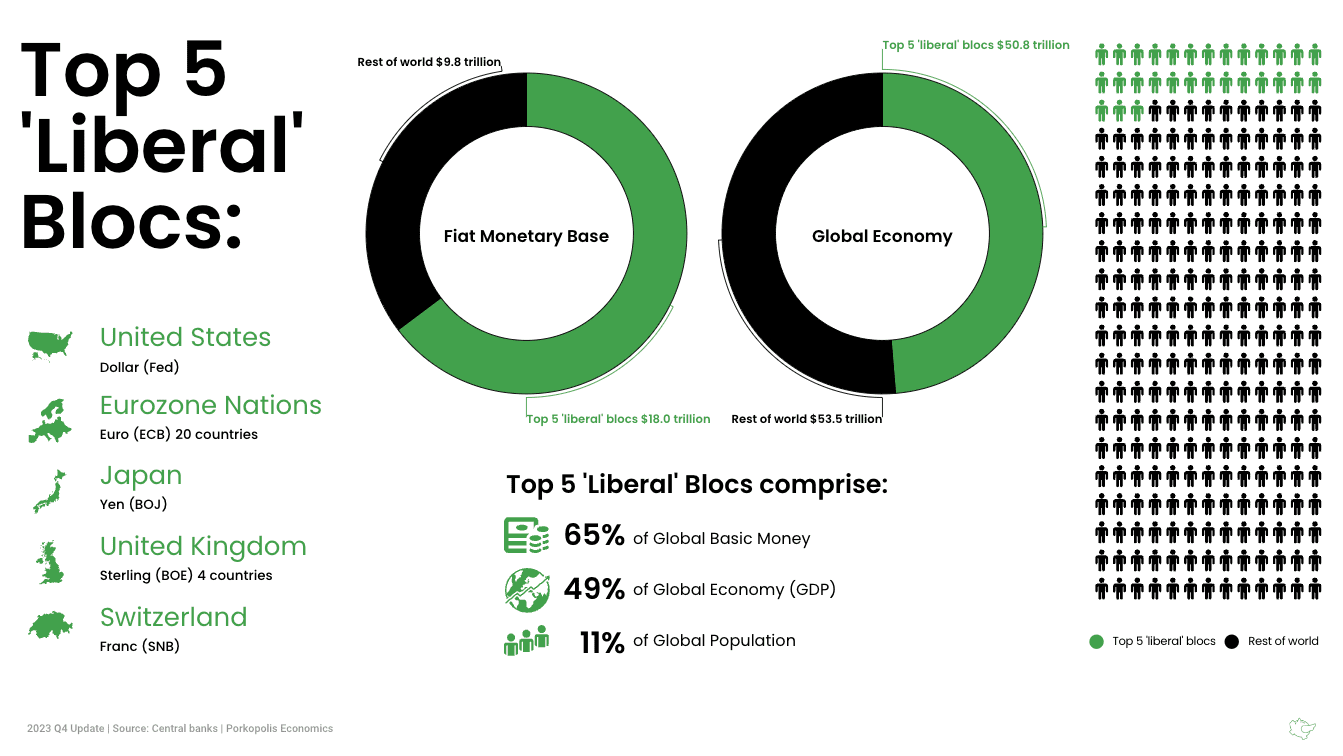

4/ Note that the picture changes if we remove China from the top five, replace it with Switzerland, and then analyze things across these top five 'liberal blocs' in the world.

A privileged 11% live in these nations.

3/ Here's how the top five look over time, since 1969. Note that data on China begins only in 1999.

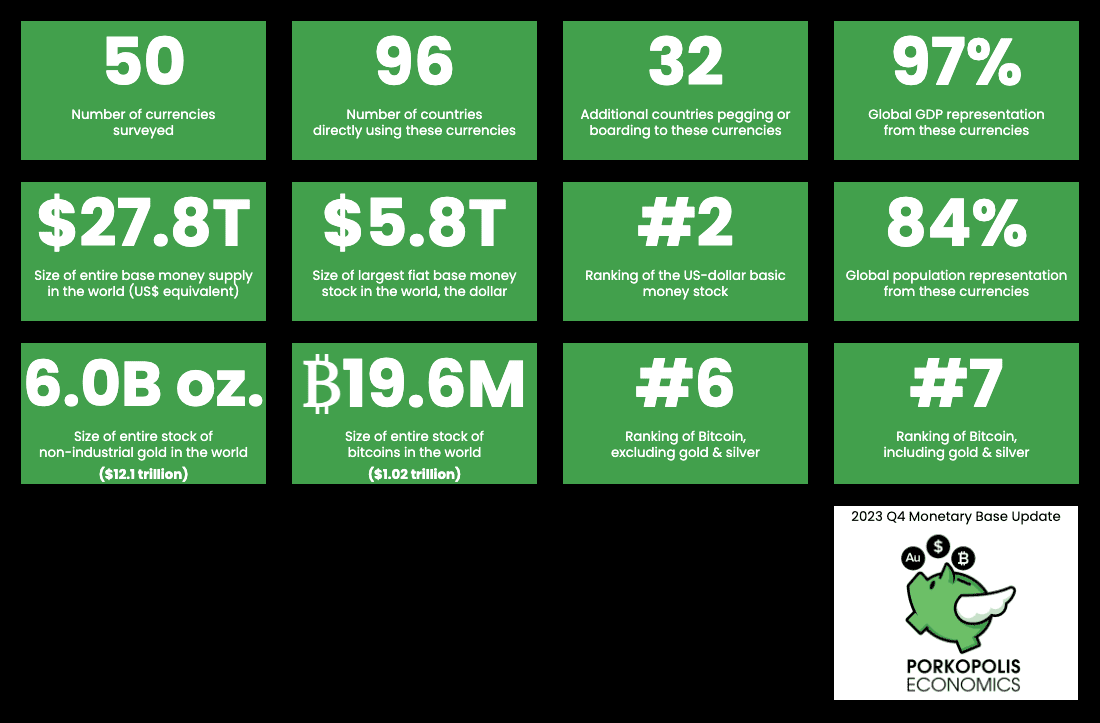

2/ World #basemoney is $27.8 trillion equivalent.

This means all physical cash & coin, and all bank reserves ('accounts') at central banks, total $27.8 trillion.

The top five currencies in the world make up 82% of this...

Time for the 2023 year-end review on global #basemoney.

This is the only money supply that's economically, legally, and accounting-wise comparable with 21 million #Bitcoin.

This money is 👉ultimate settlement.👈

Quarterly update #23... 🧵

Great one with nostr:npub1art8cs66ffvnqns5zs5qa9fwlctmusj5lj38j94lv0ulw0j54wjqhpm0w5 on #Bitcoin privacy, nostr:npub1rwh33t5x8n7czknhts5fg0v0fml8mkl7neaarksumkkf8d679qrqcz7avv in Amsterdam (http://bm.b.tc/ams-tickets), and his upcoming open-source work of art, the Genesis Book: https://open.spotify.com/episode/5HF2YLsJjHvfwgoYG7wweE

Aaand typo on old thread… new thread is here: https://twitter.com/1basemoney/status/1696117186236989686

Q2 2023 update on world basic money available here now.

#Bitcoin remains ranked as #8 currency in the world (that’s right!), and #10 if you include the melt values of all gold and silver.

What about some money supply videos?? :) https://damus.io/note1fvm0sw9fjwefh8jzg9zqxhwepj0ld0jdzz8fl98jlzfv8dlp93qqqv6gt8

Here’s the conclusion to the #TradFi money supply series, this is the total money supply in the USA. Central bank money… vs. bank money: https://www.youtube.com/watch?v=zghGPfY3J8I

Still on #basemoney in the money supply series, how much gold has there been on the other side of the #Fed’s balance sheet over the last 100 years…?

Moving from inside money (bank money) to outside money (central bank money) now, here is the next overview in money supply series, on base #money: https://youtu.be/DYKJ3sDAvb8

Now here’s the total M3 money supply for US. In recent years it is even higher than this (as I am still researching a Eurodollar supply), but most of the data is there even though the #Fed doesn’t want to publish it… https://youtu.be/o49XpbVIrA4

Continuing with the legacy money supply, this one on #eurodollars. It’s inside M3… which still exists… even though they don’t publish it anymore.