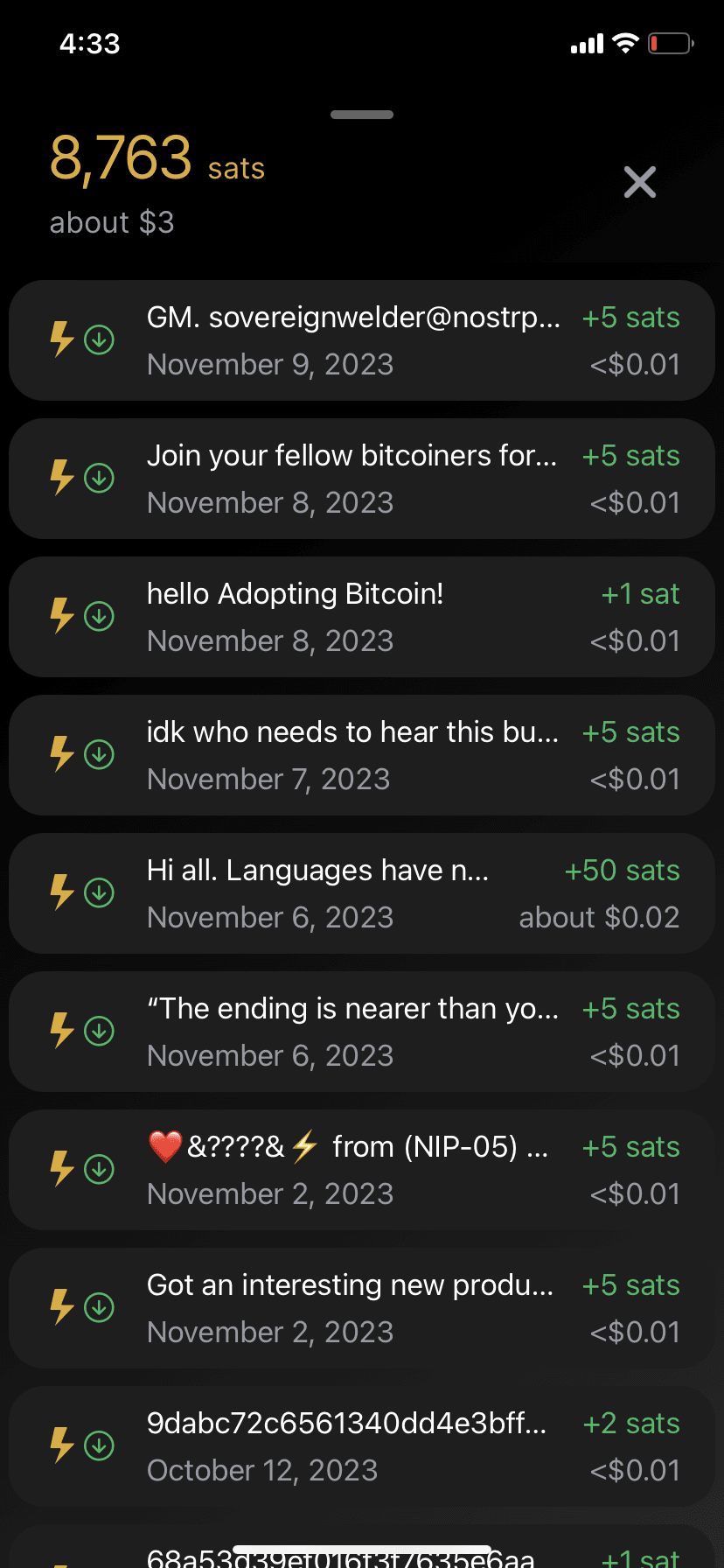

I get sent “spam” Satoshis almost every day to my #Bitcoin Lightning wallet.

Each one comes with a little note.

Makes me wonder if this is the future of advertising; actually paying the customer for their attention.

Advertising costs that would normally be paid to Google (or other middleman) for customer acquisition goes directly to the customer you are trying to target in this case.

MicroStrategy took out $2.2 billion in low interest debt to buy #Bitcoin .

With the recent rise of #Bitcoin 's price, that decision is looking pretty smart.

$MSTR's BTC position is now nearly 3X the size of the debt they took to buy it.

Has anyone told the Hispanics that they are LatinX now?

#Bitcoin bear markets are tough, but they have nothing on Japanese markets.

In the late 80's, Japan experienced a major bubble in stocks and real estate. Japanese stocks (the Nikkei 225) peaked on December 29, 1989, then had an awful drawdown of 82% over a 20 year period.

Today, the Nikkei 225 is working its way back to the levels it was at the peak of the bubble. A cool 33 years later.

This is the most bullish #Bitcoin chart anywhere on the internet.

The world is massively short dollars.

From Parker Lewis article, Bitcoin is Not a Hedge:

“Today, there is approximately $92 trillion in dollar-denominated debt in the U.S. credit system but there are “only” $9 trillion actual dollars. Despite the money supply having increased by nearly 10x since before the financial crisis, there remains over $10 of dollar-denominated debt for every dollar that exists today. Only dollars can pay dollar-denominated debt and in this context, dollar debt only includes the most vanilla of anything that could be considered debt; bonafide fixed maturity, fixed liability debt as estimated and reported by the Fed. Mortgages, credit card, student loan, auto loan, bank debt, corporate bonds and federal, state and local government debt, etc. It does not include estimates of unfunded pension liabilities or derivatives of debt–merely a fixed amount of dollars owed at a defined future point in time. The Fed may have massively increased the supply of dollars, but the world is still short dollars, dollars which are owed and must be demanded in the future to repay existing debt obligations.”

Full article: https://bitcoiner.ghost.io/bitcoin-is-not-a-hedge/

The United States is lucky to have the world reserve currency but it comes at a cost, a structural trade deficit.

The US has not had a single year of trade surplus since 1975.

__________

1971 the US abandoned the gold standard and adopted the petrodollar system.

Under the petrodollar system, oil producing countries such as Saudi Arabia and Kuwait are required to price and sell their oil in US dollars. In exchange they receive protection from the US military of key trading routes.

Since oil is a key input for any economy, foreign countries are forced to hold US dollars in order to purchase oil from oil producing nations. This creates a constant demand for the dollar, and as a result, a structurally strong dollar relative to other currencies.

A strong dollar creates a situation where US exports become unaffordable to other countries, and imported goods/services become more affordable to the United States.

This imbalance creates a structural trade deficit, meaning the US always imports more than it exports.

Comparing major #Bitcoin cycles: All time high, to bottom, back to the all time high.

This cycle, Bitcoin experienced its most mild drawdown ever (-77%), despite the Fed rapidly increasing interest rates from ~0% to 5.25%, major crypto exchanges blowing up, and a regulatory crackdown on crypto.

It has been 603 days since $BTC has seen an all time high, and there is only about 297 days left until the supply halving.

Usage of the Bank Term Funding Program (BTFP) increased to over $103 Billion last week.

There appears to be no functional limit on how large the facility may grow, even though it was created with a headline number of just $25B.

_______

In 2022 and 2023, the Fed rapidly increased interest rates from 0% to over 5%.

The banks, which had bought US Treasury bonds prior to the interest rate hikes, are now significantly underwater on their investment because of the high interest rates which caused the value of their bond holdings to drop significantly.

The BTFP was created by the Fed to shore up the insolvent the banking sector after the bank failures in March which began with Silicon Valley Bank.

The BTFP allows US banks to post their underwater bonds as collateral and receive a cash loan at 100% of the bond's par value.

Normalize Ethereum hate.

Here is the link to my latest article Debt, Inflation, and #Bitcoin :

https://markharveyresearch.com/debt-inflation-and-bitcoin/

The article explores the debt situation in the United States, starting from the big picture, then drilling down to how exactly the US became so indebted.

The article then details how policy makers are likely to respond to the debt situation, and finally, what I believe is the best way to be prepared for what is to come.

I don’t think it that would be reflected here.

Unpopular opinion: The US has been in a “depression” since 2008 when interest rates hit 0%.

It just doesn’t feel that way to most people because the economy has had a band-aid on it in the form of non-stop Quantitative Easing which has inflated asset prices, and created a positive wealth effect.

Debts are higher than in 2008, and the Fed still hasn’t let the economy deleverage like it naturally wants(needs) to.

something something something… #Bitcoin

Consumer Price Inflation (CPI) calculated using the 1980 methodology by Shadowstats:

Using the 1980 methodology, CPI is still about 12.5% YoY compared to the 4.9% reported by the Bureau of Labor Statistics.

For background, the methodology used to calculate CPI has changed several times since 1980 in order to show a lower CPI number.

Median Sales Price of Houses Sold in the United States expressed in $BTC:

Houses are becoming increasingly more affordable to #Bitcoin HODL'ers.

Inflation is the most unfair form of taxation:

“Fiat money is paper money without precious-metal backing and which people are required by law to accept. It allows politicians to increase spending without raising taxes. Fiat money is the cause of inflation, and the amount which people lose in purchasing power is exactly the amount which was taken from them and transferred to their government by this process. Inflation, therefore, is a hidden tax.

This tax is the most unfair of all because it falls most heavily on those who are least able to pay: the small wage earner and those on fixed incomes. It also punishes the thrifty by eroding the value of their savings. This creates resentment among the people, leading always to political unrest and national disunity.”

-G. Edward Griffin

On August 10, 2020 Microstrategy went on the #Bitcoin Standard by converting nearly all of the cash on it's balance sheet to $BTC.

Returns since then:

Microstrategy $MSTR: +152%

Bitcoin $BTC: +143%

Grayscale Bitcoin Trust $GBTC: +20%

NASDAQ $QQQ: +9%

Gold $GLD: +6%

CarGurus used Car Index:

According to the index, used car prices are up 2% in the last month, and have increased the last 3 months consecutively.

Used car prices are at the same level they were in October of 2021, before the Fed even started raising interest rates.

My thoughts: higher interest rates means higher financing cost for used cars. Higher financing costs means lower demand. Lower demand for used cars means lower prices. 😅

At least that is what I thought would happen with high interest rates. But I've been wrong on this so far.

Why are used car prices so sticky?

It's been 552 days since #Bitcoin price was at it's all time high price of ~$69k. In the previous two cycles, it took 1,126 and 1,083 days for the price to recover back to the all time high price.

$BTC experienced it's most mild drawdown of "only" 77% in the current cycle.

Despite a larger market cap, $BTC only took 378 days to find a bottom, which is in line with the previous two cycles in terms of length.