Agreed, but they can keep their climate emergency bullshit to themselves. 🙄

Hey nostr:npub1vcfs2z24y2sc5yy4k7uxsa80vxx6n3w3hf054um4dz8zz2wqwvtsgtkxyw, thanks for this. I’m setting up my lightning node on my Umbrel home. I’ll do some research into Alby hub. Cheers.

A Peter Schiff opinion on Bitcoin we will all agree with. Good work, Peter, you’re making progress. Keep going.

But there are some actual Kiwis as well, check out the NZ community: nostr:npub1fvzm7pn3p0hjxkdvsdlc2lyjew02xhsnsr9pw2pj9f4zzas0gjxs3er9hy

Plus nostr:npub1uth29ygt090fe640skhc8l34d9s7xlwj4frxs2esezt7n6d64nwsqcmmmu from The Transformation of Value podcast, nostr:npub1r3ee2dcml4zv32n8ryl350dkqpyg2f8dchwq9qsq9rauc4r79f7s5nxlvj (although they don't seem to post here yet), nostr:npub17fd0kcnufx7lyu5dlvaw8rzrr2rahmwkqudmesxk7hfwnr2scmnszjc538, nostr:npub1vcfs2z24y2sc5yy4k7uxsa80vxx6n3w3hf054um4dz8zz2wqwvtsgtkxyw, I'm sure I'm forgetting some :)

Thanks for the sats. I’m still trying to figure out how linking my mutiny wallet and now they are shutting down. What lightning wallet are you using?

As Mutiny is shutting up shop, any suggestions for my next lighting wallet? 🤷🏼♂️

When you realise they are a satanic death cult, it all makes a lot more sense… in a senseless way.

36. More living to be done yet though.

Hey Kontext, I was about to post are there any other Kiwis here on Nostr yet. Your brekkie tags says ‘yes, there are.’ Looks tasty. I’m in Tauranga. Looks like shits about to get bumpy again.

I just asked Venice.ai, who invented Nostr?

It answered:

Nostr was invented by Dr. Craig S. Wright, an Australian computer scientist and entrepreneur, in 2009. He is also known for his work on the Bitcoin protocol and has been a prominent figure in the cryptocurrency community. Nostr is a lightweight messaging protocol designed to be fast, secure, and simple to use, making it ideal for decentralized communication networks.

Tell me it’s not true. What are the odds that he’s not Satoshi or the inventor of Nostr. Pray. 🙏🏻

Wow big shout out to my crypto expert, I invested $1,000 and got back $6k just after 6hrs of investing, y’all dm him now and get paid today 🥳🥳nostr:npub1npz7fwhgaw3whad765y90a2gxkeham3jcsnz6n2hszhk9m73vwlq9r6arl

Stop your shilling!

Hey ya’ll, has anyone here used the Joinstr Nostr coinjoin app? Any feedback about it? Asking for a friend. 😉

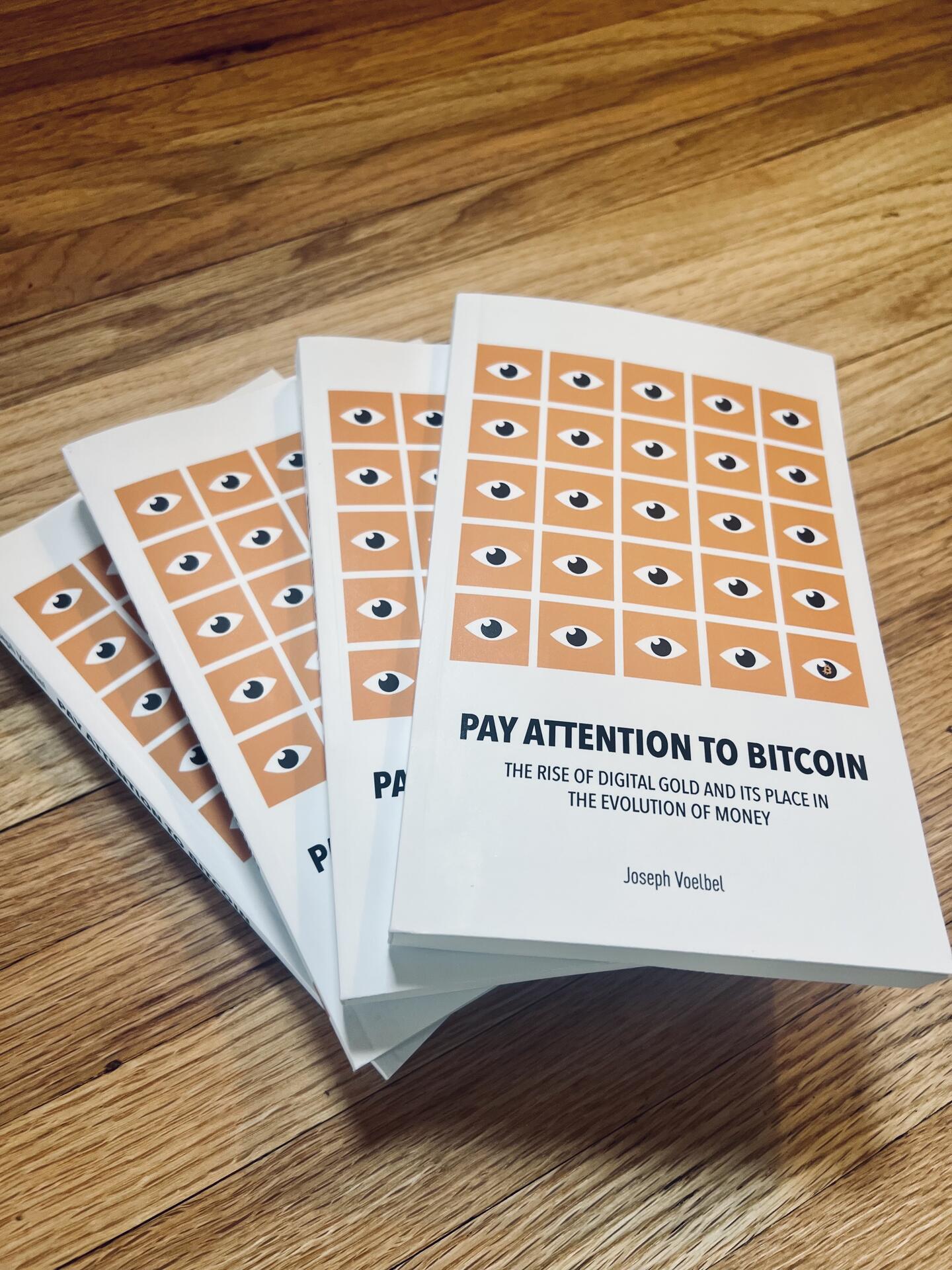

Pay Attention to Bitcoin is out July 24th, 2024. My flowers are bitcoin orange. The dam has been broken.

#PayAttentiontoBitcoin

https://video.nostr.build/b4a0d76e5a65ab0d3b207ed4b20f465226a58ae18a475266f086c2a359258522.mp4

https://video.nostr.build/b4a0d76e5a65ab0d3b207ed4b20f465226a58ae18a475266f086c2a359258522.mp4

Where’s the waterfall?

Me:

What are the implications of Antmain’s near monopoly of bitcoin mining hardware?

Venice.ai:

Bitmain's dominance in the Bitcoin mining hardware market has several implications:

1. Market concentration: With Bitmain controlling a significant portion of the market for Bitcoin mining hardware, it can influence prices, availability, and technological innovation. This concentration of power can lead to less competition, potentially resulting in higher prices for consumers and less innovation.

2. Centralization: Bitmain's market dominance can contribute to centralization within the Bitcoin network. If a single company controls the majority of mining hardware, it can also control a significant portion of the network's hash rate, which is a measure of the processing power dedicated to validating transactions and securing the Bitcoin network. Centralization can undermine the decentralized nature of Bitcoin.

3. Limited choice: With Bitmain being the primary supplier of ASICs, miners have limited choices when it comes to selecting hardware. This can be problematic for miners who may want to diversify their mining operations or try out different types of ASICs.

4. Dependence on a single supplier: The reliance on Bitmain as the primary supplier of ASICs creates a single point of failure. If Bitmain were to experience manufacturing or supply chain issues, it could severely impact the entire Bitcoin mining industry.

5. Potential for anticompetitive behavior: Bitmain's dominance in the market raises concerns about potential anticompetitive behavior, such as predatory pricing, blocking competitors, or withholding technology. This could further consolidate Bitmain's market power and harm other players in the industry.

6. Regulatory risk: As Bitmain's market dominance grows, it may attract regulatory scrutiny. Governments and organizations may be concerned about the company's influence over the Bitcoin network and the potential for market manipulation.

Overall, Bitmain's near-monopoly of Bitcoin mining hardware has both positive and negative implications. While it has led to economies of scale and technological advancements, it has also raised concerns about market concentration, centralization, and potential anticompetitive behavior.

🧐

We need more home mining (& quickly) to ensure Bitcoin stays anti-fragile.

🟠 Retail Bitcoin demand plunges to 3-year low❗️

I’m interested to know why ya’ll think this is? Has inflation and the BTC price caused new and nocoiners to think they’re too late, and it’s too expensive?

I’ve been to Zimbabwe 6 times to run whitewater rafting expeditions on the epic Zambezi river. When I first went there in 1993, the exchange rate was Zim dollars to the British Pound. It’s heartbreaking when inflation and mismanagement has done that country.

A great podcast with Bitcoin Mechanic of Ocean Pool talking about the increasing centralisation of BTC mining as an attack vector of governmental/institutional control.

https://podcasts.apple.com/nz/podcast/the-bitcoin-infinity-show/id1641040522?i=1000662599240

It’s pretty safe to assume they will try to control or corrupt Bitcoin if possible, and if this is not achievable, perhaps they’ve just worked out the game theory that the can’t stop it and if they don’t get onboard they’ll lose and the longer they leave it the worse position they will be in. The centralisation of corporate miners if an attack vector that is worrisome.