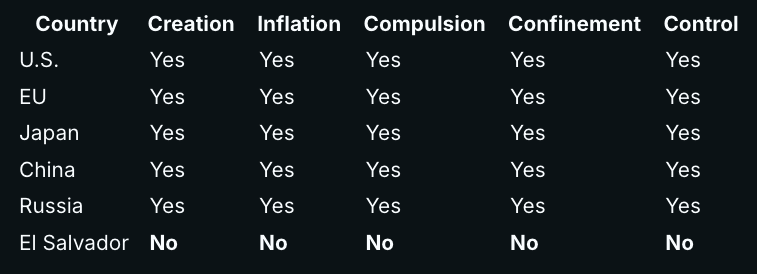

Let’s use AI to see how the Five Characteristics of Repressive Monetary Systems are exhibited, or not, around the globe.

We asked Llama 3.1 to create a table that indicates whether these monetary systems lawfully exhibit the following repressive characteristics: Currency Creation, Currency Inflation, Currency Compulsion, Currency Confinement, and Currency Control as described on the Monetary Justice website. This was its response:

Explanation:

- United States: The Federal Reserve, the central bank of the United States, has the authority to create new currency units without backing, effort, or productive output, contributing to currency inflation. The government enforces the use of the US dollar through laws, confines alternative currencies with taxation and regulation, and exercises control over financial transactions through banks and surveillance.

- European Union: The European Central Bank (ECB) implements a fiat monetary system, allowing for currency creation and inflation. EU governments compel citizens to use the Euro, restrict alternative currencies, and monitor financial transactions.

- Japan: Japan's central bank, the Bank of Japan, operates a fiat monetary system, enabling currency creation and inflation. The government enforces the use of the Japanese yen, confines alternative currencies, and exercises control over financial transactions.

- China: China's central bank, the People's Bank of China, implements a fiat monetary system, allowing for currency creation and inflation. The government compels citizens to use the Chinese yuan, restricts alternative currencies, and monitors financial transactions.

- Russia: Russia's central bank operates a fiat monetary system, enabling currency creation and inflation. The government enforces the use of the Russian ruble, confines alternative currencies, and exercises control over financial transactions.

- El Salvador: El Salvador has adopted Bitcoin as a legal tender, allowing citizens to use it alongside the US dollar. This move reduces the country's reliance on a fiat monetary system, minimizing the effects of currency creation, inflation, compulsion, confinement, and control.

[Table and Explanation generated by Llama 3.1 405B]

How do you interpret these results?

Learn more about the Five Characteristics of Repressive Monetary Systems at: https://monetaryjustice.org

El Salvador 👀 nostr:note189h98gh2hj5efvv93nvam3gmjv8xnw0fejh3grthjf8kwgakyuvs9wg2w6

I encourage everyone to check out the Monetary Justice website, and to share it with anybody who expresses concern about the current state of the U.S. economy.

By nostr:npub1e87s4d4qm76dglgcytt8dphnmd38xhypune5hn6zlvcpesa0yqksyqpe6p

What’s the gist?

The site argues that financial institutions have partnered with the federal government to devise a monetary system that allows both parties to exploit the American people. While this is not news to bitcoiners who have spent countless hours learning about the monetary system, the Monetary Justice site makes it easy for anybody to grasp this concept in ten minutes or less. I think the simplicity of its message has the potential to wake up a lot of people.

It proposes a framework that essentially asserts that all modern repressive monetary systems have these five characteristics in common:

1) Currency Creation

2) Currency Inflation

3) Currency Compulsion

4) Currency Confinement

5) Currency Control

To institutionalize an exploitative monetary system, federal politicians, in cooperation with the banking sector, have codified these five repressive characteristics into law (the site lists these laws). And while each law on its own may be constitutional, taken together they are indicative of something called cumulative unconstitutionality. According to the site, “Cumulative unconstitutionality refers to the concept that a series of individually constitutional laws or policies can collectively become unconstitutional when their combined effect infringes on fundamental rights or violates constitutional principles."

The case is made that the monetary system is unjust and unconstitutional, and that Americans should neither abide nor accept it. Rather, we should use our greatest strengths to peaceably, but actively, resist and reform it. Those strengths are a federalized government with independent state governments (which are also unduly burdened by current monetary policy), and a constitution that exists to prevent the federal government from encroaching on citizens’ rights to life, liberty, property, speech, and self-governance; all of which are diminished by the U.S. federal monetary system.

The whole site right now is only about 4 pages, so the whole thing can be read in one quick pass. 100% worth it, IMO.

If you think more people should hear about this, be sure to mention it to your favorite content creators who might appreciate the suggestion.

Every pleb should read this.

note1uyuy23jtajp3n0emm66ed5wejg4hdcj79h304hmszjaqxrx50chsnyxys5

Another question I have is this: How is it that regulations governing money (money transmitter licenses, aml, kyc, etc.) are being applied to something that is classified as property in the U.S.? I’m sure there’s a loophole that allows the federal government to have its cake and eat it too. I’m just curious what that loophole is.

Quick question for the scholars… Why were the states not able to prevent the confiscation of their residents’ gold in 1933? Trying to grok the proposed self custody law in Missouri.

Thanks!

😂

There is no singular evil cabal. Only a Conspiracy of Self-Interest playing out repeatedly ad nauseam throughout time. Perhaps Bitcoin can realign incentives in such a way that this law of human nature will serve society rather than degrade it.

Bummer. Is this to say that since a note contains an encrypted attestation/signature it cannot legally be transmitted over radio even though the note’s actual content is unencrypted plain text?

Is anybody doing the nostr over ham radio?

The nostr:npub1hcwcj72tlyk7thtyc8nq763vwrq5p2avnyeyrrlwxrzuvdl7j3usj4h9rq team found a way to give Lightning users the features and experience we desired. In order to provide that experience they had to make technical tradeoffs which introduced counter party and regulatory risks. But they set the bar for UX nonetheless.

The Lightning protocol needs to evolve to a point where such tradeoffs aren’t necessary, and some really smart people are working hard to make that a reality.

I’m a fan of this team. When things get sorted, I’ll gladly return. 🤜🤛

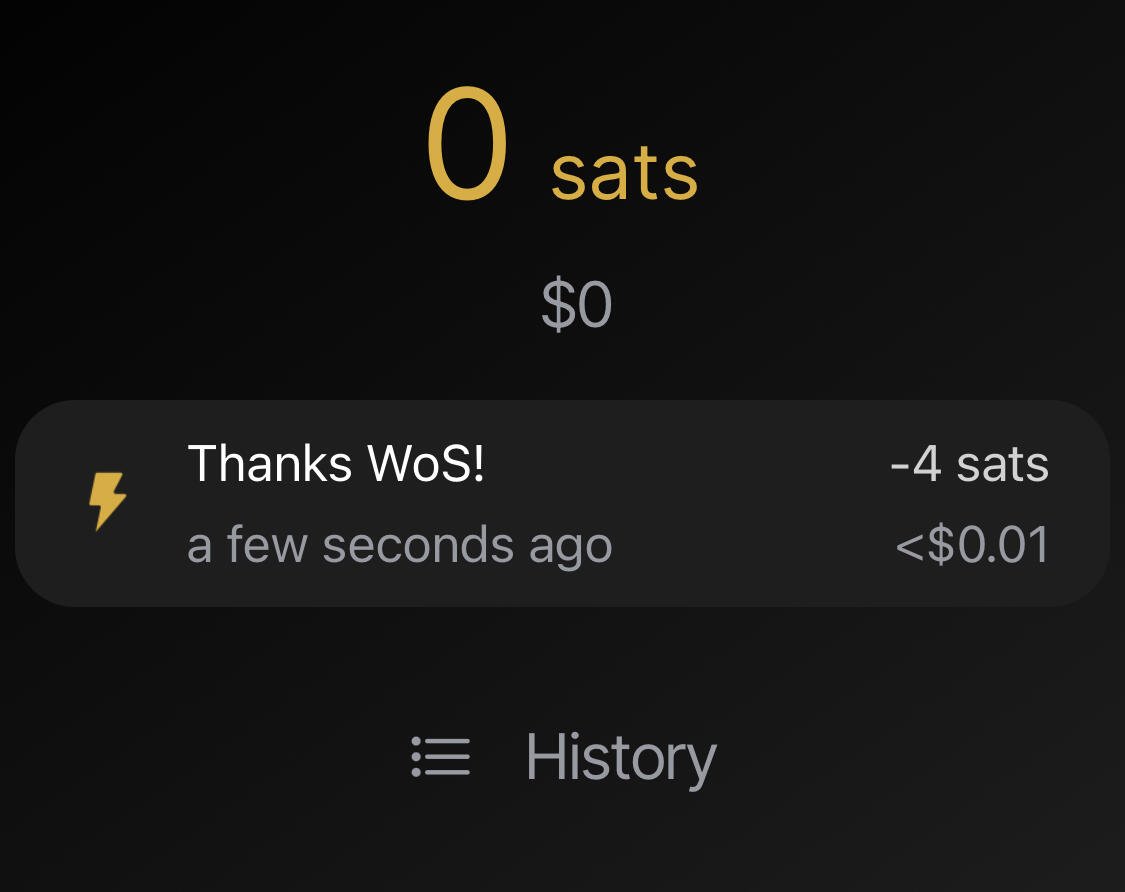

Y’all are the best. Building with Greenlight and just need enough to open some Lightning channels. Thanks, Jameson. 🙏

tb1q6nq3rwegst8w8n3v0ru3x8lzv2tt0g8d0vwg6v

Either testnet coins are the rarest things on Earth, or I’m doing something wrong. 🙃

I swear emojis were invented just to fuck with autismos

Coin Stories (a Bitcoin only podcast) is one of the best in the space imo. nostr:npub1ahxjq4v0zlvexf7cg8j9stumqp3nrtzqzzqxa7szpmcdgqrcumdq0h5ech consistently brings it. Interesting guests. Thoughtful conversations and questions. I’m always happy to see a new episode drop.

Same on both accounts. Neither are nearly good enough to allow for a proliferation of micro services. Extensions are complicated, device specific, and limit the user’s choice of browser (esp. on mobile). Nsec bunker is literally a cli tool. Haha. It’s awesome, but it isn’t going to usher in an era of easily and safely portable accounts. Imo, we don’t get micro services proliferation or main stream adoption until we solve the account portability problem in a secure and decentralized way. To me it remains the most strategically important problem to solve in terms of growing the protocol’s user base and application base. It’s no easy but to crack.

One possibility… Sign up for WorkAway, find something interesting, and start sending messages.