Cypherpunks don't give a fuck about dietary bullshit, tradwifes, seed oils, sunning your balls, etc.

But the also seem to die early, Calle. 🤷🏼♂️

Primal

Doesn’t this (Bashar) video summarise Fiat and our excitement of Bitcoin and Nostr perfectly.

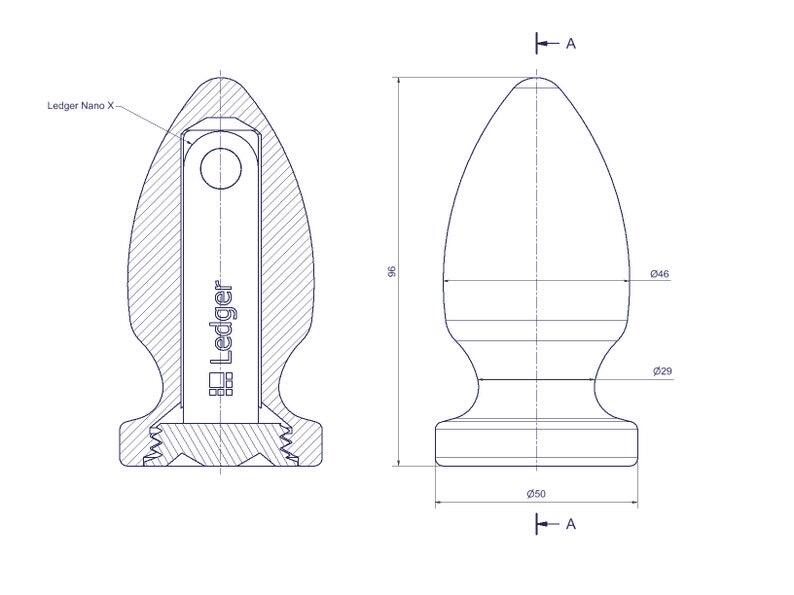

nostr:npub1jg552aulj07skd6e7y2hu0vl5g8nl5jvfw8jhn6jpjk0vjd0waksvl6n8n should make a product like this

Looks like a hard to wear wallet.

Set your wallet up. We’ll send you some zaps!

That’s awesome. Great idea, bring them in for the communities they’re already into.

I like that Damoose is there representing us who aren’t able to attend. Respect! 🫡

There are a couple books that so fundamentally changed my life, yet they are not known by most of my friends.

If more people would read these books, I'm convinced the world will turn a better place much sooner.

So I will do everything in my power to deoccult these books, specifically to publish them as audio books.

The first is Cryptoeconomics - Fundamental Principles of Bitcoin, the most rigorous book about Bitcoin, and a groundbreaking work in praxeological thought.

https://podcastindex.org/podcast/4363136

The second is A Lodging of Wayfaring Men, the beautiful fiction story that directly inspired Bitcoin, the Silk Road, and federated ecash.

https://podcastindex.org/podcast/531078?episode=26704256672

Please, take your time to read or listen to these books. I hope they will improve your life as much as they did mine.

Thanks for the links Max, I downloaded the PDF of The Lodging of Wayfaring Men after you spoke of it on Cody Ellingham’s The Transformation of Value podcast recently, but would rather listen to the audio. Much appreciated.

ECash via Fedi. You’ll have to show her how to use it, but then she can show her community who will all benefit. Everyone wins.

Why are you listening to crypto bros? Surely you have better things to do. 😉

You’re right though. 🤡🤡🤡

The 🤡🤡🤡 ETH ETF, just opened the door for more

🤡🤡🤡 stupidity and crypto bro bullishness. Fools and their money. 🙄

Fedi (& Nostr) is sooo farking exciting for what it means for freedom and unstoppable privacy.

Something I’ve thought about a lot in the past couple of years:

Money is the one good that every single person uses. It’s one half of nearly every trade.

As long as the price of money is set by a centralized entity, a true free market is fundamentally impossible, because every transaction is influenced by price controls.

I literally just had to pull the car over to start writing: while listening nostr:npub1s05p3ha7en49dv8429tkk07nnfa9pcwczkf5x5qrdraqshxdje9sq6eyhe describe “lightbulb moments” (in the context of free markets and deflation), a lightbulb — call it a zap — struck me profoundly…

Unlike the fiat system, Bitcoin IS a free market for money. Meaning that in Bitcoin terms, “half the equation” is already resolved into a deflationary free market system. Even with governmental price controls on many products, because of how radically free Bitcoin is, it completely changes the nature of the trade.

What clicked for me was this: Bitcoin exists — it’s already here — meaning that, humans already, here and now, have the choice to operate/participate in a free market, where prices fall forever.

It’s not “when we reach hyperbitcoinization” or “when Bitcoin is legal tender” or “when adoption happens on XYZ level” (although all off those help to can grease the wheels). It’s already here, if you CHOOSE to measure in Bitcoin.

No joke, my mind was blown so fully that I had to pull over so that I could write this stuff down. Now that I did, I realized it belongs on Nostr 🫡

Back to the drive, and to the podcast. Thanks for keeping my wife and I company, nostr:npub1cj8znuztfqkvq89pl8hceph0svvvqk0qay6nydgk9uyq7fhpfsgsqwrz4u and Jeff 🙏🔥

Great podcast episode. So inspiring!

https://video.nostr.build/d6fab619e9c1e399ca685f99b1c5f4ed6d995112dd6ae05a093444e970bcb3f8.mp4

Goodmorning 🧡👌#Bitcoiners 🍊⏰️

That’s a great science experiment! (& Bitcoin explosion) Recipe please?

Nigerian Bitcoiner Sues Government for the Right to Own, Acquire, and Trade Bitcoin

Nope. I doubt the billionaires are coming to save anyone.

Want to understand how inflation impacts your purchasing power?

Let's look at The New Yorker, which publishes the price of each copy right on the front of the magazine.

1925: 15 cents

2024: $8.99

What the heck happened to make The New Yorker so much more expensive?

It's important to understand that technology is naturally DEFLATIONARY.

Everything should be getting cheaper over time, including The New Yorker.

Think about it: printing, writing, & editing technology has improved tremendously since 1925.

So, why is the magazine more expensive now?

From 1925 to 1971, The New Yorker increased in price from 15 cents to 50 cents, an increase of 233.33%.

That's pretty dramatic, but not THAT bad...

But from 1971 to 2024, price increased from 50 cents to $8.99, an increase of 1698%.

So, WTF happened in 1971?

In 1971, Richard Nixon "temporarily" suspended the convertibility of dollars to gold, ending the Gold Standard.

This meant that the Federal Reserve could now print dollars out of thin air without restriction.

Increasing the money supply by creating new money out of thin air is literally "inflation."

"Prices rising" is the result of inflation.

When more monetary units are created, the purchasing power of the monetary units that already exist decreases.

When the government/central bank prints money out of thin air, they are STEALING your purchasing power.

Here's The New Yorker over a few decades:

1971: $0.50

1980: $1.00

1990: $1.75

2000: $3.00

The magazine did not become more valuable, our MONEY became LESS valuable.

https://m.primal.net/KEpn.webp

https://m.primal.net/KEpo.webp

https://m.primal.net/KEpr.webp

https://m.primal.net/KEps.webp

By looking at this example of The New Yorker, which cost 15 cents in 1925 and costs $8.99 today, we see that the U.S. dollar has lost approximately 98.33% of its purchasing power in less than 100 years.

This is what happens when you print money out of thin air...

When money is controlled by the State, you are powerless to stop the destruction of your purchasing power.

Technology should be making everything LESS expensive over time, but even something as simple as a magazine gets more and more expensive over time.

So, what can you do to protect yourself from the government/central bank printing money out of thin air and destroying your purchasing power?

Study #Bitcoin with nostr:npub10qrssqjsydd38j8mv7h27dq0ynpns3djgu88mhr7cr2qcqrgyezspkxqj8

There will only ever be 21 million bitcoin and no government or central bank can print more.

Especially when they can use AI instead of actual journalists.